Reader Bruce Hall writes:

While it is a positive development that the rate of price increases is decreasing, the absolute level is still significant year/year and from the beginning of 2021.

Technically, on a month to month basis, Mr. Hall understates the case, as the level of the CPI actually decreased 0.02%, or 0.2% annualized.

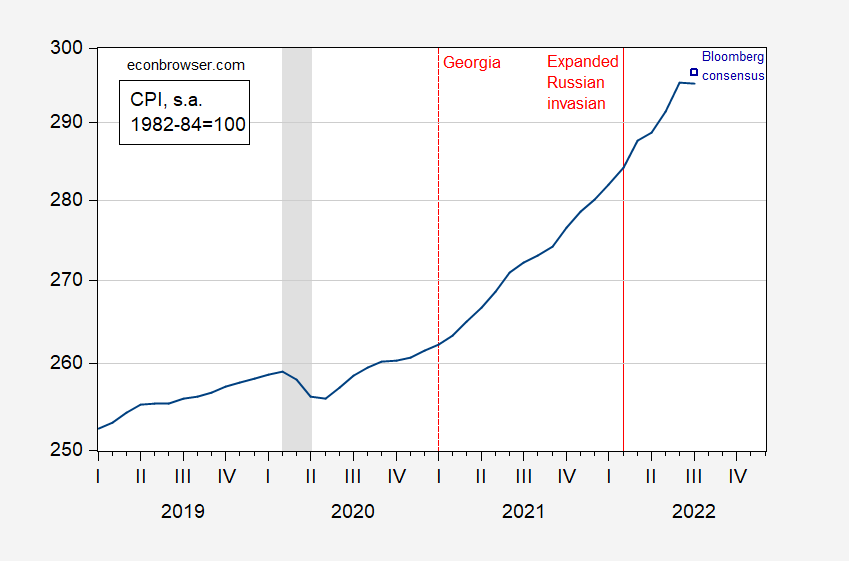

Figure 1: CPI (blue), and Bloomberg consensus (dark blue square), 1982-84=100, on log scale. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, Bloomberg.

(The second part of the statement is clearly wrongly stated; I think he meant the rate of increase is still significant year/year, or alternatively, the absolute level of is significantly higher than the level a year ago, or something like that.)

Update, 5:52pm Pacific:

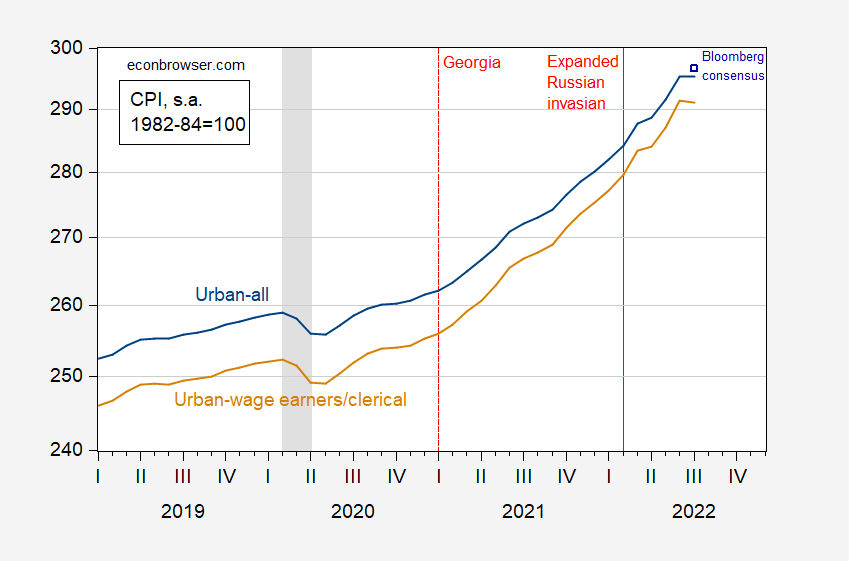

Reader anonymous notes the rapid pace of inflation y/y using CPI-wage earners & clerical workers. It’s also true that m/m, the drop in this index was bigger (1.4% annualized, vs. CPI-all at 0.2%).

Figure 2: CPI all urban (blue), and Bloomberg consensus (dark blue square), and CPI urban wage earners and clerical workers (tan), all 1982-84=100, on log scale. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, Bloomberg.

happy days are here again

those of us >66 are beginning to track cpi-w it is +9.1% for July 2022

We understand. When the data you are tracking doesn’t behave the way you want, you pick other data.

too early to call the end of the beginning

when the stage 4 ca patient is told her tumor has not advanced* in the past month she is still stage 4….

cpi w is 9.1%!

*ignoring observer and instrument errors

OK, “Anonymous,” did you not on an earlier thread declare that we were about to see a massive whopper of an increase in inflation from this CPI report? This was supposed to explain the FBI raid on Mar-a-Lago, to distract the poor masses from the massive forthcoming CPI report? Yes, you said that. Own up to it, you worthless idiot, one of the dumbest commenters on this site, maybe the dumbest. I think even the awful CoRev might be smarter than you are.

“s the level of the CPI actually decreased 0.02%, or 0.2% annualized”

Brucie did not read his first link. Otherwise he would have noticed:

(1) it reported the 12-month change;

(2) the data was not seasonally adjusted.

Of course Bruce very rarely actually READS his own links.

