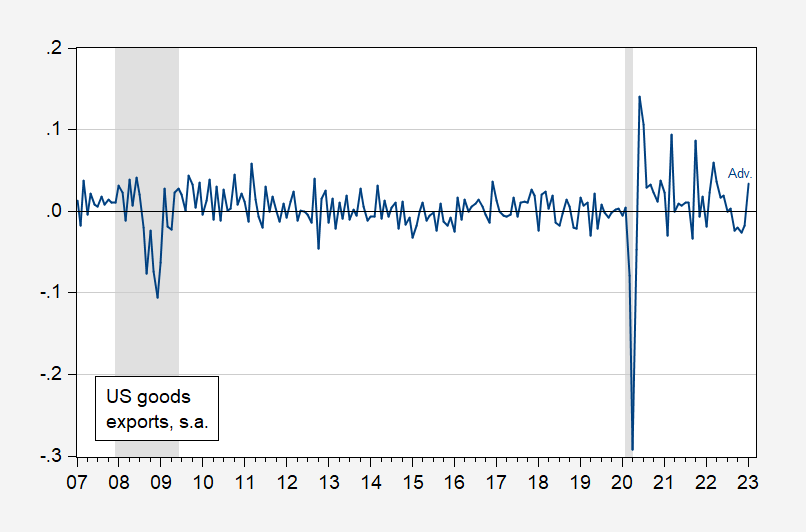

Advance estimate for January 2023 goods exports out today. Big jump, compared to the pre-pandemic past, but not compared to the recent past.

Figure 1: Month-on-month growth in US goods exports, seasonally adjusted (blue). NBER defined peak-to-trough recession dates shaded gray. Source: Census via FRED, NBER, and author’s calculations.

The standard deviation rises from 0.023 to 0.066 (2007M01-19M12, 20M01-23M01) Given the impact of the pandemic (as shown by the sharp drop in exports in 2022), it’s possible that some of the volatility is induced by the estimated seasonal factors. However, I suspect at least some of it is due to supply chain issues, and fluctuating demand overseas.

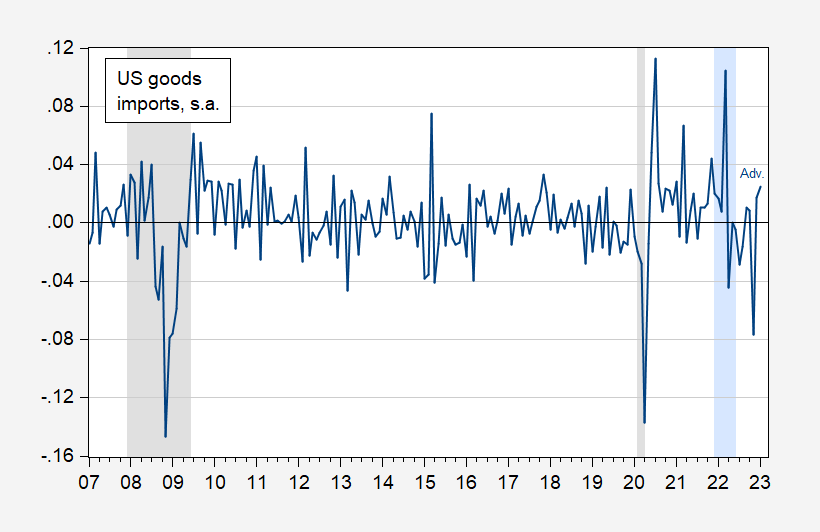

A similar pattern exists for imports.

Figure 2: Month-on-month growth in US goods imports, seasonally adjusted (blue). NBER defined peak-to-trough recession dates shaded gray. Light blue denotes a hypothesized 2022H1 recession. Source: Census via FRED, NBER, and author’s calculations.

The standard deviation rises from 0.026 to 0.043. Interestingly, while imports decline in 2022Q2, they do not fall anywhere near the decline in 2008 during the Global Financial Crisis, nor in 2020 during the pandemic. Of course, one has to be careful about interpreting imports as completely demand driven given supply chain constraints including production disruptions in China and elsewhere (the typical approach to estimating imports of goods into America during “normal” times is to assume supply is elastic).

This NSA series suggests that seasonal adjustment is not the only the only cause of volatility, though it does seem li!ely seasonal adjustment adds to the volatility of the SA series, relative to the pre-Covid expansion:

https://fred.stlouisfed.org/graph/?g=10yGp

Macroduck: Thanks. Agree – nsa series standard deviation rose from 0.06 to about 0.09, 50 percent increase.

So the standard deviation for nsa exports rose 50% while the SD for sa exports nearly tripled. Increased volatility in the underlying series and a problem with seasonal adjustment. There ya go.

