Remarks by a reader indicate it’s worthwhile to recap this topic. Consider:

If markets are informationally efficient, corporate news events such as earnings announcements should be immediately reflected in stock prices. Now, actually checking stock-price reactions to corporate events is also not as straightforward as it sounds. But Gene and his coauthors provided the standard solution to all of the empirical difficulties that survive to this day. The immense event-study literature followed, allowing academic accounting to measure the effect of corporate events by the associated stock price movements.

If markets are informationally efficient, corporate news events such as earnings announcements should be immediately reflected in stock prices. Now, actually checking stock-price reactions to corporate events is also not as straightforward as it sounds. But Gene and his coauthors provided the standard solution to all of the empirical difficulties that survive to this day. The immense event-study literature followed, allowing academic accounting to measure the effect of corporate events by the associated stock price movements.

This is from a discussion of Fama’s contributions. And what is an event study? From Investopedia:

An event study is an empirical analysis that examines the impact of a significant catalyst occurrence or contingent event on the value of a security, such as company stock.

Now consider these comments in response to this post:

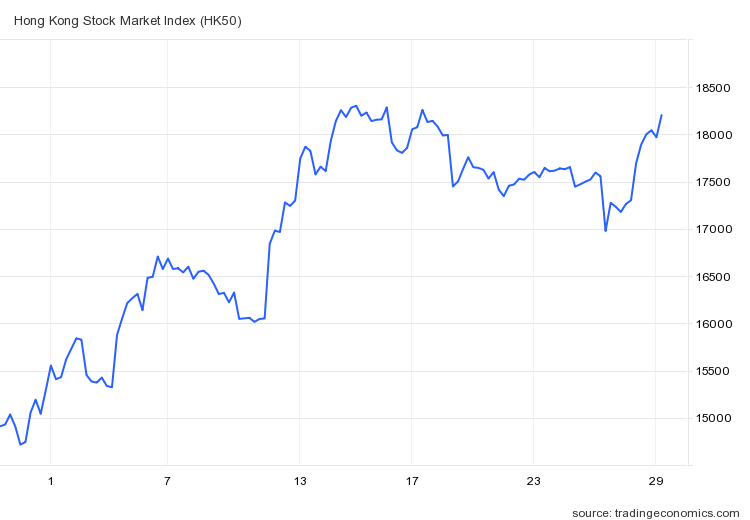

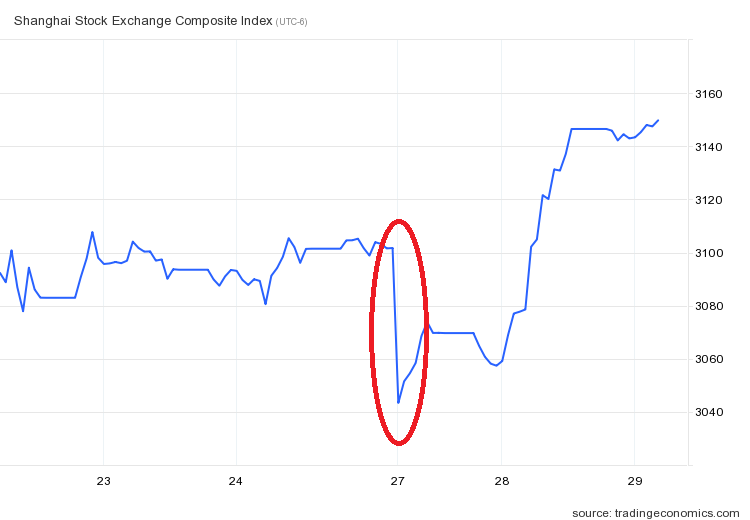

No update? The Shanghai Composite, USD:Yuan, and Hong Kong Index each recouped these relatively modest (e.g. Shanghai was only ~-2% and HK ~-3.8%) Nov 27 losses.

It’s also important to note that Menzie’s cherry-picked data sample magnifies the shock-value of recent (transitory) losses. The same datasets viewed from merely a month back would’ve shown this week’s declines as nothing much more than returns to recent levels.

Always beware economists ringing alarms.

