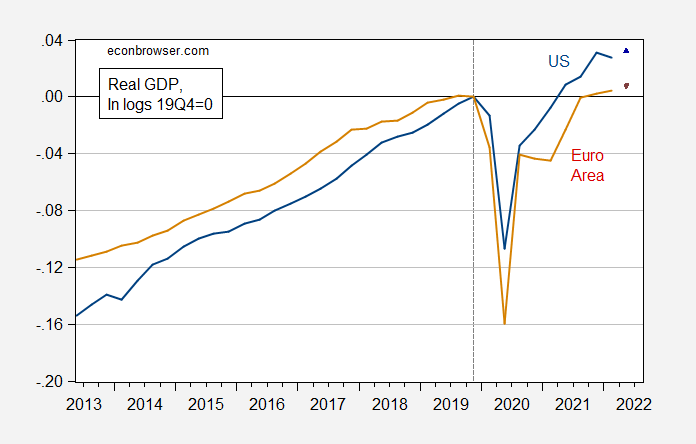

We now have Q1 GDP for the US and Euro Area. While US inflation as measured by CPI/HICP is higher than Euro Area (US core accelerating relative to EA by 0.7 ppts since the pandemic), US GDP growth has also been higher.

Figure 1: Real US GDP (blue), and Euro Area 19 (brown), both in logs 2019Q4=0. 2022Q2 observations for US is GDPNow (5/4), for EA is Cascaldi-Garcia et al. (5/6). Source: BEA and Eurostat via FRED, Atlanta Fed, Cascaldi-Garcia, Ferreira, Giannone, and Modugno, and author’s calculations.

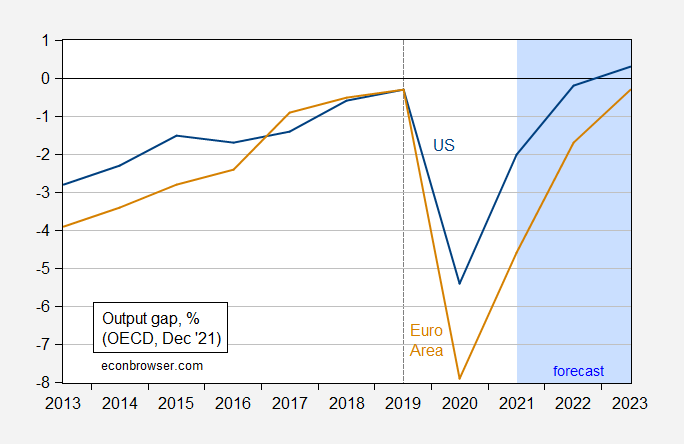

Since in the long term, growth is constrained by potential or full employment GDP, it doesn’t make complete sense to do a diffs-in-diffs comparison of growth pre- and during covid. However, we can see whether the output gaps closed faster in the US vs. the Euro (keeping in mind the caveat that output gaps are exceedingly hard to measure).

Figure 2: US output gap (blue), Euro Area 17 (brown), %. Light brown shading denotes forecast. Source: OECD.

This means that over the three years 2020-22, the cumulative output gap difference between US and EA was 6.6 ppts of GDP.

It’s important to note that the output gap measures the deviation of output from potential GDP, and does not directly incorporate cost-push shocks — so if these estimates are to be believed, the acceleration in inflation is not primarily due to demand pull (relative to potential).

The 2nd graph (output gap) indicates that neither the US nor the Euro Area reached full employment before the pandemic and only the US has reached full employment since.

Huh! We just heard from Kudlow the Klown how great the economy was under the All Mighty Donald John Trump and how much it sucks under Biden. Kudlow is a lot like the usual MAGA hat Usual Suspects here – writing a lot of political bombast without a shred of reality beyond it.

Despite certainty that pgl will have a snarky remark about this link [because the article was published in Forbes] and my “total lack of knowledge”, I’ll offer this link to an article by “Robert Barone, Ph.D. [who] is a Georgetown educated economist. He is the co-portfolio manager of UVA’s two ETFs. Robert is also a financial advisor at Four Star Wealth Advisors.”

