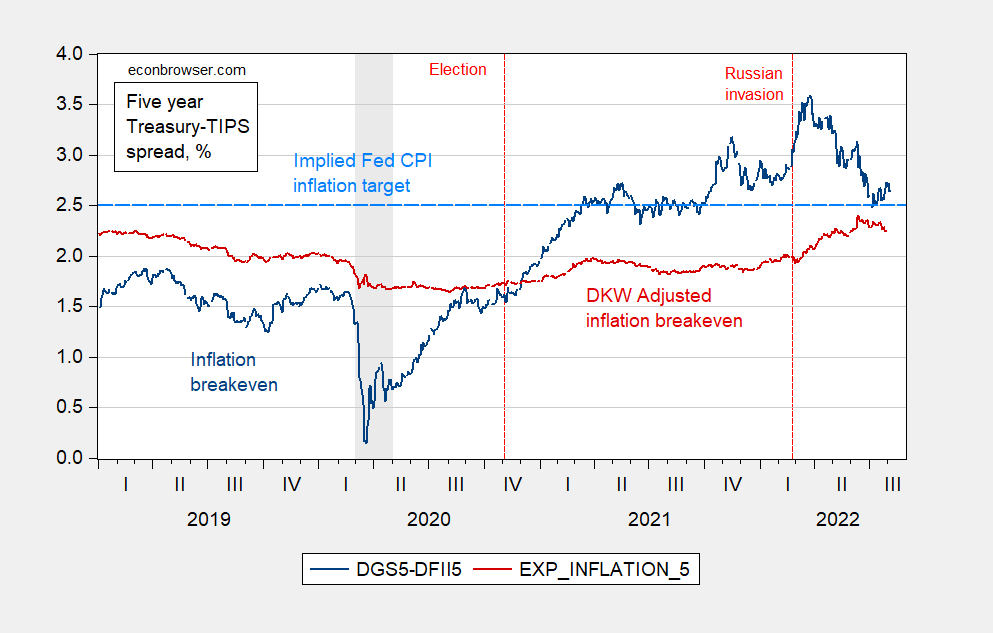

The Fed’s inflation target is 2% on PCE inflation. CPI inflation has averaged 0.5 ppts above PCE inflation since 1967. Putting these two points together, we see that expected inflation over the next five years is pretty close to target (h/t Mark Zandi).

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %. Light blue dashed line at 2.5% CPI inflation, consistent with 2% PCE inflation. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

That characterization uses the conventional 5 year Treasury-TIPS spread as the market’s measure of expected inflation. Accounting for inflation risk and liquidity premia, an alternative measure of estimated inflation compensation (red line) indicates we are below target.

https://fred.stlouisfed.org/graph/?g=LZHk

January 15, 2018

Consumer Price Index and Personal Consumption Expenditures Price Index, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=EJsH

January 15, 2018

Consumer Price Index and Personal Consumption Expenditures Price Index less food & energy, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=LZM2

January 15, 2018

Interest Rate on 5-Year Treasury Inflation-Indexed Bonds and 5-Year Breakeven Inflation Rate, 2017-2022

I think if the Fed makes a move more than .25 at their next meeting they are making a huge mistake. It can’t be “undone” if they do .75 again. And ANY AND ALL criticism they get in the future for a .75 move they will deserve. Georgetown Jerome & Friends will have to lay in their own refuse.

Deep in central banker thinking is the belief that negative real rates are inflationary. Using 5-year/5-year forwards and 5-year TIPS break-evens to stand in for expected inflation, the real funds rate is still negative:

https://fred.stlouisfed.org/graph/?g=SzhG

Using the DKW break-evens, the real funds rate is near zero. (Sorry. No picture.)

For quite some time, Fed folk have seen an inflation-adjusted funds rate of 0.5% as the long-run neutral funds rate. With inflation expected to run above target into 2024 (as of the June Summary of Economic Projections), neutral isn’t good enough. Now, expectations for recession should influence expectations for inflation. and recession expectations have risen since the June meeting. So arguably, Fed expectations for inflation in 2023-2024 have come down. To what level? Dunno.

Will falling inflation expectations and rising recession expectations have increased Fed tolerance for inflation in the near-term? I would think so, but what do I know? What I do know is that money market pricing solidified around a 75 basis point hike at the September meeting on Friday, after the jobs report:

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

Unless Fed folk begin talking down the need for another 75, or markets price out 75 without Fed folk objecting, we have our answer.

“Deep in central banker thinking is the belief that negative real rates are inflationary.”

If we go back 10 years, Lawrence Summers was co-authoring pieces with Brad Delong that undermined this belief. Of course Summers seems to have taken a very different view of late.

It should be easy to check out that hypothesis. If the real cost of borrowing drives demand then we should have a nice correlation between real interest rates and inflation. My guess is that the much better correlation would be between real cost of borrowing and asset prices. Low rates induce the investor class to leverage up their bets in the Wall Street casinos more than they induce the consumer class to borrow and spend.

Kinda looks that way. Good thing there’s gonna be a tax on buy-backs.

If businesses had better investment options, they’d take them. This isn’t about evil bankers doing banker-y things. It’s about there being much slower technological growth in the past 10 years or so than all the hype in the science and tech journalism you read. We are in a period of historically low, not historically high, technological growth.

“We are in a period of historically low, not historically high, technological growth.”

i am not sure i agree with this statement. what is your evidence? when you look at the increase in artificial intelligence and machine learning, technology is evolving rather well. and some companies, such as amazon and tesla, are capitalizing on this advancement. i would argue the technology is available, but management has done a poor job adapting. much management is simply ignorant or unable to understand how to take advantage of AI. but successful companies are doing well with it. technological growth is occurring, just not uniformly.

@baffling It’s about how you look at long-run productivity growth. Robert Gordon argues (in my mind, convincingly) that we are not in a period of high technological growth, but a period of historically low technological growth. We had high tech growth last in the 1995-2005 period (the ITC boom or whatever we want to call it, which was about mainframe computers + spreadsheets and word processing + a computer at every desk + a bit of the Internet). Today, we don’t have new technology that’s having such a big impact on productivity. They may in the future, but not yet. One way to look at it is the size of the biggest leading companies as a fraction of the economy. The current tech “boom” that is ending right now in the stock market was really about low interest rates. Amazon, Apple, etc. don’t have the impact that previous corporate giants and government decisions have had on our standard of living.

