From Bloomberg yesterday:

China reappointed several top economic officials in a leadership reshuffle Sunday, giving investors greater continuity as Beijing overhauls financial regulation and grapples with escalating tensions with the US.

People’s Bank of China Governor Yi Gang, 65, will remain in his post, as will the finance and commerce ministers. He Lifeng, a close ally of President Xi Jinping, was appointed a vice premier, signaling he could replace Liu He as the nation’s top economic official.

The retention of Yi and others — announced at the National People’s Congress, the annual parliamentary gathering — surprised analysts who were expecting a larger reshuffle. Many predicted officials with international experience, like the PBOC governor, would be replaced by men with closer personal ties to Xi but less familiar to global investors.

Keeping some of the existing economic team in place provides continuity as Beijing creates a powerful new financial regulatory body and confronts a more hostile geopolitical environment.

“The fact that the main technocrats are staying should reassure the market and reduce chances of mistakes during policy implementation,” said Qian Wang, Vanguard Group Inc.’s chief Asia-Pacific economist.

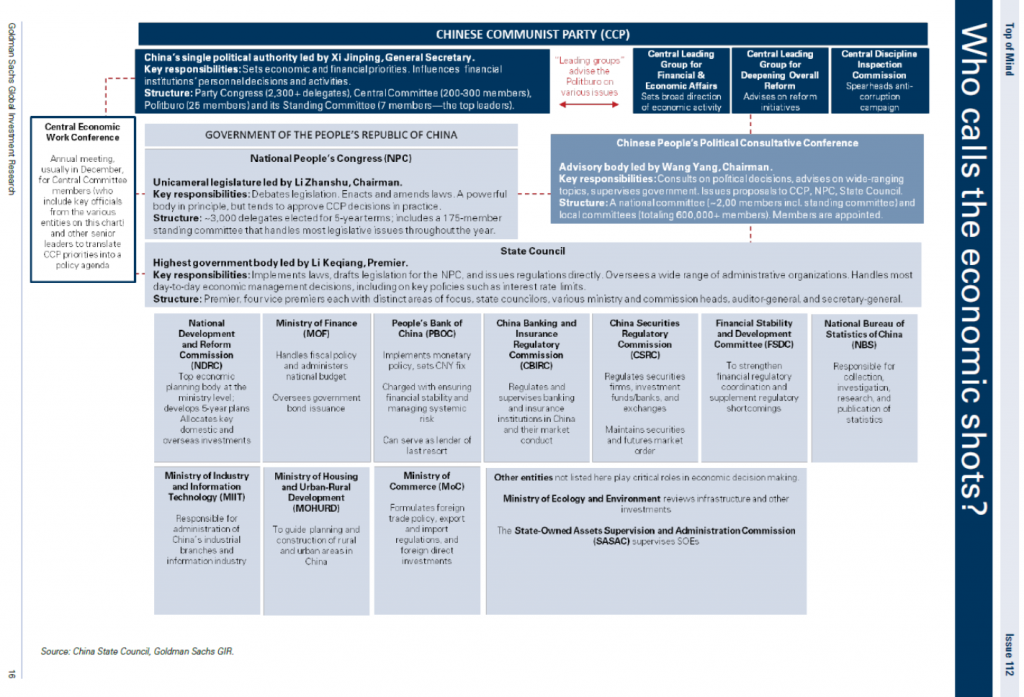

Let’s hope. List of who’s in what positions, here. And here is the organizational table (names to be updated), from GS:

Source: GS, Oct 11, 2022

Note that Li Keqiang is replaced as premier by Li Qiang, and the NRDC’s He Lifeng moves to vice-premier. Zheng Shanjie moves to head NRDC, while the heads of Finance and Commerce Ministeries stay the same.

Political leadership becomes increasingly monolithic while technocratic skills are maintained. And this is surprising? C’mon, Bloomberg, even poor little me, who has no respect at all for current Chinese political leaders, would be surprised to see abandonment of technocratic skill in the second tier.

Intolerance often looks like stupidity. Grasping for power often has the same effect as stupidity. But stupidity is its own thing, and Xi doesn’t appear to be stupid.

