That’s a comment by Steven Kopits.

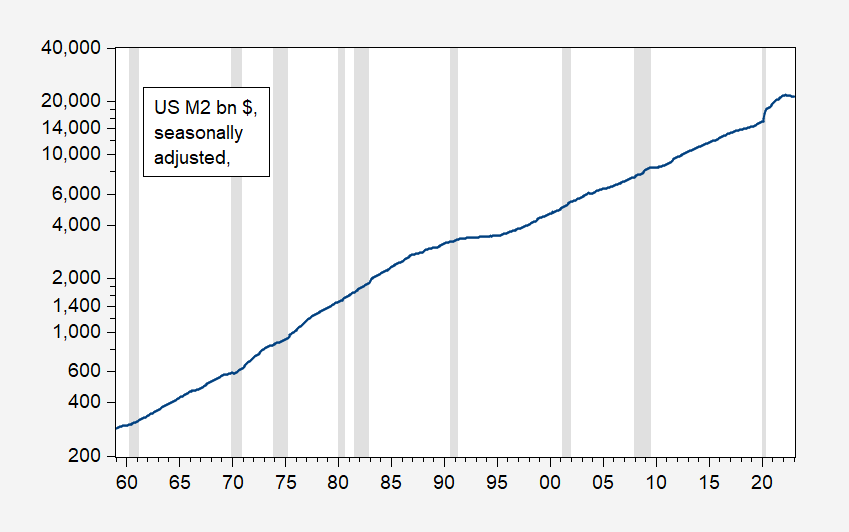

Figure 1: M2 in billions, seasonally adjusted, on log scale (blue). Source: Federal Reserve via FRED.

- Reject unit root null (intercept) at 10% using ADF: No,

- Reject unit root null (intercept, trend) at 10% using ADF: No

- Reject unit root null (intercept) at 10% using DF-Elliott-Rothenberg-Stock: No

- Reject unit root null (intercept, trend) at 10% using DF-Elliot-Rothenberg-Stock: No

- Reject mean stationary null at 1% using KPSS: Yes

- Reject trend stationary null at 1% using KPSS: Yes

If there was a debate of this sort, I missed the conclusion that Mr. Kopits refers to (as well as the general consensus of the economics profession).

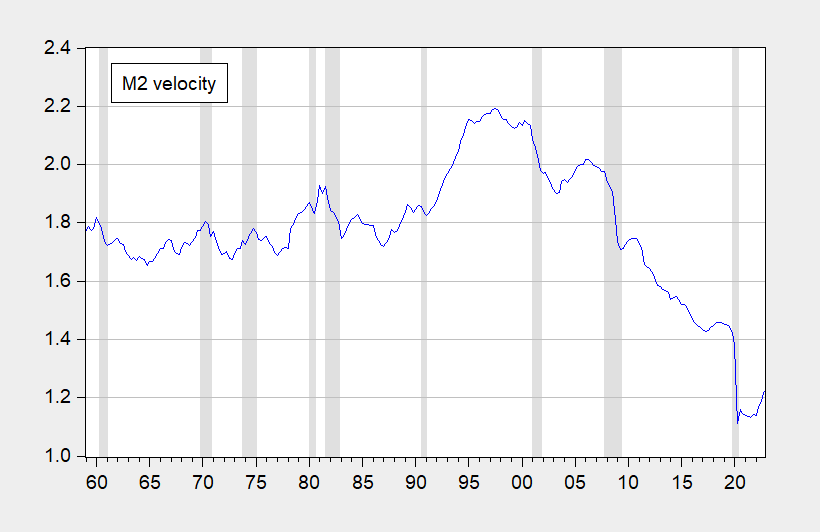

Maybe he meant velocity (M2):

Figure 2: Velocity for M2. Source: Federal Reserve, BEA via FRED, and author’s calculations.

