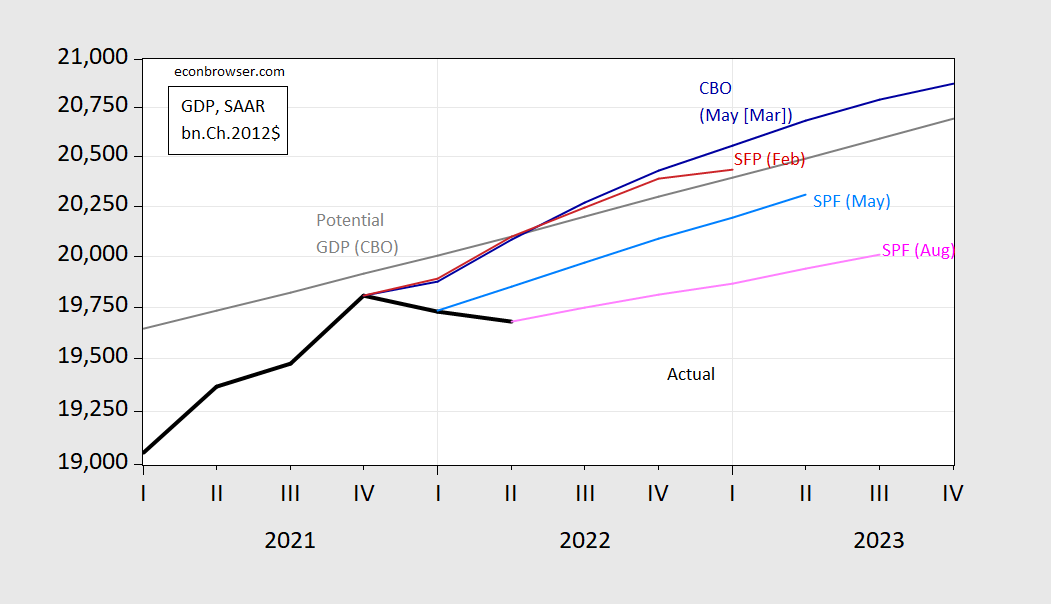

A remarkable downgrade in expected growth shows up in a large implied negative — and widening — output gap, even as forecasted long yields rise, according to the Survey of Professional Forecasters (released 8/12).

While the release is already almost a couple weeks old, it occurred after the advance Q2 release. With tracking indicating a slight upward revision to -0.3% from advance -0.9%, it’s not clear that respondents’ views would’ve changed much. So here is the picture for GDP.

Figure 1: GDP as reported (bold black), CBO potential GDP (gray), CBO May 2022 projection (blue), SPF February median forecast (red), SPF May forecast (light blue), and SPF August forecast (pink), all in billions Ch.2012$, SAAR, on a log scale. Source: BEA advance 2022Q2, CBO (May 2022), Philadelphia Fed Survey of Professional Forecasters (various).

The output gap, using CBO’s May estimate of potential, is -2.1% in Q2, rising to an implied -2.8% in 2023Q3. Taking this estimate of potential literally, one should expect substantial downward pressure on prices. In addition, the -2.1% gap in 2022Q1 suggests that cost-push shocks (and whatever expected inflation is in the system) are driving inflation, not demand push. Of course, potential GDP is notoriously difficult to estimate, so one has to be wary of making strong conclusions.