The argument is also theoretical: it’s about diminishing returns to investment at a civilizational level. We start with the basic stuff (agricultural productivity, basic transportation, not dying of typhoid and TB, not being poisoned by our food) and work our way up. It gets harder and harder to make a big impact on the standard of living.

Agree with this, but I don’t agree that 75bp is wrong. 500k new NFP jobs shows that the Fed doesn’t quite have the traction they’d like to have. It’s just very hard to believe that 500k jobs after a single 75bp hike (accounting for reporting lags) shows that the Fed needs to go more dovish.

Of course a big U-turn in next month’s jobs reports would be a different story.

Still taking jobs growth as a “negative” aye?? I see Wall Street has brainwashed your professors well, and in-turn you.

Bravo, to the propaganda of the “Masters of the Universe”. Take a bow Larry Summers & Friends.

You can take it as brainwashing, that’s fine. My opinion that 500k+ more jobs is NOT a sign that the Fed should be more dovish puts me in the company of many people I respect (and many people you might respect too). And that includes the Fed Board, I bet.

And Paul Krugman. Krugman on Twitter, Aug 5:

“It’s a recession, I tell you! Actually not good news: The Fed needs to cool off the economy, which this report says isn’t happening yet, and wage increases hotter than expected”

https://twitter.com/paulkrugman/status/1555533607699185664

That “It’s a recession” bit was sarcasm of course 🙂

Long and variable lags to the effects of monetary policy. In some markets, we are still seeing last year’s policy.

So Moses,

On the subject of likely Fed policy, here’s a head-scratcher based on GDP/GDI divergence. If one squints at a picture of the output gap and the real fed funds rate, one can get the inpression that rate policy is driven by the output gap, as long as inflation is well behaved. Notice that the funds rate follows the output gap around, except for the period from 1978 to the late 1990s, when the Fed was fighting inflation (real and imagined). Since the Great Recession, neither the output gap nor the real funds rate has spent much time above zero:

https://fred.stlouisfed.org/graph/?g=SzJO

With me so far? OK, with the output gap negative, the funds rate should be, too. Except we know that the Fed changes its behavior when inflation behaves badly. So maybe more big rate hikes make sense in Fed world right now. And we also know that the real funds rate is pretty negative, when calculated with realized (rather than expected) inflation.

But what if the output gap were positive? Here’s the same picture using real GDI rather than real GDP:

https://fred.stlouisfed.org/graph/?g=SzKL

Look way over on the righthand side. See the difference? Negative real funds rate, POSITIVE output gap! Oh, Nooooo!

And inflation is not well behaved. There’s a new low in the jobless rate. And 3-month average job growth is 437, 000 per month. Whatever we may think about the appropriateness of big rate hikes, I imagine Fed folk are commending themselves for their restraint in hiking just 75 basis points last time.

I’m too lazy to draws a picture of a GDPplus or GDO or whatever-you-call-it output gap. It’s still Q1 in GDI land, so use your imagination. But anyway, however right James Galbraith is, however little influence the Fed has on supply-side factors, however much damage to the lives of the future unemployed is done by policy today, rate hikes are essential in Fed world.

The biggest danger from excessive Fed interest rate hikes, and unlike some people here, I do not know what is exactly the right amount, it is the negative impact on many developing nation economies, many of which are already hurting very badly. The USD is rising and rising interest rates in the US are really putting severe pressures on some really struggling economies. That is where we have people seriously hurting, including places suffering malnutrition and even borderline famine given the food price hikes that have been happening, as well as all the energy price hikes.

To me, I mean if I could create a metaphor for Jerome Powell making another .75 hike, it’s like we see this waif of a girl, she’s 6’3″ and we’re playing dodgeball. And she just got pegged really hard and she’s halfway down to hitting the hard gym floor. And you’re standing on top of her at the midpoint line going. “Oh, F*** it, I’m gonna go ahead and tag her so she knows she’s out”. Any kind of logic (does anyone have that anymore?? or is logic like rotary dial phones now??) tells you, you can raise rates, but a .75 move is incredibly dumb, and on top of it I think it could be argued whether it’s even effective when most of it is still related to supply problems.

I’d also like to ask, does anyone really “know” how much of the lowering of inflation recently isn’t even that related to interest rates, but would have happened anyway due to the semi-resolving of supply issues and shipment times?? Has the Federal Reserve made any effort to ask themselves “How much of the recent lowing of inflation is more related to lowering of shipment times than anything our navel gazing moves have done??” Personally I think it’s a pretty damned important question, but I haven’t seen a lot of Fed Notes on the topic.

*lowering, excuse me

This is a very nicely made point.

I’d add that the slower the rate normalization, the better. I think we’d all prefer that. But it’s a hard call. The Fed had a point in the summer of 2021 that normalization wasn’t yet in the cards. But they were wrong, and if they had started normalizing then, we may have avoided much of the inflation AND reduced the probability of a Fed-induced recession.

This stuff is hard.

https://news.cgtn.com/news/2022-08-07/Rate-hikes-are-not-the-right-answer-to-wage-price-persistence–1ciBMDkClkA/index.html

August 7, 2022

Rate hikes are not the right answer to ‘wage-price persistence’

By James K. Galbraith

It is a bit jarring when a secure and comfortable professor writes that others must lose their jobs so that inflation can be contained. And it is even worse if he explains that “the only solution … is to restrain demand” through higher interest rates – a very good solution for those with cash on hand. But let me reply on the merits to Jason Furman’s recent call for this “solution.”

Furman writes that in the United States, “Aside from food and energy price increases, the bulk of the inflation was originally caused by demand.” The words “aside from” are key. Over the 12 months through June 2022, energy prices are up 40 percent – with gasoline up 60 percent and fuel oil up almost 100 percent – and food prices have risen 10 percent. Prices of everything else have risen just 5.9 percent, and one must allow that energy prices affect the price of everything else. Furman’s claim recalls the old gag: “Aside from that, Mrs. Lincoln, how was the play?”