The economy lost 2.9 million jobs under donald trump . The unemployment rate increased by 1.6 percentage points to 6.3%.under donald trump. 14.7% unemployment April 2020.

If only we could live the MAGA dream again, 2% inflation and 14.7% unemployment. I miss it so bad.

《the absolute level of is 》

Wha-a?

Are you admitting you are as clueless as Bruce Hall? Got it!

I just heard one of those rather dumb MSNBC reporters tell us “month to month” there was “no change in inflation”. The screen, however, correctly reported that CPI rose by 0.0% over the last month. Maybe I should start listening to Faux News. Yea – they are stupid too but I do not expect them to get anything right.

I believe we have a resident New Yorker here who discusses transfer pricing from time to time??

https://www.stlouisfed.org/on-the-economy/2022/aug/transfer-pricing-intangible-assets-patent-data

This is a must read paper – thanks. Let me digest what it is telling us and I’ll get back to everyone.

I will read that June 2022 AER papers shortly but let me highlight this:

“Take, for instance, the case of Bermuda, which has a corporate tax rate of zero percent. We found that, for every patent application by a Bermudian inventor of the IP, there are 38 patent applications filed abroad by owners of the IP. Additionally, 96% of these patent applications are filed by multinational corporations.”

The first important corporate inversion occurred 30 years ago when Helen of Troy {HOT} became a Bermuda based corporation. HOT outsources production of its beauty products to third parties and outsources its marketing to Revlon. So all it does is design new products and distribute them. The designers live in the US but their efforts ended up being “owned” be Bermuda.

80% of their sales are in the US with the rest in Europe. The distribution affiliates in both places ended up with a 10% profit margin but end up paying Bermuda royalties equal to 6% of sales thereby netting tax income equal to only 4% of sales. By this accounting magic, 60% of HOT’s income is tax free.

Did the 2017 tax cut for the rich change that at all? Of course not.

Now time to give the IRS a little credit. The article mentions two ways income is shifting to low tax jurisdictions. Companies like Coca Cola do the easy way. Ireland only produces the concentrate which is a low value added activity but they end up with over half of the profits as the royalties are less than half their true value. But wait – Coca Cola lost its transfer pricing battle with the IRS recently.

Companies like Western Digital transfer valuable IP to Ireland for pennies on the dollar. Now they got some big shot to say that was fair market value. His 40 step complicated defense had a fatal fallacy which the IRS figured out so Western Digital had to pay big bucks.

So with a little enforcement, we can make these multinationals pay their fair share. Of course the Republicans do not want the IRS to be properly staffed. Go figure!

Interesting stuff, and as far as I know, completely off many people’s radar.

“I think he meant the rate of increase is still significant year/year, or alternatively, the absolute level of is significantly higher than the level a year ago, or something like that.”

Bruce Hall’s writing is often very tortured. Than again when one writes on topics that one has no clue about – this is what you get.

https://jamanetwork.com/journals/jama-health-forum/fullarticle/2792505

May 12, 2022

The Costs of Long COVID

By David M. Cutler

More than 6 million people have died from COVID-19 worldwide, including nearly 1 million in the US. But mortality is not the only adverse consequence of COVID-19. Many survivors suffer long-term impairment, officially termed postacute sequelae of SARS-CoV-2 infection and commonly called long COVID.

Long COVID—typically defined as symptoms lasting more than 30 days after acute COVID infection—has received some public attention, but it is not nearly as intense as it is for acute COVID-19 infection. Support groups are devoted to the condition, and Congress has allocated more than $1 billion to the National Institutes of Health to study it. But the relatively meager attention that has been paid to long COVID is unfortunate because its health and economic consequences are likely to be every bit as substantial as those due to acute illness.

David M. Cutler is the Otto Eckstein Professor of Applied Economics at Harvard University.

Paul Krugman outlined the same sort of COVID-19 analysis for Florida, but did not complete a paper. David Cutler estimated the long COVID costs for the American economy in excess of $2.5 trillion in May 2022.

I am at the SABE conference at Lake Tahoe where I just saw a session by Gigi Foster, who has a book out, and some others, basically showing that the cost-benefit ratio of Covid lockdowns has been on the order of 60 to 1, right costs 60 times as great as benefits. I asked about China’s lockdown policies. The response from this well-informed and published international panel was over the top outraged. Sorry, ltr, China is damaging the entire world, not just itself, with its overblown lockdown policies.

Mask mandates and social distancing good. Lockdowns, especially for schools? No no no.

The big question; what is counted on cost side and what is counted on benefit side. If you try to focus on the cost of lock downs (rather than cost of Covid) you can have a hard time sorting out what was cost of Covid and what was specific cost added exclusively because of lock downs.

The numbers I remember from Sweden (no lock downs) vs. the other nordic countries (lock downs) was that the economy took exactly the same kind of hit – however a lot of swedes died – but I guess that dead people don’t get added into the economic calculations.

cost-benefit ratio of Covid lockdowns has been on the order of 60 to 1

cost-benefit ratio of Covid lockdowns has been on the order of 60 to 1

cost-benefit ratio of Covid lockdowns has been on the order of 60 to 1

[ceaseless racism]

https://www.worldometers.info/coronavirus/

August 10, 2022

Coronavirus

United States

Cases ( 94,348,507)

Deaths ( 1,060,755)

Deaths per million ( 3,191)

China

Cases ( 232,109)

Deaths ( 5,226)

Deaths per million ( 4)

China is damaging the entire world, not just itself, with its overblown lockdown policies.

