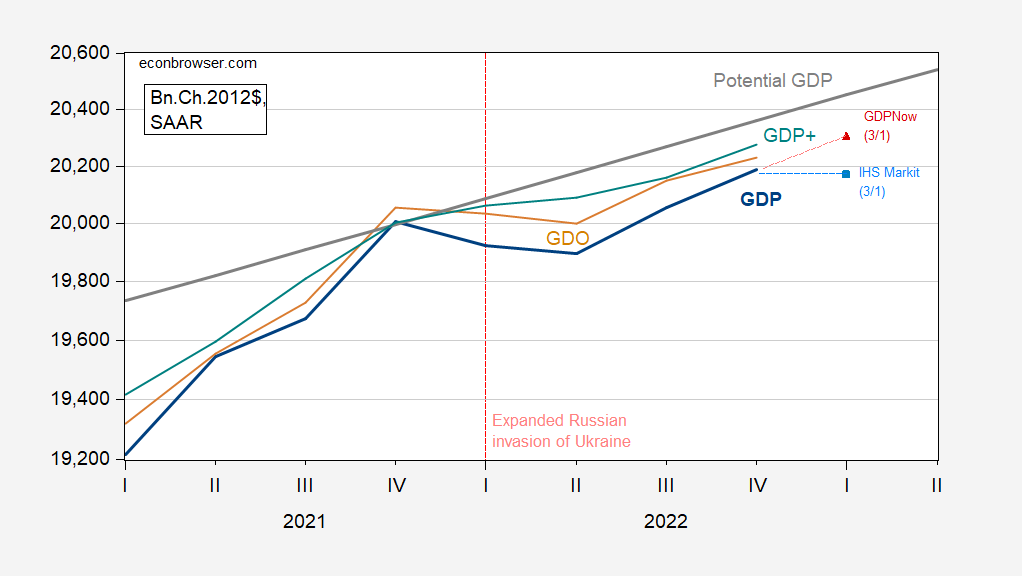

We have a 2nd release for GDP, and nowcasts for Q1. We also have GDP+ and a guess for GDO for Q4. This is the picture, taking CBO’s estimate of potential GDP.

Figure 1: GDP (blue), GDO (tan), GDP+ (teal), nowcast from Atlanta Fed (red triangle), and IHS Markit/S&P Global (sky blue square), and potential GDP (gray line), all in billions Ch.2012$ SAAR. GDO estimate holds enterprise surplus in GDI constant at nominal 2022Q3 levels. GDP+ cumulates growth rates onto 2019Q4. Source: BEA 2nd release, Philadelphia Fed, Atlanta Fed (3/1), S&P Global (3/1), CBO Budget and Economic Outlook, February 2023, and author’s calculations.

Interestingly, even estimates of robust economic growth, such as in the Atlanta Fed’s GDPNow estimate of 2.3% q/q SAAR for Q1, fail to substantially close the estimated output gap.

