From Anders Aslund at Project Syndicate:

And on March 8, the central bank decided to stop exchanging rubles for foreign currencies, which means that the ruble is no longer convertible.

More specifically, from Law360:

[T]he Bank of Russia said that citizens holding accounts in dollars and other convertible currencies can withdraw no more than $10,000 in cash until Sept. 9. Withdrawals will be given in dollars, at the market rate on the date, regardless of which currency the account is in.

“Banks may take several days to bring the required amount in cash to a specific branch,” the central bank said. Citizens can withdraw the rest of their cash held in foreign currency accounts in rubles at the market rate on the day of issue, the Bank of Russia added.

Russians will continue to be able to hold funds in foreign currency accounts. Lenders will not sell currency to citizens during the next six months, but they can exchange cash currency for rubles at any time and in any amount, the Central Bank of the Russian Federation, as it is also known, said.

The latest controls on the movement of capital were imposed after a decision by the Bank of Russia on Feb. 28 to block foreign investors from selling Russian securities and an order for the Moscow stock exchange to remain closed, as it attempts to stem the flow of money out of the country.

President Vladimir Putin has in the meantime approved a special executive order calling for foreign debt to be repaid in rubles, including on bonds originally issued in foreign currencies, to maintain the stability of the Russian market and protect the interests of creditors.

Concerns are mounting that Russia will have problems serving its hard-currency debt after a string of unprecedented financial sanctions imposed by Britain, the U.S. and Europe.

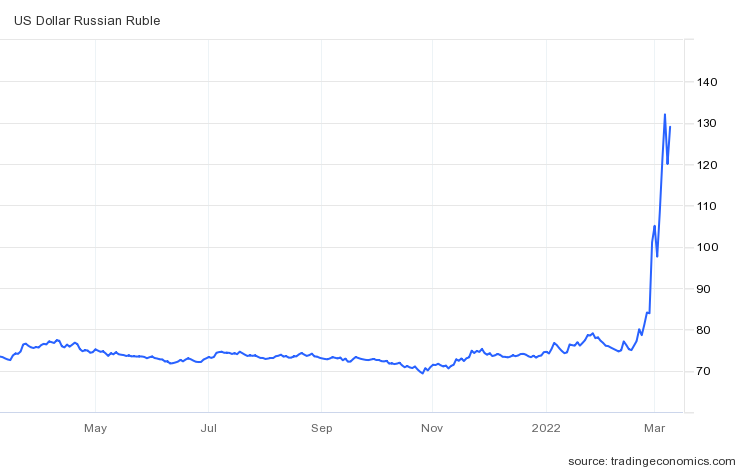

The ruble has collapsed, with no real recovery in value, despite some fluctuations.

A longer perspective highlights how truly disastrous the collapse is.

(Note: time averaged data in this long span graph).