There is no actual evidence that demand, rather than cost, caused the non-energy, non-food price increases – and there are good reasons to be skeptical. Costs are wages and raw materials plus profits; they are paid for by sales, also known as demand. Thus demand and cost are nearly inseparable; they are opposite sides of the same economic accounts. Furman himself has written that “the exact combination … is unknowable.”

Shifting his ground from demand to cost, Furman writes that “businesses will most likely continue to pass along the costs of higher wages to consumers.” He barely mentions profits. Yet profits are very high, and high profits come partly from high profit margins – meaning prices. Furman focuses on the dynamic of a “wage-price spiral” (renamed “wage-price persistence”); he is silent about profiteering. Has he not heard of market power, monopoly power, or the predatory corporation?

And what do higher interest rates have to do with “wage-price persistence”? The answer is: absolutely nothing, at least in the short run. Higher interest rates initially just enrich people and institutions (like banks or Harvard University) holding supplies of ready cash. For business borrowers, interest is another cost that will be passed along to consumers in the form of higher prices.

Only when the U.S. Federal Reserve pursues truly extreme measures will prices start to fall, as happened when Fed Chair Paul Volcker pushed short-term interest rates to 20 percent in the early 1980s. But this mechanism works by slashing growth and driving up joblessness, bankruptcies, foreclosures, suicides, and crime. That, sad to say, is what Furman urges the current Fed chair, Jerome Powell, to do.

But high interest rates are not “the only solution.” …

The late great James Tobin would applaud this discussion as he recognized the enormous cost of recessions. The President of the SF FED was on Face the Nation noting a large part of the rise inflation was cost driven not aggregate demand driven.

Wow, no commentary from “What’s ‘GVC’??~~and what war in East Europe??” Larry Summers?? OMG, Bloomberg forget to pay their brainwash the public fee for the month of August?

I did notice July 25th WSJ got to quote Johnny “GrumpyFruitcake” Cuckrant though. So all of this was really worth it. I’d hate to think the Hoover Institute bastard had ranted about 1970s inflation for the last 30 years straight only to be wrong once again.

Damn it – I have not checked out his blog for months but you made me go find this on inflation:

https://johnhcochrane.blogspot.com/2022/07/inflation-explainer.html

OK I will have to read the long winded rant later as I am too busy cursing the local coverage of the Mets trashing my Braves to notice anything more than the cute seal. Grumpy has a few other long winded rants that I think I will just skip.

If Scherzer was pitching what did you expect??

Did you see the throw to home plate by Luisky Ormes?? About as good as it gets.

BTW, pay attention to the comments section of that same Cuckrant post, you’ll see at least one familiar name. Probably Cuckrant’s most adoring student/ protégé.

Luis Guillorme I guess is the Mets player’s name. The guy that made the terrific throw to home plate. I think the color guy mispronounced his name, because I swear the first version I typed was how it phonetically sounded when the color guy said it. AMAZING throw no matter how you say his name.

It seems Moses watched the Mets/Braves game too and he had to remind me of how poorly my Braves did relative to the Mets. And to top it all off I had to had to my misery but reading the latest from Grumpy Cochrane which began with:

‘A few Stanford colleagues got together to talk about inflation, and that gave me an incentive to summarize recent writings as compactly as possible.’

It was certainly not compact and Cochrane went on and on with his theoretical musing complete with worthless equations and his presentation of data. But it all comes down to two things:

(1) Fiscal policy as “helicopter money” which ranks up there with suppression as one of the dumbest terms in macroeconomic parlance; and

(2) As long as the real interest rates is negative we are off to HYPERINFLATION.

MacroDuck noted some central bank types might believe (2) but I would submit this proposition is utter BS. A younger Lawrence Summers used to agree with me. What ever happened to that dude?

Oh well the baseball season has two months to go before the playoffs. Hopefully my Braves start playing like World Champions.

I promise you, the mentioning of the Guillorme play wasn’t meant to be malicious or twist the knife blade in. I mean you have to admit the throw to home plate was a great show of athleticism. You should take it this way, It took one HELL of a play to beat the Braves on that day, most days the Braves are not going to see plays like that from their opponents. And most days they will not face a pitcher like Scherzer, in my opinion the last 5 years or so, maybe longer, Scherzer has been the best pitcher in baseball. The man is a beast.

Moses Herzog

August 8, 2022 at 11:31 am

You are right. The Mets play was playoff level quality in August. I actually have several Mets fans – which I tried to avoid today. But when they asked me about the game I got over my pity party and told them their team is doing incredibly well. I am still hoping the Braves can catch them but if not – they will be a wild card team.

To be honest, I like the Mets fans a whole lot better than those damn Yankee fans. And their team is hot and the mighty Yankees are on a losing streak.

Ignoring the pricing power due to supply chain issues is either stupidity or malignant ignorance. Businesses are jacking up their prices as far as they can and if those price increases were “forced upon them” by wage demands they would have falling profits not exploding ones. If the low end wage workers had no power to demand better salaries, prices would still be exactly the same – just that profits would be even more insanely high.

The current Fed “cure” is great – just no good for the current “disease”.

Supply chain disruptions and monopoly powers are not sensitive to interest rates. If anything rate increases may drag out those problems by making it more expensive for newcomers to build up and dip into current insane profit levels. Furthermore, if consumer spending is based on increased income (rather than borrowing) it is not that sensitive to interest rates.

Maybe, but if trend holds, those prices are coming down. Product has to move and supply chain speed has returned to normal.

“Supply chain disruptions and monopoly powers are not sensitive to interest rates.”

That’s hard to believe. If that were the case, market power driving huge price increases would have been the case *before* our inflationary episode. It needs inflation to kick in.

Besides, there are theoretical reasons to doubt that on net inflation is largely driven by market power. Tighter goods and services markets make it *harder*, not easier, to maintain collusion. Rotemberg and Saloner wrote about this in 1986, and Rotemberg went on to write some stuff with Woodford about how this might work in a macro environment.

“There is no actual evidence that demand, rather than cost, caused the non-energy, non-food price increases – and there are good reasons to be skeptical.”

