With consumption (nominal at 0.2% vs.0.4% consensus) and personal income May releases, we have the following snapshot of some key indicators followed by the NBER BCDC.

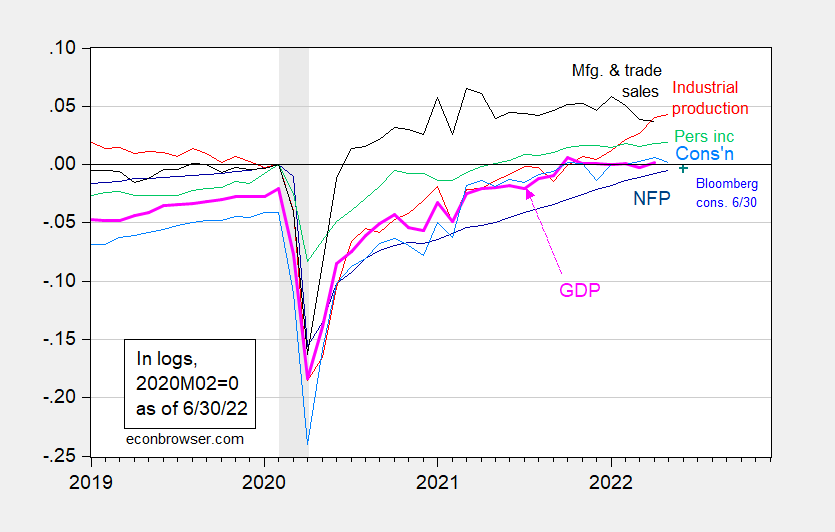

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for NFP (blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (6/1/2022 release), NBER, and author’s calculations.

Three of four indicators for which we have May data are still rising, while real consumption is decreasing. The drop in consumption of 0.2% m/m is surprising, but not unprecedented; it fell 1.4% m/m in December of 2021. Here’s a decomposition of real consumption, and changes in real consumption.

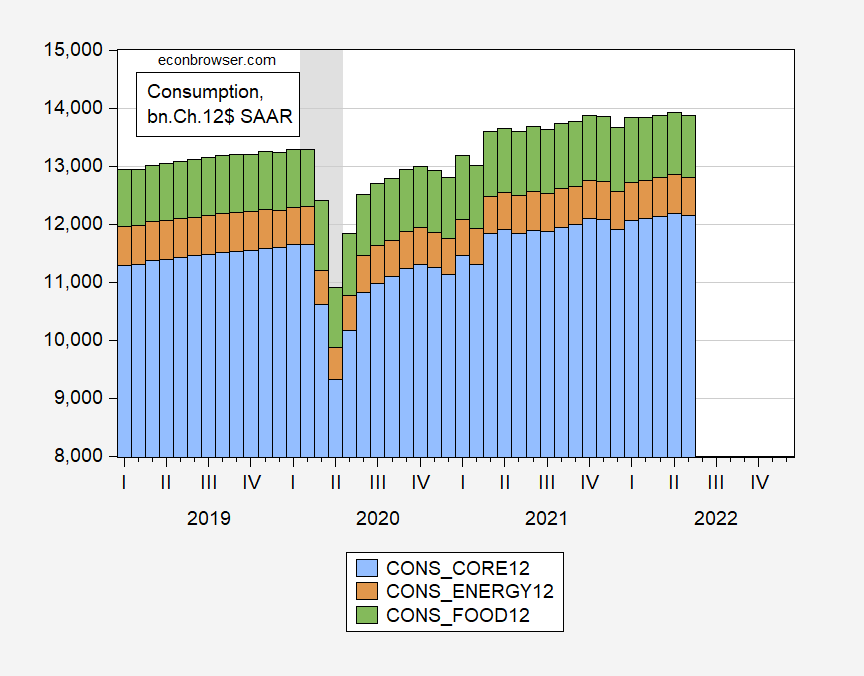

Figure 2: Nonfood nonfuel consumption (blue), energy goods consumption (tan), and food consumption (green), in billions Ch.2012$ SAAR. Source: BEA.

