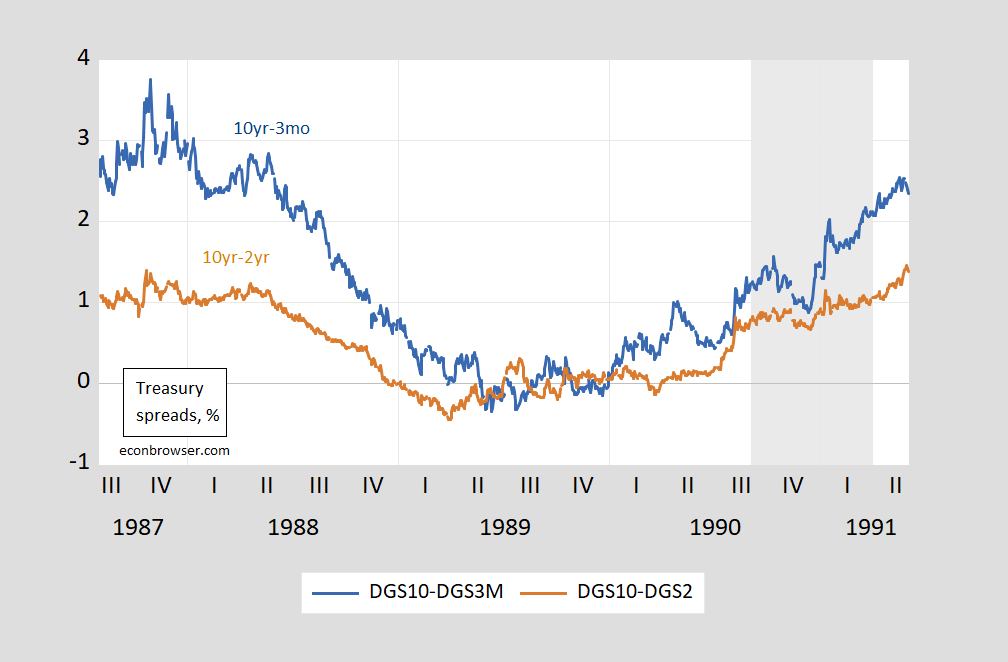

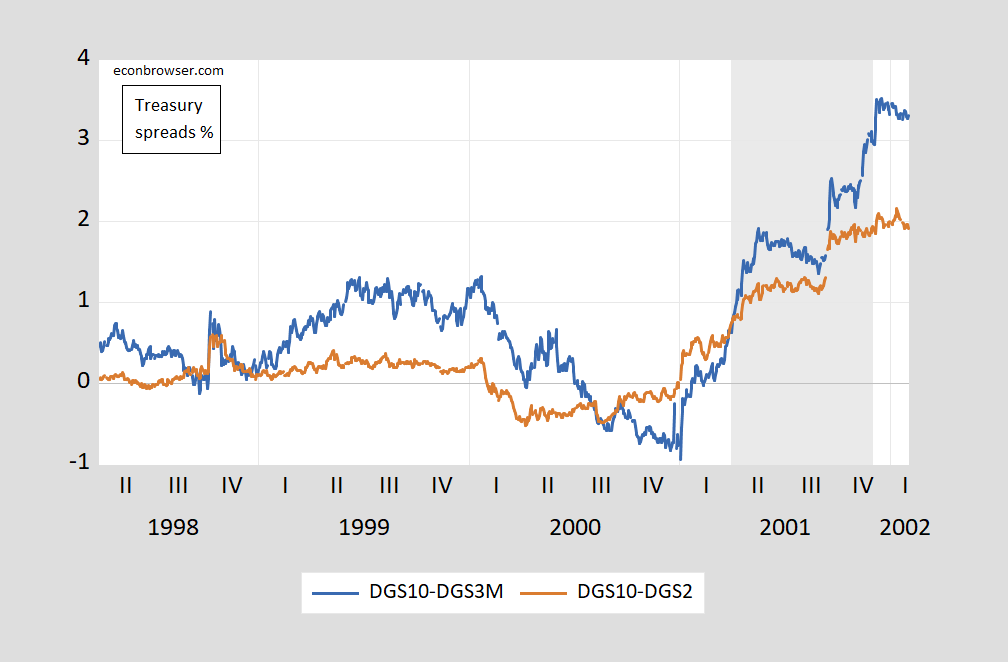

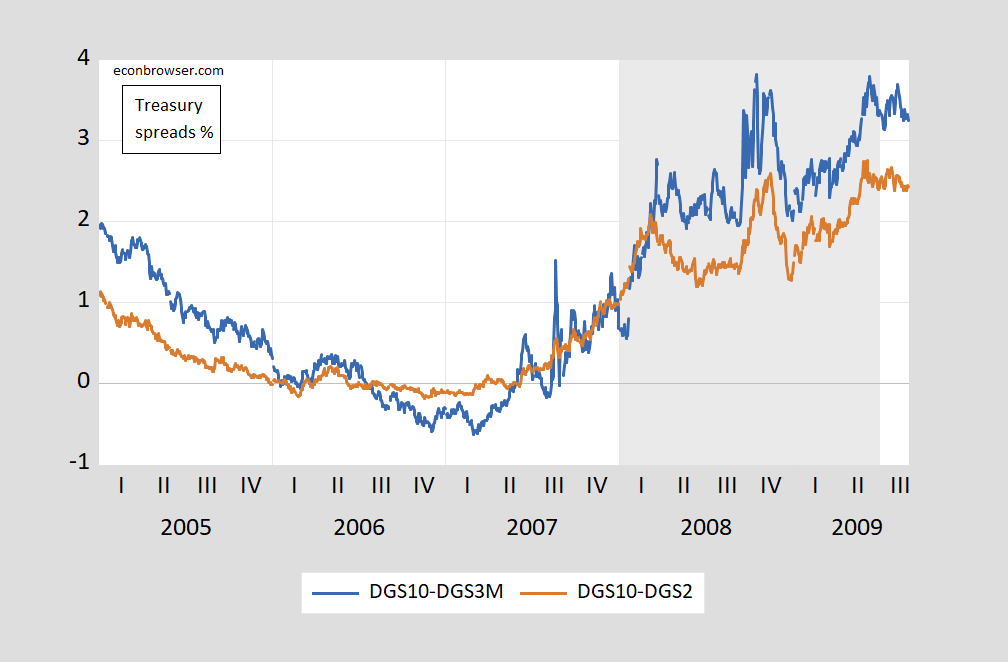

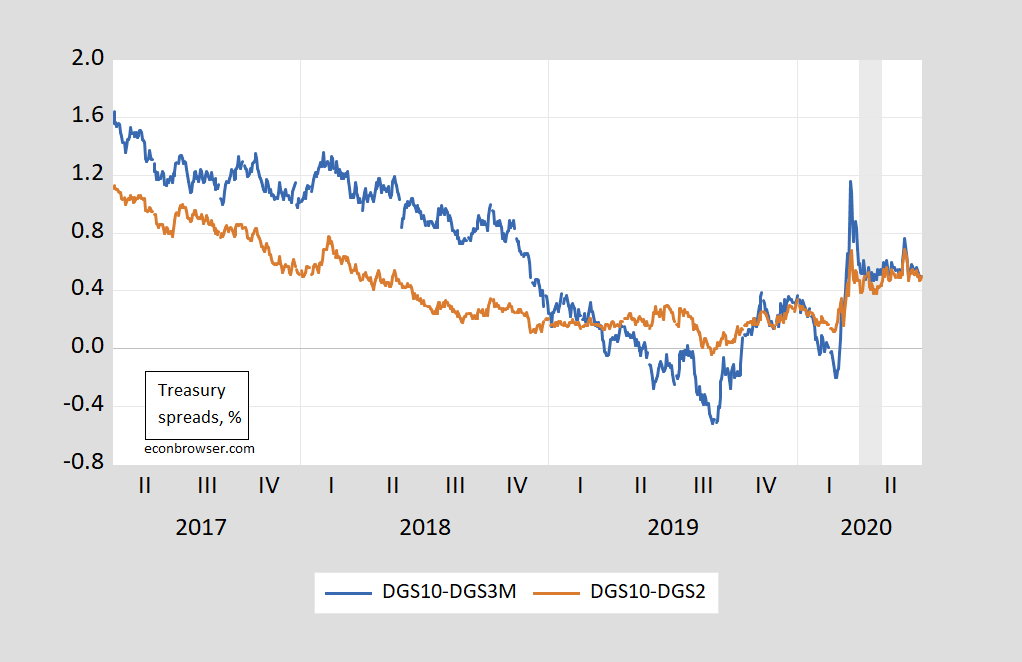

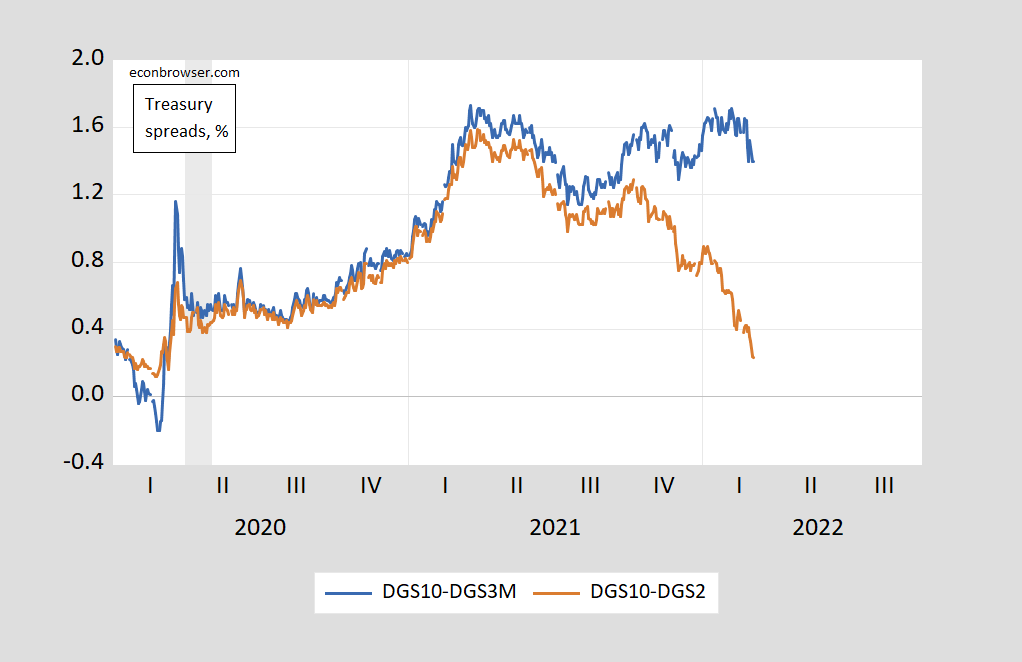

A spate of articles mention the possibility of recession [1] [2]. Here’s the evolution of the 10yr-3mo and 10yr-2yr term spread in the months preceding the last four recessions.

Figure1: Ten year – three month Treasury spread (blue), and ten year – two year Treasury spread (brown), in %. NBER defined recession dates. Source: Treasury via FRED, NBER, and author’s calculations.

Figure2: Ten year – three month Treasury spread (blue), and ten year – two year Treasury spread (brown), in %. NBER defined recession dates. Source: Treasury via FRED, NBER, and author’s calculations.

Figure 3: Ten year – three month Treasury spread (blue), and ten year – two year Treasury spread (brown), in %. NBER defined recession dates. Source: Treasury via FRED, NBER, and author’s calculations.

