Interestingly, if implied forwards are to be believed, the Fed won’t be raising rates too fast.

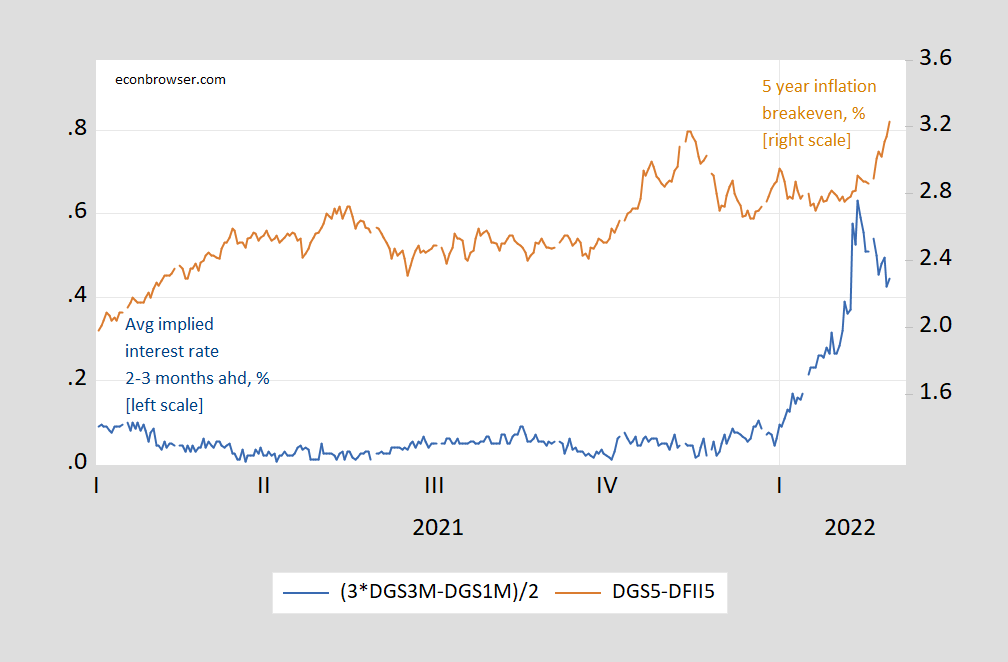

First, forwards as the 5 year inflation break even moves up.

Figure 1: Implied Treasury yield 2-3 months ahead, % (blue, left scale), and 5 year inflation breakeven, calculated as simple difference between Treasury and TIPS yield (brown, right scale). Source: Treasury via FRED, and author’s calculations.

