One way to assess external financial stress is to look at exchange market pressure (EMP) – the change in the exchange rate, change in reserves, and change in interest rates, possibly weighted by inverse of standard deviations. or otherwise (see e.g., Patnaik, et al. (2017) for several different versions).

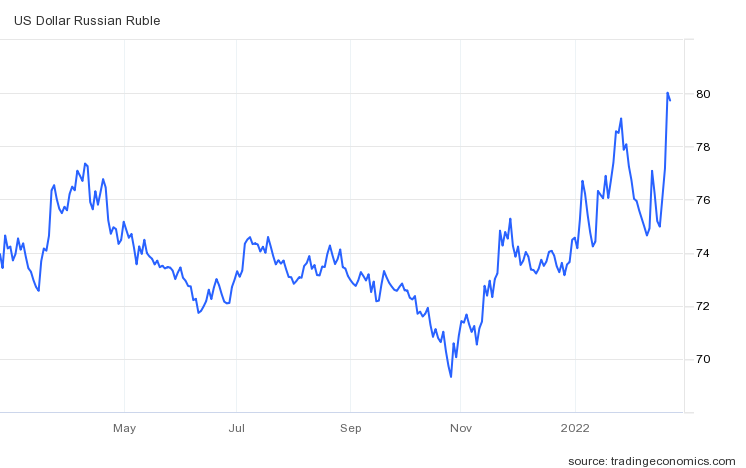

Without calculating the index (I don’t have access to some of the relevant variables), here’s what we see as of today, over the past year.

At a monthly frequency, reserves fell slightly in January.

Obviously, we (or I) don’t see reserves day by day, so we don’t know what’s happening in terms of intervention.

More broadly, confidence as summarized by the stock market, is plummeting.

These data predate the announcement of sanctions today. Going forward, expect to see a combination of ruble depreciation, reserve depletion, and interest rate increase. How much depends on the stringency of the economic sanctions, how successful Russia has been insulating the economy from financial sanctions. A jump in oil prices ($120/bbl is a figure I hear a lot of) will mitigate pressure by increasing foreign exchange earnings so, unclear what the net effect is.

Capital Economics notes:

- There are so many permutations that putting a number on the impact is nigh on impossible. For what it’s worth, we estimate that the sanctions imposed in 2014 reduced Russian GDP growth by about 1%. That seems about the right ballpark for the sanctions mentioned above (although the risks are probably skewed towards a bigger impact than 1%). There would be larger impacts in areas that are particularly dependent on Western goods and services (e.g. software, some capital goods).

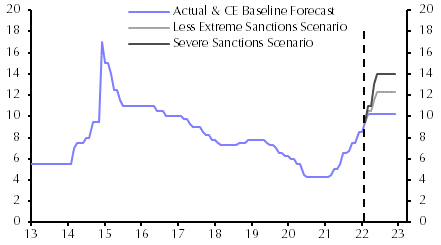

- As for the financial market impact, it looks like a situation somewhat more severe than the annexation of Crimea in 2014 (and subsequent sanctions) is now priced in to Russia’s financial markets. But even so, there is probably scope for further falls if sanctions are imposed due to the uncertainty about whether sanctions will need to be ratcheted up further in order to influence Russian policy. We suspect that the ruble could fall by another 10% in this situation, pushing inflation up further and prompting the central bank to deliver at least another 200bp of interest rate hikes, to 12.0%. (See Chart 2.)

I reproduce their Figure 2 below.

Source: W. Jackson, “Russia and the possible impact of sanctions,” Capital Economics, 22 Feb 22.

