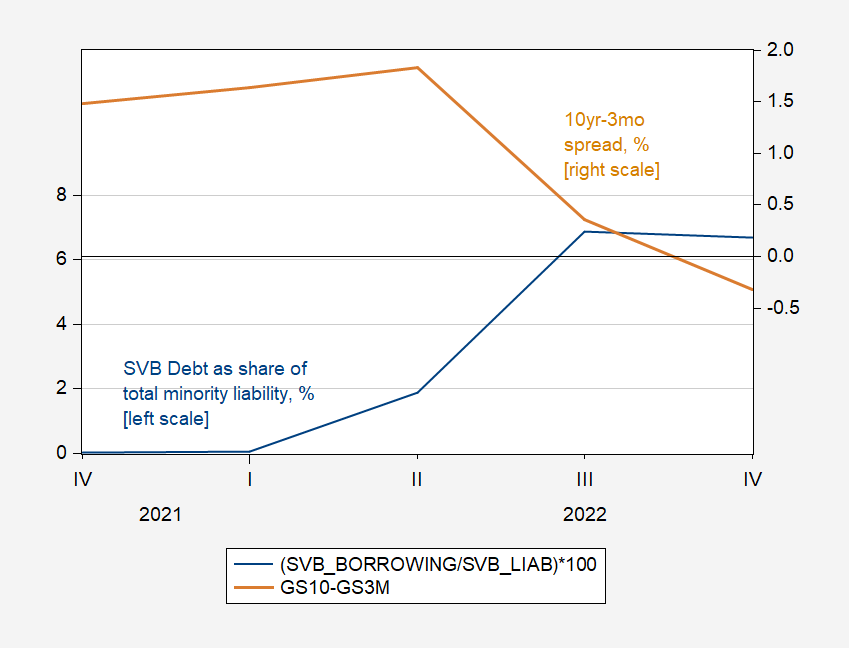

SVB was a collapse waiting to happen. One indicator is the increasing reliance on debt acquired on the capital markets (as opposed to deposits).

From WSJ:

SVB’s year-end balance sheet also showed $91.3 billion of securities that it classified as “held to maturity.” That label allows SVB to exclude paper losses on those holdings from both its earnings and equity.

In a footnote to its latest financial statements, SVB said the fair-market value of those held-to-maturity securities was $76.2 billion, or $15.1 billion below their balance-sheet value. The fair-value gap at year-end was almost as large as SVB’s $16.3 billion of total equity.

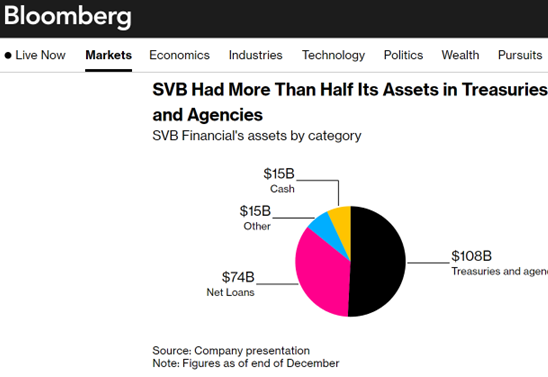

Here’s a picture of assets from Bloomberg:

Source: Bloomberg, 3/10/2023.

It’s kind of funny to think of credit risk associated with Treasurys, but one can make a capital loss (as opposed to loss due to default) if prices change a lot, as they have for Treasurys in the wake of QT and rises in the Fed funds rate.

Hence, SVB experienced a classic bank run in the face of solvency concerns, given that deposits exceeded the insured amount. In the run-up to the crisis, the bank increased its reliance on debt acquired in the capital market (as opposed to deposits which would’ve required higher interest rates). In this sense, incurring more debt should be viewed as a signal, rather than a causal factor.

Figure 1: End of quarter debt as share of total net minority liability, % (blue, left scale), and ten year-three month Treasury spread, % (tan, right scale). Source: YahooFinance, Treasury via FRED, and author’s calculations.

There is a sort of “You break it, you buy it” element here for the Fed and Treasury.

It’s going to be really hard to sell the thing to another bank when Powell has publicly pledged to continue to devalue its major assets.

