The economy is still likely to grow, according to at least the 10yr-3mo spread. Less definitive indicator from the 10yr-2yr. Expected inflation rates have stopped moving up, and so too have implied future rates 2-3 months ahead; in fact they’ve both fallen in recent days. (For what analysis, rather than markets, think about inflation, see Jim’s Monday post; on recession, see Jim’s Wednesday post.

Figure1: Ten year – three month Treasury spread (blue), and ten year – two year Treasury spread (red), in %. NBER defined recession dates shaded gray. Source: Treasury via FRED, NBER, and author’s calculations.

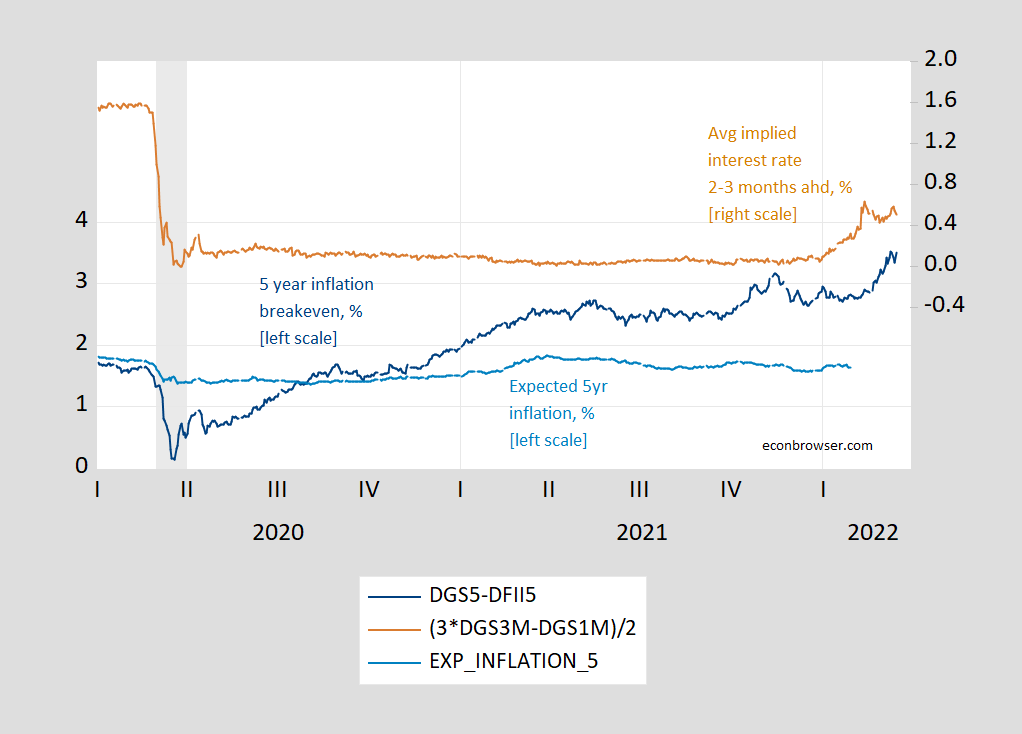

What does expected inflation look like, and how are interest rates seen as moving in response?

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (dark blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (light blue, left scale), 2-3 months forward interest rates (brown, right scale), all in %. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW), NBER.

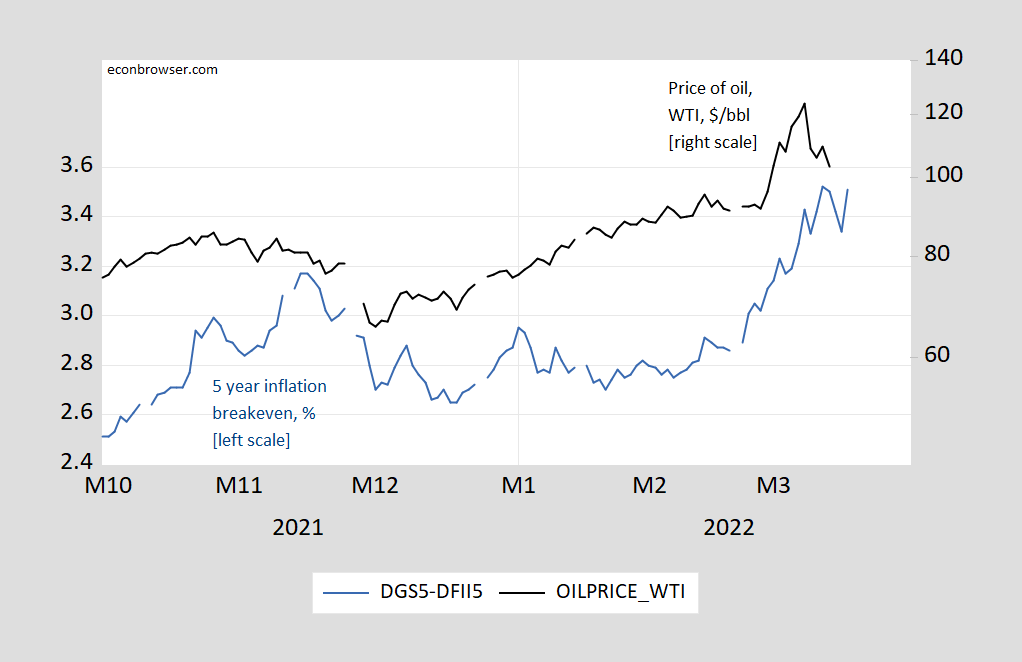

It’s hard to see how the 5 year inflation breakeven is evolving, but it’s stopped rising, as oil price have retreated.