He has a somewhat more jaundiced view of the present economic situation in the US using a combination of government and private data.

https://www.forbes.com/sites/greatspeculations/2022/05/07/the-recession-no-one-will-discuss-as-equity-investors-rush-to-exit/?sh=2cfa7864720e

It drives pgl nuts when anyone presents information casting doubt on the prevailing, liberal “don’t worry, be happy” narrative.

Be prepared for a generous dose of mockery and insults, pgl’s specialty…and apparently his only known competence.

You actually want to join in on Bruce Hall’s praise of Donald John Trump? Seriously dude – macroduck has already called you out as a right wing troll. I guess you have to prove him right over and over!

Bruce Hall: You should examine Figure 2 in this post. You will see the 3 month change in the civilian employment series (from household survey, and hence not affected by BLS birth/death model) indicates even faster growth than the NFP series. But, don’t let facts bother you.

“don’t let facts bother you”

Brucie never does. Facts are Communist plots in his MAGA world.

Just in case Bruce gets lost again – here is your very concise and precise statement:

While I place little weight on the household survey for month-to-month employment developments in the aggregate, it is somewhat reassuring that both all three series are moving upward: NFP at 4.2% vs. CES adjusted to NFP concept at 5.9%, both on 3 month change annualized.

Seriously Bruce – try READING these posts as you might one day learn something.

Barone looked at one month’s worth of Household Survey data not recognizing as ALL labor economists do how noisy this series is? Damn – he is even dumber than you. I would ask you to look at both series over a longer period of time – which Dr. Chinn just made easy for you.

Another episode of MAGA level stupidity!

“The Labor Force Participation Rate (LFPR) (the percentage of the working-age population with a job or actively looking for one) fell from 62.4% to 62.2%. As a result, the labor force declined by -363K. Strong labor markets do not see such declines.”

No one who has followed BLS reporting for more than like a week or two would write such a dumb statement based on one month’s observation. Your dude is a stock market type who typically would not understand labor economics even had they bothered to take a college course (which of course Bruce Hall never has).

https://www.nfib.com/foundations/research-center/monthly-reports/jobs-report/

Gee Bruce – your new guru forgot to tell us what the NFIB monthly jobs report said about small businesses plans to hire more workers. I see your guru also LIES a lot like you do!

Bruce’s Forbes dude writes:

A survey conducted by the National Federation of Independent Businesses (NFIB) suggested that small businesses are paring back their hiring plans.

Really? Gee Bruce – I bothered to find what the NFIB chief economist said about this survey:

Small business owners continue to attempt to fill historically high levels of open positions, according to NFIB’s monthly jobs report….“The labor force participation rate is slowly rising, which is good news for small businesses looking for workers,” said Bill Dunkelberg, NFIB Chief Economist. “While wage gains have been good, inflation has outpaced it, reducing real disposable income. Small employers continue to raise wages and make business adjustments to attract qualified employees.” Seasonally adjusted, a net 46% of owners reported raising compensation, down three points from March. A net 27% of owners plan to raise compensation in the next three months, down one point from March. Both actual and planned compensation changes eased in March but remain near record high levels.

Like I said – the Forbes dude lies almost as much as Bruce Hall does. And this is the point that JohnH decides to back lying right wing troll Bruce Hall? Seriously?

Barone’s title declares that nobody wants to talk about recession. Google metrics show that isn’t true. But, heck, pretending to be smarter than everyone else is a common trick among the mediocre. Let it pass.

Certainly, as a Fed watcher, Barone is no better than mediocre:

“In past tightening cycles, the Fed never issued ‘forward guidance,'”

From the FOMC website:

“The Federal Open Market Committee (FOMC) began using forward guidance in its postmeeting statements in the early 2000s. Before increasing its target for the federal funds rate in June 2004, the FOMC used a sequence of changes in its statement language to signal that it was approaching the time at which a tightening of monetary policy was warranted..”

https://www.federalreserve.gov/faqs/what-is-forward-guidance-how-is-it-used-in-the-federal-reserve-monetary-policy.htm

If he had simply made one rookie Fed watching mistake, we could pat Barone on the head and encourage him to be sure of his facts before writing. Kids make mistakes. However, he also took one of the best NFIB planned employment index readings on record and spun it’s bad news. Mr. Barone neglected to mention that the decline in the index was from unprecedented high levels to merely very high levels. Nor did he mention extremely high levels of unfilled openings. That looks more like withholding information than honest analysis.

