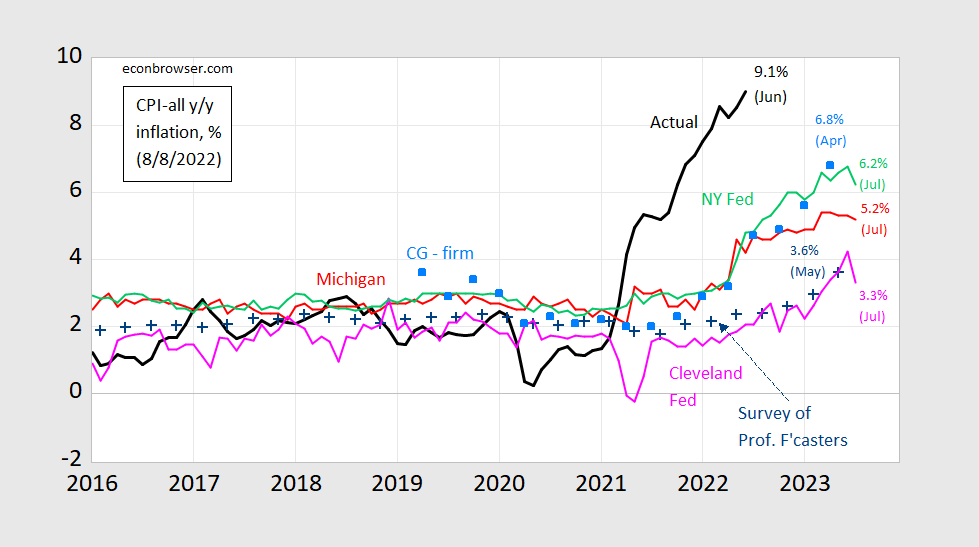

The NY Fed measure of inflation expectations dropped dramatically from 6.8% in June to 6.2% in July. This is a much larger drop than the Michigan series (0.1ppt).

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Michigan July observation is preliminary. Source: BLS, University of Michigan via FRED and iPhiladelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

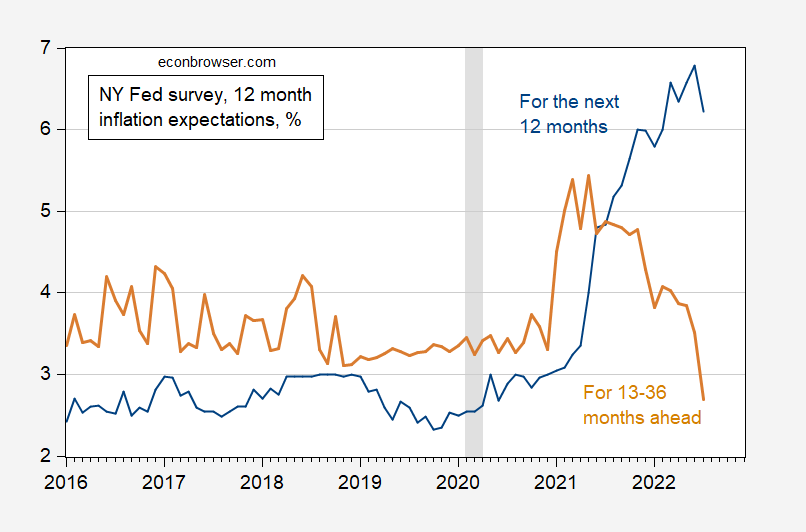

Not only did the median one year expected drop, so too did the implied 12 month inflation rates for 2-3 years out (h/t Steven Englander/Standard Chartered).

Figure 2: One year median from NY Fed Survey of Consumer Expectations as of indicated date (blue ), implied 12 month growth rates for 2-3 years out (tan). Source: NY Fed, and author’s calculations.

