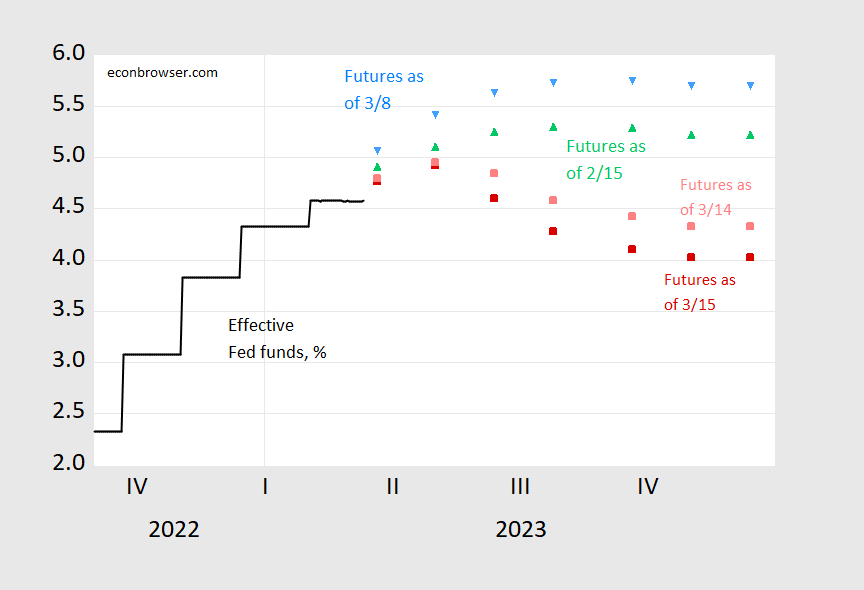

Using CME futures, from 1:30CT today:

Figure 1: Effective Fed funds (black), implied Fed funds as of March 15 1:30CT (red square), March 14 (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Source: Fed via FRED, CME Fedwatch, accessed 3/15 1:40PM CT, and author’s calculations.

Two pieces of news today – the first was regarding Credit Suisse, the second is macro news, where the PPI undershot, as did retail sales (slightly). My guess is that financial stress dominated.

It is interesting that the path was higher a week ago relative to a month ago, likely incorporating Chair Powell’s fairly hawkish comments regarding inflation persistence and consequent Fed policy. The downshift in the implied path of the Fed funds is all the more remarkable in that context.

I wish to say something “deep” or “insightful” here while drinking the last of my wine, just say, “horizons changing fast, take care of yourselves”

Out of hooch at mid-afternoon? What kind of example is that for the bankers? Planning is everything.

But come to think of it…I need to go shoppjng.

The banking wobble is generating a wider range of headlines today, at least some of which reflect actual spill-over from the banking wobble:

https://www.bloomberg.com/news/articles/2023-03-15/treasury-reviewing-us-financial-sector-exposure-to-credit-suisse

(As Menzie noted.)

https://www.google.com/amp/s/www.cnbc.com/amp/2023/03/15/goldman-sachs-cuts-gdp-forecast-because-of-stress-on-small-banks.html

https://www.latimes.com/business/story/2023-03-15/first-republic-bank-cut-to-junk-status-by-s-p

We can read these as specific stories, but also as general issues arising from the wobble.

If you scratch a little under the surface of the inflation numbers its clear that inflation is under control. If you scratch a little under the surface of the bank crisis/problem its clear that the Fed is a big part of the problem, and their only way to fix it is to stop raising rates – right now! So I am not surprised that the events of the last week has changed expectations drastically

However the huge shift in just one week point out how difficult it is to make any long term predictions of the most important economic number in the world – the Feds rate. Those who depend on such predictions should always allow for a large margin of error.

Russian ground attacks have been reduced to less than 1/3 within the last week. Talk about running out of steam, soldiers, ammo and equipment.

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-march-15-2023

If that holds, then the Russian offensive to take Donbass by the end of March is a completely failure. The Ukrainians are presumably finishing up training soldiers on the new western weapons and strategies. They are also getting ready to deploy a substantial number of new volunteer soldiers who are finishing their training just in time for a spring offensive.