Given the difficulty small firms are having finding employees (so says the same NFIB report Barone cites), one might wonder whether the decline in ADP small business employment reflects a shortage of workers, rather than a shortage of jobs. Barone seems too eager in telling his own tale of doom to consider such possibilities.

The household survey did register a decline in employment in April. That regularly happens during expansions, which Barone also neglected to mention.

Almost exactly a year ago, Barone published a piece entitled “The ‘economic boom illusion'” since which the NFIB, ADP, household and payroll numbers all show a real boom. Not to mention that real GDP rose 6.7% (SAAR) in the very quarter in which he called the boom an illusion.

But enough of Mr. Barone. Why is it that Brucie picked Barone’s dissembling wreck of an article from among all the analysis that’s being written?

Now, personally, I’m a bit worried about prospects for the economy next year. But I would never rely on something as shoddy as Barone’s piece to validate my concerns.

Well said. And isn’t it funny that JohnH endorsed Barone’s horrific rant? Bruce Hall and JohnH – two peas in a pod.

“Why is it that Brucie picked Barone’s dissembling wreck of an article from among all the analysis that’s being written?”

Same with the climate skeptics. Why take their word over the IPCC? It has to be more than “I like this one graph.”

Not only is potential output tricky to estimate, but as a single, economy-wide measure, it doesn’t do much to account for capacity limits in individual sectors. Trade and transport may have reached capacity limits while restaurants were standing empty.

There is also a question of short vs long-term potential.

The Fed doesn’t have the power to target individual sectors. Responding to short-term disruptions could also hold demand below potential in the somewhat longer term and limit growth in capacity as a result. The Fed is in a bad spot.

The ECB is in a similarly bad spot, though with less inflation and less growth.

Good comments. This is the problem with losing credibility. Price stability below potential may be better than price instability at potential. This casts the Fed’s behavior in the decade after the Great Recession in a different light. They may have been too hawkish in terms of getting back to full employment, but given the risks once at full potential, that may not have been a bad course of action. Throw in Covid supply issues and you have an entirely different level of inflation risk.

https://fred.stlouisfed.org/graph/?g=P3ho

August 4, 2014

Real per capita Gross Domestic Product for Euro Area, Japan, United States and United Kingdom, 2007-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=P3hE

August 4, 2014

Real per capita Gross Domestic Product for Euro Area, Japan, United States and United Kingdom, 2007-2020

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=P3mx

August 4, 2014

Real per capita Gross Domestic Product for Germany and Turkey, 2007-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=P3mH

August 4, 2014

Real per capita Gross Domestic Product for Germany and Turkey, 2007-2020

(Indexed to 2007)

[ Interestingly, Turkish growth continued at a comparatively fast rate in 2021 for all the criticism of Turkish policy. ]

https://www.imf.org/en/Publications/WEO/weo-database/2022/April/weo-report?c=223,924,132,134,534,536,158,186,112,111,&s=NGDP_RPCH,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2022

Gross Domestic Product for Brazil, China, France, Germany, India, Indonesia, Japan, Turkey, United Kingdom and United States at constant prices, 2007-2021

2021

China ( 8.1) *

Germany ( 2.8)

India ( 8.9)

Japan ( 1.6)

United States ( 5.7)

Brazil ( 4.6)

France ( 7.0)

Indonesia ( 3.7)

Turkey ( 11.0)

United Kingdom ( 7.4)

* Percent change

https://fred.stlouisfed.org/graph/?g=LAfA

August 4, 2014

Real per capita Gross Domestic Product for China, United States and Euro Area, 2007-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=LAfB

August 4, 2014

Real per capita Gross Domestic Product for China, United States and Euro Area, 2007-2020

(Indexed to 2007)

You should compare both to the mighty OZ!

