Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.

In recent months, there has been a great deal of discussion in the financial media about how aggressive Fed tightening has pushed up the dollar and poses (at least) two dangerous consequence for the global economy. First, higher U.S. interest rates and a stronger dollar are creating difficulties for emerging market economies (EMEs), which must buy dollars to repay their dollar debts with cheaper local currencies. And, second, those cheaper currencies, in advanced as well as emerging market economies, are boosting import costs, adding to already-strong inflationary pressures, and forcing foreign central banks to tighten their own monetary policies. Both these developments purportedly are pushing the world into global recession.

There is some truth to these concerns. A rising dollar is one of the channels through which U.S. monetary policy tightening helps cool the economy, and this inevitably involves exporting a certain amount of our inflation to other economies. It is also true that, historically, tighter Fed policies have meant bad news for EMEs: plunging currencies, rising credit spreads, and disruptive capital outflows.

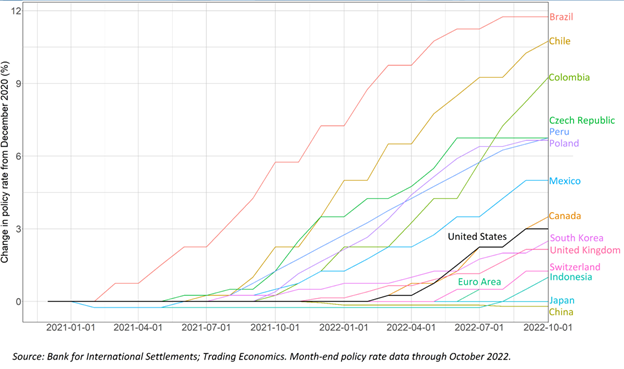

However, as I explore in my recent note, Will the Strong Dollar Trigger a Global Recession, much of the current discussion exaggerates the role of Fed tightening and dollar appreciation in darkening prospects for the world economy. First, contrary to the impression conveyed by many commentators that the Fed has been exceptionally aggressive, central banks in many countries started tightening monetary policy before the Fed and most of them raised rates by a great deal more.

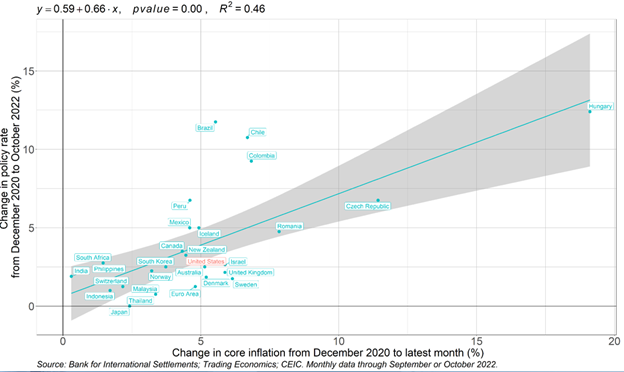

Countries with larger increases in core inflation (excluding food and energy) generally implemented larger increases in interest rates—the Fed’s response to inflation has been very much in line with that relationship.

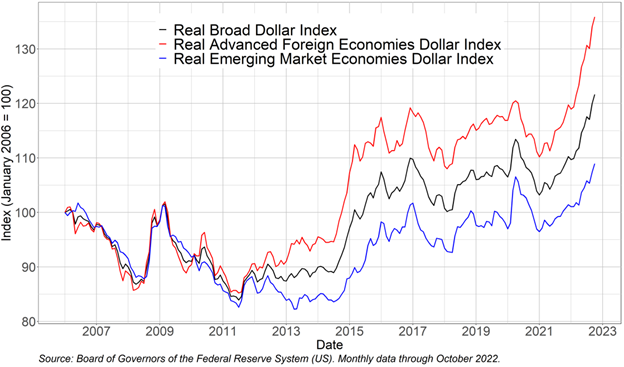

Second, the strong dollar is putting less pressure on EMEs than is generally believed. Most discussions of this issue focus on the dollar’s value against the currencies of the advanced economies. Even after giving up some of its gains in the past week, this is up about 15 percent since the beginning of 2021, based on Federal Reserve data. By contrast, the value of the dollar against the currencies of our EME trading partners is up only about 8 percent over the same period.

