As noted by Jim in his post on the 2022Q3 GDP release, exports and imports accounted (mechanically) for more than 100% of 2022Q3 GDP growth:

Figure 1: Top panel: GDP growth (blue); Bottom panel: consumption, investment and government spending (blue bar), exports (tan), imports (green), all in %, q/q SAAR. Source: BEA, 2022Q3 advance release and authors calculations.

Increase in real exports of goods and services, and decreases in real imports, accounted for 2.8 ppts of the 2.6 ppts of growth, q/q SAAR. Domestic components (C, I, G) fell from a big contributor of overall growth in 2021 Q4, to a small negative in Q3.

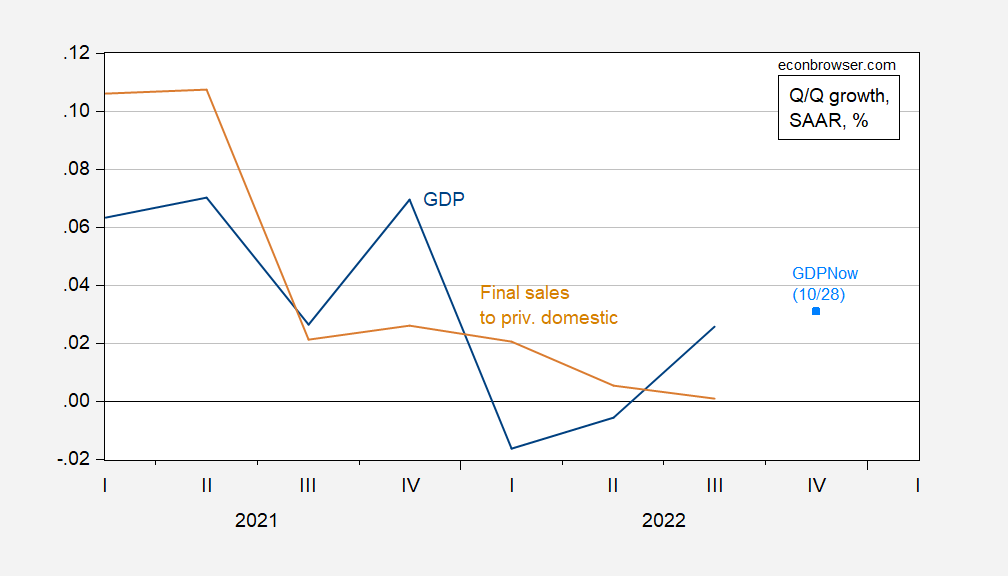

In other words, the domestic component of aggregate demand is waning in strength, and this is further confirmed by a picture of q/q growth in final sales to private domeestic purchasers, as compared to GDP.

Figure 2: Real GDP growth (blue), GDPNow forecast of 10/28 (sky blue square), real growth of final sales to private domestic purchasers (tan), all in %, q/q SAAR. Source: BEA, 2022Q3 advance release, Atlanta Fed, and authors calculations.

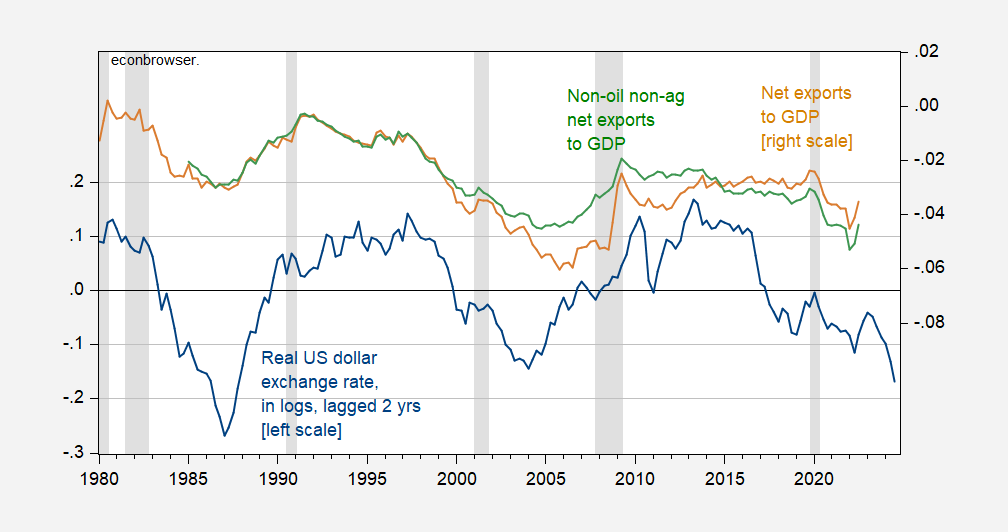

How is the external environment likely to impact GDP? Here’s a picture of net exports (total, ex-agric. exports, ex-oil) to GDP, against the evolution of the real dollar exchange rate.