[ Prejudiced nonsense. ]

Sorry, —, China is damaging the entire world, not just itself, with its overblown lockdown policies.

[ “Sorry” is meaningless given such a distressing assertion. The assertion is of course absurdly incorrect, and sadly prejudiced. ]

https://news.cgtn.com/news/2022-08-10/Chinese-mainland-records-444-new-confirmed-COVID-19-cases-1cnoJbUdHi0/index.html

August 10, 2022

Chinese mainland records 444 new confirmed COVID-19 cases

The Chinese mainland recorded 444 confirmed COVID-19 cases on Tuesday, with 380 attributed to local transmissions and 64 from overseas, data from the National Health Commission showed on Wednesday.

A total of 650 asymptomatic cases were also recorded on Tuesday, and 5,440 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 232,109, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-08-10/Chinese-mainland-records-444-new-confirmed-COVID-19-cases-1cnoJbUdHi0/img/74e33c1dd106461eb8fdc9e8dd16923b/74e33c1dd106461eb8fdc9e8dd16923b.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-08-10/Chinese-mainland-records-444-new-confirmed-COVID-19-cases-1cnoJbUdHi0/img/286ddbad595e4bd593c7bd0637029ff5/286ddbad595e4bd593c7bd0637029ff5.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-08-10/Chinese-mainland-records-444-new-confirmed-COVID-19-cases-1cnoJbUdHi0/img/d28aa82ddfd6408bae16c8a049942d15/d28aa82ddfd6408bae16c8a049942d15.jpeg

https://www.worldometers.info/coronavirus/

August 9, 2022

Coronavirus

United States

Cases ( 94,128,907)

Deaths ( 1,059,641)

Deaths per million ( 3,188)

China

Cases ( 231,665)

Deaths ( 5,226)

Deaths per million ( 4)

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

August 4, 2022

Cumulative Number of Child COVID-19 Cases

Nearly 14.2 million children are reported to have tested positive for COVID-19 since the onset of the pandemic according to available state reports; over 359,000 of these cases have been added in the past 4 weeks. Approximately 6.3 million reported cases have been added in 2022.

American Academy of Pediatrics

Children’s Hospital Association

off topic

Just thought this article was interesting and thought others here might take an interest:

https://www.vox.com/recode/23289433/newsletters-substack-subscriptions-bari-weiss-semafor-peter-kafka-column

And here I just figured out what “substack” is.

Hahaha, I finally found something you are behind the curve on. Though a pretty good argument can be made substack is non-substantive. It has some good stuff though, similar to “Medium” and I think you know them.

In today’s installment of soap opera and melodrama, Weiss, of “what is a toady??” fame and beneficiary of the substack platform, is claiming top editors at NYT run some editorial opinion columns by Senator Schumer for approval before publishing them. It is even said that one “Anonymous” person at NYT supports Weiss’s claim. Weiss strikes me as an extremely flaky woman (right up there with my former favorite, he typed red-faced, Tulsi Gabbard), so take it for however you will.

For Brucey, “you got to accentuate the negative, eliminate the positive…”

And Anonymous apparently no longer thinks a sizable chunk of the U.S. law enforcement system served a warrant (the first of many?) against a twice-impeached former president to draw attention from the CPI report.

How noble of these guys, embarrassing themselves to protect a chronic liar who wants to bring an end to American democracy.

“you got to accentuate the negative, eliminate the positive…”

He says the same about nonwhite culture.

Freshman calculus time. Inflation is the rate of change of the price level as in its 1st derivative.

When Bruce Hall writes “the rate of price increases is decreasing” he is making an assertion about the 2nd derivative.

Now if prices were still rising, then this might be correct – that is the 1st derivative was positive but the 2nd derivative was negative.

But wait – the price level fell last month. So the first derivative was negative.

Yea I get it. Bruce Hall flunked 1st grade arithmetic so expecting him to grasp calculus at even the most basic level is asking too much.

pg13,

You need a remedial course in both macro and calculus.

Inflation is not the derivative of the price level. The derivative is the instantaneous rate of change, but inflation is not defined as the instantaneous rate of change of the price level. And for good reason. The price level is not a continuous function, so it can’t have a derivative. Didn’t your PhD program have basic math requirements?

“Inflation is not the derivative of the price level. The derivative is the instantaneous rate of change”

WOW! I figured THE RICK was some overrated lawyer but this is the proof. Hey Rick – way to go making an easy issue that Bruce Hall does not get unnecessarily complicated. Is such irrelevant BS what Art Laffer taught you at Pepperdine?

@ pgl

If I gave you my personal word, I would never unveil your name on the blog, even if we got into future arguments (because I am here anonymous, and also respect other people’s anonymity) and that I suspected your first name began with an “H”, what would you tell me??

Moses,

If you tell me your suspicions, I promise I won’t tell.

If your suspicion actually has a PhD, I have to say it’s probably not pg13 though. There’s no way someone with a PhD in economics could think inflation is the derivative of the price level.