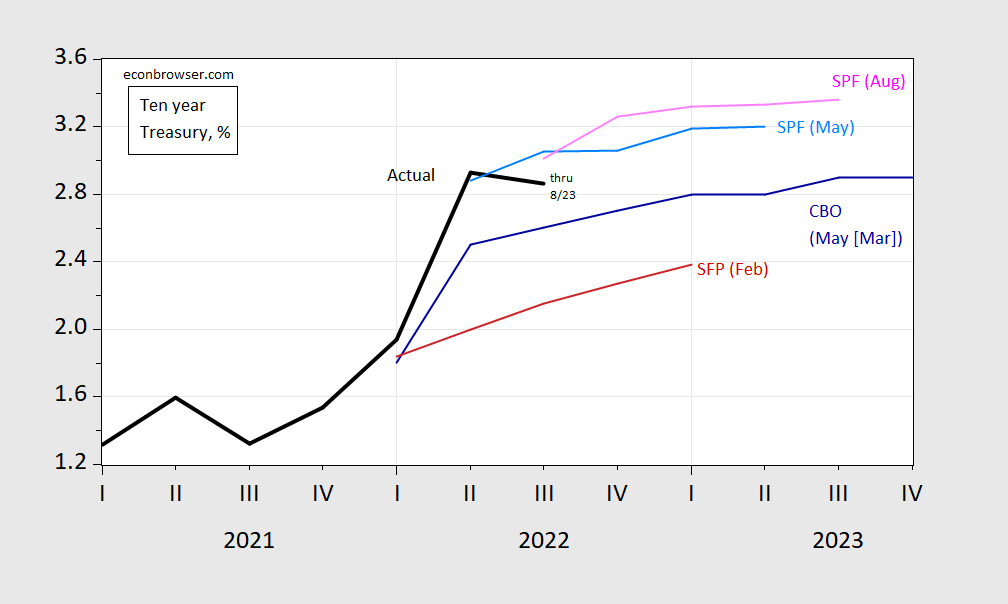

In terms of expectations regarding long term yields, these have consistently risen over the past three quarters.

Figure 2: Ten year Treasury yields as reported (bold black), CBO May 2022 projection (blue), SPF February median forecast (red), SPF May forecast (light blue), and SPF August forecast (pink), all in %. 2022Q3 observation is thru 8/23. Source: BEA advance 2022Q2, CBO (May 2022), Philadelphia Fed Survey of Professional Forecasters (various releases).

Note that the big upward shift is February to May. Doubtless, there’ll be some movement after the Jackson Hole speech, but probably not enough to change the material substance of the projection for long yields.

“A remarkable downgrade in expected growth shows up in a large implied negative — and widening — output gap, even as forecasted long yields rise”

I think this is strong case for the FED not to raise interest rates any more. These forecasts are basically saying we will have 2.8% inflation for the decade? We could live with that.

I rate hike of 75 bps is extremely dumb. But it wouldn’t be the first time and it won’t be the last time the Fed has been dumb under Georgetown Jerome. He’s like Greenspan, he wants to be worshipped by the TBTF bankers and Republican Senators. And if middle-income America gets jerked around by the doggy choke chain in the process, count Georgetown Jerome as unmoved. Jerome’s gotta keep those relationships going for his fat payday at the revolving door.

pgl has suddenly become a recession cheerleader? My, oh my!

Only the dumbest little baby boy would have written that STOOPID comment. Hey Johnny boy – tell your mommy to change your diaper.

How does one beat fear mongering hate filled Ron DeSantis for governor of Florida? I think Charlie Christ has an interesting answer:

https://cnsnews.com/article/national/susan-jones/democrat-charlie-crist-wins-fla-gubernatorial-primary-im-running-love

“He is on the battlefield of hate,” Crist said about DeSantis on Wednesday morning.

“I’m on the battlefield of love. There’s faith, hope and love. And the greatest of these is love, it’s in Corinthians in the Bible. I’m going to beat him because I’m running on love and love always wins.

“And if he wants to run on hate and culture wars and dividing people and making people hate each other, that’s his turf. It’s not mine.

“I’m on a different plane. I’m on a different turf. And it’s what Floridians deserve. You know, he’s torn my state apart. And Florida’s beautiful, as everybody knows. I want to bring her back together. That’s what this campaign is about. Hate versus love. His hate, our love. God’s love.”

Love is one thing, but Crist said he’s also running on abortion rights, voting rights, and “affordability.”

crist choses to espouse a narrow, lacking theology religion and claims infallibility.

the theology of faith, hope and love is from St Paul, and anyone that pulls one of the thre as superior does not understand the 3 are a venn…

so crist has no interest in the first amendment…. preaching the religion of the democrats

far deeper than crist!

Anionymous,

One might think that you are making a joke here, but given the low level of your intellect, I suspect not.

Um, Jesus said that the most important commandment is “love they neighbor as thyself.” So, sorry, this is not just one third of a Pauline doctrine. It is pretty much fully acceptable presumably to all Christians.

