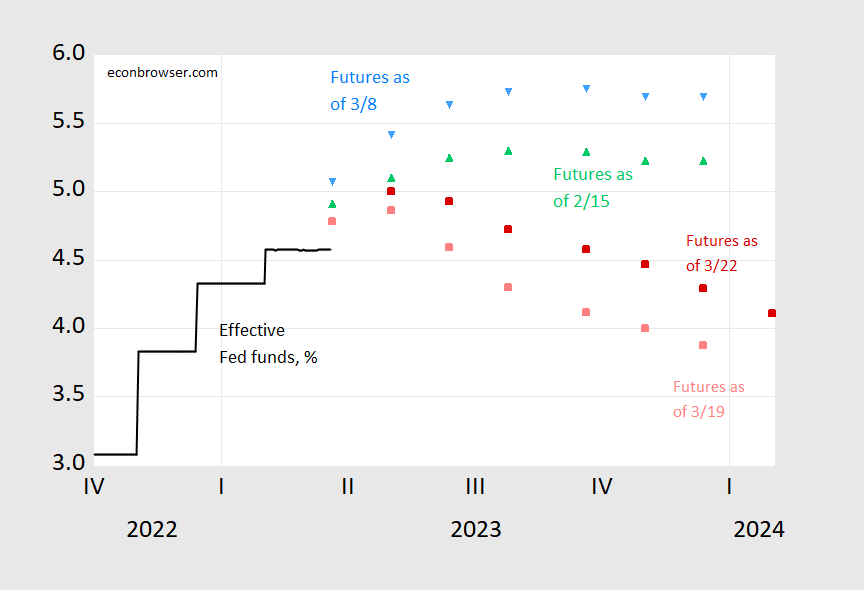

Up relative to yesterday (or the 19th), as expected given Powell’s statement. However, still way down relative to March 8th.

Figure 1: Effective Fed funds (black), implied Fed funds as of March 22 6PM CT (red square), March 19, 4:30 CT (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Source: Fed via FRED, CME Fedwatch and author’s calculations.

The path is still downward, after a peak at the May 3 meeting. This implied path contrasts with Powell’s statement (CNBC):

“In that most likely case, if that happens, participants don’t see rate cuts this year,” he said.

Powell added that what lies ahead for the economy may be “uncertain,” but rate cuts are not currently in the central bank’s “baseline expectation.”

Brainard supposedly met up with Dimon and Moynihan at some Financial Forum in D.C. Not sure if we’re supposed to “read between the lines” on that or not, but Reuters seemed to imply it had something to do with the attempt for capital infusion at First Republic.

There was also this:

https://www.reuters.com/business/finance/citigroup-ceo-says-this-is-not-credit-crisis-after-us-bank-failures-2023-03-23/

And this:

https://www.reuters.com/markets/us/us-working-restore-capacity-designate-non-bank-finance-institutions-systemic-2023-03-22/

Signature was not a major failure. It’s been dead for awhile. They just tried to hide behind the SVB flap.

Market implied rates differing from the SEP shouldn’t necessarily be surprising.

Market implied rates are certain to have expectations of recession, FOMC failure to tame inflation, war, elections, etc baked in. I’m not saying the market expects any or all of these specific variables to occur in a negative fashion, but the market’s objective function is more likely to account for these, and other variables, as market participants see fit. On the other hand, it’s important to remember the objective function of the Fed BOG and District Presidents. SEP projections are supposed to be based on each participant’s assessment of the appropriate monetary policy to foster the FOMC’s statutory mandate.

Contrasting projections from contrasting objective functions shouldn’t contrast with expectations.

Even in the absence of serious further financial contagion, there is an obvious risk of further tightening in financial conditions. The Fed’s real target is financial conditions. The funds rate target is simply a tool for controlling financial conditions. If financial conditions are not broadly what Fed policy makers expect, then the funds rate they set will also not be what they expect.

Market participants are pricing in a lower rate path than the Fed. One way of reading that is that market participants are pricing in tighter financial conditions than the Fed expects. Keep in mind that the Fed has lowered its expected rate trajectory, bringing it more in line with how markets were priced even before the SVB hiccup.

MD response shows the misplace focus so many other liberals have on the Fed’s response. ” The Fed’s real target is financial conditions. ” Really? where is their focus on Biden’s inflation.

What MD describes is the Fed’s main path of influence, and not the MANY other paths impacted. Y’ano like SVB and the many other banks with shaky assets, housing prices and sales, auto prices and sales. Need I go on, because that list is extensive?

The liberal mind does amaze.

Excuse me little CoRev? Was there some point to your latest worthless chirping? I didn’t think so.

Excuse me little pgly? Was there some point to your latest worthless chirping? I didn’t think so.

Oh Jonny boy has a new friend. Yea – CoRev is little Jonny boy’s style. WHEEEEE!!!!!!!!!!!

pgly has a new target to trash. No substance or constructive criticism from pgly, just trash WHEEEEEE!

The standard first lecture on monetary policy expliains that policy has a short-term target – typically the funds rate or money suuply growth – over which the central bank has good control, but that target is merely n service of intermediate and long-term goals, such as price stability, financial stabilitty and maximum employment. CoVid’s comment suggests he is unaware of that operational scheme.

More likely, however, is that CoVid doesn’t care about that operational scheme. Like yer everyday partisan thug, he spews bile to serve the interests of his ideological masters, without any concern for truth. CoVid is all “Biden this” and “liberal that” while the rest of us try to figure out how the world works. Sad little man.

Anyone notice that MD uses personal attack when he con not make a counter argument: “…while the rest of us try to figure out how the world works.” He is such a sad little man. When his crazy liberal policy fantasies don’t work int the real world.

