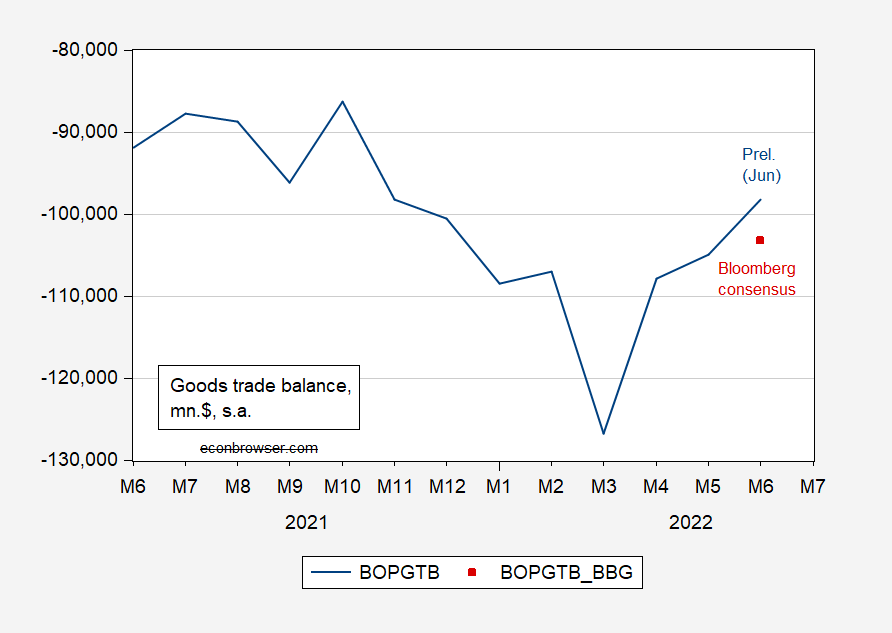

Following up on the previous nowcast post, there are two items of relevance: (1) trade balance (for May); (2) manufacturing orders. Here’s trade balance (release):

Figure 1: Goods trade balance (blue), and Bloomberg consensus as of 7/26 (red square), in millions dollars, s.a. June observation is advance. Source: BEA/Census and Bloomberg.

In an accounting sense, once you have set ideas for C, I, G, and your estimate of NX is revised upward in light of new information, then you move up your nowcast for C+I+G+NX, i.e., hence for GDP growth.

The surprise positive number on durable goods orders should help like a tiny tiny tiny bit, yes?? But I guess it’s kinda a drop in the bucket. Or drop in the ocean??

iirc orders are not part of gdp which is accounting for exchange of goods/services for money

Anonymous: Orders are inputs into inventories, I believe.

For business accounting purposes, wouldn’t the inventory entry be made when title passes per the FOB point. I don’t think title would pass from a purchase order.

When title passes, for the seller, debit AR or Cash, credit Sales and (if using a perpetual inventory system) debit Cost of Goods Sold, credit Inventory.

For the buyer, debit Equipment (or Inventory if purchase is for resale), credit AP or credit Cash.

Does Economic GDP accounting assume a sale upon order?

AS: I should have said in a “bean counting” sense, not in a literal accounting sense…my mistake.

If you’ve only got actual inventory data through May, e.g., and then you have June orders some of which then went into June inventory, then you have a better guess on overall inventories for April-June, which is what you need for Q2.

Professor Chinn,

Good point on using the new orders to estimate inventory for June.

Sorry, I missed that thought, by being too literal on the accounting entries.

I’ll move to the back of the class.

AS: No need to move back – that was my sloppy use of term “accounting”. Keep it up!

it has been years but it was both challenging and interesting; financial inventory accounting is complicated.

unobligated on order (uoo) is a term in cash management accounting used to track budget authority that is ‘committed’ to the incipient orders for inventory or direct sale (jit).

once the order is contracted with the seller the uoo becomes “obligated” by which the cash is fenced and cannot be moved unless the order is cancelled.

once the receiving dock processes the receipt, the programs cut the check (unless contracting agent review is required), and the money set aside is expended.

my understanding having argued a couple of times is: gdp counts money paid in exchange ie expended.

