That’s economist Trump in 2018, as cited in Coy (2018). Now, from USITC “Economic Impact of Section 232 and 301 Tariffs on U.S. Industries” (page 22), a conflicting assessment.

The Commission’s econometric model estimates that tariffs under sections 232 and 301 resulted in a nearly one-to-one increase in prices of U.S. imports following the tariffs. This implies that a 10 percent ad valorem tariff raised the price of U.S. imports from China by about 10 percent. This nearly complete pass-through (meaning that prices received by exporters were largely unaffected and prices paid by U.S. importers increased by the same amount as the tariffs) is unusual but has been similarly found by other recent studies, which conclude that U.S. importers have borne almost the full burden of section 301 tariffs.

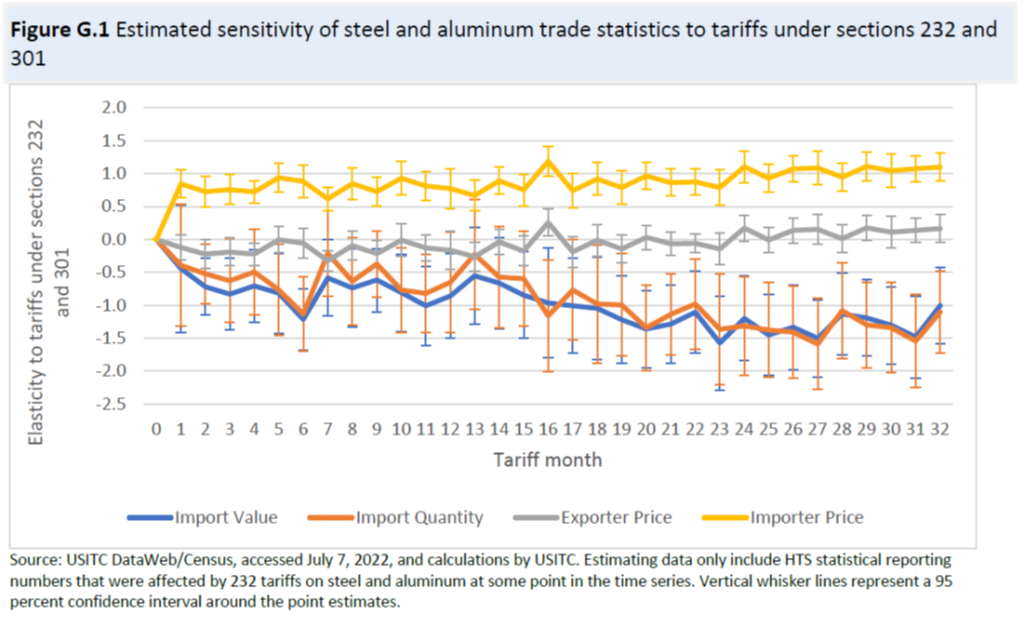

Here is the estimated pass-through of tariffs into steel prices.

Source: US ITC (2023).

Estimates of tariff pass-through are pretty close to one, i.e., a 25% ad valorem tariff results in essentialy a 25% increase in price faced by a domestic consumer (broadly defined). This means that we are paying the tariffs, not the Chinese, in these two cases.

So, if you weren’t paying attention, the US seems to be a small country insofar as steel and aluminum markets are concerned (see Econbrowser posts [1], [2], [3], – so contra Mr. Bruce Hall’s comment).

In other words, the US government made money on imports. Not altogether bad.

As for the increase in consumer prices, the 10% increase in tariffs would not necessarily pass through to consumers. Much would depend on how much value was added in the US—logistics, marketing, services, etc.

We saw this fearmongering done with washing machines…and the price increase borne by consumers turned out to be much less than advertised, even though the industry is oligopolistic.

I’m not sure what is to be gained by exaggerating the cost to consumers…unless “free” trade with zero tariffs is in and of itself somehow sacrosanct…which seems to be the case, ignoring the fact that like everything else “free” trade has its costs and it’s benefits.