@ Rick Stryker

For Rick Stryker’s and all readers’ FYI, I am not going to unveil who pgl is, because it would be extremely hypocritical, and worse than unethical for me to do so, since I am also an anonymous commenter. I am 98% sure I know who he is now. It was mainly a personal curiosity or kind of “mystery” I was wanting to solve~~~ONLY to kill my own curiosity. Now that I have “quenched” that curiosity, as far as I am concerned it’s a dead topic now.

Moses,

That’s pretty good sleuthing. Sure, no names, but can you give me some clues to get me started?

@ Rick Stryker

I doubt anyone else has figured it out who wasn’t directly told, so I’d be lying if I said I wasn’t a teensy-weensy bit proud of myself. Nope, sorry. What if someone had figured out who you are?? You’d be a little angry wouldn’t you?? Especially if the person who exposed you was also pseudonymous/anonymous?? I doubt you would “take in stride”/

I read Bruce’s statement and he was perfectly clear. He did not make any misstatements. In his sentence, “absolute level” obviously refers to “rate of price increases,” not the level of the CPI. As usual, Menzie continues to waste people’s time with these foolish posts. Do readers really want to see him attempting to embarrass commenters he doesn’t like? That’s what they want to read about on an economics blog?

Menzie knows perfectly well that you made an incredibly boneheaded statement but he won’t call you on it. Nor will he put up a special post on your statement. I wonder if Barkley is honest enough to call you on it.

He did not make any misstatements. In his sentence, “absolute level” obviously refers to “rate of price increases,” not the level of the CPI.

Pepperdine is trying to get a hold of you. They have rescinded your Ph.D. Rick – we have all suggested you were as dumb as a rock. Only – the rocks in my garden are telling me that they are a lot smarter than the moron who wrote that comment.

“the instantaneous rate of change” might be something we can calculate if the BLS reported prices each and every second. Now if THE Rick knows how to do this – let him write a paper for the American Economic Review. What? The AER has never published any of his BS. No wonder since this pretend Ph.D. writes some theoretical babbling with zero knowledge of how real world data is compiled.

pg13,

If the BLS calculated prices once per second, the price level would still not be a continuous function and therefore the instantaneous rate of change, the derivative, would still not exist. This is basic calculus.

You are seriously clueless. How can you be so ignorant? You must have never studied calculus. PhD? Published papers? Yeah, right.

Keep digging you hole deeper. You might soon end up in China.

Like we knew you were the most pointless troll ever. Keep reminding us please.

So you have your own precious definition of instantaneous and your own precious definition of continuous? How cute!

You are aware of the regular use of calculus in economics, using periodic data? Seems like that’s what you’re arguing against.

Don’t bother telling me I’m wrong. Tell me how I’m wrong. Should be entertaining.

Macrod!*k,

No, I’m using the standard definition of continuity and the derivative from basic analysis, which I’ve established that neither you, pg13, nor Barkley understands.

I already explained how pg13 is wrong in my comment. You can’t take a derivative if you don’t have a continuous function. You also can’t say that you can approximate a derivative if you can’t take the derivative in the first place. That you asked me to explain why when I already did shows me that you too don’t understand basic calculus.

It’s simply wrong to say that inflation is a derivative. You’d get zero points on a principles midterm question if you answered that it is.

I need to stop saying Princeton Steve is the most worthless troll ever as you clearly are far superior at being totally worthless.

You are right. I tried to make that statement too as Barkely noted. But given the fact that THE RICK is even worse than Princeton Steve in every dimension, he has to continue with his non-point over and over again. Of course our host has weighed in. Let’s wait for Rick’s next stupid reply as this has me rolling on the floor with laughter.

pg13,

No, you are lying. You made no statement other than “the instantaneous rate of change” might be something we can calculate if the BLS reported prices each and every second.” Wrong. Wrong. Wrong. F in freshman calculus.

Rick,

You actually had gotten some credibility with me given your claims to have been involved in developing derivatives and such things for some big fin corps. This stuff is basically of no value to society in general, in contrast to the kinds of public policy work Menzie has done (and some of the rest of us as well), but it can make money for these outfits and it does involves some substantial intellectual capability.

Now, I do not know if you lied when you made this claim about what you have done, but you just totally trashed your cred with me, and I know many of the the top people in qfin, not gong to get into that here now, as well as having pubbed on some of thi stuff, although we know you do not respect publishing, but this denial that inflation is the first derivative of the price level with the rest of your accompanying nonsense has totally destroyed your cred with me.

Yeah, so we are talking about the difference between difference equations and differential equations, Duuuuh. As pgl accurately notes the government authorities are not able to track price changes instantaneously, even though in fact the actual rate of inflation is changing essentially continuously, so the data series they produce with their periodic reports generate mere difference equations.

Now there are some matters where the difference between difference equations and differential equations is important, but none of them matter for this discussion. So, for example in chaos theory, something I happen to know a bit about, different dimensionality requirements are involved between models of difference equations and ones involving differential equations. But this stuff is really not important here.

So, those discrete and thus discontinuous measures of price changes that the government makes are imperfect measures of the rate of change of the price level, its first derivative. You should know this., and I think maybe you do. Or else maybe you were lying to us about being involved in developing derivatives for big fin companies. Which is it, Rick Stryker? Are you lying or just actually dumb?

Barkley,

First of all, to claim that derivatives have no social value is ridiculous.

Second, you don’t know the top people in quantitative finance.

Third, yes I did do lots of work on derivatives and much more.

