The CBO released its Budget and Economic Outlook: 2023-33 yesterday. The projection, based on data available as of January 6, shows a shallow decline in GDP in 2023Q1 and 2023Q2.

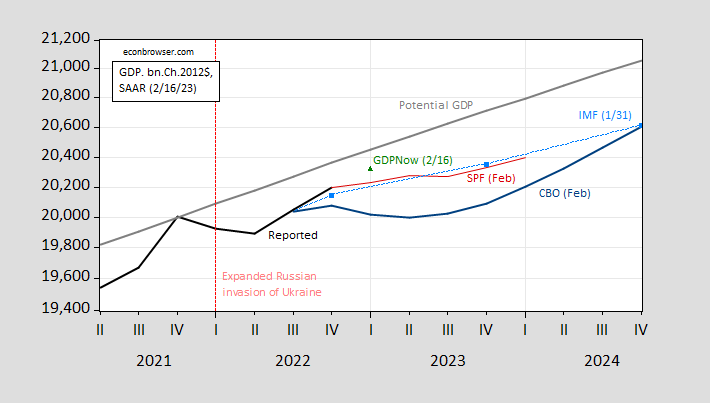

Figure 1: Reported GDP (bold black), CBO projection (blue), SPF median forecast (red), IMF WEO projection (sky blue), GDPNow at 2/16 (green triangle), potential GDP (gray), all in billions Ch.2012$ SAAR. Source: BEA 2022Q4 advance release, CBO, Philadelphia Fed, Atlanta Fed, IMF WEO (January), and author’s calculations.

The CBO forecast was based on data available January 6th, so does not incorporate the Q4 advance release, nor subsequent information.

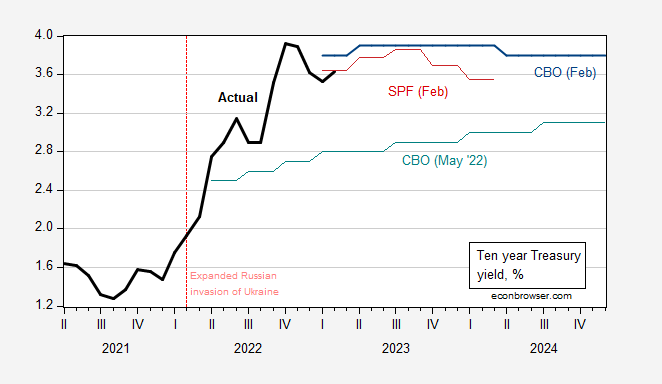

Note that interest rates are also projected to be much higher, following actual developments in financial markets.

Figure 2: Ten year Treasury yield (bold black), CBO February 2023 projection (blue), CBO May 2022 projection (teal), and SPF February median forecast (red), all in %. 2023Q1 is for first half of quarter. Source: Treasury via FRED, CBO (various), and Philadelphia Fed.

The higher interest rates — along with other developments — imply slower growth in GDP, so slow there are two quarters of negative growth (although the Q2 rate is -0.1% q/q, essentially zero). The implied peak for GDP is 2022Q4 in the CBO projection. Nonetheless, the document makes no mention of a recession in 2023.

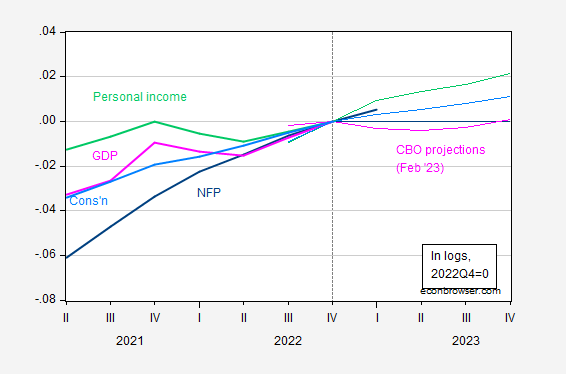

Figure 3: Nonfarm payroll employment – actual (bold blue), projected (blue), GDP – actual (bold pink), projected (pink), real personal income ex-current transfers – actual (bold light green), real personal income – projected (light green), real consumption – actual (bold sky blue), projected (sky blue), all in logs, 2022Q4=0. 2023Q1 NFP observation is for January. Source: BLS, BEA 2022Q4 advance, CBO (February), author’s calculations.