https://www.msn.com/en-us/news/us/florida-releases-reviews-that-led-to-rejection-of-math-textbooks/ar-AAX1z2i?ocid=msedgdhp&pc=U531&cvid=95ff3ca8207f494496222a4130fa45fe

Ever wonder why right wingers are so bad at even basic arithmetic? Check out how the DeSantis government is banning a lot of math textbooks in Florida’s schools. MAGA!

https://news.cgtn.com/news/2022-05-08/Chinese-mainland-records-329-new-confirmed-COVID-19-cases-19RnJtSBvtC/index.html

May 8, 2022

Chinese mainland records 329 new confirmed COVID-19 cases

The Chinese mainland recorded 329 new confirmed COVID-19 cases on Saturday, with 319 linked to local transmissions and 10 from overseas, data from the National Health Commission showed on Sunday.

A total of 4,133 new asymptomatic cases were also recorded on Saturday, and 97,512 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now number 219,625, with the total death toll from COVID-19 at 5,174.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-05-08/Chinese-mainland-records-329-new-confirmed-COVID-19-cases-19RnJtSBvtC/img/3a3b6573f6bf446ba959128bfeae2563/3a3b6573f6bf446ba959128bfeae2563.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-05-08/Chinese-mainland-records-329-new-confirmed-COVID-19-cases-19RnJtSBvtC/img/070ee4b5571e40bd97cade43ddfd9894/070ee4b5571e40bd97cade43ddfd9894.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-05-08/Chinese-mainland-records-329-new-confirmed-COVID-19-cases-19RnJtSBvtC/img/998518c6a9524f2d826ad022093b65d7/998518c6a9524f2d826ad022093b65d7.jpeg

https://www.worldometers.info/coronavirus/

May 7, 2022

Coronavirus

United States

Cases ( 83,567,707)

Deaths ( 1,024,525)

Deaths per million ( 3,062)

China

Cases ( 219,296)

Deaths ( 5,166)

Deaths per million ( 4)

Democrats will not be able to pass a woman’s right to control her own body in the Senate without nuking the filibuster – something that is unlikely this year.

Now if Republicans get control of both the House and the Senate during the fall elections – it does seem Mitch McConnell will try to get a Federal ban on all abortions though the Senate as you know he will nuke the filibuster:

https://www.vanityfair.com/news/2022/05/mitch-mcconnell-acknowledges-a-national-abortion-ban-is-possible-if-roe-is-overturned?msclkid=dc82d9b3cefa11eca1d15bd2e859815b

BTW – SNL had a skit on the medieval nature of Alito’s draft opinion. Very funny!

About the “mighty OZ”:

https://fred.stlouisfed.org/graph/?g=P593

August 4, 2014

Real per capita Gross Domestic Product for Australia, Germany, Japan and United States, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=P59a

August 4, 2014

Real per capita Gross Domestic Product for Australia, Germany, Japan and United States, 1977-2020

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=GQkt

August 4, 2014

Real per capita Gross Domestic Product for Australia, Germany, Japan, United States and China, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=GQkx

August 4, 2014

Real per capita Gross Domestic Product for Australia, Germany, Japan, United States and China, 1977-2020

(Indexed to 1977)

Thinking about “mighty OZ” or Australia; after many years of running a current account deficit, Australia has been running a current account surplus these last 3 years. I want to think through the change, since much has been made in the past of the run of deficits extending from 1980 to 2018:

https://www.imf.org/en/Publications/WEO/weo-database/2022/April/weo-report?c=193,156,112,111,&s=BCA_NGDPD,&sy=1980&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2022

Current Account Balance as percent of Gross Domestic Product for Australia, Canada, United Kingdom and United States, 1980-2021

Just coming back to this post. I did not realize that Europe actually fell harder than the US in those first few months of the pandemic. I was under the impression (early data? bad memory?) that the US fell harder, but roared back faster. Interesting. Some of this, I’m sure, has to do with Europe’s higher overall density, and the fact that the early phases of the pandemic seem to have been density-intense.

I wonder how much of the quicker US rebound was larger fiscal support vs. a more flexible labor market.