Fourth, you blow up your own credibility by trying to claim that inflation as actually measured is an approximation of a derivative. I thought you might just remain silent rather than try to defend pg13. Menzie will just stay silent, which is what you should have done. Inflation as measured can’t be a discrete time approximation to a derivative since the derivative doesn’t exist.

So, three of the most vociferous critics of people like Bruce Hall and Corev don’t understand basic mathematics or economics. Too funny.

Rick Stryker: Seriously, most of the profession will allow that while technically we should be talking about difference equations rather than differential, given the discrete nature of the data, it’s typically understood what is meant when one talks about first derivative, with the data we have. Or, should I throw away every paper that has a phase diagram in it? We also log-linearize tons of equations in macro – should we stop doing that?

Menzie,

We are not talking about modeling strategies. Of course, people sometimes assume continuous time when developing economics models. People have used differential equation models in your field, international finance, as you well know.

What we are talking about is pg13’s silly attack on Bruce Hall. pg13 said Bruce Hall didn’t understand calculus since Bruce should have realized that he was talking about the first and second derivative in his inflation comment, because inflation, according to pg13, is the first derivative of the price level. That’s flatly wrong–it can’t be true mathematically. You could represent the price level in continuous time in some model. But we are talking about measured CPI and its rate of change here, not modeling strategies.

I think it’s interesting that you bend over backwards to find a way to re-interpret the clearly wrong statements of liberal commenters as not actually wrong, but parse every word that conservatives say, looking for anything to attack. You can’t re-interpret pg13 to be talking about models since he doubled down, saying “’the instantaneous rate of change’ might be something we can calculate if the BLS reported prices each and every second.” No, you can’t and to make that claim shows real ignorance of basic mathematics.

Rick,

So Bruce compared two different time periods for differences in CPI. The shorter one, the one closer to but not equal to the actual instantaneous first derivative of the CPI, month to month slightly dropped, but yeah, the much longer year to year one has not changed much and remains high. Sure, there are plenty of people who care about the latter, but the shorter the time period, the closer to what is actually happening. Of course, Bruce got himself in trouble by using “absolute level,” which you think is absolutely unambiguously clear, but which in fact was a poor use of wording and opened him up to criticism he received.

I am not going to play a name dropping game with you, but I am pretty sure I know at least as many of the top qfin paople as you do, and I mean the ones really at the top. I did write the entry on econophysics for the Third Edition of the New Palgrave Dictionary, and am a coeditor of the Fourth Edition. Not going to push this too hard because it will probably set Moses Herzog off on a frenzy of talking about my grandchildren or spouting various acronyms. I will simply note that I have published about areas of math I suspect you barely even know exist.

As for the social value of derivatives, want to provide actual examples? Futures markets clearly stabilize many markets and aid production, as in agricultural ones. Even options are arguably somewhat helpful. But derivatives? Many of us remember 2008.

Oh, and of course Menzie is right about this whole business of differences and differentials, the point I made. Your effort to somehow declare that anybody saying that the discrete measures government agencies make are efforts to approximate first derivatives of economic variables does not know basic calculus or math just make you look like a total blazing hypocritical idiot.

You claimed to have understood what Bruce Hall said even as you make an entirely tortured nonpoint. Buit re-read his continuing nonsense about targeting the price level versus targeting say a 2% inflation rate. That was the basic point that apparently you are too dumb to get. I provided Bruce a link to Keynes 1923 discussion of this point. Apparently something your “PhD” program never asked you to read. Even though price level targeting versus inflation targeting has been a basic macroeconomic issues for a century.

When did you get your Ph.D. again? On 1905. Got it.

rick is the one who is adding specific terms to the conversation, like continuous function, instantaneous rate of change, etc. these are of course specific to infinitesimal calculus. pgl did not make these specific claims. there are other forms of calculus, as prof chinn and rosser have noted, that are of the finite variety. and it is not unusual for people to use the concepts from the more widely taught infinitesimal approach to convey similar ideas. people speak of derivatives when actually using finite calculus all of the time. nobody says “the finite difference approximation of derivatives” in conversation, even though it is technically correct.

of the more interesting point, is why rick would belabor this issue why claiming the superiority of “real world” work. in the real world, any function you use is simply a continuous function approximation to the measured data of the real world. any numerical work you do is based not upon infinitesimal calculus, but finite calculus. so rick, the work you claim to do is not “real world” based, but simply an approximation to a measurement. if it cannot be measured, then it is not real. and if it is measured, it is discrete, and not continuous. it seems rick has confused his “real world” work with what is actually a bit of fantasy world work. and he views his fantasy work as superior to others. interesting.

Barkley,

You don’t know anyone in quantitative finance. Econophysics is not quantitative finance. Nor do you know the field of quantitative finance. Why pretend you do?

You point to some benefits of options and futures but then ask what benefits derivatives have. You don’t seem to realize that options and futures are derivatives.

beyond the simple application of options and futures, one really does have to wonder what value financial derivatives really bring to the economy. they are the tools that brought the financial industry to its knees 15 years ago. buffet calls them weapons of mass destruction. rick, one could argue your life’s work has been wasted on financial derivatives, producing little contribution to the world around you.

