Nowcasts for tomorrow’s CPI print is 1.1% m/m (Cleveland Fed), and Bloomberg consensus is 1.2%. In contrast, core CPI nowcast is 0.52%, consensus at 0.5%. The large gap is in large part attributable to gasoline prices, which rose 20% in March (all grades), even though the CPI weight of gasoline is only 3.8%. What do gasoline prices look like in April? This will depend on oil prices.

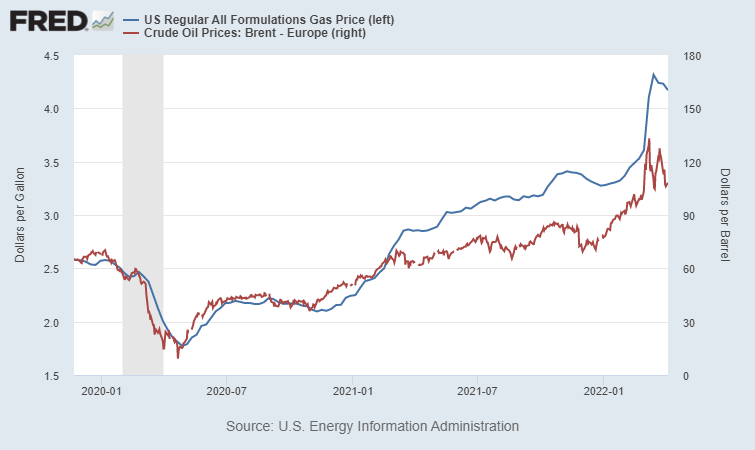

Figure 1: Price of gasoline, all formulations, $/gallon (blue, left scale), and price of oil (Brent), $/bbl (red, right scale). Source: FRED.

Gasoline prices are already falling.

A regression of gasoline prices on oil prices yields a coefficient of 0.027, implying each $1 change in the price of Brent implies a 2.7 cents increase in the price of gasoline — not too far off of Jim’s estimate of 2.5 cents.

The average price of Brent in March was $117.25, while the price today was about $100. If April price sticks at that level, then April gasoline prices will be about down about 47 cents from March’s $4.22/gallon.

Futures are backwardated, so that far futures are lower priced than near futures.

Some short-term considerations:

https://www.nj.com/news/2022/04/gas-prices-are-dipping-even-though-strategic-reserve-oil-hasnt-hit-the-streets-yet-heres-why.html

Summer blend could push prices back up

Experts say the relief we’re seeing now could start fading as soon as April 15, when summer blend gasoline starts replacing winter gas in gas station tanks.

“Those (summer) blends are more difficult to refine and complicated to distribute, increasing the price,” said Robert Sinclair, a AAA Northeast spokesman. “Winter blends must be flushed from the system, leading to sale prices on the flushed fuel,” which is what we’re seeing now.

There is a caveat: Winter gas that’s already in the system can be sold until June 1, which in some locations could stall a price increase of up to 20 cents per gallon that summer blend gas usually brings, Kloza said.

But that increase — along with higher demand for gas as the summer driving season starts in New Jersey, and any unforeseen disruptions to the gas supply — could make prices “sizzle” this summer, he said.

“Warming weather leads to more folks heading out to shake off the Covid doldrums, leading to more driving and more demand for gasoline,” Sinclair said. “That leads to higher prices. Memorial Day is the start of the summer driving season, more demand and definitely higher prices.”

How can the release of those millions of barrels from strategic oil reserves offset the higher cost of summer gas? Expect a price reduction of about 18 cents to 35 cents per gallon, Kloza said.

“Enjoy it while you can, because the odds are stacked for a sizzling summer of prices again,” he said. “There will be diversity in prices, people will line up at Costco” and other discount gas retailers.

Seasonal adjustment of consumer prices means that if winter blends are cheap, prices will have been adjusted upward. If summer blends are expensive relative to winter, they’ll be adjusted downward. So while seasonal variation in gasoline prices is a thing, it is not a thing that necessarily implies higher CPI readings. I realize prices at the pump aren’t seasonally adjust for consumers, so don’t bother waving that around. Menzie’s post is about the effect of gasoline prices on CPI, and CPI is seasonally adjusted.

Thanks for playing.

Bruce and macrod et al,

The summer blend adjustment amounts to about 15 cents. Not a big deal. Duh.

per gallon, of course. Sorry about the lacuna.

I believe the article was discussing a combined effect of summer blend price increases and price increases due to higher summer driving demand. It’s all about perception to the consumer. They will not be thinking about “seasonal adjusted pricing”.

