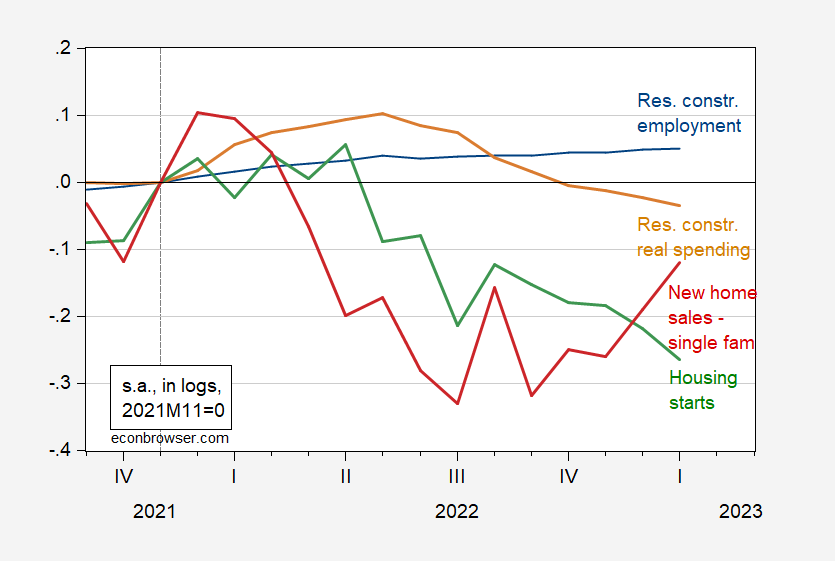

That’s what Ed Leamer noted back in 2007. Residential construction employment, spending, housing starts, new home sales, all normalized to 2021M11.

Figure 1: Residential construction employment (blue), residential construction spending deflated by PCE (tan), housing starts (green), new homs sales of single family units (red), all seasonally adjusted, in logs 2021M11=0. Source: BLS, Census, Census/HUD, BEA, and author’s calculations.

Back in September, Leamer didn’t see an imminent recession. Not sure what we would make of the current data. In fact, he argues that housing is a less reliable predictor of recession, given the lack of a big buildup in housing in the face of continued strong demand, and the general strength of the financial system, in contrast to 2007.

Housing is overblown. It always has been. It’s only about 3% of total investment and it’s impact on consumption is less than the Boomer era replaced by nonbanks and subprime commercial banking(which was looking shaky ground in 2019, bailed out by the pandemic). Why borrow from your home???? Waste of time.

It seems you conflate economic impact with investment.

Housing matters because it is a major focus for jobs, materials consumption, economic activity ranging from building to buying/selling to maintaining to upgrading.

Investment matters … hardly at all. The stock market is almost orthogonal to real life, as if the preponderance of money losing listed public companies isn’t evidence enough.

Hello, c1ue,

Don’t recall seeing you in comments before. Welcome from a regular.

Thirty year mortgage rates over 7%, mortgage spread over 3%.

https://www.mortgagenewsdaily.com/

At this rate small savers could get a positive real return on their savings for the first time in 15 years! But who cares about small savers? It’s much better to take care of wealthy investors by dropping interest and driving up asset values!

Small savers are now getting the same rate that homeowners pay to the banks? Dude – you have lost it. Oh wait – you never had it in the first place. Never mind.

Way to misread a comment dude! Have you checked out the rates that are being offered on CDs and compared them to the CPI over the past six months?

It’s really interesting how economists constantly focus on the negative side of interest rates and don’t talk about the positive side. Well, maybe not so surprising after all…high interest rates hurt wealthy investors in stocks. But of course, they mask their antipathy to high rates by emphasizing us how much they will hurt labor!!! Any time mainstream economists start showing their concern about labor, it’s time to start sniffing for the rat!

Here is what YOU wrote: Thirty year mortgage rates over 7%,

Now if you meant to say CD rates then do so. Damn – having a conversation with you is worse than talking to a retarded dog.

Why does Jonny boy make claims without providing a single source? Could it be he has lied? Or is he just too stupid to consult with FRED?

https://fred.stlouisfed.org/series/NDR12MCD

National Deposit Rates: 12-Month CD

Well a nominal rate = 1.4% beats 0.13% but if Jonny boy thinks this covers inflation and still provides for a real return, then the poor little child once again flunk preK arithmetic.

I love cites like this:

https://rates.savingsaccounts.com/cds?src=574275&quadlink=http://o1.qnsr.com/cgi/r?;n=203;c=1374838;s=3086;x=7936;f=201212070917370;u=j;z=TIMESTAMP;&ad=79096232576818&fb=cd%20rates%20today&campaignid=41794797&adgroupid=1265538458586661&targetid=kwd-79096468178080:loc-190&feedid=&ki=79096468178080&mt=e&dev=c&network=o&iloc=&sq=cd%20rates%20today&msclkid=1c28fba9252c10fd9a6b9fab02d46bf2

Betterment is claiming it is paying 15 times the national average when they claim they are paying 4%. Anyone who buys this malarky probably regularly shops at the snake oil salesperson shop.

This just shows how little pgl knows! Here’s another site showing CD rates: https://www.schwab.com/fixed-income/certificates-deposit

Apparently pgl knows as little about CD rates as he does about why the mortgage spread is now 3%.

What are you talking about?? These CDs are the best thing I’ve done in my life since I got the “My Pillow”. Did I tell you also??~~ my Audi A4 Quattro I got is the best car I’ve ever owned since the Ford Pinto. Make sure you get the used with very high mileage.

Schwab? Jonny boy finds some misleading quote from Schwab and he actually thinks this is the national average? Yea – he is really dumb!

