In a new paper prepared for the Handbook of Financial Integration, edited by Guglielmo Maria Caporale, Hiro Ito and I examine bond based measures of financial market integration (so, no quantity stock/flow measures, nor banking integration).

In short, covered interest differentials have risen, but uncovered interest differentials seem to have shrunk. There is ambiguous evidence regarding real interest differentials.

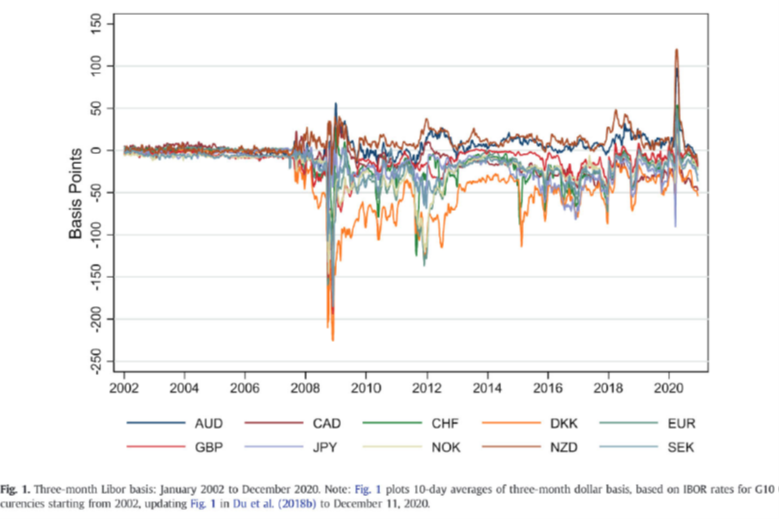

Figure 1: Covered interest differentials, bps. Source: Cerutti et al. (2021).

See some discussion of this phenomenon in this 2016 post.

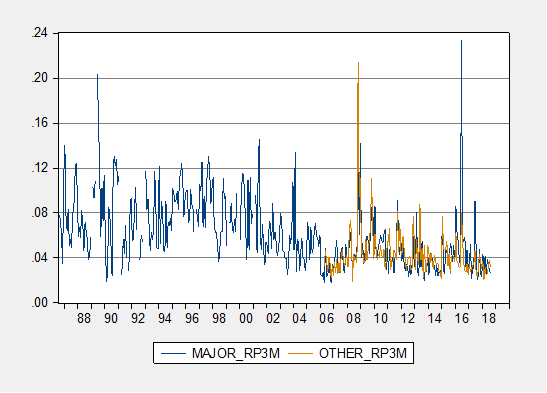

Figure 2: Average absolute uncovered interest differential for advanced economy currencies (blue), for emerging market currencies (tan), annualized. Calculated using survey data.

See discussion of using survey data to infer what is happening with expectations, and how this changes our view of uncovered interest parity, here, and here; see Chinn and Frankel (2020).