Here’s a detail on the change in consumption:

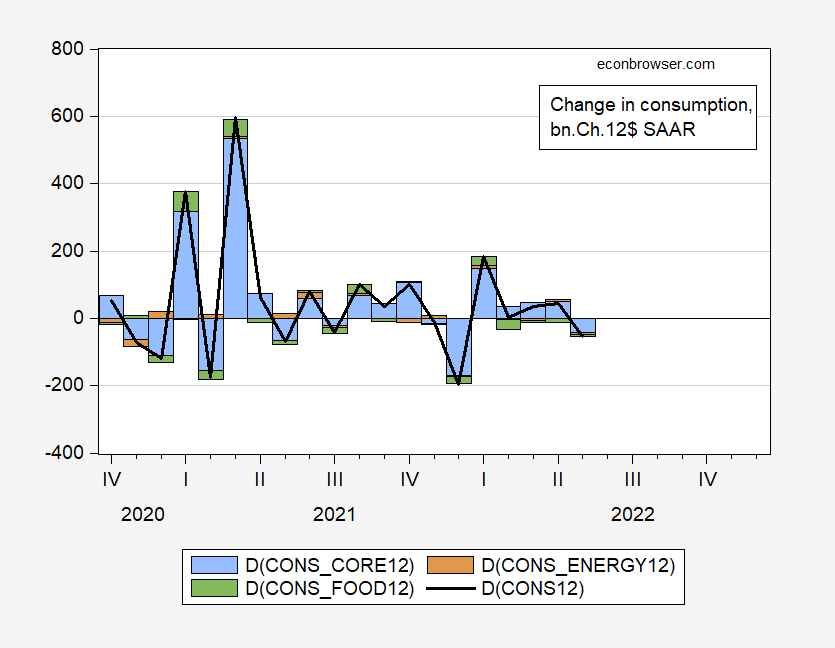

Figure 3: Change in nonfood nonfuel consumption (blue), energy goods consumption (tan), and food consumption (green), in billions Ch.2012$ SAAR. Source: BEA.

Consumption fell in all categories, although in numerical terms, core consumption decline accounted for most of the change (which makes sense since core is about 87% of total).

In nominal terms, the share of noncore spending has risen from 4% to 4.9% going from 2021Q1 to 2022Q1, so energy and food price increases have definitely squeezed core expenditures.

I thought it of interest to see how seasonal adjustment in the wake of the 2020 recession has affected our understanding of growth in consumption. It turns out the y/y change in the not seasonally adjusted series and the (standard) seasonally adjusted series differ (which has not typically been true between 2014 and 2019):

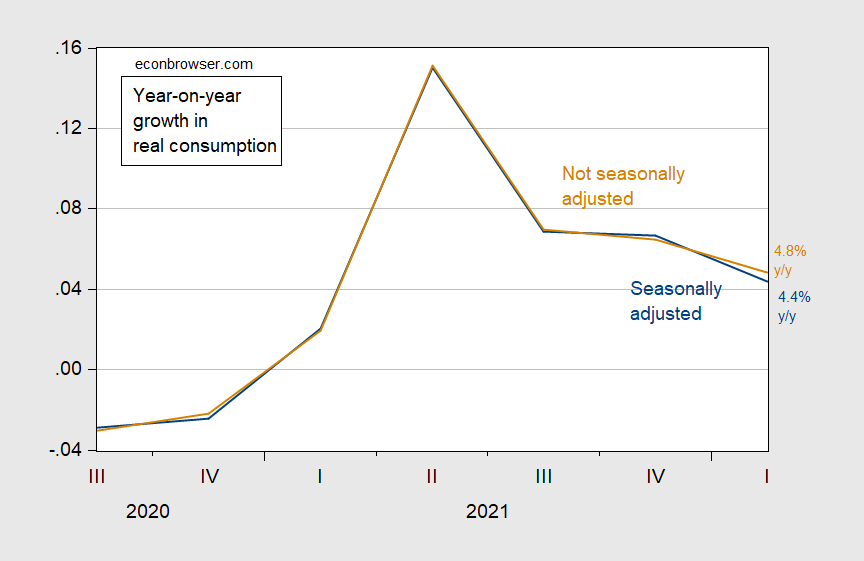

Figure 4: Year-on-year growth rate of consumption (blue), and not seasonally adjusted consumption (brown), calculated as log differences. Source: BEA, author’s calculations.