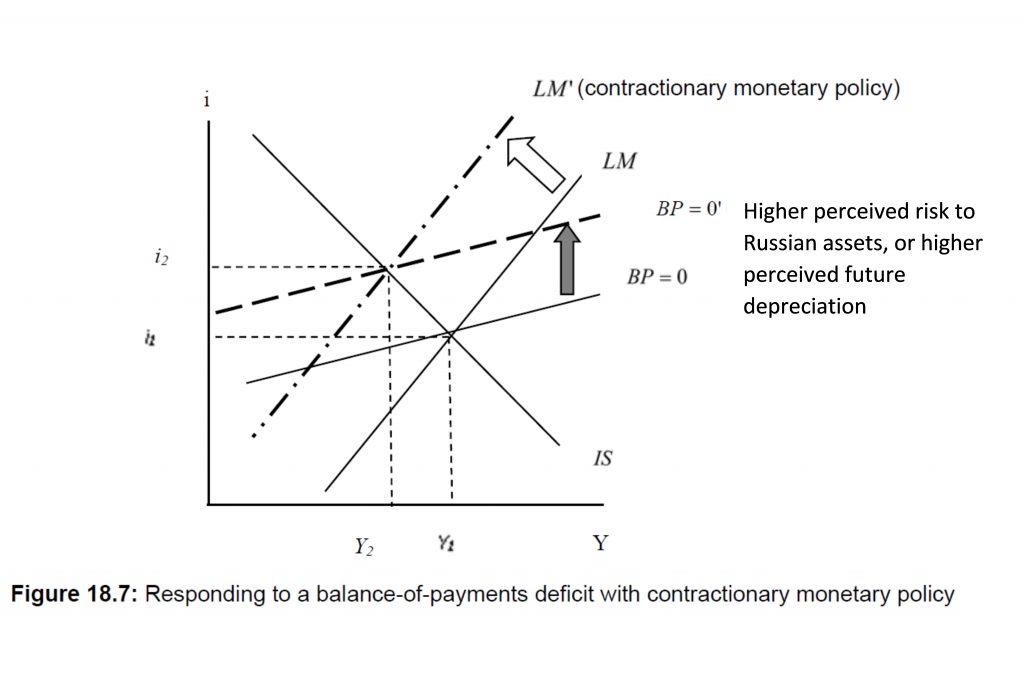

In other words, if the Russians don’t want to burn through their reserves in order to prevent a free-fall in the Ruble, the interest rate defense is the way to go (so this motivation is added onto the motivation they might have to squelch inflationary pressures).

Graphically, in Mundell-Fleming:

A higher interest rate will indeed stem a balance of payments crisis induced by heightened risk aversion, costs of transactions, or elevated expectations of currency depreciation — but at the cost of a recession (I’m ignoring complications from second-generation multiple equilibrium balance of payments crises a la Obstfeld, Jeanne, etc.). Oh, and higher US interest rates to deal with inflationary pressures would also exacerbate balance of payments challenges for Russia.

Update, 6:50pm Pacific:

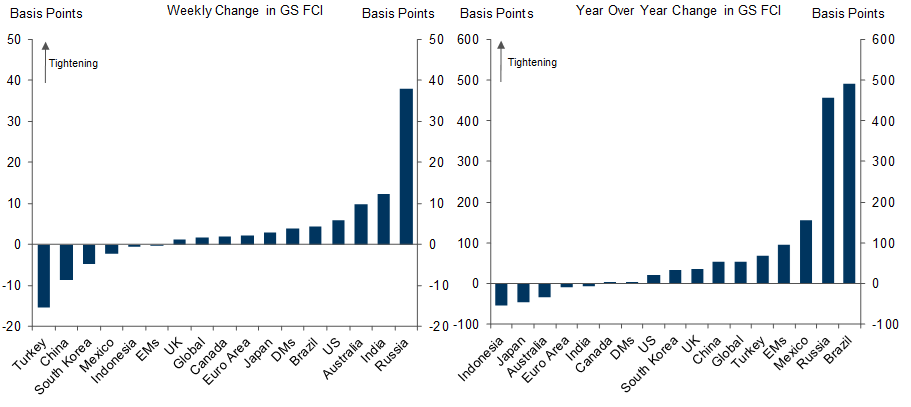

Goldman Sachs notes today that their Financial Conditions Index for Russia has already tightened 450 bps year-on-year…

Source: Hatzius, et al., Global: GS Economic Indicators: Russian FCI Is Now 450bp Tighter Than a Year Ago,” Goldman Sachs, 22 February 22.

