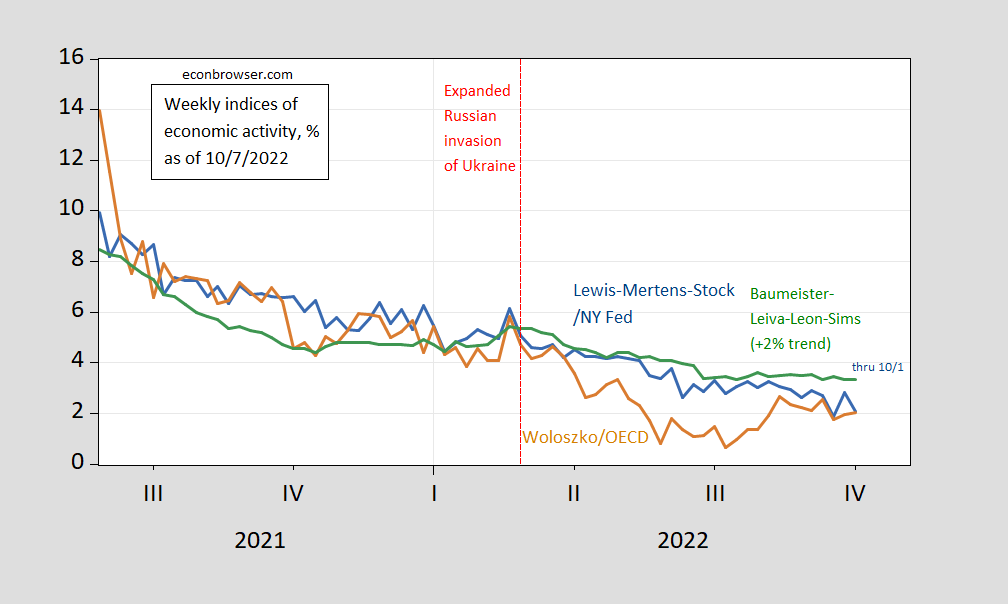

As measured by NY Fed WEI, OECD Weekly Tracker, and Baumeister, Leiva-Leon and Sims WECI.

Figure 1: Lewis-Mertens-Stock (NY Fed) Weekly Economic Index (blue), Woloszko (OECD) Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green) Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The WEI fell from the previous week, down to 2.1% from 2.8%, while the Weekly Tracker continued to rise. The divergence, which is not surprising, given the large differences in methodologies, has closed in recent weeks. The WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales). The Weekly Tracker — at 2.0% — is a “big data” approach that uses Google Trends and machine learning to track GDP.

The WEI reading for the week ending 10/1 of 2.1% is interpretable as a y/y quarter growth of 2.1% if the 2.1% reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 2% is interpretable as a y/y growth rate of 2% for year ending 10/1 (this series was revised downward noticeably from last release). The Baumeister et al. reading of 3.4% is interpreted as a 1.4% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 3.4% growth rate for the year ending 10/1.

Since these are year-on-year growth rates, it’s possible we were in a recession in H1 as one observer suggested a bit over a month ago, but it (still) seems unlikely.

One observer – the gift that keeps on giving!

Steven Kopits

August 23, 2022 at 8:14 am

Cratering housing market. See CR.

CR = CalculatedRisk aka Bill McBride who NEVER said the housing market is cratering. Stevie just made that up too.

The housing market is slowing dramatically to the point of freezing. Interest rates matter and the data lags dramatically. It’s even more dramatic now as every move is in real time even as the data lags. Not saying anything about CR or Steve or a recission. Just saying in the now now things have stalled. How do I know? I’m living it and nothing is moving except the under $200,000 end as rents are very high; so renters are trying to buy. But moving up is dead as everyone with an under 5% mortgage from the last 12 years is not moving up and so the intermediate “move up” market is cratering. How do I know? I’ve repriced my house down $200,000 in the last 30 days and doing the interest rate calculation that may not be enough to get the monthly payment comparable given higher interest rates.

This is not a criticism of anyone; merely a real time experience being reported. As the sale of my house matters for the house I’m contracted to purchase it all matters as I will probably eat the deposit and sit tight. I just wish everyone would do what we used to do online and that is figure out where we’re going rather than wanting to be right. Everyone has opinions and really who cares about that? What matters is where we’re going with real time data. The whole GOTCHA thing is just old and boring and not helpful.

And now a lament. I miss the old days when stupidity was not rewarded with a response. I miss when anne wasn’t Itr. I miss when pgl wasn’t angry. I miss paine and his poetic insights. I miss when Steve was not so wedded to his political views and had a very useful perspective. I miss Tanta and her amazing insights and all the very helpful comments. I understand that is over; but it doesn’t mean I don’t miss moderate discussion and apolitical insights.