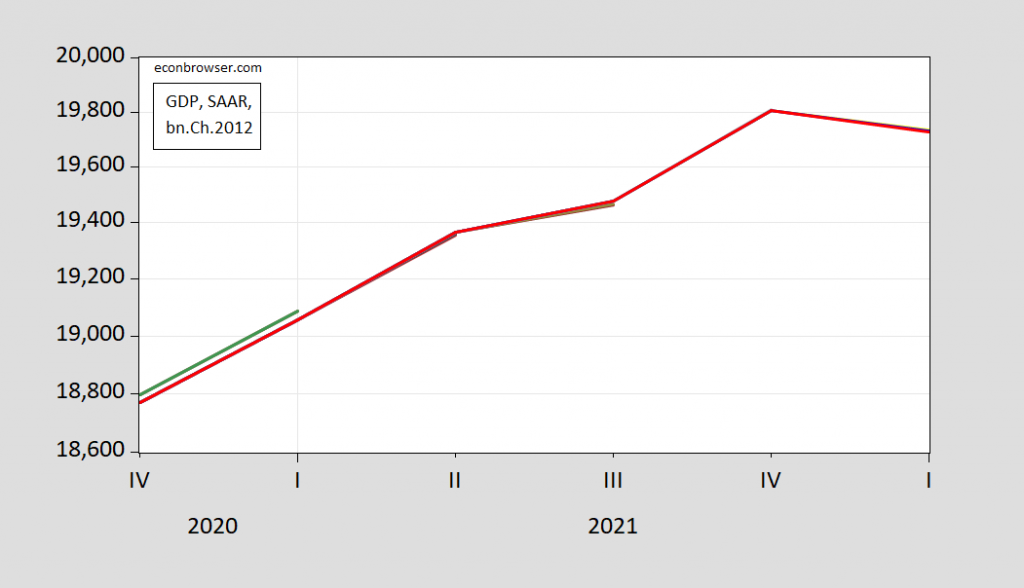

It’s important to recall, especially as some nowcasts suggest a negative reading for Q2 growth, that GDP numbers are revised. The first release is called an “advance” release because a substantial share of the inputs are estimated. Below are the various vintages of GDP, starting after the trough so as to better highlight recent revisions.

Figure 1: GDP, various vintages, in billions Ch.2012$ SAAR. Source: BEA via AFRED.

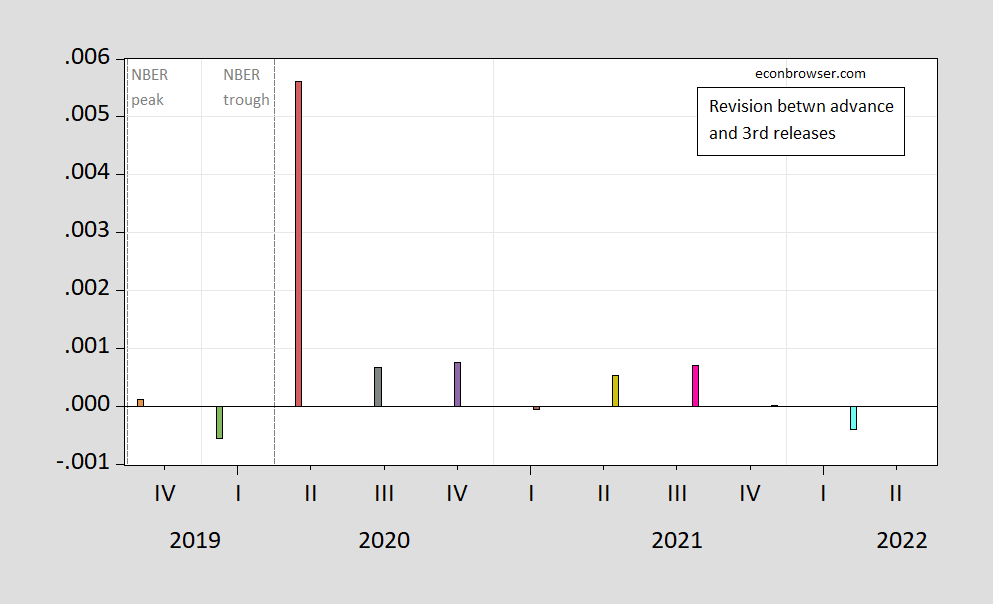

The errors between advance and third release are shown in Figure 2 (in log differences; hence 0.0002 indicates a .02% revision).

