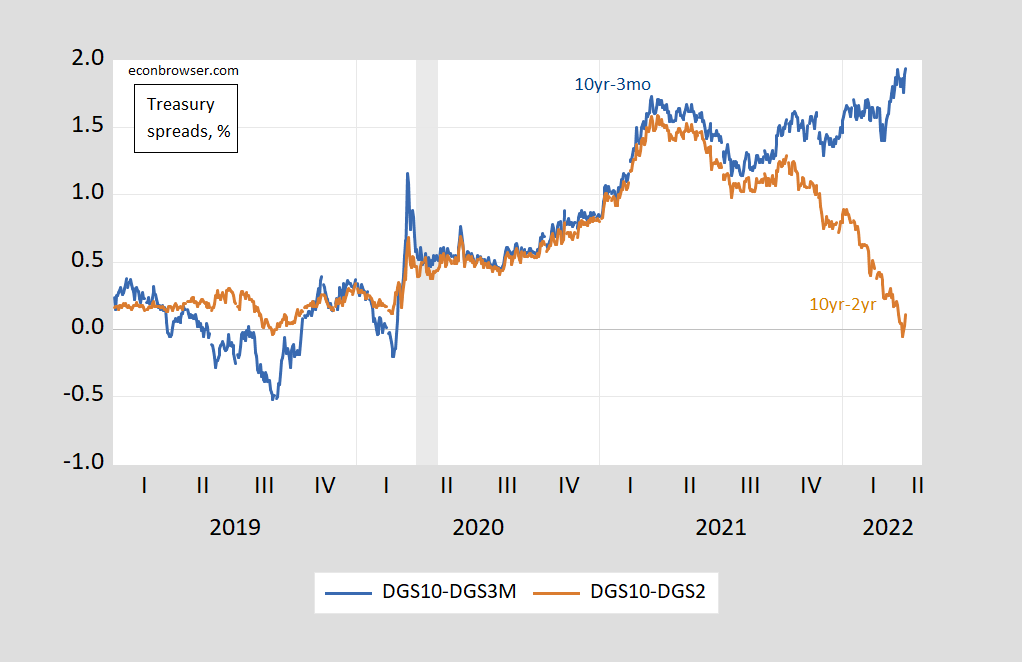

As is well known, the recession talk has surged in the wake of the (short-lived) inversion in the 10yr-2yr spread.

Figure 1: 10 year – 3 month Treasury spread (blue), 10 year – 2 year spread (brown), all in %. NBER defined recession dates shaded gray. Source: FRED, NBER, and author’s calculations.

What’s obvious is the wildly divergent signals coming the 10yr-3mo. In previous recessions, both spreads inverted.

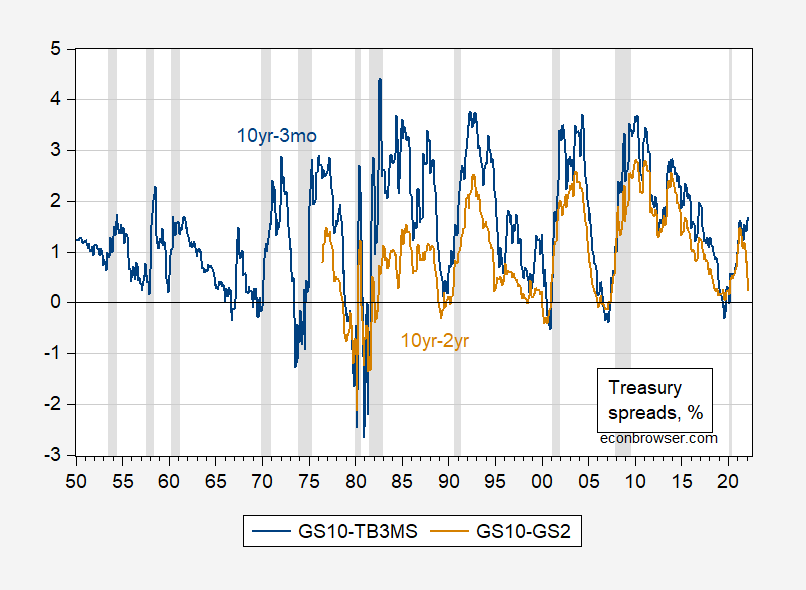

Figure 2: 10 year – 3 month Treasury spread (blue), 10 year – 2 year spread (brown), all in %. 3 month Treasury is on secondary market. NBER defined recession dates peak-to-trough shaded gray. Source: FRED, NBER, and author’s calculations.