Figure 3: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield, % (blue, left scale), and price of oil, WTI, $/bbl (black, right log scale). Source: Treasury and EIA via FRED.

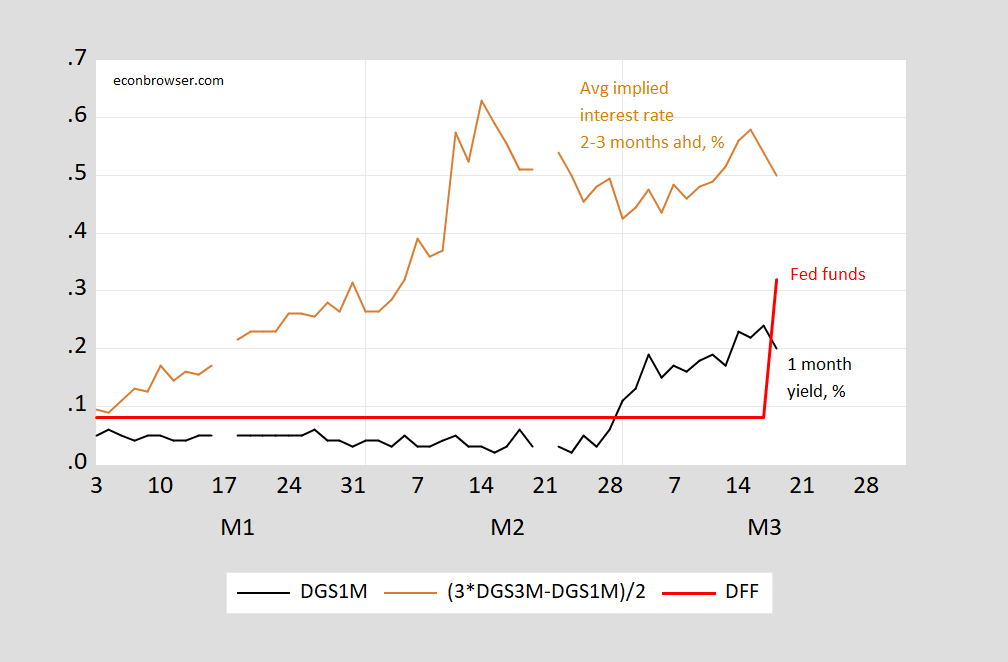

Interestingly, as the Fed funds rate was increased, the 2-3 months forward interest rate decreased (although this could be because of the fall in oil prices).

Figure 4: Fed funds rate (red), one month Treasury yield (black), 2-3 months forward interest rates (brown), all in %. Source: FRB via FRED, Treasury, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW).

Jim presents his overview of “Sanctions, energy prices, and the world economy” in this video.

So recession is locked in then?

NO ONE said that. But do troll on as it is ALL you do.

Oh noes, did Lucy just get whooshed?

You should date Bruce Hall as he seems to be desperate.

The FOMC’s expectations of economic growth for the year were quite muted relative to projections from the committee’s prior meeting. The median projection was down from 4% to 2.8% for GDP in 2022 without any change in the outer years. Of course median projection for Core PCE was also revised quite a bit going from 2.7% to 4.1% for the current year.

Which is probably a mistake.

Jim Hamilton rocks,

Menzie, I gave a long diatrIbe about how I foresaw the natural gas situation with Germany going. It was about 4 posts or something back, I’m drinking NOW, ok, did I do seomthing to piss you off??? Because my thoughts on natural gas in Germany. were NEEAR genius

https://econbrowser.com/archives/2021/07/covid-19-forecasts-one-year-ago-and-today#comment-256496

I made that comment here on the blog, 7 months ago. Am I a dumb guy?? Often times I am a dumb guy. Once in awhile I said something pretty clever, PLEASE GIVE ME MOTICE FOR THOSE RARE TIMES I SAID SOMETHING PRETTY CLEVER, PLEASE

Did I really just go down that rabbit hole, and do I actually feel compelled to give you the “motice” you asked for?

Will somebody please color me shocked that Lucy was dead wrong on that, as usual?

Do I feel your pain?

https://www.msn.com/en-us/news/politics/mccarthy-says-madison-cawthorn-is-wrong-about-zelenskyy/ar-AAVfa0x?ocid=msedgdhp&pc=U531

NC Republican Congressman Madison Cawthorn is the most vile of the Putin puppets as he is spreading Kremlin disinformation about Zelensky. Of course Kevin McCarthy has to call out this traitor but when asked if McCarthy will support Cawthorne’s reelection – he said he would. Kevin McCarthy is a disgusting joke.

Term premium, while volatile lately, has-been trending upward. Nearly back to zero – Ta Da!

That’s partly in response to the Fed’s tapering, and now the stated intention of reducing the size of its balance sheet. I don’t know how large that effect is, but any given yield spread today is a different signal than the same spread before tapering began.

However you read it, the curve is signaling a higher risk of recession than at any time since growth resumed after the Covid collapse.

No it isn’t. The curve has tightened because said cycle is moving into later stages. When debt expansion rises and begins to backfill demand. See 2017-19 and the close to collapse of subprime lending.

You aren’t explaining how yield spread works as a signal. You’re trying to explain it away.

I don’t even know what “backfill demand” means, and I’m not sure you do either. Please, with better clarity, tell us how you tuink this works.