‘durable orders’ may track obligated $ for high value inventory requisitions.

yes, durable goods surprised with a 1.9% increase in new orders, seemingly indicating economic strength…but dig into the details and

(NB: the Census Bureau calls bombers and fighter jets “transportation equipment”)

More from the BLS on the employment dynamics for 2021QIV:

https://www.bls.gov/news.release/cewbd.nr0.htm

BUSINESS EMPLOYMENT DYNAMICS – FOURTH QUARTER 2021

From September 2021 to December 2021, gross job gains from opening and expanding private-sector establishments were 9.6 million, an increase of 781,000 jobs from the previous quarter, the U.S. Bureau of Labor Statistics reported today. Over this period, gross job losses from closing and contracting private-sector establishments were 6.7 million, a decrease of 785,000 jobs from the previous quarter. The difference between the number of gross job gains and the number of gross job losses yielded a net employment gain of 2.9 million jobs in the private sector during the fourth quarter of 2021.

uptown made some comment about labor participation

maybe why wages falling behind price level risings

https://www.huffpost.com/entry/brittney-griner-paul-whelan-offer-russia_n_62e186afe4b0c60a56647b83?d_id=4675423&ncid_tag=tweetlnkushpmg00000016

The Biden administration has offered a deal to Russia aimed at bringing home WNBA star Brittney Griner and another jailed American Paul Whelan, Secretary of State Antony Blinken said Wednesday. In a sharp reversal of previous policy, Blinken also said he expects to speak with his Kremlin counterpart for the first time since before Russia invaded Ukraine … Blinken said Washington would like a response from Moscow. Russia has for years expressed interest in the release of Viktor Bout, a Russian arms dealer once labeled the “Merchant of Death” who was sentenced to 25 years in prison in 2012 on charges that he schemed to illegally sell millions of dollars in weapons.

Bring Brittney home!

https://www.nytimes.com/2022/07/27/us/politics/senate-chips-china.html

July 27, 2022

Senate Passes $280 Billion Industrial Policy Bill to Counter China

The lopsided bipartisan vote reflected a rare consensus in the otherwise polarized Congress in favor of investing federal resources into a broad industrial policy to counter China.

By Catie Edmondson

WASHINGTON — The Senate on Wednesday passed an expansive $280 billion bill aimed at building up America’s manufacturing and technological edge to counter China, embracing in an overwhelming bipartisan vote the most significant government intervention in industrial policy in decades.

The legislation reflected a remarkable and rare consensus in an otherwise polarized Congress in favor of forging a long-term strategy to address the nation’s intensifying geopolitical rivalry with Beijing, centered around investing federal money into cutting-edge technologies and innovations to bolster the nation’s industrial, technological and military strength.

It passed on a lopsided bipartisan vote of 64 to 33, with 17 Republicans voting in support. The margin illustrated how commercial and military competition with Beijing — as well as the promise of thousands of new American jobs — has dramatically shifted longstanding party orthodoxies, generating agreement among Republicans who once had eschewed government intervention in the markets and Democrats who had resisted showering big companies with federal largess.

“No country’s government — even a strong country like ours — can afford to sit on the sidelines,” Senator Chuck Schumer, Democrat of New York and the majority leader who helped to spearhead the measure, said in an interview. “I think it’s a sea change that will stay.”

The legislation will next be considered by the House, where it is expected to pass with some Republican support. President Biden, who has backed the package for more than a year, could sign it into law as early as this week.

The bill, a convergence of economic and national security policy, would provide $52 billion in subsidies and additional tax credits to companies that manufacture chips in the United States. It also would add $200 billion in scientific research, especially into artificial intelligence, robotics, quantum computing and a range of other technologies….

Paul pelosi sold a good position of Nvda today……

no report on when wrt today’s sizeable advance

As we all know, only exports contribute to GDP. Imports neither add nor subtract from GDP. So if net exports go up, the only thing of importance is whether that is because exports increased or imports decreased. The former increases GDP. The latter does not.

It’s kind of hard to see exports increasing in the face of a rising dollar. For example, Microsoft’s quarterly report blamed lower than expected revenues on the exchange rate. On the other hand, JDH suggested that a major portion of the decline in exports last quarter was perhaps an accounting anomaly in petroleum exports which may be corrected this quarter on the plus side. We shall see.