The data in Figure 2 are monthly averages of daily data. At this frequency, one recession occurs with an inversion in 10yr-2yr, but not in 10yr-3mo. However, at the daily frequency, dual inversion always occurs before a recession (albeit only a few days).

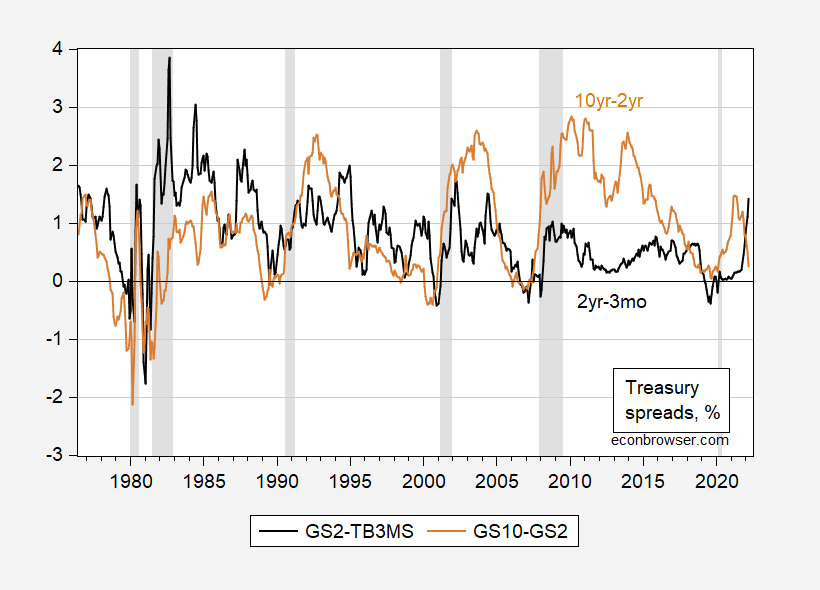

Then, there is the related question: has an inversion in the 10yr-2yr ever occurred while at the same time the 10yr-3mo is spread is so large and positive?

Figure 3: 10 year – 2 year Treasury spread (brown), 2 year – 3 month spread (black), all in %. 3 month Treasury is on secondary market. NBER defined recession dates peak-to-trough shaded gray. Source: FRED, NBER, and author’s calculations.

It’s hard to identify such a combination preceding recession.

Is the 3-month treasury bill more constrained at a low level compared to the 2-year treasury note?

You’re referring to the spread or the interest rate itself?? Your question is slightly confusing as to what exactly you’re asking. Shorter terms with the same risk profile are always going to offer lower rates.

Good comment, Of course, short rates are generally lower than two-year rates.

I may not be able to clearly explain but here goes:

Compared with past history, is the 3-month rate currently more constrained related to and relative to upward movement of the two-year note? Is the market functioning differently on the 3-month bill compared to the two-year note compared to past market history? Is the low fed funds rate causing more “gravitational” attraction to the 3-month rate compared to the two-year note, again, relative to past history?

Think in terms of adding up nominal interest rates.

Expected cost of funds + expected inflation + term premium = nominal rate.

For a 3 month bill, cost of funds is nearly fixed and highly predictable (in developed countries), while inflation has limited impact and term is extremely short. So, there is a fairly strict tie between funding cost and 3-month rates. Less so as maturity lengthened. I think this is what you are asking?

