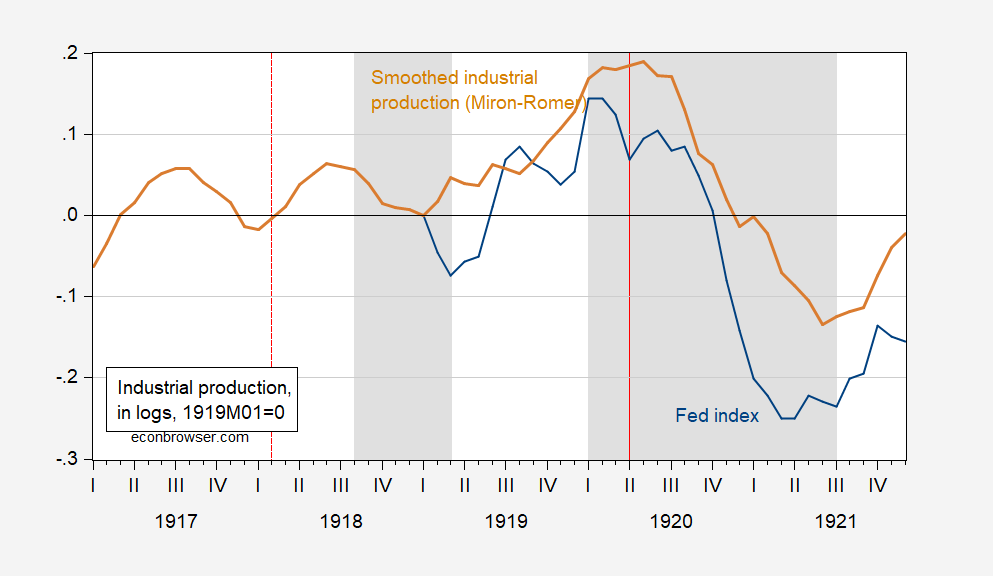

Here’s industrial production (Fed, Miron-Romer) index during the 1920-21 recession, as reader Steven Kopits thinks this is the template for a conjectured current ongoing recession (or incipient – the conjecture keeps on changing).

Figure 1: Industrial produciton from Federal Reserve (blue), and from Miron-Romer (tan), both in logs normalized to 1919M01=0. NBER peak-to-trough recession dates shaded gray. Red dashed lines at beginning, end of Flu Epidemic. Source: Federal Reserve via FRED, Miron-Romer, NBER, and author’s calculations.

Notice that industrial production declined through the recession of 1920-21. Can we compare to the experience since 2021M11 (peak in official GDP was 2021Q4)? Why, yes we can! Here’s the evolution of the Fed series in both cases.

Figure 2: Industrial production log normalized to 1920M01=0 (tan), and to 2021M11 (blue). Dates indicate months since NBER peak or hypothesized NBER peak. Source: Federal Reserve via FRED, NBER, and author’s calculations.

To me, this indicates that the similarity here between 1920-21 and 2021-22 is not there.

Stevie cannot even get our macroeconomic history straight for the period just after WWII. How do we expect him to understand events a century ago? Yea – I know there are economic historians who have covered this period but remember Stevie is too busy to read what anyone else has written.

Let me get this straight……. our “wonderboy” of intentional economic illiteracy is comparing a recession from the early 1920s characterized largely as a period of oppressive deflation, with a time where we have not verified if we are in fact in a “recession” and all of Kopits’ Republican compatriots and Larry Summers are screaming “hyperinflation!!!! from every hilltop.

Is Kopits’ channeling Stephen “I Don’t Pay Alimony” Moore?? Or is he channeling Stephen “I Brag About My Own Adultery Openly in Front of My Children” Moore?? Perhaps Kopits’ is like Grumpy Economist blogger Johnny Cuckrant of Hoover, he thinks if he ejaculates continually for 30+ years “Inflation is coming!!!! Inflation is coming!!!! Inflation is coming!!!!”, if for one 6-month period in that 30 years time inflation hits (during an East European war that Cuckrant never foresaw when he was calling inflation) , he gets a victory lap around the stadium??

Brother, if you play Whack-a-Mole, and you just stand there ten minutes with the mallet over the same hole, and the mole pops out of the hole you’ve been holding the mallet at for 10 minutes straight, it doesn’t mean you are now “The Pinball Wizard” version of Whack-a-Mole. Please pass this epiphany on to the Confederacy of Dunces at Hoover, would you please??