Off topic, the effectiveness of parachutes when jumping from an airplane –

If you are having a bad day or are feeling dull-headed, read this:

https://www.bmj.com/content/363/bmj.k5094

The study finds no difference in outcome between the experimental group with a working parachute and the control group wearing empty parachute backpacks.

Read to the end. Otherwise, don’t bother.

Was this their idea of a practical joke?? I’m surprised the publishing date wasn’t April 1. That is just WACKO. Isn’t anyone involved even afraid they will lose credibility doing such a thing??

Science humor. It’s not like other humor. What can ya do?

BMJ does a parody issue every year. In this case the parody is perfect satire; poking fun at how studies with really fundamental flaws (i.e. couldn’t actually study people jumping out of airplane in the sky so they only studied people jumping out of an airplane on the ground) are used to generate clickbaity headline conclusions that spread.

The picture of the girl jumping “out” of the plane did make me chuckle. I was just surprised because academics tend to be so stuffy/uptight about those things.

Not sure what to make of these charts. Could be…

1. the pandemic disrupted the supply chain and imports and exports are now more erratic or, more likely,

2. the pre-pandemic seasonal adjustments are currently less reliable.

Bruce Hall: Well, the fact is that we are now using post-pandemic sample period estimated seasonals. So the problem is not the pre-pandemic seasonal adjustments (they’re not being used for the post pandemic period). Wow.

As noted in my response to Macroduck, the fact that the standard deviation is higher by 50% in the recent period indicates that at least a good chunk is due to disruptions.

Question: Do you know how seasonal factors are estimated?

1. I didn’t see your response to Macro when I wrote my comment (it appeared later) and the charts didn’t clarify that.

2. Yes, I was working with seasonally adjusted data back as far as 1975 using the Census II method.

https://www.semanticscholar.org/paper/The-X-11-variant-of-the-census-method-II-seasonal-Shiskin-Young/e0b90ecf7d2466c7a21fe4e593e08b248ee5c0ad

But thanks for the clarification. I’d have to say that if you are using only post-pandemic data for seasonal adjustments that it is probably insufficient to get a good estimate.

Maybe we don’t need to teach Karen Hall about X-11 ARIMA or X-12 ARIMA. Maybe the best thing we could teach Karen Hall is to be quiet//silent when topics arise that they know nothing about. I always took strong hold of the cliché that when you don’t know anything it’s better to be quiet than open your mouth and prove to everyone that you don’t know anything. Hence IRL, away from the internet, I tend to be a very quiet person.

Some people interpret being quiet and “sticking to one’s self” as “snobbery”. If they only knew.

Hey, Moses, I’m glad statistical magic has progressed to the point where 24 or so months of data can result in stable, reliable seasonal factors, especially with so much disruption in the supply chain. I always considered about 4 years worth of monthly data to be the minimum needed for decent analyses. Yeah, you can get a rough estimate with 2 years, but you da man who can get really precise with 2 years. Woo hoo!

https://www.anamind.com/anamind-blog/how-much-data-is-required-for-forecasting/

Bruce Hall: You misunderstood me. The prior data is still used. However, the seasonal factors have changed with the addition of new data. This updating is done once a year for employment data.

I know some people are going to think I’m rude for saying this, but to hell with it, most people here probably view me as kinda rude anyway, so…….

This near futile argument a little bit reminds me of Barkley Rosser and the infamous incident where he didn’t know “headline” GDP is nearly always expressed SAAR. So first he stated he was doing it the same way, then his 2nd quarter 2020 GDP number was >30% off and he goes “Oh, I didn’t know SAAR was the standard for headline GDP”.

Part of these export/import numbers, reinforces my argument that supply chains have been the larger issue vs increase in consumer demand as the “major”/”main” cause of USA inflation. I have argued supply chains to the point, I would guess Menzie probably agrees more with Larry Summers than he does me (though I kinda guess Menzie stood somewhere in the middle between me and Summers on the main cause of inflation, but leaning more towards Summers’ view). But to use an overused and worn out word, when you enter a~~~”new paradigm”(puke)~~~the respiratory virus pandemic~~~you can’t just treat every year as the same. The note that Menzie is trying to make to Karen Hall is that seasonal factors have also become more varying, aside from the uneven/sporadic flow of goods through distribution channels. Not that you truncate the data. Only one moron on this blog would believe Menzie is advising to truncate prior years’ data.

Menzie, that makes more sense. The pandemic created a discontinuity in the global marketplace normal transactions so the seasonally adjusted data for the most recent years (’21-’22) can’t be seen as reliable as prior to the pandemic. If I were faced with trying to make better sense of the data, I might test a moving three month average of the adjusted data until 2024. That creates a little lag, but maybe gives a more reliable picture.

And, yes, I understood that the adjustment factors are normally updated annually. When seasonality is an important consideration, usually the factors don’t change all that much. But when that which is being measured is subject to a lot of random disturbance, those seasonal factors can be affected significantly.