I am unaware of where Crist claimed any infallibility. Why are you lying here? Oh, you want to imitate Trump?

As it is, I see lots of politicians making definite theological claims about abortion that are not accepted by a majority of the population. Want to denounce these politicians? No, you are too dumb, not to mention hypocritical.

What?

Oh, Anonymous. I get it. You are unable to read. You think there is an “H” in Crist’s name right after the “C,” right?

Princeton Steve first tells us 30 year mortgage rates are over 5.7% and then he comes back and declares that this interest rate is rising. Now here is what FREDDIE MAC and Fred have been saying by date:

June 23: 5.81%

June 30: 5.70%

July 7: 5.30%

July 14: 5.51%

July 21: 5.54%

July 28: 5.30%

August 4: 4.99%

August 11: 5.22%

August 18: 5.13%

Tomorrow we get the August 25 reporting, which I suspect will be near 5.28%.

Stevie is not alone with his lying to us about mortgage rates as JohnH is pulling the same cheap tricks. I guess these two trolls are now BFFs but I will continue to correct the record when these two misrepresent the data.

Mortgage News Daily daily survey (8/24) reports 30 year fixed mortgages at 5.84%, up 0.36% from a week earlier.

MBA weekly survey (8/24) is at 5.65%, up 0.18% from a week earlier.

FreddieMac (8/17) is at 5.13% (week old data)

https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

Of course pgl is notorious for claiming that he has the truth, the whole truth, and nothing but the truth…and anyone not agreeing with him is a rotten, no good liar!

But one thing is clear, mortgage rates, after declining somewhat from their June peak, are rising again, which does not bode well for 3Q growth.

Also, “Pending home sales declined for the second consecutive month in July, and for the eighth time in the last nine months, according to the National Association of REALTORS®. ” https://www.advisorperspectives.com/dshort/updates/2022/08/24/pending-home-sales-modest-decline-in-july

And durable goods orders for core capotal goods rose 0.4% in July, with June oders revised to up 0.9% from 0.7%, which bodes well for Q3 GDP. Funny how you only pay attention to the bad news.

So, Johnny, now that you have another piece of bad news for Q3 growth… copied from below, since Johnny pretended not to see it:

I’m still waiting for you to screw up your courage (any courage at all) and take the bet –

If U.S. real GDP falls in each of the first 3 quarters of 202 (final GDP), as you have suggested it will, I will stop posting comments here for all of Q1 2022, on the condition that you will stop posting for a full quarter if GDP does not fall in all three quarters.

You’re already had the advantage, and today, the Atlanta Fed resived its GDPNow estimate for Q3 lower.

COME ON, JOHNNY! How long are you gonna hide?

At this point, I’m opening this offer up to any recession-mongering regular commenter who has the courage of their convictions. The line forms to the right (naturally).

MD,

It seems that Bloomberg defines “core” durable goods orders as “durable goods orders minus transportation”, FRED series, ADXTNO, which showed a 0.3% m/m increase. I had forecasted 0.4%.

https://www.bloomberg.com/markets/economic-calendar

Econoday seems to define “core” durable goods orders as “nondefense capital goods excluding aircraft”, FRED series, NEWORDER, which showed a m/m increase of 0.4%, as you mention.

https://us.econoday.com/byshoweventfull.aspx?fid=541699&cust=us&year=2022&lid=0&prev=/byweek.asp#top

You are the whiny little baby boy. But to your alleged “points”:

FreddieMac (8/17) is at 5.13% (week old data)

I did say that on Monday and you accused me of lying? Pathetic. This series is published weekly and like I said it comes out tomorrow. Oh wait – they do not publish this hourly so a lying troll like you claim Freddie Mac lies.

Of course your rate is the subprime rate. Sorry dude but your fellow liar Princeton Steve is “on record” for using Freddie Mac reported rates. So take up your pathetic parade with your new BFF.

“But one thing is clear, mortgage rates, after declining somewhat from their June peak, are rising again”

Wait – your BFF denied this decline. Thanks for undermining your own BFF! BTW if you ever learned to READ, you might see I noted the recent rise. But according to you – I lied about that too.

Lord Johnny boy – we knew you were stupid but DAMN!

