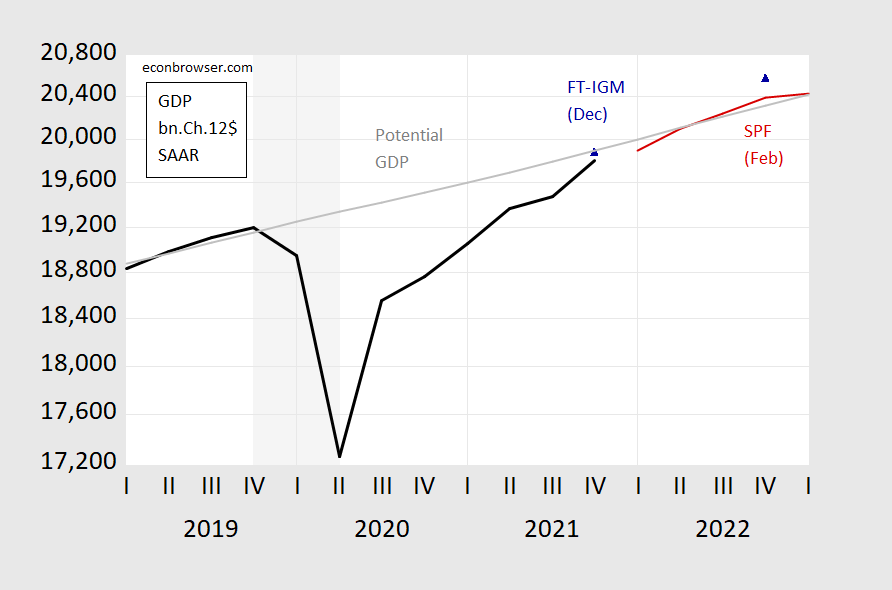

A hiccup in growth for Q1, then resumed growth (SPF) eventually exceeding potential GDP (at least as estimated by CBO last June).

Figure 1: GDP as reported (black), Survey of Professional Forecasters mean (red), FT-IGM December survey (blue triangle), and potential GDP (gray line), all in billions Ch.2012$, SAAR. NBER defined recession dates peak-to-trough shaded gray. Source: BEA, Philadelphia Fed SPF, FT-IGM, NBER, and author’s calculations.

The Wall Street Journal survey (from early January) and the SPF (surveyed late January/early February) are very similar in terms of trajectory.

Shouldn’t there be a wide, wide margin around the forecast line? So wide as to make it useless?

rsm: No.

Adam Posen was on PBS NewsHour making some semi-interesting comments. Generally I support semi-truck drivers. And I’m not totally sad whenever it dawns on semi-truck drivers (once in a blue moon) how much power they have if they ever chose to use it (for example reforming the labor union). But acting like 6 year olds (actually the 6 year olds tend to be handling this better than the adults) over being asked to wear a simple surgical mask, doesn’t exactly strike me as a suitable issue to exercise that power.

Some reading from me:

Let Putin Buy Crimea, in the American Thinker this morning: https://www.americanthinker.com/articles/2022/02/it_is_possible_for_putin_to_get_crimea_without_force.html

The Fall of The Wall

https://www.princetonpolicy.com/ppa-blog/2022/2/10/the-fall-of-the-the-wall

I am scheduled to be discussing the latter with Steve Bannon at the War Room at 11:15 eastern. https://warroom.org/

Well aren’t you a crass little self-promoter?

Menzie, when I start my fudge factory, may I advertise here? For free, please.

So you are in bed with the traitor Steve Bannon. I guess that explains your two utter BS little. It was a waste of my time reading your clap trap. I will leave to others to mock that un-American garbage

Of the thousands of really asinine statements in that 1st stupid rant one has me falling on the floor laughing. You at one point demands that we not allow the maps of Europe to be redrawn. But your vaunted magical solution is for Ukrto just up on Crimea and Don as. First of all you are an idiot, And Neville Chamberlin q had more of a spine. Thank God you are not in charge as Putin would walk all over you

inviting chamberlain to any argue shows a lack of depth ……

munich was munich and germany vs a vis england and france was liquid through 1940….

when the french collapsed.

