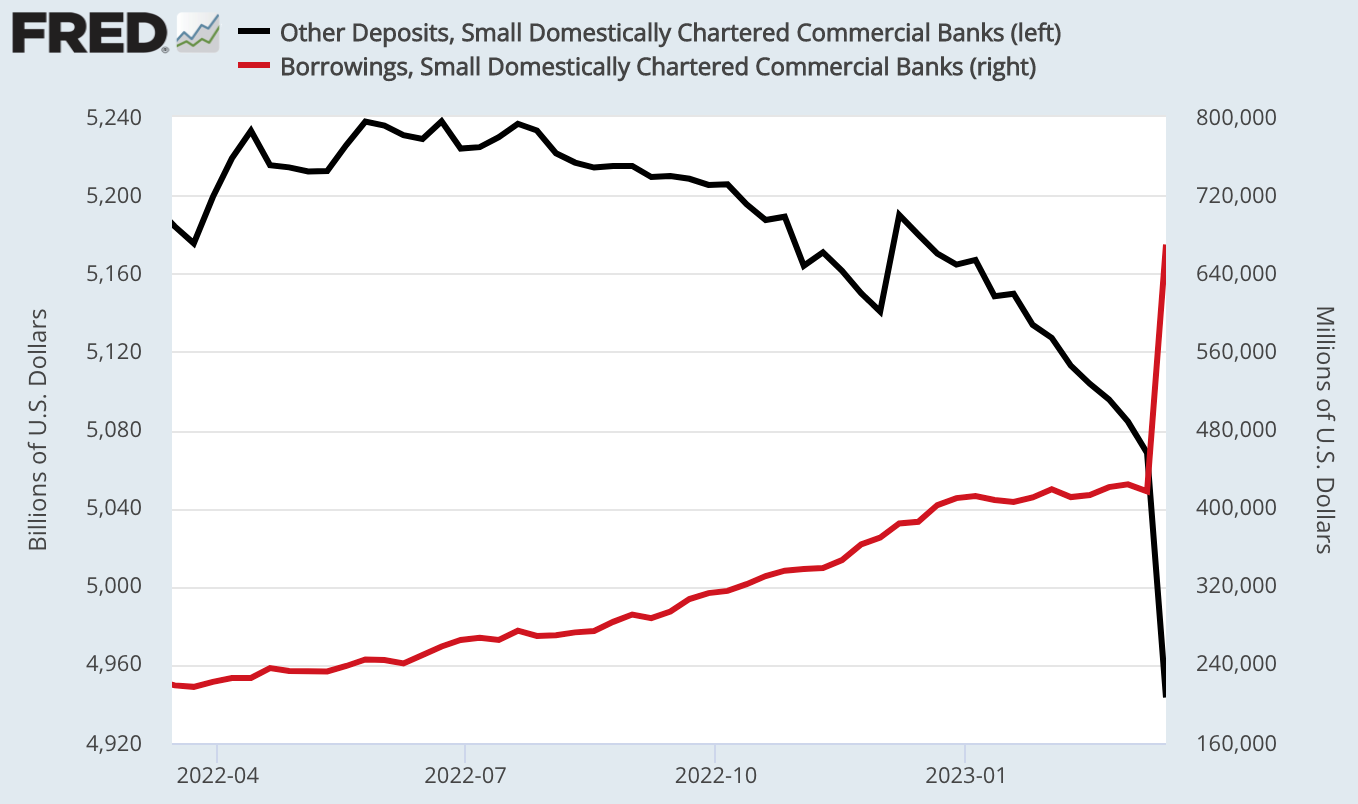

Rashad Ahmed brings my attention to the following:

Source: Ahmed via FRED.

“The H.8 data is updated through March 15 and the data shows quite starkly the “run” on small banks in black. “Other deposits” are basically proxying liquid demand deposits (total deposits less large time-deposits). “Borrowings” proxies for banks drawing credit from the likes of FHLB and Fed.”

