Weekly and daily readings through 8/13:

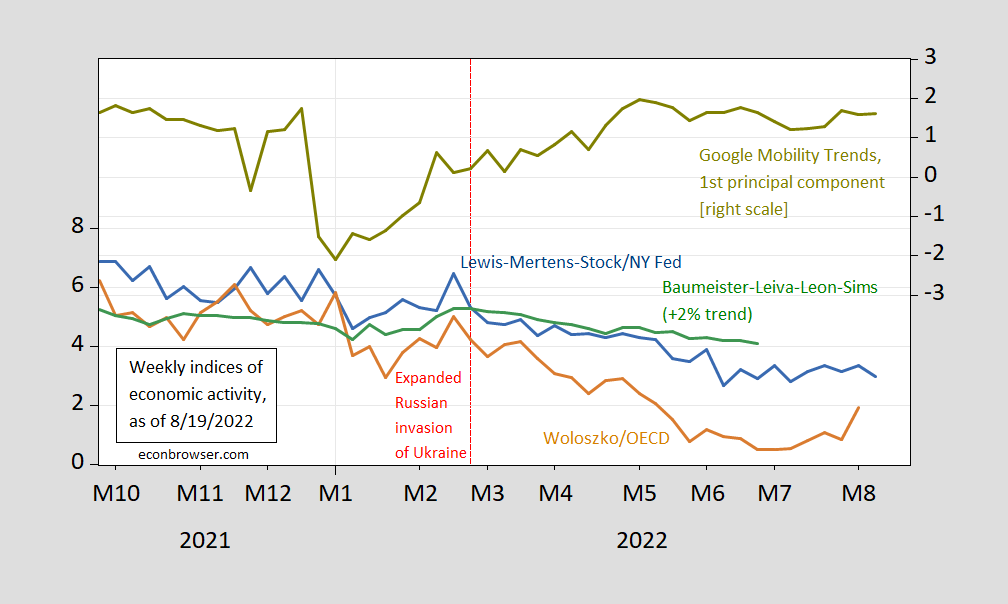

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue, left scale), OECD Weekly Tracker (tan, leftt scale), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green, left scale), first principal component of Google Mobility Trends (chartreuse, right scale). Source: NY Fed via FRED, OECD, WECI, Google and author’s calculations.

Needless to say, most of these indicators suggest continued growth through mid August (with the OECD WeeklyTracker indicating a bigger slowdown in May-July). The first principal component of google mobility trends indicates a plateau from May onward. The individual google mobility trends indices are shown in Figure 2.

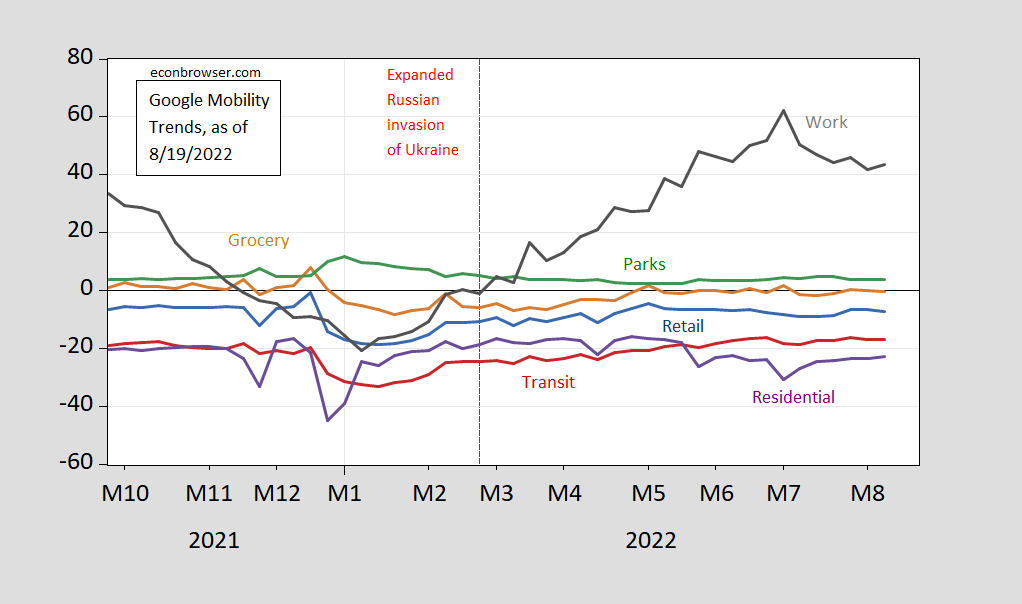

Figure 2: Google Mobility Trend Indexes for retail and recreation (blue) grocery and pharmacy (tan), residential (purple), transit stations (red), parks (green), and workplaces (dark gray), all in % deviations from baseline. Source: Google.