Two distinct issue which only a moron like you would conflate.

See, I knew you couldn’t resist! Sooo predictable.

Oh, and notice the “it’s about ” construction. “It’s about” without an antecedent is a ubiquitous linguistic dodge in the 21st century. What’s about perception? It. It’s about perception. No antecedent necessary. Being clear about meaning limits wiggle room, and Brucey is all about the rhetorical wiggle.

Brucey wants to keep the focus on problems that the weak of mind can be convinced are Biden’s fault. It’s the central theme of his comments. Covid causes inflation? Biden. Russia boosts recession risk? Biden. Seasonal patterns in gasoline prices? Perception…of Biden.

Brucey? Partisan wiggler.

15 cents is not huge. And it is also not unusual, which was Macroduck’s point. This happens ever summer but Bruce Hall is on another dishonest mission to blame Biden for everything. It is not only dishonest but it is tiresome because anyone with an IQ greater then 10 would know Bruce Hall’s repetitive rant is simply wrong. Yet he repeats over and over again.

Bruce Hall has been playing this rather dishonest card over and over again. And when called on it, Bruce Hall goes into his usual whiney mode.

I realize prices at the pump aren’t seasonally adjust for consumers, so don’t bother waving that around.

Okay, then. Naturally, consumers will look at the pump prices and think, “Oh, that’s just seasonality.”

https://www.bls.gov/news.release/cpi.nr0.htm

Uh, no. The monthly seasonally adjust price of gasoline was >18% higher than February, so consumer perception was right.

I suspect, however, that there will be a much touted decline in gasoline prices when the April report comes out and that will be welcomed by all. The article I shared was that the good news (very relatively speaking) for consumers may be short lived when June rolls around. As to the CPI impact, you may be correct and there may be none at all. If pump prices get high enough, many vacations may be converted to staycations.

So you go to the dumbest people at the gasoline station to get your economic wisdom? Got it!

a good run down on summer grade gasolines. and the fact 14 jurisdictions requires different (reid vapor pressure) rvp than baseline epa std.

https://www.eia.gov/todayinenergy/detail.php?id=11031

note, the changing gasoline mix may effect distillate and kerosene yields, too.

David Ruccio: “ It’s not price gouging, corporations tell us—it’s inflation. You know, supply and demand. Not enough supply, because of forces beyond their control, and too much demand, but they’re doing the best they can to meet it.

Not a word about profits, though. Not from the corporations. And not from mainstream economists and pundits (or, for that matter, from the Biden administration, which prefers to point the finger at Putin). When they do go beyond supply and demand, they blame worker shortages and rising wages. They call it the Great Resignation…

Actually, last year was the most profitable year for American corporations since 1950!”

https://rwer.wordpress.com/2022/04/10/rebrand-this/#more-42470

As for gasoline prices, Robert Reich notes that “ Last year, when Americans were already struggling to pay their heating bills and fill up their gas tanks, the biggest oil companies (Shell, Chevron, BP, and Exxon) posted profits totaling $75bn. This year, courtesy of Putin, big oil is on the way to a far bigger bonanza.”

https://www.theguardian.com/commentisfree/2022/mar/20/big-oil-gas-prices-windfall-tax-russia-ukraine

Reich proposes a windfall profits tax.

Have mainstream economists even noticed what Ruccio and Reich are documenting? Cat got their tongues?

Funny how you didn’t wait for an answer about “mainstream economists”, which you keep insisting means economists who haven’t written in the popular press explicitly about whatever is bothering you, before making unfounded accusations against cats.

The answer, dear Putin pet, is that many, many, many mainstream economists have noticed profits. Data on profits are as available as data on incomes, wages, household formation, automobile production, interest rates and myriad other topics oninterest to economist. Yet you keep insisting that economists ignore all kinds of things you are bothered about.

Next, you’ll tell us economists are ignoring the virtue and humanity of Vladimir Putin. Sad, sad little Johnny.

Who gets those profits? Johnny boy cannot tell us. Of course high oil prices increase the economic rents for upstream operations. Economists dating back to Adam Smith have noted this many times. But Johnny boy has not seen this noted on the front pages of the NYTimes in the last couple of days so he writes his usual stupid rant.

Naturally, macroduck, the commenter with all the data, cannot cite any mainstream economists who have expressed concern publicly about price gouging and near record corporate profits. His usual blather…

What we do know is that an overwhelming percentage of mainstream economist disagree with the statement that “ A significant factor behind today’s higher US inflation is dominant corporations in uncompetitive markets taking advantage of their market power to raise prices in order to increase their profit margins.” https://www.igmchicago.org/surveys/inflation-market-power-and-price-controls/

Basically, the reason mainstream economists don’t write about price gouging and excess profits is that corporate plunder is of no concern to them…particularly those who advise hedge funds.