The pandemic of Omicron in China is the new monkey wrench. The autocrat in Russia has been unable to adjust his strategy to a new reality. How will the germaphobe autocrat in China adjust to a new viral variant that is not nearly as amenable to the approach successfully used against previous variants. Massive lockdowns in China could have very serious consequences for the world economy in the short-term and for Chinas in the long-term.

Nope. Massive lockdowns they are not. Try harder.

You’re quibbling over the meaning of “massive”. Anyone who wants to can find out how extensive China’s lodkdown is, so we don’t really need you to decide what “massive” means.

Meanwhile, a heck of a lot of professional forecasters agree with Ivan. You’re nobody.

Only 37 million under lockdown. And if China follows its pattern of locking down where cases are spreading, more to come. So, please, please let’s all spend ink quibbling over the meaning of “massive.”

But then, that’s mostly what the bot does. (S)He declares that others are wrong in a dismissive way, without any evidence. Cheap internet troll trick.

Furthermore, the effects are not just the direct “parts missing” effects. It is also the effects of “can we trust China to be in our supply chain if they can suddenly lock down like that”. The original case numbers and lockdowns (topping at about where they are now) had a lot of companies, depending on China, losing a lot of money. I mean “fool me once shame on me – fool me twice…well you can’t fool this fool again”.

Not yet. But if Omicron keeps spreading they will either change approach or have massive lockdowns.

Speculation in the press is that a negotiated settlement is now possible for Ukraine. That is a natural assumption, given Turkey’s efforts and what Turkish official are telling reporters, along with Russia’s poor military performance.

Take that notion and rub it up against the latest expansion of Russian aggression into western Ukraine, and it seems likely Putin is trying to kill as many people as he can to put pressure on Zelensky to give ground in negotiations. Puin is killing people in order to smear lipstick on his pig.

Is it too ironic that Erdogan, who fights inflation with indexation, contrary to all economic orthodoxy, is the one to save our economy from the irrational expectations of Putin, whom market forces should never have let rise to such a powerful position in the first place because he ignores economic incentives so brashly?

What explanatory power does economics bring to the table, really?

You sure you know he meaning of “ironic”?

More to the point, you sure you know how to make a valid argument? Erdogan’s mediation effort has nothing to do with his failed effort to contain Inflation. And thank goodness for that.

biden will show putin! no matter how many dead ukraines it takes to get to what biden refused in january

I think you’re mistaken about Biden’s position. Some guy named Zelensky is president of Ukraine.

how much of nato war stocks will be captured when putin rolls in to zelenskiyy’s domain?

if zelenskiyy’s cut off he has no title.

Anonymous,

Listening or watching too many Putin bot sources again. The only place Russian forces seem to be moving forward currently is maybe into the city of Mariupol, which has amazingly enough still not fallen, despite over 80% of its structures reportedly damaged by bombardment. Otherwise, there are reports of Russian forces actually being pushed backwards in certain locations near both Kyiv and Mykolaiv, the latter making it less likely that Odessa faces a serious assault. Oh, there has also been some small movement in the Donbas.

Here is a very serious bottom line: Russian forces have not conquered even a new small-sized city since March 1 when they took Kherson. That is nearly three weeks now. So, sorry, Anonymous, it does mot look like Zelenakyy is abou to be “cut off” or that piles of “nato stock” wil be captured, certainly not anytime soon and increasingly likely never.

Just how stupid are you anyway?

Just to pile on, since you have opened yourself up so blatantly, Anonymous, Russian forces have failed to take even the three major cities they have been attacking that are near the northern Ukrainian border: Kharkiv, Sumy, and Chenihev. Heck, that third one was supposedly taken on like the second day of the invasion, but it turns out that it remains unconquered as of now, despite thousand pound bombs being dropped around it. And Kharkiv is a totally Russian-speaking city only 35 miles from the border that nearly became the capital of yet another separatist republic. But here it is, after weeks of being surrounded and bomarded, and Russian troops have not even been able to enter it.

Correction: Khakiv only 25 miles from the Russian border, close enough it can get bombarded from across the Russian border. But, again, Russian troops have not even been able to enter it, despite massive ongoing bombardment that has involved damaging Russian cultural centers like the famous Russian Orthodox Cathedral in its downtown.

I know the russians want to make him out to be illegitimate, but zelensky is the democratically elected president. 15000 russian soldiers have died so far. And thousands more russian soldiers will die if this unprovoked war continues. We will make sure russian mothers are reminded of this senseless loss for generations to come. The russians are following a madman right now. It is time that we encourage regime change in russia, today.

You have a very “1984” way of expressing things. No NATO troop, tanks, aircraft or ships are in Ukraine. So the idea that NATO would lose armament in the case that Russia figures out how to make progress against Ukrainian forces is nonsense. It is obviously Russia that has lost a chunk of its arsenal. Russian losses are nearing 15,000 soldiers, 100 fixed-wing aircraft, 120 helicopters, 500 tanks, 1,000 pther vehicles and 230 artillery pieces, alon with sundry other stuff. Yet there you are, writin about “when” rather than “if” Zelensky loses. You really ought to pour off the scum before you drink any more coolaid.

When Russia enters Zelensky’s doman? Well, they’ve already entered his country, starting in 2014. That was before Zelensky ever had a title, but the title, and more importantly the legitamacy and leadership role, remain in his hands. Not sure a democratically elected president has a “domain.”

