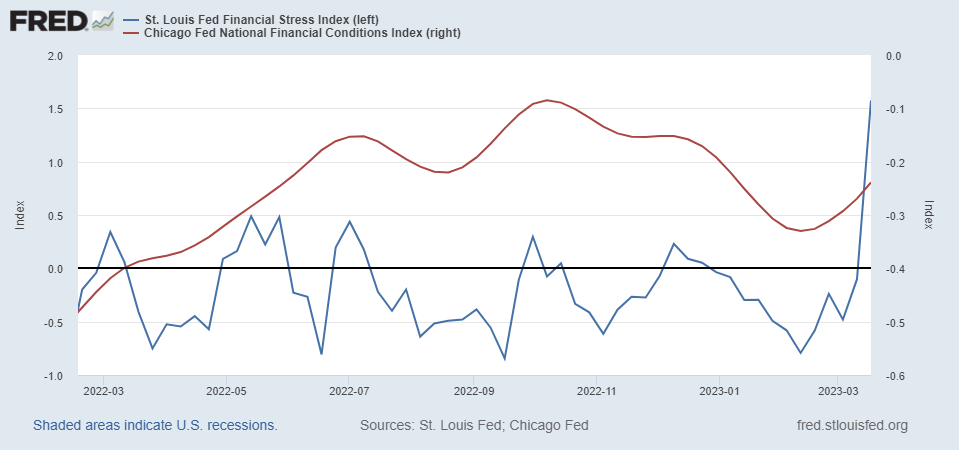

St. Louis Financial Stress and Chicago Financial Conditions Indices.

Figure 1: St. Louis Fed Financial Stress Index, v. 4.0 (blue, left scale), Chicago National Financial Conditions Index (red, right scale). “The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together.” “The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and “shadow” banking systems. Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.” Source: St. Louis Fed and Chicago Fed via FRED.

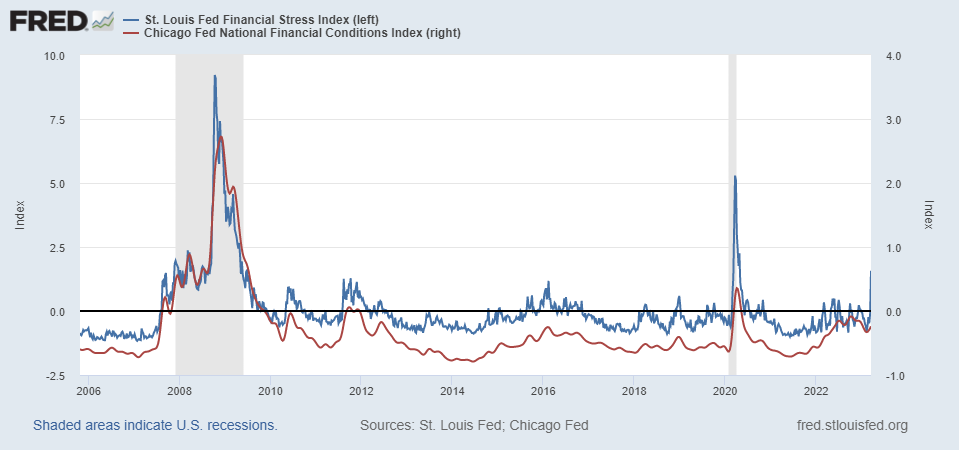

It’s hard to see exactly what this means, without comparison to recent periods of extreme financial turmoil. Below is a picture with a longer span of data.

Figure 2: St. Louis Fed Financial Stress Index, v. 4.0 (blue, left scale), Chicago National Financial Conditions Index (red, right scale). Source: St. Louis Fed and Chicago Fed via FRED.

Hence, while financial stress — measured in two ways — is elevated relative to recent history, they are not close to levels recorded during the pandemic or the global financial crisis.

In this case, much ado about nothing. Not systemic.

Another data point to tie back to your prior post.

Interesting that these indices spiked at the start of the pandemic as well as during the Great Recession.

We also saw a temporary spike in corporate bond spreads at the start of the pandemic but nothing like what we saw after the collapse of Lehman Brothers. I wonder what is happening to credit spreads now.

https://www.barrons.com/articles/fdic-svb-sale-decision-eeeb2434

The indicators of financial stress included in both indices are, of course, indicators of financial conditions. So while financial stress is not at crisis levels, financial conditions (CoRev won’t understand this, but the rest of you should) are much tighter than they were 2 weeks ago.

Financial conditions are tighter than those which induced the Fed to stop tightening prior to the pandemic, tighter than in the Eurozone financial crunch and tighter than those in the corporate credit (mostly oil patch) squeeze in 2016. It ain’t a crisis, by the numbers, but it ain’t good.

@ Macroduck

Is my mind acting funny again, or is it kind of amazing how the two graphs seem to mirror one another??

https://www.financialresearch.gov/financial-stress-index/

Everybody had to have a financial stress index after the Lehman flop. They are mostly measuring the same underlying issues, but are constructed differently, so behave somewhat differently. You’ll notice the OFR and Chicago indices aren’t as scary as St. Louis. You pays yer money, you picks yer index.

Not really. This is a survey. A poor one. Let’s note financial stress was worse in 2007-8 than what that graph showed. Are financial conditions tighter or looser???? This graph has no clue.

“Let’s note financial stress was worse in 2007-8 than what that graph showed. ”

and your evidence for this is what? because you say so? according to the graph, 2007-08 was an order of magnitude worse than today. you have some ‘splaining to do greg.

@ Macroduck

Did you know that Hugh Hendry has had his own podcast for quite awhile now?? I used to love reading and seeing this guy over on ZH (Yeah, I know….. ) and was wondering why he had fallen off the Earth, only just to find out tonight I could have been DL’ing his podcast this whole time. Dude is entertaining.

You like him ’cause his dad drove trucks. I don’t trust him ’cause he’s just a kid (b. 1969). Let’s see what he does when he gets some years on him.

He’s a little bit like Gundlach over at DoubleLine. A lot of showmanship, and you wonder at times how honest he’s being. Most of the time I don’t like those “types” of people. But Hendry (and Gundlach) keep it just short of used car salesman levels of BS, which is kind of the zone I find entertainment in, if that wording makes any sense.

Like, the guy is spooning out a little BS, but not completely insulting your intelligence in the process. Making it “buyable”.

One question is how much of this stress is panic and how much is real. Both of the previous spikes had some serious underlying problems. I don’t see anything here that is fundamental or large. Maybe if the GOP push us into default we could crash – but would they really be that stupid?

Some are so stressed (or brain dead) that they are taking money out of banks and placing it in money markets ??

https://www.washingtonpost.com/business/2023/03/24/bank-deposits-withdrawals-money-markets/

Have they never heard of FDIC insurance and do they know what it covers and what it doesn’t cover? Lets once again kill the idea that people act from knowledge and rationally in their own best interest.