In case folks do not go tune into Bannons chat with Stevie let me summarize his essay. If we do not build Trumps stupid wall the rest of Stephen Miller’s racist immigration approach is just fine. Bannon will love this

https://www.splcenter.org/hatewatch/2014/04/23/american-thinker-needs-start-thinking

It seems Princeton Steve wants to pad his “publication” list after he utterly embarrassed himself with his ignorant attacks on Dr. Cook. So he writes a totally brain dead rant on Ukraine which The American Thinker picked up. Now if you read some of rants from this far right piece of trash, you might understand why the SPLC called this rag “a not so thoughtful far-right online”:

https://www.splcenter.org/hatewatch/2014/04/23/american-thinker-needs-start-thinking

Steve’s kind of place!!!

So you hang with crooks and traitors to the US Constitution. Not a good look, Steve.

Well kids, regulars here are aware of what a simpleton Uncle Moses is. Eduardo Porter (one of the better economics focused journalists out there) has a story in the NYT today and also there is a picture of 3 semis on the cover. So you know Uncle Moses has to pick up a copy. I am not sure what the number is on Eduardo Porter’s google scholar count, but I still like reading him. Not to mention the fact I looked left-right-left to see if the coast was clear on having to stomach David Brooks’ latest 3rd grade essay. It appears we’re in good shape.

Then I have to pick up an apple pie for a diabetic relative with no sense of self-restraint. What are friends for??

I’m certainly not having Marjorie Taylor Greene cook for my SuperBowl Party. Memo to the most racist dingbat in Congress – Gazpacho is really good and had nothing to do with Hitler’s reign of terror:

https://news.yahoo.com/marjorie-taylor-greene-confuses-gazpacho-232737585.html?fr=sycsrp_catchall

Warn a guy! Nearly spit my coffee.

Herman G. and his pal Heinrich H. were the original Soup Nazis?

Remember how Gretchen Carlson paraded herself around as the braindead blonde until she was no longer getting a paycheck from FOX and then “somehow amazingly” immediately following her exit became articulate?? I mean, what name do we want to give this??~~ “performance stupidity” for the crowd?? How certain are we Taylor Greene isn’t working from the same playbook/script as Gretchen??

https://news.cgtn.com/news/2022-02-12/Chinese-mainland-records-99-confirmed-COVID-19-cases-17AjPkoUfSM/index.html

February 12, 2022

Chinese mainland reports 99 new COVID-19 cases

The Chinese mainland recorded 99 confirmed COVID-19 cases on Friday, with 40 linked to local transmissions and 59 from overseas, data from the National Health Commission showed on Saturday.

A total of 41 new asymptomatic cases were also recorded, and 823 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 106,863 with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-02-12/Chinese-mainland-records-99-confirmed-COVID-19-cases-17AjPkoUfSM/img/8eb08cbbe0bb48ac86c577aac00e9f30/8eb08cbbe0bb48ac86c577aac00e9f30.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-02-12/Chinese-mainland-records-99-confirmed-COVID-19-cases-17AjPkoUfSM/img/78e111c5778745129a83a90123dd2ad6/78e111c5778745129a83a90123dd2ad6.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-02-12/Chinese-mainland-records-99-confirmed-COVID-19-cases-17AjPkoUfSM/img/6587cd8a7ef2493faf5d8e9aadde52b3/6587cd8a7ef2493faf5d8e9aadde52b3.jpeg

https://www.worldometers.info/coronavirus/

February 11, 2022

Coronavirus

United States

Cases ( 79,228,628)

Deaths ( 942,006)

Deaths per million ( 2,819)

China

Cases ( 106,764)

Deaths ( 4,636)

Deaths per million ( 3)

https://www.nytimes.com/2022/02/11/opinion/folk-economics-monetary-policy.html

February 11, 2022

Wonking Out: Very serious folk economics

By Paul Krugman

A few days ago, Tressie McMillan Cottom published * an insightful article in The New York Times about the power of “folk economics” — which she defined as “the very human impulse to describe complex economic processes in lay terms.” Her subject was the widespread enthusiasm for cryptocurrency, but her article sent me down memory lane, recalling the role folk economics has played in past policy debates.