Put your money in treasury direct. They have outpaid cd’s over the past year.

https://fred.stlouisfed.org/series/MORTGAGE30US

Now FRED tells us mortgage rates have been around 6.6% for the past two months. But what do they know since little Jonny boy uses his advanced

Google analytics to find some weird headline that says this rate is above 7%.

Here’s the latest data, pgl. https://www.mortgagenewsdaily.com/mortgage-rates/mnd

But I guess we’re only to use data that pgl officially approves of…and certainly not industry data!

Yea I saw your little clown show reporting. And your point is? Oh yea- you have all sorts of devices to misrepresent. Dude – we got that. But FRED and Fannie Mac is not what people in the financial markets sector rely on? Damn – you are indeed stupid.

pgl’s Mt. Trashmore is erupting again, spewing garbage and BS everywhere, hoping that some of it will stick.

And who is pgl to tell us what people in the financial markets use? Heck, he doesn’t even understand what drives the mortgage spread…and I’m sure they just love the stale data provided by Fred and Freddie Mac!

JohnH

March 3, 2023 at 11:27 am

pgl’s Mt. Trashmore is erupting again

Oh my – little Jonny boy got his feeling hurt again and he is throwing a tantrum in the sand box. Hey Jonny boy – when you are ready to go the grownups at the big boy table, let the rest of us knw.

JohnH, Mt Trashmore???? Now that’s another name for Ole Bark, bark that I can support. The few times he actually provides content instead of his special forms of trash are so rare it adds his comments to the “Do Not Read list”, which BTW is growing.

Hey Jonny boy – did you not notice their graph which showed interest rates from four different choices? Now had you done so, you would have noticed that 3 of the 4 sources show a lower rate than the source you keep citing. So why do you just ignore the other 3 sources? Two choices for little Jonny boy. Either:

(1) Jonny boy is too stupid to real his own links; OR

(2) Jonny boy is a serial liar.

Oh wait – there is a 3rd possbility. Jonny boy is not only stupid but also a really bad liar. That’s it!

Hey, piggly, did you notice that one of the graphs put the rate over 7%? And the others showed rates climbing…along with that mysterious mortgage spread?

“JohnH

March 3, 2023 at 4:17 pm

Hey, piggly, did you notice that one of the graphs put the rate over 7%? ”

The one you choose but not the other 3, which is what I said. My apologies to saying the retarded dog next door is as dumb as you are because you have to the dumbest troll God ever invented.

Mt Trashmore finally notices what shopping for rates can produce. Again showing his profound economic ignorance.

Mortgage News Data explains the discrepancy. “Freddie Mac’s rate survey came out today and it showed 30yr fixed rates at 6.65. Understand that most of Freddie’s survey responses come in on Monday and rates have risen since then. The survey also includes upfront points and does not include the new fees that are hitting a vast majority of borrowers. If we were to adjust for the market movement that’s happened since Monday, the upfront costs, and the fees, Freddie’s number would likely be right in line with 7.1%.”

https://www.mortgagenewsdaily.com/markets/mortgage-rates-03022023

But pgl’s not really interested in the data per se. What’s he’s really interested in is trashing others.

Oh wow – this is like how Gas Buddy brags about its unreliable but up to date quotes. Our host dressed down Bruce Hall over this a while back. I just hope he sees your latest trash and puts up a post just for you.

This just shows how little pgl knows! Here’s another site showing CD rates: https://www.schwab.com/fixed-income/certificates-deposit

Apparently pgl knows as little about CD rates as he does about why the mortgage spread is now 3%.

Consumer Reports quotes Mortgage News Daily. Now piggly will probably trash Consumer Reports for using a non-piggly approved source!!!

https://www.consumerreports.org/mortgages/how-to-find-the-cheapest-mortgage-a4425781032/

pgl arrogates himself the role of adjudicator of “The Truth.” No chutzpah there!

And, you know what, last August pgl trashed someone for noticing that mortgage rates were spiking at Mortgage News Data. And guess what? The other data sources confirmed the trend the following week.

‘But pgl’s not really interested in the data per se. What’s he’s really interested in is trashing others.’

Did little Jonny boy get his little feelings hurt again? Awww. BTW with all your huffing and puffing you never produced a chart of interest rates from any of the four potential sources but I will give credit to Mortgage News Daily for this:

https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

‘This page provides average 30 year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey).’

The only one that claimed mortgage rates have gone back above 7% was Mortgage Daily News which of course lead little Jonny boy to declare this one of these four sources is the industry standard.

Look Jonny – we all know you love to lie about everything. Too bad you suck at lying too.

Now pgl is accusing Mortgage News Daily of lying! Pgl has relegated himself the job the god of truth! Wow!

Face it, JH. “Trashing” you does not require extended effort. Bursting a narcissist’s bubble is not that difficult. In your case, relatively easy, considering your highly inflated admiration of, uh, yourself.

Yea I need to take on someone who actually has a few chops. Jonny boy has been throwing these worthless trantrums since the Mark Thoma days.

Pgl lied: “ Now FRED tells us mortgage rates have been around 6.6% for the past two months.” The FRED series shows that they haven’t been that high since November.

WTF? You just said what I said. Come on Jonny boy – you do not have to prove you are total moron over and over. We get it. Damn!

Funny! One day pgl tells us that the extraordinarily high mortgage spread is high because of volatility. The next day he claims that rates have been stable around 6.6! Methinks that pgl is confused, very confused…

OMG you are STUPID. What I said is that you cannot tell the difference between a chart showing a measure of volatilty and what is happening to the level of interest rates.

Why are we wasting our time reading your incessant STUPIDITY? Run away little boy as you are a total nutjob.