Figure 2: Revisions between advance and 3rd release, in log terms. Source: BEA, author’s calculations.

There are always revisions. A previous discussion of G-7 GDP revisions is here. Clearly, contra earlier studies, these revisions tend to be positive, although whether the difference is statistically significant is something I haven’t checked.

Notice that there was a huge positive revision going from advance to third release in 2020Q2 — over half a percentage point, in log terms. This is understandable given the turmoil associated with this period. However, the fact there was an enormous drop in 2020Q2 GDP brings up the issue of dealing with seasonality in the wake of that quarter. This is not an issue unknown to statisticians — see Lucca and Wright (2021) as well as BLS (2022).

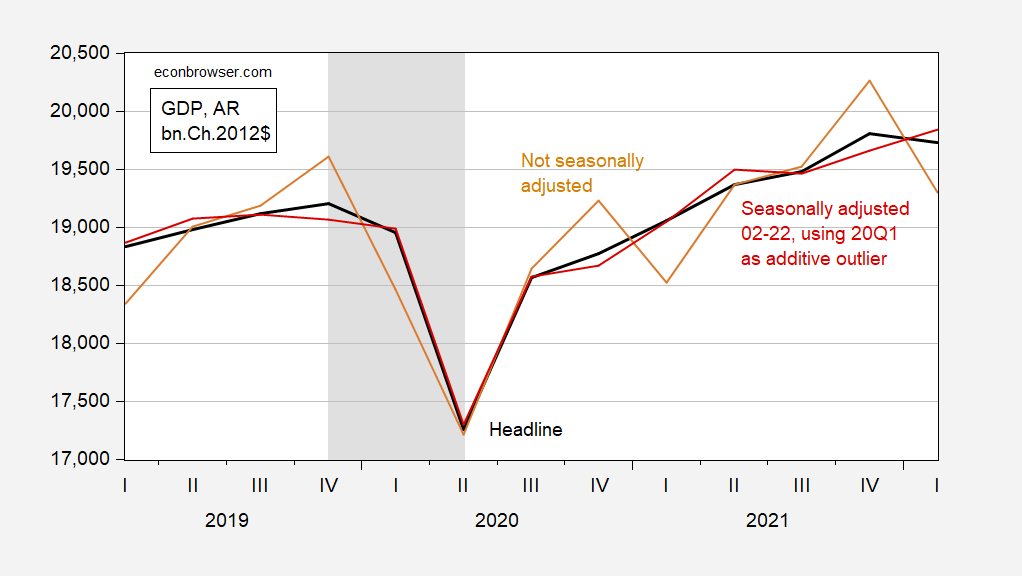

This brings us back to what different seasonal adjustment approaches show us. Figure 3 shows the official BEA series, the official seasonally unadjusted series (all the latest vintages), and my ad hoc seasonal adjusted series, using the 2002-2022Q1 period, Census X-13 with log transform and an additional outlier for 2020Q2.

Figure 3: GDP, seasonally adjusted as reported by BEA (bold black), not seasonally adjusted (tan), and seasonally adjusted using X-13, log transform, allowing for additional outlier at 2020Q2 (red). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Note that my seasonal adjustment process is not going to replicate the BEA’s. BEA applies seasonal adjustment to entire sample of individual components before summing. I’ve applied a seasonal adjustment filter to the aggregate series over 2002-22, the period for which I have nsa data. Hence, my point here is not to argue GDP growth is more properly measured as positive in Q1; rather it’s to highlight the pitfalls of over-interpreting the advance release on a q/q basis. (In fact, come July 28, estimates for 2022Q1 will be revised in the annual benchmark revision.)