Prof. Chinn:

It is true that the 2% difference between the 3 year treasury and the 3 month and Fed funds rates is historically wide, and when it has occurred in the past 40 years has only been several years or more before the next recession.

BUT, that is a reflection of just how far behind the inflation curve the Fed is, as shown by the below graph showing the difference between the Fed funds and inflation rates:

https://fred.stlouisfed.org/graph/?g=NVKd

The Fed funds rate is currently 8% below the inflation rate. Even in the 1970s the worst it got was 5% below. The quickness with which the relationship can deteriorate is demonstrated by the 1980-81 period.

In short, if the Fed decides it has to get aggressive now, all bets are off (and based on the fact that Owners Equivalent rent is increasing sharply, following the house price indexes, as surely as night follows day, it’s a good bet that the Fed will soon be stomping on the brakes).

P.S. Note that the 10year-2year spread inverted months before the 10year-3month before the 1990, 2001, and to a lesser extent the 2008 recessions as well.

This, boys and girls, is how fact-based comments are written.

NDD, Welcome to the party.

Good point. I think the worry would be that this difference would help cause inflation expectations to be unanchored. If they don’t become unanchored (if market participants still think the supply stuff is being resolved and fiscal stimulus will turn negative soon and the housing market, which is alreading cooling, will cool more) then maybe this is just an aberration, albeit a big one.

I would offer up the caution that hind sight is 20/20. when the fed began to fall behind, there was ample evidence to suggest that the inflation was transitory. and if that was the case, and they had acted on inflation aggressively, we probably would already be in a recession. the fact that we are not is good.

their is still ample evidence to suggest that inflation is more transitory, although lengthier than many expected. that is why the fed is in the difficult position right now. if it is transitory, and we raise rates as inflation falls, we enter a recession. the fed wants to avoid causing a recession. they have been willing to wait it out, and only willing to cause a recession if inflation ran too high. maybe we are there now? but I don’t think the phrasing that has been used recently, that the fed is behind the curve, is necessarily accurate. it implies they do not know what they are doing. I disagree. I think their priority was to avoid a recession, until and unless it was absolutely necessary. and they stated repeatedly, they were willing to absorb higher inflation over a period of time in order to test the waters better before acting on rates.

https://news.cgtn.com/news/2022-04-07/Chinese-mainland-records-1-323-new-confirmed-COVID-19-cases-191Vw0KwPbG/index.html

April 7, 2022

Chinese mainland reports 1,323 new COVID-19 cases

The Chinese mainland recorded 1,323 new confirmed COVID-19 cases on Wednesday, with 1,284 linked to local transmissions and 39 from overseas, according to data from the National Health Commission on Thursday.

A total of 21,784 new asymptomatic cases were also recorded on Wednesday, and 132,948 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 160,116, with the death toll at 4,638.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-04-07/Chinese-mainland-records-1-323-new-confirmed-COVID-19-cases-191Vw0KwPbG/img/c08b9d51a24049dd89a3acbafdf9df6a/c08b9d51a24049dd89a3acbafdf9df6a.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-04-07/Chinese-mainland-records-1-323-new-confirmed-COVID-19-cases-191Vw0KwPbG/img/cae9c29e248245f1b891fea13e8be1fe/cae9c29e248245f1b891fea13e8be1fe.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-04-07/Chinese-mainland-records-1-323-new-confirmed-COVID-19-cases-191Vw0KwPbG/img/dc56ff4768cd48278c2591d2c61e3ec1/dc56ff4768cd48278c2591d2c61e3ec1.jpeg

https://www.worldometers.info/coronavirus/

April 6, 2022

Coronavirus

United States

Cases ( 81,900,012)

Deaths ( 1,009,390)

Deaths per million ( 3,022)

China

Cases ( 157,378)

Deaths ( 4,638)

Deaths per million ( 3)

https://newseu.cgtn.com/news/2022-04-07/Israel-China-free-trade-deal-to-be-accelerated-after-talks-191mRVwq23K/index.html

April 7, 2022

Israel-China free trade deal to be accelerated after foreign ministers call

China and Israel have agreed to accelerate negotiations on a free-trade deal following a phone call between the Chinese State Councilor and Foreign Minister Wang Yi and Israeli alternate Prime Minister and Foreign Minister Yair Lapid, on Wednesday.