James Hamilton is not mainstream? Do you not realize by now that EVERYONE here has figured out you dishonest game about what “mainstream economist” do or not do. It is old, stupid, dishonest, etc. And yet you continue? MORON.

Paul Krugman has a Nobel Prize. Does that count?

JohnH would tell us that Krugman did not say what he has often said – THIS WEEK ON THE FRONT PAGE OF THE NYTIMES.

So none of his many writings on this topic count according to Johnny boy.

“What we do know is that an overwhelming percentage of mainstream economist disagree with the statement ”

they disagree because the evidence says to disagree. John, you have not provided any evidence to the contrary. you have simply said that many intelligent people with expertise in economics are wrong. some layman called Johnh knows more than these experts, and yet is unwilling or unable to share the date that points out their mistake.

to be clear, I have not seen evidence to suggest that record corporate profits are what is causing the increase in inflation.

“The evidence says to disagree,” as long as you throw away contrary evidence…

But consider that “ Corporations are quick to blame this new reality [inflation] on the pandemic, but another major culprit is hiding in plain sight: their own profiteering.”

https://www.baystatebanner.com/2022/03/17/its-not-just-inflation-its-price-gouging/

Do economists take into account what CEOs say about their pricing behavior? After all, they are the ones who set prices.

Economists’ resistance to the obvious makes me think of H L Mencken ” It is difficult to get a man to understand something, when his salary depends upon his not understanding it.”

“as long as you throw away contrary evidence…”

john, then show me that evidence. you claim it exists. give me a solid analysis in support of your assertion. you have yet to do so.

What macroduck said. But wait – what was the policy proposal again?

What to do? Hit big oil with a windfall profits tax. The European Union recently advised its members to seek a windfall profits tax on oil companies taking advantage of this very grave emergency to raise their prices. Democrats just introduced similar legislation here in the US. The bill would tax the largest oil companies, which are recording their biggest profits in years, and use the money to provide quarterly checks to Americans facing sticker shock as inflation continues to soar. It would require oil companies producing or importing at least 300,000 barrels of oil per day to pay a per-barrel tax equal to half the difference between the current price of a barrel and the average price from the years 2015 to 2019.

I bet you had no clue what Norway has been doing for years. Oil profits pay a profits tax in excess of 70% which would be even more than what this proposal does. And yes – economists have recommended windfall profits taxes for decades. But since no one told the most ignorant troll ever – it does not matter?

“pay a per-barrel tax equal to half the difference between the current price of a barrel and the average price from the years 2015 to 2019”.

This is a bizarre way to define what most economists think of when discussing a tax on economic rents. I checked FRED to see what the average WTI price was from 2015 to 2019 and it was $53 a barrel. Economic rents are defined as the market price of oil minus the economic cost of exploring and producing oil. For a lot of upstream operations, these economic costs are far below $53 a barrel so Reich is proposing an incredibly weak tea version of a windfall profits tax.ve

Now maybe for shale oil producers, the economic cost of production is above $50 a barrel so in a few cases his tax base might actually exceed economic rents. But in general, Reich has not put in the hard thinking in terms of designing a tax on economic rents.

Now if JohnH actually understood this issue, he would realize how weak tea Reich’s poorly thought out proposal really was. But of course basic economics is not something Johnny boy does.

So you’re saying it’s *not* inflation, *not* the tight labor market, *not* the Russian invasion of Ukraine?

Have you not noticed that clean energy profits are also through the roof? Should we tax their “windfall profits” too?

“Actually, last year was the most profitable year for American corporations since 1950!”

I call BS.

Everything you say or quote is framed through a very narrow ideology.

“Have mainstream economists even noticed what Ruccio and Reich are documenting?”

David Ruccio was looking at overall corporate profits whereas Robert Reich was focused on the profits for the oil and natural gas sector. I would say that even you knows the difference but maybe you do not. After all – you have a long track record of being extremely confused.

BTW Paul Krugman has noted many times the rise in overall corporate profits. But I guess he does not count as “mainstream”.

“Actually, last year was the most profitable year for American corporations since 1950!”

His 1947-2021 chart defined the profit margin which is nominal profits relative to sales. This is a VERY different concept from the one displayed in his earlier chart, which showed data from 2009 to 2021. So was it the “most profitable year” in 72 years? His language I fear is even worse then the dumb things you say.

pgl, the faux progressive growth liberal defends corporate profiteering yet again!