And just in case things weren’t messy enough, don’t forget the EU’s TRAMO-SEATS approach to seasonality.

Actually, I should have said Eurostat’s approach.

They are describing this man as a “person of interest” in the Chicago 4th of July parade shooting:

” Officials said he was 22-year-old Robert “Bobby” E. Crimo III and is believed to be driving a 2010 silver Honda Fit.”

I got to see roughly 50% of the shooter’s Youtube channel before they took it down. Three things struck me.

1) He had one video of what looks like a suburban street at a time of zero traffic with tons of American flags on each side of the road. That to me is a pretty huge coincidence not to be foreshadowing his plans for the shooting. The video of the plethora of American flags along a vacant suburban street was posted 10 months ago.

2) He is incredibly underweight. Like the type of underweight you see in methamphetamines users.

3) And the 3rd thing that strikes me about the video is he has some similar traits to the Colorado cinema killer (I won’t mention his name). That is, his behaviors are similar to that of some teenage girl, his behaviors scream out “I need attention” “I am craven for attention” “I am desperate for attention”. If it goes a long time before they catch him, there may be folks who say “maybe he has committed suicide”. I don’t think so. I think his psyche profile is such he badly badly wants to see the reaction to his shooting, he’s ready to soak up the attention. Like oxygen for him. So even if it takes them awhile to find him, I believe they will find him~~alive.

I did not see his Youtube but listening to reports of what this clown put up and how many people had viewed his Youtubes, some people had to know this was likely to happen. But no one spoke up even as this punk was purchasing lots of guns and ammo. This killing was planned well in advance and yet nothing was done to slow him down.

Here is my feeling about it, obviously as an outsider, having no real connection to the man. I labeled it “foreshadowing”. Maybe others can find more apt words. But did his friends know?? I would guess people inside his social circle had to have some strong suspicions. How do you approach local police and say “I have strong suspicions, my kinda-of sort-of friend, oddball X, may be about to commit a serious act of mass violence”, and how does the typical police dept react to that?? Maybe they drive to the kid’s house and have a “sit down” talk with him?? It’s really kind of hard to know what to do at that point, even if you identified a high probability of potential bad act, and what is the next step?? That’s the $64,000 question nobody has answered yet that I am aware of. And if they had gone to local police to discuss their strong suspicions about the young man, it would have changed what?? YES, the effort would still have been worth it, but……

Agreed. All I will add is how the eff did they allow him to guy guns? Seriously?

Crimo is in custody.

the question for those who are not yanks is why do you have an advanced estimate when quite a few items are ‘estimates’ that is not data. most of us who have superior statistics bureaus merely have 1st and 2nd revisions and even then we have substantial revisions to actual numbers!

You come from Hobbit country, right? Do Hobbits have difficulty counting? According to your own superior Hobbit bean counters, there are an initial release and five revisions to GDP data, a total of six, not two:

https://www.stats.govt.nz/corporate/revision-policy-macro-economic-statistics

One day, maybe you’ll get past questions of style in data reporting and give some thought to substance.

Md,

Not Trampis is from Australia, not New Zealand. They are both very proud of not being each other, right, mate NT?

When thinking about the potential for revisions, it’s worth noting the volatility of inventories in the Covid era:

https://fred.stlouisfed.org/series/CBI#

Inventories were the biggest drag in Q1 GDP (as reported), and are the biggest drag on the Atlanta Fed’s latest estimate of Q2 GDP. Volatility is a good indication of the potential for measurement error.

Mitt Romney attempts to be bipartisan in a recent essay but Kevin Drum fact checks Romney’s BS in particular over things like fiscal policy and immigration:

https://jabberwocking.com/one-cheer-for-mitt-romney-but-thats-all/

https://www.nytimes.com/2022/07/04/opinion/another-step-toward-climate-apocalypse.html

July 4, 2022

Another Step Toward Climate Apocalypse

By Paul Krugman

We’re having a heat wave, a tropical heat wave. Also a temperate heat wave and an Arctic heat wave, with temperatures reaching the high 80s in northern Norway. The megadrought in the Western United States has reduced Lake Mead to a small fraction of its former size, and it now threatens to become a “dead pool” that can no longer supply water to major cities. Climate change is already doing immense damage, and it’s probably only a matter of time before we experience huge catastrophes that take thousands of lives.