“Our FCI is defined as a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP.” Source.

Update, 7:15pm Pacific:

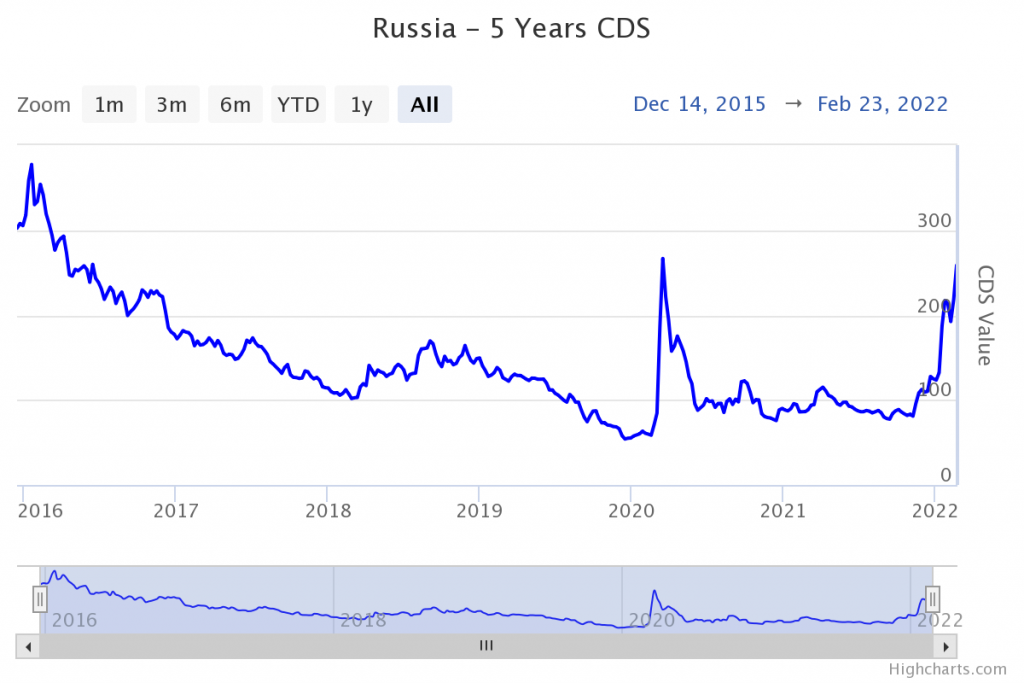

Risk as inferred from Credit Default Swaps on 5 year Russian government bonds are also up – although not back up to 2016 levels. Still a quick climb in recent weeks.

Source: WorldGovernmentBonds.

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Gross Domestic Product based on purchasing-power-parity (PPP) valuation * for Brazil China, France, Germany, Hong Kong, India, Indonesia, Japan, Macao, Russia, United Kingdom and United States, 2007-2021

2021

China ( 27,608)

United States ( 20,940)

India ( 10,181)

Japan ( 5,634)

Germany ( 4,843)

Russia ( 4,447)

Indonesia ( 3,530)

Brazil ( 3,438)

France ( 3,322)

United Kingdom ( 3,276)

* Data are expressed in US dollars adjusted for purchasing power parities (PPPs), which provide a means of comparing spending between countries on a common base. PPPs are the rates of currency conversion that equalise the cost of a given “basket” of goods and services in different countries.

https://fred.stlouisfed.org/graph/?g=KhoO

August 4, 2014

Real per capita Gross Domestic Product for Russia, Indonesia, Brazil, France and United Kingdom, 2000-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=KhoS

August 4, 2014

Real per capita Gross Domestic Product for Russia, Indonesia, Brazil, France and United Kingdom, 2000-2020

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=KRAn

January 15, 2018

Real Broad Effective Exchange Rate for Russia, Indonesia, Brazil, France and United Kingdom, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=LW3G

January 30, 2018

Total Reserves excluding Gold for Russia, Indonesia, Brazil, France and United Kingdom, 2007-2021

https://fred.stlouisfed.org/graph/?g=L2HN

January 15, 2018

General government gross debt as share of Gross Domestic Product for Russia, Indonesia, Brazil, France and United Kingdom, 2000-2020

we [used to] specify weapons circuitry to be shielded from ’emp’: electromagnetic pulse.

i am sure it remains a performance requirement.

your ’emp’ is safer.