Off topic, again

I thought commenter “ltr” might enjoy this one:

https://unherd.com/2022/08/china-cant-afford-to-invade-taiwan/

Actually, Moses, I continue to be surprised that you have not taken this opportunity to denounce Pelosi as you have done so many times. She did not need to visit Taiwan. She offered Taiwan northing of any substance or importance, only puffed her own ego and record, getting praise even from GOPs who never praise her, and even with you, who endlessly denounced her, now falling all over yourself in praise.

No, PRC will not invade Taiwan now. But, not being covered at all in the news is that these exercises have now become entrenched. I hear Xi is not going to end them any time soon. This is far more serious than all those Trampscheiss threatening civil war over the Mar-a-Logo raid. This is in fact now a major blockade of Taiwan that is also seriously blocking major international commercial air and sea lanes for world traffic. The US will now be under serious pressure to go in and break this blockade with USS Ronald Reagan and other major naval forces. This threatens war with China.

And you complained that Pelosi ate ice cream? Most of you do not get it and are as out of it as all those Russians who think Putin is great for invading Ukraine.

Oh, and let us be clear. I am NOT defending this action by Xi. Pelosi had every right to visit Taiwan and in fact gave them nothing. This is totally unacceptable by Xi, which is why Biden will be completely justified in smashing the Chinese war machine, and why he and his associates tried to talk Pelosi out of doing this massively stupid and irresponsible visit.

Reasonable people can have different opinions on this specific issue. Sorry…….. not taking your “Barkley desperately needs attention” bait for today.

Barkley Clueless says: “But, not being covered at all in the news is that these exercises have now become entrenched. I hear Xi is not going to end them any time soon.”

https://www.militarytimes.com/flashpoints/china/2022/08/10/china-appears-to-wind-down-military-drills-near-taiwan/

I remain hopeful that one day Barkley Junior’s grandkids will introduce him to the “refresh” button in his browser.

Good.

I suspect we will have to wait on FRED to update its reporting but here is the data from BLS in a very convenient format.

https://www.bls.gov/news.release/cpi.t01.htm

Note it reports June 2022 and July 2022 so Bruce if he actually were honest (cough, cough) would report what happened to CPI over the last month. But yea it shows July 2021 so one could do a 12-month change if one wanted to.

And one can do this for each category.

Now that Bruce has this information (which is not that hard to find) let’s sit back and have a good laugh at all the manipulations he pulls!

@Ole Bark, bark, these are the numbers I watch:

Electricity

2.609 227.672 257.557 262.347 15.2 1.9 1.3 1.7 1.6

Utility (piped) gas service

0.993 198.207 269.278 258.666 30.5 -3.9 8.0 8.2 -3.6

From these totals I can make another prediction: The IRA will further increase the cost of electricity as renewables are added to the various US grids. Adding renewables always adds to the grid costs.

Way to go kids. Show us all how economically counter productive are your policies. As if we weren’t already aware via living with those results.

natural gas continues to cost more each year. so you want to invest in future utilities where you will increase the demand for the fuel, but you think that the fuel cost will not go up? explain that to me in economic terms covid. in the long term, natural gas is simply not economically viable. Irregardless of its impact on climate change.

Baffled claims: “…but you think that the fuel cost will not go up? explain that to me in economic terms covid.” The continuing War on Fossil Fuels is a MAJOR cause of rising fuel costs, a major cause of the Ukraine/Russian war, and the cause of the EU not drilling/fracking their own gas.

Adding renewables to a grid always adds cost to that grid. This graph shows the TX cost to renewables ratio: https://149366104.v2.pressablecdn.com/wp-content/uploads/2022/08/Picture1-1-720×361.webp

This graph shows the EU electricity prices: https://saltbushclub.com/wp-content/uploads/2020/10/Electricity-prices-in-Europe-2019.jpg

You might notice the countries with the highest prices are also those with higher usage of renewables.

I know, I know, it’s just a coincidence. Only the unthinking believe in renewables. Only liars insist on renewables with out a reasonable cost benefit analysis.

I see a lot of excuses. the fact of the matter is that natural gas prices have continued to increase. and there is not a great deal of reason to believe they will suddenly drop to levels that make natural gas an attractive fuel source. natural gas is being used as a bridge as we mature the renewable market. even the big energy producers have acknowledged that fact. even the state of texas has embraced renewables. corev cannot because he is too proud to admit he lost the battle. he will go down with the ship, rather than admit he lost. pride hurts.

My Lord man – you have truly gone bananas. Has you family decided to move out fearing for their lives?

There are, by the way, indications of inflation becoming less widespread, as well as less rapid. The 16% trimmed meam CPI measure has risen less than core CPI in each of the past three months, and the dispersion of rising prices was less in June than in many months, this not back to pre-Covid levels:

https://www.frbsf.org/economic-research/indicators-data/pce-personal-consumption-expenditure-price-index-pcepi/

By the way, I would recommend a prayer to the Fed as it attmpts to honor both sides of its mandate:

Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference.

Maybe they could give the Fed Res the power to hold lotteries where they randomly choose people to either fire or lower their wages, since they and Larry Summers have decided that’s the root cause of inflation now.

PPI came out today and it did not rise in July either.

I have been in Shandong. One of the very few places I went for recreational travel outside of the metro area I lived in. This might be worth keeping an eye on, but seems relatively contained for the moment:

https://www.theguardian.com/science/2022/aug/10/newly-identified-langya-virus-tracked-after-china-reports-dozens-of-cases

Saw that. Big Uh Oh!