Figure 4: Ten year – three month Treasury spread (blue), and ten year – two year Treasury spread (brown), in %. NBER defined recession dates. Source: Treasury via FRED, NBER, and author’s calculations.

We don’t know when the next recession will begin, but we do know where spreads are as of today? That’s shown in Figure 4 below.

Figure 5: Ten year – three month Treasury spread (blue), and ten year – two year Treasury spread (brown), in %. NBER defined recession dates. Source: Treasury via FRED, NBER, and author’s calculations.

While the 10yr-2yr spread is falling quickly, the 10yr-3mo spread remain at non-alarming levels.

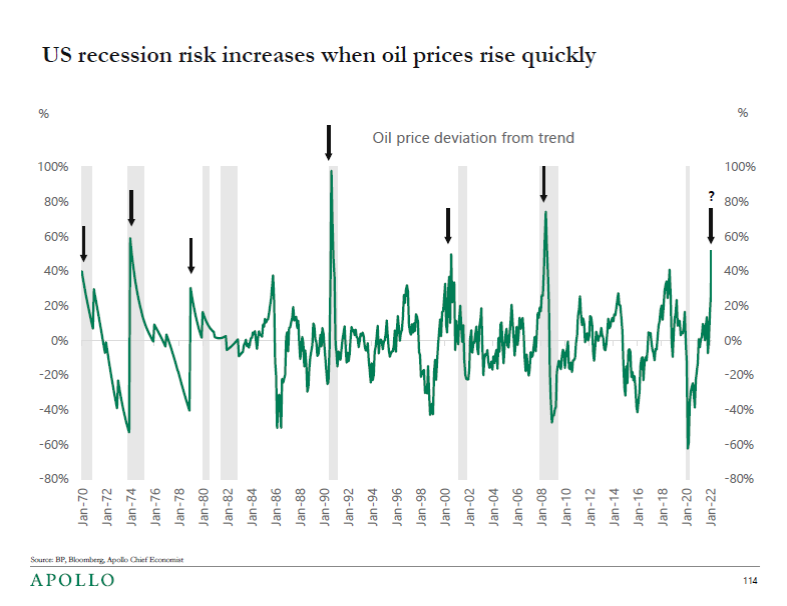

Torsten Slok notes that sharp increases in gasoline prices presage recessions.

Source: Torsten Slok/Apollo, March 5, 2022.

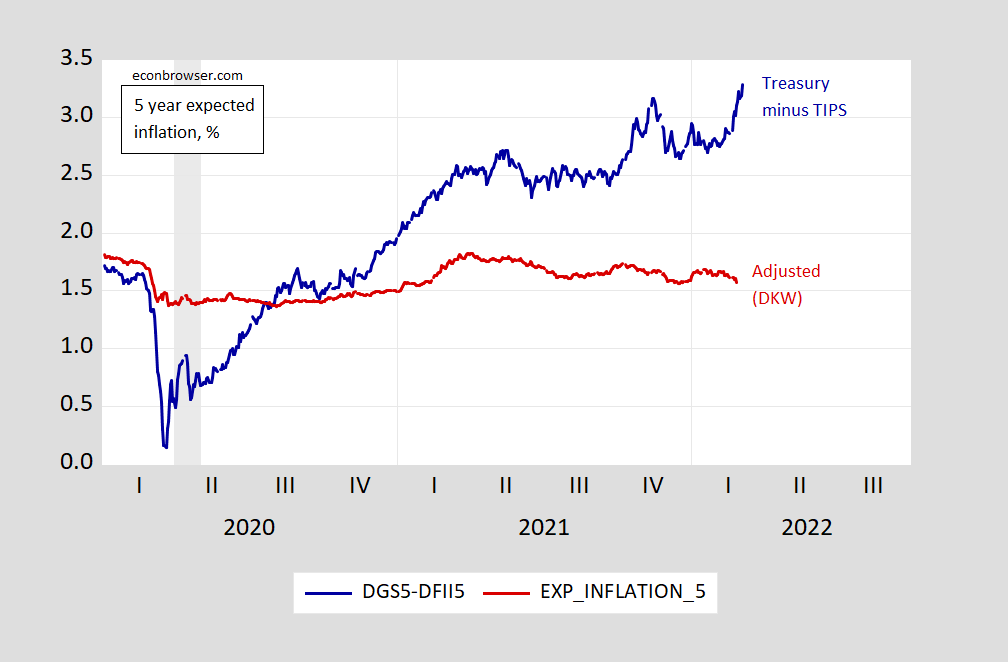

As for inflation expectations, 5 year inflation breakevens indicate an upward movement. However, adjusting for estimated inflation and liquidity premia suggests no acceleration of expected inflation (at least through the end-of-February).

