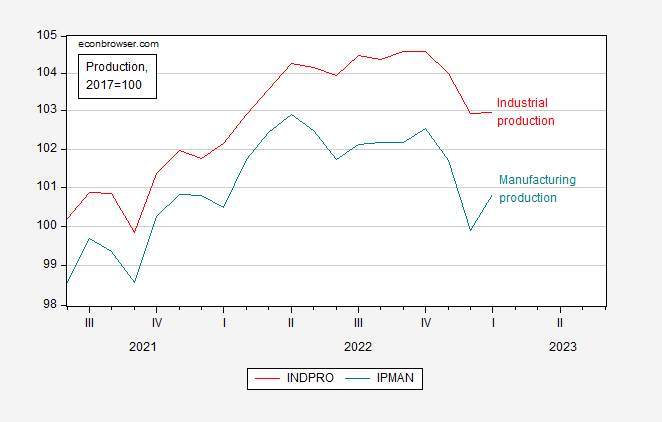

Industrial production at consensus, while manufacturing production and retail sales above. For conjunctural analysis, industrial production is what NBER Business Cycle Dating Committee pays more attention to.

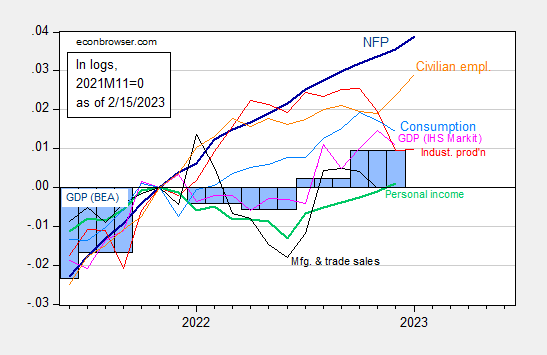

Figure 1: Nonfarm payroll employment, NFP (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (2/1/2023 release), and author’s calculations.

Manufacturing production, which is not directly influenced by weather conditions (namely warmer than expected), rebounded, 1% m/m, above 0.8% consensus.

Figure 2: Industrial production (red), and manufacturing production (teal), both 2017=100. Source: Federal Reserve Board via FRED.

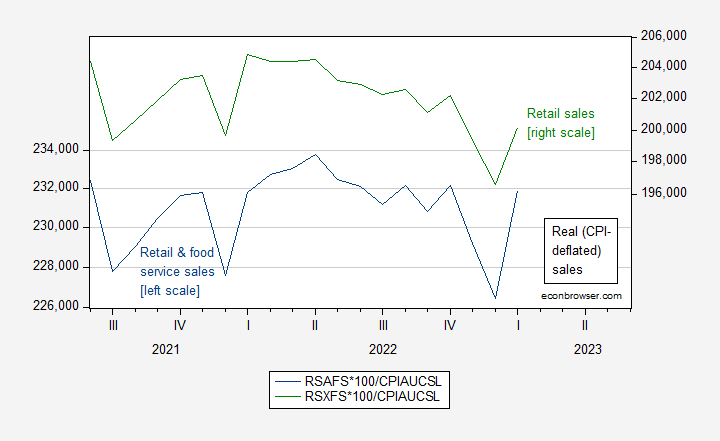

Finally, retail and food service sales — which gives us some insight into consumption, was also above consensus (3.0% vs. 1.8% consensus).

Figure 3: Retail and food service sales (blue, left scale), and retail sales (green, right scale), in 1982-84$ millions/month (CPI deflator). Source: Census via FRED, BLS, and author’s calculations.

The growth in retail sales suggests consumption remains strong.

Topical to now and general food for thought. Highly recommended:

https://jwmason.org/wp-content/uploads/2023/02/Rethinking-Supply-Constraints-1-23-23.pdf

Back to Russia. First, thanks for the piece from the Carnegie Endowment (Alexandra Prokopenko) on Russia’s economy. Helpful.

I think, however, some corrections and clarifications are appropriate.

First, Prokopenko writes

January 2022, when there was a budget surplus of 125 billion rubles ($25 billion), while revenues fell by over a third..

She is off by a decimal. The Jan. 2022 budget surplus was $2.5 bn, not $25 bn.

Further:

For this reason, there is no point in guessing what the budget deficit will be at the end of this year based purely on figures for the first month. Last September, for example, the government and analysts expected the budget deficit to not exceed 1.5 trillion rubles—and then came the additional spending surge in December.

That is, Prokopenko notes that the December budget deficit ($56 bn by my numbers) was worse than expected, the implication being that 2023 could also be worse than expected base on Jan. 2023 numbers. I will take the under.

Hidden reserves are indeed important, and Prokopenko alludes to these, but does not list them in any detail. It would be good to see these in table form.