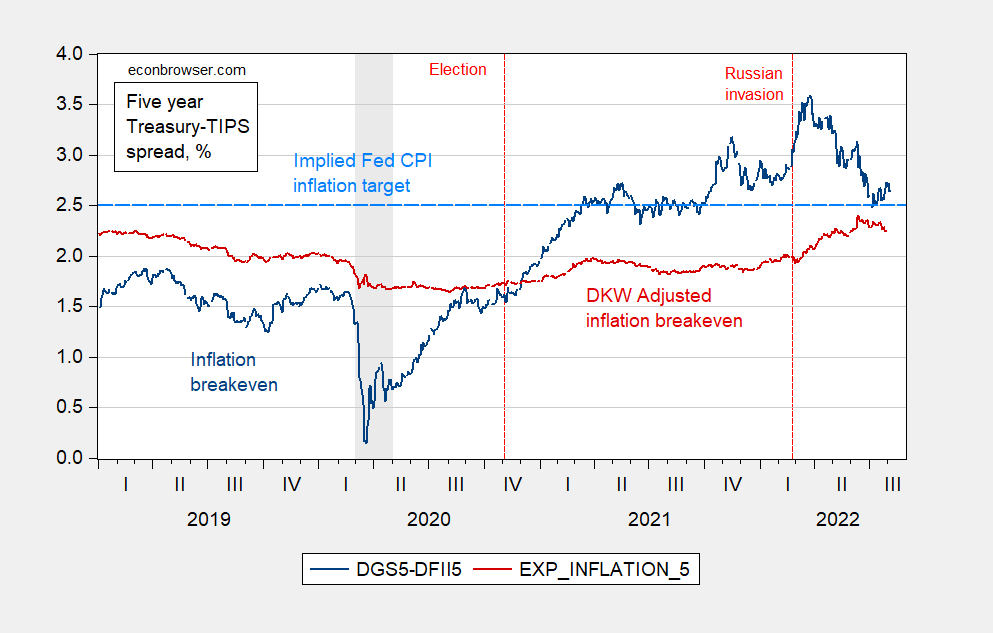

Notice that the longer term expected rate 2-3 years out is back to (and less) than where it was pre-pandemic. This is consistent with the five year inflation breakevens (unadjusted and adjusted) reported in yesterday’s post.

Figure 3: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %. Light blue dashed line at 2.5% CPI inflation, consistent with 2% PCE inflation. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

Bruce Hall dismissed this survey for “reasons” unique to Bruce’s total misunderstanding of what any of these terms mean. Bruce provided us a subset of what Reuters wrote but not what this document actually said:

Median one- and three-year-ahead inflation expectations both declined sharply in July, from 6.8 percent and 3.6 percent in June to 6.2 percent and 3.2 percent, respectively. Both decreases were broad-based across income groups, but largest among respondents with annual household incomes under $50,000 and respondents with no more than a high school education. Median five-year ahead inflation expectations, which have been elicited in the monthly SCE core survey on an ad-hoc basis since the beginning of this year, also declined to 2.3 percent from 2.8 percent in June. Expectations about year-ahead price increases for gas and food fell sharply. Home price growth expectations and year-ahead spending growth expectations continued to pull back from recent series highs. Households’ income growth expectations improved.

Bruce forgot to tell us a lot of this especially the improvement in expected household income growth. Wonder why? Oh yea – Kelly Anne Conway only allows him to report bad news. Never mind.

https://newseu.cgtn.com/news/2022-08-07/UK-faces-financial-timebomb-without-new-measures-says-ex-PM-Brown-1cjesYvqny8/index.html

August 7, 2022

UK families face ‘financial timebomb’ without emergency measures, says ex-PM Brown

By Tim Hanlon

Former British prime minister Gordon Brown has warned of a “financial timebomb” that could “push millions over the edge” as he called for an emergency budget for families struggling with the UK cost-of-living crisis.

Conservative leadership candidates Rishi Sunak and Liz Truss should meet with Prime Minister Boris Johnson to plan emergency measures or risk “condemning millions of vulnerable and blameless children and pensioners to a winter of dire poverty,” said Brown, writing in the Observer newspaper. *

Many people in the UK have been hit hard by rising inflation that has pushed prices up – a situation that is only going to get worse during winter when more will have to be spent on heating.

Energy prices have risen considerably and some have spoken of the need to choose between food and heating.

“A financial timebomb will explode for families in October as a second round of fuel price rises in six months sends shockwaves through every household and pushes millions over the edge,” said Brown.

“A few months ago, Jonathan Bradshaw and Antonia Keung at York University estimated that April’s 54 percent increase in fuel prices would trap 27 million people in 10 million households in fuel poverty.

“Now, 35 million people in 13 million households – an unprecedented 49.6 percent of the population of the United Kingdom – are under threat of fuel poverty in October.” …

* https://www.theguardian.com/commentisfree/2022/aug/06/fuel-poverty-is-creating-a-left-out-generation-that-will-never-recover-from-the-scars

https://english.news.cn/20220807/958906b184f44bc99cbfcd385d48bb9c/c.html

August 7, 2022

China’s foreign trade of goods up 10.4 pct in first 7 months

China’s foreign trade of goods jumped 10.4 percent year on year to 23.6 trillion yuan (about 3.5 trillion U.S. dollars) during the first seven months of the year, official data showed Sunday.