- Reject unit root null (intercept) at 10% using ADF: No,

- Reject unit root null (intercept, trend) at 10% using ADF: No

- Reject unit root null (intercept) at 10% using DF-Elliott-Rothenberg-Stock: No

- Reject unit root null (intercept, trend) at 10% using DF-Elliot-Rothenberg-Stock: No

- Reject mean stationary null at 1% using KPSS: Yes

- Reject trend stationary null at 1% using KPSS: Yes

M2 velocity. I was not clear, but the link was correct. If you’d looked at the title of the link, or clicked through, that would have been apparent. I don’t see any reason why M2 would be mean reverting; the basic assumption would be that increases with GDP, no?

https://fred.stlouisfed.org/series/M2V

“Maybe he meant velocity (M2)”

Well you took the time to admit we were talking about velocity. We did have this debate and YOU said it was mean reverting, which we showed was an absurd proposition. But as usual little Stevie does not pay attention to what others have reasonably said or even reality.

“that (M2) increases with GDP”

Tax revenues have been rising with GDP as well. Are you telling us higher tax revenues are driving inflation? Oh wait – you are too stupid to even know that the recent increase in tax revenues has nothing to do with fiscal policy. Of course little Stevie does not know even the basics of macroeconomics – so hey!

Stevie, you have acknowledged your labeling problem, but not your far larger problems. You have insisted that the velocity of money is mean reverting when it is not. Menzie has demonstrated that and you’ve ignored him. You have insisted that the quantity theory of money is a good tool for policy analysis and a good guide to policy, but that is nuts if velocity isn’t stable.

The quantity theory, as formalized in the Fischer equation – MV=PY – relies on a handful of assumptions, including that velocity is independent of money supply and that change in the quantity of money doesn’t effect output, that Y is independent of M. In other words, fluctuations in the money supply from trend show up *only* in price, not in output or velocity. Here’s the picture:

https://fred.stlouisfed.org/graph/?g=11N20

Velocity, since around 1990, has varied with money supply growth. Price, since 1990, has mostly not varied with money supply growth. There was a structural change around 1990. That is a widely observed fact which has tossed the quantity theory onto the heap of quaint old, useless notions. Like phlogisten and racial inferiority.

You can pretend otherwise, but then, why show up here where your pretense does no good?

Because total M2 is actual borrowing of money. Velocity is how fast its being churned in the economy. So borrowing went up a bit, for awhile. But now is coming back to its trend. Velocity is probably moving back up to its trend line as well.

So, Menzie, do you thing MV comes back near pre-pandemic levels, or not? I think it comes back into the 1.38-1.42 range, which would suggest an additional 10-16% cumulative inflation, depending on GDP growth and the time to close the gap.

And that would bring you pretty close to what a QTM model might suggest. See Fig. 1. If monetary policy continues the trend of the last two quarters, we’d see an additional 5 pp of cumulative inflation. If dM2/dGDP remained flat, then we might see another 14% cume inflation over the next 8-12 quarters.

I’d rather eat the inflation than destroy the banking sector.

And remember, house prices still have far to fall. The bad debt part of the story is still ahead of us. I’d rather inflated prices to reach current house price levels than try to cram down house prices another 20% from here.

https://www.princetonpolicy.com/ppa-blog/2023/3/21/understanding-the-bank-run

“And that would bring you pretty close to what a QTM model might suggest.”

That is sort of like saying living in Brooklyn puts me close to Ukraine. Hey Stevie – why do you continue to double down on some of the dumbest comments in the history or mankind.

It is not even close to 1.4. Dude – stop trying so hard. Everyone knows you know nothing.

“an additional 10-16% cumulative inflation”.

Classic Stevie – monetary policy is not tight enough except when you are blaming the FED’s recent tight money for SVB. Do you even have a clue how utterly contradictory and idiotic your babble even is?

The fact that you think something will happen, and that if it happens your view will be validated, is irrelevant. Your view IS your expectation – your argument is at this point entirely circular – and the evidence says your view is wring.

Your assertion of another 10-16% inflation is Nota reasonable basis for further discussion.

“Maybe he meant velocity (M2)”

Well you took the time to admit we were talking about velocity. We did have this debate and YOU said it was mean reverting, which we showed was an absurd proposition. But as usual little Stevie does not pay attention to what others have reasonably said or even reality.