Figure 3: Real US dollar trade weighted exchange rate in logs, lagged two years (blue, left scale), net exports to GDP (tan, right scale), net exports ex-agriculture, ex-oil, to GDP (green, right scale). NBER peak-to-trough recession dates shaded gray. Down in exchange rate denotes dollar appreciation. Trade weights exports of goods through 2015, exports of goods and services thereafter. Source: Federal Reserve via FRED, BEA 2022Q3 advance, NBER, and author’s calculations.

The rebound in Q3 is in part attributable to the weakening of the currency back in 2020Q3. This graph shows that net exports will probably deteriorate again in the near future as dollar appreciation feeds through into deteriorating competitiveness.

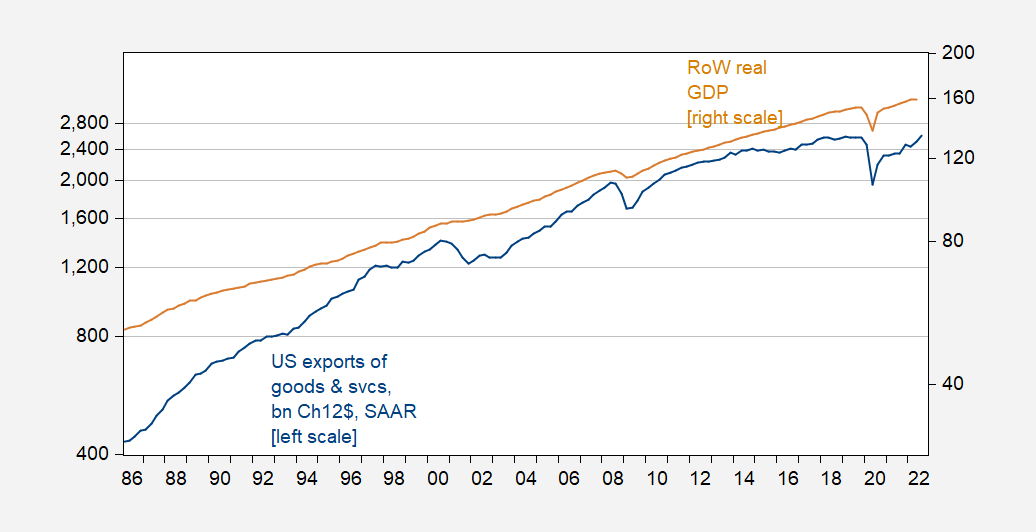

Exports also depend on foreign economic activity, as discussed in these posts. This is shown in Figure 3 below.

Figure 4: US exports of goods and services, bn.Ch.12$ SAAR (blue, right log scale), rest-of-world export weighted GDP (tan, right log scale). Source: BEA 2022Q3 advance, Dallas Fed Database of Global Economic Indicators.

The long run relationship between exports (expgs), rest-of-world GDP (y*) and the real exchange rate (q) is:

expgs = 1.1 y* + 1.43 q

For 1986-2022Q2, estimated using Johansen maximum likelihood method. This is a slightly lower income elasticity and higher price elasticity than reported in Chinn (2010), but encompasses a later sample than reported there.