If you think this is no surprise then it should be no surprise if there are more.

w: Yes, I would not be surprised that more banks fail. I would be surprised that there are a lot of banks that are similarly exposed to borrowing (taking deposits) from high tech industry, and concentrating holdings in Treasurys and Agencies. Remember, high interest rates reduce asset valuations, so damage should be incurred on the asset side of the bank balance sheets.

There were a number of problems with SVB’s operations as a bank. First, the reliance on one industry (high-tech and start-ups to boot) is always a bad practice for a bank. Second, they were overly reliant on the idea that low interest rates would last forever. As a result, they put most of their assets in longer-term debt securities (10 year MBS’s and treasuries) against a HUGE base of short-term liabilities (deposits). Making matters worse, 25% of their customer base accounted for 88% of those deposits.

There’s also a very detailed discussion that I would recommend about how banks carry assets (treasuries and other debt instruments) and how that pricing affected the need for SVB to raise capital – https://www.netinterest.co/p/the-demise-of-silicon-valley-bank

IF the Fed is smart, they will pause their interest rate

death marchhikes until the market is assured of stability in the rest of the banking sector. %6 inflation isn’t Zimbabwe and I believe that the fallout from the SVB debacle will put a hurt on the west coast economy that may result in decreased spending.“One indicator is the increasing reliance on debt acquired on the capital markets (as opposed to deposits).”

Not to nitpick but isn’t the concern that too much of their asset portfolio was government debt whereas “deposits” for a bank is their liability.

pgl: Perhaps I was unclear. Increasing reliance on debt securities (not necessarily US Treasurys and Agency debt) for funding — as opposed to deposits — is typically a harbinger of trouble. You are right that on the asset side, their problem was reliance on US government securities which experienced large capital losses as interest rates went up. They also have interest rate risk. To sum, they’ve got credit risk, liquidity risk (given fears of solvency), *and* interest rate risk. Not sure what they don’t have.

I’m reading a lot of things that make me hope someone can clarify both how they raised funds and what they did on the asset side. The LinkedIn discussion I just saw is something I wish the author would put on something more readable than Linkedin but I did note with interest how incredibly low its capital to asset ratio was. It reminds me too much of the S&L crisis.

@ Menzie

Lots of things entering my mind on this, a real scrambled eggs, jumbled, untidy set of thoughts.

We cannot say it was “one thing” here. But I am wondering if your post and thoughts on this, are~~put in more concentrated fashion~~that SVB’s “biggest problem” or “main problem” / “initial cause” is “deposit risk” or lack of counterparty diversity???

They were not funding using debt securities. They were funding by customer deposits.

Those debt securities listed above were the bank’s assets, not liabilities. All banks lend money. The resulting loans are the bank’s assets, whether directly to customers or indirectly to the government (treasuries) or indirectly to the public (agency-backed securities).

Steven Kopits: Er. Look…at…Figure…2…They…*had*…been…funding…using…large…deposits…but…had…to…rely…more…and…more…on…short…term…credit…markets.

You’re misunderstanding what that ‘minority interest’ is.

Let’s take a look at the numbers per the Dec. 31, 2022, SVB consolidated 10-K;

SVBFG contractual obligations:

—- Deposits (1) (2) 173,109 90%

—- Borrowings (2) 18,935 10%

—- Non-cancelable operating leases 459 0%

—– Commitment to Affordable Housing 754 0%

Total Obligations 193,257 100%

We can see from this that 90% of all SVB’s obligations (liabilities) were customer deposits. External borrowing was a mere 10% of all liabilities. You’re misinterpreting that minority interest line from the Yahoo Finance link. For example, if you look at the Yahoo Finance link, on which line are the customer deposits? The minority interest line includes deposits.

Source, page 86 of the link below:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000719739/000071973923000021/sivb-20221231.htm#ibb4dd73a1d3f4bff944b5d35fd2c5e2a_103

So, to repeat my point: The assets are a use of funds, not a source of funds, Menzie. Otherwise the title would read: “SVB had more than half its liabilities in Treasuries and Agencies”.