JohnH, too often economists and econ-wannabees like Mt Trashmore, use averages forgetting how they misrepresent the volatility buried within the data. Yano, like the willfully ignorant of arithmetic and logic!, But, we need to remember behind the ignorant commentary lies a liberal ill-functioning brain, where facts and data can not get an entry point.

CoRev always jumps in to defend to the lowest scum and dumbest trolls ever. After all – he enjoys the fact that his fellow trolls are almost as pathetic as he is.

And who but the renowned seer and expert in ALL academic disciplines—the one and only CoRev— understands “the volatility buried within data”?

He’s a riot. A regular riot.

And now, he’s happily hitched himself to,yes, John H. Let the. comedy—and all the mountains of expertise possessed by these titans—continue.

Some new competition against Jimmy Kimmel and Stephen Colbert for late night comedy King:

https://twitter.com/maxseddon/status/1631703725399056384

One of the bank notes was saying China’s numbers are starting to take off and be strong again. They see a pretty big recovery for home sales data in China when the new numbers come out March 15th. That’s another number I’ll be very interested in, assuming my damned memory can stretch out that far. Their graph on China PMI was pretty convincing.

https://tradingeconomics.com/china/business-confidence

China’s retail sales and employment also looking much better. It’s enough to make commenter “ltr” leap up 35 feet high into the air and swan dive straight back down into a small cup of instant noodles.

Sharing without editorial comment:

https://i.redd.it/1505cz2afbla1.png

Folks, if you want to learn about the state of the housing market you need to read Kevin Erdmann’s substack. In fact, he’s doing better work than Calculated Risk or Dean Baker at reading the tea leaves. This is not 2006.

Aaaaaaaawwww yes, The Koch Brothers bribed for answers Mercatus Center “holds all life truth”. When is their “Mein Reagan Kampf” book coming out??

I’ve been reading a few of his discussions including this one noting the rising in housing prices in land rich Texas:

https://www.mercatus.org/research/state-testimonies/regulations-are-main-cause-inadequate-housing-supply-and-rising-rents

He is arguing that the housing supply is inadequate with the solution being ….. wait for it ….. DEREGULATION!

Erdmann is a George Mason type who writes for the National Review. But hey some of his posts look interesting. Even if he is a right wing type I bet what he has to offer is infinitely better than the above trash JohnH is feeding us. After all – the latter cannot distinguish between a mortgage rate and a CD rate.

Better work than Bill the Diver? Seriously? You might want to have a thought for your own credibility.

A few noteworthy points:

1. Leamer himself blew it in advance of the Great Recession. In his famous lecture, he declared “this time it’s different” and forecast that there would be no economic downturn. Oops!

2. There is a logjam in the Fed’s transmission mechanism through housing. While permits and starts have both turned way down, there was such a delay in construction due to materials shortages that housing units authorized but not started just peaked in September and are only down 3.5%. Housing units under construction – which I believe are the actual measure of economic activity – just peaked in October and are only down 0.6%: https://fred.stlouisfed.org/graph/?g=10GUb

Multi-unit construction has not turned down at all, and just made an all-time record in January. I do think this metric will turn down sharply in the coming months, but whether that is in February or May or even August is very unclear, given the long lag in multi-family construction. Importantly, with the exception of 2001, no recession has started until construction also turned down substantially.

3. Real residential construction spending looks different depending on what deflator you use. There are at least 2 PPI construction indexes that are candidates. Here’s what residential construction spending looks like deflated by each of them: https://fred.stlouisfed.org/graph/?g=10GRw

I am not saying either one is necessarily better, although I have always used the special index. I am curious (not criticizing) as to why you used PCE instead.

CPAC on Putin and Ukraine goes incoherent:

https://www.msn.com/en-us/news/politics/republican-s-remarks-about-putin-stun-cpac-2023-audience/ar-AA18aDw0

“A speaker at the Conservative Political Action Conference (CPAC) in National Harbor, Maryland was met with silence on Thursday when he said that he doesn’t trust Russian President Vladimir Putin.”

So the crowd trusts Putin? But wait – this same speaker said:

Following his comment about Putin, Johnson went on: “And, by the way, I think it’s kind of ridiculous to be sending $100 billion over to Ukraine when we’re going broke here.”

So Johnson who does not trust Putin would just let the Russian soldiers roll over Ukraine? Your modern MAGA party!

Curious if Johnson and other Republicans think a war would be cheaper after Putin gained access to Europe’s land resources??

The underlying question is whether Russia is a dangerous rival or a benign competitor. If Russia is a dangerous rival, and if Ukranians want to fight for their country, it is hard to imagine a better use of our military budget than to grind down Russia’s military, economy, budget and civilian support for Putin’s government than support for Ukraine’s defense.

Anyone arguing against this spending is likely to fall into one (or more) of a few categories:

– Ignorant of or unconcerned about geopolitics (a majority of the minority opposed to aiding Ukraine)

– Unconvinced that Russia is a dangerous rival ( Yves Smith? Jeffery Sachs?)

– Supportive of Russia’s agenda in Ukraine (Johnny, Elon Musk? anonymous)

– Utterly contemptuous of the truth – for reasons political (Josh Hawley) or economic (Tucker Carlson)

– Isolationist (Rand Paul, though he fits in other categories, as well)

– Fearful Russia will resort to nukes (OK, that’s fair, even though I doubt it)

Macroduck

I’m drinking now, just say your comment is AAA+++ : )

If you need an afternoon nap watch Haley’s speech on Youtube. You can save a couple melatonin gummies for another day. She’s not going to make any farther than Copmala Harris with that schlock. Embarrassingly cliché pandering lines to the CPAC crowd, then 15 seconds of awkward silence waiting for the crowd to realize they missed the applause cue.