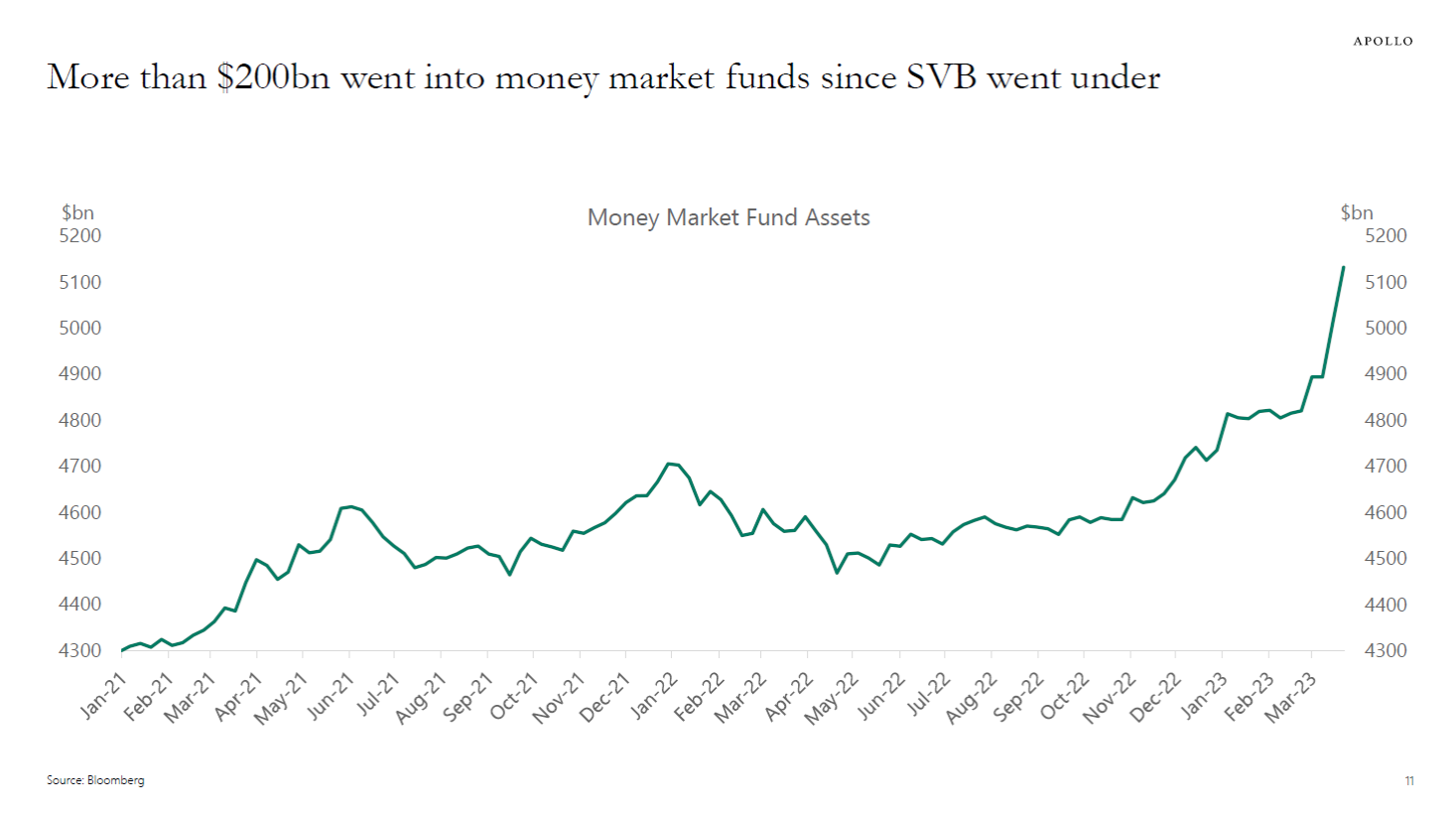

Not only are funds shifting locations, they are shifting out of deposits, as pointed out by Torsten Slok at Apollo today.

“The divergence between the Fed funds rate and interest rates on checking accounts is the fundamental reason why money is being moved out of bank deposits and into higher-yielding investments, including money market accounts, see charts below. Higher rates as a source of instability for deposits and Treasury holdings is highly unusual compared to previous banking crises, where the source of instability has typically been credit losses putting downward pressure on the illiquid side of banks’ balance sheets.”

“The divergence between the Fed funds rate and interest rates on checking accounts is the fundamental reason why money is being moved out of bank deposits and into higher-yielding investments, including money market accounts”

The natural question here is why are not banks paying depositors higher interest rates?