This suggests a little caution in interpreting high frequency growth (seasonally adjusted y/y growth is 3.5% vs. 4.1% for real GDP).

Addendum:

For Q2, GDPNow at -1.0%, IHS-Markit, -1.5%; Goldman Sachs at +1.9%.

I don’t know if I am stating something patently obvious, but again, you have two very well respected forecasters. IHS and Goldman, with a 3.4% difference in a quarterly “forecast”. It strikes me as an incredibly huge difference by two parties who are pretty good at their craft.

Moses,

Several years ago, I got copy of “Principles of Econometrics 4th ed”., Hill, Griffiths, Lim, Wiley publishers. The textbook came with a workbook and a CD with the student edition of EViews. As I recall, the software was useful for a few years and only became a problem when the software version was no longer supported, for all users. The book is excellent and so is the workbook. Nice to have a workbook when there is no one to ask for help. The fifth edition is now available. You would need to check to see if EViews is still included.

Do you have thoughts on how a run through with the text you used (4th edition) with no workbook, no CD, and a download of the year long Eviews trial would work out?? Could I piece it together still or would that be a strained effort??

Moses,

The text is very good, and one can follow it, but EViews has its own knowledge requirements that the workbook demonstrates step-by-step. I think it would be a “strained effort” without the workbook and without an instructor.

“For Q2, GDPNow at -1.0%, IHS-Markit, -1.5%”

Hmmm.

Steven Kopits: You neglected Goldman Sachs at +1.9%

Don’t make Stevie angry as he might start hurling dishonest insults. After all – his entire life rests on a recession.

And you included Atlanta and IHS.

I am going to guess that Goldman Sachs does not use as articulated a forecasting system as does either the Atlanta Fed or IHS. But we know a couple of things.

First, the Q2 forecast has been steadily unwinding, and therefore a lower number seems more likely. I am personally penciling in around that -1.5% when the dust settles, but in any event, at least some forecasters have mooted the possibility of a materially negative Q2, which I think implies a recession starting in Q1.

Let’s wait and see what the data says on the 28th.

I’d also add that I think Q3 could be pretty rough. I think real estate prices start to dive this quarter (although I’ve been wrong before). Here’s my particular situation: My house is worth 62% more than it was two years ago (and is up 20% since February!). Meanwhile, the 30 year fixed mortgage rate has risen from 3.25% two years ago to around 5.75% now.

Home buyers are going on strike, and I think this will only intensify. I think homes could easily lose 1/3 of their value, that is, about 3x the value of the associated down payment. Thus, if one purchased a house today at 5.75%, they could lose their down payment and more by Labor Day, and then be locked into a costly mortgage for a decade or more because their house is worth less than the mortgage and can’t therefore be refinanced. In any event, I expect home prices to begin to fall by 3-5% per month, starting pretty soon and extending at least to year-end, with a correction of 20% or more in total.

I personally do not seem how such a correction occurs without serious economic troubles, which I think are just about upon us.

steven, if you want to predict a 1/3 loss in home values in the upcoming year, you need to have a lot more evidence than has just been presented. that is a headline grabbing number. and if presented without a valid thesis, it looks more like propaganda than anything else. that is a very aggressive rate of decline for home prices. i don’t see how that would be realistic. you need a driver for the prices to go down. during the financial crisis, this was forclosures caused by people walking away from homes they have very little invested in. i don’t think that environment exists today. many of these homes were purchased with cash, not leverage. i simply don’t see a fire sale in real estate, in the upcoming year.

He did mention this in passing:

‘although I’ve been wrong before’

Never mind he is wrong about as many times in a day as the stopped clock. OK – twice in a day he got it right by accident.

Baffs –

Forgive me, I was extrapolating from my own home. Housing values have appreciated at quite different paces in different parts of the country. Your comment is salient if we consider the national market as a whole.

The Case-Shiller National House Price Index (HPI) is up 39% since March 2020, when the whole go-big-or-go-home thing started. If we project a naïve trend (a simple linear pull-down using excel), then we would have expected the April 2022 National Index to stand at 234 vs the 300 observed. This implies home prices in the US nationally are 28% above the level we would have otherwise predicted.