Cool. Sick own of Steven Kopits! I’m like most of your few readers. I don’t care too much about all that economics analysis stuff and you don’t spend a lot of time on it anyway. I follow this blog to see you own the commenters you don’t like. Keep up the good work–you have worked very hard to reduce the number of commenters on your blog to a small handful with approved views.

Hey Ricky – how is the porn star business doing? Sorry dude – but none of like you either.

Uh-Oh…….. Rick Stryker stubbed his toe, and everything looks blue and dark today. Rick hits his Menzie Chinn punching bag and *STILL* feels miserable. How sad for Ricky.

“Approved view” = views based in economics. Stryker comes to an economics blog for something other than economics? Good to know.

Trump is nothing more than a cheap dead beat:

https://www.msn.com/en-us/news/politics/trump-s-waco-rally-leaves-el-paso-officials-seething/ar-AA194vt7?ocid=msedgdhp&pc=U531&cvid=0f3ccc74038f45eab34de914d6783dd1&ei=10

But across the state, in El Paso, city officials there tell Raw Story that they’re still waiting for Trump’s campaign committee to pay hundreds of thousands of dollars worth of bills stemming from the former president’s February 2019 visit to their border town. “The Trump campaign has not submitted any payments for their debt,” El Paso city spokesperson Laura Cruz-Acosta confirmed to Raw Story, noting that the current Trump tab is $569,204.63, including a city-issued late fee of $98,787.58. El Paso is still trying to get Trump to pay up. In late 2020, the El Paso City Council unanimously took action to hire the Law Offices of Snapper L. Carr to “advocate in the City’s interest in the collection of the outstanding invoices,” Cruz-Acosta said. “The city continues to seek the payment of these past due expenses, so city taxpayers do not continue have to bear the cost,” she added.

I wonder how much Trump owes McDonald’s for all those Big Macs fatty has consumed.

This bimbo thinks Trump is Jesus Christ?

https://www.msn.com/en-us/news/politics/president-trump-is-our-savior-woman-reads-bonkers-email-live-on-air-demanding-da-stop-torture-of-trump/ar-AA194yP4?ocid=msedgdhp&pc=U531&cvid=8ec021781bce425580dd248ac7d4e4ad&ei=18

“BARBARA”: Let’s send an e-mail. And I said to, “Dear Mr. Bragg, I hope you had a restful weekend and had some time to be on your knees praying to our God Almighty about your decision regarding our precious, precious President, Donald J. Trump. How would you like to be in his shoes? His torture brings to mind what Jesus Christ went through to save us. President Trump is our savior in this country. There is no one else who can make us whole and great again. Please do not continue to tarnish and persecute this precious, precious man. He is only a man. He is only human. And we are all human. Have forgiveness in your heart for all the damage that everyone has done to him. And please do not continue. Thank you.

Excuse me but was Jesus a flaming racist? Did he abhor Jews and allowed Muslims to be tortured by his racist followers? Did he have an angry mob try to overthrow a government so he could be King? Did he allow his mob to beat and kill law officers? Did he threaten people with a baseball bat? Did Jesus serially abuse women for his sexual pleasure? Did Jesus rip children from their parents and throw them into cages simply because they were Hispanic?

Come on woman – you are an insult to Jesus so SHUT UP.

“Velocity is an important issue to be sure.”

Actually is not. It is a useless ratio that does not describe the behavior of any segment of a macroeconomic model. One could teach undergraduate, intermediate, or even graduate macroeconomics without this worthless identity.

Oh wait – Stevie does not do macroeconomics. He does meaningless babble. So to him – I guess it is an important issue. But one he does not understand as he does not understand even how to tie his own shoes.

I agree completely there. Velocity describes the aging, slower economy of today. Trend growth isn’t 3% anymore. Its more like 1.5-2%ish range. The financial crisis was the passing of a era and the release of a generation in terms of driving growth.

Well, how low does velocity go? To zero? Clearly not. To one? Interesting question.

Velocity is apparently being driven by money growth, so decisions about money growth will determine velocity. The Fed is now tightening monetary policy. While the Fed eased, velocity mostly fell. As the Fed has tightened, velocity has risen. Clear violations of the assumptions behind the quantity theory.

Velocity is unstable, so the quantity theory not useful. QED.