Historically, a deadly type, but his strain hasn’t killed anyone that we know of. Suspected to have jumped from animals initially, but the cluster suggests some human-to-human transmission.

Watch out for shrews.

OK FRED has been updated:

https://fred.stlouisfed.org/series/CPIAUCSL

If one plots this series from July 2021 to July 2022, it is clear that its slope used to be a bit steep but over the past month, prices have declined slightly.

So yea – if one knows how to read a graph, one gets that Bruce Hall clearly misspoke (the Dick Cheney term for lying).

Ole if he’s writing he’s lying, here Are the actual numbers for Biden’s administration starting in January” 2021: 1.4 1.7 2.6 4.2 5.0 5.4 5.4 5.3 5.4 6.2 6.8 7.0 4.7

2022 7.5 7.9 8.5 8.3 8.6 9.1 8.5″ From here: https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Aren’t you proud of the Biden policies responsible for this horrid picture? Have you sense of decency?

Year to year changes. Month to month, the last figure was less than zero. Oh wait – you did not know that. Figures.

BTW when you stop barking and chasing your own tail, check out today’s release of PPI. It fell in July too. Woof, woof.

Ole Bark, bark, if he’s writing he’s lying.

As of now, a third of the way through August, oil and gasoline rides continue downward. It’s too soon to know whether that will mean another month of flat (actually falling) headline CPI, but it’s a pretty good start on another month of tame headline inflation.

Owners equivalent rent? So far, the best we can say is it stopped accelerating:

https://fred.stlouisfed.org/graph/?g=SFsr

Reports from around the country suggest a deceleration in housing cost gains, but the slowing in July owners equivalent rent isn’t enough to hang our hats on. Still-rapid rent gains very likely mean the PCE deflator for July will be tamer than CPI. Heck, maybe even a month-over-month decline.

While prospects for slower inflation are improving, don’t plan eating much beef:

https://www.reuters.com/markets/us/shrinking-us-cattle-herd-signals-more-pain-high-beef-prices-2022-08-09/

Sorry, Moses.

Back to cheap burger and chicken Aye?? Even during the worst of the pandemic I was pretty lucky finding some good meat. We’ll see. If it gets super bad and I find some red meat bargains I’ll “humble brag” here on the blog. Or maybe even arrogant brag, who knows?? I can even go over to dofu if things get super crazy. That gets my protein. Although some paranoid conservative radio show hosts say dofu has high amounts of estrogen. So if I substitute dofu for my red meat, I’ll also let the blog know if I get limp wrists, take up crocheting and start wearing pink a lot. Anything for the edification of America.

I’d ask you to mail me some, but I haven’t seen much improvement in delivery times since the order of it.

Ronaldo’s cost of living is insanely high. Then again he can afford it!

https://www.insider.com/cristiano-ronaldo-net-worth-how-soccer-star-makes-spends-money-2022-8#he-also-likes-to-splash-the-cash-on-buying-expensive-jewelry-for-his-fiance-11

Phooey on you!!! He’s an impostor, this is the REAL Ronaldo!!! :

https://en.wikipedia.org/wiki/Ronaldo_(Brazilian_footballer)

https://fred.stlouisfed.org/graph/?g=lpNZ

January 30, 2018

Multiple Jobholders as a percent of Employed, 1994-2022

https://fred.stlouisfed.org/graph/?g=lpO2

January 30, 2018

Multiple Jobholders as a percent of Employed, 1994-2022

(Indexed to 1994)

[ A reader asked about multiple job-holding, which is relatively low at present. ]

“A reader asked about multiple job-holding, which is relatively low at present.”

As that FRED data shows clearly. Thanks. The “reader” was Bruce Hall who did more than ask. He tried to tell us this was high. Another Bruce Hall lie exposed by the data!

https://fred.stlouisfed.org/graph/?g=lSy9

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2022

* Output per hour of all persons

(Percent change)

https://fred.stlouisfed.org/graph/?g=lSyd

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2022

* Output per hour of all persons

(Indexed to 1988)

[ Productivity growth has slowed markedly. ]

“Productivity growth has slowed markedly.”

I noted a recent Jason Furman tweet that took this observation a bit further!

https://fred.stlouisfed.org/graph/?g=SDiv

January 15, 2018

Real Average Hourly Earnings * and Labor Productivity in Manufacturing, 1988-2022

* Production & nonsupervisory workers and Output per hour

(Indexed to 1988)

[ A startling depiction of flat real earnings in manufacturing since 1988; with increasing growth in productivity, then a flattening of productivity. ]

If you can get past the paywall, alot of interesting stuff here and in the “related” stories at the very bottom of the article.

https://www.nytimes.com/2022/08/10/us/politics/scott-perry-phone-fbi.html

I think they easily have enough for criminal charges, it’s just a matter of how hard they persue the evidence.

LOL! English can be difficult.

I wrote:

>While it is a positive development that the rate of price increases is decreasing, the absolute level is still significant year/year and from the beginning of 2021.

Technically the CPI didn’t decrease yr/yr; it increased 8.5%. But based on initial <b<absolute levels, CPI went from 296.311 in June to 296.276 in July or a negative change of 0.035 (which is probably too close to be meaningful. Of course, that’s subject to revision/manipulation.