Ha! pgl lied again. He said that FreddieMac rates this week were 5,55%, the highest since June 30 and much closer to MBA and MDN numbers than to his own.

Actually most people would not think that pgl was a liar, he just made just made a mistake. But in pgl-world, he is definitely a liar, since anyone who used a different data source or forecasts a different number is nothing but a rottne, no-good liar! And pgl never makes a mistake!

I accurately reported that FREDDIE MAC’ series of mortgage rates rose from 5.13% (last Thursday’s data) to today’s reporting of 5.55% and you said I LIED? You are a complete clown. Yea you pulled some subprime numbers from last week – so? That you are a lying moron? Just wow – keep it up troll. Everyone here – I said EVERYONE – knows you are a disgusting little troll. But please keep reminding us.

“since anyone who used a different data source”

I have been consistently reporting FREDDIE MAC’s reporting. You are the lying troll who mixes sources and dates. But once again my thanks for you proving you are a lying fool.

I am guessing 2% growth in the first quarter and 0% for the second quarter a decade from now as revisions come in. Big revisions to 1st quarter GDP are pretty common looking back 30 years. Most of it is exports issues.

Kevin Drum’s update on inflation:

https://jabberwocking.com/raw-data-core-inflation-vs-food-inflation/

Energy prices actually falling and core inflation lower. BUT food inflation is still high.

ltr provided us with Krugman’s latest on this – which suggests food prices may soon start falling. Let’s hope so.

WTI is up $7 over the last week.

usa crude inventory eia 19 aug print:

spr 453 mbbl -27% y on y (by end of planned draw about 380mbbl)

comm’l 421 mbbl -2.5% y on y

refined product:

gasoline 216 mbbl -4.5% y on y

distillates 112 mbl -19.4%

usa exports in eia 19 aug print:

2.6 mbbl/day

cum avg .534 mbbl/day

you would think there was a glut of crude and product in the usa!

demand destruction in distillate in winter is not comforting

RBOB Gas Futures down 2.7% over the last week.

Gee Stevie – you are oil on the brain. Have oil prices been rising every day this summer like mortgage rate and unemployment insurance claims?!

Six months ago, on February 24, Russian forces invaded Ukraine. Since the, 5587 Ukrainian civilians are co firmed to have been killed, with the actual number likely in the tens of thousands. Nine thousand Ukrainian soldiers have been killed. Roughly 1/3 of Ukrainians, 6.6 million, have been driven from their homes. Hunger has increased throughout much of the world as a result of Russia’s war.

http://www.nytimes.com/2022/08/24/world/europe/russia-ukraine-war-toll.amp.html

Back on topic –

Johnny, where are you? I’m still waiting for you to screw up your courage (any courage at all) and take the bet.

If U.S. real GDP falls in each of the first 3 quarters of 202 (final GDP), as you have suggested it will, I will stop posting comments here for all of Q1 2022, on the condition that you will stop posting for a full quarter if GDP does not fall in all three quarters.

You’re already had the advantage, and today, the Atlanta Fed resived its GDPNow estimate for Q3 lower.

COME ON, JOHNNY! How long are you gonna hide?

At this point, I’m opening this offer up to any recession-mongering regular commenter who has the courage of their convictions. The line forms to the right (naturally).

do you think anyone listening?

Johnny has a new task in life. Supporting Princeton Steve’s parade of lies. Aren’t they cute as BFFs?

…all of Q1 2023.

Did you mean you’d be more quiet in Q1 2023?? I’m confused. I remain somewhat neutral on the recession thing (as regards future quarters), but I wouldn’t take this bet anyway because if I won then that would be like a punishment. That’s like saying “OK, if you can throw this NFL regulation football farther than me, you will not be allowed to eat any rice krispie treats, and no cherry pie with coffee for 3 entire months.”

(Actually I’m better with Nerf balls I used to play with in late autumn on the northwestern Oklahoma frozen tundra of my best friend’s backyard hearing the timpani drums and the voice of John Facenda in “The Autumn Wind” in the background of my head)

Johnny has been too busy helping Putin celebrate all those deaths in Ukraine that you discussed.

md

Population of ukr was 41 million in 2021.

possible down to 38 million due to emigration

9000 Kia seems to be a lot of bugging out

why they demand the 60 km long range weapons

Kiev equal to kabul

This is how it unravels and ultimately ends…when challenges to the dominant narrative move from the fringes to become widespread…and more widespread yet.