Anonymous,

Following on Macroduck’s point, there are now reports that the Ukrainians are increasingly supplying themselves with armor that they are obtaining from attacking Russian supply lines, especially in the north. It seems the Russian soldiers in these supply lines totally lack any morale. Blow up the lead vehicle, and many of them will promptly get out of the following ones and run away.

So, if somehow Russia was able to “cut off” Zelenskyy, what they might get would not be a bunch of “nato stuff,” but maybe s bunch of their former armor that was rebranded and reconfigured to be used by the Ukrainian milittary.

Putins demands in January were neither Biden’s to refuse nor accept. Putins demands were rejected by Ukraine and can only be accepted by Ukraine. In contrast to Putin we in the west accept that democratically elected officials of a nation has the exclusive rights to bargain away their territory, laws and rights.

More likely Putin needs the settlement more than Ukraine. His given terms won’t be as good as February.

Yeah, SARS-CoV-2 currently threatens the level of economic activity in (and supply lines from) both China (omicron, apparently) and Europe (deltacron) and soon will threaten our output again. Add to that Putin’s War of Brutality (now! with even more war crimes!) contributing to slow European growth, and we could have the double problem of persistently high import prices (those darn supply lines) and reduced foreign demand for our exports. Anyone up for Stagflation, the Reboot?

Everywhere the Fed looks, there be dragons. I’m not sure they could pay me enough to have Jay Powell’s job right now.

Deltaomicron is a nothing. When will you get that has been around for months and using cases on a rising Sun angle is your fault. Especially when Europe inflates actual rates.

The problem in both China and Europe is Omicron 2.

Not clear how much of it is in China yet, but it will get there and “push through” their lock-down strategy. Vaccinations in China will help keep hospitalizations down. But the lock-downs will be as detrimental to the world economy as it is inefficient as a public health tool against Omicron 2 infections. Chinas autocratic dictator is a germaphobe and it may take a long time before he accepts the reality that the Danish approach is what he needs against Omicron 2.

Europe is facing the problem that although many got their 3’rd shot, that happened so long ago that their protection against infection (and ability to spread the virus) is waning. I think Europe is done with lock-downs, so economically its just the effects of people staying home (with the disease or due to exposure). At the start of Omicron in Denmark they decided to just let it rip and only institute restrictions if hospitalizations got out of hand (that never happened in a country with 80% fully vaccinated and top notch health care). At the peak they had almost 1% of the population diagnosed every day, now they are down to 20% of that peak, and still falling. US will likely follow that path , but by default not by design – with a much higher mortality because we have a lot more people who are not vaccinated.

It looks like the decline in new cases has halted and may be starting back upwards again, 32,000 seven day average compared rto 31,000, and daily deaths seem to still be holding at over 1000 per day. Biden’s budget just cut the remaining Covid aid funds, probably a bad idea. Given that the lag from case inreases in Europe to US has sometimes been about two weeks we may be about to see an unpleasant surge about to hit again. As it is, the majority of new cases are still of the Omicron 1 variety, so 2 has not taken off yet, but may be beginning to creep in more.

It’s down to 27000 and deaths will keep falling. 1000 a day???? Nope. You don’t respect reporting artifacts or lags in reporting.

Okay, Lucy, start screeching about this:

https://finance.yahoo.com/news/larry-summers-warns-interest-rates-225331167.html

The problem is simple, Summers says: To beat inflation, the Fed has to raise interest rates higher than the rate of inflation, which he thinks will persist at levels above the Fed’s 2% target rate.

“If you want to tighten policy you have to raise interest rates by more than inflation went up,” Summers said. “We’ve got to raise interest rates by more than 4 percentage points, we’ve got to raise them by 4% to stay neutral and we probably have to raise them more than that.”

Unlike Fed chair Jay Powell, Summers doesn’t think inflation will fade on its own, at least not in the near term. “I don’t think we can count on the transitory inflation view,” he said.

And Summers is convinced that more inflation is on the horizon. “Perhaps we’re moving in the right direction,” he said, “but I think there’s a long way to go, and I don’t think the Fed has really done all that will be necessary to preserve its credibility in the face of the substantial inflation that I think is likely to come to us.”

Fed officials call for bigger hikes: St. Louis Federal Reserve President James Bullard, the lone dissenting vote in this week’s decision to raise short-term rates by a quarter-point, has been pushing the central bank to move more aggressively on inflation, and on Friday said he thinks the Fed needs to raise its interest rate target for the year.

“I recommended that the Committee try to achieve a level of the policy rate above 3% this year,” he said in a statement. “This would quickly adjust the policy rate to a more appropriate level for the current circumstances.”

Bullard also wants the bank to raise rates more rapidly, by half a percentage at a time, at least initially. Federal Reserve Governor Christopher Waller seconded that view Friday, telling CNBC that although he voted for the smaller quarter-point hike this week based on geopolitical concerns, bigger hikes should be on the table at future meetings.

“The data’s basically screaming at us to go 50,” Waller said. “I really favor front-loading our rate hikes, that we need to do more withdrawal of accommodation now if we want to have an impact on inflation later this year and next year. So in that sense, the way to front-load it is to pull some rate hikes forward, which would imply 50 basis points at one or multiple meetings in the near future.”

Gee Bruce – watching Faux News has left you totally in the dark. The FED has announced its intentions and they agree with Summers. Of course a know nothing like you has no clue what Summers said.

Lucy, good retort! You managed to turn agreement into a snarky reply.