Guess who had some unexpected free time in the early afternoon??

pgl

what is gained by Putin rolling over Ukraine by destroying huge amount of us& eu hardware and ordnance, or he rolls over Ukraine w/o burning through expensive western stuff.

why do you think all the stuff we give them will alter the limitations of Ukraine as a state which lost 25% of population as refugees?

it looks to me leopard tanks, and himars will not effect the outcome, and have given the opposition a lot of data on nato weapons and tactics.

Looks to you? Well, call off the defense of a sovereign nation. anonymous doesn’t think it’s gonna work.

when the us/eu/nato definition of ‘security’ is ‘no country left standing that could fight them…..’

all offense is posed as defense.

serbia was dismembered to start to dismember the russian federation….

and the alliance who decimated libya now stands for integrity of national borders. years after it pulled kosovo out of serbia

the freshest joke ever is us/eu/nato claiming the wage just war!

That was funny, I hope you meant it to be funny.

The hardware and ordnance destroyed represents a miniscule amount of money to the western countries. Russia is burning through a lot more and has an economy the size of Spain. Economic impact is clearly being much more problematic for Russia than the west. Same with weapons and strategies. Russia has been using all its range of weaponry and tactics, losing many into the hands of Ukraine. The value of learning about its hypersonic missiles abilities and inabilities will be priceless for development of defenses against them. The west has not given top-of-the-line weapons to Ukraine and are not using new tactics of its own. All Russia seem to learn about in Ukraine, is how to get its ass whopped.

Russia is directly fighting this war with all the conventional weapons they have available. So we are learning a lot about their abilities (or lack thereof). But they are not fighting this war against NATO forces. Instead they are fighting Ukrainian forces, with old Soviet and 20-50 year old NATO surplus weapons. So Russia is learning nothing about fighting a conventional weapons war against NATO.

“20-50 year old NATO surplus weapons”

this is all nato has!

that age weapons includes f-15, f-16, mirage 2000, tornado, abrams, leopard, bradley etc

the only weapon on that list “replaced” is f-15 replaced with f-22 which delivered 183 airframes for the price of 750, and so f-15 is kept alive

along with f-18, f-16 and a-10 bc f-35 is a broken system

and abrams tanks were not replaced bc us army future combat system spec’ed tanks that were not feasible… and was terminated w/o new programs.

you keep old weapons going bc you cannot replace them.

Any Congressional inquiry led by Jim Jordan will feature as witnesses a pack of MAGA liars:

https://www.msn.com/en-us/news/politics/revealed-jim-jordan-s-fbi-whistleblowers-were-paid-by-trump-ally-and-spread-j6-conspiracy-theories/ar-AA189SLf?ocid=msedgdhp&pc=U531&cvid=47c4b9d284ae40c0bd136892e8a78b84&ei=13

A trio of witnesses being called as “whistleblowers” by the GOP committee investigating the “weaponization” of government were paid off by a Trump ally and spread conspiracy theories, reported The New York Times on Thursday. “The first three witnesses to testify privately before the new Republican-led House committee investigating the ‘weaponization’ of the federal government have offered little firsthand knowledge of any wrongdoing or violation of the law, according to Democrats on the panel who have listened to their accounts,” reported Luke Broadwater and Adam Goldman. “Instead, the trio appears to be a group of aggrieved former F.B.I. officials who have trafficked in right-wing conspiracy theories, including about the Jan. 6, 2021, attack at the Capitol, and received financial support from a top ally of former President Donald J. Trump.” “The roster of witnesses, whose interviews and statements are detailed in a 316-page report compiled by Democrats that was obtained by The New York Times, suggests that Representative Jim Jordan of Ohio, the chairman of the panel, has so far relied on people who do not meet the definition of a whistle-blower and who have engaged in partisan conduct that calls into question their credibility,” said the report. “And it raises questions about whether Republicans, who have said that investigating the Biden administration is a top goal, will be able to deliver on their ambitious plans to uncover misdeeds at the highest levels.”

https://democrats-judiciary.house.gov/uploadedfiles/2023-03-02_gop_witnesses_report.pdf

GOP WITNESSES: WHAT THEIR DISCLOSURES INDICATE ABOUT THE

STATE OF THE REPUBLICAN INVESTIGATIONS

Democratic Staff Report

Committee on the Judiciary

U.S. House of Representatives

March 2, 2023

Cliff Notes version – Jim Jordan is a really bad liar.

What does the chart mean?

I’d say it means builders have seen that a slug of new homes will come on market this spring into the teeth of high mortgage rates so they have slowed down on new starts and residential construction employment will soon drop.

The Fed won’t be happy until there are people out of work, so they will do what they can to assure that outcome.

This is a common cause of the lag in the effect of rate hikes, but the big pile of unfinished houses may mean the lagged effect is larger – for housing, anyway.

Like much of macroeconomic analysis right now, the aftereffects of the Covid recession make drawing conclusions from the data tricky.

If we look at housing like we’d look at the factory sector, unfinished houses are an asset financed with an offsetting liability, and they amount to inventory. The (recently) highest level in record for unfinished inventory suggests inventory overhang. The financial result depends on how revenue from the sale of the asset stacks up against the liability. Plenty could go wrong.

Disappointing, but sad to say, not really surprising:

https://www.yahoo.com/news/rep-alexandria-ocasio-cortez-may-200944269.html

And then blaming it on a staffer makes her actions even lower. They always like to blame staff workers for their own decisions don’t they? She claims she’s “pro labor” and then when we get ourselves into hot water we go “My staff made the mistake”. No AOC, you want the glamour/status, then you better do your job. She hasn’t really come through for the NY unions either.

https://news.yahoo.com/amazon-union-leader-slams-aoc-205555458.html

#FAIL She’s shown herself to be an insincere fraud and I am no longer an AOC fan from today onward.