Here’s another chart showing recent, record corporate profits:

https://www.economicgreenfield.com/wp-content/uploads/2022/03/CP-GDP-3-30-22-.11250.png

But that ignores the main question…why are economists so reluctant to talk about corporate price gouging as a contributor to inflation?

“Last year, when Americans were already struggling to pay their heating bills and fill up their gas tanks, the biggest oil companies (Shell, Chevron, BP, and Exxon) posted profits totaling $75bn.”

How lazy can Reich get? These 4 companies all had negative profits in 2020 but did manage to receive profits margins in the 10% to 15% range for 2021. But that struck me as low until I checked the filings at http://www.sec.gpv (10-K or 20-F). All four have some upstream operations which were highly profitable (economic rents hello) but they also have significant downstream operations which tend to have modest profit margins.

Reich is smart enough to read these filings which allow one to check upstream profit margins as opposed to downstream profit margins but he didn’t. I would ask JohnH to do so but I know he is too lazy to bother and even if he did – he would have no clue what he was looking at.

Count on pgl, the faux progressive growth liberal, to defend oil company price gouging!

《Yet you keep insisting that economists ignore all kinds of things you are bothered about.》

Doesn’t Macroyuck’s bald assertion beg the question, why doesn’t Menchie mention profits in this post?

Is it too presumptious to point out that the widening gap between the blue and red lines in Munchie’s chartcrime (where are the error bars?) represent profits, not supply or demand issues?

In other words, are mainstream economists deliberately blinding themselves to the glaringly obvious fact pointed to by Munzie’s graphs: prices are just really pretty frickin’ arbitrary, nay?

Not a worry for those driving electric vehicles.

As I have stated earlier, sanctions on Russian oil exports as currently practiced are not sustainable, and Russian oil exports are rebounding. That’s what oil prices are telling us. The risk premium to me looks to be less than $10, so figure Brent in the $90-94 range would be the price without the war in Ukraine.

https://nypost.com/2022/04/11/russia-earning-huge-oil-gas-profits-despite-western-sanctions/

https://markets.businessinsider.com/news/commodities/russian-oil-exports-ukraine-war-sanctions-shipping-moscow-2022-4

The risk premium? We all love the fact you use terms you do not understand.

The fact that the credit rating of Russian government bonds is below CCC and the forecasts of a massive Russian recession both tell most of us that the sanctions are working. But leave it to Princeton Stevie to suggest only oil prices matter. And we thought JohnH and Bruce Hall were the only morons here.

Russian govt bonds have virtually nothing to do with the price of oil. Completely irrelevant comment.

Are you this effing STUPID? A nation has defaulted on its government bonds and you declare the sanctions do not work simply because oil prices have not hit $200 a barrel? Stop writing this garbage as EVERYONE has gotten fed up with it.

Russia uses about 3 mbpd of oil, 3% of the world total. Even a steep recession there would cut demand by, what, maybe 10%, 0.3 mbpd. That’s noise in the global context.

The NYPost has a link to a rather smart discussion from Michael R. Strain. Yea I actually lowered myself to read something from the AEI but it is something you should read because he is at least more a tune to the real world than you will ever be.

Gee – did you even read the opening of your 2nd link?

Russian oil exports are rebounding to pre-invasion levels, but cargoes are traveling on far longer delivery routes.

Do you even get what longer deliver routes mean in terms of transportation costs incurred? And you claim to be an oil markets consultant? Seriously?

Exactly. The real issue is not Russias sales volume (if we knew what they actually are), but sales income. If some Russian oil stay in the ground and world market supply is reduced we get drastic increase in oil prices. That is of more harm than help to the west – and a lower sales volume could end up giving Russia a higher sales income. However if Russia end up selling its oil at a 20-30% discount even a sustained sales volume would give them a substantial reduction in sales income.

With Chinas impending economic slump Pushing down overall oil demand and political pressure further pushing down demand for Russian oil, it could get hard for Russian hydrocarbons to finance Putins military adventures, even in the short term.

I stated that the volume reductions to Russian exports would be pretty small, probably 5% or less. That already seems to be the case.

The more pertinent issue, as Barkley has pointed out, is the per barrel discount. I believe that will also fall to the 4-8% range, so figure the total lost revenue to Russia would be on the order of 10% of no sanctions. Given that sanctions are driving up prices by about 10%, the current sanction regime is going to be pretty close to a net wash for Russia by May or so.

Meanwhile, Russia was booking about $55 / per barrel from 2015 – 2021. Even if I include a $10 discount to Brent, Russia will be banking about $45 / barrel more than it did in the 2015-2021 stretch. That amounts to about an additional $100 bn per annum that Putin can use to fund his war.

