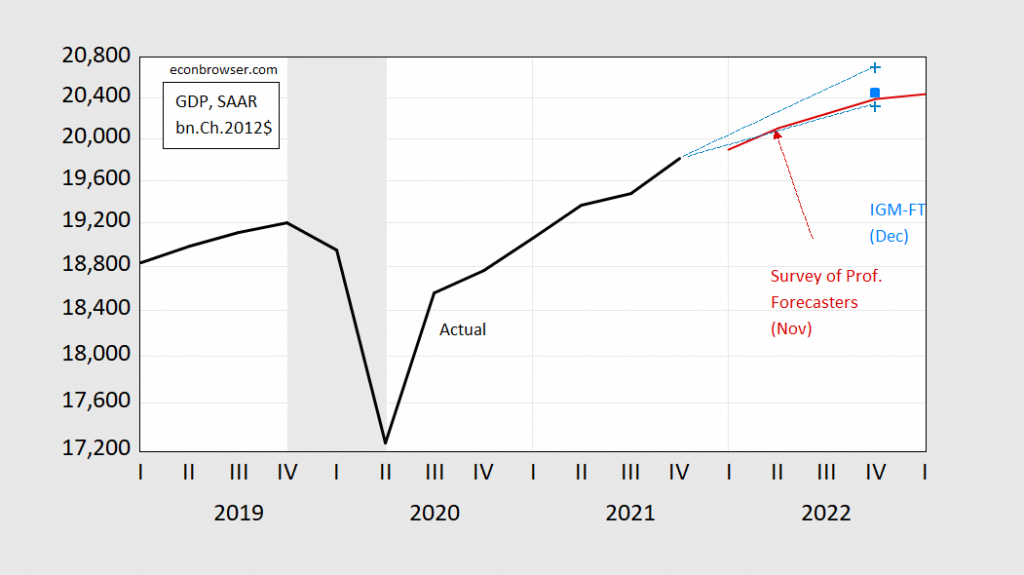

Survey taken last week, published today here. The FT-IGM Survey of Macroeconomists median forecast implies this path for GDP:

Figure 1: GDP (black), FT-IGM survey median (large light blue square), and 10th/90th percentile (light blue +), and Survey of Professional Forecasters February mean (red), all in billions Ch.2012$ SAAR. NBER defined recession dates peak-to-trough shaded gray. Source: BEA, Q4 2nd release, FT-IGM survey, Philadelphia Fed, NBER, and author’s calculations.

The FT-IGM survey was conducted on the eve of the Russian invasion of Ukraine (21-23 February). It’s interesting to see how this information was incorporated into the assessment (lots of other data came in between the early December and late February surveys, including the Q4 advance GDP release).