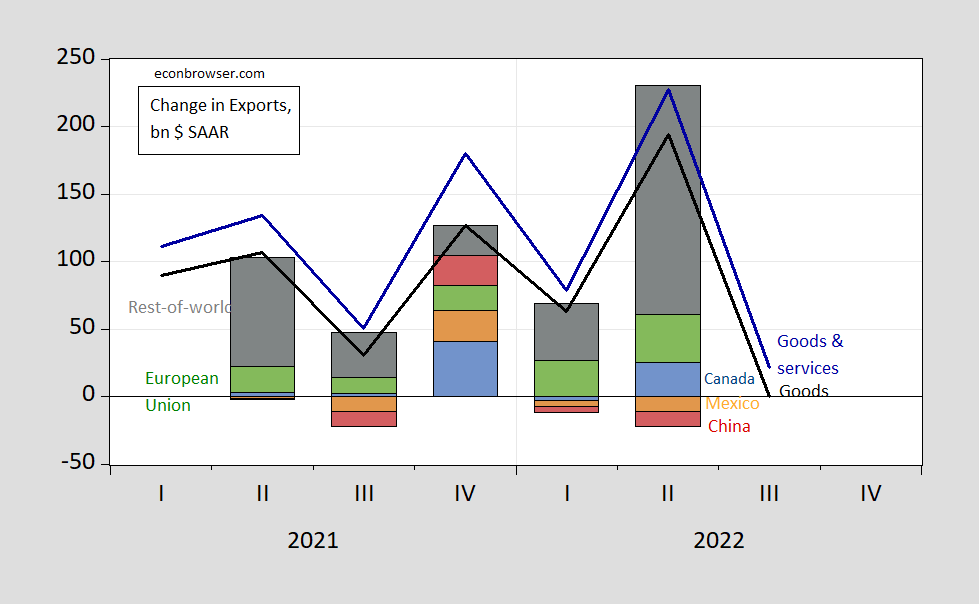

We can show the geographic contributions to q/q changes in goods exports, at least through Q2.

Figure 5: Change in nominal exports of goods and services (blue), of goods (black), goods to rest of the world (gray bar), European Union (green bar), Canada (blue bar), Mexico (tan), China (red), in billions $, q/q SAAR. Source: BEA 2022Q3 advance, BEA/Census International Trade release, author’s calculations.

While we (rightly) worry about China, the direct aggregate demand emanating from China for US goods is small (the indirect, through the rest of the world is likely not so trivial). So far, Canada and European Union has contributed measurably to exports of goods. A slowdown in the European Union should then be more worrisome insofar as there is a direct impact on US exports of goods.

October 2022 IMF World Economic Outlook forecasts are for 2.2%, 1.3% for Canada in 2022, 2023 (q4/q4), 2.4%, 1.2% for Mexico, 1%, 1.4% for Euro Area (not EU), and 4.3% and 2.6% for China.

“the domestic component of aggregate demand is waning in strength, and this is further confirmed by a picture of q/q growth in final sales to private domeestic purchasers, as compared to GDP.”

This is a big concern, which is why trying to understand how net exports will behave going forward is so important. Nice detailed analysis on this important issue.

“How is the external environment likely to impact GDP? Here’s a picture of net exports (total, ex-agric. exports, ex-oil) to GDP, against the evolution of the real dollar exchange rate.”

That would be the 4th graph which shows net exports excluding agriculture and oil rose as much as net exports overall. I forgot who sensibly asked how much of Q3 growth was due to ag exports, which is a good question. Then again – we got another one of JohnH’s angry rants which tried to school us that all of this growth was due to higher LNG exports. I suspect that claim is false especially since Johnny boy provided not a shred of actual data.

LNG is the US’ third largest export and fastest growing.

https://www.forbes.com/sites/kenroberts/2022/06/28/aviation-hits-new-low-ranks-as-4th-leading-us-export-in-2022/?sh=33a4af95477

https://www.forbes.com/sites/kenroberts/2022/08/13/lng-fastest-growing-us-export-since-covid-19-heading-to-europe/?sh=7639833767c5

But pgl insists that fast-growing LNGexports did not materially contribute to 3Q net export growth! Wrong again!

I guess you are too stupid to take up my challenge. Yes LNG exports rose. But what was their increase relative to GDP. Your original links did not come close to answering this question and the information here does not come close either. Look Johnny – you can download Excel onto your computer quite easily. But I guess you have no idea how to use it.

“But pgl insists that fast-growing LNG exports did not materially contribute to 3Q net export growth!”

This is one of your patented LIES. I never said LNG exports did not rise. What I asked you was what was this increase as a percent of GDP. As in an apples to apples comparison to the statistics Dr. Hamilton post. Ok – I get you are too dumb to comprehend my simple request. But your stupidity is not my fault.

I just checked with http://www.census.gov data on what the US exports by product. Dr, Chinn cites this data all the time but I guess JohnH has not learned to use it. It reports exports of LNG as well as other products. It seems LNG exports represent 1.76% of total exports.

