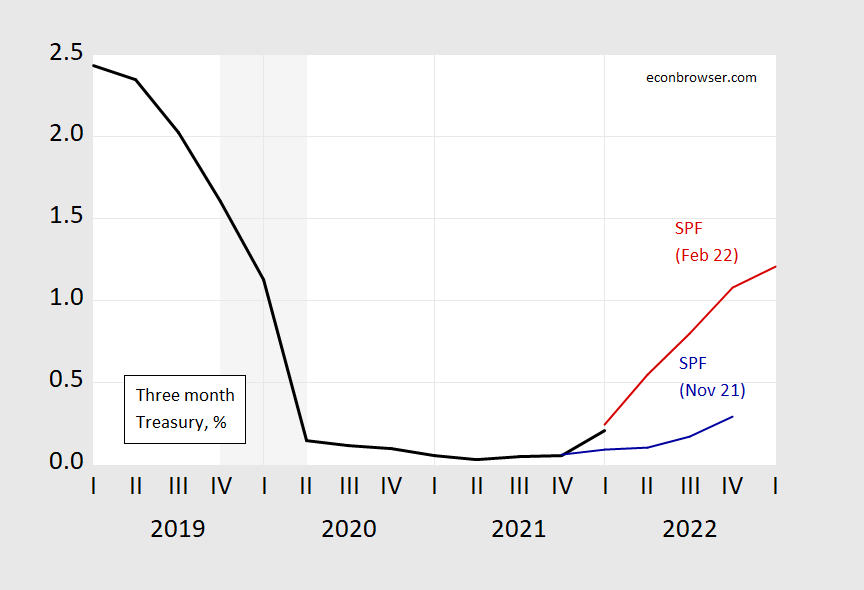

Even before the Thursday’s CPI release, forecasters had upped their short term rate forecasts, along with long term.

Figure 1: Three month Treasury bill yield (black), Survey of Professional Forecasters November 2021 survey (blue), February 2022 (red), in %. Actual 2022Q1 is through 2/10. NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, Philadelphia Fed SPF, and NBER.

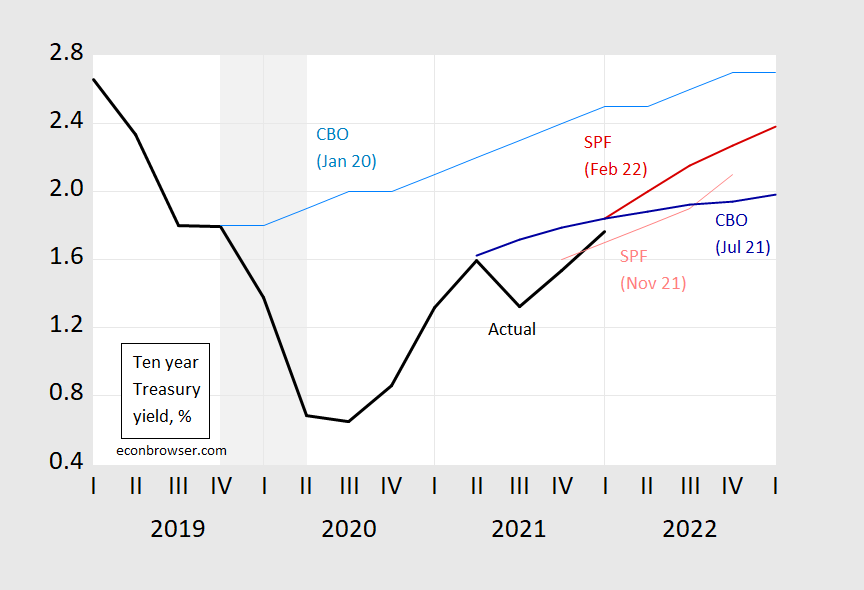

The trajectory for ten year Treasurys also rose:

Figure 2: Ten year Treasury yield (black), Survey of Professional Forecasters November 2021 survey (blue), February 2022 (red), CBO January 2020 projection (sky blue), CBO July 2021 projection (blue), in %. Actual 2022Q1 is through 2/10. NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, Philadelphia Fed SPF, CBO, and NBER.

Forecasted Q1 yields are now at levels CBO projected back in July of 2021; but the trajectory is for a faster rise in the future — although to levels still below what was projected on the eve of the pandemic.

https://www.federalreserve.gov/aboutthefed/boardmeetings/20220214closed.htm

what is going down at this closed meeting of the board of governors – federal reserve?

Your link indicates:

“Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.”

So that’s probably it?

Who knows what evil lurks in the hearts of Fed governors? The Shadow knows.

The UST 10 year was over 2% a day or two this past week. Supposedly, Ukraine war jitters drove [flight to safety] it down end of week.

From January 2017, they increased the FF target seven times to 2.25% – 2.50%. In November 2018, I observed the 10 year at 3.24%. The national average, 30-year fixed rate mortgage was 5.15% in November 2018; I saw 3.5% end of January 2022.

I believe these Fed governors do not have the courage to act.

Is it so hard to see that shorting bonds is the new momentum trade, and bond shorts are bullying the Fed into rate hikes, cynically but enthusiastically using stale old economic fairy tales about inflation that nobody profiting from shorting bonds actually believes?

“…bullying the Fed into rate hikes…”

You’ve been reading the wrong comic books.

I like this comic book. OK, he’s no Judge Dredd or Black Kaiser, but he’s pretty good:

https://www.interfluidity.com/v2/9122.html