I just don’t buy this. The Fed hikes rates by 75bp and the job market gets hotter, not cooler. There’s no way that’s due to some magic energy price passthrough (which as JG correctly notes must explain some of the core inflation increases). The job market is too tight.

And have I mentioned before that the public absolutely detests inflation? And how it hurts the poor more than everyone else, despite what some claim?

Then again, Galbraith *would* say all this.

https://www.nytimes.com/2022/08/05/world/europe/us-africa-russia-sanctions.html

August 5, 2022

A U.S. diplomat warns African countries against buying anything from Russia except grain and fertilizer.

By Ruth Maclean

Ahead of a trip to Uganda and Ghana this week, the U.S. ambassador to the United Nations, Linda Thomas-Greenfield, said in an interview that it would be a “listening tour” and that she wanted to find solutions, not assign blame, over a food insecurity crisis intensifying on the African continent since Russia’s invasion of Ukraine.

But after arriving in Uganda, she warned African countries that there were red lines they should not cross.

“Countries can buy Russian agricultural products, including fertilizer and wheat,” Ms. Thomas-Greenfield said on Thursday, according to The Associated Press. But, she added, “if a country decides to engage with Russia, where there are sanctions, then they are breaking those sanctions.”

Buying Russian oil could constitute breaking those sanctions. The U.S. banned imports of Russian oil and natural gas in March, and the European Union will ban most imports of Russian oil by the end of the year.

“We caution countries not to break those sanctions,” Ms. Thomas-Greenfield said, because then “they stand the chance of having actions taken against them.” …

https://english.news.cn/20220804/14bed40337ca40c2bae765c8ab29f38e/c.html

August 4, 2022

President Mnangagwa says Zimbabwe will prosper despite Western sanctions

Zimbabwean President Emmerson Mnangagwa on Wednesday vowed to continue working for the development of Zimbabwe, warning that Western countries that have imposed sanctions on the country will not succeed in their machinations to derail the nation.

HARARE — Zimbabwean President Emmerson Mnangagwa on Wednesday vowed to continue working for the development of Zimbabwe, warning that Western countries that have imposed sanctions on the country will not succeed in their machinations to derail the nation….

https://english.news.cn/20220711/5ed659ab8a7e40c5a2baa116589bcede/c.html

July 11, 2022

Two-decade-old U.S. sanctions leave Zimbabweans suffering, triggering protests

* The U.S. sanctions against Zimbabwe have been piled on since 2001, following a government decision to repossess land from minority white farmers for redistribution to landless indigenous Zimbabweans.

* The sanction-induced economic mire has inflicted a myriad of real challenges on Zimbabweans, especially amid an unprecedented global pandemic.

* Given the distressing effect of the sanctions on the viability of businesses in Zimbabwe, there have been outcries against the economic punishment in and outside the country.

By Tichaona Chifamba, Zhang Yuliang and Cao Kai

HARARE — Opposite the U.S. embassy northwest of the Zimbabwean capital of Harare sits an anti-sanctions camp marking 1,200 days of protest….

Professor Chinn,

Apology for asking a question that I may have asked a year or so ago. I need to make a note on my worksheet clearer for the future.

Is column (C) on the DWK worksheet the correct column for the DWK data on your chart?

I see a DWK entry on 5/29/2022 of 2.24% for line 10,337, column (C). The entry on your chart seems to be eyeball close to 2.24%.

What confused me is that when I go back to 4/28/2021, my data show 1.77% in column (C). The DWK update worksheet on July 29, 2022, shows a value of 1.94% for 4/28/2021, line 10,010, column (C)

Dow DWK periodically update the entire data series? I scanned the DWK information on the linked FEDS Notes page but did not see a comment about historical revisions.

oops,

DKW not DWK

Oversight while looking at all the numbers.

WTF is Apple up to with this? Foxconn may have its corporate headquarters in Taiwan but everyone knows most of the assembly is done in the PRC. Now most of the value is components imported from places like Japan, South Korea etc.

https://www.theguardian.com/technology/2022/aug/07/apple-asks-suppliers-in-taiwan-to-label-products-as-made-in-china-report

Apple has reportedly asked Taiwan-based suppliers to label their products as being produced in China, in an effort to avoid disruption from strict Chinese customs inspections resulting from the visit of the US House speaker, Nancy Pelosi, to Taipei.

According to Nikkei, the company has asked manufacturers on the island to label components bound for mainland China as made in “Chinese Taipei” or “Taiwan, China”. The labels are required in order to comply with a longstanding but previously unenforced rule that requires imported goods to suggest the island is part of the People’s Republic of China.

The phrase “Made in Taiwan” can lead to delays, fines, and even the rejection of an entire shipment under the rule. But Taiwan itself requires exports to be labelled with the point of origin: either the name “Taiwan” or the country’s official name, “Republic of China”.

The choice to require suppliers to deny Taiwan’s independent existence has led to criticism from around the world. GreatFire, which works against Chinese censorship online, noted that the move was an escalation from a previous slight by Apple, which removed the Taiwan flag from emoji keyboards for users in China and Hong Kong. “Is it a question of time before Apple starts removing apps whose name contains the characters [for] Taiwan without specifying ‘province of China’,” the organisation asked.

“Unfortunately, we suspect that Apple’s ‘red-line’, the moment where it will say: ‘Stop, no longer, we cannot continue to collaborate with the Chinese regime and enforce its requests for censorship,’ is nowhere close,” GreatFire’s Benjamin Ismail told the Register news site.

Apple may have felt as if it had little choice but to comply with China’s requests. Shipment delays now would be ruinous, as the company moves into the final production phase for the iPhone 14, expected to be announced at a press event next month. Supply chain shortages have already started to bite, with the company taking the unprecedented decision, according to influential analyst Ming-Chi Kuo, of shipping the cheaper non-Pro variants of the phone with the same core chip that is already in the iPhones 13 currently on sale.

Off topic –

Let’s ignore the “recession is whatever I say it is” crowd. They have a political agenda and the economy is interesting apart from implications for politics.

A few days ago, the JOLTS report for June was released. I know I should only be interested in July data now that Friday’s jobs report was such a surprise, but I’m slow.