Today’s (3/21) remarks by Powell:

The Inflation Outlook Has Deteriorated Significantly

Turning to price stability, the inflation outlook had deteriorated significantly this year even before Russia’s invasion of Ukraine. (Yeah it was Trump’s fault)

The rise in inflation has been much greater and more persistent than forecasters generally expected. For example, at the time of our June 2021 meeting, every Federal Open Market Committee (FOMC) participant and all but one of 35 submissions in the Survey of Professional Forecasters predicted that 2021 inflation would be below 4 percent. Inflation came in at 5.5 percent.2

For a time, moderate inflation forecasts looked plausible—the one-month headline and core inflation rates declined steadily from April through September. But inflation moved up sharply in the fall, and, just since our December meeting, the median FOMC projection for year-end 2022 jumped from 2.6 percent to 4.3 percent.

Why have forecasts been so far off? In my view, an important part of the explanation is that forecasters widely underestimated the severity and persistence of supply-side frictions (yeah, Trump shut down all of those states’ economies triggering supply problems from overseas), which, when combined with strong demand, especially for durable goods, produced surprisingly high inflation.

The pandemic and the associated shutdown and reopening of the economy caused a serious upheaval in many parts of the economy, snarling supply chains, constraining labor supply, and creating a major boom in demand for goods and a bust in services demand. The combination of the surge in goods demand with supply chain bottlenecks led to sharply rising goods prices (figure 4). The most notable example here is motor vehicles. Prices soared across the vehicles sector as booming demand was met by a sharp decline in global production during the summer of 2021, owing to shortages of computer chips (yeah, Trump forced Taiwan to shut down chip production). Production remains below pre-pandemic levels, and an expected sharp decline in prices has been repeatedly postponed.

Many forecasters, including FOMC participants, had been expecting inflation to cool in the second half of last year, as the economy started going back to normal after vaccines became widely available.3 Expectations were that the supply-side damage would begin to heal. Schools would reopen—freeing parents to return to work—and labor supply would begin bouncing back, kinks in supply chains would begin resolving, and consumption would start rotating back to services, all of which could reduce price pressures. While schools are open (no thanks to Trump’s people who wanted schools closed so the kids could be put to work in sweatshops), none of the other expectations has been fully met. Part of the reason may be that, contrary to expectations, COVID has not gone away with the arrival of vaccines. In fact, we are now headed once again into more COVID-related supply disruptions from China (which is nobly trying to save the world from another wet market variant). It continues to seem likely that hoped-for supply-side healing will come over time as the world ultimately settles into some new normal, but the timing and scope of that relief are highly uncertain. In the meantime, as we set policy, we will be looking to actual progress on these issues and not assuming significant near-term supply-side relief.

You think I agreed with any of your usual pro- Putin BS? Not quite troll.

BTW Brucie – a few others such as Ivan, Macroduck, and 2slug are calling you out as the moron and liar that you have always been. Do try answering Macroduck’s insightful questions sometime. Snicker.

BTW – Powell’s comments are insightful but some troll had to inject his own usual word salad. What is the matter Brucie? Did it finally sink into your limited little brain that Powell was contradicting your previous lies?

Summers has been so wrong so many times that he no longer can be taken serious. If Summers would tell us why he doesn’t “think we can count on the transitory inflation view” we may take time to listen to him – otherwise its Jay Powell (who actually has explained why he think it is transitory). The worst thing you can do is to overreact to a transitory inflation event. It is impossible to flip the other way fast enough to prevent a Fed induced recession.

Well, Summers was right last year that inflation was not as transitory as many of us thought it would be. But that he was right then does not mean he is now. Yes, it looks like inflation will probably accelerate more in the next few months between the effects of the Ukraine war and the Omicron 2 outbreak in East Asia. But those effects are likely to ease over the next d=few months, and other sources of supply chain disruptions will have dissipated or declined. Furthermore, much of the extra ARP spending that had Summers worked up last year and may have added a point or two to US inflation has largely stopped, and indeed the Fed is raising interest rates and changing its balance sheet policy. He could easily be wrong that it will take a recession to slow the inflation. Jim Hamilton here seems to disagree with him.

Can’t wait to commodity traders are forced to unwind positions???? 48$ oil by June??? Putin once again shows he is a idiot with Ukraine politics. The deal he will get now, won’t be what it was in February.

Fwiw, the war is providing U.S. Stimulus….as war always does.

Congress has authorized $13.6 billion in spending to help Ukraine, which amounts to 0.065% of U.S. GDP.More than that will be spent because of arms transfers, but that gives an idea of the magnitudes we’re looking at from the “stimulus” of war.

The latest FOMC summary of economic projections cut 1.2 percentage points from the 2022 GDP forecast. You’re focused on fly speck and ignoring the real action.

Then another bunch of rebuilding from the war. Try harder.

Well – we are certainly increasing production of war machines even if the spending is characterized as foreign aid.

Whence inflation?

https://voxeu.org/article/demand-supply-imbalance-during-covid-19-pandemic

An interesting discussion. Too bad you have no clue what they said – even if elements of their discussion have been discussed for a quite a while. Now Kelly Anne Conway does not take kindly to her minions posting links to smart discussions even when that minion cannot articulate what the article said.

Recent Biden speeches have included references to the ‘best economic growth in the last four decades.’

