Goldman Sachs raised the probability of recession from 25% to 35% in light of the SVB related turmoil (although their guess is still lower than the consensus). This prompted me to wonder what was the net effect of the turmoil and Fed response (less tightening) on economic activity.

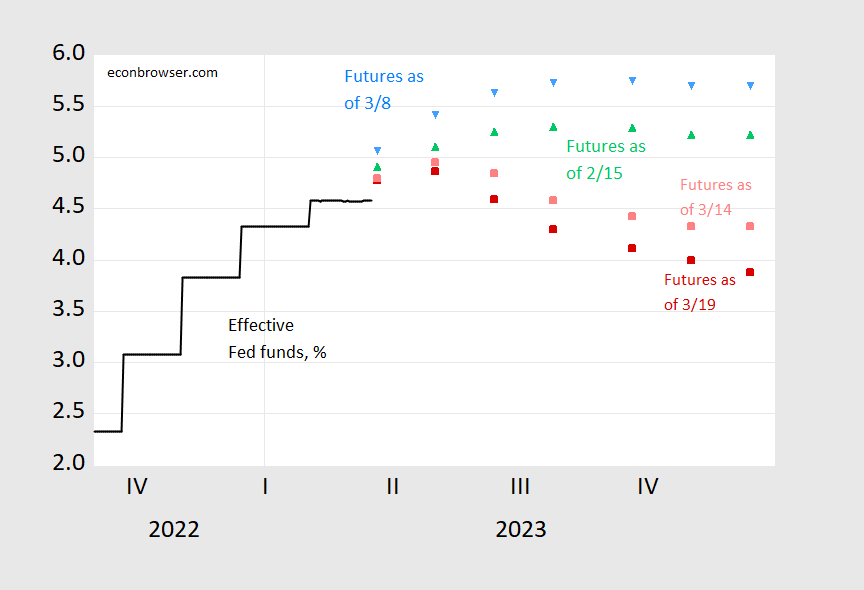

First, the path of Fed funds — as perceived by the market — Sunday vs. a couple weeks ago.

Figure 1: Effective Fed funds (black), implied Fed funds as of March 19 4:30CT (red square), March 14, 1:30 CT (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Source: Fed via FRED, CME Fedwatch and author’s calculations.

By years-end, the implied Fed funds is about 180 bps lower than what was seen almost two weeks ago. Bauer and Swanson (AER 2023) estimate a 100 bps shock results in a 0.24 to 0.60 ppts decrease in growth rate. Of course, 180 bps lower rate is not really a “shock” as considered in the VAR literature (the reduction is based on an inferred reaction function that takes into account dimmer growth prospects), but let’s take this number as a ballpark figure. That implies less pronounced tightening adds around 0.4 to 1 percentage point growth. Say half of 180 bps is a “shock” in the sense it’s motivated by concern about the banking system. Then that takes the positive impact something between 0.2 to 0.5…

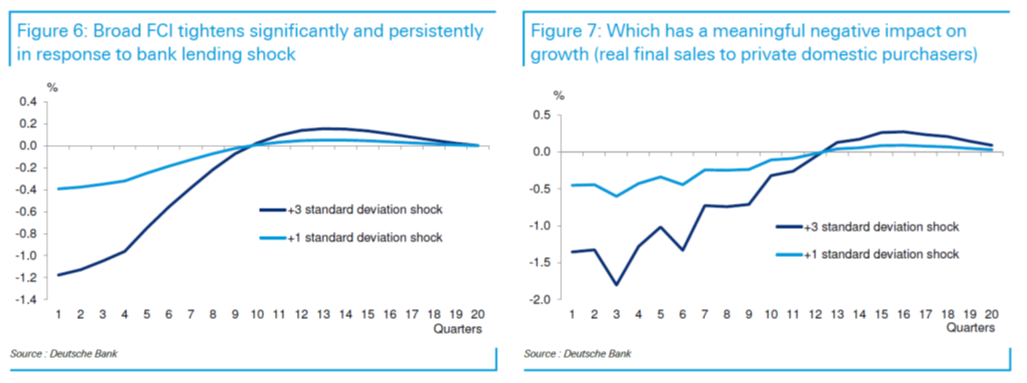

Set against that, the shock to the banking system is likely to reduce bank lending, and hence growth. Luzetti et al. at Deutsche Bank (“(Credit) crunching the numbers”, 20 March 2023) estimate a 10 point increase in the Senior Loan Officer Survey (SLoOS) of lending conditions (which was typical in the 1990’s and early 2000’s recessions) would result in a 0.4 percentage point growth reduction at a 4 quarter horizon.

Notes: 10 point increase in SLoOS approximately equals 1 std deviation shock to FCI. Source: Luzetti, et al. (2023).

I wouldn’t take these as anything more than a back-of-the-envelope calculation, but it does remind us that there are offsetting effects of recent developments.

I can’t be certain what the deal is, it may be things on my end, I mean issues with my own computer, but I can’t get the AER download on mine, so if anyone else is having the same problem, here is an OLDER ungated version of what I think it the same Bauer Swanson paper:

https://www.imfs-frankfurt.de/fileadmin/user_upload/IMFS_WP/IMFS_WP_155_Update.pdf

Interesting…… just found out digital version of economist is no longer available through my library. That magazine has weird management. Not the first time they manage things badly compared to other mainstream magazines.

This imp!ies there is actually tightening. What if it causes loosening??? Capital flows don’t work in a textbook manner.

Sen Warren’s blunt assessment of Fed Chair Powell sums it up: “He has had two jobs. One is to deal with monetary policy, one is to deal with regulation. He has failed at both,” Warren said” https://finance.yahoo.com/news/elizabeth-warren-says-jerome-powell-165239311.html I think he spend way too much time listening to Fed Whisperer Summers – who is still calling for rate hikes last time I checked.

He’s got his JD you know.

/sarc

If it is generally agreed that the Fed will lower rates later this year why would they even consider raising them this week?

Except for keeping financial markets uneasy what is accomplished by a temporary (2-6 months) increase of 25bp

Because if they don’t zig and zag every other week on policy to create the same problem they are there to “solve”, people will start to figure out their greatest function in life in breathing on a mirror and creating mist.

I am not sure it is generally agreed they will lower rates this year. And i dont think they should have raised rates again this week, given market behavior. They are slipping away from soft landing. Not sure that was a goal of theirs to begin with.