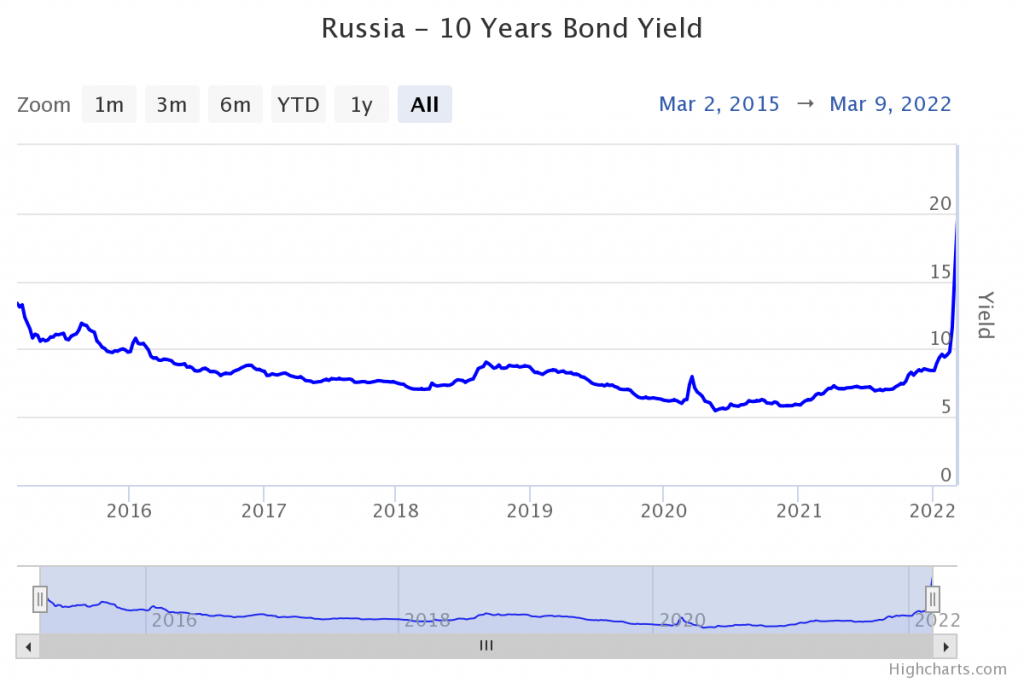

The policy rate remains at 20%, while sovereign yields have skyrocketed. Once again, looking at the longest span available.

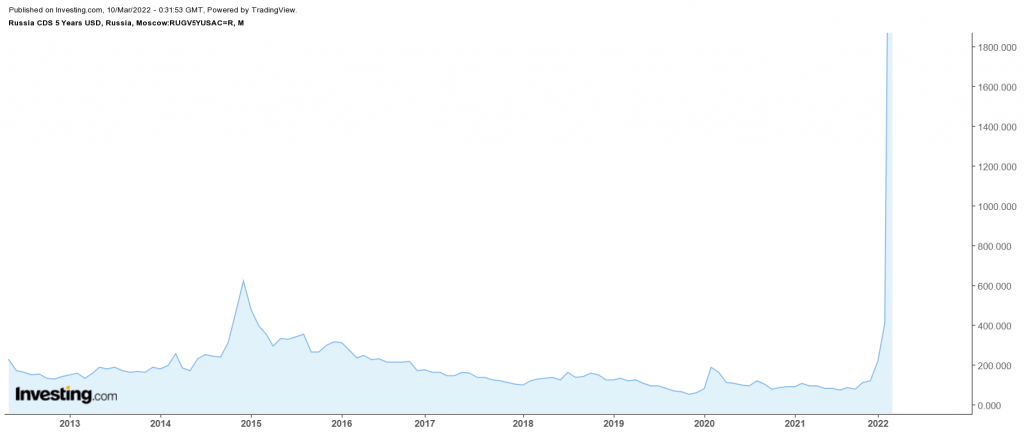

CDS on 5 year bonds were on March 3 412 (a record going back as far as 2015), with an implied probability of default of 6.87% assuming a 40% recovery rate (WorldGovernmentBonds). However, an March 5th FT article notes that the implied probability of default inferred from CDS’s might be misleading:

Russia’s five-year CDS now trades at around 45 percentage points upfront, a level that implies investors can expect to receive more than 50 cents on the dollar in a restructuring of Russia’s foreign debt. The price of the bonds themselves, however, at around 20 cents on the dollar indicates a much less favourable outcome for holders.

The issue could come to a head if Russia fails to make its next interest payment on its dollar debt on March 16, something investors see as increasingly likely. Moscow this week made an interest payment on its rouble-denominated debt — which is not covered by CDS — but said the money would not reach foreign holders, citing a central bank ban on sending foreign currency abroad.

Some traders even fear that the swaps could end up not paying out anything at all, emulating previous CDS mishaps such as car rental company Europcar in 2021 and Dutch lender SNS Reaal in 2013.

Analysts at JPMorgan say the small print of some of the debt may mean the bonds are beyond the scope of CDS in the event of a default. Six of Russia’s 15 dollar bonds contain a “fallback mechanism” allowing Moscow to repay in roubles rather than dollars or euros.

A further three bonds are subject to settlement in Russia, meaning they have effectively become untradeable since Russian authorities blocked offshore settlement at Euroclear.