Figure 6: Five year Treasury yield minus five year TIPS yield (blue), and five year expected inflation (brown) Source: Treasury via FRED, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 3/7/2022, and author’s calculations.

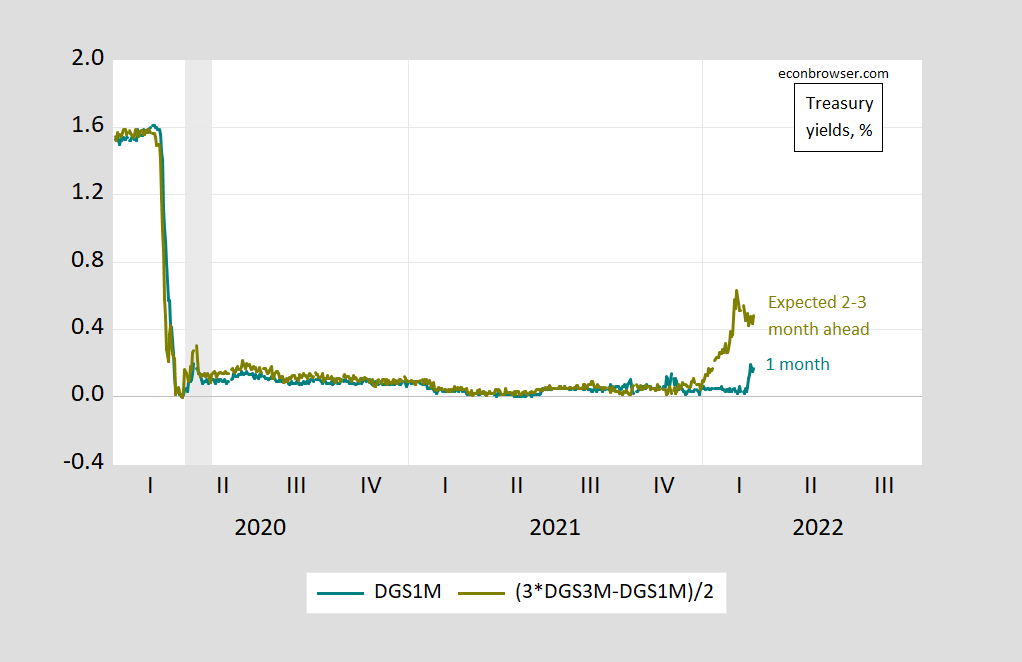

Despite the anxieties about higher inflationary pressures arising from higher commodity prices, market implied short rates 2-3 months ahead have declined.

Figure 7: One month Treasury yield (teal), and implied yields 2-3 months ahead (chartreuse), in %. NBER defined recession dates. Source: Treasury via FRED, NBER, and author’s calculations.

I’ll see your Torsten Slok reference and beat it with a…… with a…….. with a…….. damn there’s few people as insightful as Torsten Slok. But my guess (which would have, it appears, been wrong) was that your next post was going to be on the dreaded “S” word. Stagflation. BNP Paribas had a note that said the media references for “Stagflation” have spiked very recently. I mean like that spike similar to your 1990 oil price spike there in that graph. I’m not a believer yet, but you can get how people might be headed to that line of thinking.

Why not treat energy inflation as just another payments system problem to be fixed with an overwhelming supply of liquidity, just as the Fed treated repo hyperinflation in September 2019 by offering repo at below-market rates?

Something similar to what you are suggesting was tried in the 1970s and was found not to work. Adding financial liquidity in the face of high oil prices merely turned a relative price increase into a general price increase – the inflation of the 1970s.

You might want to learn the tiniest bit about economics before wasting time on policy fantasies.

To put it another way, high oil prices are not a payment system problem, so treating high oil prices like a payment system problem would be foolish.

The headlines at Bloomberg may give some indication of the sentiment regarding a recession. That doesn’t mean an inflationary stoked recession is in the cards, but let’s just say that it can become a self-fulfilling prophesy pretty quickly.

The Fed looks like it will use the only tool it has in its toolbox, but it has had a history of reacting too slowly at first and then keeping the foot on the brake too long (2006-07).

https://finance.yahoo.com/news/fed-pressing-ahead-rate-hike-004155402.html

The Fed chief said he thinks inflation will ease in the coming months, “as supply constraints ease and demand moderates because of the waning effects of fiscal support and the removal of monetary policy accommodation.”

Interpretation: “There will be enough supply to meet demand because there will be no more free money from the government and no one will want to buy stuff at the highly inflated prices.”

Crude Oil Apr 22 (CL=F)

NY Mercantile – NY Mercantile Delayed Price. Currency in USD

125.16+5.76 (+4.82%)

As of 09:00AM EST. Market open.

https://www.bloomberg.com/news/articles/2022-03-07/from-oil-to-nickel-to-wheat-commodities-mayhem-in-five-charts

Text can be seen at Yahoo Finance here:

https://finance.yahoo.com/news/oil-nickel-wheat-commodities-mayhem-184853060.html

And we thought Princeton Steve wrote macroecomic gibberish. Bruce should stick to his day job as a Putin count jester

Okay, pgl, this is your chance to shine. Rather than make snide comments without substance, how about providing some substance? That will be a new and probably onerous effort for you, but give it a try.

We are all waiting with bated breath for your pronouncements about the possibility of an imminent recession and its causes. You’ve already dismissed the issues raised at Bloomberg and the rising cost of energy and the Fed’s upcoming rate increases which I cited. So, give it a try, pgl. ‘Splain yourself, Lucy.

Interest rates are not the Feds only tool. And you suggest we had a recession in 2006? We know you are stupid but DAMB. I guess you were ordered to write that stupid stuff by Putin

pgl, too bad reading is not your forte so that you always infer the wrong idea.

But let me spell it out to you in non-Snarkese:

The Fed ran up interest rates in 2006 into 2007 despite signs that the economy was beginning to struggle. Having set the course of higher interest rates to combat inflation, the Fed was reluctant to reverse course until later in 2007 when cracks in the economy were plainly visible. By the time the recession and housing crisis hit in 2008, the Fed was in scramble mode to lower rates, but couldn’t catch up to the falling sword… which left us with the mess in 2008-09.

Did the Fed cause the recession? Obviously not. But the Fed’s misreading of the situation certainly didn’t help get us out.

https://www.thebalance.com/2007-financial-crisis-overview-3306138

Stick to day trading, Lucy or ‘splain yourself better. Come on, Lucy. Let’s hear about the tools you expect the Fed to employ this time around.

Inflationary stroked recession??? And we thought suppression was dumb

Princeton Steve is a moron but he is smarter than Bruce Hall

Hey, Lucy… yeah inflationary-stoked recession. What happens when inflation starts to concern those in charge (like the Fed). Yup, and when the fed (and other central banks) does that, what happens? Yup. And when the correction goes too far what happens? Yup, recession.

https://www.investmentexecutive.com/news/research-and-markets/relentless-inflation-could-lead-to-recession-fitch/

Now, read the whole thing, not just the first third. That’s tough for a headline-only reader.

