I see constant references to labor shortages in the Wisconsin economy (e.g, [1]). I think it’s important to understand the word “shortage” is not being used in the sense that a neoclassically trained economist would use the term.

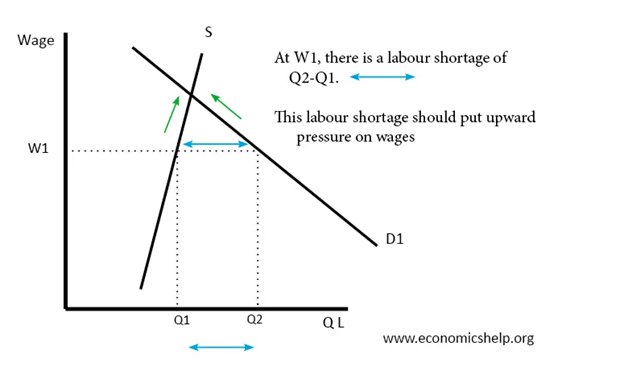

A “labor shortage” as we teach in the introductory micro course Econ 101 at UW Madison would show up as:

Figure 1: Classical shortage. Source: economicshelp.org.

Now, to my knowledge, Wisconsin has not implemented a ceiling on wages that can be paid (such as denoted by wage W1), so there is no Classical shortage. And the floor (the Federal minimum wage) is not binding, so we don’t have a Classical unemployment. So what is meant by the term “shortage”?

What is meant is that at the wages the member firms are willing to pay, there are insufficient takers. In a neoclassical world, firms should then be willing to raise wages they offer until the marginal worker is willing to take pay at the wage the firm is willing to pay (which in turn should equal — in product wage terms — the marginal productivity of the worker (see this recent graph for the US nonfarm business sector).

Rather, what proponents of the labor shortage argument are saying is that the labor supply curve of households is “too high”, and that either (1) benefits being paid to the unemployed are elevating the reservation wage of workers, or (2) workers are having a distorted view of the dangers of working in a world where a lot of people are still unvaccinated and the delta variant is spreading quickly, or (3) preferences have changed relative to working situations (see a run-down here). Looking at this quote reifies this point.

The fierce competition for talent won’t end soon, and employers across industries must adapt to survive the statewide worker shortage, northeastern Wisconsin workforce experts said. Until then, residents must continue to live with the impacts of a tight labor market: Store and restaurant closures, supply shortages and longer wait times.

Thousands of jobs are going unfilled due to longstanding demographic trends and workers’ changing expectations about benefits, pay, hours and workplace culture.

I think the term “availability” would better serve the debate than “shortage”, as there’s no regulatory barrier to wages being raised by the private sector. The process of “fierce recruitment” outlined above is then part of the adjustment process to a new equilibrium in a supply-demand framework if we are taking the definition of shortage literally.

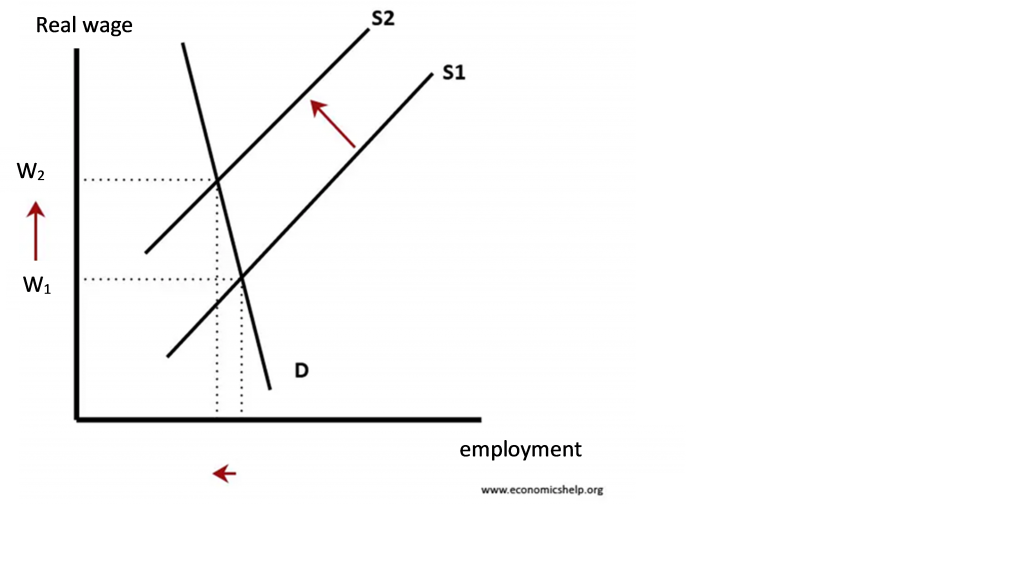

Now, in a neoclassical framework, if there is a constraint on labor supply (which more accords with business complaints), then we should see real wages rising. Using an (utterly conventional) supply-demand graph:

