April HICP numbers are out for the Euro Area. The US reports April CPI on Wednesday. Using the Cleveland Fed’s nowcast for April core (0.52% m/m vs. Bloomberg consensus 0.4%), we have the following picture.

Figure 1: Month-on-month annualized core inflation for US (blue) and Euro Area (red), calculated using log differences. Euro Area core HICP seasonally adjusted by author using geometric Census X-12. April US core CPI uses Cleveland Fed Nowcast of 5/8. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, Cleveland Fed, NBER, and author’s calculations.

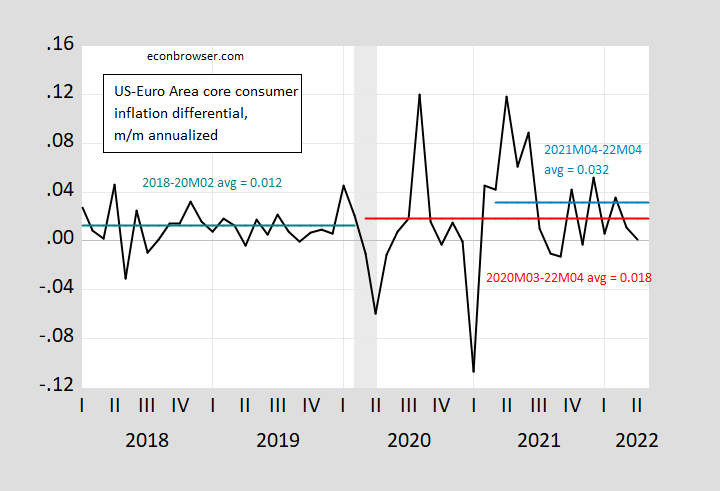

In order to see when core US inflation accelerates with respect to Euro Area, I show the differential below.

Figure 2: Month-on-month annualized core inflation differential US minus Euro Area (black), calculated using log differences. Euro Area core HICP seasonally adjusted by author using geometric Census X-12. April US core CPI uses Cleveland Fed Nowcast of 5/8. Teal line is 2018-2020M02 average, red line is 2020M03-2022M04 average, light blue line is 2021M04-2022M04 average. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, Cleveland Fed, NBER, and author’s calculations.

Clearly, there is a slight acceleration 2020M03 onward. However, this acceleration is not statistically significant treating inflation as stationary (and the price level as nonstationary). There is much better case for a statistically significant acceleration starting at 2021M04 (2.1 ppt acceleration relative to 2018-2021M03, with significance at 15% msl using HAC robust standard errors). 2.1 ppt is economically significant, in my view, even if not statistically significant in this case. This is likely coming from demand pull (or at least compositionally goods demand pull vs. capacity) rather than cost-push shocks, given the timing. This timing is also consistent with a smaller (in absolute value) output gap in 2021 for the US vs. the Euro Area, as discussed here.

(One could treat the log price ratio as a I(0) series with a structural break vs. an I(1) series, using a Bai-Perron test. Then one could reject in favor of a break with statistical significance; see this post.)

Great piece in the NY Times: “ Last fall, as container ships piled up outside the Port of Los Angeles, it looked as if inflation was going to be with us for longer than many had predicted. Curious how C.E.O.s were justifying higher prices, my team and I started listening in on hundreds of earnings calls, where, by law, companies have to tell the truth… shortages or companies’ typical profit motives; it was the plain old corporate profiteering. The Economics 101 adage that “inflation is just too much money chasing too few goods” doesn’t come close to the full story…

Most economists believe that markets are efficient allocators of scarcity and that governments should have little, if any, role in guarding against unfair pricing. They argue that price hikes will help cool demand and alleviate scarcity by efficiently rationing goods by consumers’ ability to pay. If sellers take price hikes too far, customers will just go to a competitor across the street. But what if there are no competitors? Not to worry: Truly exorbitant markups will all but guarantee new businesses entering the market. Many economists even argue that publicly traded companies have an obligation to shareholders to bring in as much profit as possible. If they see any interventionist role of government, it is in suppressing demand through interest rate hikes by the Federal Reserve, a blunt policy tool with a high likelihood of throwing the country into a recession.“

https://www.nytimes.com/2022/05/05/opinion/us-companies-inflation.html

Bottom line: most economists are still in deep denial about a major driver of inflation and wilfully oblivious. If they provide cover to corporations for their contribution to inflation, it begs the question of how many other issues they also provide them cover for…