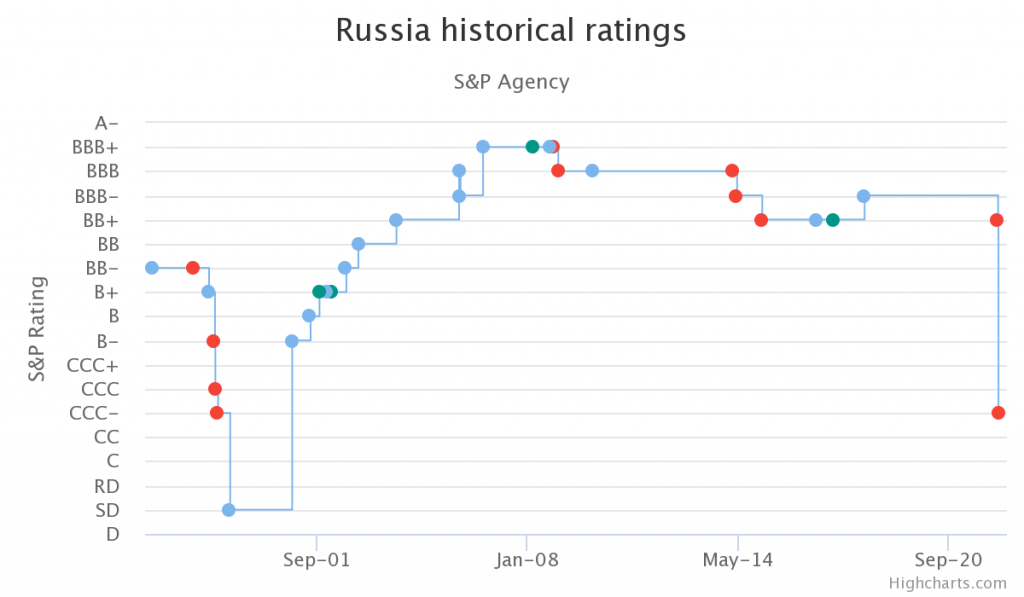

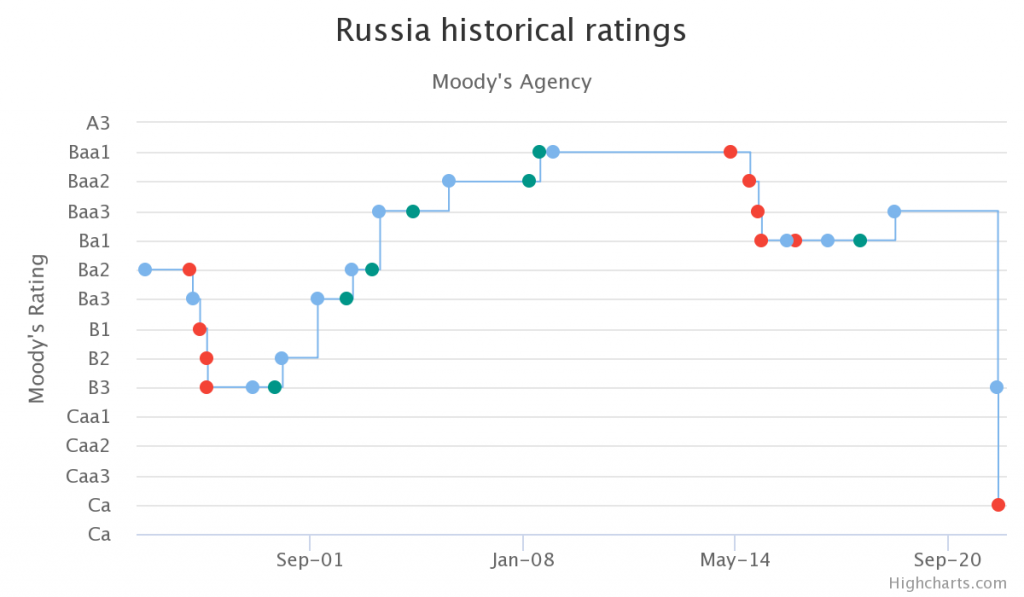

Here’re time series on the credit ratings for Russian sovereign debt, from S&P, and from Moody’s.

So we are headed toward a (very) likely sovereign default.