‘Applications for US unemployment insurance fell for the first time in three weeks, suggesting demand for labor remains healthy. Initial unemployment claims decreased by 2,000 to 250,000 in the week ended Aug. 13, Labor Department data showed Thursday.’

The last time the series fell (3rd week of July) Princeton Steve kept telling us over and over it rose. Yea he lied. And why do you think he will acknowledge this inconvenient data point?

This story caught my eye for several reasons:

https://www.msn.com/en-us/news/politics/ex-trump-official-donald-is-desperate-to-know-who-is-ratting-him-out-and-fears-what-they-might-say-next/ar-AA10R2XD?ocid=msedgdhp&pc=U531&cvid=9b11419ab52a4592ae214d66601dd128

On Friday’s edition of MSNBC’s “Deadline: White House,” former Homeland Security official Miles Taylor broke down how former President Donald Trump is desperate to figure out who tipped the FBI off about the classified documents at Mar-a-Lago. This comes as lawyers representing the former president, including Christina Bobb, make the rounds on right-wing media to defend against the investigation. “They’re now — their public position is — [Bobb’s] position last night was, you got to go check with the maintenance people, basically. Somebody’s got to call a janitor to find out exactly how secure this room was,” said anchor John Heilemann. “If that’s really their public posture, is that not damaging for them, politically if not legally?” “I would tell you right now, it looks to me like Donald Trump is going into the major leagues with some minor league lawyers,” said Taylor. “That lawyer that you just featured was planted by the White House to work under me while I worked at the Department of Homeland Security, and I will say, we did not trust that individual in some cases with a photocopier, let alone handling a federal case like this … I don’t feel convinced by the arguments Christina Bobb made on television. This is the type of thing that would get people thrown in jail if they were anyone but the president of the United States. This makes Hillary Clinton’s emails look like a child’s petting zoo. I mean, this is massively significant, that they were storing information, allegedly of this high classification, down in a basement.”

First of all the Mole of Maro Lago is driving Trump nuts. Secondly Trump does hire a lot of bimbos are attorneys. Christina Bobb may be incompetent but she is also corrupt which suits the mob boss just fine.

Poor Alan Dershowitz:

https://www.msn.com/en-us/news/politics/alan-dershowitz-says-every-reputable-attorney-he-s-spoken-with-has-told-him-their-firms-won-t-let-them-go-anywhere-near-trump/ar-AA10QZ2G?ocid=msedgdhp&pc=U531&cvid=a46094628df948d09969e0fe3db314fc#image=AA10Qgxa|4

Alan Dershowitz, the lawyer who defended former President Donald Trump in his second impeachment trial, told Insider that most reputable law firms aren’t letting their attorneys go anywhere near Trump as his legal issues snowball. “All big firm lawyers have told me that their firms won’t let them do it,” Dershowitz said in an interview. “The firms won’t let them go near any case involving Trump. These are firms that want to continue to have clients, and they know that if they represent Donald Trump, they’ll lose a lot of clients.” Dershowitz spoke from experience. After he represented Trump in his second Senate impeachment trial following the deadly January 6 Capitol riot, Dershowitz said he lost job opportunities and many of his speaking engagements.

Gee – who knew lying for a traitor and the mob boss might be a career limiting move even if one teaches at HARVARD!

34. Fill in the blank. Which best fits the sentence?

“The _____ won’t go anywhere near Trump.”

a) law firms

b) banks

c) insurance companies

d) educated voters

e) high-end Florida homebuyers

f) …

w) all of the above

https://news.cgtn.com/news/2022-08-20/China-s-installed-renewable-energy-capacity-up-in-July-1cEkKkw3DDa/index.html

August 20, 2022

China’s installed renewable-energy capacity up in July

China’s installed capacity of renewable energy registered year-on-year growth in July, according to the National Energy Administration, which released energy figures for the January-July period on Friday.