So, the flows go like this:

SVB client deposits cash at SVB,

then,

SVB lends cash to SVB clients and others, some of it no doubt long term, ie > 1 year; that’s about half of it

The remainder SVB put into ‘riskless’ securities, notably, treasuries and agency-backed paper, ie, securities with theoretically no repayment risk. This is an extremely conservative investment strategy on the face of it.

That is, unless the Fed is playing Russian roulette with the economy, by, say, raising the risk-free rate by 5% (pp) in fourteen months!

Now, the problem is that SVB will have acquired its assets, both the treasuries and agency paper, in the zero-interest environment, let’s say with mortgages paying 3%. But the bank has to pay 5% on deposits now, or else depositors will simply go out and buy treasuries at near 5%. So the bank — and not only SVB, but the whole banking system — is facing a situation where their deposits (the bank’s liabilities) — all short term and liquid — have to pay 5%, whereas locked-in revenues are at best hauling in 3%. Clients will start saying, well, why should I keep my deposits in the bank at 2% if I can earn 5% on treasuries? This will prompt an outflow of deposits, requiring the bank to sell its assets — treasuries and agency paper — to cover withdrawals. When this happens, the bank will have to realize losses on those assets, which gets the regulators all over them.

There is nothing special about SVB that I can tell, save that they were relatively more exposed to low interest rates, which had a disproportionate effect on the tech sector. That doesn’t make SVB unique. It makes them the canary in the coal mine.

To wit: Our local bank, Cape Cod Five, sent a note around to its clients comforting them that all is well. Except here’s the thing. I refinanced my mortgage with them at 3.3% last January, and their cost of deposits is 5% + bank expenses. How long do you think that will last? And there is nothing special at CC5. It’s just a small regional bank, like hundreds of others.

Basically, the Fed has a few days to push the FFR back to 2.5% or else the whole system may collapse. That’s my read.

And by the way, where are the Fed and the regulators? Right here:

https://twitter.com/wdiamond_econ/status/1635843245417590788/photo/1

Egregiously bad policy analysis from the Fed and Treasury, once again.

Steven Kopits: I wish you would read (and comprehend) the post. Figure 1 refers to assets. SVB had assets concentrated in Treasuries/Agencies which experience a big capital loss (actual or incipient if they couldn’t hold the HTM component to… HTM). Figure 2 refers to liabilities, i.e., how much of liabilities were in non-deposit borrowings. Your less than 10% is consistent with my graph. My point was that as deposits became more scarce (clients having to draw on their lines of credit), then SVB had to rely on short term capital markets. This is a completely typical phenomenon – it happens to banks, it happens to countries (emerging market debt crises are almost always presaged by increasing borrowing at short term). So…read the post a bit more carefully.

In any case, I want to see you explain what a confidence interval is, in your own words.

Both you and I are using Dec. 31 numbers, Menzie. The difference is that I used the 10-K and you used Yahoo Finance.

I don’t see any unusual reliance at SVB on interbank lending or anything similar. Are you stating that 10% debt is somehow ‘reckless’? On what basis? What interest rate are they paying and how did that contribute to the financial meltdown? You haven’t made that case, because it didn’t.

What happened to SVB is that it was unable to digest a 5% (pp) risk free (r*) interest rate increase in 14 months. Well, duh. Banks borrow short — that’s what demand deposits are — and lend long, that’s what mortgages are. When interest rates were at zero, everyone refi-ed or took out a rock bottom loan and SVB is locked into that interest rate. Similarly for securities purchased then. You can flip them and repurchase, but you’ll ride the interest rate rise all the way up. On the other hand, with mortgage rates at 7%, no one is borrowing even as deposit rates are heading to 5%.

If you’re interest income is 3% of assets, and your interest paid is 5% + another 1.5% to cover operations, well, the bank will be losing money at the pace of 3-4% of assets per year. If equity is 5% of total assets, then the bank will find itself on life support pretty fast.

This is not rocket science. Except at the Fed and Treasury, apparently.

If you’re right, then there’s no systemic risk. Then why CS? Why Signature? Why a giant banking downgrade? Why did the Treasury (FDIC) guarantee the entirety of US demand deposits? Doesn’t seem like just an SVB problem to me.

You simply confused assets and liabilities. Simple as that.