Here is the updated graph for the Shanghai composite:

Figure 1: Shanghai 30 index.

The event I focused in on my 27 November post on is shown in the red circle is what I focused in. The point was the outbreak of widespread protests, as “news”, as shown in one-week-detail below:

Figure 2: Red circle denotes response to protests.

For an example of the application of the concept of “news” in efficient markets, see this post.

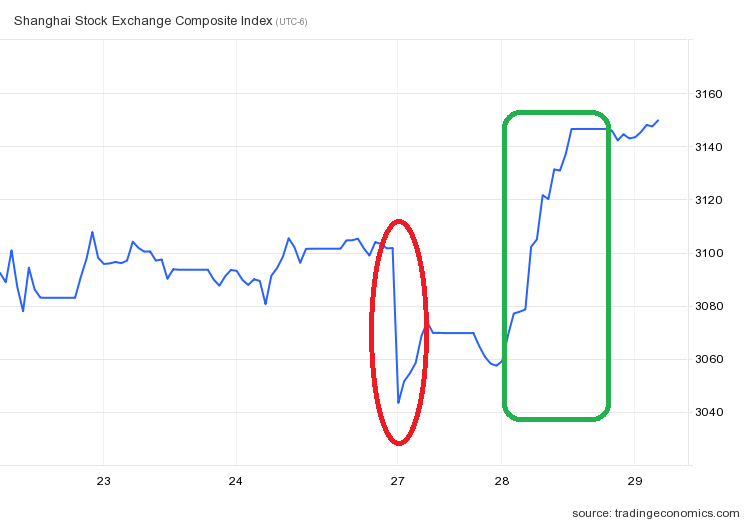

The reader brings out attention to the recouping of losses on Tuesday (local time). However, it’s not as if nothing happened on Tuesday. Rather, as indicated in the WSJ:

Hong Kong’s benchmark Hang Seng Index jumped 5.2% on Tuesday, ending on a high after China’s national health authority talked down the risks of the Omicron variant of the coronavirus and said it would increase vaccinations for the elderly.

The move shows the government is still refining its approach to Covid-19, one of the biggest concerns of global investors. China’s strict Covid-19 policies recently fueled protests across the country, something that was partly to blame for falling markets in both Hong Kong and the U.S. on Monday.

Tuesday’s rally was also helped by a move by China’s securities regulator to loosen restrictions on property companies raising equity funding in its domestic market, a source of capital they haven’t had access to for years, said strategists. Chinese developer Longfor was among the best performers, rising more than 11% in Hong Kong.

…

China’s CSI 300 index rose 3.1% Tuesday, while the Shanghai Composite increased 2.3%.

This is shown in the green rectangle in the figure below:

Figure 3: Green rectangle denotes government policy measures to support real estate sector, increased vaccination for elderly.

In other words, not all else was held constant on Tuesday.

I didn’t think I’d need to explain this concept, but apparently I do. Here is an earlier application of the “news” concept (again China-related, but this time hogs).

Addendum:

According to Han and Kong (2020), the standard deviation of Shanghai stock price is 1.6% (2001-2020).

“In other words, not all else was held constant on Tuesday.”

Correct me if I’m wrong but didn’t Paul Samuelson explain something called the Efficient Markets hypothesis some 60 years ago. Look – lots of events impact stock valuations. But I guess Econned never bothered to read anything of substance on valuations.

Did I say 60 years ago? No – this was published 57 years ago:

Samuelson, Paul “Proof that properly anticipated prices fluctuate randomly”. Industrial Management Review, 1965.

Before Econned makes another arrogant yet incredibly STUPID comment, he should be required to READ this classic.

Just curious about the gains for the Shanghai 30 index during the first half of November. Does anyone know what event(s) may have been driving that?

Please only informed comments as I do not want to hear from Know Nothings like Econned silliness such as Irrational Chinese Exuberance or some Princeton Stevie pooh’s bubble mania.

On another topic. I hope Tyler Adams leads his team to a big win over Iran. We need a win to advance.

“Green rectangle denotes government policy measures to support real estate sector, increased vaccination for elderly.”

I have a different take.