Anonymous: Yes, I always thought this version of EMP was nicer than the other (EMP burst, eg)!

that’s what i thought this post was going to be about, too…i saw the headline and thought “oh-oh, one of Menzie’s crazy commenters thinks Russia is gonna nuke us”

I don’t mean to say that there isn’t legitimacy to the theory, but it makes me wonder how much am radio, leaning to the conservative side you listen to. This is a standby plot the radio shows are always pushing.

It pains me to see am radio dying, but even an old man (in spirit anyway) like me is slowly gliding over to podcasts. I don’t even know why it bothers me, it just does

Outstanding post. Like the graphs and relatively uncomplicated layout/explanation.

This is what leadership looks like:

https://www.cnn.com/videos/world/2022/02/22/president-joe-biden-russia-ukraine-response-sanctions-sot-vpx.cnn

This is what being a weak pathetic disgraceful loser looks like:

https://www.forbes.com/sites/nicholasreimann/2020/05/31/trump-hid-from-protests-in-underground-bunker-report-says/?sh=224e44a5d984

If Republican politicians aren’t busy insulting military generals with war time experience, they’ll note what the difference looks like.

Real GDP growth averaged 2.2% in the 2017-2019 period. That leaves out the initial effects of the oil crash and sanctions, as well as Covid. That’s about as generous as I can figure out how to be. Take 1% away and growth would fall to 1.2% (assuming I got the math right).

Add in 2020 and growth averaged 0.8%. Take away 1% for new sanctions and…well, you can figure it out.

Slower growth is not the end of the world, but it reduces resources available to Putin for making trouble. Making trouble is itself costly, because it diverts resources from other uses. Growth of 1.2% doesn’t feel quite as good when a big chunk goes to killing and destroying.

Sanctions should be as painful and prolonged as possible, aiming for a bigger impact than last time. Sanctions should also aim at specific harm to Russia’s economy such that GDP loss understates harm. Seizing bad guy’s money, cutting off access to technology, rapid and severe retaliation for cyber attacks, launching our own cyber attacks, every credit tool in the book, travel restrictions, embargoes. Prosecution of violators, large and small. Most of that is on the list. Even Nord Stream 2 certification has stopped.

Some commenters here have sald Russia will simply pivot toward China more quickly in response to sanctions. Well, yeah. And in a world in which Russia can be kept out of mischief by not imposing sanctions, that might be a pretty good argument.

Except that a gradual pivot toward China allows Russia to keep sucking money out of trade with the West while pivoting at a pace of Russia’s (and China’s) own choosing. Why is that good for us? Tack on the fact that Russia is financing adventurism with money acquired from the West while pivoting from the West, and I don’t see why we should wring our hands.

russia is also pivoting to the persian gulf with recent inroads toward selling arms to ksa, in addition to investments in iraq and iran petro infrastructure…… its petro experience is useful beyond its territory

If the west were to tell China that it is Russia OR us – Putin would be dumped like a hot potato. Russia may be able to offer China hydrocarbons at slightly discounted prices, but he cannot offer them a consumer market for their products.

The pulse runs both ways. What surprises me is that, after all the squawking about European banks’ loan exposure to Russia, it’s tens of billions for the most exposed. From Reuters:

“Banks in Italy, France and Austria are the world’s most exposed international lenders to Russia. Italian and French banks each had outstanding claims of some $25 billion on Russia in the third quarter of 2021, according to figures from the Bank for International Settlements. Austrian banks had $17.5 billion. That compares with $14.7 billion for the United States.”

These loans aren’t peanuts, but $25 billion for a rich nation’s banking system is manageable with official help. Total EU bank loan exposure to Greece during the worst of its financial crisis was around $95 billion (could be too low, working frommemory) and that’s over a decade of growth and inflation ago.