But JohnH insists that rising LNG exports are the only reason why exports might have risen. Yea he cannot count past 10 without taking off his shoes.

pgl is too lazy to substantiate his claims that the data provided in the Forbes articles is inaccurate!

According to BEA release, the leading contributors to the [3Q] increase were industrial supplies and materials (notably petroleum and products…

That includes LNG exports…something pgl didn’t know!

Seriously? Dr. Chinn has a new post devoted to your BS. It seems you failed to understand your own link.

“industrial supplies and materials (notably petroleum and products”

Wow – you really do not know how these classification systems work – do you?

Johnny, you’ve made a claim about Q3 based on text which is based on April data (your first link) and text which doesn’t validate your claim about the magnitude of gas exports (second link), but rather than pace of growth. So whatever pgl may have written and whatever the data for Q3 so far may indicate, you’re once again pretending to make a point which you haven’t actually made.

it’s as if you think economics is all about name-calling and bad faith. Try using data. Even better, use data from the period about which you have made a claim.

OK, so Johnny is the one who insisted, based on a couple of magazine articles instead of data, that liquified natural gas exports contributed to net export growth in Q3. It’s not my job to look up data. That was Johnny’s job, since he’s the one making the claim. I’ve done it, though, because that’s the kind of guy I am. I look up data.

Before we get to the dtaa, though, let’s ask ourselves – is there any reason to think that a statement in a magazine article based on April data might not be a reliable indicator of what happened in Q3? I can think of one. Maybe, just maybe, LNG exports have run into capacity constraints. What with the rapidrise and all.

Well anyway, let’s get on with the data. Wanna know the highest monthly level for LNG exports? March of this year. Way back in Q1! Wanna know the lowest level os LNG exports so far this year? July! That’s a pretty sketchy start to net export growth in Q3.

Ah, but what about August and September, you ask? Turns out, we don’t have data for those months yet. So Johnny climbed up on his little highchair and declare that LNG added to net export growth in Q3 when we have very little data forthe quarter, and the data we have say LNG exports fell.

Have a look:

https://www.eia.gov/dnav/ng/hist/n9133us2M.htm

That’s why Johnny can’t do economics.

Let’s see if Johnny can take these quantities and translate them to the dollar exports of LNG at current market prices for US LNG. He should then translate this to a percent of overall exports, which I bet would be a tiny percentage. I asked him to do this several times but so far he hasn’t.

BTW I did go to http://www.census.gov which reports that LNG exports per annum have been running around 1.76% of total exports.

Now if Johnny thinks LNG exports are such a massive amount of total exports, he does need to provide calculations based on reliable data. But of course he won’t.

See Dr. Chinn’s new post devoted to Johnny boy’s confusion. It seems this troll cannot even read his own link. Going into the BEA or Census data or your EIA data – that is too much for Johnny.

JohnH,

So, why are you so worked up about this? Does this mean that the US is actually really really in a recession as you keep trying to claim? Or is it a sign that V.V. Putin is really winning the wae in Ukraine as you so frequently seem to want to claim as well?

I’m worked up about this? All I did was to make the accurate statement that LNG exports contributed to US export growth.

In fact, the chart in my first link showed that LNG exports were $9.28 Billion through June, almost double the previous year’s figure. I mean, isn’t it widely known that US LNG exports are booming?

But for some reason this triggered pgl and MacroDuck…neither of whom managed to add any new data!

john, you do know the freeport lng plant shut down due to explosion in june of this year, and has yet to come back online? that plant has 20% of the nations lng processing capability. that is a lot of lng that cannot be exported. so july to november will have a very difficult time tying to match anything that happened in the first half of the year. that plant closing has been very impactful on the price of natural gas in the usa this summer as well.

“All I did was to make the accurate statement that LNG exports contributed to US export growth.”

Oh brother. Of course LNG exports have risen. But you made the false claim that rising LNG were the driving force behind overall export growth, which of course is false. But now you are trying to weasel out of your original claim.

Look dude – your inability to read or write clearly does not give you license to LIE. Which is what you did.

“But for some reason this triggered pgl and MacroDuck…neither of whom managed to add any new data!”

Now that is truly a lie. BTW – check out the new post. Just try to accuse Dr. Chinn for not providing reliable data. I dare you. BTW – Dr. Chinn points out where you completely misrepresenting your own link.