T. Shaw,

Which happens to be correct. The 5.6% GDP growth rate in 2021 was the highest seen in the US since 1983, Reagan’s “Morning in America” year, although he had a declining inflation rate then to make it much more noticeable and popular. But you are unaware of this? Where are you getting your fantasy that Biden is somehow wrong about this, although looking at what you actually wrote you do not claim he lied.

Does this mean that you agree with him and are noting a positive element in all this? Or is having the highest growth rate in four decades a bad thing?

Lucy, I appreciate the encouragement in the form of a snarky retort. Some creatures just can’t move beyond their basic natures.

More evidence that Putin’s little poodle has no clue what he is actually linking to. Come on Putin – feed your poodle as his limited brain cells are start to rot from starvation.

Only 37 million under lockdown. And if China follows its pattern of locking down where cases are spreading, more to come. So, please, please let’s all spend ink quibbling over the meaning of “massive.”

But then, that’s mostly what the bot does. (S)He declares that others are wrong in a dismissive way, without any evidence. Cheap internet troll trick.

Ketanji Brown is a highly qualified nominee for the Supreme Court but leave to the Senate’s lead racist (Johh Hawley) to lead the charge against simply because she a black woman. Hawley may think he has a hot issue but as usual this Trumpian jerk is flat out lying:

https://www.msn.com/en-us/news/politics/durbin-defends-supreme-court-nominee-jackson-e2-80-99s-record-on-child-pornography/ar-AAVidOa?ocid=uxbndlbing

Lucy, interesting perspective. Judge Jackson may be well qualified despite reversals of her judgments. But the POTUS sort of screwed the pooch when he establish the narrow criteria of race and gender. Had Biden simply kept his mouth shut and then sprung the nominations, that would have removed most of the criticism. Now it’s just another “affirmative action” nomination.

Imagine if the Board of Directors of Google or Apple declared that they would only consider black females for upper management roles. Well, aside from being illegal, it might cause a ripple in the news, too.

But I’m anxiously awaiting the next POTUS with an opportunity to nominate a judge to SCOTUS that the only acceptable candidates will be Asian American transgender males (born female).

Bruce,

The Board of Directors of Apple and Google did not run for president and make a promise to select a Black woman for the SCOTUS if elected. If Biden did not do as he has done, then all the people like you who do not like him could run around whining about how he does not keep his campaign promises.

So, if the next POTUS gets elected after promising to appoint an Asian American transgender male (born female) one would hope that it will do so when an opening comes up. Capiche?

Bruce Hall thinks the only black qualified for the Court to be the extreme Federalist Clarence Thomas. Of course no woman should ever serve on the Court unless she is opposed to the rights of women according to Brucie Boy. Yea – I’m sure he hearts a return to the 1850’s where women could not vote but maybe they could boss the plantation slaves around.

“But the POTUS sort of screwed the pooch when he establish the narrow criteria of race and gender.”

I figured you would go racist and sexist but repeating the LIES of Josh Hawley. Brucie – your MAGA hat needs refitting as it has squeezed what little in the way of your already limited brain cells out of your teenie weenie head.

“Asian American transgender males (born female).”

Gee – you just figured out what transgender means!!! And of course no Asian American you know could get a law degree. I thought Donald Trump was a racist pig but damn – you have him beat! Now make sure you mother picks up your KKK outfit from the cleaners in time for tonight’s cross burning.

https://www.cbsnews.com/news/lloyd-austin-defense-secretary-transcript-face-the-nation-03-20-2022/?ftag=MSF0951a18

Defense Secretary Lloyd Austin on Face the Nation this morning discussing the situation in Ukraine.

Lucy,

The US military has been making statements that kind of play both sides of the betting game. Gen. Milley was quick to point out the Kyiv would fall within 72 hours and it didn’t, so now Sec. Austin is quick to point out that it didn’t. The US and NATO have provided ground troops with some weapons that have helped the Ukrainians stymie the Russians, but not enough to start driving the Russians back. For example, part of the new authorization for weapons is the small version 1 of the Switchblade drone. https://abcnews.go.com/Politics/100-us-switchblade-drones-heading-ukraine/story?id=83490886

The problem is that it still leaves Ukraine vulnerable to attack from the air from higher flying planes and missiles. Stingers can hit lower flying aircraft up to about 10K ft., but that leaves a lot of airspace above that. NATO’s reluctance to send in the heavy stuff, both air weapons and ground weapons, forces Ukraine to fight a guerrilla action only. While that can be costly to the Russians, it virtually assures widespread destruction of Ukraine cities and dislocations of millions of people in a very protracted conflict.

Now it could be that NATO at the urging of the Biden Administration has done the calculus and said the destruction of Ukraine is worth the isolation and temporary impoverishment of Russia and the creation of a strong Russia-China alliance. I tend to see that as a lose-lose scenario. Tangentially, India has now had to remain cautiously neutral about the Russian invasion of Ukraine because India depends heavily on Russia for weapons which India’s military uses in its standoff with Pakistan and China. This could have consequences for the West if India pushes to strengthen ties with Russia to flank Chinese efforts to do so.

https://www.nytimes.com/2021/12/06/world/asia/india-russia-missile-defense-deal.html

This could also be an opportunity for the US to strengthen ties with India by providing a trustworthy alternative to Russia for military equipment and supplies, but I don’t look to the Biden Administration to do that. In fact, it looks like Biden is intent on driving India closer to Russia for some unknown reason.

https://thehill.com/policy/international/596693-biden-weighing-sanctions-on-india-over-russian-military-stockpiles

Biden’s foreign policy guys are not the sharpest knives in the drawer.