And the Republican majority on the Supreme Court just voted to limit the Biden administration’s ability to do anything about it.

It says something about the state of U.S. politics that a number of environmental experts I follow were actually relieved by the ruling, which was less sweeping than they feared and still left the administration with some possible paths for climate action. I guess, given where we are, objectively bad decisions must be graded on a curve.

And for what it’s worth, I have a suspicion that at least some of the Republican justices understood the enormity of what they were doing and tried to do as little as possible while maintaining their party fealty.

For party fealty is, of course, what this is all about. Anyone who believes that the recent series of blockbuster court rulings reflects any consistent legal theory is being willfully naïve: Clearly, the way this court interprets the law is almost entirely determined by what serves Republican interests. If states want to ban abortion, well, that’s their prerogative. If New York has a law restricting the concealed carrying of firearms, well, that’s unconstitutional.

And partisanship is the central problem of climate policy. Yes, Joe Manchin stands in the way of advancing the Biden climate agenda. But if there were even a handful of Republican senators willing to support climate action, Manchin wouldn’t matter, and neither would the Supreme Court: Simple legislation could establish regulations limiting greenhouse gas emissions and provide subsidies and maybe even impose taxes to encourage the transition to a green economy. So ultimately our paralysis in the face of what looks more and more like a looming apocalypse comes down to the G.O.P.’s adamant opposition to any kind of action.

The question is, how did letting the planet burn become a key G.O.P. tenet? …

Wow, If Menzie will pardon my French (Menzie knows by now I can’t control myself, right??) Look at these weird-a$$ed headlines:

https://www.reuters.com/business/energy/brent-up-strike-norway-threatens-disrupt-oil-gas-output-2022-07-05/

Has anyone checked in with Larry “I’mCrochetingDoiliesOnBloombergNow” Summers to see if these thoughts on drop in oil demand check out his genius meter?? We gotta run these market events by Larry first, don’t we?? Doesn’t talk of lower oil demand break some treaty we have with Summershstan?? (Similar to my interactions with the Harrisonburg PhD, I’m trying to make this all about Larry, because I know narcissists feed off that).

Oil plummeted about 9% on Tuesday in the biggest daily drop since March on growing fears of a global recession and lockdowns in China that could slash demand. Global benchmark Brent crude settled at $102.77 a barrel, losing $10.73, or 9.5%. U.S. West Texas Intermediate (WTI) crude ended8.2%, or $8.93, lower at $99.50 a barrel. There was no WTI settlement on Monday because of a U.S. holiday. Both benchmarks logged their biggest daily percentage decline since March 9 and hit share prices of major oil and gas companies.

I could care less if Exxon’s share price fell. Hopefully this means lower gasoline prices and somehow this signals to the FED to ease off on its monetary restraint.

Moses,

Not sure what I have to do with Larry Summers, although you seem to like to drag me into all sorts of things.

On the oil price decline, one indicator that we might indeed be getting into a recession is an item especially tied to the oil market, a report that sales of cars by several major companies declined in the second quarter. Supposedly this was not due to demand weakness but more supply chain stuff, in particular continuing chip shortages. Really hard to tell what is going on.

BTW, for all the breast beating going on, I note that while the stock market is down from previous highs by quite a bit, the Dow is about where it was when Biden took office, and the S&P 500 is a bit above what it was then.