Johnny boy is so dumb that after he realizes he is in a deep hole, he just keeps digging!

JohnH,

Looks like you were inaccurate about your numbers, and you also have provided zero significance for this issue at all, whatever the numbers.

BTW I am NOT claiming that the US is in a recession. What I am claiming is that the average American is experiencing a recession due to real earnings having regressed to 2019 levels. Strange that economists have no word for this. And it’s strange that an economist like Rosser does not understand that GDP growth does not necessarily correlate with income growth of average Americans. Obviously, players besides labour are experiencing while average worker income regresses.

Decline in real wages Not recession in real wages. Oh wait you suscribe to the Princeton Steve Dictionary of Economics. Got it!

JohnH,

It looks like real wages and real per capita income are now rising, even if they were declining earlier. And again, declining real wages do not a recession make, no matter how much you want to claim otherwise.

Speaking of Putin – JohnH as his little lapdog is angry we are exporting LNG to European nations helping Ukraine fight off Putin’s war crimes. I bet that is the real reason is so worked up that he makes claims he cannot back up.

pgl,

I suspect you are right, although I do not see what on eaeth he gets from reporting that the US is helping Europe out at this time when they have lost natural gas imports from Russia. Does he want the US to stop this exporting so those naughty Europeans will get all angry with Zelenskyy and stop supporting him?

Really, JohnH’s Putin trolling is truly despicable.

Me thinks Hershel Walker needs to SHUT UP before he insults everyone:

https://www.msn.com/en-us/news/politics/herschel-walker-just-gave-the-worst-definition-of-a-man-yet/ar-AA13xwF2?ocid=msedgdhp&pc=U531&cvid=c220e9c2d0dc4ac58b86a9a56c28bf17

Walker was having a friendly discussion with Rock Springs Church’s Pastor Benny Tate in Milner, Georgia, and he started making fun of transgender people, comparing living one’s life authentically to identifying as a cat.

“I’ve preached here 32 years, and I’ve always said, you got a man, you got a woman, womb-man,” Tate replied. “If you don’t know what you are, if you have a womb, you’re a woman.”

Walker decided to jump in with the definition of a man.

“If you can’t have, if you can’t produce a child, you’re a man,” he said, sounding satisfied that he achieved the same level of wordplay that Tate did even though he missed the mark. The audience laughed.

Online, people pointed out that there are many people who aren’t men who can’t produce children, making the point that providing a definition that is broad enough to include everyone who is a man or a woman and narrow enough to exclude everyone who isn’t is actually complicated.

That is even before we get into the complicated world of real doctors who find that some babies are born with both sets of genitals or with something that is literally impossible to decide on. Is that a huge clitoris or a small penis? Is that something politicians like Walker, preacher boys like Tate or doctors and parents should decide?

There was a jump in imports beginning in March which has been reversed, accounting for the improvement in net exports:

https://fred.stlouisfed.org/graph/?g=VpYi.

That short-term adjustment in imports (Container glitch? Dunno, but it was geographcally widespread) confuses any effort to assess an underlying trend..

GDPNow anticipates continued improvement in net exports in Q4. Dollar strength suggests deterioration in net exports. Given the distortion in imports and incomplete data for Q3, my money is on “Ask again later”.

Donald Trump Jr. comments on the violent attack on Paul Pelosi and acts like the pathetic little jerk we all knew he could be:

https://news.yahoo.com/trump-jr-comments-paul-pelosi-042712593.html

Donald Trump Jr. commented on the recent home invasion and attack on Paul Pelosi, the husband of House Speaker Nancy Pelosi, saying it should motivate Democrats to address violent crime more seriously. In a post on Truth Social Saturday afternoon, the former president’s son accused Democratic lawmakers of not doing enough to help ordinary citizens, given their wide reaction to Friday’s break-in. “Imagine how safe the country would be if democrats took all violent crime as seriously as they’re taking the Paul Pelosi situation,” Trump Jr. wrote to his 2.6 million followers on the platform. “They simply don’t care about you,” he added in the post.

Don Jr. – even more disgusting than his dad.

https://english.news.cn/20221028/3cf7d61695104edbb572b675b642e3bc/c.html

October 28, 2022

China’s international trade in goods, services up 10 pct in September

BEIJING — The export and import of China’s international trade in goods and services in September, 2022, hit 4.2833 trillion yuan (about 615.2 billion U.S. dollars), up 10 percent compared with the same time last year, the State Administration of Foreign Exchange said Friday.