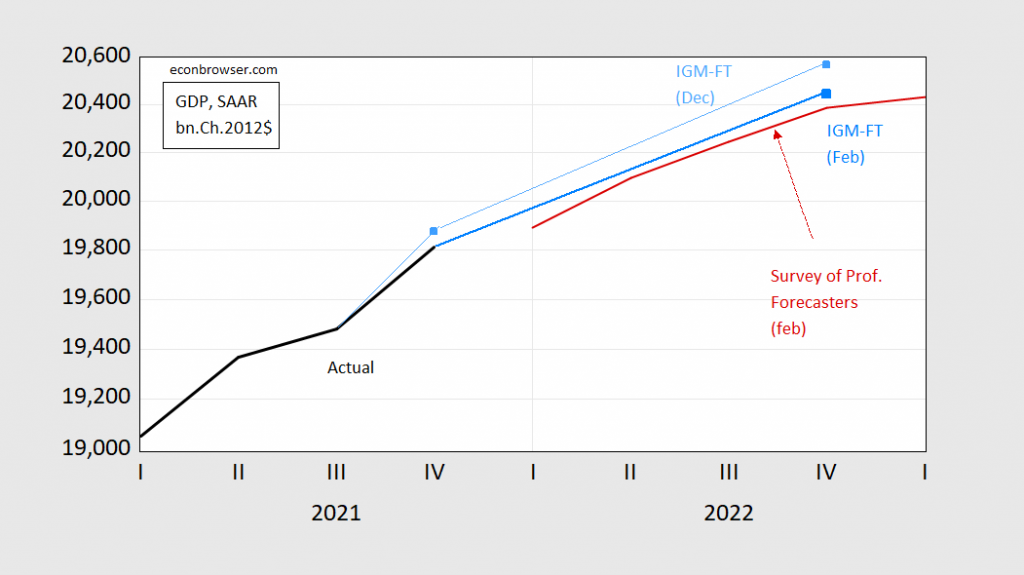

Figure 2: GDP (black), FT-IGM survey median response from February (large light blue square), and from December 2021 (small light blue square), and Survey of Professional Forecasters February mean (red), all in billions Ch.2012$ SAAR. Source: BEA, Q4 2nd release, FT-IGM survey, Philadelphia Fed, NBER, and author’s calculations.

My reasoning for downshifting the estimated growth was obvious, given that I was almost 100% convinced by Tuesday that an invasion was coming. Then, higher oil prices induce a direct contractionary effect via supply shock, and a tighter monetary policy. (WTI is now bumping around $100/bbl).

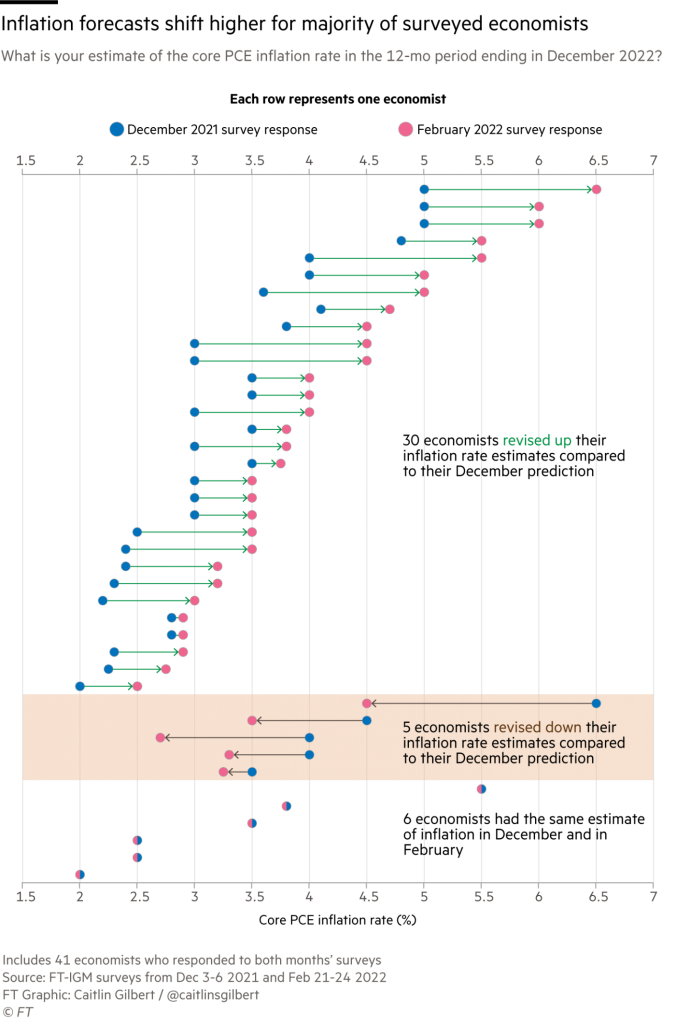

Economists in the survey raised their estimates of inflation, as noted in the FT article describing the survey results; my estimate went up because of the persistence of inflation above and beyond what I’d anticipated; but it also went up given elevated oil prices.