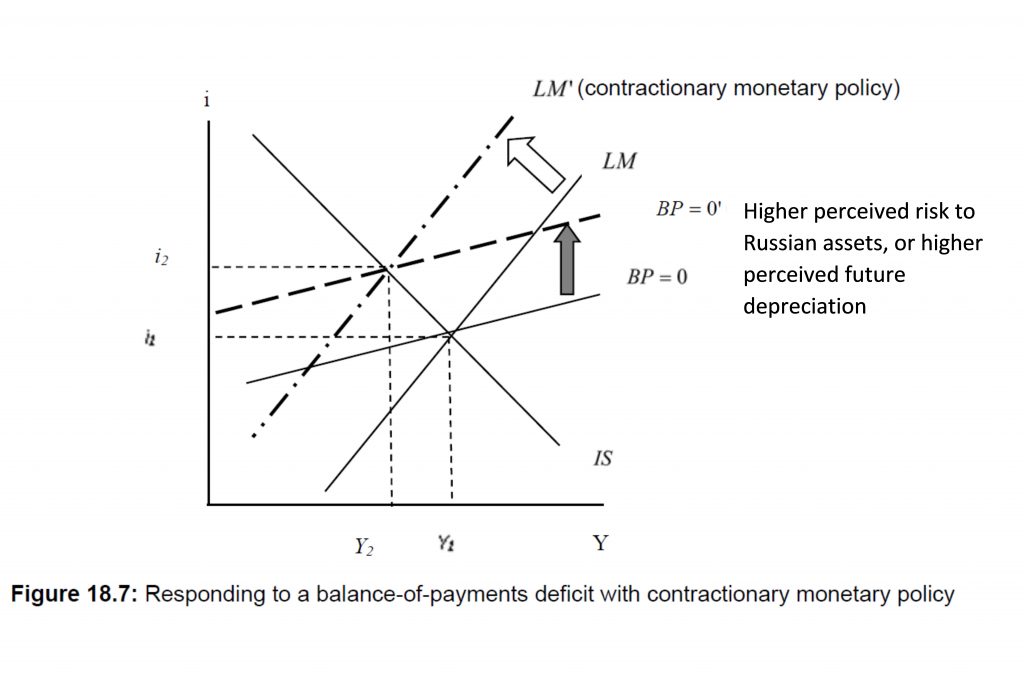

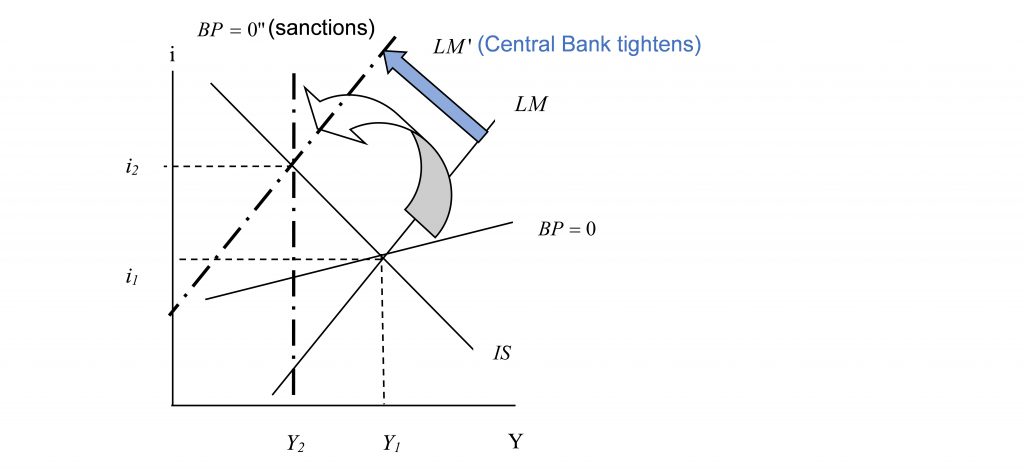

Two weeks ago, I interpreted the external macro situation thus:

This depiction is no longer relevant. The closest description is “sudden stop” combined with reserve exhaustion. Between the imposition of sanctions, the end of currency convertibility, the situation is more like the below, where the BP=0 line has rotated counterclockwise.

Figure 18-6 (modifed) from Chinn-Irwin textbook.

At income level Y1, interest rate i1, reserves are being decumulated. The money supply would shrink as reserves flow out (unless those flows are sterilized); but the central bank has raised rates — here I depict it as sufficiently high to staunch outflows (at i2). I’m not sure that’s the case. If that’s not the case, then available reserves (those not frozen) will be exhausted.

Addendum, 4:40pm Pacific:

Here’s a picture of 5 year Russian government bond CDS, through 3/8/2022, from investng.com

Source: investing.com accessed 3/9/2022.

The flip side: “ There is a known $41 billion in Credit Default Swaps (CDS) on Russian debt. There is likely many billions more in unknown amounts. There are also billions more in Credit Default Swaps on state-owned Russian corporate debt and non state-owned Russian corporate debt.