I remember (long ago) when forecasted high volume replacement parts sales for the year could be fairly accurately projected based on seasonally adjusted sales through April. That’s because every year in March and April, there were promotions and discounts to both dealers and distributors that were pretty much the same percent of annual sales every year. Then a new marketing manager decided that those promotions were too expensive and disruptive and decided to go with smaller, shorter, more frequent and targeted promotions. So much for all of those old SAARs calculations. Overall annual demand didn’t change all that much, but the pattern of sales changed significantly.

When the vehicle introductions were changed from October to staggered introductions, the old SAARs forecasts for annual vehicle sales were greatly affected. You could just throw out the old data.

Hey Brucie – we found someone dimber than you. Marjorie Taylor Greene!

https://www.msn.com/en-us/news/politics/the-maths-are-hard-marjorie-taylor-greene-mocked-for-not-understanding-what-seized-means/ar-AA184dQD?ocid=msedgdhp&pc=U531&cvid=ac4789dd6b544320a19dcd06e06bc827&ei=10

‘The maths are hard’: Marjorie Taylor Greene mocked for not understanding what ‘seized’ means

United States Congresswoman Marjorie Taylor Greene (R-Georgia) undermined her own attack on President Joe Biden’s immigration policies surrounding illegal drugs that have been intercepted by Customs and Border Patrol during a Tuesday House of Representatives Homeland Security Committee hearing. “I want you to know that in 2020 there were 4,800 pounds of fentanyl seized by CBP. But in 2021, fiscal year 2021, it increased to 11,200 pounds of fentanyl was seized by the CBP. That is a direct result of Biden administration failure policies,” said Greene. “Now here we are in – to date, to date, fiscal, fiscal year 2023 – they have already seized 12,500 pounds of fentanyl. The Biden administration is failing this country by not protecting our border and securing our border, and stopping Chinese fentanyl from being brought into our country illegally by the cartels, and people are dying every single day because of it.” Social media users immediately pounced on Greene for, apparently, not understanding what the word “seized” means.

Anyone else getting excited about Durant’s first game with the Phoenix Suns against the Charlotte Hornets tomorrow?? The funny thing is I don’t have cable TV so I won’t be able to watch it live. But I will catch the highlights with few commercials after the game on YT or whatever. Going to be awesome!!! And by the way Deandre Ayton is a major weapon as well. This team is going to be dangerous. I think at worst, they make it into the semi-finals.

If KD fits in well with the Suns – I suspect they will win the Western Conference. Meanwhile back here in Brooklyn, we are wondering if the Nets still exist.

Things in Brooklyn might have turned out better minus one nutjob who refused to get vaccinated.. And being Black is not an excuse for not getting vaccinated. They were using the same vaccine for all citizens. It’s not 1945, what did the stupish*t think??~~commercial pharmacies had a vat of syringes just for when Blacks showed up??? What a damned idiot. And the same to Russell Westbrook, nobody wants KrazyKyrie on his current salary now. Except the fruitiest owner in the league, Mark “WhiteTrashSharkProducts” Cuban. What’s Cuban going to do, have Kyrie on ABC’s “Give Us Your Lunch Predatory Part-Owners” LLC selling a perfume that with a single squirt makes bungholes smell like cinnamon for 3 months straight?? Guy is a goofball. Wrestling’s Jim Cornette without the tennis racket is all Cuban is.

I think “Econned”, “Manfred”, and “Karen Hall” are going to get the super glue going in their shorts reading this one:

https://www.wsj.com/articles/why-i-stood-up-to-disney-florida-woke-corporatism-seaworld-universal-esg-parents-choice-education-defa2506?mod=hp_opin_pos_2#cxrecs_s

Here’s a lifting from a WaPo article not terribly long ago:

“After the Tampa Bay Rays tweeted that mass shootings such as the one that left 21 dead in Uvalde ‘have shaken us to the core’ and made a $50,000 donation to gun violence prevention, DeSantis blocked $35 million in state funding for the team’s spring training facility, saying it would be ‘inappropriate to subsidize political activism of a private corporation.’ “

https://www.washingtonpost.com/politics/2022/10/19/desantis-disney-corporate-america-war/

If you’re afraid someone in your family might die from a mass shooting someday, don’t expect help from Ron DeSantis. DeSantis is very happy to watch the mass killings rage on.

Check out Kevin Drum’s graph of the latest from the Cleveland FED:

https://jabberwocking.com/raw-data-expected-inflation-is-low-and-getting-lower/

Kevin writes:

The 5-year/5-year forward inflation measure is currently at 2.2%, which closely matches the Cleveland Fed estimate. Note that all of these figures are continuing to go down even after January’s re-benchmarking and the bad January inflation numbers from both the CPI and PCE.