Steven Kopits: I did not write that 10% debt financing was reckless. I wrote that increasing short term debt accessed via short term capital markets is usually a signal of difficulties in financing the usual way. It’s a signal.

The hunt for similar behavior has begun. Signature Bank has been shut down by regulators – another crypto mess. Marketwatch has identified 20 other banks which would suffer if forced to mark assets to market (which is what happens if cash is needed), but I’m over my Marketwatch limit, so no link for y’all.

Friday’s bank sector equity trade looks, from the sidelines, like a hunt for similar business lines. That makes sense for portfolio rebalancing. Now comes the hunt for similar financial practices (Signature Bank, for instance). The repo market will treat bad actors poorly, not because of market liquidity problems (at first, anyhow), but because of concern about credit quality. This is what repo guys are paid for, and they are vicious when red flags go up.

The Fed has an intelligence system which will be looking for signs of systemic trouble. That system, and any liquidity facilities that are stood up un response to trouble, come ahead of monetary policy tools in securing financial stability. Even so, the overwhelming favorite for the March fed funds decision is now for a 25 basis point hike, down from 50 bps on Thursday. The modal estimate for the year-end funds rate is unchanged at up 50 bps, but the median has shifted down a bit. If trouble spreads (as it has to the UK throught SVB’s subsidiary there), expectations are likely to shift to Fed easing. Fed talk may be “cards to the vest” for a while.

Raising capital is a likely prescription for some, which means pressure on equity values, perhaps only for a narrow sector, but with money expensive, perhaps more widely.

“Raising capital is a likely prescription for some, which means pressure on equity values, perhaps only for a narrow sector, but with money expensive, perhaps more widely.”

Would this raise the cost of capital? Did someone decide that Modigliani-Miller is junk science?

As far as being “forced” to adopt mark to market – there was a time financial economists argued that better accounting was a good thing. Yea I get that the banking sector hates people like me – but screw them.

I doubt it, because the Fed is the primary dealers. These are not only not primary dealers, but enemies. Here is better advice Macro, stop giving out so much debt, stop getting used by parasites like Peter Theil. Fed rates are irrelevant. They were dead by December of 2020.

A financial wizard who used to work for me before he got into what he wanted to do put up something really detailed on LinkedIn. I did not spend enough time going through all the great information but one thing that jumped out at me was that its equity to asset ratio before the collapse was a mere 5.6%.

I thought we were insisting banks hold at least 10% (with the Greenspans of the world arguing for 20%). Thin capitalization and no real regulation (ala Donald Trump) is a recipe for disaster.

I think the good news here is it was mostly fat cats that got hurt, not small depositors/ small savers. I just hope between this and his contributions to donald trump that Peter Thiel doesn’t have to go to a soup kitchen or food pantry tomorrow morning. Or we might start to think the “Masters of the Universe” are just a bunch of dumb guys that were born on third base and thought they hit a triple.

https://www.nytimes.com/2022/02/07/technology/peter-thiel-facebook.html

We can’t have “Masters of the Universe” intelligence levels questioned. The next thing you know the typical American won’t be buying “My Pillow” anymore or fawning over the latest trump donator moron on TV with a shiny forehead and veneers on all his teeth.

https://theintercept.com/2019/05/02/peter-thiels-palantir-was-used-to-bust-hundreds-of-relatives-of-migrant-children-new-documents-show/

https://www.politico.com/media/story/2016/05/gawkers-peter-thiel-contingency-plan-004549/

https://www.vanityfair.com/news/2018/02/the-thiel-gawker-saga-takes-an-even-darker-turn

https://www.amazon.com/Conspiracy-Peter-Gawker-Anatomy-Intrigue-ebook/dp/B07637TDJJ/ref=sr_1_1?ie=UTF8&qid=1519564069&sr=8-1&keywords=conspiracy+ryan+holiday

Thiel is apparently wanting the U.S. Federal Government to socialize/subsidize his losses on bad tech investments:

https://theintercept.com/2016/07/21/peter-thiel-i-miss-the-days-of-strong-daring-federal-spending/

https://theintercept.com/2023/02/03/china-americas-frontier-fund/

Isn’t it interesting that “businessmen” will spend all day bad mouthing socialism, but when they want free money from the federal government, they run straight to “free market” Republicans with their beggar thy neighbor hand out. It ends up being a kind of kickback. “I give you $1.25million to F*ck-up the nation any way you desire, and you subsidize my “businesses””X” number of multiples of my $1.25million bribe, deal??”