While I understand your feelings about this (and share them, to a degree) the obvious asymmetry of standards in this country has got to end. We cannot decry somebody for wearing a coat in the same Congress that allows people to quite literally lie and cheat and steal their way into national public office. (And I should probably add “Supreme Court” to that as well, it now being acceptable to lie to get there with no ramifications whatever).

ECB confronts a cold reality: companies are cashing in on inflation

https://www.reuters.com/markets/europe/ecb-confronts-cold-reality-companies-are-cashing-inflation-2023-03-02/

‘Huddled in a retreat in a remote Arctic village, European Central Bank policymakers faced up last week to some cold hard facts: companies are profiting from high inflation while workers and consumers foot the bill. The prevailing macroeconomic narrative over the past nine months has been that sharp increases in prices for everything from energy to food to computer chips were ramping up costs for companies in the 20 countries that make up the euro zone. Data articulated in more than two dozen slides presented to the 26 policymakers showed that company profit margins have been increasing rather than shrinking, as might be expected when input costs rise so sharply, the sources told Reuters. An ECB spokesperson declined to comment for this story. “It’s clear that profit expansion has played a larger role in the European inflation story in the last six months or so,” said Paul Donovan, chief economist at UBS Global Wealth Management. “The ECB has failed to justify what it’s doing in the context of a more profit-focused inflation story.”‘

That profit margins rose was somewhat US economists noted a while back. So will the ECB get the right policy message?

‘Inflation fueled by higher corporate margins tends to self-correct as companies eventually put the brakes on price rises to avoid losing market share, making it a very different beast to tame than a wage-price stampede. So a new inflation narrative focused on margins could give the more dovish members of the Governing Council some ammunition to fight against further rate rises after their resistance proved largely futile over the past year, according to economists interviewed by Reuters.’

Well maybe there is indeed a little sanity in Europe!

“Inflation fueled by higher corporate margins tends to self-correct as companies eventually put the brakes on price rises to avoid losing market share, making it a very different beast to tame than a wage-price stampede.”

I don’t know whether Campena is aware of any evidence for this claim, but from the following “according to economists”, I doubt he is. He doesn’t seem to think evidence is necessary, and given where he works, that’s a safe atitude. Campena makes the argument that wage increases must be resisted by cental banks while profit increases need not be resisted. His rhetorical choices are drippings with coolaid; wage gains are a “stampede” while profit-driven inflation is “self-correcting”. He offers these assertions as truisms, without any suggestion that evidence is needed.

Businesses set wages and prices, both with an eye to market share and margins. If workers benefit, government intervention is required. If share holders and managers benefit, no intervention is required, because of a truism. I know I’m sounding a little bit like Johnny here, but the “profits aren’t a problem” backlash has been really strong, and all over the place. It’s creepy.

Hey Jonny boy – did you not notice their graph which showed interest rates from four different choices? Now had you done so, you would have noticed that 3 of the 4 sources show a lower rate than the source you keep citing. So why do you just ignore the other 3 sources? Two choices for little Jonny boy. Either:

(1) Jonny boy is too stupid to real his own links; OR

(2) Jonny boy is a serial liar.

Oh wait – there is a 3rd possbility. Jonny boy is not only stupid but also a really bad liar. That’s it!

Perhaps a more accurate statement would be that housing often, but not always, leads economic cycles. Housing’s cyclical influence and its success as a leading indcator depend on the cyclicality of housing itself. Here is a picture of housing’s share of GDP and housings cntributiono to changes in GDP:

https://fred.stlouisfed.org/graph/?g=10HNN

Just eyeballing, a share in excess of 5% of GDP seems like a pretty reliable indication of coming trouble. This cycle, 4.8% was the peak – limited capacity for damage, but capacity, nonetheless.

So why the large swing in the contribution to GDP from residential investment in the post-Covid period? The denominator, GDP, rose sharply, dominating the swing in the numerator. In that fact, we see what we already knew – that other factors, including supply-side constraints and government transfers, have had outsized effects on swings in GDP. Housing never rose above 5% of GDP – no glut. And by the way, no glut and an extended period of low mortgage rates means prices were due for a bigger swing than quantities.

The Fed has had a hard time slowing the economy so far, but it’s early days. Maybe housing’s modest share in GDP has something to do with that, but let’s be patient. The lag in the peak impact of Fed rate changes in the era of forward guidance is something like 12 months. The first hike in the current tightening was just 12 months ago. Plenty more to come.

If housing isn’t primed to do serious damage to growth, what about other factors? Durables consumption as a share of GDP is still very high relatve to the prior expansion…and quite normal relative to earlier expansions:

https://fred.stlouisfed.org/series/DDURRE1Q156NBEA

Make of that what you will, but durables are often bought with borrowed money. Mian, Sufi and Werner warn that borrowing resulting in above-trend household consumption is a warning sign for recession. (Will I ever shut up about those guys?) In addition, durables demand is partly driven by home purchases, so we may have two factors limiting future durables demand.

A follow-up on JohnH’s boasting that he speaks several languages which is his way of claiming his incessant babbling is actually some sort of advanced thinking. I just remember the Russian inspired English known as Nadsat used by the teenage gangsters in A Clockwork Orange:

https://en.wiktionary.org/wiki/Appendix:A_Clockwork_Orange

Let’s study up on this as maybe it will help us better understand the usual insanity Jonny boy spews!

Yeah, Johnny’s pretense of learnedness was annoying. Show of electronic hands – anybody here who isn’t somewhat conversant in more than one language? Foreign language study was once a requirement for many degrees at most good colleges, so most every college grad was somewhat conversant in more than one language. Times have changed, but the readership here (as represented in comments) seems to skew old, so presumably language skills are common.