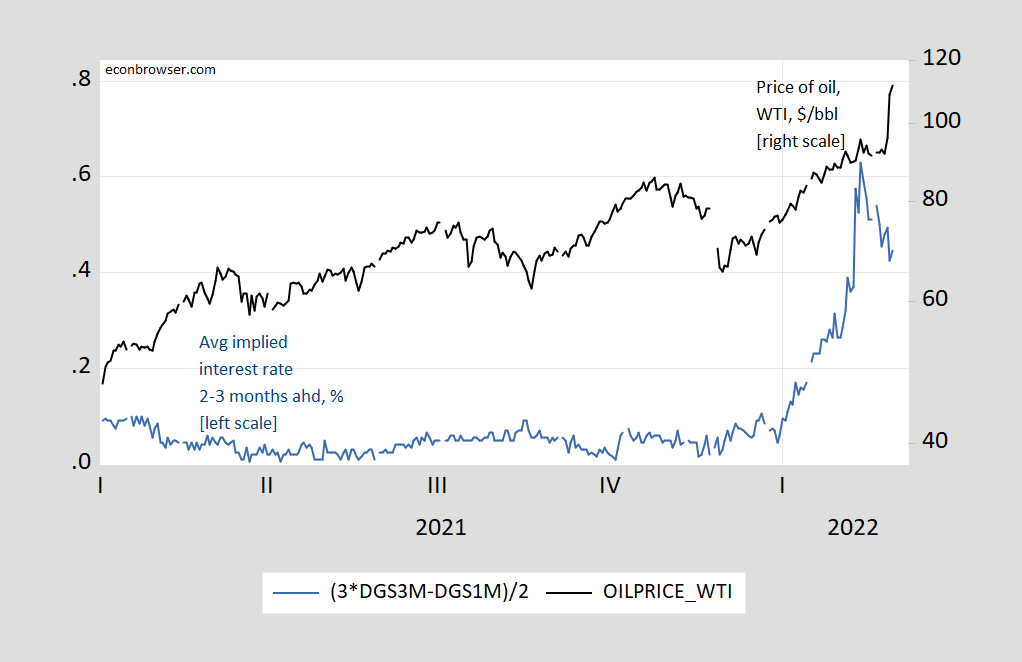

Second, forwards as the price of oil (WTI) rises.

Figure 2: Implied Treasury yield 2-3 months ahead, % (blue, left scale), and price of oil, WTI, $/bbl (black, right log scale). 3/1 and 3/2 observations are near month futures. Source: Treasury, EIA via FRED, NYMEX, and author’s calculations.

Of course, the calculation of forwards abstracts from any term premia, and the the calculation of inflation breakeven abstracts from term and liquidity premia (see this post).

Update, 6pm Pacific:

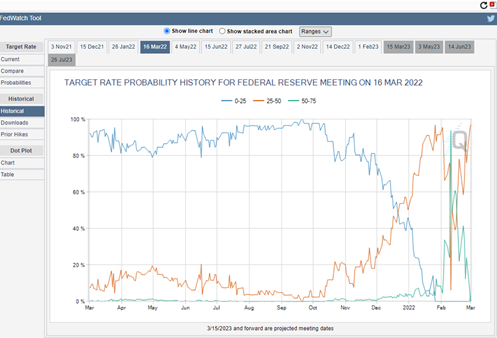

The CME Fed Watch utility shows how the probability of a 25 bps increase fell, as the probability of a 50 bps increase rose to a peak at February 10th, and then fell — even before the Russian invasion of Ukraine.

Source: CME FedWatch, accessed 3/2/2022.

While credit conditions have tightened enough to get the Fed’s notice, swap spreads – a measure of financial market stress – are behaving pretty well:

https://www.google.com/amp/s/www.nasdaq.com/articles/u.s.-short-term-funding-stress-gauge-rises-libor-ois-spread-hits-highest-since-april-2021%3famp

Spread widening is somewhat inhibited by gobs of Fed liquidity, but in a real scare, central bank liquidity has a hard time assuring market liquidity. Right now, market liquidity is good. We’ll, outside of Russia liquidity is good.

《in a real scare, central bank liquidity has a hard time assuring market liquidity.》

Aren’t the Fed’s actions and positive market reactions indicate that the market is indeed implicitly insured by central banks, who deploy their balance sheet expansion ability to act as value buyer?

[CORRECTED VERSION]

《in a real scare, central bank liquidity has a hard time assuring market liquidity.》

Aren’t the Fed’s actions and positive market reactions in 2008 and 2020 indicatative that the market is indeed implicitly insured by central banks, who deploy their balance sheet expansion ability to act as value buyer?

No. That idea is an abuse of the notion of insurance.

The U.S. economy is the focus of Fed policy. The Fed, as a financial institution, has only financial tools with which to affect the economy. Fed action to support the economy through financial market intervention can give the impression to foolish people (say, for instance, people who lose large sums in financial market transactions) that the Fed “insures” financial markets.

Lehman’s collapse is prima facie evidence that the Fed does not insure financial markets. The loss of $1 trillion in MBS value and $8 trillion in the value of corporate equity holdings, a 57% drop in the value of the S&P index and $4.2 trillion in losses of home equity also offer strong proof thar no insurance, implicit or otherwise, existed.

You might want to look up the word “insurance”. It doesn’t mean what you seem to think it means. Nor do you seem to know what a “value buyer” is. Amd there are grammar problems, as well, which kinda suggest you really aren’t putting the little grey cells to work.