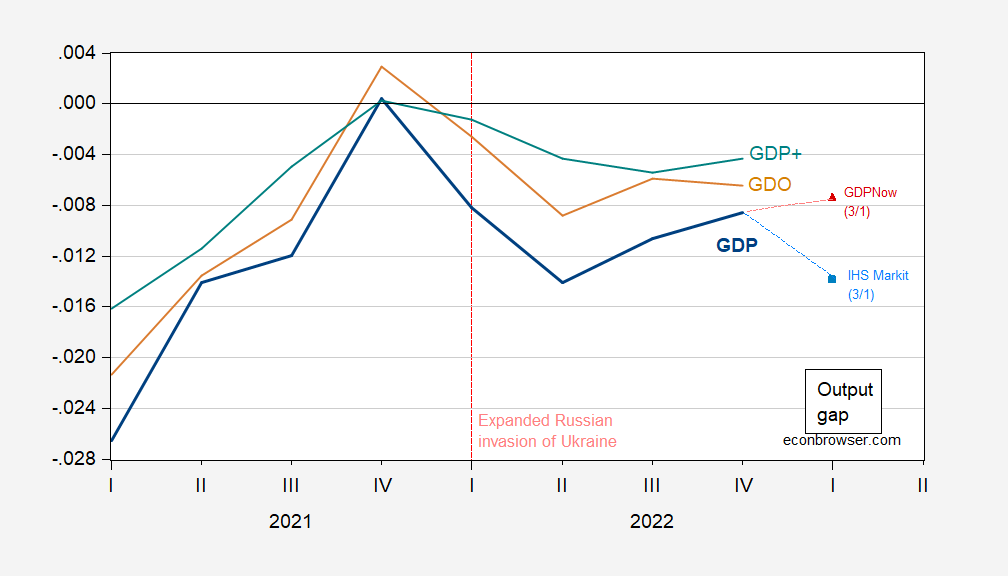

It is interesting to observe that the output gap went negative with the shock induced by the expanded Russian invasion of Ukraine in February 2022.

Figure 2: Output gap implied by GDP (blue), GDO (tan), GDP+ (teal), nowcast from Atlanta Fed (red triangle), and IHS Markit/S&P Global (sky blue square). GDO estimate holds enterprise surplus in GDI constant at nominal 2022Q3 levels. GDP+ cumulates growth rates onto 2019Q4. Source: BEA 2nd release, Philadelphia Fed, Atlanta Fed (3/1), S&P Global (3/1), CBO Budget and Economic Outlook, February 2023, and author’s calculations.

The output gap as of 2022Q4 is between -0.4 and -0.8 percentage points of GDP, depending on measure. IHS Markit/S&P Global sees a recession coming in 2023, with its nowcast indicating a widening of output gap even as nowcasted growth is only slightly negative in Q1 (at -0.3% annualized).

“The output gap as of 2022Q4 is between -0.4 and -0.8 percentage points of GDP”

So we were at full employment as of 2021Q4. With potential GDP growing at say 2%, the very modest (but positive rise in real GDP last year) we are now below full employment with inflation coming in at modest rates. So WTF is the FED still keeping interest rate high?

So now, I can rest my thumbs…

But I won’t. We keep hearing from Putin puppets how little effect the western response to Russia’s war has had on Russia’s economy, and how bad the western response has been for western economies. Except that, aside from the initial impact, the U.S. economy has been doing fine while sanctioning Russia and supporting Ukraine. Meanwhile, Russian GDP fell in 2022 and the most recent reading suggests an acceleration in the decline.

And shouldn’t the fiscal stimulus of war boost Russia’s output? All the fighting has been in Ukraine, so no degradation of Russian physical capital. But sanctions aren’t working. Right.

https://tradingeconomics.com/russia/gdp

“Russian GDP fell in 2022 and the most recent reading suggests an acceleration in the decline. And shouldn’t the fiscal stimulus of war boost Russia’s output?”

Check out Dr. Chinn’s latest post.

You mean the bankers interest rate.

Tom Sizemore died today. I feel pretty sad to hear this news. Whatever you think of Tom Sizemore, good or bad, and there was LOTS of “bad” there, no doubt. HE was GREAT actor. I remember when I was driving semi—we were somewhere out east,, I just felt so empty, So empty, LIke there has nothing left in my gas tank, And I remember Tom Sizemore, BIG AS LIFE, telling Al Pacino, in a robbery film titled, “The Heat” that the reason why he robbed, banks was. Sizemore’s Character “just loved the juice” the adrenaline of robbing banks. I was holding on for dear life as a semi-truck driver, it seemed like a good enough reason, to keep going on , and driving semi.

Hey Tom Sizemore, we’re gonna miss you brother,.

Per pgl, “we are now below full employment.” Yet the unemployment rate is close to the lowest it has been in the past 50 years.

https://fred.stlouisfed.org/series/UNRATE

So why is pgl complaining? Is his stock portfolio being adversely impacted by high interest rates? Why else would he suddenly care about workers except to use them as an excuse to lower rates?

If pgl really cared about workers, not investors, he should continue to support the Fed’s efforts to lower inflation rates. As we all know, inflation hurt workers’ real incomes., which dropped to 2019 levels last year before starting to rise again as inflation decelerates. As an added bonus, higher interest rates are helping small savers, such as retiring Boomers–one quarter of the population–who haven’t experienced a positive real interest rate on their secure savings in more than a decade.

Why is it that economists are biased toward low interest rates, when significant parts of the economy benefit from higher rates? In fact, some periods of rapid growth (eg. 1990s) were accompanied by rates much higher than those of the past 15 years.