The rapid rebound reflects traders’ perception that Beijing will back down on harsh COVID restrictions, in the face of wide-scale protests. That would open up a very broad economic growth prospect for the next few months.

David O’Rear: Yes, that could be part of it. But the measures to help the real estate sector were really there, and mark a continued diversion from the attempt to reform/deleverage the housing sector. And increasing elderly vaccination rates is clearly part of a plausible program to open up the economy. (I’d say using Western mRNA vaccines would be a more credible measure, but heck, we’re talking about the CCP).

Professor,

We do not disagree, but I place the urgency of the rise in the market index squarely on the new information — that the leadership would compromise — rather than the rather long in the tooth real estate and vaccination insights.

David,

The problem with your theory is that there has been zero news regarding actual Covid policy in China. If anything, I would say that if this spike is at least partly about Covid policy, it would be that the markets have figured out that the regime can probably crush the protests and thus maintain its policy, which is clearly what Xi Jinping wants in order to maintain fully his recently enhanced power.

Mr Rosser,

Didn’t you get the memo?

The Guardian, Nov 30, 2022: Covid restrictions lifted in Chinese city of Guangzhou after protests

https://www.theguardian.com/world/2022/nov/30/us-and-canada-urge-china-not-to-harm-zero-covid-protesters-amid-calls-for-crackdown

Reuters, Nov 30, 2022: Two Chinese cities ease COVID curbs after protests spread

https://www.reuters.com/world/china/covid-protests-escalate-guangzhou-china-lockdown-anger-boils-2022-11-30/

There are now some reports of possible small backdowns on Covid policy, most particularly that at least in some areas residential buildings will not be sealed off for more than 24 hours at a time. Perhaps speculation about that played a role.

https://www.msn.com/en-us/news/world/belarus-dictator-fears-for-his-life-after-minister-murdered-with-russian-poison/ar-AA14FtjV?ocid=msedgdhp&pc=U531&cvid=7a971f11d99741678cf28902c02ab78d

Hardline Belarus dictator Alexander Lukashenko fears he could be the next target after his foreign minister was ‘murdered’ with a poison produced by Russia’s spy agency, it is claimed. The death of Vladimir Makei has sparked panic in Belarusian political circles with president Lukashenko said to be in a state of shock. According to a Russian opposition figure, the president has ‘ordered that his cooks, servants and guards be replaced… and his children provided with additional protection’. It comes after Mr Makei, 64, died last weekend, reportedly of a heart attack, days before he was due to meet his Kremlin counterpart Sergey Lavrov in Belarusian capital Minsk. Exiled Israeli businessman Leonid Nevzlin, who was born in Russia but later renounced his citizenship, said sources told him Mr Makei had been killed ‘with a poison developed in a special laboratory of the FSB [Federal Security Service]’.

A lot of us keep wondering why JohnH tells so many lies in defense of Putin. But think about it folks. Jonny boy is a pet poodle in the Kremlin. So if he actually dared to criticize Putin as the war criminal he really is – Putin would probably poison Jonny boy too.

pgl,

The story does note that there are those doubting this theory, with this foreign minister having been very pro-Putin at least publicly. There is some speculation that it might have been the Poles or somebody else who did it. Not clear at all. After all, many of us thought maybe Putin was behind the bomb attack on Dugin’s daughter, only to have it come out later that it was the Ukrainians, with the US disapproving of the action.

I have seen a more recent report that claims that Makei was a main player in efforts by Lukashenka to keep lines open to the West. So, I think we do not know what is going on with this particular death, which could still be completely natural. Obviously Putin has been trying to pressure Lukashenka to send in troops, but it looks to me that Lukashenka is simply not going to go along with this, no matter how great Putin’s pressure gets.

Menzie,

You proclaim:

“ I didn’t think I’d need to explain this concept, but apparently I do. Here is an earlier application of the “news” concept (again China-related, but this time hogs).”

You don’t need to explain the concept to anyone but yourself – it takes a reader pointing out that ceteris is hardly ever paribus in the real world for you to reverse course. That’s the “life” concept that you don’t seem to grasp.

