Olivier Blanchard and Larry Summers had an interesting exchange about interest rates and secular stagnation, and target inflation rates today, at PIIE. Blanchard mentioned the evolution of r vs. g as a key issue in thinking about secular stagnation, and this spurred me to look at the data.

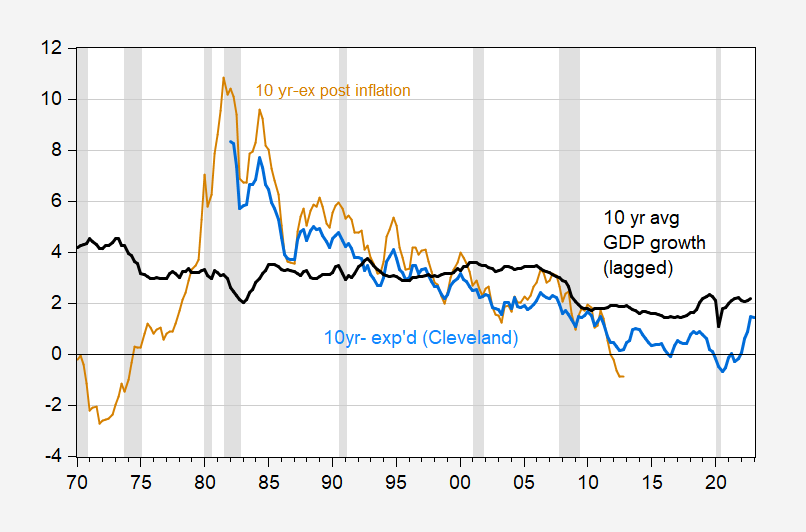

First, real 10 year Treasury rates adjusting for expected inflation, vs. 10 year growth rates over the previous ten years.

FIgure 1: Ten year Treasury yield adjusted by ex post inflation (tan), by Cleveland Fed expected inflation (blue), and average growth rate of GDP over the previous ten years (black). NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Cleveland Fed, BEA, NBER, and author’s calculations.

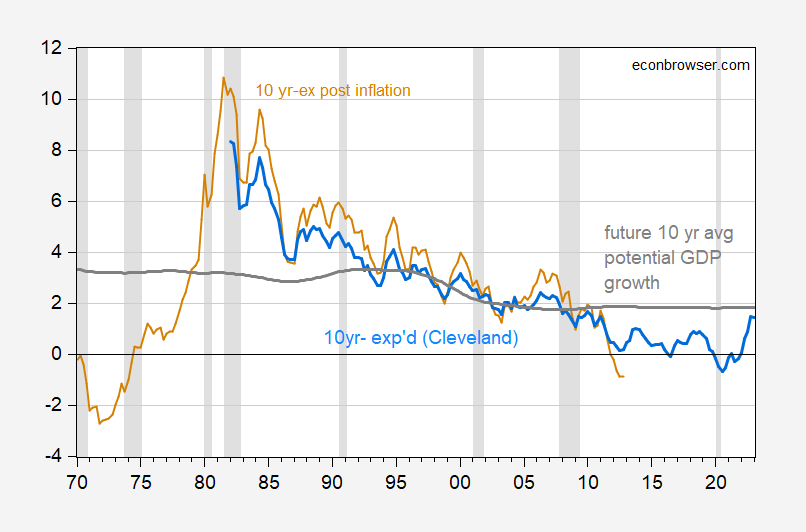

In fact, one might be better thinking of the real interest rate vs. the growth rate over the relevant period. We could calculate and use the ex post growth rate of GDP (ending with the observation in 2012Q4), but instead I use CBO’s estimate of potential growth.

FIgure 2: Ten year Treasury yield adjusted by ex post inflation (tan), by Cleveland Fed expected inflation (blue), and average growth rate of potential GDP over the next ten years (gray). NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Cleveland Fed, CBO, NBER, and author’s calculations.

g > r for the past decade, including 2020-21. Right now the two have converged, but given the evolution of these two rates over the recent past, we can see why the debt to GDP ratio has not exploded, post-Trump, despite large (in dollar terms) deficits.