Come on, man! I shouldn’t have to explain that to a smart day trader like you.

Bruce calls me Lucy? Makes sense since this dumba## is Charlie Brown hoping to kick a field goal

Wrong Lucy, Lucy. Although your comments do come off a bit cartoonish.

Keep trying.

Investment Executive? I might say you prove your stupidity by using such suspect sources. But I did read the entire discussion which does not support your new thesis at all. So are you lying again ? Or did YOU fail to read the when thing? Or maybe this just shows what everyone knows…You are really dumb

Very first sentence:

If inflation remains stubbornly high into the second half of 2022, there’s a risk that rates may go up further and faster than currently expected, raising the risk of recession, says Fitch Ratings.

Oh, yeah, what do they know? Just a bunch of day traders.

I suppose you’ve never looked at Barrons or Bloomberg articles that quote sources deemed sufficiently worthy of citing. Of course, not. Lucy only sits in on meetings at the various Fed offices for >real information.

Oh gee Bruce hall tries to mansplain us on why the economy faltered in 2008 by noting those 4.5 percent interest rates in 2006. Yea he is that stupid

Try again, Lucy. I said 2006-07.

http://www.fedprimerate.com/wall_street_journal_prime_rate_history.htm

Now, if you want to say that business and the general economy borrows at the Fed Funds rate, that’s a little disingenuous and stupid.

http://www.fedprimerate.com/fedfundsrate/federal_funds_rate_history.htm

December 2007 is not 2006/7. Oh that’s right – you never learned to read a calendar. And the Great Recession’s causes are not generally attributed to long-term interest rates being a mere 4.5%. But of course anyone who learned macroeconomic from Judith Curry must be excused for being dumber than a rock.

Come on, Lucy,

It wasn’t one action of the Fed. They just kept increasing rates as the economy bogged down. But you know that. Parsing comments is disingenuous.

Moving on.

i’ve been watching price spikes on the commodity exchanges in the wake of Ukraine…so far, European gas, palladium, nickel, copper, aluminum & wheat have all topped all time highs, and corn and soybeans are around ten year highs…

WTI is at $128 in the wake of Biden’s ban of Russian oil this morning…Brent hit $139 yesterday, both bouncing off of 14 year highs…

there is still hope for deals with Venezuela and Iran to replace Russian crude…state dept talks with Maduro were said to have been “cordial.”

gasoline topped $3.80 this morning (1000 barrel contract price per gallon) and diesel/heat oil topped $4.35 / gal….both of those would be all time records on NYMEX..

there is still hope for deals with Venezuela and Iran to replace Russian crude…state dept talks with Maduro were said to have been “cordial.”

Taking the high road with Russia and the very, very low road with Venezuela and Iran.

So you oppose cutting off Russian oil exports. Figures since you are Putins court jester

Hey, Lucy! You’ve already forgotten my earlier comments when I chided Biden for not cutting off Russian oil imports. Tsk! Tsk! Better have that short-term memory checked out. I’ve seen that happen with my 100-year old mother-in-law.

Opposing dealing with rogue states does not imply that I’m trying to protect Putin. Only a fool would extrapolate that. Oh, wait. Sorry….

Look Brucie. We know you are stupid. We know you.lie 24-7. So stop this incessant embarrassing your poor mom

Lucy,

We know when you have no real argument against what I wrote. Pointing out the hypocrisy of Biden dealing with Venezuela and Iran while banning oil imports from Russia is hardly supporting Putin. Your logical fallacy is that there are no other choices.

So, why don’t you open a box of wine cooler, spread some of your Cheez Whiz on your graham crackers and enjoy some Sex in the City reruns?

then bruce, you will not complain about high oil and gas prices going forward? or do you reserve the right to nix a possible solution and still complain about the problem?

Kevin Drum highlights how carbon poisoning has led to a lot of IQ declines among the US population. I bet the effect was particularly acute among the Usual Suspects including Bruce Hall

Ah, yes, Kevin Drum talking about the 60s and 70s when you were in a densely packed city with other dense people. I was far from that situation with the Strategic Air Command. Sorry about your loss.

that’s lead poisoning… 170 million Americans born before 1996 lost a combined 824 million IQ points due to lead in auto exhaust alone…obviously, the impact varies by how close you were to auto exhaust sources in your youth..

Oh, I believe he was referring to lead poisoning, but I understand how you have been affected.

I can still complain that Biden’s national policies have created a situation where it is harder to draw on our national reserves of oil.

https://abcnews.go.com/Business/wireStory/biden-halts-oil-gas-leases-amid-legal-fight-83047602

Biden’s antagonism toward fossil fuel producers certainly isn’t engendering confidence that he won’t squash any investment they make right now with the first opportunity he has.

Drill baby drill? Yea that will show Putin. Idiot

Lucy, you finally figured out something pretty obvious. Oil production is correlated to the number of rigs in operation. Wow! I am sooo impressed with your deductive reasoning.

You might note (by selecting Overview and the 3-year timeline) that oil rigs in operation have not yet returned to 2019 levels despite a slow linear increase. https://ycharts.com/indicators/us_oil_rotary_rigs

Now obviously, some of that has to do with funding and finding people to work those rigs. It also has to do with replacing those rigs where they’ve pulled out as much oil as economically feasible and moving on to new locations. That brings us to the new locations issue:

https://www.cnbc.com/2022/02/24/biden-administration-pausing-new-oil-and-gas-leases-amid-legal-battle-.html

I repeated that last link just for you. But hey, you’ll argue anything to support Old Uncle Joe, right? So, I get it: drill baby drill… in Venezuela and Iran because (drum roll) climate change.

Putin’s war crimes against Ukraine can’t save Joe Biden.

pgl, There are effective treatments for A.D.D.

There is no rational argument that Venezuela would be more deserving of being cut out than Saudi Arabia. Venezuela is a dictatorship, but so are many other of our dear trading partners. Last time I looked they have not attacked and tried to take over other countries. So a switch from giving oil money to Venezuela instead of Russia would be a step up for human decency – small but at least up.

Bruce following reasoning? No he follows his political masters which was Trump but now is Putin

No, Ivan, giving oil money to Venezuela and Iran are not steps up from Russia. Venezuela has been actively trying to destabilize democratic governments in South America, Iran is a rogue terrorist state. There is nothing morally better about that route.

Old Uncle Joe cut off oil from Canada and is stalling production on U.S. public lands. Are Venezuela and Iran better moral alternatives? The idiocy about calculating the costs of climate change for U.S. production and ignoring it for production elsewhere is overwhelming. On top of that, the “cost” of climate change can’t be calculated without using unverifiable assumptions.

Perhaps the world could be powered by burning the bulls**t [edited MDC] coming out of Washington, DC.

Bruce Hall: Have you ever looked up the word “assumption”? As in assumption, in mathematical proofs. Just curious.

More lies? Or are you so incredibly ignorant of the real world to have noticed US shale oil companies are producing more and the Canadian province of Alberta just promised to replace that Russian oil we will not buy. I guess 2 years of hiding in your basement will do that. BTW old hay little boy that my name is not Lucy. Even if you found an old lady named Lucy she would not a total moron like you

Menzie, “assumptions” are not necessarily “mathematically proven”. They are presumed or estimated relationships that can have a significant degree of error, especially with regard to climate models which, by the way, have notoriously overstated warming for the past 30 years. I can provide you lists of links in that regard, but I know you have made up your mind.