“most economists are still in deep denial about a major driver of inflation and wilfully oblivious. If they provide cover to corporations for their contribution to inflation, it begs the question of how many other issues they also provide them cover for”

Your usual soapbox BS. But hey – it is what you do.

It should be a requirement that people who post links like this be upfront who wrote the piece:

https://groundworkcollaborative.org/meet-us/

OK an actual Ph.D. who advises Senator Warren. At least it was not your usual nutjob we routinely see Bruce Hall putting forth as his expert on whatever.

This is Mises vs Polanyi. The conventional view that “the rule of law” is critical to economic efficiency is Polanyi’s legacy. Polanyi is less famous than Mises because Polanyi doesn’t have an army of historical revisionists workin on his behalf. Any claim which contradicts Polanyi is benighted. That includes the reporter in Johnny’s link and Johnny.

Rightwingers who pervert the rule of law into mere property rights and contracts are a clear problem, but ignoring Polanyi’s dominance in modern modern economic thinking bespeaks eiyer ignorance or bad faith.

https://english.news.cn/20220508/6a1a93aacbb24b52b0b96b2d17464270/c.html

May 8, 2022

Egg shortage looms in Sweden as Ukraine crisis fuels food prices surge

Several major egg producers have announced their intention to raise their prices “sharply.” But such a price rise on eggs, an essential staple food, would inevitably burden consumers, who already struggle with inflation in all aspects of their lives.

By Fu Yiming, He Miao and Patrick Ekstrand

STOCKHOLM — For Johan Wellander, a Swedish egg producer, the rocketing cost of feeding his laying hens has made the situation unsustainable, thanks to the inflation accelerated by the ongoing Ukraine crisis and the western sanctions against Russia.

The Russia-Ukraine conflict has stricken commodity markets and caused a ripple effect globally. Sweden’s egg industry is the latest to bear the brunt, as it is highly dependent on grain to feed livestock — and this against the backdrop of ever higher costs for fuel.

“SITUATION IS URGENT”

Standing among feed silos and farm buildings housing more than 90,000 laying hens, Wellander described a dire picture to Xinhua: Egg farmers in Sweden are struggling to make ends meet, as they are caught in between the hiking costs of egg production and capped retail prices.

“The situation is urgent and unless the egg price increases, we will have to phase out our business,” Wellander said at the poultry farm, which he runs with his brother in an agrarian flatland outside the city of Orebro, some 160 km west of the Swedish capital of Stockholm.

His worries echoed that of Leif Denneberg, who is chairman of the board at Svenska Agg, the trade association of the Swedish egg industry.

The price of feed has lately doubled, and the fact that the price of eggs in stores does not move at the same rate will be devastating to the country’s egg industry, Denneberg told local newspaper Aftonbladet.

If an average egg costs 2.5 Swedish crowns (0.25 U.S. dollars), 0.80 crown of it is the cost for farmers. But today, all of this 0.80 crown is used to buy feed, Denneberg explained.

For Wellander, the nightmare does not end here, as egg production is a business with long lead times.

“We will have new laying hens delivered in a few weeks at a cost of around 1 million crowns, but given the current situation with the spiraling cost of feed, fuel and electricity, the most economical thing to do would be to pay the invoice without receiving the hens,” he said.

“Then we would ‘only’ lose 1 million crowns instead of 2 million if we put the hens into production.”

BURDEN ON CONSUMERS …

So, does this egg crisis in Sweden mean they will join NATO?

Egg prices here have doubled. Oh well – I was eating too many of them anyway.