Often, levels of quits, separations and hires are passed over in favor of openings. I have long thought that is a mistake, because openings diverged from net hiring some time ago, suggesting a change in behavior by firms. The other series didn’t change so much, so I think they are more reliable.

We know from the rapid rate of net job gain that new hires have out-stripped separations by a wide margin lately. What we learn from the individual series is that both separations and hires are elevated; turn-over in the labor market is high. That’s generally seen as healthy, a sign of dynamism. Workers move to jobs in which they can produce more, increasing labor productivity in the longer term. Here’s the picture:

https://fred.stlouisfed.org/graph/?g=SzmS

Note that quits also remain elevated, contrary to claims by some pundits that the “great resignation” is over. In fact, quits account for over 70% of job separations, discharges only about 21% – historically extreme for both. Quits are generally seen as a sign of confidence among workers in their ability to find new jobs. These data are for June, but the strong performance of payroll hiring in July suggests continued strength in gross hiring and quits:

https://fred.stlouisfed.org/graph/?g=Szny

If there is wisdom among crowds, these data are a good sign for the labor market, at least in the near term.

While JOLTS-like data must have existed for periods prior to 2000, I don’t have access so I can’t draw pictures of how these series behave over a bunch of business cycles. The little data we do have suggest a lag in quits relative to expansions and contractions in the economy, which is probably what most people would have expected.

Republican Senators complain that if the rich pay another dime in taxes it is INFLATION.

And then declare higher government spending means RECESSION.

Keynes is rolling in his grave.

Off topic –

Europe’s fuel shortage and rate hikes, along with bad data, have been the focus of economic concern. The heat wave has been the focus of environmental concern. Turns out, the heat wave is part of a larger problem which includes widespread drought. Some French nuclear plants may have to shut down or cut back due to low water conditions. Spain’s reservoirs are at 40% of capacity. One hundred French towns in 66 departmentes have run out or water. Wine forecasts are heartbreakingly bad. (Moses, I am so sorry.)

Haven’t seen any efforts to sum up the economic impact. Please post them if you find them.

I get mostly cheap domestic stuff. Beringers when I can find the flavor I want. “Barefoot” Rubbish. And lately I switched over from Corona Mango to the tall cans of Smirnoff “Smash” coolers. They are the big cans for $2.58. I’m not feeling inflation pain in the wine dept. Was kinda feeling it in the steak dept about 2 months back?? But even that seems to be getting back to normal now when I can get a good sized steak for $6-$8. I always get “New York” “Rib Eye” or Chuck eye, I stick to those 3 pretty religiously, just looking for whichever of the 3 is the deal. My goal is always $4.50 per steak, but that’s been tough to get lately. I also like to get the lamb loin chops. I can get about 5 lamb loin chops for $9–$11. But they cook pretty fast, and I figure without coupons you’re gonna pay $7.75 at most fast food places. So…. maybe $9.50 for the loin chops and another $1 maybe for my veggie, that’s a meal and I didn’t waste any gasoline going out.

Once in a blue moon I will get livers to fry and then have them swimming in the A-1 sauce, ‘cuz they are cheap as hell. But I can only have that maybe once a month ‘cuz they are like eggs they are LOADED with cholesterol/ Ice Cream got my Dad’s heart and I ‘d rather avoid that road if I can. I can get a large pack of fish (enough for 2 people really, or 2 dinners, for $6.10. That’s not horrible. That’s $3.05 for your protein and then $1 for your veggie, it’s a $4 meal and no gasoline wasted. And chicken I can even do better depending on brand and quality. I can get a boatload of chicken cheap, just repack it in the freezer.

Is this 2011-13 all over again????

@ Macroduck

This is probably not really what you were hunting for, it’s more of a look towards the past, and it’s pretty thick/tedious reading. But I thought as a fall back in the absence of anything else I could find it might be faintly helpful:

https://eartharxiv.org/repository/object/242/download/475/

Honestly I didn’t do an “exhaustive” search but, I was kinda surprised more stuff didn’t pop up on this, at least from the ECB, er something.

Murky buckets! It isn’t what I had in mind, but it’s really interesting. This is the thinking we I’ll have to be doing for the rest of other lives.

“Our lives”. Auto-correct is killin’ me.

I told you to turn it off dude. on a Mac it’s easy, just do a web search with the obvious key words. So much frustration/aggravation gone in about 5-6 clicks. You notice I make less typing mistakes than about 6 months ago?? I am just as lazy and sloppy as ever. Reason for progression on typos?? Two moves: turn OFF auto-correct, get a cheap Logitech Keyboard. Mission accomplished. Logitech makes good equipment and you don’t have to give up your left arm to buy one. Look over at Target man, and I don’t even like Target.

I’m assuming the Senate bill just passed will help. Younger people have a much better attitude on this climate stuff (although we saw what happened to much of the hippie generation–many of them turned into Gordon Gecko). But there’s still a few subatomic particles of hope here.

I notice that if one lags the DKW data by 60 months and compares actual CPI five-year compound growth, the DKW forecasts look reasonably close to actual, with allowances made for the unexpected recent surge in inflation.

A scatter graph also seems reasonably useful.

AS: Interesting. I did something like this a year ago, in this post.

Professor Chinn,

Thanks.

Check out how Donald Trump’s advances to a hot woman athlete got shot down:

https://www.msn.com/en-us/news/politics/watch-swimmer-riley-gaines-dodges-trump-as-he-tries-to-kiss-her-on-stage/ar-AA10nQw4

CPAC invited Riley Gaines to speech as this world class swimmer does not want transgender athletes to compete. OK – I may think this is bigoted but hey I am not a swimmer. But wait – Trump is still married – rights? Yes this woman is athletic, talented, and bigoted. But no Donald – she does not want to go to bed with you. Maybe it is because you are very FAT. Not her type.

While I get the fact that MAGA hat wearing morons want to blame Biden for high oil prices, the truth is that the increase in oil prices over the last couple of years was from a strong Chinese economy combined with a US economy coming back from the Trump COVID disaster. Now this is a preface to this interesting discussion of falling oil prices. It seems Chinese imports of oil are down because of their COVID restrictions and the cooling of US aggregate demand growth:

https://www.msn.com/en-us/money/markets/oil-sinks-as-weak-chinese-imports-fuel-demand-concerns/ar-AA10pPqe?ocid=msedgdhp&pc=U531&cvid=0d02942c605448bca59521e1930d16a7

Good news for people buying gasoline but I pity the neighbors of CoRev the mad dog and Brucie who is crying foul for days.