Uncredited and ING are heavily exposed both in Russia and Turkey, so I hope their regulators are of the empathetic sort.

Couple of tidbits that most of you probably already know –

Regular Russian troops are have entered the disputed territories in Ukraine and are approaching “contact lines” with Ukrainian troops.

Putin has declared that Russia will support claims by Russian-backed Donetsk and Luhansk Peoples’ Republics for their entire respective oblasts. That means Russia is supporting claims for Ukrainian territory held Ukrainian forces. Pretext for a shooting war.

It would be nice to think that Russia (Putin & Co.) would respond to economic pressure as France or Canada might, but that’s not too likely. Outside of short-term negative financial impact that sanctions on Russia will have in the U.S. (higher oil prices, higher inflation, stock markets dropping), what else might happen?

Will Russia:

• stop exporting oil to the U.S.?

https://www.msn.com/en-us/money/markets/how-much-oil-does-the-us-import-from-russia/ar-AATW9fE

• stop exporting natural gas to Europe?

https://www.npr.org/2022/02/09/1079338002/russia-ukraine-europe-gas-nordstream2-energy

• stop exporting strategic materials to the U.S. and Europe?

https://www.instituteforenergyresearch.org/international-issues/united-states-dependent-nations-critical-strategic-minerals/

• stop exporting potash (for fertilizer) to the U.S.? (admittedly a small portion of U.S. imports of this material)

• export more of all of those to China?

• create a military alliance with Iran and expand the one with China?

https://newspunch.com/russia-and-iran-join-forces-in-historic-military-deal/

• export military systems to Iran, Venezuela, and Cuba?

https://thehill.com/policy/defense/589595-russia-suggests-military-deployments-to-cuba-venezuela-an-option

https://www.miamiherald.com/news/local/news-columns-blogs/andres-oppenheimer/article258564108.html

• start seriously hacking our infrastructure systems?

https://news.yahoo.com/russian-invasion-could-reach-farther-232444833.html

Russia is not a simple adversary like the Taliban.

Bruce

Most of this list is no big deal with lots of it stuff that is happening anyway, such as exporting military systems to Iran, Venezuela, and Cuba as well as that tilt to China that you think is some big deal. The only one of these that actually looks like it might really hurt badly aside from some higher prices, is the natural gas to Europe matter. But do keep in mind that for a lot of these things, either they are going to lose money themselves by not selling stuff, or they may face retaliation. They might hack our infrastructure systems, but so far the US has not hacked back. I have little doubt that our csapability for hacking is as great as theirs and probably better. Too much of that stuff from them, and they can get it too, very big time.

You are just way too impressed by all these things Russia can supposedly do. Do keep in mind that for all their tanks, oil, and cyberhackers they have an economy the size of Spain’s, despite having more land area than any other nation.

Barkley,

I am not “impressed”, but I do feel that the picture being painted by the administration regarding sanctions is overblown and one-sided. Certainly, Russia has already been active with Iran, Venezuela, and Cuba to some extent, but you certainly must consider the potential for disruption that could lead to if they chose to disrupt the Middle East, and South and Central America which have some degree of instability already.

As to Russia’s growing economic and military cooperation with China, these sanctions can only accelerate that process.

I notice you did not comment about what U.S. imports from Russia and what disruption of that trade might mean. Can I take it that your silence on those matters means you don’t believe there will be much economic impact on the U.S. if Russia were to take the actions I listed? This is becoming a game of shi*ting in each other’s kitchens (and a nice distraction for Uncle Joe away from his domestic problems). Why wasn’t the UN invoked? Is that an organization to be brought into play when the U.S. wants to take military action against lesser adversaries?

One other point, the size of the economy isn’t really the issue, is it? Not when it comes to military capability and aggression. North Korea has demonstrated that a nation can be an economic junkyard and still a formidable military threat (sure, not much of a navy or air force, but a large army and those nuclear-tipped missiles catch your attention). You put too much stock in the ranking of economies when it comes to aggression and conflict. Besides, Russia has a lot more of what the rest of the world wants and needs for their economies than does Spain.