I wouldn’t be too certain. The draconian (an overly used word by pretentious people, but accurate here in my opinion) Covid-19 lockdown was a very dumb political move. I agree Xi is quite sharp, but that was a clear showing of cognitive imperfection (i.e. the man can make missteps). And I would present the possibility that if not for the openly public and wide protests to the lockdown, we would have seen more knifings of technocrats in the above blog post. But that failed “testing of the waters” by Xi (a very trumpian style “test” of how far we can push limits) is causing Xi to be more pragmatic on how low he can limbo (insert cronies) and not fall to the floor.

Xi is famously a germaphobe so not a big surprise that the lockdown initially was very severe and held there for a long time in spite of the costs. However, the eventual abandonment was a sign that fact-based technocratic input eventually was allowed to override even that phobia. It took a number of things to finally push the fact-based policies of Australia and New Zealand past the dictators phobia to implementation even in China:

1. Facts demonstrated that Omicron was a completely different virus which was upper respiratory rather than lower. That meant more contagious and less deadly. Actually to the point where the strict containment policies began failing anyway.

2. Both vaccines and treatments had come to a point where Xi and his leadership could easily be protected even if a pandemic swept the country.

3. Xi had solidified his power (at the congress) so a “failure” to contain the pandemic would not threaten his dictatorship.

4. The damage of continued strict lockdowns had induced protests that might get out of control.

It was all of those things that precipitated the change in policies that for long had been very successful in selling the minions on how the lockdowns (and lack of deadly pandemic) demonstrated the superiority of China over the weak and decadent west.

On the subject of stability, this is a little worrying:

https://www.france24.com/en/europe/20230310-russia-casts-georgia-protests-as-coup-attempt-accuses-west-of-fomenting-unrest

Invade me once, shame in you. Invade me twice?

Life has been rough for Steven Kopits since donald trump was voted out of office, and now you wanna drop this in his lap?? Have some conscience.

BTW, where is “ltr”?? Is he drawing the water for Li Keqiang’s bath and prepping his hands for Li’s first post-retirement full-body rubdown?? I mean, I know “ltr” loves China, but this is taking it too far.

Where’s Putin pet poodle Jonny boy. After all:

“The days-long demonstrations point to turmoil over the future in Georgia, which aims to join the EU and NATO, much to the frustration of Moscow, which invaded in 2008 and recognised two separatist territories in the north of the country.”There is no doubt that the law on the registration of non-governmental organisations… was used as an excuse to start, nerally speaking, an attempt to change the government by force,” Russian Foreign Minister Sergei Lavrov said in comments carried by Russian news agencies.

The protests, he added, “are of course being orchestrated from abroad” and with the aim of creating “an irritant on the borders of Russia”.The Kremlin criticised remarks from Georgia’s president delivered from the United States and accused a third-party of stoking “anti-Russian” sentiment in the Black Sea state.

“We see where the president of Georgia is addressing her people from,” Kremlin spokesman Dmitry Peskov told reporters. ‘Agents of foreign influence’

Wow Georgians do not want to be slaves of the Kremlin? What a bunch of neocons according to our missing pet poodle.

Turns out, bookkeeping matters. Anybody familiar with finance has seen instances in which that’s true. Well, the latest banking wobble brings to light an interesting bit of bank bookkeeping.

Banks are required to categorize financial assets as either “hold to maturity” or “available for sale”. HTM assets are carried at face value, while AFS assets are marked to market. See where this is going? If a bank wants the flexibility to sell an asset, tossing it into the AFS bucket makes sense. If a bank wants to avoid marking to market, the asset goes into the HTM bucket. Here’s the catch – you can’t shuffle assets back and forth. Even worse, if a bank has to sell an asset from the HTM bucket, the bank’s entire holding of HTM assets must be marked to market. Right now, the total unrealized loss on HTM assets for all U.S. banks is around $620 billion:

https://www.cnn.com/2023/03/12/investing/stocks-week-ahead/index.html

A bank which met all the regulatory capital and asset ratio requirements on Tuesday can, upon selling an HTM asset ahead of its maturity date, find itself in the regulatory soup on Wednesday. So now we deliver a shock to banks – like two banks being grabbed by regulators over the same weekend – and maybe some need to sell assets from the HTM bucket to cover withdrawals because Marketwatch names then in an unflattering article – (Found it!):

https://www.morningstar.com/news/marketwatch/20230311313/20-banks-that-are-sitting-on-huge-potential-2

This bookkeeping issue could be part of a domino effect for banks. Which is probably why we’re seeing headlines about regulators making all SVB depositors whole, not just insured depositors – no more Lehmans, please. Banks being forced to book some part of $620 billion in losses would be a nightmare.