And we are still waiting to see something happen on the employment front. I shall repeat something I have said elsewhere on this blog that if we indeed get two consecutive negative growth quarters for GDP and people declare we are in recession, this will be the weirdest recession ever seen, given that it would be coinciding with one of the hottest job markets we have ever seen. Indeed, I am mysified how it is that we are getting all these reports of actual declining output in various sectors but the job market continues to be so strong, truly mystified. I have no explanatin for this at all.

https://english.news.cn/20220703/0ad9e2f4265b475eb409424cae5a9150/c.html

July 3, 2022

New roads, railways improve lives of local Tibetans

By Lin Jianyang, Lyu Qiuping, Liu Hongming and Liu Ying

LHASA — Passengers carrying luggage of varying sizes, many in Tibetan costumes, chat with each other or bury themselves in their phones while queuing on the platform for their trains.

Such scenes play out daily at the railway station in Lhasa, capital of southwest China’s Tibet Autonomous Region, and stand in stark contrast to what existed 16 years ago.

When the station opened on July 1, 2006, marking the start of the official operation of the Qinghai-Tibet Railway, the region’s first railway line, the platform was more like a tourist attraction packed with visitors.

“Curious about trains, many Tibetans just bought a platform ticket and brought snacks for a picnic here,” said Tsogpa, who has been working at the station since its opening and is now office director of the Lhasa railway station.

With heavy spending on the construction of railway and road facilities, Tibet has seen rapid development and constant improvements to the lives of the locals.

Since 2012, more than 337 billion yuan (about 50.4 billion U.S. dollars) has been spent as fixed-asset investment in Tibet’s transport sector, according to the region’s transport department.

DRIVING ECONOMIC GROWTH

Over the past decade, three railway lines have formed a “Y” shape on the plateau region, with the latest Lhasa-Nyingchi line, the region’s first electrified railway line, kicking off operation on June 25, 2021. The Lhasa railway station, where the three lines meet, has witnessed explosive growth in passenger flow, surging from 2.24 million in 2007 to more than 4 million in 2021.

Bullet trains have brought tourists to the city of Shannan, through which the Lhasa-Nyingchi Railway passes.

In Tashi Chodan, a community in Nedong District of Shannan known for its Tibetan opera, some 30 artists perform for tourist groups from across the country.

Dawa Drolma, 52, one of the performers, said they have shows every night during the peak season.

Dawa Drolma and her family have also refurbished their house into a homestay with six beds. “During the busiest time, all rooms are full,” she said, adding that the opera performance and homestay business bring the family an extra income of more than 50,000 yuan every year.

In 2019, the Nedong district government spent some 50 million yuan for improving the living conditions of the community, including upgrading road facilities. The 2.5-meter-wide cement road was replaced by an 8-meter-wide asphalt one, allowing tourist coaches to arrive at the community.

Over the past 10 years, the per capita disposable income of the community more than doubled to 25,000 yuan a year in 2021, which is largely attributable to the burgeoning tourism industry.

“Tourists would not possibly come without convenient transportation,” said Basang Tsering, Party chief of the community.

Furthermore, a handloom fabric cooperative in Nedong District supplies its textile products, such as handmade scarves and purses, via logistic services. The cooperative, which has helped more than 400 farmers sell their fabric products, raked in a sales revenue of 10.5 million yuan last year, a whopping increase of 20 times from 2010.

“With convenient transportation, we can sell our products to big cities such as Beijing and Shenzhen,” said Basang, head of the cooperative.

Over the past decade, the total length of roads in Tibet has increased by some 55,000 km to 120,000 km, including more than 90,000 km of rural roads, according to official figures.

PROPELLING PROSPERITY

In Medog, Nyingchi City, daily necessities were earlier brought home on shoulders or horseback. Students had to trek for days to school, and ailing patients had to be carried on shoulders to a hospital in the city proper….

Baffs –

You worried about belief in ufo’s. From The Hill, today:

https://thehill.com/opinion/national-security/3545072-stunned-by-ufos-exasperated-fighter-pilots-get-little-help-from-pentagon/

A popular financial market story lately has been that the financial market response to the Fed is priced in and that asset prices now depend on the economic outlook.

Money market futures have taken out 25 basis point of hike for the February funds rate over the past week. Tens have shed 11 bps since Friday, oil is down about ten bucks today, but equities have lost, not gained. That’s consistent with the story that the economic outlook is what matters now.