As a general matter, I don’t think dM2 and M2V or dM2V necessarily covary. They did inversely in the case of the pandemic, because so much of the stimulus was parked at the banks. That money has been making its way back into circulation in the last year, to appearances a primary driver of recent inflation, as M2 itself has been falling at the pace of 2.5% / year over the last five months.

Steven Kopits

March 26, 2023 at 12:01 pm

As a general matter, I don’t think dM2 and M2V or dM2V necessarily covary.

Stevie finally admits he does not think! BTW if these do not covary then how can this troll claim they do as in his precious mean reversion hypothesis. It does seem Stevie has admitted he has no clue what he is babbling about.

So as long as velocity is not zero – your mean revision BS is validated? Stop making stupid comments. And no – your babbling is not interesting. In fact you became BORING years ago.

The question is, what is the lower bound for velocity? It can’t be zero unless people stop spending entirely. So what determines the lower bound?

“Steven Kopits

March 26, 2023 at 11:57 am

The question is, what is the lower bound for velocity? It can’t be zero unless people stop spending entirely. So what determines the lower bound?”

Well duh – GDP is not about to go to zero. Which is why I said your first comment was stupid. This one is even dumber. I am not a proponent of your stupid QTM so why I have to address such a stupid and irrelevant question. Move on troll – your stupidity is getting beyond pointless and boring.

I was hoping Menzie would do a post soon on “trend growth” this year in his next post. I’m very curious about it. This year, 1 year, 3 year, 5 years, past here. Just a look back. Menzie is a kind person that way,

“an additional 10-16% cumulative inflation”

Little Stevie pulls a Bruce Hall. Gee if we have average price increases near 2.5% per year for the next 4 years, Stevie will tell us that the additional CUMULATIVE inflation would have been 10%. It is nice when one is allowed to just make up BS numbers as one goes!

We need a minimum IQ test for participating. Anyone whose IS is in the teens of lower (me think Stevie’s is single digit) should be required to pollute some other blog.

I notice that for the period 1966q1 to 1978Q1 there is some question as to whether M2 velocity has a unit root.

Augmented DF rejects unit root at 0.0941.

Phillips-Perron does not reject unit root.

KPSS rejects stationary at 0.074

Elliott-Rothenberg rejects unit root.

Maybe that is why change in M2 was able to be used to forecast inflation during that period.

The period mentioned has only 49 observations, so was it just “idiosyncratic” happenstance to show any support for stationary M2 velocity?

There have been a number of structural changes in banking which provide pretty good explanations for changes in velocity in the final quarter of the 20th century and the first quarter of the 21st. The end of regulation Q, widespread use of credit cards, widespread availability of money market accounts, brokered deposits, etc.

The last few decades aren’t the only ones in which velocity has proven changeable. There is some evidence that the shift from agrarian to industrial output causes trend changes in velocity – try “Velocity in the Long Run:

Money and Structural Transformation”.

In the U.S. from the Civil War to WWII there was a decline in velocity, an increase thereafter (https://www.jstor.org/stable/1992543).

So your notion of happenstance seems correct.

Life-Cycle Effects, Structural Change and Long-Run Movements in the Velocity of Money

Thomas H. Mayor and Lawrence R. Pearl

Journal of Money, Credit and Banking

Vol. 16, No. 2 (May, 1984), pp. 175-184

A classic that a lot of macroeconomists read back in the day. The notion that velocity was some stable constant was rejected even back then. But how would little Stevie know that since he never reads actual economics before making up BS as he goes.

Russia budget deficit at 10% of GDP for Jan-Feb.

https://www.princetonpolicy.com/ppa-blog/2023/3/25/russia-jan-feb-deficit-running-at-10-of-gdp

‘This is a relative improvement over January, when the annualized deficit was running at the pace of 13.7% of GDP. ‘

We said January was an outlier and we were right. Taking one additional month and annualizing is stupid even for you.

No wonder no one reads your worthless blog.

Hey Stevie – what is Russia’s velocity? Is it mean reverting? After all you think velocity is an important topic (it is not) so why have you not written the scholarly paper on the application of the Quantity Theory of Money in Russia?