During their conversation, Lapid said Israel and China are two ancient nations that have created great civilizations, and now both are committed to accelerating the modernization process and have strong innovative capacity, adding that the two sides understand and appreciate each other.

Noting that the Israeli side regards China as a friend and has always adhered to the one-China principle since the establishment of bilateral diplomatic ties, Lapid said the position has never changed and become an important foundation of its relations with China.

Israel expects to maintain close high-level exchanges and deepen cooperation in various fields with China, he added.

Wang said that the Chinese nation and the Jewish nation have helped each other in history, and today we should support each other even more….

off topic.

https://www.cnbc.com/2022/04/07/gm-trolls-tesla-changes-approach-with-hummer-ev-rollout.html

an electric HUMMER that reaches 60mph on par with a corvette! and yet we still have people on this blog who continue to parrot the inaccurate claim that EV’s do not perform as well as gas engines. hogwash-they outperform them.. hey Steven, the EV revolution is in full motion, despite your predictions.

Hey Baffling, Steve Kopits wrote an article for the National Enquirer yesterday titled “I Watched a Wild Hog Eat My Daughter” and it was read by over 2,000,000 people. What did you do today Baffling??

physics: have you heard of elon’s tesla ‘ludicrous drive’, been out several years……

time to deliver max torque in electric motor is tiny fraction of the time to spin up a drive shaft using combustion.

time to 60 mph is one of many merits to measure.

don’t run out of juice anywhere but at a charging station.

Thr torque curve for electric motors is a thing to behold.

I dislike the electrical engineers. they are arrogant. they make indecipherable computer code. they work in the abstract too much. but boy can an electron kick the butt of combustion!

it will be several decades b4 the electrons arrive reliably from processes other than combustion and nukes…. if ever.

We take your word for it because you can see into the future? Don’t think so.

well in texas last year, the reliability of natural gas combustion was extremely poor, as the state lost power for nearly a week do to the inability of natural gas to produce when expected. so your timeline is very much off. i am not sure if your comment is simply misinformation, or ignorance?

and now jeep is building a wrangler that goes 0 to 60 in 2 seconds. but of course, EV vehicles lack performance, right? the world is changing before your eyes.

https://www.cnbc.com/2022/04/08/jeep-new-electric-wrangler-suv-concept-as-fast-as-a-tesla.html

You remind me of the Klass Klown saying anything just to get attention. My recommendation has been to just ignore worthless trolling like yours.

https://www.cnn.com/2022/04/07/politics/un-russia-human-rights/index.html

When a proposal to kick Russia off the UN Human Rights Council, the Putin government lobbied hard to sink this proposal making all sorts of threats to other nations unless they voted no. The Russian efforts failed as a majority of the UN members voted to kick Russia out.

close run as to whom is more depraved.

https://www.newsweek.com/ukrainian-troops-seen-killing-russian-pows-video-1695896

both sides have a ‘lethal aggression’ dilemma.

the ‘troubles’ there go as far back as any in europe.

why europeans left to come to america when they could.

this video lasted on your favorite msn.com link about 2 minutes….

simple solution. lets hold all accountable for war crimes. I will tell you the Russian line will be MUCH longer. stop using equivalence as an excuse. the Russians were executing civilians, including women and children. the ukranians were not invading Russian territory to commit war crimes. if they occurred, it was because the Russians were in Ukraine, no? stop with the propaganda. what Russia is doing is murder. they will be held accountable.

you are ill informed or unaware of the back story.

easy bc you are willing subject of a psyop…..

there is no backstory that would excuse the military execution of the ukranian population at the hands of russian invaders. this actually happened. given my fondness for the russian culture, it pains me to be so critical of russia. but putin will go down with comparisons to some of the most brutal dictators of the past century, based upon his complete disregard for humanity during this murderous campaign. and if the russian people continue to stand behind putin and his actions, they will continue to be viewed in a dismal way. the serbs have never really recovered from their support of the murderous milosevic. russia is headed down a similar path.