In addition to Wall Street not knowing which global banks and other financial institutions are on the hook to pay out on the Credit Default Swap protection they sold in case of a Russian sovereign debt default (or Russian corporate debt default), there is also approximately $100 billion of Russian sovereign debt (whose default is looking more and more likely) sitting on the balance sheets of foreign banks.”

https://wallstreetonparade.com/2022/03/the-big-question-on-wall-street-is-which-banks-owe-41-billion-on-credit-default-swaps-on-russia/

Sitting on the balance sheets of foreign banks? Depends partly on how one defines “banks”. SIFIs probably don’t hold much, relative to the size of their balance sheets. Ties up too much capital. Commercial banks? Same problem. Investment banks? Yes, but they will probably hold limited amounts, enough to be in the game so they can collect fees. Buy-side firms – investment funds, hedge funds, family offices – they’ll be on the hook.

The impact on wider financial markets will be limited to the extent that buy-side firms, instead of intermediary firms, are hurt. The wealth effect is pennies on the dollar. Adjusting portfolio risk will have a substantial near-term impact on risky asset prices. That’s mostly a flow effect. It abates after the flow stops. Impact on real investment? Mostly limited to Russia.

Systemic effects are what you don’t want. They are surely present, but may not be large.

Speaking of systemic troubles, the LME suspended nickel trade this week due to a payment problem. China’s Tsingshan holding was short nickel contracts – not an odd position for a large nickel producer – when nickel prices rose roughly 100%. The LME’s own stress testing only checked price moves up to 26%, so there was good reason to think the nickel exchange could have failed. So shut ‘er down and let Tsingshan round up money to cover losses, which amounted to around $8 billion. Financing arranged, short position covered, nickel trade back in action.

Which is to say, despite Russia’s small economic size and limited financial importance, it has a large enough presence in some markets to create systemic risk. Looks like a good job was done to stop the spread of the nickel short problem – this time, anyhow.

Presumably, Tsingshan is good for the money, what with being a producer of a commodity that is expensive as all get out right now.

One last thing…

Often, one reads the assertion that commodity producers and consumers can hedge away risk in futures markets. That is true as long as markets function normally. Tsingshan was doing just that – hedging away market risk. Oopsy!

That complacent assumption about hedging was on elaborate display prior to the mortgage (stock market, REIT, corporate bond, ABS, refi…) shock a little over a decade ago. Have we forgotten?

This gives us some clue:

Reuters reported on February 28 that Citigroup has $10 billion in exposure to Russian loans and various other types of Russian exposure. Given Citigroup’s history of understating its subprime exposure during the financial crisis of 2008, that $10 billion may not be the whole story. On February 1, Citigroup closed the trading day at $66.56. It closed last Friday at $56.59 – a decline of 15 percent. Citigroup’s commercial bank, Citibank, also has a significant commercial banking presence in Russia.

$10 billion would be a lot to you or me but it is pennies on the dollar for this megabank.

https://finance.yahoo.com/quote/C/balance-sheet?p=C

Yahoo Finance is a nice tool. First of all it tracks what happened to the stock price for Citigroup. It also shows that Citigroup’s total assets at the end of 2021 were near $2.3 trillion so $10 billion in Russian assets is a rounding error.

Russian government bonds rated CCC-. That is junk in the extreme:

‘After years of Vladimir Putin and his cronies mocking the ineffectiveness of previous US and European sanctions and building resilience against future measures, the Russian economy has now effectively collapsed. In launching his war against Ukraine, Putin clearly underestimated Western capabilities and resolve.’

Putin’s pet poodle Bruce Hall keeps chirping how ineffective Biden’s response to this invasion. Of course Bruce never had a problem spreading dumb lies for Trump so why not for Putin the butcher too?

Agree. The orange disaster talked about doing things – Biden is getting things done. A lot of people are surprised that Europe are getting it together. However, when something as big and bad as what Russia is doing now happens, a lot of people are ready to make sacrifices and follow good leadership. Again Biden knew that and stepped up as the leader setting the course behind the scenes, and letting other European leaders have visibility. Competence matters.

Current affairs.

“MOSCOW, March 3 (Reuters) – Russia’s finance ministry said on Thursday [March 3, 2022] that it was halting purchases of foreign currency and gold for this year as part of a suspension of parts of its fiscal rule relating to the use of extra oil and gas revenues.

“Under a rule adopted in 2017, Russia buys foreign currency when oil prices are high and sells when prices go below $44 per barrel, shielding the rouble from oil price swings.”

Oil is about two-and-a-half times $44.