Where Do You Keep Your Liquid Wealth—Bank Deposits or T-bills? by Julian Kozlowski and Samuel Jordan-Wood

https://research.stlouisfed.org/publications/economic-synopses/2022/12/16/where-do-you-keep-your-liquid-wealthbank-deposits-or-t-bills#:~:text=The%20deposit%20spread%20has%20continued%20to%20increase%20because,and%20those%20paid%20on%20CDs%20have%20also%20increased.

A nice discussion noting how TBill rates have risen faster than CD rates with the difference being what they call the deposit spread. They also note:

‘CDs typically pay a higher rate than checking or savings, but when you deposit money into a CD, you cannot withdraw that money until maturity or else you must pay penalties.’

Well duh – people do pay for liquidity as well as the convenience of writing checks with a fee. Something some of Economic Know Nothings do not get.

One thing the authors have yet to explain – why has their deposit spread risen so much?

Jonny boy is mansplaining to Macroduck the horrors of real returns to CD being negative 1.5%. WTF he got this number – no one knows even Jonny boy. I just checked with FRED and the 5-year measure of expected inflation is 2.2%.

So wait – is Jonny boy saying the nominal rate is only 0.7%? My link seems to say so. But wait government bond yields are closing to 4.5% so isn’t the real return over 2%?

OK I get there is a deposit spread but Jonny boy kept telling us that depositors were getting those higher government bond yields. OK, OK, Jonny boy never bothers to check the data before babbling his usual nonsense.

Doesn’t this also imply it’s mostly “more sophisticated” or wealthier individuals moving their money??

I’m a financial economist within Market Risk & Supervision at the US Department of the Treasury – Office of the Comptroller of the Currency.

In other words, someone who gets financial markets (unlike a few self styled experts here who babble BS).

Rookie question here: Do these moves influence monetary velocity and general money quantity in a way that would further dampen inflation? I’m trying to imagine a scenario where millions of people regard mattresses as safer than banks. I’m not rich, and I go about my life with the assumption that my local bank isn’t making lots of risky loans so I still feel comfortable keeping cash there so it can continue to lose purchasing power at a slightly lower rate than my mattress. Am I an idiot?

@ David S

If you’re that worried about your bank, you might look into an NCUA member credit union. They tend to be both safer and offer better rates (on loans and savings)

Put in your address/ zip code here and it will help you find the nearest one.

,b> https://mapping.ncua.gov/

If they have member rules, don’t assume they won’t let you in. Talk to them in person. Often times a relative can help get you in (Say your father is in the military or your wife is a teacher etc). They want your dollars, they will get creative. But not just “any” credit union. You need to make certain it’s an NCUA member,

Movement into money market mutual funds doesn’t impact total deposits as the funds ultimately find there way back into the banking system. For example, if I transfer $100,000 into a MMMF, the fund will then buy securities, and the issuer (or seller of a previously issued security if not a new issuance) of those securities will have higher deposits (unless parked at the FRB’s ON RRP facility or used to buy bank non-deposit borrowings). In other words, only the central bank and commercial banks are able to change the level of total deposits and therefore the money supply, all other transactions are simple transfers between deposit holders. See the BoE primer for a fuller explanation:

https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy

Yes, some depositors are fleeing, spurred by abysmally low real interest rates. But most depositors, particularly small savers, will just suck it up and stay put.

Does any economist care to explain how such exploitation of savers can persist in a “free” market? Why has the time value of money become negative? And would any of the “public policy” experts here care to weigh in on the fairness of such exploitation?

Hey troll – why don’t you provide your “enlightened” explanation. I’m sure the JMCB editors would love to see it. They need a good laugh.

Price discrimination is common across any number of markets; sellers charge different prices to different buyers. In the case of interest on deposits, it’s the buyer who is paying different prices to different sellers, but the principle is the same.

Anyone claiming knowledge of economics ought to be aware of price discrimination. Price discrimination is, in fact, a reflection of the freedom of a market. It is in regulated markets that buyers most reliably receive the same price. Irony quotes don’t change that.

Let’s see. Interest free checking. Liquidity. Other economic factors economists note but little Jonny boy never got.

Just posted a link to Where Do You Keep Your Liquid Wealth—Bank Deposits or T-bills? by Julian Kozlowski and Samuel Jordan-Woo.

Interesting data and discussion but still not a full explanation of deposit spreads.

