From Goldman Sachs (Milo, Struyven, Revisiting Recession Facts”) today:

We see the risk that the economy enters a recession in the next year at 30% in the US, 40% in the Euro area, and 45% in the UK. … Our subjective recession probabilities are significantly higher than the average 15% annual unconditional probability of advanced economies to enter a recession since the 1960s.

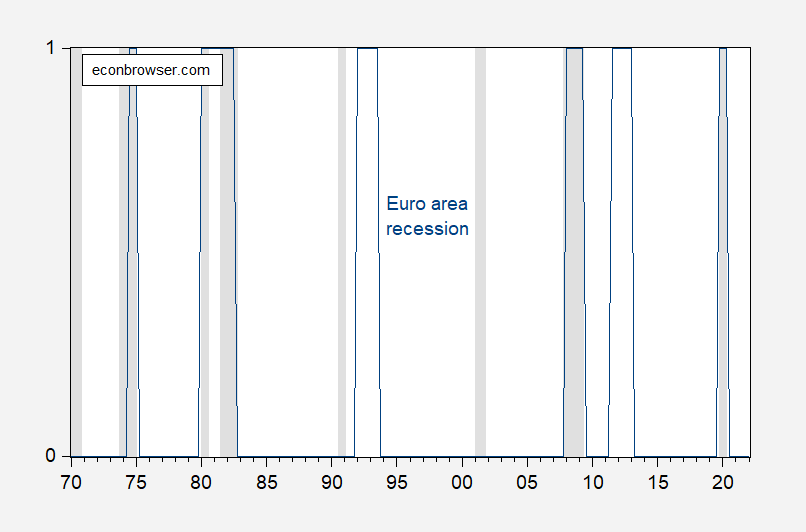

Robin Brooks has been emphasizing a coming (not yet here) global recession. This led me to wonder if there’s ever been a recession in Europe without a recession in the US. Here’s CEPR’s list of recession dates (peak-to-trough) compared to the NBER US recession dates.

There was a recession in what was to become the Euro area, in the early 1990’s, and another recession in the Euro area in 2011-12. Interestingly, the CEPR_EABCN EABCDC November 21, 2021 announcement makes the following observation regarding the two quarters of negative growth:

the two quarters of negative GDP growth in 2020Q4 and 2021Q1 are judged, based on available data, to be part of the unsteady expansion that started after 2020Q2. A sui generis recovery is following a sui generis recession.

Which is germane to the utility of the two consecutive quarter negative growth rule-of-thumb that many people refer to.

So there have been two recessions not coincident with US recessions.