Problem is, this could create a sort of “implicit guarantee” like the one the government denied existed for Agency MBS before the mortgage crisis. All deposits ate guaranteed? By what pool of money?

I think there will be more bank defaults, over say, the next 3–6 months. But I think (USA-wise) these will be “isolated incidents”. Do I “know” that for a fact?? NO. But I just think this is what the picture looks like, and I don’t see much melodrama unfolding.

Ah, the Fed’s Bank Term Funding Program gets around the bookkeeping problem by accepting Treasuries, MBS and “other qualified” assets as collateral at par (not marked to market) for a year. The Fed’s ability to hold assets to maturity (as the lender of last resort) erases the available-for-sale/hold-to–maturity distinction.

All sins forgiven.

It does seem like a way to create instability if a bank has to mark ALL HTM to AFS, even if they sell just a little of their HTM portfolio. A much better rule would be that whatever amount they sell from the HTM portfolio, they would be forced to move an equal amount to the AFS portfolio. That would allow them to sell some HTM early, before a problem becomes serious. There would still be a penalty for putting too much stuff into HTM, but not a death penalty for correcting a smaller misallocation problem.

For the record,

Premier: Li Qiang

Vice premiers: Ding Xuexiang, He Lifeng, Zhang Guoqing, Liu Guozhong

State councilors: Li Shangfu, Wang Xiaohong, Wu Zhenglong, Shen Yiqin, Qin Gang

Secretary-general of the State Council: Wu Zhenglong

Qin Gang, minister of foreign affairs

Li Shangfu, minister of national defense

Zheng Shanjie, head of the National Development and Reform Commission

Huai Jinpeng, minister of education

Wang Zhigang, minister of science and technology

Jin Zhuanglong, minister of industry and information technology

Pan Yue, head of the National Ethnic Affairs Commission

Wang Xiaohong, minister of public security

Chen Yixin, minister of state security

Tang Dengjie, minister of civil affairs

He Rong, minister of justice

Liu Kun, minister of finance

Wang Xiaoping, minister of human resources and social security

Wang Guanghua, minister of natural resources

Huang Runqiu, minister of ecology and environment

Ni Hong, minister of housing and urban-rural development

Li Xiaopeng, minister of transport

Li Guoying, minister of water resources

Tang Renjian, minister of agriculture and rural affairs

Wang Wentao, minister of commerce

Hu Heping, minister of culture and tourism

Ma Xiaowei, head of the National Health Commission

Pei Jinjia, minister of veterans affairs

Wang Xiangxi, minister of emergency management

Yi Gang, governor of the People’s Bank of China

Hou Kai, auditor-general of the National Audit Office.

Wu Zhenglong, secretary-general of the State Council

Money markets are pricing in a 25 basis point Fed hike for March, with the decision nine days away – too late for any official chatter. Some chance of another 25 is priced into the May decision, then easing prced in, starting wth the July meeting.

Broad stock indices are wobbly, but holding up pretty well. Many bank shares, however, look terrible. At a guess, the prospect of Fed easing is boosting shares not exposed to much bank risk, balancing losses on bank shares.

Ten-year Treasuries have shed 43 bps since Thursday morning. Twos have shed that much just today and 85 to 90 bps (depending on when you check – it’s volatile out there) since Thursday. Falling Treasury yields are helping to shore up bank balance sheets at an impressive rate.

Off topic but funny. According to my little news feed:

‘More than a million pages of internal Fox messages have revealed that a producer for Fox News host Tucker Carlson described the show’s audience as “especially dumb” and “terrorists” who sleep with their cousins.’

Oh wait – you knew that already.