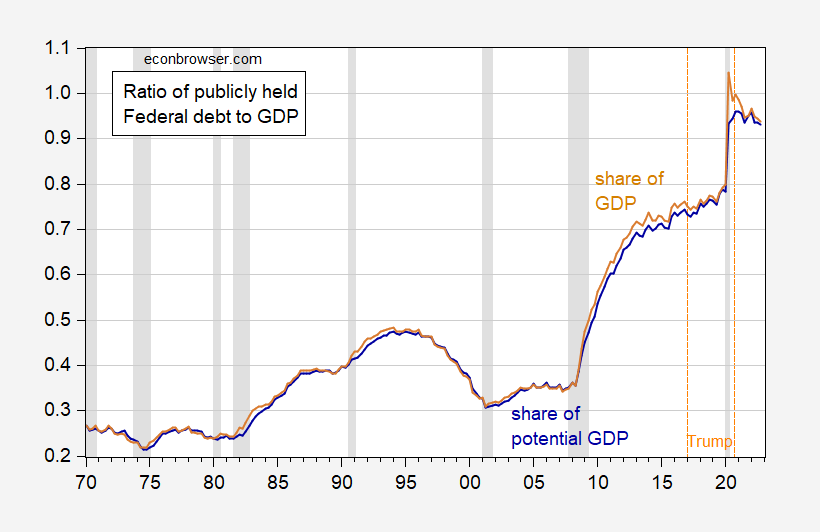

FIgure 3: Federal debt held by public as a share of GDP (tan), as share of potential GDP (dark blue). NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, BEA via FRED, CBO, NBER, and author’s calculations.

To recap, Debt-to-GDP dynamics are described by this expression.

(1) dt-dt-1 = [(rt-gt)/(1+gt)]× dt-1 – pt

Where d is the debt to GDP ratio, r is the real (inflation adjusted) interest rate, g is the growth rate of real GDP, and p is the primary (noninterest) surplus to GDP ratio. In words, the debt to GDP ratio rises when the real interest rate-growth rate gap is sufficiently positive, or the primary deficit is sufficiently large.

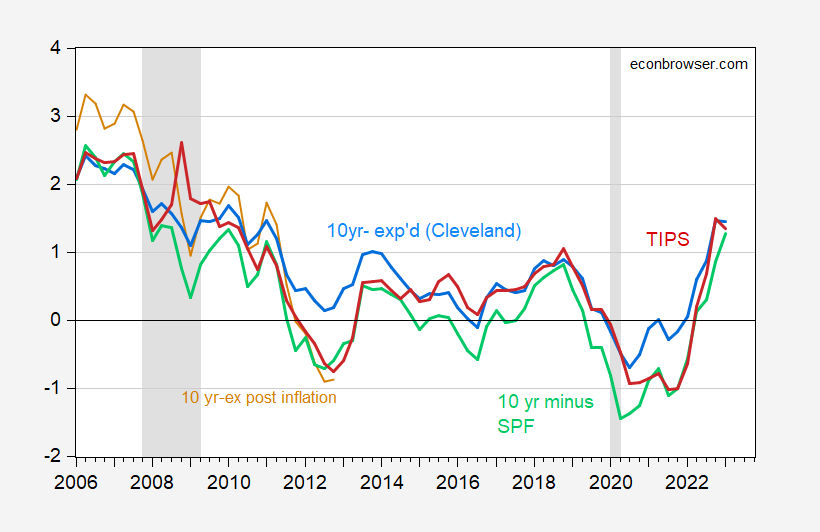

Note that different measures of expected inflation yield similar measures of the real 10 year rate as of the first two months of 2023Q1.

FIgure 4: Ten year Treasury yield adjusted by ex post inflation over subsequent ten years (tan), by Cleveland Fed expected ten year inflation (blue), by SPF median expected ten year inflation (green), and TIPS ten year yield (red). NBER defined peak-to-trough recession dates shaded gray. 2023Q1 observation is for first two months. Source: Treasury via FRED, Cleveland Fed, BEA, NBER, and author’s calculations.

Clearly if real rates further rise, or growth prospects diminish, then the debt dynamics do not work to our advantage.

CBO’s latest projection puts the ten year rate at 3.8% in the out years, and CPI inflation at 2.3%. Assuming the y/y inflation projected for 2028-2033 is the expected inflation rate for the ten years ahead, this means the projected real 10 year interest rate is 1.5%. The corresponding projected real growth rate is 1.8%.

r v g PLAYS its own role in the important work of Piketty (even if Mankiw tried to mock it:

https://www.rweconomics.com/Piketty.htm#:~:text=What%20Piketty%20is%20saying%20here%20is%20that%20if,individual%E2%80%99s%20fortune%20will%20grow%20faster%20than%20the%20economy.

r v. g is important consideration in the debate over the long-term government budget constraint (even though this topic is way over Bruce Hall’s little brain).

For the widest distribution of economic benefits, the optimal condition is g>r. For the benefit of the wealth, the optimal condition is r>g. Right now, the condition is g=r:

https://fred.stlouisfed.org/graph/?g=10yFI

Ahhhh! Equilibrium? Only if you think wealth for the wealthy is as important as the widest distribution of economic benefits. But it’s late, and I’ve been imbibing, so I could be wrong.

What if g=r, but the wealthy are getting almost ALL of the “r”??

I find that Elizabeth Warren puts this “we must raise interest rates to protect the wealthy!” in language I can understand in her latest exchange with Fed Chair Powell. You should watch the video of the exchange – but I will link to a media article for reference of date and time: https://news.yahoo.com/elizabeth-warren-asks-fed-chair-173904383.html The media frames this incorrectly IMO – in the video she questions what he plans to do after the Fed puts millions out of work. How exactly does that solve supply chain issues and price gouging by large corporations?