But it’s worse than this, because 30 year mortgages stood at 3.25% in March 2020, versus 5.75% now.

So let’s work through an example. Imagine a person purchased a home for $500,000 in March 2020 with a 30 year fixed mortgage carrying an interest rate of 3.25%. Assuming a 0.38 DTI (that, 38% of the person’s income could be used for debt service, the DTI here excluding property insurance and property taxes), the purchasers would have required income of around $75,000.

On average, that house has now appreciated by 39%. (Hmmm, what else was up 39%? Oh, yes, I recall: M2). In order to purchase that house, now worth nearly $700,000, with a 5.75% 30 year mortgage, the required income would be $140,000, almost double the income required just two years ago.

Of course, wages are up. Hourly wages are up by 11% over that period, thus, certeris paribus, a purchaser would could have afforded the house at $555,000 if interest rates had remained at 3.25%.

On the other hand, even with wage inflation, the purchaser could today only afford the house valued at $420,000 at 5.75%, that is, a nominal price reduction of 16% compared to the March 2020 value. Thus, the purchaser can only afford the home in question at 39% below its current value, even allowing for intervening wage increases.

I think we will see a pretty quick decline of about half the gap, so figure 12-15% nominally on an national level. In the case of my particular house, I would expect a decline of 20-25% in the same period, call it to year-end.

Therefore, to year-end, we might expect house values to decline by 2-3% per month, around 4% per month in the case of my particular house.

I would note that the Zillow value on my house is holding its peak, so the turn probably comes between now and Labor Day. That’s my best guess of what could happen. Anyway you slice it or dice it, it’s going to be ugly, and I don’t think the US will see GDP growth during that stretch. Thus, at this point, I think we are in a recession which began in Q1 and will likely extend through Q1 2023. That’s my sense of it at this point.

Jan Hatzius (born December 17, 1968) is the chief economist of investment bank Goldman Sachs. Notable for his bearish forecasts prior to the Financial crisis of 2007–2008, he is a two-time winner of the Lawrence R. Klein Award for the most accurate US economic forecast over the prior four years. He has also won a number of other forecasting awards, including the Wall Street Journal, Bloomberg, and Institutional Investor annual forecaster rankings.

Yet Know Nothing Princeton Steve writes:

“I am going to guess that Goldman Sachs does not use as articulated a forecasting system”

Seriously Steve. I know some of the folks at Goldman Sachs. I plan to let Hatzius know you think he is not that good at forecasting. Given the lawyers at GS, expect a lawsuit.

“Home buyers are going on strike”

Gee – I did not know they formed a labor union. Oh wait – construction workers might go on strike but buyers? Come on dude – English may be your second language but could you tone down the most ridiculous writing ever?

This is behind a paywall, but hopefully some of you can finagle your way past it. I thought it was interesting and maybe something other corporations (especially USA corporations, although Lego is Dutch) could learn from and possibly copy, especially if they didn’t have to tear down existing buildings in order to do it. It’s a way to possibly solve long-term supply chain problems.

https://webcache.googleusercontent.com/search?q=cache:v_TNMyz6b38J:https://www.wsj.com/articles/lego-to-spend-1-billion-on-new-u-s-factory-11655307229+&cd=2&hl=en&ct=clnk&gl=us&client=safari

I think LEGO is a privately held company but they publish an Annual Report:

https://www.lego.com/cdn/cs/aboutus/assets/blt248041929be3b572/Annual_Report_2021_ENG.pdf

Sales are growing fairly rapidly and their operating margin is quite high. I guess there is a future in what was one of my favorite childhood activities.

I notice that the change in May’s nonfarm employment was revised down from 428K to 390k. I had forecasted was 310k for May. I also notice that the Bloomberg consensus forecast is at 295k for June, I forecasted 303k a while back. As mentioned, I had tried to forecast FRED nonfarm series, PAYEMS, but could not seem to show a consistent reliable forecast. For the past few months, I have forecasted detail employment categories and summed the forecasts; now at 17 categories. Hopefully this detail category method will continue to be in the consensus range, otherwise, I will need to be an observer as I can’t think of another approach to make a forecast for nonfarm payroll.