Intelligent discussion requires at least some understanding of the meaning of words. I realize intelligence is a lot to ask of a guy whose entire motivation in life is his failure in the financial markets. Some of us, though, are motivated by curiosity and an interest in the world. You’re just in the way.

https://www.silive.com/news/2022/03/sending-a-message-to-russia-newark-council-votes-to-revoke-licenses-of-lukoil-gas-stations.html

New Jersey is shutting down the local 3rd party retailers under the name Lukoil. So if this is where you purchased gasoline – you need to find another station. Now support for Ukraine is great but is this hurting the Russian parent corporation or just local US business owners?

https://finance.yahoo.com/quote/LUKOY?fr=sycsrp_catchall

It seems that Lukoil had an incredibly profitable year in 2021 but its stock price has plummeted in 2022. Go figure!

Lukoil is Russia’s 2nd largest oil company with Gazprom being the largest. Putin is a major shareholder in the latter. Gaxprom’s 2021 profits were also high but its stock price has also recently plummeted:

https://finance.yahoo.com/quote/OGZPY?fr=sycsrp_catchall

Could it be that the sanctions are putting a real hurt on Putin and his rich cronies?

In an alternative universe imagine the effect of John Bolton back in 2004 calling the 2003 invasion of Iraq a mistake. OK, Bolton did not have the guts to do so. But in 2022 with Putin’s invasion of Ukraine – one of the Kremlin advisors had done just that:

https://news.sky.com/story/ukraine-invasion-kremlin-policy-adviser-reveals-his-shock-over-vladimir-putins-decision-to-invade-12555163

While the U.S. and oher developed economies have increased inflation worries due to Russia’s attack on Ukraine, developing economies have bigger worries. Looks like Egypt is struggling with nascent capital flight:

https://www.reuters.com/markets/europe/egypt-sees-exodus-dollars-since-start-ukraine-war-bankers-2022-03-02/

Egypt relies heavily on Russia and Ukraine for wheat imports:

https://www.world-grain.com/articles/16546-egypt-seeking-alternatives-to-wheat-from-russia-ukraine

In fact, Egypt and Russia had created a join venture late last year to import more Russian wheat to Egypt, beginning in the current quarter. Oops.

U.S. rate hikes generally draw money out of developing economies. Egypt has already suffered an acceleration of inflation, food-price driven. Eqypt and countries in similar circumstances don’t need the side-effects of Russia’s war making things worse.

What if the Fed sold inflation swaps to manipulate breakevens?

In other geopolitical inflation news, Section 301 rides again:

https://www.marketwatch.com/story/biden-administration-readies-confrontation-with-china-over-trade-and-industrial-policy-11646236245

Over the last month*, Urals oil (a medium sour grade) has moved from Brent-$2 to Brent-$12. However, over the same period*, Brent went from $90 to $110. (It’s even higher now, but I’m trying to match the time frame for the diff and the Brent and have less data on the diff.) So, basically, Urals oil is still getting to market. Mostly, it’s heading to Asia (displacing other crudes, which can now go to Europe or other places…oil is pretty fungible.) The new diff is pretty large, more than the increased transport cost to Asia. But buyers also need to be compensated for risks with the financial system and to shipping in the Baltic (and even worse shipping insurance costs in the Black Sea). But net, net, the oil is moving and Russia is actually getting a higher price (~$98 versus ~$88) than they were a month ago.

Of course natural gas can not be moved around so easily, to new markets. But gas is still flowing strong in Nordstream 1. And even through (and to) the Ukraine. It is sort of one of the paradoxes that we have a war going on and the gas is still flowing. The Ukrainians understand that turning off transit would turn their European allies against them. (Although they have this right, it’s their territory.)

*Mostly in last week.

https://www.nytimes.com/2022/03/02/world/europe/nato-weapons-ukraine-russia.html

The title of this NYTimes article is partly good news and partly pathetic. The good news is that NATO is sending the brave Ukraine military the tools they need to fight off Putin’s invasion. But what effing jerk put concern that Putin would see this aid as widening the conflict? Eff Putin if he thinks that.

I sort of get saying no to enforcing a no fly zone but maybe we should be demanding even more action not less – as in a no fly zone. If Putin wishes to attack NATO forces over this – NATO should level the Kremlin. Putin is the monster here not NATO and certainly not Ukraine. If Putin wants World War III give it to him and end the life of this devil.

Of course I seriously doubt Putin really wants that so it seems to me that his bluster is just that. Call his bluff.

pgl,

I have not been constantly beating the drum on it, but I came out for a no fly zone several days ago and nothing has changed my mind. If anything, with the Ukrainian government more and more insistently calling for it, my view is simply becoming more reinforced, especially after this latest outrageous Russian attack on a major nuclear power plant in Ukraine.