Oil isn’t the only commodity down over the long weekend – metals, too. With oil now at the lowest price since April, gasoline futures have been falling for about a month, down 15% from the high in early June. Prices at the pump have cooled a bit,, but nothing like futures. Looks like headline inflation may cool in July, after another jump in June.

Speaking of metal prices, here is the price of copper per pound which was near $5 back in early March but is now below $3.80.

https://www.macrotrends.net/1476/copper-prices-historical-chart-data

Factory orders for May beat the upper end of the Econoday consensus range. Actual was reported as up 1.6%. The higher range forecast was 0.8%.

The Econoday consensus forecast was 0.5% as was the Bloomberg consensus.

https://us.econoday.com/byshoweventfull.asp?fid=541730&cust=us&year=2022&lid=0&prev=/byweek.asp#top

https://www.bloomberg.com/markets/economic-calendar

Non-military capital goods, ex-aircraft, +0.6% m/m.

Non-durables, +2.3%.

Unfilled orders, +0.4%.

So far, so good.

What? I thought the chief economist for Fox and Friends guaranteed we were in a recession already.

Maybe sand “batteries” are the solution for medium term storing of solar/wind energy.

https://www.bbc.com/news/science-environment-61996520

They are dirt cheep (pun intended). Maybe a solution for individual houses that goes off grid. Have excess solar panels to make sure that there is enough for the AC in the summer, but also store heat for the winter when the sun is less productive.

Ivan, even another cost added to electricity users trying take advantage of that FFRRREEEEE renewable energy. The war on fossil fuels is driven by that FFRRREEEE energy lie. Obviously, installing the wind mills and solar panels are also free. Adding a battery, sand or otherwise, to store the FFRRREEEE solar and wind energy is also free.

Then when theses marvelous renewables are not functioning, then the hookup to the fossil fueled power grid is the backup. But that ole backup must be sized to cover the entirety of the grid demand, especially during times of stress. If not, the smartest people pushing this FFRRREEEEE energy, will blame the fossil backuo for the problem.

All the while simply staying hooked to the grid would have saved the user all those costs (free additions needed to support renewables), and the grid would have probably operated at lesser expense than with that FFRRREEEE energy attached to the grid.

There’s an example of kinda thinking about energy. It’s how we got into this war on fossil fuels.

We were fully expecting more of your gibberish but FFRRREEEE? FFRRREEEE! FFRRREEEE! FFRRREEEE!

Come on CoRev – put down the gun and take your meds.

Finnish researchers have installed the world’s first fully working “sand battery” which can store green power for months at a time. The developers say this could solve the problem of year-round supply, a major issue for green energy. Using low-grade sand, the device is charged up with heat made from cheap electricity from s or wind. The sand stores the heat at around 500C, which can then warm homes in winter when energy is more expensive.

Interesting. Of course we should prepare for the next CoRev tirade in ALL CAPS!

Barking Bierka – the NYC Jerk, answer this question: Why would extreme solutions like a sand battery be implemented in Finland? Here’s a hint: What percentage of Russian energy does Finland rely upon?

As I pointed out, this is another unreliable cost added to Finland’s grid. How long is Winter in Finland and how long will the sand batteries last?

Juts wondering for a friend.

CoRev,

Is your friend the guy you hired to come and take away all those logs you were struggling with that you cut down in your yard because you know that global warming is a hoax? Did some of them have some of those medals you earned in the Apollo program on them, hack cough?

The usual argument for the FED’s tight money is that it needs to avoid having high inflation getting anchored into high expected inflation. Kevin Drum knocks down the typical arguments behind this rational:

https://jabberwocking.com/the-fed-is-gunning-for-a-completely-unnecessary-recession/

Not a bad case for easing up on the FED’s perhaps unnecessary tight policies.

Why is it so hard to just acknowledge that GDP is meaningless noise?

rsm,

Why is it so hard for you to just axknowledge that nearly every post you put up here is meaningless noise?