My take on the outlook for M2 velocity

M2 Velocity: A Polarized Outlook

https://www.princetonpolicy.com/ppa-blog/2023/3/25/m2-velocity-a-polarized-outlook

Stevie, you haven’t addressed the problems with your earlier post. Having failed to address those problems, what’s the point of writing another one on a similar topic? Similar topic, similar shortcomings. Baby steps, Stevie. Baby steps.

Velocity has a long-run declining trend. Velocity is mean reverting. My Lord – this troll does contradict himself a lot. And we wonder why NO ONE reads his worthless blog.

“This accelerated to 2.2 times during the Clinton administration, but began a long decline after 2000. Velocity stabilized a few times in the intervening years, but resumed its decline eventually. From 2017 until the start of the pandemic, velocity appears to have stabilized around 1.45 turns per year.”

So this troll has two alternative and contradictory “models” for forecasting an utterly worthless ratio (GDP/M2). Consider how he structured each:

(1) A mean reversion that considers the relevant history a 3 year period (2017 to 2019). Seriously? Not some longer term. Oh wait – then he has no clue what mean even means.

(2) Long-term trend that considers only 20 plus years. Hey FRED provides data that goes back 60 years. And that JMCB paper goes back to the Civil War. But according to Stevie that is too long for the long run.

You cannot take this troll seriously. He has no clue what he is babbling about even if he is arrogant to think his babbling is interesting and the latest word in economics.

“These are two highly polarized outcomes, one with an inflation surge and another promising a bout of brutal deflation, almost certainly accompanied by a stiff recession.”

Gee – Stevie’s worthless model #1 says inflation will be 9%. His worthless model #2 says we will have 3% deflation. Of course if one is as stupid as Stevie is, one could take a weighted average of his two worthless model and predict an inflation rate of 3%. Of course, weighting two stupid models is not how any sane person would do this.

An analogy from a valuation dispute where I did the heavy lifting for the taxpayer’s expert. The government hired an appraiser who was almost as stupid as Stevie. Now had everyone let me talk to the judge, I would have valued the business at $100 million using a smart application of DCF. The moron the government hired used DCF to suggest a value = $80 million but he had some crackpot approach that said the value was $160 million. So goofball took the average to claim the value was actually $120 million.

The taxpayer’s expert played with the stupid application of DCF a bit and told the judge the value was closer to $70 million. Ultimately the judge took these two weird variations of DCF and ruled that the value was $75 million.

But what happened to that $160 million value estimate? My main contribution to this dumb debate was to write a devastating rebuttal of this alternative approach. The judge got even more brutal as he should.

Now we know little Stevie is utterly incompetent at valuing assets but given my experience I bet the government might hire him as their valuation expert. Cheating taxpayers would be delighted.

I caught Rick Jr on the internet again trying to post here and other places. He knows he’s grounded.

Anyway, couldn’t help seeing this post. I told Rick Jr that in my experience when Menzie tries to own a commenter with some econometrics he only ends up owning himself. I reminded Rick Jr about the time that Menzie attempted to falsely claim that Ironman ran a spurious regression. I had to take Menzie to time series school on that one.

And here he goes again, trying to allege that because M2 velocity appears to be non-stationary according to standard tests that that means that M2 velocity can’t behave as if it’s mean-reverting. Obviously from this post, Menzie has never seen the article by two well-known economists, Charles Engel and James Hamilton, entitled “Long Swings in the Dollar: Are They In the Data and Do the Markets Know It?” I’m sure this is what Steven Kopits had in mind intuitively when he said M2 velocity was mean-reverting. Rick Jr tells me that Menzie is teaching some kind of forecasting course. I don’t have time to take him to school again, but Menzie should read the Engle and Hamilton article to better educate himself on time series issues. It’s really important to know more than your students when you are teaching a course.

Dr. Chinn certainly knows the work of Charles Engel and James Hamilton better than you do. And all three will have a good laugh at this premise that the strange ratio GDP/M2 has anything to do with exchange rates. Maybe your baby boy should ban daddy from the internet before he embarrasses the whole family.