I tried to get Stevie Kopits to actually read some serious NBER research on the 1920/21 recession but apparently he has not read that either. Yea we had a pandemic back then but I guess Stevie forgets about the impact of the end of WWI.

Now Stevie has realized that there were macroeconomic impacts from the end of WWII which led to economic weakness in late 1945 and early 1946. Of course the calendar challenged fool think he as discovered the 1947 recession even though we did not have a recession in that particular year.

It all sorts of reminds me of how Republicans blamed the 1982 recession on Jimmy Carter.

Given the fact that Stevie pretends to know economic history even though he is incapable of presenting numbers, here is an account of inflation rates dating back to 1913:

https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-

Note how the high inflation of 1920 turned into massive deflation in 1921.

Now Stevie keeps making up some alleged 1947 recession which never occurred but note we had high inflation in 1947.

Which begs the question – did Stevie’s parents ever teach the boy to tie his own shoes?

So, pgl, is monetary policy too tight, or not?

Do you EVER read what others like Macroduck or yours truly bother to write? We have both criticized the FED for its tight monetary policy right now. Of course you might be saying the same thing now but then you run into extreme hyperbole about tight money one week but the previous week you were found screaming HYPERINFLATION to the cows come home.

I have no obligation to repeat my consistent and sane comments to a flip flopping Chicken Little fool like you.

@ BlueStatesResidentKopits

You’re obfuscating from the important point here, keep your eye on the ball~~where is VMT right now?? If I’ve told you once I’ve told you a thousand times Kopits, keep your TV on FOX Business News and you won’t make these elementary errors of forgetting about the VMT.

[ happy/contended sigh ] This brings back memories of being a pretend non-certified teacher in China. Guiding the youth of tomorrow……. good times……..

Menzie –

Let me reiterate what I said:

1. H1 was a recession by the most commonly used standard

2. Nevertheless, the H1 downturn did not have some of the characteristics of many recessions, notably, unemployment did not rise

3. This sort of phenomena was last seen in 1945 when US defense spending collapsed, that is, a decline in GDP without a material decline in employment.

4. Thus, the H1 downturn plausibly could be explained by aggressively contractionary fiscal policy. Biden just yesterday crowed that he had reduced the budget deficit by $1.4 trillion in little over a year. That’s about 7% of GDP, so we might expect a contraction on the order of 4% of GDP (allowing for intervening, underlying GDP growth), and that’s about what we have seen.

5. Thus, from this perspective, H1 could be seen as a ‘technical recession’, but which I mean a formal downturn in GDP without an underlying business cycle.

So that’s fiscal policy. Let’s turn to monetary policy.

1. The Fed mistook a suppression for a depression and therefore put interest rates to depressionary levels, that is, with the FFR near zero. This had only happened twice in the last century, both in depressionary circumstances, notably during the Great Depression and from 2008/2009 to around 2016. Because these latter two events were properly characterized as depressions, in my view — which means they were associated with compromised collateral — short term govt interest rates set to zero for seven years or more did not materially raise real estate values.

2. Because the covid downturn was a suppression, not a depression, the zero rate policy was inappropriate during the covid downturn. Collateral was not impaired, and therefore zero interest rates led to surging home values and equity prices.

3. The result of fiscal and monetary policy, in some combination, has led to historically high levels of inflation. The cause of this inflation is not entirely clear, or more precisely, I have not seen an allocation of it among all of fiscal policy, monetary policy, and supply chain bottlenecks.

4. The Fed’s current monetary policy is predicated on the notion that inflation has been caused principally by low interest rates (ie, a 40% increase in M2)

5. Therefore, the Fed is willing to put rates to levels not seen in some time, with 7%+ mortgage rates now on offer, twice the level of rates pre-pandemic.

6. This is leading the housing sector to collapse, with not only disinflation, but outright deflation, now gathering steam around the country.

7. This suggests next year might see outright deflation. This is what we saw in the 1920/1921 depression, which followed the Spanish flu pandemic and may therefore serve as a template for the coming 18-24 months (forward-looking, not backward looking, please)

8. If the 1920/1921 template is correct, then monetary policy is set far too tight and we may expect outright deflation next year, as we did 100 years ago.

9. On the other hand, if the more traditional M2 surge / excessively low interest rate thesis is right (per Summers), then interest rates have to continue to be raised.

10. In either event, a 2023 recession would seem to be in the cards.

You’d better know what you’re thesis is when you set rates.

https://www.youtube.com/watch?v=75FCOZjACco

https://www.calculatedriskblog.com/#google_vignette

https://www.youtube.com/watch?v=h3UGw8-4nNU&t=2s