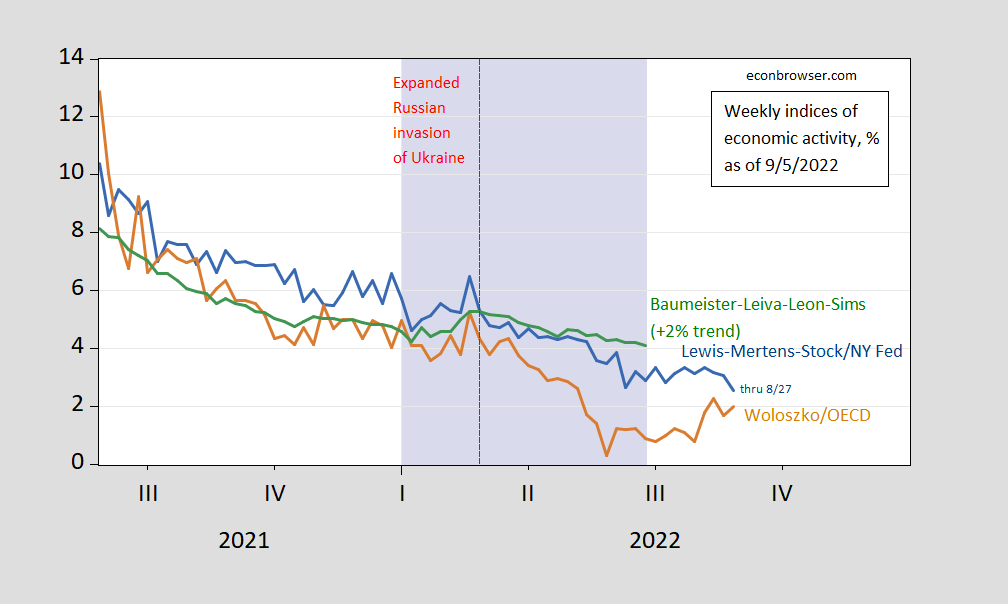

New OECD Weekly Tracker index (Woloszko/OECD) is out. Here’s the resulting picture:

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green) Lilac shading denotes a hypothetical H1 recession dates. Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The WEI reading for the week ending 8/27 of 2.5 is interpretable as a y/y quarter growth of 2.5% if the 2.5 reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 2.0 is interpretable as a y/y growth rate of 2.0% for year ending 8/27 (note the previous tracker reading for 8/20 has been revised down by nearly a percentage point). The Baumeister et al. reading of 2.1% for the week ending 6/25 is interpreted as a 2.1% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%.

Off topic, European energy situation –

European gas storage is nearly 80%, ahead of schedule. China is one source of gas for Europe. China’s economic slowdown means it has excess gas imports from Russiaz which it is reselling to Europe:

https://www.ft.com/content/1e20467a-5b53-42b7-ad89-49808f7e1780

So Russia sells at a discount due to sanctions, Europe pays double last year’s prices and Chinese firms which contract for Russian gas pick up the vig to stay afloat during a rough patch. So many of our current big stories all in one story.

The interesting thing is that this works to the benefit of all. This fall/winter Russia gets just enough income to make it through. China gets extra income to help soften the blow from idiotic policies that were never adjusted/changed as they needed. Europe gets a big kick in the ass to move away from hydrocarbon energy, but neither supply nor prices will hit levels that they cannot deal with.

Next winter Europe will be independent of Putin and have all the hydrocarbons they need at a reasonable prices. Russia on the other hand will have an even lower income from hydrocarbon sales than now. With sanctions in place Putin will have to sell at a discount from a higher world price; if they are gone he will have to sell at a lower world price. His natural gas pipelines and the income they generated will be gone for good.

@ Macroduck

Great find. Hats off. As well was your Russian links in the most recent thread. Really solid stuff.

I’m still wondering about Putin’s health. I’m not a big rumors guy, but some of these rumors on his health really kinda strike me as legit. They may be “getting the details” wrong, some of them, but something is there, there’s enough “smoke” there to believe there’s “fire”. It may not be 5-alarm yet, but enough it’s effecting his life and performance around others. You know what I would love to see?? A website or blog that does nothing else but solely tracks Putin’s public, “live” appearances, over the last two years and up to whatever the current date is. I think that’s a whole interesting topic unto itself.

Maybe he felt that is was now or never to become the great savior of “Rusky Mir” – lionized in history books for eternity.

Most likely, or some similar such. Along those lines.

In Russia these days, isn’t “health” a euphemism for proximity to an open window?