Of the total, export of goods recorded 2.1291 trillion yuan and import of goods reached 1.6454 trillion yuan, resulting in a surplus of 483.7 billion yuan.

Export of services recorded 213.1 billion yuan and import of services totaled 295.7 billion yuan, resulting in a deficit of 82.6 billion yuan.

In terms of the major items, the export and import of transport services, other business services, travel services, and telecommunications, computer and information services registered 185.4 billion yuan, 89 billion yuan, 81.3 billion yuan and 51.7 billion yuan respectively.

https://english.news.cn/20221027/d6d60f57204045f19c9ca343cf64edf8/c.html

October 27, 2022

China’s FDI inflow surpasses 1 trln yuan in Jan-Sept

BEIJING — Foreign direct investment (FDI) into the Chinese mainland, in actual use, expanded 15.6 percent year on year to 1.00376 trillion yuan in the first nine months of the year, the Ministry of Commerce said Thursday.

In U.S. dollar terms, the inflow went up 18.9 percent year on year to 155.3 billion U.S. dollars.

The service industry saw FDI inflow jump by 6.7 percent year on year to 741.43 billion yuan, while that of high-tech industries surged by 32.3 percent from a year earlier, data from the ministry showed.

Specifically, FDI in high-tech manufacturing rose 48.6 percent from the same period a year ago, while that in the high-tech service sector surged 27.9 percent year on year.

During the period, investment from Germany, the Republic of Korea, Japan, and the United Kingdom climbed by 114.3 percent, 90.7 percent, 39.5 percent, and 22.3 percent, respectively.

FDI flowing into the country’s central region reported a year-on-year increase of 34.8 percent, followed by 33 percent in the western region and 13.3 percent in the eastern region….

https://english.news.cn/20221029/f5a992c5ed24422a8ed7c878d04ce143/c.html

October 29, 2022

Pilot FTZs gear up China’s high-quality opening up

* In 2013, China’s first pilot free trade zone (FTZ) was launched in Shanghai. In less than 10 years, the number of such zones has surged to 21.

* The speedy expansion of pilot FTZs demonstrates China’s firm determination to open wider and share development opportunities with the rest of the world.

* By virtue of their significant role in boosting high-level opening up, pilot FTZs have become China’s new high ground for financial innovation and reform.

HEFEI — In the Hefei area of the pilot free trade zone (FTZ) in east China’s Anhui Province, Volkswagen Anhui MEB (Modular Electric Drive Matrix) plant construction is in full swing, with mass production of electric vehicles scheduled for 2023.

Several kilometers from the MEB plant, the Dazhong College, co-built by Volkswagen Group China, Volkswagen Anhui and Hefei University, has started running in the pilot FTZ. Inspired by Germany’s vocational education system, the college is aimed at cultivating more skilled talent suiting the needs of enterprises.

Established in 2017 in the provincial capital Hefei, Volkswagen Anhui focuses on the research, development and manufacturing of new energy vehicles (NEVs) to tap into the world’s largest NEV market.

“The pilot FTZ has provided not only many convenient services and support for our projects, but also help for foreign staff’s daily lives in the zone, boosting the confidence of foreign enterprises,” said Ronny Buechner, head of government relations of Volkswagen Anhui.

Last month marked the second anniversary of the inauguration of the Anhui pilot FTZ. In the first half of this year, it generated foreign trade of 95.93 billion yuan (about 13.38 billion U.S. dollars), up 28.5 percent year on year, according to the administration office of China (Anhui) Pilot Free Trade Zone.

Pilot FTZs serve as “test fields” for China to advance reform and opening up. In 2013, China’s first pilot FTZ was launched in Shanghai. In less than 10 years, the number of such zones has surged to 21, located in both coastal economic hubs like Guangdong and Zhejiang and inland regions such as Sichuan and Shaanxi.

The Shanghai pilot FTZ is now home to automaker Tesla’s first Gigafactory outside the United States, which began construction in January 2019. In mid-August, the Gigafactory hit a new milestone with its 1 millionth vehicle produced….