Source: FT, February 28, 2022.

maybe it’s already been answered by a commenter on another post, but how do the latest sanctions affect Russia’s ability to get paid for their exports? for instance, they account for 18% of the world’s supply of wheat, which jumped 10% with the invasion and is now twice the average price of before 2020…their oil exports of 4.6 million barrels per day are second behind the Saudis, and account for about 4.7% of global supply…they’re also 38% of Europe’s natural gas, and over 60% of European thermal coal imports…switch to renewables, and you’re talking about a major supplier of nickel, cobalt, copper and platinum group metals…..does the world forgo that supply, and associated price increases, to punish them?

In crude terms, the immediate goal of sanctions is not to prevent Russia from exporting, but to prevent Russia from being paid for exports. Russia then faces the need to find a way to turn accounts receivable into imports or hard currency. All the comments about Russia turning to China have to do (whether commenters realize it or not) with China becoming a trade and financial intermediary for Russia. Think of the vig!

To the extent that sanctions work, the rest of the world will forego the use of Russian exports – unless Russia is content to pile up receivables in the hope of someday being paid for them. To the extent that Russia finds ways around sanctions, it will mean Russia earns smaller fraction of the market price of its exports because intermediaries will take more.

The effect of higher fed funds will be watered down if safe-haven flows flatten the curve relative to funds, as happened today. Higher oil prices and lower market yields mean lower, rather than higher, inflation-adjusted yields.

It may be that today’s drop in yields is a short-term flow effect that will dissipate quickly, but maybe not. It may be that the Fed takes lower market yields into account and hikes rates more than currently expected. Tough environment for yield traders.

The near term is weightier now than at most times. Many non-market factors at work to change the outlook. This would be a really good time for domestic politics to work for the common good, but I guess you go to war with the politicians you have.

Why should anyone care about these fictitious, ergodicity-assuming forecasts that are wildly inaccurate historically and are purely psychological in that they only mean something if enough ignorant people believe in them?

Where is the 8.5% February 2022 inflation line?

Pardon the digression – more Russia stuff.

Russia has decided that protecting its currency is worth having interest rates that private firms will find hard to deal with. That’s the standard trade-off in a currency defense and is why currency defense tends to induce recession.

Russia’s private debt-to-GDP ratio is around 60%. That’s high for Russia, but not high by developed economy standards. I haven’t been able to find data on the maturity profile of Russian private debt, so I have little way of gauging how much damage a 20% central bank rate will do in the near term. Anybody have a source?

I also don’t know much about official provision of credit in Russia. High interest rates are counter-productive even for the currency in the medium-to-long run because of damage to the real economy. Direct provision of credit (as seen in China) can reduce that harm. Russia’s central bank is pretty well managed, but if credit facilities don’t already exist, a decision to provide direct credit will be slower in having an effect.

ltr has posted comments on Russian off-shore holdings. Those comments strongly suggest that many firms in Russia don’t have large domestic cash reserves to fall back on to finance operations when credit dries up. Owners don’t leave cash in domestic banks. All the more reason to seize oligarchs off-shore assets – average Russians won’t be affected much. Sucks to be a non-oligarch in Russia.

https://www.washingtonpost.com/opinions/2022/02/25/irs-is-doing-best-it-can/

Somewhat different topic but enforcing the US tax rules against rich tax cheats is important. Look – I know not everyone who worked for the Federal government during the Trump years was incompetent but come on. The IRS failed in a lot of ways under Trump. Yes it was underfunded and yes that 2017 tax cut for the rich made the code too complicated with more holes for tax evasion. But these problems were the plan. Let’s not justify tax evasion on the grounds that this dude tried while he failed.

Menzie, most sincerely I have a question for you only a dumb drunk guy might ask. Is there any way to know which (or if those FT-IGM economists are shy , what % ) of economists felt or deeply intellectually thought that the 2020 (Covid-19) recession’s shape was “reverse radical”?? Yeah…… I’m a selfish jerk trying to prove me/myself/I might have been correct on that point (whatever I said, I forgot now)

I mean to say AFTER the FT-IGM economists looked at it later, did they think it was “reverse radical”, without remark to whether they originally got it right or not.