And “I read foreign newspapers” isn’t restricted to speakers of second languages, since most major newspapers have English-language editions.

And if one does not speak the language, one can use Google translate. Not perfect but it produces material a lot more coherent than the usual Jonny boy ramblings.

Being multi lingual is a necessity for reading and understanding mortgage rates.

Touche!

Putin seems to want his own soldiers to needlessly die:

https://www.msn.com/en-us/news/world/conscripts-who-complained-to-putin-wiped-out-in-battle/ar-AA18bJMg?ocid=msedgdhp&pc=U531&cvid=e8bc52a3bc104c3d926d42709a531bfe&ei=26

Nearly all the Irkutsk region conscripts whose video appeals to President Vladimir Putin decrying their lack of training made headlines last February are believed to have died in Ukraine’s Donetsk region on March 1, the Sibir.Realii website reported on Friday. The unit’s members came to prominence in February 2022, when its recently mobilized reservists made three video appeals to the Russian president complaining of being made subordinate to officers from the Donetsk People’s Republic, a self-proclaimed separatist entity whose territory was annexed by Russia in February 2022. The men also complained of being sent to storm Ukrainian positions with insufficient training and a total lack of military intelligence. They claimed they had been warned they would be shot if they refused to follow orders. Sibir.Realii reported on Friday that only a few unit members are still alive, with much of the regiment being wiped out after being ordered to storm a fortified area in the Donetsk region of eastern Ukraine on Wednesday.

A power hungry despot who wants Ukrainians to needlessly die who does not give a damn that his own soldiers also needlessly die. What a guy!

House Democrats put Jim Jordan and his fake whistleblowers on the spot:

https://www.msn.com/en-us/news/politics/house-dems-call-jim-jordan-s-bluff-and-dare-him-to-have-his-whistleblowers-testify-in-public/ar-AA18c4QT?ocid=msedgdhp&pc=U531&cvid=ba9c94c96c54467691459d6448b98271&ei=9

Unimpressed House Democrats want to put Judiciary Committee Chair Jim Jordan (R-OH) on the spot by making his three FBI “whistleblowers” face public questioning about the so-called “weaponization” of the law enforcement agency. According to a report from the Washington Post, Democrats thus far have been unimpressed with what they have heard, claiming the agents Jordan has dug up have no direct evidence of wrongdoing and are just passing along second-hand anecdotes. According to an earlier report from the New York Times, “The first three witnesses to testify privately before the new Republican-led House committee investigating the ‘weaponization’ of the federal government have offered little firsthand knowledge of any wrongdoing or violation of the law, according to Democrats on the panel who have listened to their accounts. Instead, the trio appears to be a group of aggrieved former F.B.I. officials who have trafficked in right-wing conspiracy theories, including about the Jan. 6, 2021, attack at the Capitol, and received financial support from a top ally of former President Donald J. Trump.”

My girl friend cracked up over this one:

https://www.msn.com/en-us/news/us/desantis-disney-appointee-suggested-tap-water-turns-men-gay-report/ar-AA18bLZ8?ocid=msedgdhp&pc=U531&cvid=33a0a5c79f9a4197894b0df80559af97&ei=12

A man appointed to Florida Gov. Ron DeSantis’ Disney oversight board has a history of making anti-LGBTQ comments, including a claim that tap water could be turning people gay, CNN reported. Ron Peri, an Orlando-based former pastor and the CEO of a Christian ministry, is one of five people who will oversee the Reedy Creek Improvement District, the government body that has given Disney unique powers in Central Florida for more than half a century, according to CNN. In a January 2022 Zoom call, Ron Peri asked, “So why are there homosexuals today?” In a January 2022 Zoom call, Ron Peri asked, “So why are there homosexuals today?” “There are any number of reasons, you know, that are given. Some would say the increase in estrogen in our societies. You know, there’s estrogen in the water from birth control pills. They can’t get it out,” Peri said. “The level of testosterone in men broadly in America has declined by 50 points in the past 10 years. You know, and so, maybe that’s a part of it.” “But the big part I would suggest to you, based upon what it’s saying here, is the removal of constraint,” he continued. “So our society provided the constraint. And so, which is the responsibility of a society to constrain people from doing evil? Well, you remove the constraints, and then evil occurs.”

She brought me a glass of tap water with ice saying it should all be OK as long as we never go to Florida again.

I thought women didn’t like jokes about water breaking??

Something to do with labor day?? Nevermind.

Precious bodily fluids –

General Jack D. Ripper : Have you ever seen a Commie drink a glass of water?

Group Capt. Lionel Mandrake : Well, no, I can’t say I have.

General Jack D. Ripper : Vodka. That’s what they drink, isn’t it? Never water.

Group Capt. Lionel Mandrake : Well, I believe that’s what they drink, Jack. Yes.

General Jack D. Ripper : On no account will a Commie ever drink water and not without good reason.

Group Capt. Lionel Mandrake : Yes. I – I don’t quite see what you’re getting at, Jack.

General Jack D. Ripper : Water. That’s what I’m getting at. Water

Want to hear a joke about paper?? Nevermind, it’s tearable.

You actually WROTE that! 🙂

Uncle Moses, feeling shameful, looks at his shoes, then giggles very quietly

Broad paraphrase of “What does this picture mean”?

“Is this time different?”

Yes, this time is different. This time is always different, but how and how much different are important questions. We did not have a housing-led expansion (in the contribution-to-growth sense) so we may not have a housing-led recession. That remains to be seen – see wally’s comment. We had a massive supply-side shock and a massive government response, not at all like most recessions and recoveries – this time is different.

Interest-rate-driven asset price increases have been followed by big losses in asset values – nothing different about that.