Apparently the drop in gasoline prices were simply not enough to move the inflation needle. But, yes, I’ll grant you that technically there was a decrease in the index month-to-month. But I don’t believe most people would interpret that as inflation is over. That’s sort of like saying, “The patient’s temperature dropped from 106.0º to 105.9º… the fever broke.

English is not that hard if one actually understands basic economic concepts. You either do not or you are following the strict orders of Kelly Anne to continually spread disinformation.

“That’s sort of like saying, “The patient’s temperature dropped from 106.0º to 105.9º… the fever broke.”

If temperature is your analogy for the CPI then you just admitted you are one of those gold bug types who wants the price of a Coke to return to a nickel. Good to know.

Bruce Hall insists we must return to the price level observed 18 months ago. CPI now is 12.6% higher than it was back then so Bruce Hall is advocating more than a reduction in the inflation as he is arguing for Deflation, which is something Lord Keynes noted was the monetary policy of the Bank of England in the early 1980’s in his classic A Tract on Monetary Reform:

https://www.classicly.com/bibi/pre.html?book=4738.epub

13 years before he published The General Theory Keynes was already noting the harm of gold bug policies to target the price level. Now I get Bruce Hall does not read ANY economics but most of us have read Keynes. What Bruce Hall is advocating is a repeat of the Great Depression. Yes – he is that dumb.

Early 1920’s not 1980’s. Keynes was forward looking but not that forward looking.

OK the press keeps saying the inflation rate as measured by the change since July 2021 is still 8.5%. But the annualized inflation rate from June 2020 to July 2021 was actually slightly negative. What is going on?

A small analogy from Brooklyn’s favorite game – pickup basketball. 24 dudes showed up half of which will play for my team and the other 12 will play for perhaps the worst basketball coach ever – Bruce Hall.

I have picked 11 and so has Bruce. Each team so far has players whose average height is 6 feet and 0 inches. Bruce gets to pick a player and then get to pick the last. For some odd reason Bruce picked some dude who is only 5 feet tall while I picked a true 7 foot center.

Now to show you how dumb Bruce is he noted his team still averaged 5 feet 11 inches which is not that bad while my team averaged 6 feet 1 inches. So yea an average over 12 players disguising the mistake he made with his last pick.

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=HKys

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=QKnA

January 30, 2018

Case-Shiller National Home Price Index / Consumer Price Index, 1994-2022

(Indexed to 1994)

[ From an historical perspective, from 1890 on, real home prices are at an exceptional level. ]

https://news.cgtn.com/news/2022-08-10/China-s-CPI-up-2-7-in-July–1cngJ1aOv1m/index.html

August 10, 2022

China’s consumer prices rise in July, factory-gate inflation ease

Vegetable and pork prices pushed up China’s consumer price index (CPI) in July while the factory-gate inflation eased from June, official data showed on Wednesday.

China’s CPI edged up 2.7 percent year on year in July, data from the National Bureau of Statistics (NBS) showed. The producer price index (PPI) increased by 4.2 percent year-on-year during the month, down from a 6.1 percent uptick in June. Both gains were smaller than forecast in a Reuters poll.

“Affected by the rising price of pork, fresh vegetables and other foods, coupled with seasonal factors, the CPI in July turned from flat to a month-on-month increase, and the year-on-year growth slightly quickened,” said NBS senior statistician Dong Lijuan.

Pork prices surged 25.6 percent compared with June when reduced supply meets the recovery of consumer demand. Continued high temperatures in many places pushed up the price of fresh vegetables from a decrease of 9.2 percent in June to a jump of 10.3 percent last month.

“The CPI is expected to rise moderately in the future, with a high probability of breaking through three percent in some months (September and December), but the annual average will remain within the policy target,” wrote Wen Bin, chief economist at China Minsheng Bank in a research note.

China’s core consumer inflation, which excluded the volatile prices of food and energy, rose marginally at 0.8 percent year-on-year, slower than the one percent increase in June….

pgl

“But the annualized inflation rate from June 2020 to July 2021 was actually slightly negative. ”

I think you mean “from June 2021 to July 2021”?

((295.271/295.328) ^12-1) *100 =-0.23.

https://fred.stlouisfed.org/graph/?g=sVz7

January 15, 2020

Consumer Price Index and Consumer Price Index Less Food & Energy, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MMDX

January 15, 2020

Consumer Price Index and Consumer Price Index Less Food & Energy, 2020-2022

(Indexed to 2020)

Thanks for the edit!

AS, no! If he’s writing he’s lying.

Has your master not feed you all summer? Dude – you really need to eat as your comments are getting dumber than the dumbest rock.

https://jabberwocking.com/raw-data-inflationary-episodes-over-the-past-70-years/

Kevin Drum’s graph of inflation over the past 70 years is a must see. The current situation is rather tame in comparison.

Rather than get into a big fight about this, let me advise people who want information to see

https://www.bls.gov/news.release/cpi.nr0.htm#:~:text=The%20energy%20index%20increased%2032.9,the%20period%20ending%20May%201979.&text=12%2Dmos.

Links to the source data (BLS) are always welcomed. BLS released the PPI data today and I provided a link somewhere in all of this dizzying discussions.

Biden will be completely justified in smashing the ——- war machine…

[ Though this of course would be impossible, the statement is recklessly violent. Try being properly temperate. ]