When was the last time you shared an “X CRISIS IN CHINA!!” story? Never? “SITUATION IS URGENT!!!”

month on month annualised.

Why not do 3 months at an annual rate. reduce the volatility and see if there is a trend.

Not Trampis,

They are not doing it just to upset you personally.

Barkes, using annualised figures simply makes the overall figures more volatile than they are. why you yanks want to do that is beyond me.

no-one else does it.

As I said use a three month annual rate

you repeat this argument every month or so. why?

i am thankful you aussies exported the flat white. but maybe not your economics.

They’re also excellent at philosophy, genetics, and all summer Olympics events, past and future.

We are just completely insane, NT. But then you already knew that, didin’t you, mate? You just want to keep reminding us, :-).

too right cobber. wanting to know the trand and then using annualised figures is silly.

flat white is one of our great exports

Excluding fuel and food will tend to minimize how the consumers perceive their wallets being affected. Food prices are expected to rise throughout the year. Fuel prices may flatten, but that’s not going to be satisfactory for consumers looking for $3.00 per gallon gasoline… realistic or not.

https://gasprices.aaa.com

https://www.usatoday.com/story/money/shopping/2022/04/05/food-prices-inflation-grocery-stores/9477026002/

pgl says those reports are all lies. Bidenomics is saving us from 1º average warming. Woo hoo! Just plug into the nearest windmill and everything is going to be great for you.

Bill Clinton’s advisor James Carville said it best. It’s not the official statistics; it’s how the economy is perceived. When costs are rising faster than incomes and your investments are falling, yeah, it’s the economy, stupid.

But we can take solace that we’re no(t much) worse than Europe.

I have never accused AAA of lying. Hey Bruce – we know you lie 24/7 but then AAA is too smart to have you on their team.

Bruce,

You are right that voters will look at food and energy prices rather than just core inflation. Where you go off the rails is when you start blathering about this having anything to do with “Bedenomics.” Oh, I know, you have told us about some restrictions Biden put on oil production in the US, but all that affected long term production and much of it has been reversed. The high gasoline prices are about global crude oil markets, not this trivial stuff you have whined about.

Now if T had been in, maybe he would have just let Putin take over Ukraine without any limits on oil exports and, wow! matybe food prices would still be high because of blockadess od Ukrainian exports, but gas at the pump might be just great!

OTOH, we would probably have worse supply chain shortages more generally because T would have handled the pandemic’s new variants more poorly than Biden has. After all, those Red states with GOP govs opposing mandates and vaxxing have largely had much higher death rates than others. So, part of “Bidenomics” has been much better management of the pandemic, something the public apparently recognizes.

Don’t you know – Biden causes COVID19. Biden caused the 1982 recession. Biden was the moron who started the 2003 invasion of Iraq. Oh wait.

Why did Chintzy’s blog spring immediately to mind when reading the following phrase in https://www.ineteconomics.org/perspectives/blog/how-economics-forgot-its-subject-matter ?

《practice becomes increasingly thoughtless and alienated from economic reality whilst practitioners affect rigor and insightfulness.》

rsm: You truly are an ignoramus who believes he/she knows more than he/she actually does. The article you cite was written for an audience of people who really don’t know much economics. My advantage over you – I took a class with Harvey Leibenstein, so I read the source material rather than the watered down version. Suggest you read some Leibenstein, Scitovsky, Akerlof rather than second-hand accounts.

Have you considered that it may be time to review your data, theories, and assumptions, and look at how corporations are actually behaving in the current environment? Unless you have data that shows that corporate America is NOT in aggregate increasing prices in excess of inflation, resulting in extraordinarily high margins, and profiteering in general, then I will continue to side with the majority of the American public, who feel that corporate America is in fact contributing to inflation.

The data in the survey cited confirms that corporations are in fact raising prices in excess of rising costs, and the piece I cited states that they are happy to tell shareholders about it.