Exports rose 14.7 percent year on year to 13.37 trillion yuan, while imports increased 5.3 percent from a year ago to 10.23 trillion yuan, according to the General Administration of Customs (GAC).

During the period, China’s trade with the Association of Southeast Asian Nations, the European Union and the United States, expanded by 13.2 percent, 8.9 percent and 11.8 percent from a year ago, respectively.

From January to July, China’s trade with Belt and Road countries and other members of the Regional Comprehensive Economic Partnership (RCEP) soared by 19.8 percent and 7.5 percent year on year….

https://english.news.cn/20220803/fb1e307e0d1140efaf34531bc598418e/c.html

August 3, 2022

China’s service trade up 21.6 percent in H1

BEIJING — China’s service trade value grew 21.6 percent year on year in the first half of 2022, data from the Ministry of Commerce showed on Wednesday.

Total trade value stood at 2.89 trillion yuan (about 426 billion U.S. dollars), according to the data.

Service exports expanded 24.6 percent yearly to 1.41 trillion yuan, and service imports were 1.49 trillion yuan, up 18.9 percent from a year ago.

Service trade deficit dropped 34.3 percent to 79.19 billion yuan in the first half.

China’s trade of knowledge-intensive services maintained steady growth in the period, rising 9.8 percent year on year to about 1.21 trillion yuan, said the ministry.

Sectors such as telecommunications and information services saw rapid increases in exports, while insurance services were among the fastest growing areas in imports….

The NY Fed writes the following:

“Median one- and three-year-ahead inflation expectations both declined sharply in July, from 6.8 percent and 3.6 percent in June to 6.2 percent and 3.2 percent, respectively. Both decreases were broad-based across income groups, but largest among respondents with annual household incomes under $50,000 and respondents with no more than a high school education.”

What would cause the households with incomes under $50,000 to expect lower inflation?

I thought that folks usually extrapolate to the future what they currently experience. These folks must be reading Econbrowser.

The July CPI forecast consensus from Bloomberg shows:

1. CPI All at 0.2% M/M and 8.7% Y/Y. The low current month CPI All is due to the decline in the energy component, which will most likely show an unweighted decline of about 3.4% M/M.

2. Unweighted CPI Core at 0.5% M/M, 6.1% Y/Y, that shows 5.8% annualized.

Based upon my efforts, the unweighted food component of CPI will most likely show an increase of about 0.8% M/M, 10.2% Y/Y and 10.0% annualized.

I am showing the M/M weighted contribution to CPI All as shown below:

Food**********0.107

Energy********(0.298)

Core**********0.368

CPI All********0.177 or rounded 0.20% M/M

“What would cause the households with incomes under $50,000 to expect lower inflation?

I thought that folks usually extrapolate to the future what they currently experience.”

A guess? Inflation expectations aren’t base entirely on current inflation. Rather, expectations are backward-lookingz and folks remember a time when inflation was much lower. The big example we have of entrenched expectations for ugh inflation is decades ago.

Good question. My guess (adding to the list here – and as good as anyone’s!) is the salience of gas prices.

Oh and I hasten to add that Steve Kopits was right about one thing if that’s the case: the political salience of gas prices (vs. general inflation).

i don’t see any reasons, today, that inflation would remain elevated 2 or 3 years down the road. somebody needs to provide a mechanism for which that were to occur. i have not seen a valid model for which it occurs.

PGL called attention to this critically important study:

https://www.nature.com/articles/s41558-022-01426-1

August 8, 2022

Over half of known human pathogenic diseases can be aggravated by climate change

By Camilo Mora, Tristan McKenzie, Isabella M. Gaw, Jacqueline M. Dean, Hannah von Hammerstein, Tabatha A. Knudson, Renee O. Setter, Charlotte Z. Smith, Kira M. Webster, Jonathan A. Patz & Erik C. Franklin

Abstract

It is relatively well accepted that climate change can affect human pathogenic diseases; however, the full extent of this risk remains poorly quantified. Here we carried out a systematic search for empirical examples about the impacts of ten climatic hazards sensitive to greenhouse gas (GHG) emissions on each known human pathogenic disease. We found that 58% (that is, 218 out of 375) of infectious diseases confronted by humanity worldwide have been at some point aggravated by climatic hazards; 16% were at times diminished. Empirical cases revealed 1,006 unique pathways in which climatic hazards, via different transmission types, led to pathogenic diseases. The human pathogenic diseases and transmission pathways aggravated by climatic hazards are too numerous for comprehensive societal adaptations, highlighting the urgent need to work at the source of the problem: reducing GHG emissions.