I know it’s fun to talk about fat cats and bad-mouth “businessmen”, but this is a situation where the Fed is targeting bond rates (inversely therefore bond and T-bill values) and also is actively trying to grind down the stock market and has already tanked commercial real estate values and is driving down residential home markets. So it is rapidly undercutting the value of bank assets.

So where would you, imagining yourself at the helm of a bank, put your assets?

Think about it. The Fed helped break this bank. You can argue semantics and “no taxpayer money” and blah, blah, blah till the cows come home but if there are a couple more failures and the finger gets directly, loudly (and politically) pointed at the Fed, the charge carries some weight.

@ “w”

It’s not a systemic issue at this point for the banking system [ I feel like I’m arguing with idiot Rosser again ]. It’s like the old Buffett joke, “when the tide goes out you see who’s standing there nude”. Well guess what, nearly all of the swimmers have their trunks on, only SVB and a minute few don’t know how to run a bank properly and got caught in the nude.

You’ll notice Peter Thiel is a man who can normally never keep his mouth shut. He’ll rattle on about ANYTHING. You notice how quiet Thiel is right now since the collapse of SVB?? If the man thought he had one half of a single table leg to stand on, he’d have been belly-aching for the last 3 days solid on CNBC about how the FDIC was “out to get him”. What does Thiel have to say now about SVB?? Radio silence. That tells anyone above idiocy level VOLUMES about who is to blame here. And this is coming from a man (me) who hates Jerome Powell.

This seems correct. Right now the political winds are mad at Silicon Valley techbros and Twittering VCs. Break another bank or two as a perceived consequence of interest rate hikes (whether wholly accurate or not) – especially one in the Midwest or Southeast – and the winds will start shifting right onto Powell’s lap. And that could happen a lot more faster than the FOMC might realize.

Yeah…… but who’s brain is “more faster”?? Yours or your mother’s?? Possibly if your parents adopted a child it is the “more fastest”??

I keep trying to figure out how my Ex-gf in China taught herself better spoken and written English in 3–6 months time than USA lifetime resident FOX viewers. I think I know the answer to that, but still seems a fascinating phenomena in my mind.

*Excuse me, that should read “whose brain”. I’m doing nothing to change these morons and they’re rubbing off on me.

You got to stop thinking high tech produces a bunch of growth. It doesn’t. It produces globalist wealth schemes that weaken growth. That is facts. No surprise this becomes big after the financial crisis. It’s a anti-innovation scam.

So… they were “overexposed” to government bonds. In a world where the Fed has also targeted real estate values and stock (equity) values, what is a sound asset?

The Feds rapidity in raising rates really did not give banks much time to adjust, so I go back to the claim that the Fed helped break this bank.

Biden says those responsible will be held to account.

Really?

They were overexposed to Fed interest raise risks – because they were allowed to “mark to maturity” rather than mark to market, on treasuries. They would not have placed so much money into long treasuries if their official capitalization was based on mark to market. Because we allow mark to maturities they chose a slightly higher yield on long treasuries with little consideration for interest raise risk. Treasuries are still the soundest asset you can get, but the long ones are practically not really as liquid as many consider them.

Maybe. But not really. They were exposed to bad crypto loans, which tripled in 2020.

“Mark to maturity” is valid if you are holding to maturity… until you have a bank run.

Here’s a hypothetical: would it be cheaper to buy back the treasuries at par during a run than it would be to bail out the failed bank after a run?

After all, you are now going to have some pretty bad optics: the US accusing bank directors of holding too much US long-term paper. Talk about shooting yourself in the foot.

If we are allowing mark to maturity we might have to also allow that a bank sell its long bonds back to FDIC (or the Fed) at par during a run. But only when it basically is failing. If they all could do it anytime we would just have encouraged risky banking bets. But I am not sure that it will make a big difference. A bank run is an avalanche and not much can stop it.