The peak in the funds rate (till now) coincides with the low in the jobless rate (till now):

https://fred.stlouisfed.org/graph/?g=10Iml

Nothing different about that. Check the lags in that picture thenext time somebody suggests rate hikes aren’t working. We…don’t…know…yet.

Figuring out what is different in new cases, what the same, is a big part of the game. Before you can do that, you actually have to have a grip on regularities, on the stylized facts of economics. Some folks here are really good at the stylized facts. Very pleased that you are here.

Anybody else notice that the troll choir has mostly stopped singing? It’s almost as if an invisible hand ( the ine from “A Theory of Moral Sentiments”) guided the trolls toward a reconsideration of their behavior.

The invisible hand in this case could be their partisan masters. Ya know, what with the Dominion Voting Systems testimony depositions and all. Partisan lies are in bad odor right now.

Well we have been spared the BS from ltr, CoRev, and even Bruce Hall. Alas JohnH and his BFF Princeton Steve has decided to fill the void in the space of utter stupidity. Even Trump is baaack promising George Jetson flying cars for everyone.

MD, Nah! Wrong again. It’s the subject matter being presented. Why get involved with the articles questing to interpret the economic tea leaves? Where are the predictions showing understanding instead of the wandering articles trying to find meaning?

CoRev must be feeling lonely so what does he do? Defend the only troll here more dishonest, pointless, and stupid than even CoRev. Gee CoRev – the pandemic is over so why not run over the little Jonny’s place bringing a nice bottle of wine. You two would be such a cute couple.

You mean, why does an economics blog bother with economics? Well, anything that keeps you from polluting comments is a good thing.

An economics blog where only a select few understand—as the all seeing, all knowing CoRev has noted—“the volatility of data.” What would this site do without the observations of CoRev, his new partner JH , and hard working Manfred, who somehow finds time away from his busy schedule to enlighten us.

Meet George Jetson ala Donald Trump:

https://www.msn.com/en-us/news/politics/trump-proposes-10-futuristic-freedom-cities-featuring-jetsons-like-flying-cars/ar-AA18bY7O

Trump proposes 10 futuristic ‘Freedom Cities,’ featuring Jetsons-like flying cars

Former President Donald Trump called for a national contest to “charter new cities” on federal land.

Trump, the top Republican 2024 presidential candidate, also called for the federal government to help the U.S. beat China in the race to develop flying personal vehicles.

Trump also advocated for a focus on lowering the costs of buying a car and building single-family homes.

OK!

“The policy-light plan sketched a vision of America’s future that was in some ways reminiscent of “The Jetsons,” the classic cartoon depicting a high-tech utopian society where commuters traveled to work by flying car.”

Jane – stop this crazy train!

trump going on about being the peace candidate,

Page acting slightly weird again. It’s not that bigguh deal, I mean the posts are still there, which is the important thing. But one time it shows 42 comments in a thread, then it shows 27 later, this is a little weird. If you’re paying someone to run the blog’s server I would have a little discussion with them. If the server is free, maybe “ride it out” and see if the glitch goes away?? . Or just tell weirdo blog fans like me to get a new hobby. I don’t know.

How diplomacy is shaping up in the South China Sea, as reflected in hightened risk of military confrontation:

https://www.scmp.com/comment/opinion/article/3211972/south-china-sea-trigger-points-grow-even-beyond-us-control-what-will-china-do

The U.S. gains influence in direct proportion to China’s grabbiness. Here’s the same topic, from the same author, with a focus on China’s dilemmas and motives:

https://www.scmp.com/comment/opinion/article/3210849/south-china-sea-china-faces-hard-choices-us-support-rivals-grows

The whole “China takes the long view” thing has lost credibility under Xi. Pour cement – stop pouring cement. Expand credit – limit credit. Lock down – open up. Build regional alliances – steal from other countries in the region at gunpoint. Being a hegemonic autocrat is soooo hard!

Somewhat related question:

Does the prominence of 30-year mortgages in the USA contribute to additional stickiness in the US residential housing market? Might not amount to much but could complicate matching homes to buyers.

Don’t know how much you know, so apologies for over explaining.

You can’t sell a home you don’t own, so having an outstanding balance on a mortgage is, in theory, an barrier to selling a home. But in practice, you just have to use the new buyer’s money to pay off the balance. Problem solved. There are also “assumable” mortgages, which allow the new buyer to pick up the existing mortgage. The buyer assuming the mortgage only writes a check to the seller for the the seller’s equity in the house. (And another check to the realtor, and another to the lawyer and another for a title search…but the big check is to the seller.)

The existence of long mortgages avoids the risk of refinancing “balloon” payments, as are common in some markets – Canada, I think. Balloon mortgages are available here, as are adjustable-rate mortgages which carry some of the same risk as balloons. Anyhow, if 30-year mortgages do cause problems, they also avoid other problems.

Small down payments definitely cause stickiness. If the nominal owner has little equity inthe house and the market value of the house falls, the nominal owner may be unable to sell. Money to pay the outstanding balance on the mortgage has tocome from somewhere, andit won’t come from the new buyer.

Kevin Drum covers an idiotic oped ala Peggy Noonan on the alleged COVID lab-leak theory so we don’t have to:

https://jabberwocking.com/peggy-noonan-and-the-common-sense-of-covid/

Check out Noonan’s nuttiness as it is straight out of a Princeton Steve rant. Kevin ably shoots down this latest BS.

“the virology community pretty unanimously believes the genetic structure of the COVID virus shows no signs of an artificial origin”

That is an essential part of why you can find very few actual virologists thinking the lab leak theory has much chance at all as an explanation. We have no credible evidence of lab manipulation. It is possible that a laboratory collected natural strains and grew them up for study (and had an accidental release), however that is a really low probability given all the precautions and safety protocols in this type of facilities. It is a lot more likely that the path from a natural strain to humans came through an animal market where live animals are handled with bare hands by people with no gowns or masks to protect them. Its all about probability and the lab leak theory has a much lower probability than the wild animal handling theory.