While GDP does drop slightly, NFP is flat, and consumption and personal income continue to rise. As NBER’s Business Cycle Dating Committee does not place main reliance on GDP (given the numerous revisions that occur to it), but rather employment and personal income, it makes sense that recession is not projected.

GDPNow as of today indicates that GDP in 2023Q1 will be substantially higher than forecasted by CBO (green triangle in Figure 1; at 2.5% SAAR in Q1), and indeed higher even than the median from the February Survey of Professional Forecasters. However, that doesn’t mean the slowdown is canceled, merely perhaps delayed.

Credit to Moses for reminding us of all the trash from Nikki Lightweight. Now here is her position on Social Security:

https://www.msn.com/en-us/money/personalfinance/nikki-haley-says-social-security-is-the-heart-of-what-s-causing-government-to-grow/ar-AA17zQQD

“What they need to be doing is looking at entitlements,” she told Cavuto. “Look at Social Security, look at Medicaid, look at Medicare, look at these things and let’s actually go to the heart of what’s causing government to grow.”

Translation please – massive cuts to your retirement benefits to pay for tax cuts for the rich.

I’m struck by how the graph shows: (1) real GDP reached potential output but did not exceed it as of 2021Q4; and (2) how real GDP is now below potential output. So tell me again – why is the FED keeping interest rates so high?

Beware revisions

@ pgl

Larry Summers says it’s “out of control demand” and too many people are employed and the Armageddon dark threat that if labor has negotiating power in a “tight” labor market they could soon attain a LIVING wage (Oh G*d!!!! Oh G*d NO!!! Labor negotiating power!!!! Aaaaaahhh!!!). All very very frightening to Jerome Powell, credit card companies (i.e. banks), and corporate “leaders”. JD Jerome wets the bed every other night just thinking about it.

I wonder what millennium it will dawn on them that the inflation rate is now lowering because supply chains are now operating better, and near not a G*ddamned thing to do with their rate hikes?? I respect Menzie, and I like Menzie as a person—that being said, Menzie can hold his breath ’til his face turns blue for when the Larry Summers and Jerome Powells of the world “realize” (or do they already know and sing a tune for their masters??) that a recovered supply chain has more to do with inflation lowering than their “excessive demand” fairy-tale.

In January, import prices rose less than 1% YoY for the first time in over a year.

Maybe I (do I dare say “we”??) should start paying closer attention to “anecdotal” data. I mean it’s pretty confusing now, and especially when things are on the precipice it’s really not a bad idea to forage for anecdotal facts. I noticed there’s some strong conjecture Facebook is going to fire more of its workers this year. You can say that tech is just one sector of the economy and that’s true. But I would say when a company with as deep a pockets as Facebook is saying “we need to make this the year of shoving our workers out the door on their ass” that could be a gauge on where things are going. There’s a lot of undercurrents that aren’t being picked up on right now. And you keep calling the economy’s bluff by raising rates at an absurd time to be doing so, you might find out Miss Economy was bluffing your pants off the whole time, and doesn’t even have a face card. But Mr. Recession just needs one more card out of the river and he’s got a straight. It’s dumb to keep playing with rates here, incredibly incredibly dumb.

The CBO is telling us we will see defense spending fall to only 3% of GDP. In a world of Putin aggression and Xi threats – this strikes me as optimistic.

Obama did manage to get this ratio below 3.9% by 2016. Of course, fiscal “responsible” Donald Trump (oh wait – Bruce Hall wrote that quote – sorry) increased defense spending so much that it was 4.19% by 2020. Of course he paid for this Reagan style by cutting taxes for the rich.

Now “wild spending” Biden (darn – my keyboard let Brucie boy take over again) has managed to get this ratio back to 3.63% even as he actually supported Ukraine (something Trump would never have done). So maybe there is hope we can get defense spending under control. I hope so but something tells me this may not happen as CBO forecasted.

pgl: Well, CBO is required to do projections under “current law” rather than “current policy”.