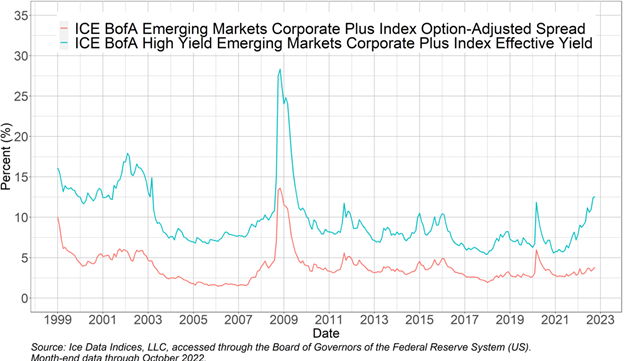

This smaller rise in the dollar against the EMEs translates into a smaller rise in their debt burden. Indeed, so far this year, most of the major EMEs have held up reasonably well. As shown below, credit spreads over U.S. Treasuries on dollar debt owed by EMEs, a good measure of the market’s assessment of their creditworthiness, have widened on average but generally remain with historical ranges. To be sure, high-yield spreads for especially fragile economies, such as Sri Lanka, Pakistan, and Argentina, are rising more, but these largely reflect their own fundamental imbalances and, in any event, are unlikely to drag the global economy into recession.

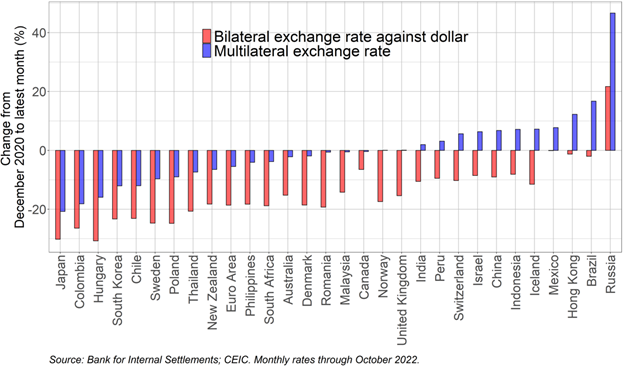

Finally, the role of the strong dollar in boosting inflation abroad has been exaggerated. Because nearly all currencies have fallen against the dollar, each foreign economy’s “multilateral exchange rate”—that is, its average exchange rate against all of its trading partners—has fallen by much less (or even risen) than its “bilateral” rate against the dollar. In consequence, the foreign economies experienced smaller increases in import costs and thus consumer prices than would be implied by the depreciations of their currencies against the dollar alone. (In addition to imports from the United States, commodity prices such as oil are also invoiced in dollars, but their prices generally fall when the dollar rises.) And this means that foreign central banks have had to tighten monetary policy by less.

Summing up, the rise in the dollar poses challenges for the global economy, but those challenges should not be overstated. A narrow focus on the strong dollar underplays what are undoubtedly the more salient forces pushing the world economy toward recession: elevated energy and food costs; energy shortages, especially in Europe, resulting from Russia’s invasion of Ukraine; soaring inflation rates prompting central banks around the world to tighten monetary policy; China’s growth-strangling zero-COVID policy; and economic scarring and debt buildups left as the legacy of the COVID-19 pandemic.

This post written by Steven Kamin.

https://news.yahoo.com/iran-threatened-families-world-cup-131028591.html

Iran threatened families of its World Cup team after players refused to sing the national anthem, report says

I have said this before but this pathetic government of Iran should leave its football players alone. Come on FIFA – do something for the players for a change. Of course, this pathetic natioanalistic BS is the kind of garbage Trumpians inflict on American players.

A nice piece. I thought this was particularly interesting:

“First, contrary to the impression conveyed by many commentators that the Fed has been exceptionally aggressive, central banks in many countries started tightening monetary policy before the Fed and most of them raised rates by a great deal more. Countries with larger increases in core inflation (excluding food and energy) generally implemented larger increases in interest rates—the Fed’s response to inflation has been very much in line with that relationship.”

It sounds like we used to assume the incompetence of developing countries’ central banks. Maybe that’s not appropriate anymore.

Unfortunately, that still leaves us with Russia’s weaponization of Europe’s dependence on imported gas.

“contrary to the impression conveyed by many commentators that the Fed has been exceptionally aggressive, central banks in many countries started tightening monetary policy before the Fed and most of them raised rates by a great deal more.”