JohnH: I am (as is often the case) mystified by what you write. In an intertemporal framework, lower interest rates raise the present value of dissavers relative to savers. To the extent that lower income households have smaller stocks of savings, isn’t this a plus for them? Isn’t that who you purport to be on the side of? Please explain. If you can couch your explanation in terms of a model, that would be helpful to me to understand your logic. Thank you in advance.

Jonny boy is mad at me for mocking his comment about how wonderful it was that mortgage rates are high, which he read as saying small savers are getting more income. Yea – his ramblings do make one scratch one’s head.

Dissavers? Are they a defined economic or political cohort? If so, why is it good public policy to preference them to savers over the long term?

The biggest dissaver that I can think of is the federal government. I can see why politicians would want to perpetually borrow money at negative real interest rates. However, that becomes problematic when funds, like Social Security, invest in government debt. In 2022 effective rates on Social Security in 2022 were 2.4% while the CPI was about 6.5%.

https://www.ssa.gov/OACT/ProgData/annualinterestrates.html

Meanwhile the increase in benefits was 8.7%. From where I sit, that doesn’t bode well for the sustainability of the program.

The Social Security situation is similar to that of people nearing retirement or in retirement. Their secure savings have been yielding zero or negative real interest rates for years, threatening retirement security. The Vanguard Total Bond Market Fund has yielded 0.9% per year over the past ten years while the CPI has been 2.7% per year over the same time period.

This is what you mean by “in an intertemporal framework, lower interest rates raising the present value of dissavers relative to savers?” IOW, the faster retirees get rid of their retirement savings, the better off they will be?

‘Dissavers? Are they a defined economic or political cohort? If so, why is it good public policy to preference them to savers over the long term?’

OK – you are a clueless troll. But we all knew that. Dr. Chinn asked you for a model and you gave him your usual babbling.

Apparently pgl thinks it’s great policy to punish savers with negative real interest rates for more than a decade…and let Wall Street borrow the money to inflate asset prices for wealthy investors. Wow! What wonderful public policy!

“JohnH

March 5, 2023 at 5:20 pm

Apparently pgl thinks it’s great policy to punish savers with negative real interest rates for more than a decade”

No – I do not think that. But yea – little Jonny lashes out with such pathetic comments because his little feelings got hurt. Dude – do you not know why the other kiddies in the sand box keep laughing at you?

“So why is pgl complaining?”

Jonny boy must be really upset that someone called out his latest ramblings. You and your BFF Princeton Steve predicted a 2022 recession which I noted here never happened. But yea – we could see some rise in real GDP to get back to full employment. I guess little Jonny boy now thinks this is a bad thing. Why? Because Jonny boy has serious emotional issues.

Actually what would happen if we lowered interest rates? If the experience of ten years ago is any indication, pgl’s stock portfolio would rise, bank profits would quickly reach new record highs, and a few years down the road unemployment would drop…and maybe somewhere in the distant future real wages would rise.

Anytime you hear economists hearting labor, it’s time to check for the hidden agenda!

OMG – you are one dumb gold bug. What might happen if we followed your little agenda? Another Great Recession? Now that is going to help the little guy – NOT. Seriously – Rand Paul needs a better economic advisor.

You mean estimated output, with flawed estimates. It’s a mess. Exports/imports ratio and inventory are likely being understated which is causing a data mess with other data which adjusted for Demographic changes the last 3 years, a pretty fluid normalization. My view is real GDP is being under estimated and frankly that seems the consensus of the financial elites in Washington. I have another possibility, but it would completely undermine a data service agencies provide and might very well been battered by pandemic accounting. I will not go there for now until I see better evidence.

Gregory Bott: I would love to see why you think GDP is understated; and perhaps why GDO or GDP+ are missing. Links to paper, or a spreadsheet with your calculations would be welcome.

“that becomes problematic when funds, like Social Security, invest in government debt. In 2022 effective rates on Social Security in 2022 were 2.4% while the CPI was about 6.5%.”

Oh gee – SSTF invests in government bonds. The horrors. But wait – real returns on government bonds over a long period of time are positive and a lot more stable than real returns on almost anything else.

Hey Jonny boy – you should like the economist advisor for Senator Rick Scott.

Ah G. Bott – I would think one could question the reliability of potential GDP but actual GDP? Come on man!