I would suggest that you read Dr. Judith Curry’s blog and, perhaps, this post in particular: https://judithcurry.com/2022/02/19/how-we-have-mischaracterized-climate-risk/#more-28343

Bruce Hall: Jeez. Look up the word “assumption”. You “assume” something, i.e., you posit. It’s in fact the exact opposite of “proven”. My god – did you not take geometry?

Since you recommended this analysis, you will excuse me if I don’t rot my brain further.

“I would suggest that you read Dr. Judith Curry’s blog”

Can we blame Menzie for not reading the BS from Trump’s favorite climate change denier. Of course Brucie actually thinks that the 2006 recession was solely caused by a slight rise in interest rates. Yes – Brucie is that STUPID!

Menzie, I immensely respect you, but in this instance you are playing pgl’s game of parsing. We are agreeing that assuming and positing are, essentially, the same thing: https://www.merriam-webster.com/dictionary/posit

That was my whole point:

On top of that, the “cost” of climate change can’t be calculated without using unverifiable assumptions.

The link to Dr. Curry’s post was in way of explaining why current “climate costs” are on very shaky ground, especially for policy decisions, because of the great complexity of climate/weather interactions that have not been well captured in climate model assumptions… and the output projections of those models have been quite inaccurate. That was related to my comment that Biden’s oil leasing actions are not rational, especially when those actions are being attempt to be offset by increasing oil production elsewhere. So, I’m afraid I do not understand your objections to my comment.

Bruce Hall

March 10, 2022 at 7:36 am

Menzie, I immensely respect you, but in this instance you are playing pgl’s game of parsing.

Gee – I never knew telling the truth was called parsing. Since Bruce Hall never is honest … parsing to him must be some dirty word;

here’s some news on both of those stories:

EXCLUSIVE Washington pins easing of Venezuela sanctions on direct oil supply to U.S. -sources –

(Reuters) – U.S. officials have demanded Venezuela supply at least a portion of oil exports to the United States as part of any agreement to ease oil trading sanctions on the OPEC member nation, two people close to the matter said.

U.S. President Joe Biden on Tuesday banned U.S. imports of Russian oil in retaliation for the invasion of Ukraine, ramping up economic pressure on a key Venezuelan ally.

U.S. diplomats have worked to find energy supplies worldwide that can help compensate for disruption to Russian oil and gas exports caused by sanctions or war. U.S. officials met Venezuelan President Nicolas Maduro in Caracas for the first bilateral talks in years on Saturday.

Venezuela has been under U.S. oil sanctions since 2019 and could reroute crude if those restrictions were lifted.

U.S. officials made clear their priority was to secure supplies for the United States, the people told Reuters. The officials told their Venezuelan counterparts that any relaxation in U.S. sanctions would be conditional on Venezuela shipping oil directly to the United States, the sources said.

The United States had not previously made stipulations about the specific destination of cargoes permitted under waivers to sanctions.

Chevron Corp (CVX.N), the last U.S. oil producer still operating in Venezuela, could be the first beneficiary if a deal is reached with Maduro’s administration. Chevron has been barred from shipping Venezuelan oil from its joint ventures since 2020 and has pushed to overturn the ban.

The California-based company has a special license that allows it to maintain a low-level presence in the country, only to ensure the maintenance and safety of its facilities.

With that license due to expire in June, Chevron has sought authorization from the U.S. Treasury Department to trade Venezuelan oil cargoes for debt repayment through a revamped exemption, Reuters has reported. Chevron wants the revised permit so it can recoup hundreds of million dollars in unpaid debt and late dividends from its joint ventures with PDVSA.

If Washington decides to ease sanctions, Chevron could be in position to partially recover production in Venezuela and resume exports to its own and other refineries on the U.S. Gulf Coast, one of the sources said, replacing Russian barrels.

Iran Nuclear Deal Awaits Final Decision As Negotiators Return To Their Capitals – Diplomats familiar with the situation say that the Vienna talks on the Iranian nuclear deal are effectively over, and that the top Iranian negotiator has returned to Tehran for consultations, which are effectively the final decision on making the deal or not. Iran downplayed the consultations, but EU officials say that over the next few days, the real focus is on political decisions. It was a long time getting here, but a deal is within reach, finally.

Exact terms aren’t clear, but its been said to be close, minus a few specifics. Details resolving concerns from Russia were one of the last issues, and it’s not clear what they did about it.

US officials warn there is little time left to make a deal, while French officials say everyone needs to make a deal while they still can, and that delays could risk the position they found themselves in.

Any number of things can come up and derail the talks, with things like the Ukraine War suddenly becoming an issue just because Russia is involved in the talks. There are high hopes in the US that an Iran deal could ease oil prices, something needed as they surge to medium-term highs.

Everything out of the EU nations suggest they’re satisfied, and assuming nothing prevents Russia sanctions getting in the way, they and China should similarly be comfortable. That leaves the decision to Iran, which stands to benefit most from sanctions relief.

Meanwhile Israel is working hard to derail the likely imminent deal. Israeli officials have at times tried to present themselves as neutral to the ongoing Iran nuclear talks, but they also regularly step up to angrily condemn diplomacy and issue calls to action.

…

Israel has spent decades lobbying against deals with Iran, and agitating for military action. The US has suggested they are on the eve of a deal, and while the Biden Administration has warned Israel against being too hostile to the deal, no one could be surprised at the response so far.

@ rjs

You forgot neon gas. I’m kinda making one of my straight jokes, but it’s actually true.

you’re right, Moses, and that’s because about half the supply comes from a company in Odessa…it’s critical for lasers used in chip-making, so that appears to be another supply chain that won’t be fixed anytime soon…

@ rjs

I’m just kind of joking in my following words here at a dark situation (am I allowed??). I guess there’s no “Daniel PLainview” for neon gas is there?? Or maybe PLainview and the old “wildcatter” crew could pop up out fo their graves and help our USA petroleum supply?? Just be careful if he’s eating meat and wields a bowling pin/

Iran is actually pretty close. A Donald Trump/Putin driven issue there. Iran would be pretty close no matter what.

Thought provoking.

Wall Street sees inverted yield curves as major warning signals.

Looked over FRED’s 10 year/3 month graphs and numbers.

An inverted yield curve preceded all four recessions. However for the 1990 recession, the inversion occurred in May 1989 – (0.32%), it went positive April 1990 – 0. 97%; and June 1990 – 0.43%, before the recession. And, with the 2020 recession, the widest negative spread was August 2019 – (0.49%), then it went positive, and then back negative in February 2020 – (0.14%).

The deepest negative was December 2000 – (0.77%). The largest positive spread was August 1982 – 4.09%. December 2009 positive was 3.79%.

The current, 1.40%, spread is not that much lower than the recent March 2021 high of 1.71%.

Other than the Covid recession, term premium has not been negative before any U.S. recession. The inversion of the curve prior to the Covid recession looks like a special case; it would be a stretch to claim that the curve warned of pandemic. Term premium is negative now, so I wonder whether curve flattening is as reliable a signal of recession risk now as in the past.

In most cases, two-year Treasury yields have fallen for a least a few months prior to recession. Longer yields, too, though less reliably. There has been a brief drop in yields due to safe-haven flows since Russia invaded Ukraine, but the drop is not as persistent as was the case prior to recessions.

The yield curve is a good recession forecasting tool in part because it reflects the interaction of money policy and economic conditions; the Fed has hiked rates prior to all the recessions in Professor Chinn’s sample. This time, he Fed has tapered asset purchases and signaled future rate hikes, but has not hiked rates.

Fixed residential investment has run below 5% of GDP since the Great Recession. In all but one post-WWII cycle, that ratio has peaked above 5%, generally well before the recession began. The combination of a housing shortage and low mortgage rates is likely to provide a buffer against a slowdown, assuming supply shocks don’t derail housing construction.