There is nothing the UN can do that cannot be prevented by the Security Council and Russia sits on the Security Council. You weren’t aware? ‘Cause I’ve seen this “why didn’t Biden go to the UN?” thing going around, but without ever mentioning the Security Council – obvious rube-bait and you seem to have fallen for it.

The U.S. took just shy of $30 billion in imports from Russia last year, against total U.S. goods imports of $2.9 trillion. For the math-challenged, that’s roughly 1%.

A large share of U.S. imports from Russia is oil, but only 7% of U.S. oil imports come from Russia, and in a global market, oil Russia sells elsewhere means oil from elsewhere becomes available to the U.S. So 1% probably overstates U.S. reliance on Russian exports.

All these figures are easy to find, yet you seem unaware of them. Such strong views based on so little knowledge. Who’d have thought?

I almost put up a couple links for him, and I thought “Naaaahh, what is the point?” I didn’t know and had to look them up myself because of all this nonsense being foisted on the people of Ukraine.

Macroduck,

Thank for you measured response. I realize that imports from Russia are in a very narrow band, but it I one that can affect most of the rest of our economy by triggering higher petroleum costs. No economic sanctions have affected any economy… yet. Russia has not yet retaliated. So the effects of that possibility haven’t been baked into world oil prices. Therefore this is still speculation:

https://www.thefiscaltimes.com/newsletter/20220222-Inflation-Could-Top-10-Ukraine-Conflict

Moses,

I understand the moral arguments against Russia and the societal arguments about Ukraine. I also understand the concept of economic sanctions as a deterrent… and maybe they will cause Russia to think again about what it is doing.

But the Russian oligarchy and Putin himself are sociopaths who don’t respond well or at all to moral, social, and economic arguments as has been demonstrated amply over the past two decades. This is about military power and geographic control. Start a war pretty much negates all of the other considerations. Russia would only respond with hesitancy if faced with a comparable counterforce willing to engage. The U.S. and the rest of NATO have no stomach for that. So, save yourself the effort to put up links about the damage being done to Ukraine. The damage to Ukraine is because of the West’s unwillingness to face down the Russian military when the Russians have a significant strategic advantage.

So, consider the so-called independent states a done deal and those territories will “request” to be annexed by Russia. The West has tacitly admitted that those territories are not worth an actual conflict with Russia.

@ Bruce Hall

Don’t tell me Putin is a sociopath, tell your personal hero:

https://www.cnn.com/videos/world/2022/02/23/putin-biden-mcconnell-trump-gop-haberman-borger-ac360-vpx.cnn

“All these figures are easy to find, yet you seem unaware of them. Such strong views based on so little knowledge.”

Am accurate depiction of all of Bruce Hall’s comments regardless of the topic.

Moses,

Tell my personal hero? That’d be my wife. She’s put up with me for 55 years. BTW, is pgl still creating sound and fury signifying nothing?

I am not wasting time with your parade of utter stupidity here except to note this line which you have basically repeated:

“I notice you did not comment about what U.S. imports from Russia and what disruption of that trade might mean. Can I take it that your silence on those matters means you don’t believe there will be much economic impact on the U.S. if Russia were to take the actions I listed?”

Beyond our imports of oil from Russia and a few precious stones – do you have an effing clue what else we import from Russia? Of course you do not as you are the most research impaired idiot ever. But if you were up to checking you would find out we do not import much of anything from Russia beyond oil and precious stones.

We have asked before for you to actually have a clue what you are babbling about before commenting but I guess we have set the bar too high for you.

Just in case you fail to open Moses link to the CNN about your “personal hero”, here’s the title

‘Trump praises Putin’s strategy in Ukraine’

Now I am not surprised as I knew years ago Trump was a traitor. And yet you work for him. Go figure.

pgl,

‘Trump praises Putin’s strategy in Ukraine’

LOL! CNN pulls a verb out of its collective butt and you hold it dearly as gospel. You and Chris have a lot of time on your hands, so why don’t you create the FNN … Fantasy News Network.