Prokopenko writes:

This year, the Finance Ministry took note, and processed 11 percent of annual planned spending in January alone. If state contracts are excluded from the equation, then budget spending grew just 6 percent.

This is a bit of “Other than the shooting Mrs. Lincoln, how did you like the play?” State contracts — defense spending on the war in Ukraine — is the crux of it.

Since a significant portion of advance payments was made at the beginning of the year, it’s reasonable to expect remaining government expenditure to be distributed more evenly throughout the year.

I think it more likely that Russian defense vendors simply lacked the working capital to be able to post-invoice for delivered goods. That is, the respective manufacturers needed, say, tank construction to be pre-financed to set up production lines, hire people and purchase materials and other supplies. Personally, I doubt this gets better before it gets worse.

Finally, the most important point: the ‘collapse’ of the Russian economy. I personally do not know what the term ‘collapse’ means. The Germans were gamely fighting on in 1917 and 1945 well after their economies had collapsed.

The issue is rather the point at which ending the war looks better than the associated costs of continuing it, that is, the extent to which Russians are willing to tolerate lower social spending, higher taxes, mortality, and frankly, being hated by everyone. The calculus is quite different here than in, say, WW2. In WW2, it was clearly a fight to the death between Germany and Russia, and there was no compromise point in between. In the current case, Russian can simply leave Ukraine, and the war is over. This is a discretionary war for Russia without existential implications. So how much adversity is the Russian public willing to bear before simply packing up and going home looks like the better option? That’s the relevant question.

Up until Thanksgiving or so, the man-on-the-street interviews in Moscow and St. Petersburg — the two cities that really matter — were pretty blasé about the war, frankly, not dissimilar to American attitudes about the wars in Iraq or Afghanistan. It was a distant, contained conflict far away without material implications for the Russian citizenry. That has now started to change, and I think is likely to become more pressing over time. I would guess that by the end of the year the fiscal issues will be pressing to the average Russian citizen. That does not mean they will necessarily rise up or even protest. The Russians appear to be utterly passive, still serfs in their hearts. But maybe not. In any event, the pressure on Putin will only grow.

I stand by my expectations for a serious structural budget deficit in Russia this year, 10%+ of GDP, and maybe considerably higher.

Does a Record Budget Deficit Herald the Collapse of the Russian Economy?

https://carnegieendowment.org/politika/89009

Apparently, the chief reserves are $130 bn in gold and $148 bn in the wealth fund. Those two would cover a $300 bn deficit in 2023. (If I were cynical, I might wonder whether all those reserves actually exist.)

But as I have pointed out, 2024 looks more challenging, should the pace of deficits in January hold up on an annualized basis.

https://carnegieendowment.org/politika/88926

https://www.ceicdata.com/en/indicator/russia/gold-reserves

“For this reason, there is no point in guessing what the budget deficit will be at the end of this year based purely on figures for the first month.”

But little Stevie did this anyway assuming the monthly deficit in January would persist for the other 11 months. I’m glad we have the link to the entire discussion which noted multiple reasons why you little forecasting trick is so incredibly dishonest:

‘Yet it would be premature to write off the Russian economy based on the figures from a single month. Despite wide-ranging sanctions, the Kremlin still has plenty of opportunities to export hydrocarbons, and the country’s economic life is gradually returning to normal. Major spending in January may make it possible to economize in coming months. That’s not to say that the Russian economy has fully adapted to the new conditions and has stopped feeling the effect of sanctions altogether, simply that their effect will be a drawn-out one.

The Finance Ministry has offered several reasons for January’s revenues falling by 35 percent. Income from oil and gas decreased to 426 billion rubles, the lowest level since 2020, because of a fall in the price of Urals crude (to $49 per barrel in January: 40 percent cheaper than Brent, while the budget is calculated based on a price of $70), and also a decline in gas exports. For now, the government can close the gap by borrowing and tapping the National Wealth Fund, Russia’s sovereign wealth fund.

Non-oil and gas revenues also decreased: by 28 percent down to 931 billion rubles. The most serious drop was seen in internal VAT and profit tax payments, though it’s primarily a technical issue linked to changes in the collection of those taxes.

Budget spending grew a record 58.7 percent to 3.1 trillion rubles. This was partly a result of advance payments being issued on state contracts, whose total value quintupled compared with the year before, from 249 billion to 1.3 trillion rubles. Previously, the Finance Ministry paid ministries and other government agencies—the main disbursers of budget finances—gradually, peaking in the final quarter of the year. Last year, for example, more than a third of all spending took place in the final quarter. The Finance Ministry had come under fire for this uneven spending, both from the Accounts Chamber and even President Vladimir Putin himself.