Just to be clear, the “folk” who hold plausible-sounding but wrongheaded views of the economy needn’t be members of the working class. They can be, and often are, members of the elite: plutocrats, powerful politicians and influential pundits. In fact, elite embrace of folk economics was a large part of what went wrong in the global response to the 2008 financial crisis. And it’s starting to have a destructive effect now.

So, memories: When the 2008 financial crisis struck, economists, believe it or not, had an intellectual framework ready to go, pretty much custom-made for that situation — because it was devised in the 1930s during the Great Depression. The “IS-LM model” ** was introduced by the British economist John Hicks in 1937 as an attempt to encapsulate the insights of John Maynard Keynes, who had published “The General Theory of Employment, Interest and Money” the previous year. There’s endless argument about whether Hicks was true to Keynes’s vision — which is irrelevant for my discussion now — because Hicks is what economists brought to the table in 2008.

According to IS-LM (which stands for investment-savings, liquidity-money), public policy normally has two tools it can use to fight an economic slump. Loosely speaking, the Federal Reserve can print more money to drive interest rates down, or the Treasury can engage in deficit spending to pump up demand. After a financial crisis, however, the economy gets so depressed that monetary policy hits a limit; interest rates can’t go below zero. So, large-scale deficit spending is the appropriate and necessary response.

But folk economics sees deficits as irresponsible and dangerous; if anything, many people have the instinctive feeling that governments should cut back in hard times, not spend more. And this instinct had a big, adverse effect on policy. True, the Obama administration did respond to the slump with fiscal stimulus, but it was underpowered in part because of unwarranted deficit fears. (This isn’t hindsight, and I was tearing my hair out at the time.) And by 2010, influential opinion — the opinion of what I used to call Very Serious People — had shifted around to the view that debt, not mass unemployment, was the most important problem facing the United States and other wealthy nations.

This wasn’t what conventional economics said, and there was no hint that investors were losing faith in U.S. debt. But deficit scaremongering came to dominate political and media discussions, and governments turned to austerity policies that slowed recovery from the Great Recession….

* https://www.nytimes.com/2022/02/07/opinion/crypto-nfts-folk-economics.html

** https://krugman.blogs.nytimes.com/2011/10/09/is-lmentary/

If you are wondering who these truckers protesting vaccine mandates in Canada are, Kevin Drum has been doing a little searching:

https://jabberwocking.com/meet-the-convoy-leaders/

A reader commented about the booming earnings in manufacturing in the Midwest, so I looked at the data and found no earnings boom in manufacturing earnings in the Midwest of nationally:

https://fred.stlouisfed.org/graph/?g=M2na

January 15, 2020

Real manufacturing earnings in Wisconsin and Minnesota, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=M0Ey

January 15, 2020

Real manufacturing earnings in United States, Michigan and Ohio, 2020-2021

(Indexed to 2020)

Oh, come back in a year for the lagging data.

Do we need to “fire-up” the recession watch?

https://www.msn.com/en-us/money/markets/signals-of-an-economic-recession-are-beginning-to-flash-as-sputtering-consumer-lacks-fresh-stimulus-jeffrey-gundlach-says/ar-AATLDXZ?ocid=BingNewsSearch

That article is lol bad. He doesn’t get revisions and move torward a mean. Maybe Grundumb should not write.

After looking at the FRED, T10Y3m, data series, the spread is currently about 1.6%, so probably early for a recession watch based on the spread between GS10 rates and 3-month treasury rates.

https://fred.stlouisfed.org/graph/?g=r4MU

January 4, 2018

Interest rates on 10-Year Treasury Bond minus 3-Month Treasury Bill, 2017-2022

https://fred.stlouisfed.org/graph/?g=noiX

January 4, 2018

Interest rates on 10-Year Treasury Bond minus 3-Month Treasury Bill, 2007-2022