Another scientific study that notes the damage from climate change:

https://www.msn.com/en-us/health/medical/climate-change-is-supercharging-most-infectious-diseases-new-study-finds/ar-AA10rB6z?ocid=msedgdhp&pc=U531&cvid=c2ccb8bac348438da40b0aaabe2dc312

More than half of all human infectious diseases in recorded history — Lyme, West Nile, hantavirus, typhoid, HIV and influenza, to name a few — have been exacerbated by the mounting impacts of greenhouse gas-driven climate change. That is the sobering conclusion of a new, first-of-its-kind paper that combed through more than 70,000 scientific studies to pinpoint how an array of climate hazards have impacted 375 pathogenic diseases known to have impacted humans. A team of 11 researchers at the University of Hawaii at Manoa conducted the analysis, which was published Monday in the peer-reviewed scientific journal Nature Climate Change. “I have to tell you that as this database started to grow, I started to get scared, man,” Camilo Mora, a climate scientist at UH Manoa and the paper’s lead author, told HuffPost. “We just started realizing that this one single thing that we do — the emission of greenhouse gasses — can influence 58% of all of the diseases that have impacted humanity. You realize the magnitude of the vulnerability that we are under. I went from excited to terrified.” Scientists have long known and warned that climate breakdown is supercharging infectious diseases, making them more frequent and dangerous. But the new paper quantifies the extent of that growing threat, concluding that a stunning 58% of all documented infectious diseases — 218 of the total 375 — have been aggravated in some way by one or more climate hazards associated with greenhouse gas emissions, including warming temperatures, drought, wildfires, sea-level rise and extreme precipitation.

Mora stressed that that estimate, as alarming as it is, is conservative. The findings exclusively draw on cases with evidence linking climate hazards to infectious disease, he said.

Now I realize that when the mad dog CoRev stops chasing his own tail, he will dismiss this as WEATHER as only a clueless scientist would argue there is something called climate change.

I used to drink Carlsberg when I lived in Dublin Ireland. Not a bad beer for the European market. Some goods for those who enjoy a good beer. While the cost of ingredients to make beer have risen the price of beer has not appreciably increased. But Carlsberg is enjoying rising profits as Europeans are buying more of their beer. Cheers!

https://www.msn.com/en-us/money/companies/carlsberg-raises-outlook-as-europe-beer-sales-outweigh-costs/ar-AA10riqD?ocid=msedgdhp&pc=U531&cvid=957ce1664f404f0d96fecf8d47b34df0

Expectations:

(Reuters) – U.S. consumers’ expectations for where inflation will be in a year and three years dropped sharply in July, a New York Federal Reserve survey showed on Monday, indicating U.S. central bankers are winning the fight to keep the outlook for price growth well-anchored as they battle to tame high inflation.

Median expectations for where inflation will be in one year tumbled 0.6 percentage point to 6.2% and the three-year outlook fell 0.4 percentage point to 3.2%, the lowest levels since February of this year and April of last year, respectively.

For the one-year outlook, the fall in expectations was driven by big drops in year-ahead price growth changes for gasoline and food, with the decline in anticipated gasoline price growth being the second largest in the survey’s nine-year history and the decline in food price growth the largest ever.

Doublespeak obfuscation. Just say that the rate of inflation is slowing but still much higher than many people find reasonable or comfortable; don’t try to make bad news into good news. Good news would be, “The CPI has returned to the target of 2.0%..

Bruce Hall: There is a difference between actual and expected inflation.

Also, CPI stands for “Consumer Price Index“, so it’s a level. It can’t return to 2%. CPI inflation on the other hand could…

I sometimes think Bruce Hall is one of those 19th century gold bugs who will not be happy until the price of a Coca Cola is a nickel again.

Skip the gold bug part and me and Bruce would finally be compatriots. Cheapskates never die. They just…… fade away……

I have followed the testimony in that massive Coca Cola transfer pricing litigation where the IRS finally big time as Coke’s experts were all overpaid arrogant dorks and the judge saw through their BS.

But here is the fun part. Imagine you paid the grocery store $1.20 for a bottle of Coke. They paid the bottler a wholesale price near $1. The cost and profit for the bottling is about $0.80 so the mighty Coca Cola got $0.20 for the concentrate (basically syrup) that costs 4 cent to produce but 7 cents to sell and market. Yes, they are making 9 cents profits off the syrup they sold for 20 cents.

Now if you can home produce the carbonated water and the concentrate, you might just get a really cheap Coke after all.

I stand humbly corrected for using change in CPI as a colloquial expression of inflation.

Bruce Hall: You wrote specifically, quoting verbatim: “Good news would be, ‘The CPI has returned to the target of 2.0%.'” That statement is patently wrong.

Doublespeak obfuscation.?

Our host has already noted you have no clue what the terms you criticize even mean. Come on Brucie – we have been through this many times. Go down to your community college and take a basic Principles of Economics class before you embarrass your poor mom again.

I found the Reuters. Alas I also read the overheated comments from a bunch of MAGA hat wearing morons. Yea Brucie is rather dumb but damn there are a lot of other insane Trump supporters with a lot of angry and zero intelligence. Bruce’s kind of people!

It is a standard practice for Bruce Hall NOT to provide a link to stories that he quotes in a cherry picking way. I wonder what else Reuters told us that would undermine the usual lies from Brucie boy.

Now I have noted a couple of times that BEA reports that nominal gross domestic income rose by 11.9% from 2021QI to 2022Q2. So even if the price of goods rose by almost 9%, real income is up almost 3% during the same period.

Of course Bruce Hall wants people to believe people have less real income. The facts note otherwise but Bruce Hall have never cared one bit about facts. He is into ALTERNATIVE FACTS.

Hmmm. so if I leave out a link that is “cherry picking”? If you actually read the comments, you might notice the last one credited Reuters. Oh, that’s too much to expect of you.

You also failed to provide a link to the NY FED survey. Our host did and what it said were things Kelly Anne would not let our little girly man write.