Anonymous,

No, not remotely a close run. Yeah, this is bad. But is it one case and it involves a soldier, an invading soldier. Russians have been killing thousands of civilians in a nation they are invading without a shred of justification.

So, sorry, not remotely close: the Russian military is far far far more depraved, and you are depraved for your continuing efforts to defend these ongoing and mounting war crimes here.

From my weekly DOE report:

– The war enters its seventh week. WTI front month was down $11 on last week, at writing to $95, suggesting quasi sanctions on Russian oil are all but ineffective.

– The Biden administration has been releasing more than 500,000 bpd from the Strategic Petroleum Reserve for the last three weeks. This is are the largest release from the Reserve since its founding, bar a three week stretch in August 2011

– The consumer is beginning to crack. Distillate (diesel) demand is back at November levels; gasoline consumption at the levels of a year ago. The numbers are beginning to outline the case for a recession.

– Inventories were mixed. On a 4 wma seasonally-adjusted basis, allowing for changes in domestic and export demand (that is, using turnover days adjusted for exports), excess crude stocks fell, -6 mb to -26 mb; excess CGD was up, +5 mb to -25 mb.

– Refining continues strong, underpinning refined product exports 1.0-1.5 mbpd above recent levels

– Oil production rose, +0.1 mbpd to 11.8 mbpd

– Incentive to Store analysis indicates market conditions have returned to their state prior to the war. Informal sanctions on Russian oil look wholly ineffectual

The war enters its seventh week. WTI front month was down $11 on last week, at writing to $95, suggesting quasi sanctions on Russian oil are all but ineffective.

You bitched when oil prices rose and now that they have retreated a bit – you conclude the sanctions on Russia are ineffective? This is the dumbest statement I have ever read. Excuse me if I do not read the rest of your sheer stupidity. DAMN!

Wait I did read a bit more and saw this?

“The consumer is beginning to crack. ”

You must be on crack. We have asked you to stop with the BS hyberbole but you continue. Did you get an F minus in 1st grade writing or what?

political economy!

kopits alluded to a hint of ‘demand destruction’:

which may or may not be the cause of gasoline inventory to be ~ equal to same week last year [with current ‘hotter’ economy], and distillates ($5/gallon) showing a 2d week of tiny inventory gain after many weeks draw.

the item kopits did not say: usa total crude inventory (1 apr report) was down 1.3 million barrels; the decline in the strategic reserve was -3.7 million, comm’l crude stocks rose 2.4 which reflects strategic release not going to gasoline/diesel supply! imported and drilled crude up year over year!

bc ‘demand destruction’, for what ever causes. or maybe refineries are running optimal and cannot take more crude.

there is promise of more release, maybe 180 million plus a few million from earlier direction!

we will see how the auctions proceed.

the history of returning the ‘released’ crude is bleak!

buying back raises the cash deficit!

Yes, declining consumption is functionally the equivalent of demand destruction in a high-priced environment. Keep in mind this is weekly data, and we are speaking of 4 week moving averages — so this is still short fuse, twitchy data. It is possible to have a down month statistically with no longer term impact. The simple read, however, is that the consumer is beginning to throw in the towel.

In terms of turnover days, refined product inventory levels are essentially normal. Crude inventories are low by about one day’s turnover. Refiners normally hold about 25 days of crude inventory, so inventory is low, but not tragically so.

Refineries are running at normal levels, really for the first time since the start of the pandemic. Weak domestic demand for gasoline and distillate is often by higher than normal product exports from the US.