Thanks for the reminder. Of course we had the episode where Paul Ryan instructed the CBO to basically make stuff up to make Ryan look good.

This is where trade policy plays an important part. Keeping advanced technology away from one’s adversaries limits their military capabilities, reducing the U.S./NATO/QUAD/AUKUS/S. Korea/Taiwan military spending load.

Cutting Russia and China off from advanced chips has had pretty noticable effect already. Need to keep up the pressure and work harder on Iran.

Two observations, neither of which is original:

1) China, Russia, Iran, North Korea, Syria, Afghanistan are all immgrant-sending countries. NATO, QUAD, AUKUS, S. Korea are all immigrant-receiving.

2) China, Russia, Iran, North Korea, Syria, Afghanistan all import technological goods, while NATO, et al, export technological goods. (Yeah, yeah, it’s not that simple, qubble, quibble, but don’t pretend you don’t understand the point.)

The purveyors of “moral equivalence” in comments here argue that one group of countries is no better than the other, but the flow of migration says they’re wrong. And the places where people choose to live are increasingly at odds with the places people choose to leave. Strategic trade gives the net-immigrant-receiving part of the world a way to thwart the expansion of net-immigrant-sending countries without resorting to war. Strategic trade is our friend.

Steel and aluminum tariffs are, of course, an entirely different matter.

One of my favorite moments of this policy dispute was when President Obama had to enlighten Mitt Romney that maybe battleships weren’t quite “cutting edge” military defense anymore. Being schooled by a Black man must have been extra rough for the fetal tissue investing Mormon.

https://www.politico.com/blogs/burns-haberman/2012/10/obama-to-romney-this-is-not-a-game-of-battleship-139251

The thing Republicans and southerners hated most about President Obama was, even though he was a lazy so-and-so when it came to things like stump-speeches and getting on the soap box for mortgage cramdowns etc. Obama was well read and knew most of the issues better than they did. When you are a closet racist like Romney and many Republicans, it’s one thing to have McConnell riding your back like Rick Scott is experiencing now, but when a Black lawyer schools you on not doing your policy homework. that’s an extra big wasp sting they cannot handle. Like a mosquito bite vs getting shingles.

When Truth Isn’t Truth is must see TV covering the career of Racist Rudy Giuliani:

https://news.yahoo.com/real-rudy-giuliani-explosive-docuseries-140000723.html

According to Gitlitz, the pressure campaign on Ukraine demonstrates “the lengths that Giuliani will go to stay in power.” “My favorite line of the entire documentary is that Rudy ‘is a dictator looking for a balcony,'” she adds.

Yea – Trump was a clone of Racist Rudy!

https://www.msn.com/en-us/news/politics/a-new-twist-in-the-gop-feud-over-social-security-cuts/ar-AA17ArYT?ocid=msedgdhp&pc=U531&cvid=2917fdfc3eb94c95a5254c05402c09dd

This story briefly mentions the CBO report but is mainly about how the Republicans are all twisted in a knot on whether to be honest about their deep down desire to screw Social Security recepients. McConnell saws he will never cut them but Senator Turtle is not ever going to support taxes needed down the road.

https://www.khou.com/article/news/nation-world/bing-ai-chatbot-microsoft-looks-to-improve-software/507-ea5b9e3d-ac2a-411f-8077-3e5fee7ae745

Is Bing too belligerent? Microsoft looks to tame AI chatbot

Microsoft told everyone from the start the new product would get some facts wrong. But it wasn’t expected to be so belligerent.

Huh – this AI chatbot is a lot like our Usual Suspects.

Oh, look! Here’s a new batch of Larry-splaining about how inflation won’t come down, so the Fed really needs to jump harder on the breaks:

https://www.marketwatch.com/story/the-risk-is-that-were-going-to-hit-the-brakes-very-very-hard-larry-summers-says-96a7c82f?mod=markets

‘Cause inflation won’t come down:

https://fred.stlouisfed.org/graph/?g=10aKo

And apparently ’cause there are no lags in the effects of monetary policy:

https://www.kansascityfed.org/research/economic-bulletin/have-lags-in-monetary-policy-transmission-shortened/

Larry is so good at ‘splaining.