“Meanwhile, Russia was booking about $55 / per barrel from 2015 – 2021. Even if I include a $10 discount to Brent, Russia will be banking about $45 / barrel more than it did in the 2015-2021 stretch.”

You are comparing the market when prices were $55 a barrel to the current market? You are one dumb consultant.

“I stated that the volume reductions to Russian exports would be pretty small, probably 5% or less. That already seems to be the case.”

Quantity with discussing prices does nothing for estimating revenues. Oh wait!

“The more pertinent issue, as Barkley has pointed out, is the per barrel discount. I believe that will also fall to the 4-8% range, so figure the total lost revenue to Russia would be on the order of 10% of no sanctions.”

4 to 8 percent? Did you pull that estimate out of your rear end or what? As Barkley noted – it is closer to 30%. And since those ships have to sail to China rather than Europe means high transportation costs, which you just ignore.

Yes – you are an incompetent consultant even when it comes to the oil sector.

Steven, there is still room to maneuver on Russian sanctions. the oil and gas sector has yet to feel the full brunt of sanctions. the two avenues Russia has right now are china and India. and Chinese demand may drop precipitously with covid spread. and the usa could impose sanctions that eventually close down purchases from India. this would mean that Russian exports (and income) will continue to drop. your analysis seems to indicate you do not believe further significant sanctions can be implemented on Russian oil and gas. I disagree.

I don’t think the chosen approach is viable.

How do we address all black markets resulting from prohibitions, Baffs? Legalize and tax. No different here.

Steven,

There is also the matter that at least some of this oil is being sold at substantial discounts from Brent. There have been reports of these being as much as $30 per barrel, although I have not seen reliable data on how much is being sold at discount and how large the discounts are.

This is THE point which Stevie pooh ignores. And he says the rest of us are making totally irrelevant comments? Damn – so dumb.

For pity sake, prices don’t “tell” us anything. We infer from prices. You may infer one thing while an expert (paging Doctor Hamilton) might infer something quite different.

Your assertion about the risk premium in oil prices is just your assertion. Again, a real expert might have a very different view.

Based on your comment, it seems you are unaware of a truism in economics, that short-term elasticities can be much lower than longer-term elasticities. Of course Russia’s oil industry is adjusting to new conditions. That’s what the passage of time allows. Drawing conclusions about the sustainability of sanctions based on a recovery from the very short-term impact of sanctions ignores an inevitable adjustment to the shock of sanctions.

Your self-congratulation is rather premature.

But but but Princeton Steve fancies himself as the expert consultant in everything. He clients must the fools of all time!

I am not congratulating myself. I am walking through market dynamics. Sanctions are a prohibition. Prohibitions involve a government(s) attempting to prevent a voluntary seller and a voluntary buyer from consummating a transaction on market terms. That is exactly what sanctions against Russian oil are attempting to do.

As we know, prohibitions are doomed to failure and will create a huge amount of criminality in the process. The profit on a single tanker load, say a Suezmax tanker, could be $42 million on a cargo cost of, say, $85 million. Booking a tanker is hardly more difficult than, say, chartering a plane. One or two people can arrange a cargo like this. If you think these kinds of fortunes are going to be left laying around untouched, let me disabuse you of that notion now.

Kevin Drum has been contrasting EU inflation with US inflation. His latest admits the latter rose a bit but EU inflation rose even more.

https://jabberwocking.com/chart-of-the-day-inflation-in-march/

Follow the links as he offers his views of what all of this means.

Paul Krugman mentions something similar.

That being said, Krugman has turned a corner on inflation and is now using the term ‘stagflation’ in a non-dismissive way. The labor market is troublingly hot, a point Menzie Chinn has made IIRC.

I bet JohnH has never heard of Australia’s Petroleum Resource Rent Tax, which is a 40% tax on the economic rents from oil and natural gas, even if it has been around for 35 years. Here is one of many discussions of this tax on economic rents:

https://www.business.unsw.edu.au/About-Site/Schools-Site/Taxation-Business-Law-Site/Documents/The_Petroleum_Resource_Rent_Tax_1987_Kraal.pdf#:~:text=The%20petroleum%20resource%20rent%20tax%20%28PRRT%29%20is%20a,outlays%20on%20exploration%2C%20capital%20and%20certain%20general%20expenses.

Page 9’s history of this idea notes that Adam Smith and David Ricardo advocated such ideas. If JohnH says they were not mainstream economists, then his little pet term has no meaning.