Figure 2: Inward labor supply shift

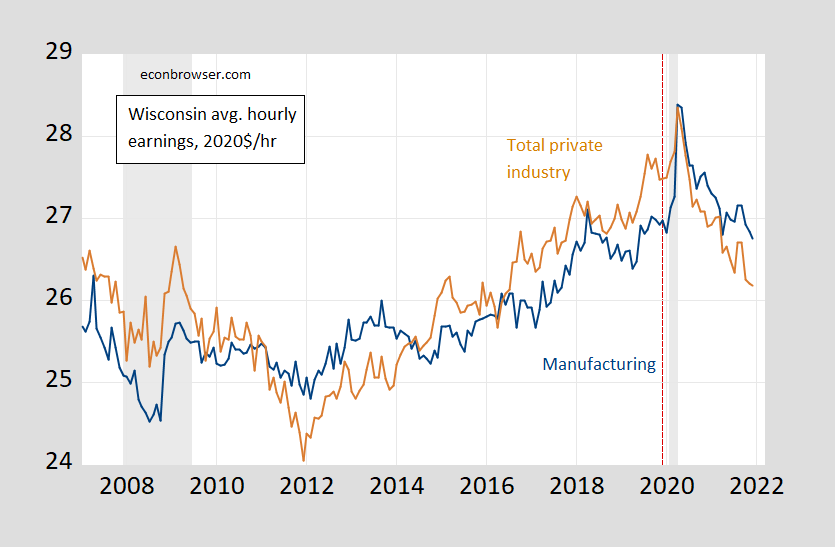

Against a backdrop of lower Wisconsin private nonfarm employment (down 2.5% relative to December 2019), what have real wages actually done, then? We only have data in Wisconsin through December, but using those data, and the nationwide CPI, we have the following picture.

Figure 3: Average hourly wages in 2020$ in Wisconsin private nonfarm business-all workers (brown), in manufacturing-all workers (blue). Deflated using nationwide CPI. NBER defined recession dates peak-to-trough shaded gray. Red dashed line 2019M12. Source: BLS, NBER, and author’s calculations.

Real wages so measured are down 5% (total private nonfarm) and 0.8% (manufacturing). That decline is more consistent with lower demand, rather than lower supply.

Now, one could use a different, more sophisticated model — after all, labor is not just like any old commodity. Still, if one were to use for instance a search model (and there are different types with very different outcomes), one would want to see if those models predicted what we have seen in wages (as well as openings, separations, etc.). CROWE has an analysis (October 2021) that looks at some of these types of indicators (notably, the brief doesn’t contain the word “shortage”).

“one could use a different, more sophisticated model”

I did suggest that the lower real wages and lower employment might be consistent with increasing monopsony power. To wit – Econned simply kept his pointless chirping. At least he did not go Princeton Steve ballistic screaming that monopsony is a banned term!

PaGLiacci,

You just can’t get enough of me, can you? Is your significant other jealous that you’re so infatuated with another? Jealous that you devote such a large swath of your otherwise empty brain to me? I must confess that it is quite roomy in here. Could use some cleaning up but the rent is free so it isn’t all terrible. You’re quite the entertaining tragic clown.

You are almost as vain as you are incompetent

Me pointing out that you are constantly mentioning my name and doing so completely unprompted isn’t vanity. Is reality. Your failing to see this is incompetence.

HonkHonkHonkHonk

Why is monopsony power increasing when there is a labor shortage? That makes no sense.

Come on dude. Pay attention please. Menzie already noted the word shortage is premature to misleading. Yes an increase in monopsony power does lower real wages as firms choose to hire fewer workers. Of course in your world it is one of those banned words so you never bothered to learn the basic microeconomics. Good thing you did not go into labor economics as you would be the truly dumbest student in the class.

What makes no sense is your constant babbling. Please stop.

“Real wages so measured are down 5% (total private nonfarm) and 0.8% (manufacturing). That decline is more consistent with lower demand, rather than lower supply.”

Typo? Should not that be ….rather than greater supply”?

No, Eric. Lower supply would lead to higher wages; greater supply leads to lower wages. Menzie has it right.

Employment would be up then

Yeah, I hate the term shortage (or glut). There’s just price (in general, pedants).

Like there is a shortage of people that will clean my apartment for $8/hour. But there’s a glut of those who will do it for $100/hour. Quite a range in there…trying to work it out. 😉

EIA monthly Short Term Energy Outlook came out today:

https://www.eia.gov/outlooks/steo/

As usual, nothing radical, but some changes, since they can incorporate “what happened recently” (is there a fancy econ term for that)?