As of the end of July, wind power capacity stood at around 340 million kilowatts, a 17.2 percent year-on-year increase, the administration said, while solar farms saw capacity hit 340 million kilowatts, an increase of 26.7 percent.

At the end of July, the country’s total installed power generation capacity stood at about 2.46 billion kilowatts, rising 8 percent from the previous year, the data shows.

The positive figures on renewable-energy capacity reflect the country’s efforts to reach its carbon peaking and carbon neutrality goals. China has announced that it aims to peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060….

https://www.nytimes.com/2022/08/18/opinion/joe-biden-achievements-president.html

August 18, 2022

What Biden Has — and Hasn’t — Done

By Paul Krugman

There’s something strange in the D.C. air these days. It smells a bit like … competence.

Seriously, it has been amazing to watch the media narrative on the Biden administration change. Just a few weeks ago President Biden was portrayed as hapless, on the edge of presiding over a failed presidency. Then came the Inflation Reduction Act, a big employment report and some good news on inflation, and suddenly we’re hearing a lot about his accomplishments.

But I still don’t think the media narrative gets it quite right. Biden has indeed accomplished a lot — in some ways more than he’s getting credit for, even now. On the other hand, America is a huge nation with a huge economy, and his policies don’t look as impressive when you compare them with the scale of the nation’s problems.

Furthermore, at this point Biden is arguably benefiting from the soft bigotry of low expectations. His policy achievements are big by modern standards, but they wouldn’t have seemed astounding in an earlier era — the era before the radicalization of the Republican Party made it almost impossible to pursue real solutions to real problems.

So, what has Biden accomplished?

As I see it, he came into office with three main domestic policy goals: investing in America’s fraying infrastructure, taking serious action against climate change and expanding the social safety net, especially for families with children. He got most of two and a bit of the third.

Last year’s infrastructure bill gets remarkably little media attention; only about a quarter of voters even know that it passed. But we should remember that Barack Obama wanted to invest in infrastructure but couldn’t; Donald Trump promised to do it but didn’t (and “It’s infrastructure week!” became a running joke); then Biden got it done.

By contrast, the Inflation Reduction Act, which is mainly a climate law, has received a lot of attention, and deservedly so. America is finally taking action against the biggest existential threat of our times. Energy experts believe that it will have large direct effects in reducing greenhouse gas emissions.

These are significant achievements, and a big contrast with the last administration, whose only major domestic policy change was a tax cut that had almost no visible positive effects.

But when I see news reports describe these laws as “massive” or huge, I wonder whether the writers have done the math….

https://www.nytimes.com/2022/08/19/opinion/housing-inflation-rents-boom.html

August 19, 2022

Wonking Out: Virginia Woolf and Core Inflation

By Paul Krugman

If you or someone you know has been looking for a place to live recently, you’re aware that the housing market has gone wild over the past two and a half years. House prices have soared; so have rents.

These developments are important to people’s lives: Keeping a roof over one’s head is a big part of most families’ budgets. They’re also important to economic policy, which is currently focused on bringing inflation down: The cost of shelter accounts for almost a third of the Consumer Price Index and about 40 percent of core consumer prices, excluding food and energy, which are what the Federal Reserve normally uses to guide policy.

So rising housing prices and especially (as I’ll explain) rising rents matter a lot. Which raises two big questions. First, why has housing gone wild? Second, what are the implications for the fight against inflation?

First, a look at the data. These days we have two different kinds of data on housing: private-sector indexes released by online services like Zillow and Apartment List and official numbers from the Bureau of Labor Statistics. Unusually, at the moment these sources seem to be telling quite different stories. Here are three rent indexes, all measuring changes since the pandemic recession began in February 2020:

https://static01.nyt.com/images/2022/08/19/opinion/krugman190822_1/krugman190822_1-jumbo.png?quality=75&auto=webp

The rent explosion.