Ducky avoids the fairness aspect of price discrimination: “ Price discrimination is common across any number of markets.” Spoken like someone who works for an investment company or an investment research firm that profits from negative real rates!.

Yes, real wages are stagnant and income inequality is growing to the advantage of the affluent and wealthy. (Not to worry… just price discrimination!)

Real returns on bonds and savings accounts were near zero for the 2010s and significantly negative since then. Real yields on average bond are now about -2.5%. Even the real rates high yield money markets are negative. (Just price discrimination!)

Meanwhile, wealthy Wall Street investors in stocks made out like bandits. But Ducky just shrugs and says, “that’s economics!” It has nothing to due with Fed policy and regulations…or with banksters’ market concentration and pricing power!!!

And some, like pgl, think that rates are too high…gotta make them even more negative in real terms to benefit Wall Street investors!

But what’s even more remarkable is how little mainstream economists talk about negative real interest rates …even more pronounced than their reluctance to talk about how Median usual weekly real earnings are back to where they were in 2019.

As for “public policy,” apparently it’s no more than a euphemism for improving the lot of the 1%.

Couple of things. Any time Johnny’s understanding of economics comes up short, as it has here, he hides behind the pretense that he is the last ethical person on earth. Johnny supports Putin, but insists he’s more ethical than the rest of us.

I’ve made this point to Johnny in the past, and will repeat it here. Understanding doesn’t begin by insisting on your own view. Understanding begins with facts. Johnny asked about different prices (interest rates) for different people. I explained it to him. Now, he’s all “boo hoo, you didn’t agree with me about fairness!”

As to mai stream economists discussing negative real rates, Johnny has once again revealed how little he knows about economics, or perhaps how little he cares about the truth when discussing economics. There is a vast literature on negative rates. Monstrously, hugely vast. Johnny, this habit you have of saying economists don’t care about subjects that are bread-and-butter issues stopped being cute the first time you did it.

Ducky, where’s the beef? Please reference posts here that discussed plummeting real rates in the past two years, when inflation was soaring and nominal rates were stagnant. Very negative real interest rates is a current problem. You can’t just CYA and dismiss it by saying that economists talked about it a dozen years ago.

Yes, I recall discussions of ZIRP over a decade ago, but those focused on nominal, not real interest rates. And if a few discussions focused on negative real rates, why not talk about them now in light of the current problem?

Ducky bobs and weaves to avoid discussion of very negative real rates. Nice evasion…with absolutely no content, just evasion and attack.

Of course, Ducky was alarmed by the JOLTS numbers last year: (gasp) How dare workers quit their jobs in mass, trying to keep up with inflation?

Now it’s depositors turn to leave in mass in search of better returns to mostly keep up with inflation. How dare they? Fact is, the chart above shows that only about 5% of deposits have fled…apparently the rest are happy to be exploited by -5% real interest rates. And that is perfectly fine with Ducky and his Wall Street crowd.

JohnH

March 26, 2023 at 6:12 pm

This troll says people have not been discussing real interest rates of late? Come on – is it not time that blatant liars be banned from the blog. After all – there is far too much stupidity being floating here. Maybe the JohnH, CoRev, and Bruce Hall should pollute Princeton Steve’s lonely worthless blog and leave this place for the grownups.

“apparently the rest are happy to be exploited by -5% real interest rates. And that is perfectly fine with Ducky and his Wall Street crowd.”

john, it appears your real issue is not with macroduck and the wall street crowd. your real issue is with the ignorance of the average person when it come to economics. folks have options, but because they choose a not so optimal option, you seem to take umbrage. fine. but don’t blame wall street. blame the individuals who are making this decision.

let me give you an example. my father in law, who is not so nimble with his finances, recently moved a big chunk of savings into short term treasuries at treasurydirect. why? because he got a substantial increase in rates, giving him thousands more in earnings from his savings. he only did this after i got him invested in savings bonds and a treasurydirect account. it was not wall street or macro that had kept him on the sidelines. it was his own fault. eventually he saw the value in the switch. most folks are in a similar position. and blaming wall street for their inability to overcome the friction of moving those assets is not a solution to the problem, even though that is what you are doing john.

I’m no fan of price discrimination as it is both unfair and inefficient. But that rant of yours is beyond incompetent babbling that aids nothing to the conversation.