Jeffrey Sachs at Common Dreams: “The West’s Dangerously Simple-Minded Narrative About Russia and China

The overwrought fear of China and Russia is sold to a Western public through manipulation of the facts.”

https://www.commondreams.org/views/2022/08/23/wests-dangerously-simple-minded-narrative-about-russia-and-china

Douglas Macgregor at the American Conservative: “Reinforcing Failure in Ukraine

The longer the war with Russia lasts the more likely it becomes that the damage to Ukraine will be irreparable…Ukraine’s war with Russia is at a decisive point. It is time to end it. Instead, the authors of the letter [by 20 notable American advocates for the war against Russia in Ukraine] seek to reinforce failure. They are demanding a deeply flawed strategy for Ukraine that will lead in the best case to Ukraine’s reduction to a shrunken, land-locked state between the Dnieper River and the Polish border. ”

https://www.theamericanconservative.com/reinforcing-failure-in-ukraine/

Ramon Marks at National Interest: “No Matter Who Wins Ukraine, America Has Already Lost”

https://nationalinterest.org/feature/no-matter-who-wins-ukraine-america-has-already-lost-204288

Meanwhile experts on the fringe, like Scott Ritter, claim that Ukraine lost in May, when Russia figured out how to defeat highly entrenched Ukrainians in Mariupol. Nonetheless, Ritter expects that fighting will continue.

Hopefully, as dissident voices start creeping into the mainstream media, more and more people will start to question why the US is engaged in yet another wasteful, pointless and futile war.

JohnH,

What a pile of crap.

Sachsc calls for an outcome that includes security for Ukraine. But how is that to be achieved with Russia having invaded Ukraine and actively continuing to attack it? The onus is on Russia to stop. The US cannot end this war. It is not even participating in it other than helping Ukraine defend itself from ongoing attack.

We have this guy Marks claiming that somehow the US has lost because Russia has turned to China. But Russia turned to China before it invaded Ukraine. Remember Putin visiting Xi at the Olympics? He already made the turn then. This would be the case, even if Russia did not invade Ukraine. Has nothing to do with that. As it is, while some of the nations he lists are refusing to condemn Russia for its invasion, almost none of them are activiely supporting it. The UN General Assembly massively condemned the invasion, with only four nations voting to support it rather than abstaining.

An this last guy, yeah, Russia took Mariuopol, and it also took Severodonetsk and Lysiychansk. But sine then, closing on two months now, it has taken nothing more than some small villages. Heck, its crawl towards Bakhmut has apparently stalled out now. It is going nowhere.

Again, it is Russia that started this war. It is Russia that can end it at any time. The US cannot stop it, despite your ridiculous attempts to put the onus on the US somehow, JohnH. You continue to shamelessly support massive ongoing war crimes.

MD has told you this over and over – this is Putin’s invasion. You can stop it if you told your master to back off. But no – you have decided to excuse these war crimes by falsely blaming someone other than your master – the war criminal.

What is the White House saying?

https://finance.yahoo.com/news/1-white-house-cuts-fy-204927136.html

The White House also adjusted down its economic projections, with 2022 U.S. real GDP growth cut sharply to 1.4% from 3.8% in March, based on fourth-quarter comparisons. It cited the resurgence of the COVID-19 Omicron variant, the war in Ukraine, persistent inflation and higher interest rates for the slowdown.

It revised its inflation projection for 2022 to 6.6%, now in line with private forecasters, from 2.9% in the March forecast. The forecast revises the 2022 average unemployment rate slightly lower, to 3.7% from 3.9% in March, with much of the next decade at 3.8% (???!!!).>

https://fred.stlouisfed.org/series/UNRATE/

What is The Conference Board saying:

https://www.conference-board.org/research/us-forecast

While we do not believe the US economy is currently in recession – due to strength in a number of sectors and the extremely tight labor market – we expect that a broad downturn in the economy is on its way. Given the greater-than-expected weakness seen in Q2 2022 GDP data we are downgrading our Q3 2022 forecast from 0.5 percent (QoQ, SAAR) to zero percent. This downgrade is associated with our expectation that consumption will continue to soften in the third quarter due to rapidly rising interest rates and elevated inflation. Furthermore, we expect both residential and nonresidential investment to contract, and private inventory expansion to continue to slow.