Academic study of money policy and MD’s comment regarding it still misses my point: “What MD describes is the Fed’s main path of influence, and not the MANY other paths impacted. Y’ano like SVB and the many other banks with shaky assets, housing prices and sales, auto prices and sales. Need I go on, because that list is extensive?

The liberal mind does amaze.”

Another point is that Biden’s energy policy caused this inflation, even though the EU, also following this same policy was already beginning to feel its economic effect.

actually, macro made a rather coherent response to what I would consider an incoherent comment by corev.

corev, why you tend to not get much direct response to your comments is because in general, when you make a statement, it aint even wrong.

CoRev continues to prove that a mind is a terrible thing to waste.

Predicting a fall in rates is an indication of thinking the Fed will drive us into a recession or a banking crisis (with associated recession). I guess the markets seeing 25bp increase and softer forward predictions, have slightly more confidence that the Fed will not manage to drive the economy into the ditch.

The Fed is really the only ones who truly know how bad the banks are at this point. Maybe markets took the 25bp as a sign that things can’t be that bad after all.

“The Market”, as voiced in views expressed on blogs, articles, etc., seems to believe that the Fed, having come too late to the party, has also stay too long at the end. In that view, understanding the lag time of its actions seems to be the Fed’s central problem.

There is also concern about the notion that central banks have one set of tools to deal with inflation and another to deal with bank instability and that they can both be used at once – much like you have both brakes and an accelerator in your car and can – in theory – use them both at once.

That Tucker Carlson someone else is a riot but check out the actual issue and you tell me if Tucker is our CoRev:

https://www.msn.com/en-us/news/world/tucker-carlson-mocked-after-delivering-most-epic-self-own-of-all-time/ar-AA18YCtJ?ocid=msedgdhp&pc=U531&cvid=a7a44747a0cd478c91bc03e8f4ee8f39&ei=6

Carlson, who has admitted to lying, attacked a new United Nations report on climate change that finds the world is rapidly approaching a dangerous temperature threshold. He suggested the fight against climate change is in reality a “coordinated effort by the government of China to hobble the U.S. and the West and take its place as the leader of the world.”

Who cares. Carlson’s own ties to China and middle eastern oil is well known. The U.N. “report” is null and void. Nobody cares about it. It’s rehashed old news. The same UN who covered up things for years in this regard.

Fourier first proposed the greenhouse effect in 1824. About this time in China, famine was common, opium was becoming a problem, the country was headed for the First Opium War and the Taiping Rebellion. So Carlson’s contention is that, in the midst of all this, the Daoguang Emporer convinced Fourier to say some crazy stuff about infrared absorbtion?

You’re right. That sounds like CoRev.

Sigh! If either of you could just answer a couple of simple questions.

1) How much temperature increase is due to infrared absorption?

2) What is the temperature range to which you aspire? And where should this occur?

before we even get to those details, lets clear up the big picture. do we have global warming or not? it is a binary answer.

Baffled, YES!. Now answer the questions.

here you go. nice writeup on the mechanics of infrared radiation and planetary temperatures. you will learn something covid.

https://courses.seas.harvard.edu/climate/eli/Courses/global-change-debates/Sources/CO2-saturation/more/Pierrehumbert-2011.pdf

at least we got you to commit to the idea of global warming, so your hiatus garbage can be agreed to nothing more than a bogus distraction.

More evidence that Reagan campaign manager Bill Casey asked Iran to hold on to U.S. hostages until after the presidential election:

https://www.nytimes.com/2023/03/18/us/politics/jimmy-carter-october-surprise-iran-hostages.html

This is about as bad as when Nixon got his friends in the State Department to undermine the 1968 efforts of the LBJ Presidencies to make a peace deal with the Vietnamese. Nixon was a traitor and these people who helped St. Reagan were Nixon clones.

Professor Chinn,

I see a page on the CME Group website titled, “30 Day Federal Funds Futures-Quotes”.

Is this where you find the futures Fed Funds rates?

For example, I see the March 2023 ZQH3 at a quote of 95.355. Do you subtract 95.355 from 100 to show the futures Fed Funds rate at 4.645% and the April 2023 ZQJ3 at 100-95.19 = 4.81%? If this is correct, I assume there is no Excel spreadsheet data to make the calculations less laborious.

Thanks

AS: All the implied Fed funds path data from CME Fedwatch tool. I had to import into Excel and calculate. There’s probabl a way to automate and do this more easily.

Thanks. I first looked at that page given your citation of sources but could not locate the data series. I’ll take another look.

AS: You have to multiply the target ranges by the probabilities. That’s why I have to import the tables into Excel and then set up the equations. Sorry not clear earlier.

Professor Chinn,

Thanks again. For some reason I was fixated on trying to use actual futures prices instead of forecasts. I am not certain about how to find

all the data points you show.

Using 3/24/2023 as an example, I see the following BPS data and averaged the various ranges prior to multiplying by the probabilities. For example, (4.75+5.00)/2 x .92 = 4.485.

Target Rate **Prob.***Weighted Average

4.50 to 4.75 **0******0.000

4.75 to 5.00**92%****4.485

5.00 to 5.25***8%****0.400

5.25 to 5.50***0******0.000

5.50 to 5.75***0******0.000

Sum****************4.885

I see only four categories, “now, 1 Day, 1 Week and 1 Month” compared to the seven data points shown on the blog for the March 22 data.

I notice a “Probabilities” tab on the CME FedWatch Tool site that shows meeting dates from 5/3/2023 to 9/25/2024. This table seems to be an easy copy to Excel and facilitates the use of the “SumProduct” function to multiply rates x probabilities.