SPR releases are running at 0.5 mbpd. This is at record territory since the founding of the Strategic Petroleum Reserve, with the exception of three weeks in August 2011, when releases averaged 0.6 mbpd. The SPR holds typically holds 670 million barrels, currently at 565 million barrels. At the current pace of releases, the SPR would last for about three years.

Steven,

Good heavens, looks like pgl is pretty much on the money here. I do not always agree with you, but usually on oil markets you at least make some sense. This is just totally incoherent and bizarre.

Yes, WTI has fallen hard, and indeed a large gap has opened with Brent crude, which remains well over $100. Why might this be? Well, duh, it looks to probably being due to Biden’s ongoing release of oil from the Strategic Petroleum Reserve. It may prove that this is not a wise move, and you kind of suggest that. But it certainly looks to be the likely cause of the sharp decline of WTI while Brent does not follow, with the claim that this somehow shows to the “quasi-sanctions” on Russian oil to be “ineffective” to be indeed not defensible at all.

It also seems to make zero sense to somehow claim that seeing demand for distiallate to have recoveredto be a sign of impending recession to be a completely bizarre argument. What? I have not seen you say so many completely off-the-wall things in a single post in a long time. Not making any sense at all here.

Barkley –

That’s what the graphs say. If you want the twice weekly ppt deck, you can sign up here: info@prienga.com.

I am telling you what the graphs say. Not more, not less.

Further, Russian oil production was down all of 0.5 mbpd for March, while US SPR releases have averaged a bit of 0.5 mbpd for the last three weeks (the second biggest release over a three week period in the Reserve’s history). Quasi sanctions on Russian oil are wholly ineffectual, and we will see the per barrel discount diminishing very rapidly. I am guessing the impact to Russian oil revenues will be less than 10%, perhaps in the 4-8% range, by as soon as May.

I am preparing a ppt on this. Again, if you want it: info@prienga.com

Let’s try this again:

Barkley –

For the month of March, Russian oil production was down about 0.5 mbpd, SPR releases were up 0.5 mbpd. Therefore, the world petroleum liquids supply, before changes in inventory levels, looks about the same as pre-war. Given fundamentals, Brent should be running about $10 cheaper; thus, sanctions look worth about $10, which is not very much. Russian oil sales were said to be discounted $35. This is not a sustainable gap, and I expect the total hit to Russian oil sales at about 10% or less in May. This would imply Russian oil exports revenues in the range of $260 bn per year, compared to an average of $160 bn per year in the 2015 to 2021 stretch. That is, Russia’s oil export revenues at an annual pace, by May, might be expected at $100 bn over the prior five years, even after the impact of soft sanctions on Russian oil .

This $100 bn windfall is perhaps 3x the effective Russian military budget (allowing for half the nominal budget of $65 bn lost to ‘shrinkage’). The current oil regime provides ample ammo for Russia to continue to create trouble in Ukraine.

Steven,

I do not think we know what Russian oil sales are. Also, it looks like while they have lost some, what is going to India and China is doing so at a massive discount. Even with Brent up from where it was pre-invasion, there is no way Russia making more now from oil sales than they were before. Note also that IEA is also releasing reserves, probably at a greater rate than is coming out of the SPR.

Steven,

Brent currently at about #102 per barrel, but reports have both China and India taking about a $30 per barrel discount for what they are buying. No way Russian oil export revenues up.

Steven,

Yeah, the Russians probably had some windfall in March, especially when Brent spiked to about $130. But they are losing money on their oil exports now relative to pre-invasion almost for sure.

Barkley –

Please read what I wrote:

“Given fundamentals, Brent should be running about $10 cheaper; thus, sanctions look worth about $10, which is not very much. Russian oil sales were said to be discounted $35. This is not a sustainable gap, and I expect the total hit to Russian oil sales at about 10% or less in May.”

I am not making a statement about current conditions, but rather expected conditions. It is not possible to hold open a $35 / barrel arbitrage in a fungible commodity like oil. Not with the current sanctions system.