As of October 2021, Russia owned 73.9 million ounces [200,000 oz. were bought in Sept and Oct 2021] of gold, and FX reserves of $618 billion. If the barbaric relics are held in the Federal Reserve Bank of NY, can they be locked down for the duration?

“shielding the rouble from oil price swings”.

It seems Russia had not shielded their currency from anything else!

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Gold prices may be high today but in inflation adjusted terms. they were higher in 1979 when the Soviet Union occupied Afghanistan.

Gold is a “barbarous relic”. As usual, Keynes was dead right. Of course the Russian Communists always hated Keynes. Thus, V.I. Lenin called Keynes an “implacable enemy of Bolshevism, which he, like the British philistine he is, imagines as something monstrous, ferocious, and bestial.”

The 2nd Congress of the Communist International, 1920.

A century later, Putin has proved Keynes correct: ” monstrous, ferocious, and bestial ” describes exactly communism in Russia.

Total clusterf**k.

Read this: https://twitter.com/kamilkazani/status/1501360272442896388?s=21

Hungary under Orban is a lesser version of this, so I am familiar with this syndrome. It really stems from communist times. Some habits are hard to shake. You can get away with this for a long time — unless you decide to become an autarky! Then the system works until you need to re-order inventory and get spare parts.

Speaking of Hungary’s Orban – he is not doing very much to counter Putin’s invasion. And you told us he was a crafty leader. Then again you said the same about Trump/

Orban has very much crawled into bed with the Russians. Lot of similarities. On the other hand, Hungarian sympathies will lie with the Poles and Ukrainians. Hungarians have had more than their fill of Russians. Hungarian elections are on April 3. Orban’s Fidesz was ahead by a bit in the last polls I saw, but I think events in Ukraine may prove decisive on the day.

“Russia’s five-year CDS now trades at around 45 percentage points up front…”

Quoting CDS “up front” is bad. It means pricing is so extreme that normal pricing conventions no longer apply. Russia has more or less already admittedan intention to default on upcoming FX debt payments by announcing payments will be in rubles. Depending on how CDS are written, some may already have to pay out. So they are up front.

Ending ruble convertibility was the foregone result of cutting Russia’s central bank off from its reserves. It will mean more defaults and more CDS payouts. CDS writers will have hedged, but there is no saying the hedges will work – depends on how they are structured. Bad environment for hedges. This, along with oil, is a clear transmission mechanism for financial shock.

Speaking of oil, The UAE oil minister has tweeted that the UAE still supports he current OPEC agreement – contradicting the earlier statement from the ambassador to the U.S. There may be a debate underway between UAE oil folk and foreign affairs folk. If so, the ambassador was upping the pressure by going public.

diesel stocks are down 5 million barrels to 114 million in this week report. but kerosene for jets is a bit up +1 to 39.2 million barrels.

total us petroleum stocks are down 10% from year ago, may not be big deal since year ago was delta surge, and prices may induce demand destruction around the economy.

opec+ seems to be hanging together including the saudis (mbs statement) affirming russia’s continued participation despite us economic warfare.

jpcoa is on a slim thread with iran demands a bit ‘stiff’.

if jpcoa opens iran oil in the months it takes to restart opec+ may do something……

while it will take time for venezuela to ramp serious coordination to find heavy oil refining capacity that is not already booked.

crude makes headlines but refineries make gasoline and diesel.

That agreement runs out in April.

Everything that has happened to Russia’s economy so far has the potential to be short-term. Well, that is, if the rest of the world decides to give back Russia’s reserves. And if ruble weakness is reversed. And if sanctions are lifted quickly. And if China decides to be generous in the commercial terms it offers Russia. And if trade diversion toward bi-lateral trade between Russia and China is large relative to Russia’s economy and import needs.

So… everything that has happened to Russia’s economy so far has the potential to hang around for a long time. Whatever Putin’s over-arching goal in attacking Ukraine (again), it likely involves power projection and Russian interests. At what point does the long-term harm to Russia’s economy wipe away any possibility of attaining Putin’s over-arching goal? Russia is going to be a poorer country in the future than it would have been if Ukraine II hadn’t happened. Poorer means less able to project power.

And that ain’t all. Poland is going to muscle up. So’s Germany. Finland and Sweden are much closer to joining NATO now. Russia looks a lot less interesting as an ally than it did a month ago. Russia will be far less able to use diplomacy and international institutions to achieve its non-military interests. Putin himself has lost gobs of credibility by miscalculating so badly and by losing money for his supporters. Russia’s military has also lost credibility. And men. And morale. Russian society has apparently lost a good bit of cohesion.