Bruce,

You are increasingly sounding like some Putin bot on Fox News even as you parade as a tough guy who can talk about whether or not Biden “has the balls” to do this or that. This post is seriously full of risible garbage and nonsense.

For starters we have your idiocy that the Milley and Austin “play both sides of the betting game.” No they are not, and your saying so makes you look like a blazing hypocritical idiot. Millley’s forecast was the conventional wisdom of most of the experts at the time the invasion began. I doubted it as did some others, but I am not a military expert, just somebody who has been to both Russia and Ukraine. So this conventional military expert opinion that Milley held proved to be wrong. Do note that we think that it is the view that probably Putin also had, which indeed turned out to be wrong. But there were many reasons to think ahead of time that it might be right, given the apparently overwhelming military advantage Russia appeared to have. Austin’s view reflects the revised view after seeing that the earlier view of Milley (and Putin) was wrong.

Then we have you somehow deciding that the Biden diplomacy vis a vis China and India is somehow pushing both of them closer to Russia. Where did you get this completely stupid and incorrect idea? Regarding China that Biden has almost certainly reinforced that China will give Russia no military aid and probably not all that much economic aid aside from continuing to trade with Russia, which it would have done anyway. Biden’s actions most certainly will not lead to China assisting Russia more than it was going to after it signed this “without lmits” agreement with Russia at the beginning of the Winter Olympics, and Putin pleased Xi by holding off his invasion until after the Winter Olympics ended, clearly something Xi wanted very much.

As for India, the problem is that Russia has been supplying them with arms for many decades, basically since soon after their independence. It is a long term project of the US to wean India off those arms, and progress has been made in that direction. But that is a long term project, and for the moment India is still way too deeply reliant on Russia for crucial arms to outright join the anti-Russian side in all this. But, again, nothing Biden is doing is pushing India closer to Russia, if anything just the contrary. Again, you seem to be completely ignorant and brainless in your analysis of this.

As for your final slice about “Biden’s foreign policy guys,” I remind you that his team was accurately forecasting that Putin would engage in a full scale invasion of Uktaine even against the view of “Winston Churchill” Zelenskyy, not to mention many others (including me) who thought Putin would hold back. Not only that, but he made the wise move to open up US intel to others and the world to publicize Putin’s plans and his efforts to engage in false flag ops, scutting PUtin’s plans for doing so.

Needless to say, neither you nor any of the GOP critics of Biden admit any of this, preferring to play games of one minute channeling Trump that it is not even worth opposing Putin’s invasion at all to simultaneously playing the other side of the betting game that, as you like to emphasize, oh he is not being tough enough, somehow lacking balls and not providing this or that weapon or this or that strategy. Which is it, Bruce, the Trump kiss Putin’s behind approach or the “bring on the nuclear apocalypse” approach? What a complete worthless hypocrite you are.

Wow – that was on par for the length of Putin’s long winded insane rants. Barkley has already taken down your various lies. But may I say how impressed how you ably translated Putin’s latest rant so we can enjoy seeing it in English.

Sean Hannity joins Tucker Carlson as part of the Putin pet poodle squad:

https://www.msn.com/en-us/news/world/putin-channeling-his-inner-trump-at-moscow-rally-says-sean-hannity/ar-AAVgtg5?ocid=msedgdhphdr

《Erdogan’s mediation effort has nothing to do with his failed effort to contain Inflation. 》

Is inflation even important in the grand scheme of things, when Erdogan proves you can simply index it away and move on to solving the current WWIII problem?

Why don’t we just index and solve shortages with engineering not rate hikes?

You raised inflation troll. Please run away and infect some other blog with your moronical trolling.

https://www.msn.com/en-us/news/world/ukraine-accused-russia-of-forced-mass-deportations-from-mariupol-to-russian-cities-comparing-the-tactic-to-nazis-in-wwii/ar-AAVjFwb?ocid=msedgdhp&pc=U531

Russia is using Nazi tactics with forced mass deportations of the citizens of Mariupol to essentially Russian concentration camps. Putin cannot win this war but this is not going to stop him from being as much of a butcher as Hitler.

Lucy, they may be Nazi tactics or they may be the tactics of Putin’s namesake and your hero for not attacking a foreign country:

https://en.wikipedia.org/wiki/Gulag (note that I used Wikipedia for your sake)

In either case, I’ve been waiting anxiously to see what Biden’s next sanction will be. Snickers candy bars can no longer be sent to Russia? Biden simply doesn’t have the balls to give the Ukrainians the big stuff to fight the Russians. But I’ve addressed that earlier and possible reasons why.

Gee Putin is no worse than Stalin so traitors like you fall all over yourself praising this war criminal.

“Biden simply doesn’t have the balls to give the Ukrainians the big stuff to fight the Russians. But I’ve addressed that earlier and possible reasons why.”

I know it is risky for a Putin poodle to tell the leader the truth but there are a lot of new weapons being used by the Ukrainians to take out the Russian invaders. Of course your boy Putin is having his own troops cremated so Russian moms will not see their sons brought home in body bags.

But do continue with your able pro-Putin disinformation campaigns as such cowardly war crimes appear to turn you on.