Off topic – Turkey is not the only country in its region suffering a currency crisis:

https://apnews.com/article/iran-currency-markets-iraq-government-syria-83d667466b51b507fbd5a827bc321234

Central to Iraq’s currency problem is a trade imbalance with Iran. If I understand correctly (highly questionable), Iraq uses oil export earnings to buy natural gas and other products from Iran. That had been a dollar trade until the U.S. stepped in to stop it. Now, the trade is in dinars. That put fresh downward pressure on the dinar, which increased the dinar price of imports from Iran, which put downward pressure on the dinar, and so on.

That the US has control of Iraq’s foreign reserves strikes me as an odd surrender of Iraq’s sovereignty. More disturbing:

Sudani’s office said in a statement that the prime minister had “issued strict directives to deal with currency smuggling, arrest smugglers and speculators at the dollar exchange rate, confiscate smuggled funds, and subject external checkpoints to monitoring and scrutiny.” The Iraqi National Intelligence Service said Friday that it had seized more than 1 million dollars from organized crime groups intending to smuggle the funds. The statement, which was carried by the Iraqi state news agency, did not specify the planned destination of the funds.

Nice detail on Iraqi exports – which seems to be oil and more oil:

https://www.worldstopexports.com/iraqs-top-10-exports/

Interesting information on how Iraq started imported natural gas from Iran aka the Baghdad Ballet:

https://oilprice.com/Energy/Energy-General/Iraqs-Energy-Imports-From-Iran-May-Come-To-An-End.html

Sergey Lavrov must think he is a stand up comedian:

https://www.msn.com/en-us/news/world/crowd-erupts-in-laughter-at-russia-s-top-diplomat-after-he-claimed-the-ukraine-war-was-launched-against-us/ar-AA18bUHI?ocid=msedgdhp&pc=U531&cvid=7501d2db703f4548946e4922fe6da1f5&ei=11

Sergey Lavrov, Russia’s top diplomat and a close ally of Russian President Vladimir Putin, said Thursday at a conference in India that the war in Ukraine “was launched against us,” prompting the crowd to erupt into laughter. Lavrov was a speaker at India’s G20 Summit in New Delhi, leading a session that was part of a “Raisina Dialogue 2023” series. He was in discussion with Sunjoy Joshi, the chair of the Observer Research Foundation in India, and took questions from the audience. One audience member asked Lavrov: “How the war has affected Russia’s strategy on energy, and will it mark a privilege toward Asia? And if it does, how is India going to feature in it?” “You know, the war, which we are trying to stop, which was launched against us, using the…” Lavrov began, before being cut off by loud laughter from the crowd. “…The Ukrainian people, uh, of course, influenced…” Lavrov tried again, before being cut off by more laughter and a shout of, “Come on!” from the crowd.

Oh wait Lavrov wasn’t trying to be funny even though his statement is beyond disgusting. Huh – JohnH keeps making the same disgusting claim.

Jack Smith strikes me as the deal. Trump definitely seems to be scared of him:

https://www.msn.com/en-us/news/politics/trump-loses-it-ahead-of-cpac-speech-accuses-animal-prosecutor-of-trying-to-torture-my-people/ar-AA18dQrA?ocid=msedgdhp&pc=U531&cvid=4fdbb1c677a4446799a219feb7465d14&ei=10

But as his 5:30 speech approached, Trump amped up his attacks on Smith, calling him an “animal prosecutor” who is using “TORTURE” to extract testimony:

This Animal Prosecutor that they stuck on me over the Boxes Hoax is trying to TORTURE my people into telling lies. It’s all for political reasons, and the fact that I’m leading, big, in all of the polls. He’s flying people from all over and throwing them in front of a D.C. Grand Jury. They are confused and scared – they’ve never done this before. These Democrat Marxist pigs should be the ones that are investigated. The nice guy prosecutor in the Biden documents case hasn’t even started yet!

I hadn’t realized Trump was a student of medieval history:

https://www.animallaw.info/article/historical-and-contemporary-prosecution-and-punishment-animals

Or maybe just Mel Brooks movies:

https://www.shutterstock.com/editorial/image-editorial/blazing-saddles-1974-5885267ad

Please tell me that there is not a single American that is going to believe this BS from Tucker Carlson:

https://www.msn.com/en-us/tv/news/they-are-lying-tucker-carlson-reveals-why-he-will-air-hidden-surveillance-jan-6th-footage-next-week/ar-AA18b6xD?ocid=msedgdhp&pc=U531&cvid=6f480d5ada614ed88107b21797c418f5&ei=10

Tucker Carlson announced that plans to air surveillance footage from January 6th, 2020 early next week. He also revealed his mission in doing so, and that is to show how “they are lying” to his viewers. “The defenders of democracy are defending democracy again,” the Fox News host said Thursday night. “They’re telling you it’s really, really dangerous. And anyone would get to see the thousands of hours of surveillance footage from January 6th, which has been hidden from the public for two years as a tiny group of people gets to make up stories about what happened that day and change the country on the basis of those stories. ”

Yea I get that we see daily doses of incredible stupidity from our Usual Suspects. Yea I get that wearing MAGA hats rots even the tiniest of brains. Yea I get Faux News has lied to its viewers for almost 30 years. But DAMN!

Look who’s back:

https://thehill.com/homenews/campaign/3884236-marianne-williamson-officially-launches-long-shot-bid-for-2024/

I’m just gonna say, I dislike that woman (Williamson) very very strongly. Was TBN religious channel busy this week??