“Good news would be, “The CPI has returned to the target of 2.0%..”

that is not the target the fed has been looking at over the past few years. they wanted it higher. people are forgetting that. once the transient component passes, my guess is inflation will probably be close to what the fed was originally targeting. probably between 4% and 6%.

baffling,

okay, once again I used the change in CPI incorrectly (according to Menzie). The Fed targeted an inflation rate of 2%. No one else uses CPI as a measure of inflation, so please excuse my ignorance.

https://www.stlouisfed.org/open-vault/2019/january/fed-inflation-target-2-percent

But since the Fed is not using the CPI as a measure of inflation, could you please explain which index they are using? I would appreciate being enlightened.

The inflation rate can be estimated using a price index, which gives a sense of how overall prices in the economy are evolving. A common calculation is the percentage change from a year ago.

Bruce Hall: You wrote specifically, quoting verbatim: “Good news would be, ‘The CPI has returned to the target of 2.0%.'” That statement is patently wrong.

Do I need to write a new post on the issue, or is this second admonition sufficient?

“But since the Fed is not using the CPI as a measure of inflation, could you please explain which index they are using?”

How DUMB can you get? People do use the RATE OF CHANGE of the CPI as a measure of inflation. Only a KNOW NOTHING like you would use the level of a price index to measure the rate of change. Bruce – this is preK level stuff and you still cannot get it right?

bruce, you need to keep up. the fed changed from a target inflation rate of 2% to an average over time of 2%. Since we had lower inflation when that occurred, it meant the fed was looking for higher inflation to offset the past lower inflation, and achieve an average of 2% over time. an article from 2019 is now out of date, especially in the years since the pandemic began.

Lawrence Summers a few years ago said this target should be 5%.

I am grateful that Dean Baker emails me such things. Here he notes while the semiconductor bill had some good features, it did redistribute income upwards. Dean suggests we could have had the benefits without the reverse Robin Hood (Dooh Nibor as Krugman calls it) redistribution of income:

https://cepr.net/the-semiconductor-bill-and-the-moderna-billionaires/?emci=68bea3a7-3a17-ed11-bd6e-281878b83d8a&emdi=43975a2c-3b17-ed11-bd6e-281878b83d8a&ceid=4616197

Bruce Hall and JohnH have something in common. Both think they are semiconductor experts even though the two of them together could not even teil us what a semiconductor even is. The notion that TSMC is the only giant in this sector is rather insulting to Intel and Samsung. If you disagree – please check out why TSMC chickened out in the collaborative efforts to develop 450 mm wafers:

https://www.msn.com/en-us/news/technology/how-tsmc-killed-450mm-wafers-for-fear-of-intel-samsung/ar-AA10r9mL?ocid=msedgdhp&pc=U531&cvid=76cfe26ea04c4a6c8e30229e2fbc3303

A former TSMC executive has described how a collaborative effort towards 450mm (18-inch) wafers for manufacturing chips was halted when the company realized it would put them in direct competition with Intel and Samsung.…

pgl–in his ignorance–is rather amusing.: “The notion that TSMC is the only giant in this sector is rather insulting to Intel and Samsung.”

pgl passionately defended some loser at a think tank who thought it would be a wise strategy to take TSMC out if China got too uppity, asserting that it would deprive China of leading edge computer chips. Of course, the US depends heavily on those chips, too. So destroying TMSC would be tantamount to the US shooting itself in the foot, something over which it seems to be developing a perverse mastery.

To get a picture of TSMC’s importance strategically–which totally escapes pgl’s feeble brain–here is a good summary: “TSMC is far and away the world’s dominant producer of semiconductors.

Now, in the midst of a global chip shortage, TSMC is arguably the world’s most important company…

Businesses may want to diversify suppliers, but the amount of knowledge and capital necessary to compete with the dominant chipmakers is staggering. The Chinese government has poured hundreds of billions into its domestic foundries to little avail, and integrated-device manufacturers in the U.S. have seen their market share steadily erode over the past three decades. Meanwhile, Beijing and Washington have sparred over the fate of Taiwan, which China claims as its territory.”

https://www.nationalreview.com/2021/04/tsmc-the-worlds-most-important-company/

Simply put, the fate of TSMC is a BIG DEAL, though pgl mocks that idea. But In fact, TSMC is such a heavyweight that Pelosi devoted a good chunk of her short visit to Taiwan meeting with TSMC management. The US has lured TSMC into building a fab in Chandler AZ. And China has been busy using higher wages to lure technical staff away from TSMC. Both countries are following reasonable strategies to gain advantage over a strategic product.

What is sheer idiocy is the idea of destroying TSMC to “get” China, something that pgl vigorously defended.

“pgl passionately defended some loser at a think tank who thought it would be a wise strategy to take TSMC out if China got too uppity, asserting that it would deprive China of leading edge computer chips.”

Chad Bown works for a loser thnk tank? Of course you just LIED about what he wrote. OK – you did not understand anything he wrote, which makes my point.

“What is sheer idiocy is the idea of destroying TSMC to “get” China, something that pgl vigorously defended.”

Another blatant lie but hey – that is all you got!

Wow – JohnH is now citing a right wing rag for his warped views on economic policy. Hey Johnny boy – call your lawyer as the FBI raided Maro Lago.

Your guru gets one thing right that you still have not grasped:

Founded in 1987 by Chinese native Morris Chang, Taiwan Semiconductor Manufacturing Company (TSMC) was the first “pure play” foundry, a manufacturer of integrated circuits designed by other companies. Previously, chip designers manufactured their products in house, but the founding of TSMC reshaped the semiconductor industry, splitting the market between “fabless” design firms without in-house manufacturing capabilities, pure-play foundries that only manufacture, and integrated-device manufacturers that do both.

Foundry is industry speak for the contract manufacturer. Fabless design firms is code for the firm that does the design of the product. Odd that some National Review nitwit called a contract manufacturer the world’s most important company. Huh if designing something is not that important, then why does the National Review defend the patent system. After all the contract manufacturing of COVID-19 vaccines is so much more important than the R&D done by Moderna.

Of course this kind of inconsistency is standard faire for a rag like the National Review.