Dean Baker must have been reading the partisan BS from the Usual Suspects (I assume Bruce Hall is allowed to remain in this group even as he is doubling as Putin’s Court Jester) over inflation and quite frustrated with the incredible dishonesty. Yes inflation has remained up but unless Biden caused the Putin invasion of Ukraine and COVID-19, Dean explains why his actual policies have not been a problem:

https://cepr.net/bidens-recovery-plan-did-not-cause-the-ukraine-war-or-covid-in-china/?emci=7e2d8c7e-35a9-ec11-a22a-281878b85110&emdi=d9040741-36a9-ec11-a22a-281878b85110&ceid=4616197

Of course Dean needs to understand that the Usual Suspects have been denying COVID-19 has been a big deal for the last 2 years.

pgl,

Well, UK inflation may match US, but EU’s is a couple of poiints lower, in the 5-6% raange. OTOH, the current EU unemployment rate is 6.8%, and their overall growth rate last year was lower than that in the US. The more stimulative fiscal policies in the US may partially account for these differences, with it worth noting that stimulative fiscal policy in the US dates back at least to 2017 when in the face of steady growth and near full employment, Trump put in place a massive tax cut favoring the rich while continuing to expand spending, with, of course he overseeing a highly stimulative policy in 2020 that was supported by both parties in Congress.

https://www.msn.com/en-us/news/world/from-biological-weapons-to-pro-nazi-ukraine-how-putin-is-trying-to-justify-the-war/ar-AAVkeu5?ocid=uxbndlbing

Putin tells more lies than even Donald Trump. His excuses for invading Ukraine are rather revealing:

(1) Putin says Zelensky is a Nazi. Of course Zelensky is not be Putin is the modern day Hitler.

(2) Putin claims Ukraine is about to use biological weapons. Ukraine does not have any but Putin does.

(3) Putin even has the audacity of accusing Ukraine of genocide. Now genocide is occurring but it is being conducted by Putun.

I forgot to add who is Putin’s main disinformation spreader here. See

Bruce Hall

March 21, 2022 at 1:46 pm

The stock market liked the Fed’s plan to raise interest rates. It’s wrong.>/b>

Larry Summers

The stock market responded positively Wednesday to the Federal Reserve’s move to raise interest rates and plan for six more increases by year’s end. I wish I could share that enthusiasm. Instead, I fear, the economic projections of the Federal Open Market Committee (FOMC) represent a continuation of its wishful and delusional thinking of the recent past.

Start with the labor market. It is now tighter than at any point in history: The vacancy-to-unemployment ratio is in unprecedented territory, quits are at near-record levels and wage growth is still rising at 6 percent, having accelerated rapidly in the past few months. The FOMC expects further tightening, to a 3.5 percent unemployment rate, which it expects will be maintained through 2024.

Three years at 3.5 percent unemployment, something the country has not seen in about 60 years, is highly implausible. Indeed, the historical experience is that when unemployment is below 4 percent, there is a 70 percent chance of joblessness rising rapidly in the next two years as the economy goes into recession.

But that is not the central absurdity in the Fed forecast. The chief problem is the idea that a super-tight labor market will somehow coincide with rapidly slowing inflation. Even on the Fed’s optimistic accounting, a balanced economy requires 4 percent unemployment, meaning that it expects the labor market will remain abnormally tight over the next few years.

Data on vacancies and tightness reinforce the case that such conditions are inflationary, not disinflationary. Wages represent by far the largest component of costs. When they are rising so fast, what basis is there for supposing that inflation will slow to the 2 percent range foreseen by the Fed?

Focusing on the tightness of labor markets as a basis for forecasting inflation is firmly within progressive Keynesian tradition. Many economists look, as Milton Friedman and Paul Volcker did, to measures of money supply or projected government debt for guidance on inflation. These indicators are much more alarming.

A look at the Fed’s forecast revisions since December reveals its confused thinking. The central principle of anti-inflationary monetary policy is that to reduce inflation it is necessary to raise real rates. Equivalently, it is necessary to raise interest rates by more than the inflation being counteracted and above a neutral level that neither speeds nor slows growth. I had thought this was universally accepted following the work of former George W. Bush administration official John Taylor and former Obama administration Council of Economic Advisers chair Christina Romer and her husband, David Romer.

Yet because of upward revisions in the inflation forecast, the Fed’s predicted real rates have actually declined in recent months. In other words, the FOMC’s plans do not even call for keeping up with the rising inflationary gap. It is hard to see how interest rates that even three years from now will be about 2 percentage points less than current rates of inflation can reasonably be regarded as providing sufficient restraint.

Does any of this matter as long as the Fed is raising rates? Some will reject my concerns as technical quibbling. But under what reasonable economic model does rapidly declining inflation occur alongside negative real interest rates and record-low unemployment?

Perhaps the Fed still believes that inflation is in fact transitory and that it will evaporate as supply chains are restored. This has never seemed plausible, given accelerating residential and wage inflation and room for acceleration in the costs of health care, airfare and lodging. It seems even less plausible today, with war in Ukraine and covid lockdowns in Asia.

Or perhaps the FOMC members are wary of pessimistic forecasting. But why shouldn’t they forecast realistically? It is an odd and damaging view of democratic accountability that demands disingenuous forecasts from revered institutions. In a world where financial crises are always possible, the credibility of the Federal Reserve is a precious asset. It should not be lightly sacrificed.

Our democracy is more threatened at home and abroad than at any time in the past 75 years. Rampant populism is a product of inflation and distrust in government. The Fed is outside of politics but not our civic life. It has an obligation to display more intellectual rigor and honest realism than it did this week.

http://larrysummers.com/2022/03/20/the-stock-market-liked-the-feds-plan-to-raise-interest-rates-its-wrong/