Great question. And who owns the media that presents things in a way which mass job losses are to be seen as “beneficial” to America?? Jerome Powell is a born liar. The same as Larry Summers. You’ll remember Larry Summers was pro re-capitalizing Greek banks if it meant that Greek citizens would starve to death and live in filth. But always right before the time people are about to suffer, Larry always thinks the TBTF banks are doing fine, and that “financial innovation” (risk taken at the expense if common depositors and savers) is the only way for humans to “progress”. Larry Summers is a sick narcissistic bastard, the same as Powell. And I think those who quote Summers like he speaks from Mt Olympus only do damage their own reputations.

I agree – it was interesting to see Sen Warren question Powell and all he could do was pass off GOP talking points “Well, inflation is hurting working class people as well.” How does raising interest rates bring more workers into the economy? Is a question Powell has no answer for.

Although in the the fever dreams of the GOP – instead of doing what United States has always done – immigration to build workforce – Republicans – taking a cue from Upton Sinclair’s The jungle – want to make children as young as 14 or 15 work in slaughterhouses and bring back the glory days of the 1890s. According to the GOP – child labor laws are now burdensome and obsolete: https://www.washingtonpost.com/politics/2023/03/08/huckabee-sanders-arkansas-child-labor/

Or change Social Security and make people work till they drop dead at 70. According to one GOP Senator (well paid, excellent healthcare, sweet govt pension plan and wearing a finely tailored suit) – poor people enjoy working in old age – gives them something to do! and they can earn their crusts of bread.

Yes that was riot. “Well, inflation is hurting working class people as well” – so let’s do something that has minimal effects on supply constraint driven inflation, but will put them out of work. I guess the guy think the pain of being kicked in the ass will disappear if he kicks them in the groin.

That comment gets 5-stars from the panel judges.

Wait – if CPI rises by 5% and nominal wages rise by 5% how are workers hurt? Now if one kills economic growth, some workers lose their job and other workers see their nominal wages increases fall. Mr. Powell – how on earth is that helping workers?

His testimony was so bad it was like JohnH was testifying.

Blanchard made some interesting points. Summers noted both are saying the long-run real rate may be near 1.5%. On two points they had interesting disagreements:

(1) Risk aversion. Blanchard argued it is higher than in the past but Summers notes that things like the equity risk premium and credit spreads may actually be quite modest.

(2) Life cycle models which turns on things like life expectancy and the impact of the decision to consume v. save. I want these two to say more and related it to the inevitable debate over the Social Security issue.

Trump wanted to bomb Mexico?

https://talkingpointsmemo.com/news/comer-house-oversight-mexico-bomb

House Oversight Committee Chair James Comer (R-KY) said Tuesday morning that it was a “mistake” that the administration didn’t go through with bombing drug labs in Mexico after then-President Donald Trump suggested it in 2020. “One of the things we learned post-Trump presidency is that he had ordered a bombing of a couple of fentanyl labs, crystal meth labs, in Mexico, just across the border and for whatever reason the military didn’t do it,” he said on Fox News. “I think that was a mistake.” That Trump suggested bombing the United States’ southern neighbor and ally was revealed in former Defense Secretary Mark Esper’s book, “A Sacred Oath,” last year. Esper relayed that Trump thought such an act of war could be performed discreetly. “When Mr. Esper raised various objections, Mr. Trump said that ‘we could just shoot some Patriot missiles and take out the labs, quietly,’ adding that ‘no one would know it was us,’” the New York Times wrote from an advanced copy of Esper’s book. “Mr. Trump said he would just say that the United States had not conducted the strike, Mr. Esper recounts, writing that he would have thought it was a joke had he not been staring Mr. Trump in the face.” During his Tuesday interview, Comer also said that “certainly we need to have a strong military presence on that southern border,” a seeming clarification of his position a couple months ago when he floated cutting off “all funding for everything” before deciding how best to secure the border. Comer also bemoaned that the Biden administration is paying more attention to the “Ukrainian border” than the Mexican border.

It is a good thing Trump is no longer President. Now James Comer needs to be removed from any responsible position ASAP.

Yes Biden has demonstrated that competence is essential in the white house if you want to solve problems. Esper is belatedly revealing how incompetence can irreparably damage our country when a moron President try to make decision without any ability or desire to think it through.

Blanchard notes he used to be an advocate of having an expected inflation target = 4% but now based on current market conditions, he notes the target should be 3%. I get the sense he agrees that the current stance of monetary policy is a bit too restrictive.

Blanchard was very reserved in his comments. But made it clear that if “g” is bigger than “r” longterm, most of this is just melodrama

bullsh*t for corporations to rationalize screwing the consumer.Presented sans commentary:

https://www.yahoo.com/finance/news/why-silicon-valley-banks-crisis-is-rattling-americas-biggest-banks-121159393.html

With these banks failing – maybe it is time to bring back Yellen and Bernanke. Powell may not be up for the job.