Crude price:

Near term up a bunch, since…well price is up now. But very backwardated. Whole strip moved but the impact is more on the near term and less on the .far out. I mean it all goes up (usually)…but the prompt gyrations overstate the long term expectations. EIA actually has their own price deck, not just using the strip. But it usually approximates the strip in shape/amount. Typically slightly higher (although maybe not now, given how crazy the strip is).

Crude production:

They seem to have incorporate both the recent outperform on production (we hit almost 11.8 MM bopd in NOV, from the last 914 survey) as well as the price deck going up. They moved DEC estimate up from 11.6 to 11.8 for instance. They do have a drop down in JAN (not sure why, maybe reversion to their model, maybe seasonality). They have 11.64 for JAN…but last month they had 11.56. So up some. And then their exit rate for DEC22 moved up from last month prediction: 12.19 going to 12.39. And DEC23 also up: 12.67 to 12.84. All of that still puts us under pre-Covid levels of production.

Overall:

A. The industry will naturally produce more when incented more with price. Still much slower under Biden (given price) than under Obama/Trump. But…it’s something to see some growth.

B. EIA has had a habit of misunderestimating shale. But I don’t think that’s the case now. Rig counts are very moderate, given price levels. We are in a regime where it is easier for EIA to make predictions.

i am watching usa distillate fuel and kerosene: stock and production.

I think inventory watching is overrated. If we’re backwardated, there’s an incentive to minimize inventory. If we’ve a forward curve to store it. (I’ve been at a refinery where we actually filled the tanks to try to make money on the roll…not sure it did anything but it made the McKinsey/Goldman/Carlisle hotshot manager feel like he was.) There’s this whole thing of looking at inventories to see if it looks like we have current supply/demand under/over 1. But really, the info you need is already in the futures strip itself.

I’m not an expert on refined products demand. Sort of makes sense that jet fuel would be in more demand. But really the US never went off a cliff like overseas areas did. Lot of internal air travel (which is most of ours, unlike Austria say) kept going even during the pandemic. Or had mostly come back last year. There’s a seasonal effect also (more travel in the summer), so the system is probably fine to meet demand even if up, right now (since we are in the slow time of year). Will be interesting to see what happens in the summer though.

odd enough that you should mention oil & gas production on a labor supply thread…DUCs (drilled but uncompleted wells) are at record lows in 4 major basins, and the lowest since February 2014 nationally….but a lot of what i’m seeing on industry sites right now are complaints they can’t find enough workers to increase production, even at higher pay…we already have 1.7 job openings for every person who’s looking for work, in almost every industry…but you can’t just hire anyone off the street to drill a well to 15,000 feet and then horizontally a mile or more through a 200 thick band of shale; in Ohio, there’s a Utica Shale Academy to teach that job….then, even if you get your extra wells drilled, you still have to contract a fracking crew to complete it for production to start…i’ve seen that a couple oilfield service providers are now talking about fielding another completion crew, but that won’t happen in the first half; you’d be talking about maybe 25 or 30 semi tractor trailers loaded with specialized equipment and the experienced personal to man them…

which brings me to this, from about a week ago:

DOI announces $1.5B in funding for orphaned well clean up – The Department of the Interior announced $1.15 billion in funding is available to states from the Bipartisan Infrastructure Law to create jobs cleaning up orphaned oil and gas wells across the country. This is a key initiative of President Biden’s Bipartisan Infrastructure Law, which allocated a total of $4.7 billion to create a new federal program to address orphan wells. Millions of Americans across the country live within a mile of an orphaned oil and gas well. Orphaned wells are polluting backyards, recreation areas, and public spaces across the country. The historic investments to clean up these hazardous sites will create good-paying, unionjobs, catalyze economic growth and revitalization, and reduce dangerous methane leaks.

the original theory behind funding the orphan well cleanup was that it would put unemployed oil and gas workers back to work…but with the industry already looking for workers, what do does DOI expect to do, train those who quit their jobs flipping burgers or stocking shelves to clean up those hazardous well sites? so it appears that either the orphan well cleanup effort will stall from a shortage of capable workers, or it will be done poorly by those who don’t know what they’re doing, creating a whole new problem of leakage from hundreds of poorly capped wells sometime in the future…

1. Good job steering it back to wages! For the reasons MC mentioned, I’m always skeptical of worker “shortages”. If you pay enough you can get people. It’s not like we have anywhere the activity of 2014 or even 2018. Yes, they’ve gotten sick of the boom/bust. But still, pay enough and you can get them. I’m not even sure that wages have reached the insane levels we saw in 2014 or 2018 yet either (especially CPIed). Not saying they haven’t just don’t know. And the whole “people complained and a news story was written is too anecdotal.

