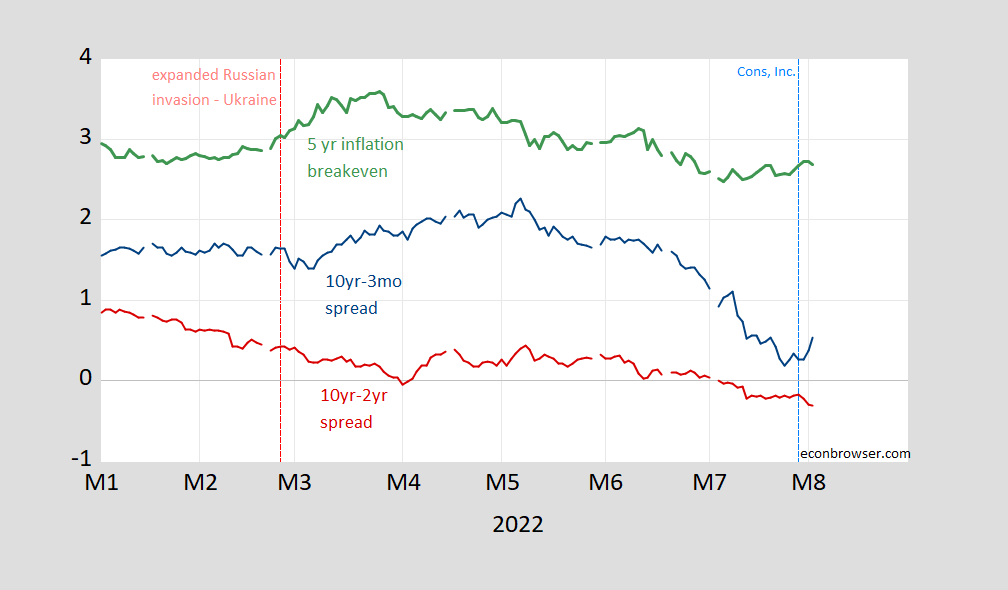

Big daily movement in 10yr, 5yr yields:

Figure 1: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (red), Treasury-TIPS 5 year spread (green). Light blue dashed line at June income and outlays release. Source: Treasury via FRED, and author’s calculations.

The 10yr-3mo spread rose, while medium term inflation expectations eased. Five year real rates are back into the positive region. If risk and liquidity premia were constant, I’d think expectations of economic activity were up; but that would be going a bit far.

somebody on this blog likes to bring up the upcoming election as a warning to democrats. well voters in Kansas just turned out in HUGE numbers to overwhelmingly stop any abortion ban from taking place in the state. and this is a conservative state. makes you wonder just how that midterm election is actually going to turn out. it appears that most Americans are against the republican position on abortion. and disagree with what the Supreme Court just did. interesting times.

Kansas is not as crazy as MAGAland.

biden is doing more to create the future of smart grids:

https://www.energy.gov/articles/biden-harris-administration-announces-26-million-program-bipartisan-infrastructure-law

it is inevitable the world will be a renewable electric grid. people will look at our current fossil fuel plants the way we look at old coal ovens. can you believe people actually burned that crap?!