“The value of the dollar appears to move in one direction for long periods of time. We develop a new statistical model of exchange rate dynamics as a sequence of stochastic, segmented time trends. The paper implements new techniques for parameter estimation and hypothesis testing for this framework. We reject the null hypothesis that exchange rates follow a random walk in favor of our model of long swings. Our model also generates better forecasts than a random walk. We conclude that persistent movement in the value of the dollar is a fact that calls for greater attention in the theory of exchange rate behavior. The model is a natural framework for assessing the importance of the “peso problem” for the dollar. It allows for the expectation of future exchange rates to be influenced by the probability of a change in regime. We nonetheless reject uncovered interest parity. The forward premium appears frequently to put too high a probability on a change in regime.”

If little Ricky thinks this research validates Princeton Steve’s rabblings, he is dumber than I ever gave him credit for.

ah ricky is back. i remember his definitive analysis on covid a few years ago. according to his calculations, the virus was going to fade away after a few months. rick, you could not have gotten your covid analysis more wrong back then if you had intentionally tried. i don’t think you are in any position to criticize others.

Hey Menzie,

I’m grounded and have to type fast. Just wanted to pass along some of my business ideas. I told my Dad that you were teaching a forecasting course in which you are charging as many as 30 students $25 per head. He said, in his usual sententious way, “That’s an optimistic view of the revenue-maximizing price and quantity combination, but Menzie is missing an obvious profit opportunity. Just give the course to one student, Moses.”

That got me thinking. Why not give the course privately to Moses and charge $2000? I bet he’d pay at least that. And then you could throw in the extras: $500 for a private dinner with you; $750 for a field trip from Charlottesville to Harrisonburg where Moses could perform a grave-spitting ceremony at Barkley’s final resting place while you look the other way, etc, etc.

You could make a lot of money here. The new business models like OnlyFans and substack operate by monetizing super-fans. And I’ll only take a 10% cut for designing the extras for you.

My Dad is walking over here. Gotta go….

Rick Stryker pretending to have a son so little Ricky can pose under another name? So little Ricky – you are not fooling anyone with this stupid little ploy.

As far as I can tell that’s a hell of a deal. A typical 3 credit hours course costs about $1500 (that’s just tuition, no other costs). I’m assuming with the superior instruction you’d get at a school like UW-Madison the cost would be higher, but I’m having a hell of a time figuring out what a 3 hours credit course would cost for in classroom instruction.

Seems like it might be a discount. I wouldn’t give Professor Chinn $500 for a dinner, but I might pay his cost of the meal, say if he didn’t mind a tuna sandwich at Panera or a sourdough breakfast sandwich from Dunkin’ Donuts. I s’pose I could splurge for Menzie’s coffee and dessert. Professor Chinn strikes me a more a full-course meal kinda guy and being raised in a Chinese family probably means strong food culture, so Dunkin’ Donuts probably turns his stomach to nausea, I don’t know. Menzie would obviously be getting the raw end of the deal.

As far as Professor Barkley Rosser, I don’t buy into the whole “revisionist history” thing after someone dies. That includes my own relatives if that makes you feel better about it. And taking aside for a few moments Barkley and my personal rankling, Barkley had no problems attacking econometricians alive or dead with better credentials than his own, both professionally and personally. So, I don’t have a lot of guilt about it. Then we can imagine for a few moments the deep personal pains Professor Rosser would have gone through if I had choked to death on some fish bone in my middle age. I don’t know if Rosser could have recovered from that kind of deep personal loss. No doubt, Professor Rosser would have been short on words upon learning of my death, (bottom of page 13 the Yates Center Kansas Dispatch) as he was always so inhibited in sharing his thoughts on things. My guess is, if Menzie had his druthers, he’d rather me not refer to Barkley in any kind of negative way. But Ricky, as you of all people should be aware of by now, Menzie tolerates differing viewpoints.