Vehicles and other consumer durables, on the other hand, could easily become a drag on growth.

I’d love to see something from Professor Hamilton on the current gasoline price spike in light of his earlier research on price and supply. Some of those gasoline price spikes were coincident wih recession, not leading. Oil supply shocks reliably induce slowdowns. Is there a measurable supply shock now of a magnitude suggesting recession?

And the Sahm Rule doesn’t show any sign that the U.S. is in recession:

https://fred.stlouisfed.org/series/SAHMREALTIME

But then Russia invaded Ukraine only a few days ago

Few days ago??? Almost 2 weeks. He basically has a limited time to actually “reign” in the Ukraine. If it lasts close to April. He is in trouble.

The Sahm Rule is based on monthly data. So yes, a few days ago.

I don’t see it with vehicles either. The shortage of chips is long over and March sales will be boosted noticeably by extra reporting(which artificially lowered February). Once again macro, if credit is available, vehicles will be sold. Maybe just not the most gassy.

Give you vehicles. I mispoke.

I keep an eye on vehicles/population, which has risen despite the parts supply shortage. That metric suggests the U.S. could easily do without a rise in vehicle production. It is not, however, a predictor of short-term demand. Fleet age is a better predictor, and has risen from an average of 11.7 years in 2018 to 12.1 years in 2021. Car ownership also skews heavily by income, so if employment growth remains strong, there will he support for vehicle sales at lower incomes.

Other durables, yough, represent a big-time potential for a drag.

An estimated 4000 Russian soldiers have died. 16000 foreign fighters have joined Ukraines army which has been given new weapons by NATO. I can only imagine how angry Putin has become. He has a few pet poodles chirping here. Pity these poodles as Putin will lash out at them

I had read death numbers for Russian soldiers higher than 5,000 from sources I considered pretty reliable, but I really feel there’s no reliable data on that right now.

It is chocking that Putin appears to not have had any real preparation for outcomes on the negative side. The fact that both his side and ours gave Ukraines military 1-4 days, should have raised a red flag. Just on the numbers, 200K foreign Russians against 150K Ukrainian homeboy forces, you would have to pause – and the quality argument would also seem optimistic, given that Ukraine has been fighting a continuous war in Donbas since 2014. Putin obviously is not a military genius by any stretch of the imagination. But in contrast to Zolensky he appears to be without meaningful input from his generals. I guess there are downsides to being a ruthless dictator.

@ Ivan and whoever bothers reading this comment

Let’s take for the moment, that our good friend Barkley Rosser’s words were true (for once) and that what intelligence sources said and various rumors were accurate—the Russian soldiers on the Ukraine north border (Belarus) had “no idea” they were about to go to war in Ukraine. that speaks to preparedness, and knowledge or terrain/geography of the land they were invading A very bad omen for those Russian soldiers, and, at that time, success in a future war.

*knowledge OF terrain/geography, excuse me

Good point. How do you prepare for a mission when you are not even allowed to know where you are going and what you are doing. Another indication that Putin is a desktop general – and a mediocre one.

Everybody in the west knew that the training story was BS and the Ukraine generals knew about and prepared for invasion at least 2 weeks ahead. Yet some of the soldiers captured in Ukraine in the first days thought they were on training exercises.

The price of oil should be probably be fixed in a war time move, until the conflict “resolves”. Russia is going to be considered a rogue nation now for awhile. Credit will be expensive in general.

The US could easily use a mixture of oil reserves and nationalized “expensive” sour crude mix for the next 6-8 years with a fixed price, with no shortage.

Agree. Market forces will make this problem worse. No private company would increase expensive oil extraction/production without some government guaranteed price floor for an extended period. Lots of new production would begin if government guarantees limited the risk of loses in a unpredictable market.

This is of course not true. An oil producer can hedge their production in the futures market, and often do. At present, it’s possible to hedge out WTI to Q4 2023 at about $85. This is a pretty high price and well above the breakevens of most shale oil operators.

CIA director today observed that Putin got into his latest invasion of Ukraine based on 4 assumptions, all mistaken. What to do when you mess up? Double down, unfortunately.

All the troops positioned to invade Ukraine now in Ukraine and Russian troops are making slow progress. Solution? Hire urban guerrillas from Syria.

Something like two or three times Russia’s current troop strength in Ukraine is widely seen as necessary for occupation. That pretty obviously represents a fifth mistaken assumption on Putin’s part. Not clear what his answer to this one will be.

The Urban guerrillas from Syria is another absurd mistake by a desperate fool. How are they going to blend into the white population in Ukraines urban areas? Can they answer in the local language when asked who they are and from where? Will they know the local hiding places and resources when dumped into a new city. If they are stupid enough to be hired into a crazy job like that, are they smart enough to survive for even 12 hours?

I suspect the idea is for Syrian mercenaries to have an effect similar to indiscriminate shelling – kill until Ukraine surrenders. The fact that they don’t share language or culture is a plus. Russian troops are not proving reliable at killing Ukrainian civilians up close.

If that’s the thinking, it’s pretty sick.

Let’s ask a very simple question~~~ If they don’t use “extreme” means (which will turn the world community against both Russia and the Syrian Mercenaries) are the Syrian soldiers better trained than the Russian soldiers?? It’s an open joke before the first Syrian soldier enters Ukraine, Unless Barkley Junior tells us they are 10 feet north of the Ukraine border, Belarus, playing dodge ball, tag, tic-tac-toe, and girl’s volleyball with each other, then we’ll know they aren’t there to start a war, Check in with Barkley Junior, he’s an “expert” on Russia.

Sadly, Syria has some of the most experienced urban fighter around.

Remember when Russia offered bounties on U.S. soldiers? That kind of incentive could lead to atrocities, especially if civilians bring the same bounty as combatants.

https://www.youtube.com/watch?v=H2UbPOqHbJ4

Macroduck, my good friend, I have a theory, which I’m a “little” biased on, that if they guys had a few drinks, they might not be “going for blood” with each other. Oh Wait, Chinese officials like to drink don’t they. Macro, what was I talking about just now?? Can’t you pretend you’re not following what I’m saying right now. “Do me solid” or something?? I know Barkley’s about to pounce on me, you’ve gotta give me “war cover” here. just over his jet shoulder like your Maverick’s Top Gun buddy

https://www.youtube.com/watch?v=7MfYW8twBlg

Menzie, I’m trying to get over you let that YT link in. Damn you, I love you man, You better let this comment in also if you’re sweet enough to let that YT link in. You damned “so and so” Menzie. I don’t care if erveryone thinks I have my nose someplace with you. YOu’re just a NICE guy. Damn man. I was trying to remember if I commented here when my father was still alive. 2012 Bro. Don’t let mw know, let me search it out. I know my father was still alive when I made my stupid comments on James Kwak’s Baselinescenario blog, Man I just. My father was a “well read” man and would have loved you and Kwak so much Brother. My Dad lived WW II and he never saw people in the same why white guys of his generation often saw them. But my ftaher wasn’t “in combat” or “the sh*t [edited MDC]: so….that might have been the difference in “viewpoint”

Moses Herzog: Every one’s been warned – if you post a YouTube link it may be a long time before I approve it (if ever), just because I don’t have infinite amounts of time to check each link. I have 180 students this semester, plus deadlines for research. To *everyone* – try to make your points without resorting to videos and/or podcasts/audio.

tac nukes!

pick a hiroshima!

since falling GDP is usually a recession indicator, the reports released today don’t look good; January saw a record trade deficit, up 9.4% from December’s revised record deficit…using exhibit 10 in the full tables (goods exports and imports in 2012$), i figure that level of goods deficit would subtract about 1.16 percentage points from the growth of 1st quarter GDP….trade in services also appears to be a negative….then January wholesale inventories were up 0.8%, but with a crude adjustment with the producer price indices for finished and unprocessed goods, real wholesale inventories appear to down by at least a few tenths of a percent….inventories added 4.90 percentage points to 4th quarter GDP, and wholesale inventories accounted for 2/3rds of that….so even stagnant 1st quarter inventories would reverse that 4th quarter GDP gain, and falling real inventories would be worse…..

check that; 4th quarter inventories only added 490 basis points to GDP because inventories went from a negative 66.8 billion to a positive 171.2 billion in $2012…so a 1st quarter inventory downturn would only reverse the 171.2 billion portion of that, or about 352 basis points of GDP..