This year, the Finance Ministry took note, and processed 11 percent of annual planned spending in January alone. If state contracts are excluded from the equation, then budget spending grew just 6 percent. Since a significant portion of advance payments was made at the beginning of the year, it’s reasonable to expect remaining government expenditure to be distributed more evenly throughout the year.’

Hey Stevie – we can see why your failed to note these important points. But come on dude – the rest of us know how to read for ourselves as we almost never trust a single bit of your babbling.

“I stand by my expectations for a serious structural budget deficit in Russia this year, 10%+ of GDP, and maybe considerably higher.”

Seriously? I guess you did not bother to read the entire discussion in that link? Do you stand by your forecast that oil prices will rise to $180 a barrel? Guess what most incompetent consultant ever – at those prices, Russia’s revenues will be a lot higher.

This is a nice pulling apart the worst Covid idiocies from the right wing alternate universe

https://www.thebulwark.com/covidiocy-marches-on/

The sad part is that this will have little effect on those morons opinions about Covid. They are locked into their false narratives and the more convincing the facts against those narratives the more the minions get convinced that those inconvenient facts are part of a big conspiracy.

“Founded in 2018 by Sarah Longwell, Charlie Sykes, and Bill Kristol, The Bulwark focuses on political analysis and reporting without partisan loyalties or tribal prejudices.”

I like Charlie Sykes but let’s be clear. The Bulwark is an old fashion conservative publication. They just are not the insane nutjobs in the MAGA Trump mafia.

“Meanwhile, one would look in vain for similar concessions or contrition on the right. No one is asking for forgiveness for the fine folks who confidently predicted in the spring of 2020 that COVID-19 would end up being no worse than an average flu season or that fatalities wouldn’t go up by much after the first 60 deaths by mid-March. Or who peddled ivermectin and hydroxychloroquine (remember that?). Or who celebrated vaccine refusers while brushing off their later deaths of COVID.”

Exhibit A – Bruce Hall.

More reporting on Europe weaning itself from Russian gas:

https://www.politico.eu/article/eu-energy-gas-supply-russia-putin-winter/

Funny how that worked out.

Nice to read some positive and emotionally uplifting news. Thanks for the share.

Love the subheadline:

Mild weather this winter is set to help Europe shrug off Russia’s energy threats next year, too.

Maybe God is on the side of the Ukrainians too.

“Mild weather this winter is set to help Europe shrug off Russia’s energy threats next year, too.”

Combination of relative high temperatures and a lot of wind. France does not need much electricity for space heating and Germany exports electricity and in some cases NG. If we assumed a winter like 2011/12 lights would go out in France, esp. when more than 15 NPPs are not working.

“ Power of Siberia 2 to divert Europe-bound gas to China” https://asiatimes.com/2022/07/power-of-siberia-2-to-divert-europe-bound-gas-to-china/

And that’s after Power of Siberia I ramps up to Nordstream volumes this year. The country hurt most by sanctions is Germany, which is stuck with high LNG prices that impact their competitiveness. Long term, Russia will be fine; Germans will be pi**ed by the US’ f*ck Europe attitude.

It’s a little premature for celebration,don’t you think Ducky?

Did Putin give his pet poodle another bone? Attaboy little Jonny!

“The construction of a second gas pipeline linking Russia and China is expected to commence within two years, a megaproject that will put Mongolia in the middle as the pipe is designed to pass through its high-elevation territory.”

Oh gee Jonny boy – revenues start flowing in during the summer of 2025? Your former BFF Princeton Stevie boy has the Putin government running of funds by the summer of 2023. Of course he is an idiot but I do wish the two of you would get your lies on the same page.

https://www.msn.com/en-us/news/us/georgia-grand-jury-suspected-perjury-in-probe-of-trump-election-interference/ar-AA17zIAh?bncnt=BroadcastNews_BreakingNews&ocid=msedgdhp&FORM=BNC001&pc=U531&cvid=a789909057c1490ca656261202cb6d3d

A special grand jury in Georgia believed that several witnesses lied under oath during its investigation of former President Donald Trump’s efforts to overturn his 2020 presidential election defeat in the state, according to excerpts from its final report release on Thursday. The grand jury also concluded that there was no widespread fraud in the election, despite Trump’s claims, and delivered recommendations on indictments to prosecutors, the document showed. Those recommendations will remain sealed for now, pursuant to a judge’s order. Trump did not testify to the grand jury. Fulton County Superior Court Judge Robert McBurney permitted three portions of the special grand jury’s report to be released: the introduction, the conclusion and a section laying out concerns that some witnesses may have lied under oath. McBurney said the report included “a roster of who should (or should not) be indicted.” But the judge ruled those details would stay secret for now out of concern that people named have not had an adequate opportunity to defend themselves.

MAGA hatters lied? Oh wait – Trump’s minions lie here all the time. But I guess a comment on a blog from a troll is not testimony under oath.