Now one who gets economics might challenge Macroduck on how could price discrimination in a market where arbitrage is rather vigorous. Oh wait I just used a term Jonny boy does not get.

Talk about babbling!!! pgl totally avoids the issue of negative real interest rates. In fact, he asked for even lower interest rates, which will mostly help investors’ portfolios grow.

JohnH

March 26, 2023 at 6:38 pm

Some one needs attention I guess but damn this some one is off to the stars proving the obvious – JohnH STUPIDEST MAN ALIVE!

“But what’s even more remarkable is how little mainstream economists talk about negative real interest rates”

Never mind this topic has been heavily discussed for the past 12 years. Come on Jonny boy – if you have a point to make here, stop polluting it with your usual insanity.

Pgl claims, “ this topic has been heavily discussed for the past 12 years.” Where’s the REAL beef? Where has it been discussed by economists in publications with more than 25,000 readers? Or is “public policy” to be discussed in obscure academic journals outside of public view?

I hate to interrupt your babbling with an interesting paper on Regulation Q but this 1978 paper by Edward Kane comes to mind:

https://onlinelibrary.wiley.com/doi/10.1111/j.1540-6261.1978.tb02032.x

You might enjoy the opening story even if you have no clue what Regulation Q was. No worries – Kane consistently asserted to we should repeal it which we eventually did. But let’s see if Jonny boy could offer what this debate was all about.

Very important points. Money is moving out of banks, but that is as much driven by the search for yields (se before March 1), as the fear of a bank collapse. So it may look like a traditional bank run but it is not. Also worth noticing that the drawdowns are in the order of $120 billion on the background of 5,000 billions not a large % of capital is moving. The borrowing is less than a billion so they are covering all the drawdowns from their own money.

What many people may not realize is that the MM high yield is very much produced by higher risk. MM accounts are not what they used to be. They often invest partly in corporate assets and sometimes even in longer bonds, in order to get the yields up. My guess is that a lot of money will move back again then people realize how risky money markets are today and that there is no FDIC insurance (and likely no Federal backstop) on these MM investment accounts.

Money markets are not just riskier, but just before Covid hit, there was a change in regulation which ended the practice of assuming par value for money markets. Marking to market meant that money market funds no longer offered zero volatility for risk accounting purposes. The weighted average “risk” of all U.S. financial assets jumped up on one October day because of the requirement to to reflect the actual volatility of money market funds.

I don’t know what effect that had on the choice between money market funds and deposits. Kinda think it might have led at least some money to park in deposits. A liquidity preference thing.

I am worried that a lot of people think of MM as that old time “can never break the buck” investment their parents and grandparents had – and have moved from banks to MM for that reason, or because the yields are better. When they realize that MM is a completely different entity now – they could just as quickly move their money again. It only takes one little MM going belly up and breaking the buck for people to realize that they didn’t have what they thought they had.

“ Money markets are not just riskier.” Apparently Ducky doesn’t know that FDIC insured banks also offer high yield money market accounts through brokers.

Some of the money is also being offered as high yield CDs (-1 to -1.5% real interest rates.) through brokers. Some banks and credit unions are also offering FDIC insured money market and CD accounts at -1.5% real interest to ordinary savers.

If the FDIC wanted to genuinely protect savers, they would advocate legislation that would require banks to compensate savers for the real purchasing power lost to banksters due to negative real interest rates.

Johnny, did I hurt your wee feelings when I cleared up that point about price discrimination? Poor baby!

This “apparently X doesn’t know about Y” is the same old junior high debating trick that trolls the internet over have been using for years. You among them, of course. Here’s a little secret about grown-ups… They often don’t spout every fact they know about a subject. That’s what school kids do to please their teachers. Grown-ups assume a certain level of knowledge among other grown-ups. However, when asked to “explain the exploitation of savers can persist in a “free” market”, we suspend that assumption and offer the explanation requested. Then Johnny throws a tantrum.

Ducky didn’t appreciate being called out for not knowing that not all money markets are all that risky!

Johnny, money market funds, as a class, are riskier than insured deposits. I didn’t claim that all MM funds are uninsured. I made a claim about MM funds as a class.

You have been on the attack in these comments, but your attack comes down to claims about what I think and what I know – claims which are made up from whole cloth – rather than about issues of substance.