“Let’s hear about the tools you expect the Fed to employ this time around.”

How about selling cheap inflation swaps to bring down breakevens? How about gas stimmies? How about CBDC COLAs?

Hah! So I just said this invasion was the first totally exogenous shock in the last several decades, but, of course, the pandemic we are just now hopefully exiting from was also one. I guess the difference is that economic conditions were rather different just before it hit, quite stable with steady inflation and low unemployment, compared with what we have just been having, rapidly growing but also with rising inflation. And we have not yet seen that we shall actually have a recession yet, while we definitely did have one with the pandemic, even if it was short while sharp. But the current situation is indeed unlike anything we have previously seen, so it is understandable the financial market conditions do not resemble what we have previously seen.

‘rapidly growing’ toward lost potential…… if we ever getthere!

thanks with all the bad news i need a bit of sunshine.

smiling!

thank you professor

saves a lot of hours, reading these comments i don’t have to listen to cnn, npr. mrs kagan, bill kristol.

nor fear to learn anything about military science

how about those germ warfare labs in kiev and the absentee owners?

re “those germ warfare labs in kiev and the absentee owners”

this is from a blogger who calls himself “a political junkie” .. i don’t know what to make of it, but his embedded documents look legit….

United States and its Biological Laboratories in Ukraine –There are a lot of moving parts in the Ukraine/Russia/United States story, most of which you will not see reported in the dinosaur media. One of the more interesting aspects of Washington’s relationship with Ukraine is the presence of a significant number of biological laboratories that are being funded by the United States Department of Defense. Here is a screen capture from the U.S. Department of State’s Ukraine website: You will notice that along the right side of the webpage, there are a number of links to fact sheets for the United States’ funded labs in Ukraine. Interestingly, these links were live at the beginning of March 2022 (thanks to this Archive link), however, this is what you will see if you click on any of the links now: Fortunately for the world, the webmasters at the Department of State aren’t that clever. They don’t seem to realize that the Wayback Machine exists and that whatever appears on the internet is pretty much there forever. Fortunately, we can still access the information for each of the biolabs which fall under the Defense Threat Reduction Office as follows, noting that each of these labs is funded by "donations" from the Department of Defense of the United States of America and that costs provided are for construction only and do not include operating costs: (embedded documents on 11 laboratories included here) While it doesn’t appear on the State website, we also have this very recent justification for an Exception to Fair Opportunity (i.e. sole source or no-bid contract) from the U.S. Department of Defense’s Defense Threat Reduction Agency for two laboratories, one in Kiev and one in Odessa which have a total cost of $3,615,812.81:

NB: i don’t stand by any of this, just offering it as a response to the previous comment…

pentagon got to out source to overseas for illegal, dangerous stuff, they don’t want oversight and cannot do here.

‘dtra’ another wash dc acronym

the pentagon mixing ‘defense’ and ‘reduction’ in the same title is oxymoron.

wuhan lab did this, too?

with us money!

curiouser and more curiouser!

it does not make ukraine look innocant and abused….

nevermind!

This is supporting Putin the liar, Of course we know you work for Putin.

“The U.S. Department of Defense’s Biological Threat Reduction Program collaborates with partner countries to counter the threat of outbreaks (deliberate, accidental, or natural) of the world’s most dangerous infectious diseases. The program accomplishes its bio-threat reduction mission through development of a bio-risk management culture; international research partnerships; and partner capacity for enhanced bio-security, bio-safety, and bio-surveillance measures. The Biological Threat Reduction Program’s priorities in Ukraine are to consolidate and secure pathogens and toxins of security concern and to continue to ensure Ukraine can detect and report outbreaks caused by dangerous pathogens before they pose security or stability threats.”

This is NOT germ warfate. Now Putin is spreading his usual lies that Ukraine is about to launch germ warfare but we know Putin is a vile liar. And it seems we have a few trolls here working for Putin.

pgl,

These people tried to pull this same stunt at the time of the problems in Kazakhstan. There is one of these benign labs there also, and various Putin bots tried to claim that there were attacks on it because it was a bio weapons lab. We should not be surprised that Anonymous is supporting this fake news propaganda, but i was not aware before that rjs was a sucker for this sort of garbage as well.

An irony in this is that at least in the case of the Kazakhstani lab, the people working there had apparently been working in bioweapons labs during the Soviet period. A major reason US DOD was investing in the lab was effectively to offer these folks something else to do that was not working in a bioweapons lab. I do not know if this is also the case for this one in Ukraine, but quite likely. In any case, this one in Ukraine is not a bioweapons lab, but the Putin people are really getting desperate to come up with something, anything, to justify this unjustifiable invasion, especially as reportedly their big charge that Ukraine is run by a bunch of Nazis is reportedly not going over all that convincingly.

I’m posting this only as a matter of information in how a Russian academic views the sanctions and the potentially negative impact on the rest of the world, particularly Europe and the US. It might be interesting to see if any of what he is proposing is credible. I have to admit that while I was aware of some issues, there are others that are quite eclectic.

https://twitter.com/m_suchkov/status/1500815250685190144

No, Lucy, I am not providing support to the bogeyman. Read the thread and then comment about the specifics.

“The conflict in #Ukraine is a collateral damage of a massive #US-#Russia crisis that has been brewing for years.”

So these “academics” are blaming the US for the war crimes Putin is committing. They are more worried about economic difficulties for Europe than Ukrainians dying. Bruce does fulfill Putin’s bidding 24/7.

But this Lucy thing is telling me Bruce is gay and desperate date a guy he can call by a woman’s name. Of course even a woman named Lucy would not want to date a lying MAGA hat wearing moron. So Brucie – try finding a boyfriend using internet dating cites. Ewww.

LOL! You’re stretching there, Lucy. I didn’t read anything where Suchkov was “blaming” the US for the invasion by stating the fact that relations between the US and Russia haven’t been exactly cordial, although there is a backstory regarding how the US and NATO have been dangling NATO and EU membership for Ukraine for years despite that being Russia’s red line. You don’t have to agree with the Russians, but failure to understand their interests and limits certainly made the situation more than one-sided.

• https://www.msn.com/en-us/news/world/nato-expansion-in-ukraine-a-red-line-for-putin-kremlin-says/ar-AAOSFXt

• https://www.cnbc.com/2021/12/08/biden-didnt-accept-putins-red-line-on-ukraine-what-it-means.html

The fact that they attacked Ukraine, however, goes well beyond years of disagreements with the West. Biden called Putin’s bluff in December and Putin, it turns out, wasn’t bluffing. It seems that there was ample stupidity on both sides since NATO really had no intention of bringing Ukraine into the fold. This whole thing escalated into war because of two giant egos. So, if that is what Suchkov was inferring, I’d have to say he was on the right track.

https://www.nytimes.com/2022/01/13/us/politics/nato-ukraine.html

What I did read were a series of comments speculating on what the outcome of the sanctions might be should Russia take some actions of its own designed to cause the most economic damage it could. My invitation for you to address those comments was probably too hard of a challenge, so you have to resort to your usual non sequiturs. Yes a war is being waged on Ukraine. Thanks for the obvious observation. The other issue under discussion is the global economic impact.