Not sure I see the bad optics in accusing banks to not manage all potential risks. Its not like the increased rates haven’t been signaled and predicted for years. They could have shifted slowly – but then their bonuses would have been hurt.

But I sure hope the Fed will stop selling its bond holdings at next meeting – that is like pouring gasoline on the fire.

looks like the fed hit it just about right. take those banks with sound assets but mark to market liquidity issues, protect the bank itself, but wipe out shareholders and management for poor business practices. the fed can bail out the depositors and still not lose any money, because the assets backing the bank will cover costs when they mature. this model might just work, as a bank can still try to reach for yield, but if it does then those responsible (shareholders and management) pay the price. for most banks, that risk is probably not going to be worth it.

svb is worth protecting, because of its long term involvement in helping tech startups. most commercial banks won’t touch startups because a commercial bank cannot understand a startups balance sheet. I think this niche is important to preserve for silicon valley. I think some VC bros, such as thiel, were playing with matches out back and burned the whole house down.

Menzie Chinn,

This is almost entirely correct.

I do laugh at the line “It’s kind of funny to think of credit risk associated with Treasurys” as that comedy show has served many people extraordinarily well. I hope you profited on this “news”. I’m told “my” company did very well on this.

I hope that the smart people who were using SVB and knew this was going to happen moved their money into a safer institution….like Signature Bank. Oh wait, they failed too! Who could have known that crypto was a scam. Who could have known that we would have a higher interest rate environment than what persisted from 2010 through 2021. These are strange times for the tech bros. In fact, it’s almost like that strange decade from so long ago—the 1990’s, but some of those smart people were in diapers then.

I seems like the right people will take the most of the hits this time. First stock holders are wiped out, then bond holders, then the FDIC takes the rest of the loss spreading the pain to banks paying fees to FDIC. That may even get some banks to argue for more regulation to keep fees low enough that they are competitive with shadow banks.

Princeton Steve declared yesterday that the Federal regulators had “botched” the SVB situation. It seems our very arrogant Know Nothing spoke once again before he had a clue what on earth he was babbling about:

https://www.washingtonpost.com/us-policy/2023/03/12/silicon-valley-bank-deposits/

Andrea Mitchell is interviewing Lawrence Summers. Summers is saying we need to rely more on regulatory discipline as market discipline is not enough. So Larry disagrees with Trump, Greenspan, and Jonny Cochrane. Larry also is confident what Team Yellen did over the weekend, which means Larry thinks Princeton Steve is a total bozo. Larry – welcome back to the real world!

normally, I agree wholeheartedly with prof chinn on the many posts to this site. it seems on this topic, he is on the side that the bank was reckless (my words, not his) and the penalty should be severe. I guess I am not yet sold on this position, and politely disagree. from what I gather, there were some failures on the side of the svb folks. interest rate risks were handled poorly, locking up long term debt reaching for yield. however, this was on the purchase of government securities (ie treasuries), not the crap that brought down Lehman and bear sterns. if the government had not bailed out the depositors, I think it would have been a pretty poor message to send to the markets in general. my guess is those uninsured deposits were mostly in the bank because the bank also serviced their rolling loan needs (ie payroll, etc), with some reach for yield a little bit of encouragement.

the way I see this playing out, the equity and bondholders of svb should pay a price, since the business failed. and action should be taken so those in management are not permitted to work in the banking industry again. but i think protecting the deposits was appropriate. in fact, we should consider increasing the insured deposit threshold to something beyond the 2008 limit. year ago, before the financial crisis, I held funds in a regional bank that worked with fellow regionals to actually cover $1 million of deposits by shuffling the funds amongst various banks. this was good for those regional banks.

I still think that there needs to be further investigation into how this bank run was instigated. I smell something fishy there, but have no true evidence. but a solvency failure due to holding treasuries (yes I understand the capital loss due to interest rate, but that is a paper loss that only occurs if the treasury is not held to maturity) is problematic. if a bank fails while holding treasuries, who truly is safe in the banking industry anymore? treasury debt may decrease in value, but it has never become worthless like a junk bond could. what was being spread on social media, and by whom?

baffling: A sectorally concentrated portfolio of assets is almost certainly a problem for any bank. But more broadly, banking *is* an inherently dangerous enterprise — banks are engaged in maturity transformation. They lend out long while taking on zero maturity debt (deposits). The only reason banking is less dangerous than in the pre-FDIC period is because of deposit insurance. But like Northern Rock in Britain, not all deposits were insured (i.e. insured only up to 250K here), you can still have a classic bank run.