I’m looking forward to all the deep journalistic coverage we’re going to get from Ekho Moskvy over the next 6 months, aren’t you?? I plan on giving updates so stay tuned to this station. The strength of the “independent” journalism of Ekho Moskvy will not be broken!!!!! Unless……..

“Owned by gas giant Gazprom’s media arm, and helmed by veteran editor-in-chief Alexei Venediktov, the station maintained a delicate balance between remaining relatively free and uncensored, and keeping up its connections with the Kremlin.

Venediktov’s own ties to the political elite — including his role in promoting a controversial electronic voting scheme for the State Duma elections last year — saw him reviled by much of Russia’s anti-Kremlin opposition.”

https://www.themoscowtimes.com/2022/03/03/russian-liberal-radio-mainstay-ekho-moskvy-closes-after-pulled-off-the-air-a76730

Will life go on without the Kremlin’s mouthpiece for fraudulent voting systems?? Stay tuned here next week, as Barkley Junior takes the stage to defend the good Mr. Penguin from the evil Batman.

https://apnews.com/article/europe-russia-elections-voting-moscow-c3f1f8d3927a1a34cc402c8b3af9468c

Moses,

Let me see. You are somehow trying to make the case that I misrepresented the role and position of Ekho Moskvy here even now, and with another idiotic round of emboldened letters suggesting that yo have been drinking excessively again and so are shouting at the wall in an empty room? Wow you are really seriously effed up.

So, just to remind everybody for the record, when I mentioned Ekho Moskvy originally here I noted that it was a matter of interest to watch how independently it was acting in its reporting. I noted that it was important that in recent years and especially in more recent months it had been veering less and less from the official Putin line while still maintaining some independence. While not noticing the trend I reported on, what you report here in these emboldened letters essentially agrees with what I said, that it was semi-independent, but this source seems to be unaware of any change in its position, only that indeed it has now been closed. But I noted this trend as an important indicator of Putin getting more and more authoritarian, something important to note, even if you were too effing stupid to figure this out, or too fixated on trying to score a gotch point that was not there and so just making yourself look even more like a hopelessly drunken pathetic idiot.

And indeed the fact that Putin has now shut it down is the bottom line proof that it has been independent, certainly too independent for Putin’s taste, despite its drift to being less so recently that I reported, but no other source you could get your hands on could report. They are too ignorant. I have been the one tracking this more closely. Your sources have been worthless on this important matter.

Ironically, the social position of those who listened to E.M. rather resembles that of those who listen to that notoriously partially government-owned radio network here in the US, NPR. Do you listen to NPR? I do sometimes. But it is notorious for being favored by liberal-minded urban intellectual types. Well, that is who listened to Ekho Moskvy in Russia, and now they have nothing to listen to except outlets that just spout the increasingly bizarre state line that Putin hands out, now lying at a level not seen since there was still a USSR. One of those missing it is my wife’s mother, who is indeed quite upset about its closing. But that is quite fine with you, worthless scumbag, Moses, I am sure.

The bottom line on this, Moses, is that you have made a totally foolish stink about this and have only made yourself look like a totally ignorant and disgusting moron. I have been completely right on this matter all along and made useful comments on it. You have attempted to somehow claim I was misleading people, but you were wrong wrong wrong even though you do not admit it and insist on getting drunk so that you can stand on a table top while shouting out your misleading drivel in emboldened letters yet again about it. Got it?

https://www.marketwatch.com/story/pelosi-says-she-supports-senate-bill-that-would-ban-imports-of-russian-oil-2022-03-03?siteid=yhoof2&yptr=yahoo

This proposed US ban on importing Russian oil is a nice symbol but we do not import much oil from Russia. Now if all other nations including China and India would follow this lead, that would crush Russia.

Somewhat better news is that Iran has decided to supply more oil which will mitigate any increases in oil prices.

avg/composite about 600kbbl/day

just under 10% of total imported crude or ~1/6 of net imported crude according to how you measure (25 feb 2022 inv rep)

a modest recession or a new c19 variant can destroy that demand!