2. DUCs are low, agreed. There was a bulge of DUCs from the slowdown, but we’re getting close to working inventory now. Eventually, it becomes a constraint and you have to add rigs or drop spreads.

I usually figure 2:1 ratio needed. oil-directed rigs versus spreads (oil and gas, they don’t differentiate). It’s a very ballpark-y thumb rule but seems to work. Right now oil rigs is at 497 (post Covid record), but spreads are at 265 (and were as high as 275 before the holidays). So, we are a little under my 2:1 thumb rule. Not awful though. I do wonder if one of the reasons for the slow post-Xmas rebound of spreads is the DUC inventory situation and basically rigs becoming a bottleneck.

OPEC reported their production for January today, up by just 64,000 barrels per day over December…..the cartel including Russia had committed to increasing production by 400,000 barrels per day each month since July; it’s now looking like they’re running ~ 800,000 barrels per day short of that; almost 1% of global demand…

i earlier mentioned backwardation as another constraint on increasing US production…March 22 WTI closed just short of $90 today, but March 2023 WTI, which probably better represents the price they’d get after filing for a permit, moving a drilling rig to the site, and contracting a backlogged completion crew to frack the well, closed at $78.54…

and there it is, right in front of my eyes, but i missed it; if oil is $90 today but futures say it’s worth $78.54 a year from now, no one in their right mind would want to hold any inventory…

https://fred.stlouisfed.org/graph/?g=LFl2

January 15, 2020

Manufacturing employment in Wisconsin and Minnesota, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=LFl2

January 15, 2020

Manufacturing earnings in Wisconsin and Minnesota, 2020-2021

(Indexed to 2020)

I have been arguing these points for a while now. The problem is not a lack of workers, it is a lack of workers willing to work at the wages being offered. If you increase wages, and still no workers, then you have a shortage. If you increase wages and fill the positions, then the “shortage” was simply a failure of management to understand the circumstances around them. since I have pretty dismal view of many people in management positions, I am inclined to believe the latter.

where have all the workers gone?

https://theethicalskeptic.com/2022/02/08/where-have-all-the-workers-gone/

not for the faint of heart

A.,

This seems to be about a pretty specific whiny white male 24 year old. I note that labor force participation rates by women and Blacks are also down by about as much as for white males, so all his going on about his race and gender do not explain the reduction in the labor force particularly. And he does not have to worry about child care, which is known to be playing a role in the problem right now.l

baffling, no matter how much you increase wages, some spots are going to remain unfilled…last week the BLS reported job openings increased to 10,925,000 in December, 61.8% higher than in December a year ago…they also reported non-farm payrolls were 2,875,000 jobs below those now indicated for February 2020, our jobs peak…no telling how many those working in February 2020 were among the 900,000+ Americans who died of Covid since, but for argument’s sake lets’s say they’re all still available…,another BLS survey last week showed the population of those over 16 had increased by 3,574,000 since February 2020 (i’m including the 1,066,000 upward revision to population also reported last week https://fred.stlouisfed.org/series/CNP16OV so by my arithmetic, than means there will still be 4,476,000 job openings that can’t be filled at whatever price, simply because of a shortage of warm bodies…

for $200

gdp up….

real wages down

what is stagflation?

To repeat myself, the cost of work has risen. A higher cost of work would reduce the supply of labor at any given wage.

Working is more expensive for a number of reasons. Child care costs have risen and availability is reduced. In-person work is riskier. The demands put on workers have increased:

https://www.nprillinois.org/2022-02-08/remote-work-isnt-the-problem-working-too-much-is-experts-say

It may be that reserve wages will be permanently higher. It may be that they will fall back if the cost of work declines. Add a decline in real wages (piling on work with no increase in pay amounts to a cut in wages) on top of an increase in the cost of work and it’s hardly a surprise that workers are hard to come by.

So sorry, employers. The laws of economics apply to you, just like everyone else.

I think you have to be careful about lags in an environment where the inflation rate has been changing rapidly in unexpected ways.

If you’d done the analysis above in, say, mid-2020, then the standard model would have held up. If you do it now, the standard interpretation does not look so good. However, I think it reasonable to assume that increases in the CPI would lead increases in wages, ceteris paribus. That is, employers would be willing to pay more when they have been able to convince themselves that they can raise their selling prices. Thus, the demand for goods would lead the demand for labor, and increases in the prices of goods would therefore lead increases in wages. I don’t know if that’s true empirically, but it makes logical sense.

Therefore, the poor performance in real wages at the moment may be reversed in the next 12-18 months. I probably would not over-interpret the current state of real wages.

I guess this rates up there with you insisting oil prices will someday pass $100 even when they were below $50. Don’t like the current data – what for it to change. Sort of like the weather I guess.