The 5-year expected inflation rate ala the Cleveland FED is 2.1%. Time for the FED to ease off.

They put some interesting stuff up on FTalpha from Torsten Slok related to housing/property. I don’t know why I’m putting this link up because the data takes the side of keeping the FFR up, which I am against. I guess I am putting this up for my fellow Torsten Slok fans here on the blog that maybe are like me and can’t access all of Slok’s writings:

https://www.ft.com/content/5e421624-4072-43c4-9ffb-e27b2e86652b

Plus there’s a cool pick of The Hulk and you really can’t pass that up.

*pic

Candy for Slokkers:

https://apolloacademy.com/the-daily-spark/

Off topic – financialization and tech –

The Biden administration asked for and gotten funding to boost domestic tech sector activity. One cause of the U.S. tech sector losing its edge, according to this article, is financialization:

https://www.ineteconomics.org/perspectives/blog/losing-out-in-critical-technologies-cisco-systems-and-financialization

Cisco’s relentless stock manipulation through buybacks is the focus of the article. Who needs innovation if you can just buy a higher stock price (and higher prices for stock options held by execs), and who can afford innovation after spending billions on stock manipulation?

In addition to subsidizing tech development, recent legislation imposes a 1% tax on buybacks. So fàr this year, the tax (plus other stuff, as as always) hasn’t cut down on announced buybacks (quite the contrary), but has led to a concentration of buybacks among the biggest firms:

https://www.reuters.com/markets/us/us-stock-buybacks-so-far-2023-big-money-fewer-companies-2023-02-07/

https://www.bloomberg.com/news/articles/2023-02-02/stock-buybacks-hit-132-billion-as-companies-snub-all-warnings

https://www.reuters.com/markets/us/us-stock-buybacks-so-far-2023-big-money-fewer-companies-2023-02-07/

Maybe 1% was not enough.

This is what “democracy” looks like in GOP-controlled Florida:

https://thehill.com/homenews/state-watch/3879164-florida-lawmakers-bill-would-get-rid-of-the-democratic-party/

Martin Wolf has a new book:

https://www.penguinrandomhouse.com/books/554951/the-crisis-of-democratic-capitalism-by-martin-wolf/

I don’t do much in the way of book recommendations here do i?? Reflecting my true shallow nature with film recommendations. But I am reading Quentin Tarantino’s “Cinema Speculation” book right now, and it really is a blast reading. You can find some gems of films mentioned here. Just one off-hand here, “Charley Varrick”, one of the most underrated films in cinema history. But many more to be found just by flipping through the book. The book reflects Tarantino’s 1970s “sensibilities” but he also mentions great films outside of that decade, so……

One paragraph from the introduction of Wolf’s new book:

“Equally large shifts occurred in politics. The first big shock was the attacks on the US on September 11, 2001, which were followed by wars in Iraq and Afghanistan. The biggest change of all was a counterpart of the economic success of globalization, namely, the rise of China and, to a much lesser extent, India. This created a shift in the balance of global economic and so political power, away from the US and the liberal West toward China and its system of bureaucratic absolutism. Yet this was far from the only way in which global politics changed. As the twenty-first century progressed, we saw a shift away from liberal democracy toward systems that some have called “illiberal democracy” but might be better described as “demagogic autocracy.” In a recent book, the Russian economist Sergei Guriev and the American political scientist Daniel Treisman call these systems “spin dictatorships,” to distinguish them from the “fear dictatorships” of old.[5] Alas, the shift toward demagogic or “spin” systems is to be seen—so far, in nascent form—not only in new democracies, but also in some of the world’s most established democracies, notably the US, where Donald Trump remained an embodiment of the aspiration for arbitrary power even after his defeat in 2020.[6] The rise of Trump, along with that of Boris Johnson in the UK, undermined the international credibility of the two countries and weakened Western cohesion. Above all, their demagogic approach to politics undermined the rule of law, the commitment to truth, and the credibility of international agreements, all fundamental underpinnings of liberal democracy. Outright despotism is the probable end point.”

@ Macroduck

I told Menzie that everything Fox Mulder said would eventually become true, but he wouldn’t listen (you recognize my good-natured goofball pokes at Menzie by now, yes??). If you see green martian antenna popping up in that little gap between your windshield and the hood of your next car, don’t say Uncle Moses didn’t warn you:

https://www.wsj.com/podcasts/tech-news-briefing/electric-vehicles-could-be-targeted-by-hackers/a2c0b075-5433-4e32-9d9b-b98d94504c46

No joke, author Michael Hastings (wrote “The Operators”) died in a very suspicious car accident. There were (somewhat credible) X-Files type theories out there after Hastings died (circa 2013) that there were parties in the U.S. Dept of Defense/Pentagon that decided they wanted to rid themselves of a huge thorn in their side. I’ll let you be the judge.