If you want to make up lies about me, at least make up credible lies. You may think that the variety of money market accounts is an arcane topic, but that’s because you have limited knowledge. You di this all the time, pretending that your level of knowledge is some standard, a standard which others are likely to have fallen short of. There is not a regular commenter here who has demonstrated less knowledge than you. I include other members of the troll choir in that statement.

You never know as much as the people you attack. You never know the real state of affairs in economics. It’s just one charade after another with you. It’s pathetic.

JohnH seriously needs emotional help. His latest rants are just beyond pathetic and pointless. Do not encourage this insane troll but do send the men in coats as Jonny boy has become a danger to himself.

I get you hate Macroduck. After all – he is smart and articulate – two qualities you lack. But damn – your writing on these topics are even dumber than the garbage we get from Princeton Steve … something I never thought was possible.

.

Summer 2007

An obscure note in the back pages of the Wall St Journal notes that a hedge fund was requiring longer periods of notice prior to withdrawals. I think it was 30 days, but I might be wrong.

Bank borrowing from the Fed spiked, hard, like it never had before.

The fecal matter promptly interfaced with the air circulatory system, and the rest is history.

Fortunately, history doesn’t repeat it self.

“I’m not so much interested in the return ON my money as I am in the return OF my money.”

Said every depositor who ever participated in a bank/hedge fund/REIT run, once Will Rogers said it first.

The move from deposits to money market accounts doesn’t necessarily cause a tightening of financial conditions (see H.B.’s comment. ) I am curious, though, whether lending multipliers are the same across all types of lenders.

However, sudden moves, of the type experienced since SVB went wobbly, are very likely to cause tightening of financial conditions. Putting aside fear, there is a period of adjustment, as borrowers are forced to follow lenders around. Existing financial relationships stop working and new ones have to be established. During that process, liquidity is reduced. Fear (I’m including the practical realization that formerly sound institutions may no longer be sound) probably does more to tighten financial conditions, but there is a purely mechanical tightening, and the two interact.

No, this is wrong. Your better than this. It means financial conditions are loosening. Especially around prime corporate debt.

You haven’t said which point you think os wrong. The fact that you disagree is not evidence that I’m wrong. Far from it. I at least lay out my thinking. Why don’t you try doing the same sometime?

Off topic – Remember how climate change was going to be good for us because it would make growing food easier? Never mind drought and flood, there’s a soil problem:

“Evolutionary responses to anthropogenic climate change are irreversible and largely uncaptured by climate models. Below-ground carbon transformations represent an important natural mitigation solution, but novel adaptive traits may alter microbial climate feedback mechanisms.”

https://www.biorxiv.org/content/10.1101/2023.03.16.532972v1

We don’t know how soils will work under higher average temperatures, because we don’t know which microbes will dominate in warmer soils. Pretending to know stuff is not the same as actually knowing stuff.

MD again show his ignorance. His Climate Fear is from predictions from Climate Models, and yet he thinks this is a valid point: Evolutionary responses to anthropogenic climate change are irreversible and largely uncaptured by climate models.”

While hie ignores the meaning of his next referenced sentence: “Below-ground carbon transformations represent an important natural mitigation solution, but novel adaptive trait may alter microbial climate feedback mechanisms.” May or may not, could, might, but no actual definitive statement. It is so typical of Climate Science statements. Remember he started his rant with this conclusive statement: “Remember how climate change was going to be good for us because it would make growing food easier? Never mind drought and flood, there’s a soil problem” “Pretending to know stuff is not the same as actually knowing stuff.” Especially when they can not decipher the wobbliness of the science.

The cognitive dissonance of the liberal mind is an amazement. Energy policies aimed at fighting these improper and inexact inconclusive climate claims can not be the reason we are seeing such wide spread and crippling inflation. Nope! They are saving the plane from climate change, but who will save the world from their stupidity?

And we thought JohnH was the insane one here. That you continue to write this trash should be a concern to anyone in your family. Seek professional help.

Poor CoVid. He tries so hard, but his efforts are calibrated for those who share his faux news point of view. I must be suffering from “Climate Fear” (note the upper case) based on “Climate Models” (more upper case), because if I’m just reading the science and taking it seriously, CoVid’s comment doesn’t make sense.

I summarize by saying “we don’t know”. CoVid insists I ignored the part of the article which says “we don’t know”. He can’t be that bad at reading simple sentences. To claim that I ignored a point which I actually made is dishonest. And remember, it’s the liberal mind that’s the problem – CoVid is wearing his partisan bais out where you can see it.