“But the Russian oligarchy and Putin himself are sociopaths who don’t respond well or at all to moral, social, and economic arguments as has been demonstrated amply over the past two decades.”

Let’s concede that little Brucey boy may have a wee point here. But if we replace Biden with Trump – the sentence is still valid. And Brucey boy works for this sociopath. Go figure!

If replace Putin with Trump. OK – I have read too much of Bruce’s garbage for one day as that rots one’s brain.

I have read too much of Bruce’s garbage for one day as that rots one’s brain.

LOL! Ad hominem non sequitur at its worst. Keep trying to actually contribute something to the conversation.

U.S. Imports from Russia of Crude Oil and Petroleum Products (by month): https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTIM_NUS-NRS_1&f=M that’s about 8% of our imports, up more than 10% year over year, more than double 2014 and up from almost nothing prior to 1999…

so why are we importing so much Russian oil? briefly and oversimplified: after our domestic supplies starting drying up around 1970, we began to import increasing amounts of oil from producing countries that were close; Mexico, Canada and Venezuela…..for the most part, those countries produce heavy sour oil, so we started configuring our new refineries to handle the type of oil they’d be getting….notably, the Koch Brothers built their refineries to handle Venezuelan crude…then along came Hugo Chavez, and later US sanctions against Venezuela…so US refineries had to look elsewhere for the types of crude they needed to process, and Russian Urals fit the bill for many of them//..if they stop importing Russian crude, they’ll have to find some near equivalent crude elsewhere, go back to Venezuela, or blend a couple different crudes from elsewhere to match what they are configured for…

here’s an interactive periodic table of over 100 different crude grades: https://www.spglobal.com/platts/plattscontent/_assets/_files/downloads/crude_grades_periodic_table/crude_grades_periodic_table.html

play with it a bit; you’ll see almost none of the light sweet grades we are producing (on the far left) matches the medium to heavy sour crude so many of our Gulf refineries were built for…some Mexican grades could be used, but Mexico is no longer exporting…lets see, maybe Iranian heavy…oh wait, not that either….but whatever they go with, i imagine there will be some extra costs involved in tweaking the refineries to use a slightly different mix than what they had been using…

Some interesting numbers:

https://www.atlanticcouncil.org/blogs/econographics/russia-and-china-partners-in-dedollarization/

Very nice. Thanks.

All part of Russia’s pivot East and China’s effort to make the Yuan a global currency.

Also: https://www.yahoo.com/news/china-state-media-editor-says-112634171.html

Waiting for Biden’s sanctions on that.

Openly traitorous to his own country. And with imbeciles like Bruce Hall and SmellyJerseyKopits walking around, why not??

https://www.cnn.com/2022/02/23/politics/donald-trump-vladimir-putin-joe-biden/index.html

Or even people with PhDs that think an invasion on a country’s northern border is “a military exercise”.

Trump has been a traitor even before we let this disaster in the White House.

Moses,

There has been no “invasion on the norhern border” and they were exercises, assuming you are talking about the Russian troops in Belarus. They were invited in by Lukashenka, and he has now agreed they are to stay for an extended period for more exercises because of the supposed “threat” to the eastern Ukraine republics. He has even offered to host Russian nuclear weapons. That most of his population is not happy about this is not surprising, but then he used Russian troops to help suppress massive demonstrations when he stole the last election to remain in power.

But this was the result of an invitation. That is not an “invasion.” Yes, if Putin decided to do Scenario 6, the full conquest of Ukraine, these troops will be the ones going for Kyiv, which might happen. But it has not happened yet, not an “invasion” yet.

YET

Awesome Addendum Menzie. You are the best. There’s some good ones out there, but if there’s a better blogger than you I haven’t found them/ Not sure if that counts as brown-nosing the host, but readers can perceive it any way they like. Krugman’s subscription only newsletter might give you a run for your money, but I can’t access that anymore, so……..