Still waiting for you to READ Samuelson’s 1965 paper. Oh wait – you flunked Finance 101. Never mind.

This is kind of amusing that “E—–d” is always complaining about our co=host highlighting questionable things commenters post here, and now he is the one getting highlighted. He has spent a lot of time claiming that this is all about egomania, when he himself seems to be the pot calling the kettle black, and I have repeatedly pointed out that I am much more egomaniacal, not taking a back seat to anybody here on that metric.

Even as he is getting ridiculed, I shall at least congratulate “E—–d” for actually making a substantive comment about economics here for once rather than just making personalistec assaults on people as he usually does. Too bad the comment turned out to be so easily ridiculed. Oh well.

Econned clearly has never read a single thing on what is a fundamental concept – the Efficient Markets Hypothesis. I asked this Know Nothing troll to read Samuelson’s 1965 paper but I guess it is WAY OVER his little brain.

“B——ey R——r”,

Menzie has regularly been infatuated with my presence and has penned prior posts devoted to said infatuation. Please do keep up.

Yes, Menzie has a huge ego problem as illustrated by his continual need to call out commenters in this fashion. It’s plain as day. Please do keep up.

Your admitted ego is irrelevant to the ego of another. Additionally, you being “much more egomaniacal” doesn’t prevent Menzie from being egomaniacal. Please do keep up.

What opinion should be held of someone who claims another is “actually making a substantive comment about economics here for once” but has also said that in the past about the same commenter? Please do keep up with your own comments.

I’m regularly feeling this “B——ey R——r” routine to be increasingly dull and quite boring – your strange obsession with me is fascinating but your continual online attempts at garnering my attention come across as quavering and really lacking in depth. Please do moderate your sildenafil citrate consumption.

“E—–d,”

Yet another comment by you without a shred of economic substance to it, just you being obsessed yet again with how other people comment on you. My estimate is that maybe in about 10 percent of your comments here you actually say something about economics rather than somebody else’s ego or obsession or whatever, mostly involving you.

So, please do keep up.

“B——-y R——r”,

Why would you expect my reply to your infatuation with me have anything to do with economics when your comment was void of anything relevant? That you fail to see it is you who is seeking my attention and not the other way around is hilarious for someone pretending to be an intellectual.

So, please do keep up.

Speaking of economics, I have another paper from Paul Samuelson for you

https://www.jstor.org/stable/3003046

Even the best investors seem to find it hard to do better than the comprehensive common-stock averages, or better on the average than random selection among stocks of comparable variability. Examination of historical samples of percentage changes in a stock’s price show that, when these relative price changes are properly adjusted for expected dividends paid out, they are more or less indistinguishable from white noise; or, at the least, their expected percentage movements constitute a driftless random walk (or a random walk with mean drift specifiable in terms of an interest factor appropriate to the stock’s variability or riskiness). The present contribution shows that such observable patterns can be deduced rigorously from a model which hypothesizes that a stock’s present price is set at the expected discounted value of its future dividends, where the future dividends are supposed to be random variables generated according to any general (but known) stochastic process. This fundamental theorem follows by an easy superposition applied to the 1965 Samuelson theorem that properly anticipated futures prices fluctuate randomly-i.e., constitute a martingale sequence, or a generalized martingale with specifiable mean drift. Examples demonstrate that even when the economy is not free to wander randomly, intelligent speculation is able to whiten the spectrum of observed stock-price changes. A subset of investors might have better information or modes of analysis and get above average gains in the random-walk model; and the model’s underlying probabilities could be shaped by fundamentalists’ economic forces.

Once again Econned proves he knows nothing about basic financial economics. But this worthless troll babbles on anyway.

one could fairly argue that econned is infatuated with prof chinn.

You are still chirping utter BS? I guess Samuelson’s 1965 paper was too difficult for you to understand.

Whoops. This should have been on the other thread, the one where the matter of “Econned”‘s comment was specifically addressed.

I have asked this worthless troll to address the financial economics noted in Samuelson’s 1965 paper many times. And the Know Nothing coward has yet to do so once.

Barkley – calling out this worthless piece of garbage is a waste of your time.