The Senate just voted to make Kentaji Brown Jackson a Supreme Court Justice 53-47. All 50 Democrats did the right thing but of course only 3 Republicans had the guts and integrity to do so.

Really was something to behold, all the slime thrown at Jackson.

I’m no legal scholar but I am OK with ideological litmus tests, at least within limits. Very extreme SCOTUS candidates should receive extra scrutiny.

But Jackson was anything but. Her record was not extreme or radical in any way, shape or form. And yet she was slimed anyway.

She’s black. And because she’s black (and appointed by a Democrat) all sorts of racist and paranoid right-wing crap can be flung at her and it will stick in the minds of many Republicans. It’s really disgusting.

In other news, Lend-Lease anyone? Makes me want to scream, “America IS Great Again!” It’s almost like we’re learning from history!

https://www.msn.com/en-us/news/politics/mcconnell-said-he-s-shocked-to-hear-that-he-s-considered-a-ruthless-politician-my-wife-thinks-i-m-a-really-nice-guy/ar-AAVYQ64?ocid=msedgdhp&pc=U531&cvid=43339fd6aad2498eab17884936f2e87a

Gee Mitch McConnell says his wife thinks he is a good guy. Of course the rest of the world is not so easily bought off. But it does seem McConnell would support any Republican in 2024 – including Trump and perhaps Hitler or Putin if they got the nominee. What a guy!

The final vote was delayed as the jerk who is the junior Senator from Kentucky choose to wait forever to cast his irrelevant no vote. As soon the 53-47 result was formally announced there was a mass exodus of Republican Senators. What a bunch of losers.

You didn’t think it was courageous for Joe Manchin to go against his own party and vote for Justice Jackson?? I always thought “crossing the aisle” was a big deal.

I just don’t get the point of this comment.

Irony. Google it.

He wants attention – desperately. Otherwise none of his comments have any point.

we will certainly bring a bright mind onto the Supreme Court, but it is still run by conservatives. and there are a couple of folks I would remove from the fed board. but we certainly do have better leadership across the board now than in the vacuous years of trump, where most appointments were to unqualified individuals. just compare the appointment of kavanaugh to that of brown jackson, as an example of the improvement in decision making.

When does Clarence Thomas leave the Supreme Court?

49 republicans voted for kavanaugh.

3 republicans voted for Jackson.

seriously, if you are a republican these numbers should be embarrassing. are you really that misinformed? or have such poor judgement? most fathers in American would not leave kavanaugh in a closed room with their teenage daughter. and yet senate republicans overwhelmingly supported him for the Supreme Court? amazing.

I believe it was Lyin’ Ted who called Brown the most extreme left-wing nominee ever to the Supreme Court.

William O. Douglas (RIP) probably wonders why he went to all the trouble to write opinions.

Brandeis would have to be my personal favorite:

https://www.npr.org/2016/06/07/481076322/revisiting-the-tenure-of-supreme-court-justice-louis-brandeis-the-jewish-jeffers

His dissent in Olmstead v. United States put his path breaking views on the Right to Privacy at the fore front of Supreme Court decisions.

I always thought the majority in this decision were wrong for other reasons as well which was the basis of the Katz decision.

His dissent laid the foundation for Griswold which was the Court’s basis for the Roe v. Wade decision.

Ted Cruz fancies himself THE expert on Constitutional which is very odd since he has forgotten about Douglas and Brandeis.

Someone should ask Teddy boy about Griswold v. Connecticut.

lyin’ ted is a fine example of the moral decay currently underway in the republican party. even after trump assaulted cruz’s wife and father, the man did not have the backbone to do what was right and defend them. spineless example of the modern republican party. but what is so amazing, is that no republican really seems to be embarrassed by the behavior of somebody like cruz. moral decay.

John Boehner may not have been my favorite Speaker but at least he knew how to address Cruz – eff you Ted.

But kavanaugh LIKES BEER. As well as harassing certain ladies when he gets drunk enough.