I’m not quite brave enough to put a number out yet. But my gut is telling me, it’s gonna be higher than 303k. Maybe not much higher, but higher.

Roughly page 4 of this pdf is the visual data worth taking a look at and thinking about. The countries at the very top of the list are Putin’s partners in war–including Germany, Italy, and the Netherlands. They are sponsors and financial partners of Putin’s mass murder in Ukraine:

https://energyandcleanair.org/wp/wp-content/uploads/2022/06/Financing-Putins-war-100-days_20220613.pdf

Roughly 6 months ago, some goofball in the southern plains of America said the following words direct at Barkley Rosser:

“You really make me laugh at your absurdity sometimes, and the absurd statements you make, conning yourself into thinking it is something very cerebral. Your support of a Russian pipeline, Nord Stream 2, which would supply a significant portion of energy to Europe, which they no doubt will provide almost no “Plan B” for as time goes on and they become dependent on it and assume it will always operate without interruption, makes me think you are a man “born after your time”. You would have been a very useful man as a jubilant witness signature for the Munich Agreement.”

https://econbrowser.com/archives/2021/12/gasoline-prices-moving-downward#comment-264952

Pretty good foresight from the southern plains goofball?? What about 7 months before the war in Ukraine started (i.e. 11 months ago)??

Completely off-topic

“I’m kinda worried about these recent stories about Russia being able to complete their Nord Stream 2 pipeline to Germany. Have we learned nothing from global supply chains during Covid-19???”

https://www.yahoo.com/now/u-germany-announce-deal-nord-192805171.html

“What happens the next time Russia misbehaves in a major fashion and then threatens to shut off Germany’s gas supply??? The EU caves on everything Russian related already. America can’t get natural gas supplies to Germany via F-16C. So they better get their sh*t together. This is another reason why I was pro-Brexit. Because then Britain/UK gets dragged along into the braindead sh*t like Nord Stream 2 the more they get tied up into it.”

https://econbrowser.com/archives/2021/07/covid-19-forecasts-one-year-ago-and-today#comment-256496

Then arguing (at one time or another) with UlenRussky, “Ivan”, BarkleyGeopoliticallyClueless, and yes, “pgl”. Again this was in July 2021, 11 months ago, 7 months before the war started:

https://econbrowser.com/archives/2021/07/covid-19-forecasts-one-year-ago-and-today#comment-256518

” So, according to you

1) Ukraine is the existential threat to Europe/Germany rather than Russia?? And Poland might invade Germany at any minute??

2) Putin would “never” use energy supplies against Western powers and/or Europe because he’s just too kindhearted of a man to ever even conceive such an idea.

3) If Germany consumed roughly 95 billion cubic meters of gas in 2019, and Russia can deliver 55 billion cubic meters of natural gas through Nord Stream 2 in a single year, the prospect of Germany receiving 58% (55/95) of its natural gas supplies from Russia over multiple years is “no threat” to German or European security??

Two Questions for Ulenspiegel: How much of donald trump’s MAGA Bleach Soda Pop have you been drinking lately?? And is there kompromat video of you soiling a hotel mattress in Moscow that we should know about??”

It continues on July 2021, 11 months ago:

https://econbrowser.com/archives/2021/07/covid-19-forecasts-one-year-ago-and-today#comment-256528

“I’m curious why Democrat Senator Jeanne Shaheen of New Hampshire has been against the Nord Stream 2 for years, beings that New Hampshire imports ALL of its natural gas from Canada and Maine (i.e.there zero NG resources inside New Hampshire)?? Senator Shaheen says it’s because the Nord Stream 2 extends Kremlin influence throughout Europe. I guess as a U.S. Senator, she’s unaware that yanking away 58% of Germany’s natural gas supplies at any moment has been ‘war gamed’. ”

The two “intelligent” replies from pgl in the same thread (with his pals Barkley, “Ivan” and UlenRussky “piling on”)?? As follows:

pgl: Thanks for clarifying this as that little debate between Ulenspiegel and Uncle Moses did become unhinged.