So, two questions:

1) What’s Russia’s new future?

B) What’s Putin’s new future?

1) The default version of Russia’s future is similar to that of Iraq under sanctions.

2) The future of Putin might be similar to that of Saddam Hussein under sanctions.

On Iraq:

When a memorandum of understanding was finally reached in 1996, the resulting OFFP allowed Iraq to resume oil exports in controlled quantities, but the funds were held in escrow and the majority of Iraq’s purchases had to be individually approved by the “Iraq Sanctions Committee,” composed of the fifteen members of the UNSC. (Additionally, some funds were withheld for Kuwaiti reparations.) The sanctions regime was continually modified in response to growing international concern over civilian harms attributed to the sanctions; eventually, all limitations on the quantity of Iraqi oil exports were removed (per Resolution 1284), and a large proportion of Iraqi purchases were pre-approved (per Resolution 1409), with the exception of those involving dual-use technology. In later years, Iraq manipulated the OFFP to generate hard currency for illegal transactions, while some neighboring countries began to ignore the sanctions entirely, contributing to a modest economic recovery. By reducing food imports, the sanctions appear to have played a role in encouraging Iraq to become more agriculturally self-sufficient, although malnutrition among Iraqis was nevertheless reported.

The effects of the sanctions on the civilian population of Iraq have been disputed.[10][11][12][13] Whereas it was widely believed that the sanctions more than doubled the child mortality rate, research following the 2003 US-led invasion of Iraq has shown that commonly cited data were doctored by the Saddam Hussein regime and that “there was no major rise in child mortality in Iraq after 1990 and during the period of the sanctions”.[14][15] Nevertheless, sanctions contributed to a significant reduction in Iraq’s per capita national income, especially prior to the introduction of the OFFP.[16] Most UNSC sanctions since the 1990s have been targeted rather than comprehensive, a change partially motivated by concerns that the Iraq sanctions had inflicted disproportionate civilian harm.

Iraq GDP / Capita

1990 $1,371

1991 $467

1992 $537

1993 $372

1994 $289

1995 $241

1996 $410

1997 $435

1998 $538

1999 $910

2000 $1,006

2001 $1,022

2002 $978

2003 $903

It would appear sanctions reduced per capita GDP by half to two-thirds, depending on the base year you choose.

Now, the question is whether this arrangement is satisfactory for Europe.

https://en.wikipedia.org/wiki/Sanctions_against_Iraq

Not sure Saddam’s Iraq is an apt analogy. Saddam was suppressing Shi’ites. Ba’athists had reason to fear Shi’ites, so had reason to support Saddam even when times were bad. There aren’t as many oligarchs in Russia as Ba’athists in Saddam’s Iraq. Putin is havng a hard time getting some of his troops to fight Ukrainians. He could face real trouble getting Russian troops to do violence to Russians on a sufficient scale.

Even if Iraq were an apt analogy – do not ever trust Wikipedia to get the data right. Of course Wikipedia provided its source but our most incompetent consultant formerly from Princeton failed to consult it.

Relying on Wikipedia which does not tell us whether this series is in nominal terms v. real terms? Lame. Now Wikipedia provides its source which does allow the user to do this in nominal v. real terms. But I guess doing that exceeds your limited competence. Of course FRED makes this so incredibly easy:

https://fred.stlouisfed.org/series/RGDPNAIQA666NRUG

Dr. Chinn has asked us to rely on reliable sources of data. Wikipedia does not cut it.

Do you think sovereign bond default means anything to Putin? Why not just pay off domestic investors in domestic currency, like China with Evergrande? Did hyperinflation stop Mugabe, Maduro, Assad, Erdogan, etc.? Isn’t economics really pretty feeble at explaining real world things, even prices?

Russia doesn’t have enough CDS credit to matter. Most of it is drowned in commodities and intermountain areas of the US. Matter of fact, a big reason for the oil dump were hedge funds dumping to cover costs. This smells of oligarchs being driven to liquidate funds. But I think the greater effect is on money laundering units like VKB or the Trump organization. Their business is cut off. Certain Hedge funds be liquidation night.

https://www.cnn.com/2022/03/10/politics/kamala-harris-andrzej-duda-poland/index.html

No jets but lots of missiles – javelins, stingers, and now Patriot missiles. Let’s hope Ukraine can do a lot of damage to Putin’s pigs with this.