So…no bank is completely safe.

“A sectorally concentrated portfolio of assets is almost certainly a problem for any bank. ”

no doubt this is true. but should a bank fail due to concentration in treasuries? lose money? sure. but fail?

at any rate, I think I read on cnn this morning that over $600 billion in unrealized losses sit on us bank balance sheets. much of that is us treasuries and agencies.

Interesting how quickly the Fed/FDIC act when deep pockets are the depositors. Finger tight on the hair trigger. HAMP mortgage cramdowns for people who lost their jobs due to macro effects totally out of their control??? “Take a number, maybe we’ll see you in 10 years, at which time some Republican appointed judge will lecture you on contract law. You should have thought about that when you got a mortgage with a job vulnerable to the macroeconomy. Shame on you, you derelict bum”

“Contract law” lectures for deposit uninsured Silicon Valley deep pockets?? “Nope, Nope, FDIC has got you covered, go back to sleep guys. You’re in the Hillary ‘I’m special and can do no wrong’ group. Take some much needed time in your backyard hammock, we got this. You didn’t think the FDIC or MHA was here for the little people did you?? MHA and the U.S Treasury mainly just enjoys lecturing the working class about ‘contract’ law and letting them know what bums they are for existing in a macro turndown. Hahahaha you gullible Silicon Valley guys, don’t cry now, please don’t cry, we’ll pay your uninsured deposits. It’s only working class asking for mortgage renegotiation after getting kicked to the curb by ‘the job creators’ that get dry reamed, relax “

Moses Herzog: If you’re saying the banks should have been regulated with greater stringency before the fact, I would agree. If you’re saying, *now* is the time to make the Silicon Valley folks (entrepreneurs who deposited their funds) pay, at the cost of collateral damage to the rest of the system, I’m not so sure.

Sort of like, we should’ve regulated all the big banks and owners of SPVs that generated MBS’s and CDO’s ahead of time. But by the time we were in the middle of the crisis, that was not an option.

The bank run was started by Peter Thiel. Who in 2019 brought the capital into SVB for crypto startups??? Peter boy. 60 billion to 200 billion. Nothing more nothing less. A 40 year tradition of tech startups……dead by crypto.

I am generally loathed to agree with Goldman Sachs on anything but this makes sense:

https://www.msn.com/en-us/money/markets/goldman-sachs-says-it-doesnt-expect-a-fed-interest-rate-hike-in-march-after-silicon-valley-banks-implosion/ar-AA18yWdj

The implosion of Silicon Valley Bank, or SVB, and the resulting panic in the banking sector is expected to thwart the Federal Reserve’s hawkish efforts on interest rates, according to one major bank.

Goldman Sachs now doesn’t expect the Federal Open Market Committee to hike interest rates at its next two-day meeting on March 21 and 22. The investment banking giant was previously expecting the US central bank to hike the rate by 25 basis points, or 0.25 percentage points at this meeting.

“In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March,” Goldman Sachs analysts wrote in a Sunday note seen by Insider.

Well, yes, it should thwart them. This has got to be one of the more needless bank failures in history and you can arguably make the case that the Fed directly contributed by its hell-bent rush to devalue the securities of its own government in pursuit if the evil inflation specter… never mind many obvious and transitory causes of that inflation ranging from a reset after a pandemic to a shooting war interrupting energy flows to bird flu killing chickens.

They will, of course, never own up directly to that responsibility but they should at least have the decency to quietly quit trying to break things.

silicon valley bank is not representative, the bbg chart does not reflect the composition of loans and agency holdings.

svb has big positions with venture and private equity business/founders in start ups and other tech that is not fairing so well in silicon valley.

that said svb may not be unique in terms of sluggish risk management and relying on valuing “not for sale” bonds and other such assets at par (which is permitted) when rising rates reduced the salable price of those assets.

bond positions, market price decline, have been effected by the fed for quite a long time.

i ran to the short end of the curve 6 months ago.