And after “Ivan” “informed” me Germany’s natural gas supply would now be “more stable” and that “Russia will have much reduced ability to harass Ukraine” and I vehemently argued that was a LIE, pgl said the following, referring to Ivan’s comment replying to me:

“So much information and not a single pointless lie attacking someone needlessly,. I would say nice but this kind of informative integrity gets old drunk Uncles Moses all angry.”

I invite one and all to read the entire thread, to see what horrible things “a drunk” will say, 11 months ago, 7 months before Ukraine was invaded. While one person who claims to have attended Yale, and the other with a PhD, and their “friends”, two trolls out of Russia, “teach” “the drunk” all about geopolitics, energy supply, and Russia. Please please, do read it. ALL OF IT, PLEASE.

https://econbrowser.com/archives/2021/07/covid-19-forecasts-one-year-ago-and-today

Moses,

While I did not push hard for canceling Nordstream II, I have not said any of the other things that you seem to attribute to me, or maybe they are to other people. I am not sure which. You are getting desperate again here. I shall not waste peoiples’ time by listing the rather large set of completely incorrect and even downright idiotic statements you have made about the whole Russia/Ukraine situation.

Of course, yet again, you imitate CoRev by emboldening all sorts of things just to highlight what an idiot you are.

Moses et al,

So, I have wasted my time by checking into the links to past discussions here that Moses provides. Gag. For the record my support at that time for Nordstream II was an extension of my mistaken expectation that Russia would not engage in a full-scale invasion of Ukraine, a mistake I made that Moses has pointed out here more times than I can count. If it were not to do so, my arguments were not all that unreasonable: that it would help offset mounting energy price increases and show friendship with German leader Merkel, in contrast to the bad treatment she received from Donald Trump.

I see that some of the other accusations you made are actually directed at others, such as Ulenspiegel. I shall not comment on those, although you seem to have made some exaggerated claims about those.

Two more notes on stuff by me you linked to. In one of the links I provided detailed historical discussions about Lviv and Crimea, fully accurate and with some details not widely known at all. While you sneer that I do not know what I am talking about, those comments were far detailed and informative about those two matters than anything anybody else has up here, most certainly including yourself.

Then in one of the other links you provided you got on your high horse incredibly idiotically about Quora to the point that Menzie took you to task in several comments on the matter. All of this, of course, brought up your complete musunderstanding avout pipulation genetics that you repeatedly posted here in your repeated misinterpretations of things said in a completely accurate article that appeared in Quora. So, here you are trying to make several of us look foolish or bad or pro-Russian or something, for what reason I do not know, and in your effort to do so you yet again link to old discussions where you made a total blazing fool of yourself with completely inaccurate nonsensical garbage that you repeated and repeated and repeated here, with Menzie having to slap your hand, which anybody here can go see.

I do not know why you decided to go on this bender of this bizarre post, but I am not going to comment on it further, already wasted too much time dredging through this nonsensical garbage.

Really stunning analysis by Moses. Best I can tell, Moses has it right here.

This agreement by Kopits, is the cruelest by far of any comment Menzie has allowed to get past the blog filter than I can directly read. Menzie, OK, I am kind of a thorn in your side, the music links you have to put in the garbage bin when I’m in slush drunk mode, haranguing you for semi-complicated (to me) answers I can google search, overly long comment tirades. I “get it”, I get it Menzie, I’m not easy to deal with, and kind of a blog host’s nightmare.

But putting up a Kopits comment where he agrees with me?!?!?!?! Frankly Menzie, I never foresaw you had this level of sadism contained inside you.

I believe Menzie allows even my “cruelest” comments to pass, including agreeing with you!

I call the as I see them. I was frankly shocked by Ulen’s and Ivan’s comment wrt to Russia, and as we know, Barkley shot well wide of the mark, too.

So, yes, I thought you assessed the situation far better than those listed above. You deserve credit for that, even if it has to come from me.

I agree that I was too complacent on the pipeline issue, looking at overall supplies versus dependency issue.

To reiterate, my error was an extension of my forecasting low probability at that time of full invasion of Ukraine by Putin, going influenced by the views of the Ukrainian leadership at the time. If no invasion, then concerns about supplies and not ordering allies around were imortant.