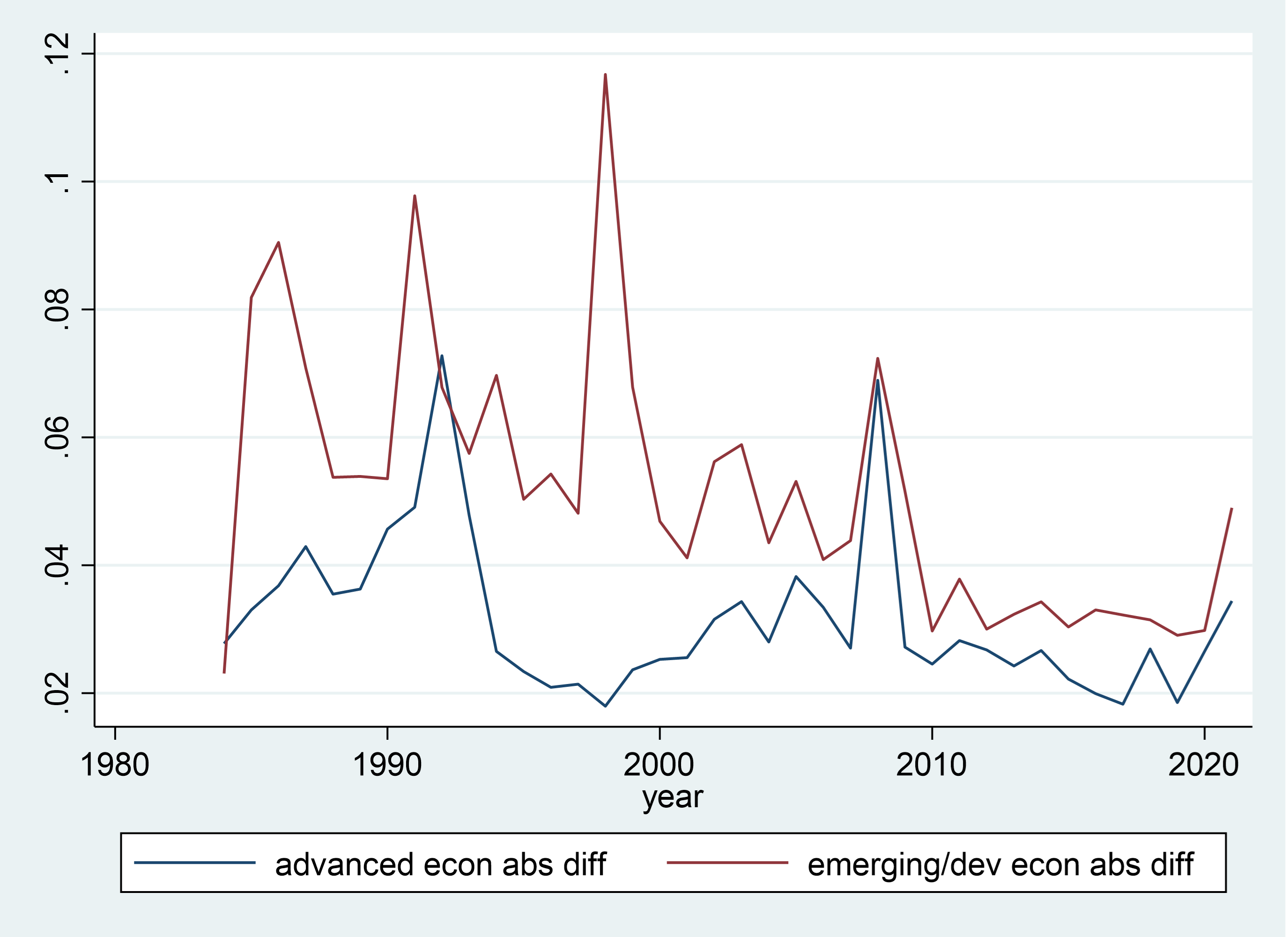

Figure 3: Average absolute real interest differentials (3 month rates, using ex post inflation rates)

We conclude:

- Covered interest parity which was previously thought to hold, up to transactions costs, no longer holds post global financial crisis. At one juncture, part of this is due to default risk (so that measured yields no longer relate to assets of same default risk), and more recently to the change in the regulatory regime that now makes hedging costly.

- Uncovered interest rate parity needs to be distinguished from the unbiasedness hypothesis – i.e., the joint hypothesis of uncovered interest parity and unbiased expectations. Once this is done, the evidence in favor of uncovered interest parity (and hence perfect capital substitutability) is much greater.

- Government bonds are not only differentiated by the degree to which their yields covary with wealth or consumption, but also by their convenience yield. Given this, it is unsurprising that nominal financial integration, defined as nominal yield equalization in common currency terms, has been incomplete.

- Ex post short term real returns have shrunk over time, but are still far from being equalized (and seemingly reversed during the pandemic and its aftermath).

The entire paper is here.

Oh, great. Now I have to read stuff. Wonder how much I’ll understand…

I just typically read those last 4 bullet points and tell the professor I had read the whole danged thing. He never buys it and thinks I’m a lazy weasel but my eyes sure to feel more rested.

[ I’m joking, but the sad thing is, it’s not far from the truth. Menzie doesn’t read these comments, does he?? ]