The B.L.S. series is owners’ equivalent rent — more on that in a moment. What’s obvious is that the private measures show huge rent increases; the official data, not so much. However, this divergence reflects not so much a conflict over the facts as a difference in what the indexes measure. The private firms are looking at listing prices for new renters; the official measure looks at what renters are currently paying, on average. Since many renters have one-year leases, average rents paid tend to lag new rents, notably when the latter are rising rapidly. Over time, we can expect the official series to catch up.

What explains this surge in rents? One explanation I’ve seen in many articles is that rents are driven by the price of houses, which has been rising for a decade — pretty much ever since the mid-2000s housing bubble finished deflating. Low interest rates and limited new supply from homebuilders burned by the crash led to a sustained upward trend in real housing prices; surely, the argument goes, landlords began demanding higher rents to reflect the prices they paid for their buildings.

But this argument doesn’t hold together either logically or empirically. Landlords charge what the market can bear; whatever they paid for their building is a sunk cost, which shouldn’t directly affect the rental market. And the great housing bubble of the 2000s did not, in fact, drive up rents. Here’s the real price of housing and real rents as estimated by the B.L.S. since 2000:

https://static01.nyt.com/images/2022/08/19/opinion/krugman190822_2/krugman190822_2-jumbo.png?quality=75&auto=webp

High house prices don’t translate into high rents.

The bubble was huge, although today’s prices are even higher in real terms. But soaring home prices in the 2000s weren’t reflected in rents at all….

The Virginia Woolf point is great and nicely made — it’s about wanting more space because of WFH.

But that point is left out here; because of that omission I think it’s tempting to (mis)read this as Krugman arguing that it’s really about market power (and not, say, supply constraints). But rents are sensitive to overall demand for housing, as there’s substitution between buying a house and renting. Also, the marginal price should affect the average, like all other things. If *building new* rental units is expensive in an expanding rental market, rents would rise because demand would be creeping up along a more steeply inclining supply curve. Krugman here is really tackling this one kind-of-dumb claim about sunk costs somehow affecting prices (while also demonstrating why it’s very, very important to pay attention in intro to micro, kids SETH FOR THE LAST TIME PUT AWAY THE GODDAMNED PHONE).

Just my two cents for anyone who might misinterpret Krugman in the way I am suggesting (in case such humans exist SETH). Also, this is not to dismiss places where large corporate landlords actually do appear to have market power.

DISCLAIMER: The names and characters portrayed in this production are fictitious. No identification with actual Econ 101 students is intended or should be inferred, even if a good number of them are indeed named Seth.

“House prices have soared; so have rents.”

Princeton Steve looks at higher housing prices and screams the market is overvaluing housing prices never understanding that higher cash flows (rents) tend to increase the value of any asset. Yea – some of the arrogant people who comment here flunked basic finance.

“The bubble was huge, although today’s prices are even higher in real terms. But soaring home prices in the 2000s weren’t reflected in rents at all….”

We should require Princeton Steve to write this on the chalk board 1000 times before his next incredibly stupid comment about this topic.

Yes, rents have been going up, in sharp contrast to the housing bubble that peaked in 2006. But in fact price-rent ratios have been going up even as rents have risen.

How much they have gone up depends on one’s data source, with Krugman usefully noting there are competing sources for rents out there, as indeed there are also for housing prices. But they all agree price-rent ratios have risen a lot and have indeed gotten plenty high.

So, Trading Economics claims that as of Q1 2022 the price-rent ratio reached an all time high in the US, noticeably above its peak in 2006. However, the Case-Shiller indexes that Calculated Risk uses do not show it having gotten above the 2006 peak. Nevertheless they also show it having risen sharply in the last couple of years and not all that far below the 2006 peak.

It is definitely the case that even as rents have been rising rapidly in many areas, prices have risen more rapidly to have gotten into substantially high territory, especially now that mortgage rates have risen from the extreme lows they were at for so long.

Very interesting points that I did not consider (though I follow Bill McBride, a big price/rent ratio guy!).

The dynamic you are talking about here must be due to older millennials shifting from rent to ownership (mea culpa). Some of the demand will splash back to rents (some people who would have otherwise jumped from rent to owning got turned off by prices), plus we’re in a hot economy (still), so we should still expect rents to rise. Just an off-the-cuff comment on your comment. (Well I guess they all are …)