Never trust a statement beginning with “as we all know”. Proper accounting math for GDP requires that imports be subtracted. Otherwise, the tally of domestic production will be too high by the amount of imports.

This is an accounting exercise – double entry bookkeeping and all that. You may have a story in which imports aren’t a drag on GDP, but that story is not consistent with the GDP accounting framework established by Kuznets in the 1930s ans used in the U.S. ever since.

Innocent mistake by joseph I think, but still good you corrected it.

Here on the eve of the much-anticipated-and-debated first announcement of the Q2 GDP numbers, it may be worth remembering what happened three months ago when those numbers were announced for Q1. There was an unexpected decline in GDP. What were the main reasons for this unexpected outcome? Unexpectedly large imports and unexpectedly low changes in inventories.

So, if tomorrow’s numbers are unexpectedly off in one direction or the other, it should not be surprising if that is due to unexpected numbers on those two items. But indeed, imports count negatively for GDP.

As it is, this may be part of the reason for the disjuncture we saw between DGP anf GDI changesin Q1. Income numbers do not directly come from imports or changes in inventories, especially the former.

https://www.commerce.senate.gov/services/files/CFC99CC6-CE84-4B1A-8BBF-8D2E84BD7965

It ought to be interesting when the CBO looks at this (presuming it has not yet done so) to determine impact on future GDP, tax revenues, and budget deficits. It appears that a lot of the funds earmarked are for loans and guarantees, but not really clear yet how much will be in the form of grants or tax abatements.

The Department of Commerce ran a PR page for the bill:

https://www.commerce.gov/news/press-releases/2022/04/analysis-chips-act-and-bia-briefing

I thought this was interesting (pages 42-43):

(C) REQUIRED AGREEMENT.—

‘‘(i) IN GENERAL.—On or before the

date on which the Secretary awards Federal financial assistance to a covered entity under this section, the covered entity shall enter into an agreement with the Secretary specifying that, during the 10-year period beginning on the date of the award, subject to clause (ii), the covered entity may not engage in any significant transaction, as defined in the agreement, involving the material expansion of semiconductor manufacturing capacity in the People’s Republic of China or any other foreign country of concern.

(D) NOTIFICATION REQUIREMENTS.— During the applicable term of the agreement of a covered entity required under subparagraph (C)(i), the covered entity shall notify the Secretary of any planned significant transactions of the covered entity involving the material expan- sion of semiconductor manufacturing capacity in the People’s Republic of China or any other foreign country of concern.

It is obvious that our evolving relationship with China is the primary impetus for this whole bill. This addresses some of the concerns that have been expressed about trade with China for well over a decade, but interestingly, nay votes came from both the far left and far right in the Senate.

Media reports suggest that the bill will pass the House and be ready for President Biden’s signature very soon. It appears that fear of China can be a powerful motivation for bipartisan action in Congress. One can imagine the senators all gathered at a cocktail party and fairly lubricated when the conversation turned to China and someone intoned that maybe the US should not have allow so much technology transfer and industrial espionage for the past three decades to a potential adversary… and someone else said, “Yeah, we should do something about that.”

So, you are for President Biden signing the bill or against President Biden signing the bill?? It’s an easy question to answer. You either type “FOR” or you type “AGAINST”. I can already perceive you are very indecisive on your feelings about the bill. Are you fearful President Biden is doing more to mitigate China’s negative influence on the world than donald trump, and resent the fact that President Biden is being more effective with the problem than the Orange Abomination??

Also, you have been paying attention to what your hero and Kopits’ hero has been busy with lately, haven’t you??

https://www.salon.com/2022/07/27/abc-news-hit-with-cease-and-desist-after-the-view-compares-tpusa-summit-to-third-reich/

I assume you like donald trump’s friends?? Like donald trump, do you and Kopits view them as “very fine people”??

A cease and desists letter!!!! Oh no!!!! Not the dreaded lawyerly version of “My daddy can beat up your daddy!”