So, the question is: are Sushkov’s observations propaganda or a real possibility?

Oh, well. You had your chance. Go back to your box of wine.

Good grief – so many words and no substance, integrity. Just constant whining that people are so mean to you and your master Putin.

Understanding the interests of the Russians? I guess that excuses genocide. You serve a monster. I hope he is paying your in dollars and not rubles.

“President Biden didn’t accept Russian leader Vladimir Putin’s “red lines” on Ukraine during their high-stakes video call that came as Russia’s military builds its presence on the Ukrainian border.”

Biden did the right thing. But of course Trump would have folded to Putin on this issue just as he would have disbanded NATO. Trump was also Putin’s poodle.

https://news.yahoo.com/ukraines-zelensky-says-cooled-joining-181721289.html

Damn that Ukrainian president understands realpolitik… unlike Old Uncle Joe.

So, folks, might not be any recession after all. UAE has apparently agreed to “open the taps” with some other Gulf nations as well, although probably not KSA. Anyway, oil prices down 11% today, with gold down also after having gone above $2000 for the first time, but crypto and stock soaring. We shall see. A lot of volatility out there. But this may yet not turn into quite the big bad oil price shock it was looking like just yesterday.

Barkley, I’m wondering how much additional oil OPEC (less Russia) can pump beyond what they are already producing.

Currently, OPEC is producing about 5 million bpd less crude oil than what I think was its peak output in 2017.

https://ycharts.com/indicators/opec_crude_oil_production

I found these data for 2016 from EIA regarding Russian exports of oil:

Russia exported more than 5.2 million barrels per day (b/d) of crude oil and condensate and more than 2.4 million b/d of petroleum products in 2016, mostly to countries in Europe. https://www.eia.gov/todayinenergy/detail.php?id=33732

There are many sources about the dollar value of Russian oil exports, but that difficult to translate into barrels. But, let’s assume for rough estimates that the Gulf nations would have to ante up an additional 7-8 million bpd to make up for the Russian shortfall. Is that possible? Plausible? And how long would it take to gear up that production?

It would seem that shutting off supplies is a lot easier that creating new supplies.

Bruce,

Oh, I don’t know exactly, although they do have a fair amount of extra capacity, especially the Saudis. But I suspect some Russian oil will leak out through China and maybe India as well with those nations making some money on buying it cheap from Russia and selling at the market price externally. Will ease some of the hit on Russia but also on the rest of the world as well. We shall see.

On another thread macroduck says the report UAE will “open the taps” is now being denied by their oil minister, so maybe we shall see the price of oil shooting up again later today. I expect we shall see a lot of volatility here in the next few days. But do note the bottom line here: this hurts Russia more than it hurts other nations. This is overwhelmingly their top export.

I prefer not to get into this sort of silly stuff, but really, Bruce, I for one am quite mystified by this nickname you have picked for pgl that you somehow think is devastatingly witty but that I at least cannot figure out what the meaning or point of it is. I thought initially indeed that it was a reference to the character in Peanuts, but it seems you have dismissed that. But if it is not her with her constantly pulling up a football Charlie Brown tries to kick, then what is it? Just seems completely arbitrary and out of the blue, and hence, frankly, just kind of stupid.

Hey, at least “pgloser” was sort of an amusing takeoff on the moniker he uses. But this “Lucy” bit just seems completely disconnected from anything and meaningless. Maybe we should start calling you “Jane,” or maybe “Mary.” Would make about as much sense and be about as witty, although I think I shall just stick with “Bruce,” Bruce. I mostly find this sort of name calling to be basically childish and prefer people just use their real names here.

Okay, Barkley. You are well respected and intelligent, so I will let you in on the nickname.

My mind’s image of pgl is of a very short hominid that dwells in a cave and does a lot of shrieking at others, but doesn’t contribute much else.

“There are many sources about the dollar value of Russian oil exports, but that difficult to translate into barrels.”

I guess Bruce is too stupid to calculate quantity = revenue/price. But there are lots of sources that capture the number of barrels produced and/or exported. Of course our Village Idiot would not know how to read those sources either.

Lucy, what price would you use? I suppose annual average price would satisfy you, but if the price is changing in one direction and the volume is changing in another, that might not be satisfactory. So, I chose to use actual EIA data even if it was a bit dated as a conservative estimate.

But, hey, I’ll let you do the calculations and then you can actually refute what I commented rather than mindless snark. I’m not holding my breath.

https://en.wikipedia.org/wiki/List_of_countries_by_oil_production#:~:text=List%20of%20countries%20by%20oil%20production%20%20,%20%20100%2C931%20%2074%20more%20rows%20

I know several morons who know how to use Wikipedia but it sees Bruce Hall is too stupid to go that. OK – this gives production by country for 2020 and not other years. But it leads by noting it sources its data from EIA. Most people – including Barkley and even the dork named Steve from Princeton – use this source a lot. But that is over the head of our Village Idiot Bruce Hall.

Lucy, anyone can edit Wiki. And if I did use Wiki as a reference, your retort would be exactly that.

Lucy,

Let’s presume that the data in Wiki was as published by EIA. Now if I had used it, you would have rightly noted that it was for 2020 which was an aberrational year for trade and the global economy and would not be representative (even if it makes a reasonable case). And you would also rightly note that even with economies recovering somewhat in 2021, demand for oil was significantly lower than 2019. You would have then made the point that those years would not be representative of the real demand for oil going forward. https://www.erce.energy/graph/global-oil-demand-and-supply/

The point is, no matter what reference I might have used, you’d have found some nit to pick. It’s your nature to miss the big picture in order to find some perceived fault which big picture issue, in my comment, was that OPEC would have a difficult time quickly making up the shortfall of Russian crude oil and petroleum products (with a link to EIA actual data) based on its current production levels.

Now, if you have data that shows that is not the case, please feel free to share it with all of us.

I have lost track of all of Bruce Hall’s stupid chirping but I did see this?

“The Fed ran up interest rates in 2006 into 2007 despite signs that the economy was beginning to struggle. Having set the course of higher interest rates to combat inflation, the Fed was reluctant to reverse course until later in 2007 when cracks in the economy were plainly visible. By the time the recession and housing crisis hit in 2008, the Fed was in scramble mode to lower rates, but couldn’t catch up to the falling sword… which left us with the mess in 2008-09.”

This is after he said the FED did not cause the Great Recession even if his past chirping claimed it did. The notion that the economy was showing signs of struggle in 2006 blatantly contradicts what most economists were saying in 2006. And the FED did reverse course on raising interest rates when Chairman Ben started to notice the rise in credit spreads.

Look I have no idea what Bruce’s latest agenda might be besides proving his is the dumbest troll on the planet. But EVERYONE knows that.

• https://www.thebalance.com/the-great-recession-of-2008-explanation-with-dates-4056832

• https://www.bls.gov/opub/mlr/2009/03/art1full.pdf

• https://www.theglobeandmail.com/report-on-business/the-2008-financial-crisis-through-the-eyes-of-some-major-players/article14322993/

The notion that the economy was showing signs of struggle in 2006 blatantly contradicts what most economists were saying in 2006. Agreed, most economists were not saying there were weaknesses in 2006 which is when the Fed’s run-up of rates began. My point, which you spun in a different direction, was that when signs of weakness showed up in 2007, the Fed did not react appropriately, but continued to raise rates for awhile.

Now, you can argue that “appropriate” to the Fed meant countering inflation and not avoiding a major recession. I’d agree that is exactly what happened. But now, perhaps, the Fed’s more cautious approach with inflation quickly heating up is that it does not want a repeat of 2008.