Heck….. if it makes you feel any better Rick, I imagine the death of the film character Otto Anderson would cause me to shed more tears than your death. Otto’s hardware store rope scene gave me more laughs than any of your attempts at humor on this blog. So, you know, when it comes to you and Barkley Rosser I’m an equal opportunity hater. Totally equal opportunity hater. But then I suppose I could be like you Ricky, and be a champion defender of “Ironman”. But I think I prefer my current station in that regard.

pg13,

I’m not surprised that this paper is too subtle for you. The point is that a series could appear to be nonstationary in levels but in fact follows a markov switching process in returns. As a consequence, the series could exhibit long swings even though it is non-stationary by conventional tests. I don’t know whether a Markov switching model describes M2 velocity and I don’t really care, to be honest. I’m not going to waste my time checking. AS enjoys doing econometric work and might perhaps check that if he wants. What I do know is that Menzie’s attempted refutation of Steven Kopit’s claim is irrelevant.

“I don’t know whether a Markov switching model describes M2 velocity and I don’t really care, to be honest.”

You just made my point. I got the Engle-Hamilton paper over 30 years ago when it came out. A good discussion of the literature at the time, which posed an interesting question needing some sort of resolution. The anti-thesis of what your pal Stevie pooh was doing. Which was my point troll but I guess my point was too subtle for you. Now go apologize to Jr. for embarrassing the entire familt.

Rick,

I think proper analysis is beyond my pay grade. I found Professor Hamilton’s paper online but would need to be in a class discussing the paper to properly follow all of the detail in the article.

But it is interesting to use the EViews Markov model to review the data.

Using M2 velocity data from 1959Q1 to 2022Q4 there seems to be an average high regime value of velocity equal to 1.8 and an average low regime value of 1.4 and the coefficients are statistically significant. According to the model, the average length of time in the high regime is 307 quarters and the average time in the low regime is 136 quarters.

It would be great for Professor Chinn or Professor Hamilton to comment on your proposition.

Perhaps using the Markov Switching model in this case is wrong.

Of course Ricky backed off when he was first challenged to provide a Markov Switching model for GDP/M2 as little Ricky does not know how. And we know this is way over the pea brain of Princeton Steve.

Dr. Chinn took up your suggestion. It seems even with this higher order version of QTM, the predictive powers are nil.

Hi AS,

It’s fine to estimate the Hamilton regime switching model for this case. However, you want to estimate in terms of growth rates rather than levels or logs of levels, which is what it appears you and Menzie are doing.

The Engel and Hamilton paper estimate a simplified version of the Hamilton regime switching model where if x = quarterly growth rate of the exchange rate, then x~N(mu1,sigma1^2) when s(t) = 1, i.e., the system is in state 1, and x ~N(mu2, sigma2^2) when s(t) = 2, i.e., the system is in state 2.

If you use the level of M2 velocity or the log of the level, you have a problem since the M2 velocity or the log of it is always positive, and yet it’s postulated to be drawn from a normal distribution.

You can also specify the model in terms of an autoregression of growth rates if you want. Hamilton did that for GNP in his original 1989 paper.

Hi Rick,

I know Hamilton uses growth in his GDP-recession model, but I missed the growth factor while scanning Hamilton’s currency paper. However, I thought that since growth would be stationary, we should use levels if we wanted to know if the level was stationary.

I totally missed the drawing from a normal distribution as you mention.

As I said, I would need to be in a class to do a proper job.

Hi AS,

I think how much you’ve learned on your own in just a few years with no formal coursework is impressive. I think you mentioned that you are learning economics during your retirement. Most people just want to play golf.

Rick,

Thanks for the compliment.

If I have learned anything, I need to thank Professor Chinn and Professor Hamilton along with EViews, and the various econometric and forecasting texts I have read over the past few years. Of course, what I have learned is just a thimble full.

I appreciate that you supplied R code. Perhaps if I were younger, I would try to learn how to program R (eons ago I took two semesters of FORTRAN). Using R seems like designing and building a vehicle prior to driving it, while using EViews allows one to drive the vehicle off the lot. Not being a programming savant, the convenience of using EViews is a luxury I appreciate at my advanced age.

fortran. you must be an engineer. it is a dinosaur. and yet you still cannot get something to work faster.

if you don’t like R (I know, the prebuilt programs are useful), then you can consider Matlab. student editions can be had at low cost. Matlab is very good without all the coding overhead. and they have quite a bit of user built programs available as well. eviews is good if you don’t mind a black box.