CoVid wants y’all to be distracted by his assertions about my views, so that you won’t READ THE PAPER. I linked to the paper because I want you to read it.

MD, why not copy the whole statement? “We don’t know how soils will work under higher average temperatures, because we don’t know which microbes will dominate in warmer soils. Pretending to know stuff is not the same as actually knowing stuff.”?

Actually we do know and have a settled science to study te subject, Agronomy https://en.wikipedia.org/wiki/Agronomy.

It is the Climate Scientists, and their adherents of the FEAR they preach, that do not know about how soils will work under higher average temperatures. Its as if Climate Scientists and YOU do not know about HOT HOUSES, and their purposes.

Don’t you Climate religious zealots talk about the Green House Effect as being similar to how a hot house works?

Incidentally the capitalization is an attempt to simulate the importance you give to your latest religious zealotry.

Why not refute what I said? A partial re-quote of a statement is a weak defense of you own failure to understand the written word.

All you have confirmed is that the blind are leading the blind believes. Yes, you do not know much about Climate Science.

“why not copy the whole statement?”

I guess you have not figured this out yet but every sane person just ignores your dishonest little parades. In other words – why bother? It’s a CoRev rant.

Wikipedia? Try this:

https://www.researchgate.net/publication/343290678_Agronomy_Climate_Change_Food_Security

Agronomy Climate Change & Food Security

July 2020

Climate change is a serious threat to field crop production and food security. It has negative effects on food, water, and energy security due to change in weather patterns and extreme events such as floods, droughts, and heat waves, all of which reduce crop productivity. Over six chapters, this book presents a comprehensive picture of the importance of agronomy as it relates to the United Nations’ Sustainable Development Goals. With an emphasis on the goals of Zero Hunger and Climate Change, this volume examines sustainable agronomic practices to increase crop productivity and improve environmental health.

Poor little CoRev – he thinks if he comes up with some BIG words, he can just ignore the research. Darn it CoRev – others here know how to do real research. You better search the Dark Web far and wide.

Wow! Ole Bark, bark shows that even he can google to find others’ writing supporting his religious views.

Showing us how wide spread is this religion has no bearing on what I pointed out as MD’s blind beliefs and inaccurate reading of even his own referenced materials.

You are a prime example of the cognitive dissonance associated with the effects of your preferred policies. Climate skeptics have been warning you about the negative effects of these policies, Inflation and the ensuing social, economic, infrastructure reliability and personal costs are just a short list.

How much damage, how many more deaths, and how much higher will the costs go before you recognize your policy failures? For inflation collation is causation for your policy failure.

Good post.

So it was a reverse bank run. Wealthy taking their money from “pandemic niches” spots into traditional risk again. This will loosen credit to Corps especially.

The Australian Financial Review has taken a stab at explaining the pressure on European banks (Howdy, Deutsche!) You’ll never guess…It’s a European Union thing!

Oh…you guessed?

The EU single resolution fund (SRF) has 60 billion euros, and was due to bouble in size last year. Italy refused to ratify the expansion. This is reportedly leading to worry that Europe may not have the resources to handle a banking crisis.

https://www.afr.com/companies/financial-services/why-european-banks-are-now-in-the-eye-of-the-storm-20230326-p5cv9y

Watching “The Pledge” JAck Nicholson movie, after watching part of the Tom Hanks film “Otto….” some things young people don’t “get” anymore. I get paying 5 feet of rope and only getting 6 feet. Most people now don’t. MOst people it doesn’t even register. Hi Macroduck. Hi “AS” Hi “2bits”, HI (new female commenter) Karen James), HI Ivan, Hi “person I always forget, starts with a w”

You guys “get” otto and the Nicholson character. and Tom Hanks’ Otto keeping his promise right?? You guys “get” keeping a promise.

Little Ricky Stryker’s return to trolling seems to have two purposes. One is to let us know he is introducing his alleged son to the porn star business. The other is his attempt to be technical as somehow casting the Princeton Steve contradictory babble over GDP/M2 in terms of a Markov switching model.

Oh wait – he admits he has no clue if his idea has a damn thing to do with the incoherent insanity from Stevie pooh. Which is just as well as Stevie does not have a model just BS. Nice try Ricky but stick to something you know – porn movies.