Perhaps my main concern – a globally coordinated monetary contraction. A query, however, if the other Central Banks did start tightening earlier and by more, why is the dollar appreciating and not devaluing?

dollar weakening against the yen, euro and pound the past couple of weeks,

why should the stronger old nag in line for the glue factory decline?

https://fred.stlouisfed.org/series/DEXUSEU/

Oh wow – the Euro now buys $1.03. And that changes the overall point that the dollar has appreciated in the last several months? Excuse me troll but YOU ARE DUMB.

yen and pound, too

no excuse

A.,

Regarding the pound, it massively collapsed a couple of months ago when Truss was PM and put forth her budget plan to cut taxes on the wealthy, which triggered a major financial crash including of the pound, resulting in her removal from office and replacement by the more responsible Sunak. Big surprise that pound recovered somewhat after that, but still very low by longer term perspective.

Did you have a point there? Please try learning how to WRITE. Damn!

Peter Doocy pulls a Bruce Hall and gets humiliated by John Kirby:

https://www.mediaite.com/news/thats-not-an-accurate-take-kirby-dismisses-fox-newss-peter-doocy-on-domestic-oil-production/

“And on the sanctions relief for Venezuela. Yes. Why is it that President Biden would rather let U.S. companies drill for oil in Venezuela than here in the U.S.?” Doocy asked, referencing the Biden administration lifting a key provision in its sanctions on Venezuela to allow for U.S. oil companies to drill in the country. “That’s not an accurate take on the president’s view,” said Kirby.

“Earlier this month, he said, ‘No more drilling. There is no more drilling,’” pushed back Doocy, quoting Biden from early November. “The president has issued 9,000 permits for drilling on U.S. federal lands, Peter, 9000 of them being unused. There are plenty of opportunities for oil and gas companies to drill here in the United States,” Kirby replied, adding: I’ll let Chevron speak for this particular issue of sanctions relief. But our expectation is it won’t be a lot of oil coming out of there. It will have to be shipped to the United States. “Does the president think there’s some benefit to the climate to drill oil in Venezuela and not here?” pushed Doocy. “No, this has nothing to do with a benefit to the climate here again. There are 9000 unused permits here in the United States on federal land that oil and gas companies can and should take advantage of,” responded Kirby, adding: 9,000! And we’re talking about one there in Venezuela. Now, look, it remains to be seen how much will get drilled down there. It will be up to Chevron to decide that, Peter. But as a function of the sanction itself, that oil, whatever product is drilled, has to come to the United States.

Yes – Doocy is a pathetic little idiot but every bit of his BS has been spewed by Brucie over and over. I guess this is what one gets when one wears a MAGA hat all day.

doocy being doocy! kirby being kirby

permits/opportunity do not equate to business case to drill.

much more than permits involved

an end to that ukraine thing and oil goes surplus world wide.

and the opec+ is planning more crude capacity.

what will doocy say when kirby touts permits to build new refineries…..

The Fed catches hell more or less any time it pursues non-neutral policy. The dollar is the most used currency in the world, the U.S. economy the largest in the world by most measures, so Fed policy is consequential for the world. Setting aside Fed policy error, what would squawkers have the Fed do differently? Is there reason to think that some policy which is sub-optimal for the U.S. would be optimal for the rest of the world?

“…high-yield spreads for especially fragile economies, such as Sri Lanka, Pakistan, and Argentina, are rising more, but these largely reflect their own fundamental imbalances.”

Let’s not be dismissive; Fed tightening does compound the problems faced by these economies. The Fed cannot chose its policy to suit fragile economies, but Fed policy does overturn apple carts.

“…narrow focus on the strong dollar underplays what are undoubtedly the more salient forces pushing the world economy toward recession: elevated energy and food costs; energy shortages, especially in Europe, resulting from Russia’s invasion of Ukraine; soaring inflation rates prompting central banks around the world to tighten monetary policy; China’s growth-strangling zero-COVID policy; and economic scarring and debt buildups left as the legacy of the COVID-19 pandemic.”

Wait…you mean it’s not all Biden’s fault?

of course it is not biden’s fault…. strong dollar that is…

Good news for Senator Warnock:

https://www.msn.com/en-us/news/politics/georgia-shatters-early-vote-record/ar-AA14Hajq

Georgia appears to have broken its record for early vote turnout in a single day, according to Gabriel Sterling, the Chief Operating Officer for the Georgia Secretary of State. More than 300,000 Georgians voted early on Monday, shattering a previous early voting record of over 233,000 votes in one day.

I suspect this means Hershel Walker will not have to be a Senator which could mean he gets to spend more time dating those cows he likes so much.

Given that indeed other nations have been raising interest rates as well as the US, I confess to being at least somewhat mystified by the strength of the USD recently. My guess is it reflects ongoing strength of the GDP of the US, although that does not necessarily lead to a strong currency, especially given that a strong GDP tends to increase imports but not exports.