Such a grown-up bunch. For those who’d like to send their own “You’re a big meanie” letter but can’t be bothers to pay a lawyer, here’s a do-it-yourself kit:

https://www.rocketlawyer.com/business-and-contracts/intellectual-property/copyrights/document/cease-and-desist-letter

Bruce Hall pretends to be a lawyer? As Moses noted – this troll cannot keep track on his own views of whether we needed to do something about semiconductor supply. But now he gets into the details of a new law? Like he is ever going to understand a word of it!

“The weekend-long summit that inspired the comments was held in Tampa, Florida last weekend and grouped students together with political leaders such as Ted Cruz, Matt Gaetz, former President Trump and Marjorie Taylor Greene for the intended purpose of providing them with leadership skills, but “The View” hosts Whoopi Goldberg and Joy Behar saw the end result as being more nefarious than that.”

Gaetz hanging with students? I wonder how many of the teenage girls he tried to pick up on.

Why isn’t Gaetz in federal prison yet?? Did he get a timeshare on Alec Baldwin’s get out of jail free card??

We need to get a list of celebrities who commit federal crimes and go wandering around America like they are on an perpetual book tour. Hillary Clinton, Matt PedoGaetz, Alec “I Never Held a Prop Gun Until Yesterday, and What Do I Know, I’m ‘Only” the Producer” Baldwin, donald trump, Mark Meadows, Steve Bannon, Roger Stone, Michael Flynn, Jim “I Don’t Report Sex Attacks on College Kids” Jordan.

Who am I missing here?? And which one of these people would not be in prison right now if they weren’t in our UK-style “special peoples’ club”?? Is this kind of like the deal where when you lobby for a foreign country in America and you don’t notify the U.S. government you don’t go to prison until you’ve been warned 50 times, and still not??

Moses, your question is sort of like are you for or against oil. Do you want plastics? Do you want heating oil in the Northeast (where they hate natural gas)? Do you want tires for your vehicles? Do you want fuel for airplanes and trains? Are you FOR or AGAINST oil?

I have been one of those who have had concerns about our dependence on China for quite awhile. I also believe that we have the ability to make all critical supplies domestically (even if paying more because we don’t use slave labor). So, in that regard I am FOR the concept of the legislation. That said, are you FOR or AGAINST having an accounting of the spending impact and spending provisions within the bill? $280 billion is not exactly spare change. What are we getting for that money? How much pork and special interests graft is built into it?

Can one be FOR the concept and AGAINST potential waste and corruption?

How is it that I ALWAYS know when you and Barkley Junior won’t directly answer a question before I even pose the question?? Why do you think that is Bruce?? EVERY TIME I know beforehand when you won’t answer a question, an EASY question. Is it because Uncle Moses is psychic, or something more simple, like I have a pretty good BS detector and I smell you two’s bullcrap from 2,000 miles off.

“Can one be FOR the concept and AGAINST potential waste and corruption?”

Let’s pose another question for Brucie boy. Didn’t he just say having semiconductors for that new car is waste and corruption? No wonder Ford struggled when this fool worked for them.

Moses, I think I did answer you question if you got beyond my rhetorical questions about oil (I know you are FOR oil). One can be for something as a general proposition, but still want to know that the actions being taken are reasonable and not a handout for cronies and special interests. Do you disagree with that?

Moses,

Does this mean my proposal for a nonagression pact is not accepted by you? This is a violation of what I proposed, although not a major one.

I see – you are in favor of subsidies for fossil fuels but spend a dime of government money on supporting semiconductor learning by doing and you become some rightwing balance the budget freak. Well guess what clueless wonder – that is why the bill raises taxes. Oh wait – taxing extremely rich people to pay for national security is COMMUNISM in your world. Got it,

p g l (aka pal)…good try at a snide comment, but a non sequitur with regard to what I wrote.

“280 billion is not exactly spare change.”

$280 billion over 10 years. I guess you having no effing clue the size of the semiconductor market. Heck – JohnH may be the dumbest person on the planet but at least he gets this is a huge market.

Come on Bruce – we get basic economic research is not your forte but please stop embarrassing your mother this way.

“Do you want tires for your vehicles?”

Well even you used to know that this vehicle needed semiconductors. Then again your IQ was in the teens back then while it is in the single digits now.