Just as a reminder, the first Fed hike in the current series was less than a year ago:

https://fred.stlouisfed.org/graph/?g=10aMY

If the peak effect of policy rate changes is now 12 months after the change, we haven’t yet felt the full impact of even the first rate hike. But Larry wants more hikes. Because one month’s inflation data fail to confirm the prior six months’ evidence of disinflation.

I should not be better at this than Larry Summers. I’m better than Larry only because Larry has chosen to be bad at it. Something is wrong with the guy.

Inflation is already down. A great deal.

Larry is a former economist who has been so wrong so many times, that he has turned himself into a joke. He is so insecure he cannot admit his mistakes, even to himself, so he is unable to learn from them. Rather than adjust his models to fit reality he tries to adjust reality to fit his models. What an arrogant moron.

The CBO is pure fantasy. Fed rates aren’t tied into consumer debt markets. Why base growth on it?

Fun Facts:

The Biden budget deficit in 2022, as a percent of GDP, was less than the Reagan deficit of 1983, and the Obama deficit of 2009 was much less than the Trump deficit of 2020. https://fred.stlouisfed.org/series/FYFSGDA188S

I’m sure Fox will have a full report on this soon. /s

Green steel is not likely to become fully competitive with the polluting production that push that part of its real cost onto society. However, in Europe the idea of placing a tax on dirty steel to recover part of that societal cost will ensure that this kind of plant can compete in the free market.

https://www.bbc.com/news/business-64538296

Its about time that government stops subsidizing and picking winners in favor of destructive corporations.

Ivan: ” However, in Europe the idea of placing a tax on dirty steel to recover part of that societal cost will ensure that this kind of plant can compete in the free market. ” and for years we’ve listened to economists wondering/conjecturing/suggesting which policies directly cause inflation. You’ve highlighted one! Just look at the stupidity being proposed by social justice useful idiots who will wonder why their markets are being lost.

CoVid’s fantasy world becomes more elaborate by the day. Every time a new bit of evidence regarding climate change is mentioned or some new (rhymes with”Pigou”) policy to deal with climate change is proposed, CoVid expands his right-wing fever dream into new territory. The guy is a broken record.

MD, “… regarding climate change is mentioned …” Speaking of a fantasy world, pleas show us where climate change is mentioned in Ivan’s or my comment. Why such a fevered focus on a subset of economics, environmentalism, or policy?

Your religious fervor is showing at its worst? Why not just refute the comment, as I did with Ivan’s?

Pigouvian taxes as the cause of inflation? And we thought JohnH was stupid. Nah – CoRev is the champion of dumb trolls.

Two companies worth paying attention to:

H2Green Steel has already signed a deal with Spanish energy company Iberdrola to build a green steel plant powered by solar energy in the Iberian peninsula, and says it’s exploring other opportunities in Brazil. On home soil it’s got friendly competition from another Swedish steel company, Hybrit, which is planning to open a similar fossil-free steel plant in northern Sweden by 2026. This firm is a joint venture for Nordic steel company SSAB, mining firm LKAB and energy company Vattenfall, boosted by state funding from the Swedish Energy Agency and the EU’s Innovation fund.

Ole Bark, bark: “… boosted by state funding from the Swedish Energy Agency and the EU’s Innovation fund.” Govt picking winners and LOSERS again, while piling on the inflationary drivers. Tsk, tsk Govt funding is always good for the economy and NEVER detrimental? Sigh! The ignroanti in action.

How are those coal companies doing after all of donald trump’s promises??

https://qz.com/1960354/trumps-promise-to-put-coal-miners-back-to-work-was-a-failure

https://www.dispatch.com/story/news/environment/2020/10/20/trump-promised-bring-back-coal-appalachia-has-he/5866420002/

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-coal-jobs-down-24-from-the-start-of-trump-administration-to-latest-quarter-61386963

Do you think the folks in Appalachia are wondering where their orange colored obese hero went?? I think Democrats must be salivating to get donald trump on the debate stage to discuss ‘The Orange Savior of Coal”. What do you think CoRev??