It seems a lot of LNG production will be from Qatar. Now the West’s multinational’s will have a 25% share of this action but it will still be Qatar exports:

https://www.barrons.com/articles/conocophillips-takes-major-new-chunk-of-qatar-gas-expansion-01667131806

US oil giant ConocoPhillips on Sunday agreed to take another major stake in Qatar’s expansion of natural gas production, the Gulf state’s energy minister said. Energy Minister Saad Sherida al-Kaabi also said Qatar was talking with Asian nations — the major market for Qatari gas — over a share in its campaign to increase annual production by 60 percent to 126 million tonnes a year by 2027. ConocoPhillips will have a 6.25 percent share in Qatar’s North Field South project, part of the world’s biggest proven natural gas reserves, Kaabi said at a signing ceremony with the US firm’s chairman Ryan Lance. France’s Total Energies and Britain’s Shell both have 9.37 percent stakes in the field, while state-owned Qatar Energy has the remaining 75 percent. Industry sources said the foreign firms are paying a total of about $5 billion for the joint 25 percent share in North Field South that will produce about 16 million tonnes of gas a year. ConocoPhillips and the other Western firms also took key stakes in North Field East this year. Kaabi told a press conference the latest deal “further strengthens our long and fruitful strategic relationship” with the US company.

Lance called it a “another milestone in our company’s business presence in Qatar”. Despite Europe’s campaign to secure new gas supplies, Japan, South Korea, China and India are the major markets for Qatar, which is locked into long-term deals with the Asian nations. Kaabi said the nations could take “a small equity participation” in the expansion. “That discussion is still ongoing with several Asian buyers.” The two officials both hit out at reports that the US administration could limit exports of oil and other energy products in a bid to keep down US prices. Lance said that restricting what goes onto global markets would increase international and US prices. “It’s a policy, or a thought, that has short term impacts, but long term it is not good for the United States,” he said. Kaabi, whose country has reaped big profits from the international price surge, said “market dynamics” should dictate prices and volumes. “Any restriction — whether it is Asian, European or American — to try to cut oil price by limiting supply, is not something that will be helpful to the market in the long term,” he warned.

“Either way it will be damaging to free trade.”

https://www.msn.com/en-us/news/politics/cnn-s-dana-bash-smacks-down-rick-scott-claim-democrats-cut-medicare-by-allowing-drug-negotiations/ar-AA13xM4z?ocid=msedgdhp&pc=U531&cvid=ca6247d83871450388620c789f766d32

Check out this interview where Rick Scott tried to duck the fact that he wants to cut Medicare benefits by accusing Biden of reducing Medicare benefits by a whopping $280 billion. Now Biden did allow Medicare to push back on the high prices of treatment which Rick Scott dubs as a benefit cut. Yea – Republicans do lie a lot.

If you don’t want financial Armaggedon, don’t vote for GOP candidates.

https://www.cnn.com/2022/10/29/investing/us-treasuries-risk/index.html

We know they get concerned about debt only when a Democrat is in the white house, and we know they will take it to the brink.

LeBron James warns Elon Musk over an alarming amount of racial slurs on Twitter and it seems Musk has looked into this. Chalk this back and forth as a win for Lebron.

https://www.msn.com/en-us/sports/nba/elon-musk-responds-to-lebron-james-tweet-about-scary-af-racial-slurs-on-twitter/ar-AA13xBfw?ocid=msedgdhp&pc=U531&cvid=3408ffee31a24c92801a77922933e013

In off-topic news, Russian oil export forecast –

https://www.reuters.com/markets/commodities/exclusive-russias-finance-ministry-cuts-2023-taxable-oil-expectations-2022-10-28/

“Russia’s finance ministry has significantly cut expectations of taxable oil production for 2023, according to the draft budget for the next three years, in the expectation Western sanctions will mean an overall decline in output and refining volumes.”

A fall in “taxable oil production” could mean two different things. Let’s hope this is a fall in Russian oil revenues which will cramp Putin’s war crimes even if this would really make old JohnH really sad.

But wait – the Russian oligarchs are really good at transfer pricing abuse which means in their case shifting taxable oil income to their Cyprus affiliates (or other tax havens). So how do we know that the reduction in TAXABLE oil production is actually a reduction in actual oil revenues?