Rather than just ignore the impressions of the public, economists would do well to develop a believable and supportable public narrative that explains how increasing prices at rates in excess rising cost increases does not contribute to inflation. Lacking such a narrative and telling the public to not believe their lying eyes just does not cut it. Rather, it only confirms the impression that economists are aloof and out of touch and whose policy recommendations are of dubious merit.

Many of us have spent careers in corporate America and understand it’s culture and behaviour…probably better than most economists. You might also consider reading Michael Porter, who in the 1989s laid out the strategy for American companies to dominate their markets and give them pricing power in those markets, a strategy whose realisation neatly explains the pricing behaviour being implemented today.

JohnH,

The problem with your analysis is not that somehow corporations are not increasing prices faster than costs right right now that raises their profits. The problem is that this amounts to a one shot further increase in prices, not an ongoing increase in the rate of inflation.

To rsm, this Gruen character somehow thinks that most economists still take seriously the “equity-efficiency tradoff” posited a half century ago by Okun. Sorry, but it has long been recognized this does not hold generally. Compare East Asia with Latin America, the former both more equal and more efficient than the latter. Gruen’s account of things in general is pretty simple minded and out of date.

“The problem is that this amounts to a one shot further increase in prices, not an ongoing increase in the rate of inflation.”

Exactly right. What evidence does Lindsay Owens present? NONE. Random quotes from a CEO or two is not an empirical analysis. Oh wait – she did link to that EPI discussion, which at best captures what you have said.

Look – JohnH is going to rant and rave on this issue til the cows come home. He always does.

The problem with reviewing John H’s analysis is: he hasn’t analyzed anything. What data has he reviewed? Or, better question, what data is he actually capable of reviewing?

Short answers: none and none.

Pontificaters pontificate. Or blow hard. Analysts analyze.

What John H does, does not require data. Only lots of wind.

“Have you considered that it may be time to review your data, theories, and assumptions, and look at how corporations are actually behaving in the current environment? Unless you have data that shows that corporate America is NOT in aggregate increasing prices in excess of inflation, resulting in extraordinarily high margins, and profiteering in general, then I will continue to side with the majority of the American public, who feel that corporate America is in fact contributing to inflation.”

This is sort of like declaring someone guilty of a crime without a shred of evidence simply because his defense attorney could not pull a Perry Mason moment. Now what is the evidence presented by Dr. Lindsay Owens (the person who penned your new favorite NYTimes oped)? None beyond random quotes from a CEO here or there. Sorry that is not an analysis. Now she did link to this from EPI:

https://www.epi.org/blog/corporate-profits-have-contributed-disproportionately-to-inflation-how-should-policymakers-respond/

Yea – one time increase in profit margins from declines in the relative prices of inputs. Now maybe you think that is proof of your new thesis but sorry dude, it ain’t even close.

pgl,

According to Bivens in your link the share of profits actually declined somewhat between the second and fourth quarters of 2021. This makes it look like that while this profit share story may have played a role in increasing inflation in early to mid 2021, it is probably not doing so much anymore. JohnH ia seriously out of it on this.

johnh, it seems to me you are not a believer in a free market and capitalist system. you seem to want a centralized economy where the government controls the efficiency and distribution of goods and resources. rather than try to change the system in the usa, why not simply return to your home country and enjoy the fruits of your own system?

“Unless you have data that shows that corporate America is NOT in aggregate increasing prices in excess of inflation, resulting in extraordinarily high margins, and profiteering in general”

actually we keep waiting for you to supply the data in support of your argument. as of yet, you have not supplied that data. only links to opinion pieces. no data.

It is interesting that JohnH also wants a return to the gold standard. He is indeed that nutty.

Chintzy? Try Dr. Chinn.

If my name were Chinn and someone called me Chintzy, I would have to resist the urge to deck him.

Or maybe you’d come exceedingly close to decking him if you were friends with a man whose family name was Chinn, and you were standing next to Chinn when it was said. (depending on if you perceived ill-will in the context/tone of the moniker’s usage)

You failed econometrics, didn’t you rsm?