What is pgl saying?

Happy Days are here again, let’s give Joe a cheer again. Inflation’s nothing to fear again, Happy Days are here again.”

What is the UK saying?

https://www.reuters.com/world/uk/uk-inflation-hit-18-early-2023-citi-forecasts-2022-08-22/

• Citi sees UK CPI peaking at 18.6% in January

• BoE may need to raise rates to 7% if inflation persists

• Ofgem cap to hit 3,717 pounds in Oct, 5,816 pounds in 2023

• BoE forecast inflation to peak in October at 13.3%

LONDON, Aug 22 (Reuters) – British consumer price inflation is set to peak at 18.6% in January, more than nine times the Bank of England’s target, an economist at U.S. bank Citi said on Monday, raising his forecast once again in light of the latest jump in energy prices.

Of course, the US is nothing like the UK (or Germany for that matter). We revel in our energy independence and wouldn’t think of abandoning that inexpensive engine of our economy for the hope of sunny days and steady winds.

You seem to have caught JohnH disease. Look I get it is comfortable being called a liar but it is not my fault that you lie 24/7. I would tell you to grow up but we are past that point. But could you have your mommy change your diaper. Damn!

Another non-response and attempt at being snide. Fail.

Ahhh – poor little Brucie boy. Hurls a stupid pointless insult and then cries when called on it. I would call you a child but most children are a lot more mature than you will ever be.

If energy independence (or independence in any commodity) is so important to growth, how come Germany and the UK are rich countries?

Please try to suppress the urge to say “white culture”. I know you can do it, Bruce.

https://www.researchgate.net/publication/24125107_Energy_and_Economic_Growth

My pleasure.

Energy and Economic Growth

April 2004

Ah Brucie – we have talked about this many times. Try READING your own links. A paper from 18 years ago? Just wow!

Hey wait – I bet Adam Smith wrote on this back in the 18th century. Find a link to that for us please.

Did You Even Read It, Episode #3023

This paper is about energy usage, not energy production. It has little, if not nothing, to do with energy independence.

Googling papers that you think support your claim but don’t because you didn’t read them or don’t understand them is not a great way to win an argument. (And do look up Granger causation at some point.)

Back to the question: How is it that Germany and the UK, and all other advanced countries that import a large fraction of their energy, are rich? Could it be that energy is just one of many inputs? Could it be that we can actually learn something from Ricardo? Do try to resist the “white culture” thing.

Check the date of his paper. Early 2004? Yea – Bruce is really, really dumb.

He finds a paper from early 2004 to provide us with the latest research on this issue? Yes – he is THAT STUPID!

Don’t think there’s anything wrong with an old paper (unless it’s out-of-date, which I can’t speak to about this paper).

The point is, it’s not about the thing Bruce Hall pretends it is about. Not in any way evidence that energy independence is good for growth. And where evidence for commodity mercantilism exists, it disappears when there’s an international market for commodities.

A good read on this:

Wright, G. (1990). The origins of American industrial success, 1879-1940. The American Economic Review, 651-668.

Again, Hall drops the ball when he could be making an entirely reasonable, non-MAGA point about energy independence and, say, volatility, or political economy.

“Finally we review the empirical literature that finds that energy used per unit of economic output has declined, but that this is to a large extent due to a shift from poorer quality fuels such as coal to the use of higher quality fuels, and especially electricity.”

Even Bruce’s 2004 paper never said Germany had to produce fuels to consume them. Could someone please tell Bruce no relationship to Robert Hall about something called IMPORTS?

‘While we do not believe the US economy is currently in recession – due to strength in a number of sectors and the extremely tight labor market – we expect that a broad downturn in the economy is on its way.’

Maybe this this is why inflation is moderating. Wasn’t there some right wing lying troll named Bruce Hall who kept jumping up and down over how inflation was the end of civilization as we know it?