“the amount of knowledge and capital necessary to compete with the dominant chipmakers is staggering.”

The knowledge part comes from fabless design companies. TSMC does not do this. Now if one is trying to say we cannot invest in tangible assets in a large scale one has never looked at the fact that investment demand has been low relative to national savings for almost a generation. I guess JohnH does not get the macroeconomic discussions for the last 20 years.

“The US has lured TSMC into building a fab in Chandler AZ. And China has been busy using higher wages to lure technical staff away from TSMC.”

Besides having a lot of fixed assets, the only real advantage TSMC is process IP. Who says so? TMSC’s Annual Report which obviously JohnH has never read. I noted the technical staff is free to move to South Korea to help out Samsung or to the US to help out Intel. But I guess went over JohnH’s head as he thinks they are moving to the PRC.

BTW I looked up the credentials of this National Review nitwit and he reminds me a lot of Donald Luskin. But at least he knows that the Biden bill will mean $50 billion in new semiconductor fixed assts. Now if JohnH could read a balance sheet – he might have noted TMSC’s fixed assets are $70 million. In other words, we will catch up with Taiwan in a few years.

Oh wait – we “lured” TMSC into building a plant in Arizona. Lured? Wow – you just got kicked out of your Make American Great Again group of right wing for sneering at the idea that American workers could make semiconductors!

companies such as TSMC are replaceable. but not in a short amount of time. it will take time to rebuild the physical infrastructure of a modern foundary. that is why the semiconductor bill is very important. nevertheless, the IP value of our chip designers is irreplaceable. if the usa does it right, they can refocus on domestic chipbuilding faster than china can, because of the chip design knowledge owned by us chip designers. while china has been trying to overcome that issue, they are still a bit behind compared to the usa. but the gap is closing. the semiconductor bill will help maintain the gap if done right.

Well said. Of course JohnH does not get “foundry” means contract manufacturer. Nor does he get the role of R&D done by companies like Samsung or Intel. Product intangibles? Hello?

One way to judge how important a company is would be to look at his Market Value which is just under $0.45 trillion for TMSC. Not bad but wait Apple’s is $2.65 trillion. Of course, looking up basic financial data is beyond the capabilities of your National Review nut case it seems. It certainly is not something JohnH would know how to do.

https://www.msn.com/en-us/news/politics/paul-manafort-concedes-he-gave-trump-campaign-polling-data-to-the-russians/ar-AA10rn9j?ocid=msedgdhp&pc=U531&cvid=46a58143f1af4674ad0ffb2f864817a3

Paul Manafort, who served as chairman of the Trump campaign in 2016, gave polling data to a Russian businessman believed to have ties to the Kremlin, he conceded in an interview. Manafort admitted to handing over campaign polling data to Konstantin Kilimnik, according to an interview with Business Insider. Kilimnik is believed to have later relayed “sensitive information on polling and campaign strategy” related to the Trump campaign over to Russian spies, the Treasury Department said.

And why did the Russian spies need this information – to help get Trump become their pet poodle President of course.

Republicans are alarmed that the IRS will have a larger budget to audit the taxes ordinary people. Except as Kevin Drum notes, the audits will only be directed at people who make more than $400 thousand a year. Yes – the ordinary Republican donor that the Republicans have made sure the IRS does not audit since the Newt Gingrich days:

https://jabberwocking.com/the-new-enforcement-budget-for-the-irs-is-aimed-solely-at-the-rich/

After spending the better portion of his life playing together with and coaching Black athletes on a football field. One of Oklahoma University’s football coaches, Cale Gundy (“coincidentally” the brother of the Oklahoma State head football coach who roughly 15 Colorado U players said used the N word in his quarterback playing days) used the N word during an “X’s and O’s” session in pre-season. Does anyone here care to ask me as a person who has spent most of his life in the Sooner state how “shocking” this is to me, and that it would have been the brother of Mike Gundy that did it?? The Gundy family matriarch must be “so proud” of her two sons, both busted post 1980 for saying the N word. I bet being a fly on the wall on MLK holiday would have been interesting at the Gundy’s house when those two were growing up.

https://www.espn.com/college-football/story/_/id/34367434/long-oklahoma-sooners-football-assistant-cale-gundy-resigns-reading-aloud-shameful-word-player-ipad

C-L-A-S-S-Y /sarc. No need to worry about the guidance of the young men on the OU football team though. They’ve got another offensive coach who was accused of trying to hide rapes his players had committed while he was coaching at Baylor University. These coaches are trying their best to “guide these young men” and protect “the student athlete”. So long as they don’t have to share the ticket gate revenues with the athletes, they will “provide leadership” to “these student athletes”.

[ initiate American anthem ]

You’ll recall Mike Gundy’s incident with OAN, in which he almost got a pink slip, until Mike Gundy and the Oklahoma State athletic dept, blew smoke up Chuba Hubbard’s skirt, convincing Hubbard how much Mike Gundy “cared for” Chuba, and was “sorry” for repping a media outlet”s T-shirt that said BLM was just a bunch of nonsense.

https://www.si.com/college/2020/06/16/mike-gundy-apology-oan-t-shirt

My brother in law was a large white dude who played football for the University of Mississippi. He was rather conservative but he never understood racism either. His comment is that it is sort of hard to play a brutal team game if you cannot trust your teammates. But there are some in the game of football that still manage to be racist. How the hell they motivate the people on the field (assuming they do) is beyond me. But don’t ask me – I ended up being a distance runner as I sucked at football.

What is more puzzling to me, is how cats like Mike Gundy can still manage to recruit 5-star Black athletes, when it’s pretty crystal clear the man harbors racist thoughts over many years. Using the N word multiple times as a player, in front of his own teammates, (did multiple Colorado Buffaloes players lie??). Making the effort to post his OAN T-shirt on social media the same exact time OAN were continually baiting BLM protesters. And yet these Black athletes will go on TV saying how “excited” they are to play for the bastard. When I look at these high quality Black athletes signing on to play for Mike Gundy, I’m reminded of the domestically abused wife with 5 purple bruises on her face and a broken arm on TV saying “I decided to stay with him, after he beat the cr*p out of me 50 times, he said he loved me after each beating”.