External environment? The world’s first global energy crisis:

https://www.iea.org/reports/world-energy-outlook-2022

MD claims this is: “world’s first global energy crisis” Really? This energy crisis is too similar to that of the 70s, but this is due to even ignorant and crazy energy policies: “At the end of last year, overall fossil fuels represented 81% of energy consumption. 10 years ago, they were at 82%,” says Jeff Currie. “$3.8 trillion of investment in renewables moved fossil fuels from 82% to 81% of the overall energy consumption.” https://twitter.com/SquawkCNBC/status/1576921977754902528

And to clarify, since ~1908 fossil fuel usage has gone from 85% to the current 81%.

Is this energy crisis even Global? Are all countries involved? Are the OPEC+ countries still included in the world? Is the US Mexico and Canada in crisis, such that they have stopped exporting?

Only the willfully ignorant believe these exaggerated claims. At least you’re saving the planet from those terrible fossil fuels.

Wait – the facts are that we are still relying a lot on fossil fuels but you claim that Biden’s alleged energy policies have starved us off of fossil fuel consumption? Hey CoRev – all that barking and chasing your tail has rotted whatever excuse you ever had for brain cells.

Bark, bark why the need to lie? “… you claim that Biden’s alleged energy policies have starved us off of fossil fuel consumption? ” Care to show us that quote?

Never mind you’ll just run away again for the Nth time.

My God – that reply was nothing more than your usual gibberish. Run away from what? You offer nothing and yet you think you made a point? You are dumb.

Bark, bark I see instead of running away, you just stayed barking more and louder. How more infantile can you get?

CoRev relies on some moron on CNBC’s Squawk Box for his analysis of the energy market? Yea – he is that stupid. Now if one follows the thread on the Twitter, a few decent questions were posed to this incredibly stupid original tweet. I guess CoRev forgot to read the whole thread.

Bark, bark claims: ” Now if one follows the thread on the Twitter, a few decent questions were posed to this incredibly stupid original tweet.” There are no examples from this clueless liar of what constitutes a decent question, but with his history it will surely be something with which he agrees, blindly.

BTW, this is who he claims is a moron on Squawk Box: – Dr Jeff Currie is an economist and the Global Head of Commodities Research in the Global Investment Research Division at Goldman Sachs….Currie earned a Master of Arts Economics at the University of Chicago in December 1990, and a PhD in economics from the university in June 1996.

Wow – you checked credentials for once? What he said was utter gibberish so maybe that is why he got just an MA. BTW – calling oneself a Dr. after getting an MA is dishonest resume padding. So your credentials check only shows how dumb you are.

This so typical of his lying: “…calling oneself a Dr. after getting an MA is dishonest resume padding. So your credentials check only shows how dumb you are. ” while ignoring this in the very same comment: “and a PhD in economics from the university in June 1996.”

I continuously wonder why liberals have this need to lie!?

Then I do understand that their preferred polices, on display for the past two years, are a disaster for which they are about to be reminded by the voters.

IEA claims this is the world’s first globalenergy crisis. Read the link. Only the willfully ignorant don’t bother to read the link. Not reading the link is kinda the definition of willfull ignorance.

CoRev,

I shall agree with you on one point and only one. it is bizarre for an outfit as reputable as Reuters to somehow claim that this is the “world’s first global energy crisis.” Indeed what happened in 1973 and 1979 was much worse than what is going on now, with both certainly qualifying as “global energy crises.”

Beyond that, you once again as usual fall into spouting a lot dumb dreck.

Fair warning – the link is a dishonest hate filled attack on Paul Pelosi. The only reason I posted this disgusting link is that Elon Musk forwarded it on the Twitter:

https://www.smobserved.com/story/2022/10/29/news/the-awful-truth-paul-pelosi-was-drunk-again-and-in-a-dispute-with-a-male-prostitute-early-friday-morning/7191.html

Maybe Musk should shut his new toy down as he cannot be trusted with it.

Apologies for another China comment. The level of China trivia cluttering up comments is annoying, I know. This article, however, provides actual substance:

https://thediplomat.com/2022/10/chinas-gradual-reform-dilemma/

The upshot is that entrenched business and local governments are blocking gradual reform, while national political leaders refuse to attempt anything other than gradualism out of fear for their own positions. Not that different from the behavior of entrenched interests elsewhere. Basic (lower case “c”) conservatism.

Extremism? Not for much longer in Brazil, apparently. Well, unless Bolsonaro suceeds where Trump has so far failed.

https://www.cnn.com/2022/10/30/americas/brazil-election-lula-da-silva-wins-intl

Is this post just another noise study as would immediately become obvious if you included error margins on the graphs?