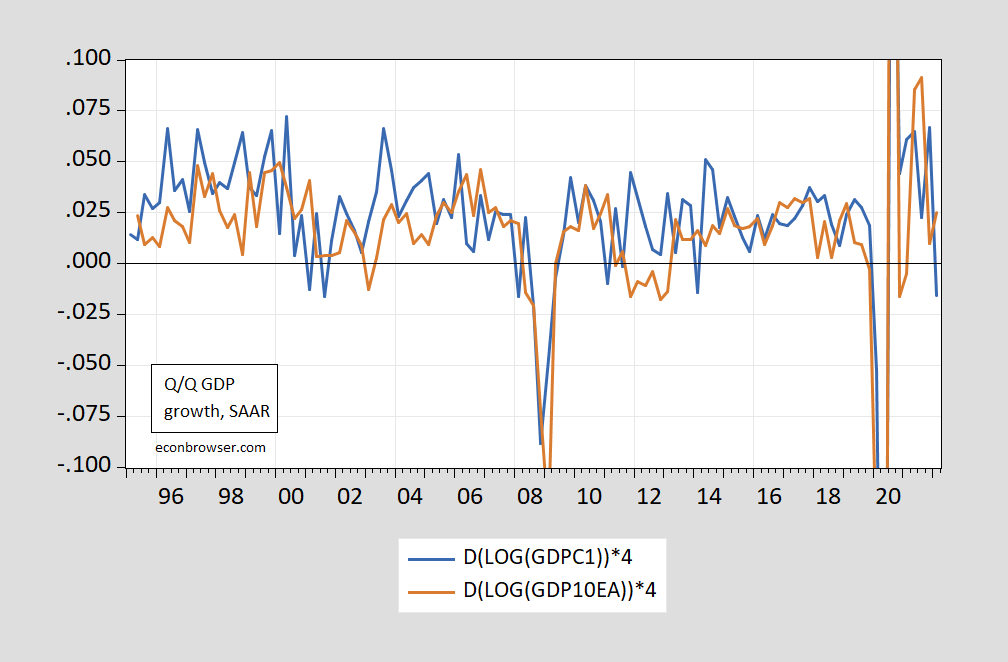

A comparison of US and Euro Area GDP Q/Q annualized is shown in Figure 2.

Figure 2: Quarter-on-quarter growth rate of GDP, SAAR for US (blue), for Euro area 19 (tan). Both calculated using log differences. Source: BEA, EuroStat via FRED, author’s calculations.

Over the period 1995-2019, the correlation of Q/Q growth rates is about 0.28; a one percentage change in US growth is associated with a 0.54 percentage point change in Euro area growth. Hence, it’s possible for Q/Q growth can diverge.

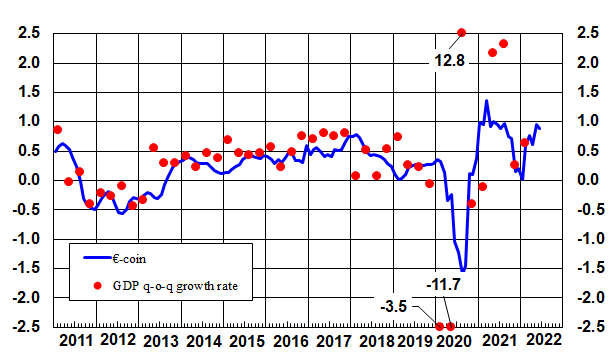

The June release for EuroCOIN, which is supposed to represent a smoothed monthly GDP q/q growth rate for the Euro area reads at 0.88% not annualized (hence, about 3.6% annualized.

Source: CEPR, 5 July 2022.

This GS recession probability for the US is slightly less than that reported by Bloomberg today (38%), but certainly higher than plain vanilla term spread models (see here).

《Over the period 1995-2019, the correlation of Q/Q growth rates is about 0.28; a one percentage change in US growth is associated with a 0.54 percentage point change in Euro area growth. 》

Do we know economists have a sense of humor, because they use decimal points?

What with making book on recession now a national pass-time, do we have any data in the accuracy of Bloomberg’s model or Goldman’s record? My understanding is that recession forecasts in general tend to be optimistic relative to realized outcomes. I am also not aware of any individual forecaster who has a record of business-cycle forecasting much better than yield-curve models, though simply by chance, somebody ought to have beaten the curve (ambiguity intentional).

Is it the case that when large numbers of forecasters put odds of a recession above 15% (or 20% or 30%), that recession is more likely than not in the next 12 (or 18 or 24) months?

My point is, do we learn anything useful or, better yet, quantifiable from knowing that Krugman or Goldman or Bloomberg thinks recession odds are elevated?

Not talking about sentiment. Sentiment boils down to people expecting recession when people expect recession.

“do we have any data in the accuracy of Bloomberg’s model or Goldman’s record?”

Good question. All I know is that the chief economist for Goldman Sachs has received a lot of praise for his forecast. Something I learned after Fox and Friends chief economist Princeton Steve dismissed Goldman Sachs entirely. Of course when I noted their forecasting record, Stevie was still dismissive claiming they had no model. I guess they just throw darts and got lucky. Well that is how he does it over at Fox and Friends.