I guess you did not read the post

https://www.nytimes.com/2019/04/21/business/trump-tariffs-washing-machines.html

April 21, 2019

Trump’s Washing Machine Tariffs Stung Consumers While Lifting Corporate Profits

New research shows how a move meant to aid domestic manufacturers instead padded profits and raised prices on a wide variety of laundry items.

By Jim Tankersley

President Trump’s decision to impose tariffs on imported washing machines has had an odd effect: It raised prices on washing machines, as expected, but also drove up the cost of clothes dryers, which rose by $92 last year.

What appears to have happened, according to new research * from economists at the University of Chicago and the Federal Reserve, is a case study in how a measure meant to help domestic factory workers can rebound on American consumers, creating unexpected costs and leaving shoppers with a sky-high bill for every factory job created….

* https://bfi.uchicago.edu/working-paper/the-production-relocation-and-price-effects-of-us-trade-policy-the-case-of-washing-machines/

“ Not only did Whirlpool (and its Maytag brand) not take advantage of a pricing strategy opportunity to hold-the-line on washer and dryer prices, they strategically (and tacitly) acted as any member of a highly concentrated oligopolistic industry would.

In this case, the company exploited an opportunity not to compete in a “ruinous” price war and increased their washer and dryer prices by the highest percentage among the brands, and therefore maximized the highest payout with little risk to their market share position.

If “consumer welfare” is the antitrust measurement of competitive markets, what does this oligopolistic behavior reveal to American consumers who pay for these monopolistic profits at the retail level?”

https://insidesources.com/washing-machines-tariffs-and-the-oligopoly-problem/

Isn’t it funny how economists go ballistic when tariffs hurt consumers but go silent when a big part of the problem stems Corporate America’s oligopolistic behavior? Par for the course for corporate friendly, mainstream economists…

Another article you cherry picked an misrepresented

This comment is pure trash for so many reasons/ I guess this interesting paper was too complicated for little Jonny boy. First of all the economists at the SEC opposed the Whirlpool-Maytag merger for reasons noted in this paper. Of course the political hacks in the Bush regime argued that free trade with the Asian suppliers would mess up the oiligopoly, which is why Whirlpool wanted those tariffs. It was indeed pointed out when this paper was introduced that tariffs facilitate market power. But I guess Jonny boy never read those comments either.

Now I get tariffs are something Jonny boy loves to endorse. I wonder why in light of the well documented prices increases after the tariffs were imposed – he is so opposed to any criticism? Clould it be that Whirlpool has hired little Jonny boy as their spokesperons.

Apparently the Hemphill article was too complicated for pgl..and it helps explain why washing machine suppliers got to pass along such a high proportion of the tariff. But pgl wants you to think that tariffs alone are responsible for 100%pass-throughs to consumers, thereby harming consumers. He just loves to deflect attention from Corporate America’s price gouging!

Funny that you read something you could not understand do you misrepresented it. Oh wait after denying the tariffs were fully passed on to consumers you finally decided they were. Damn dude – make up your little warped mind.

“pgl wants you to think that tariffs alone are responsible for 100%pass-throughs”

You pathetic lies are really funny. I opposed the Maytag acquisition whereas chief Whirlpool shrill Jonny boy shrugged it off. But do continue to misrepresent as you once again showed your utter lack of economic knowledge.

“Apparently the Hemphill article was too complicated for pgl”

That has to be the most backwards trolling comment ever. I read this reporter’s piece but unlike you I also read the research paper. What the latter clearly noted was that the Trump tariff bolsters Whirlpool’s market power which is the point I made from day one. But darn it – it is basic economics – something little Jonny boy never learned.

Hey troll – READ the actual research paper. It is excellent. Then again it is way over your little pea brain.

Now I have my computer back – time to clean up some intellectual garbage. Jonny boy seems to be wanting to write a paper challenging the literature on who bears cost of tariffs. Not consumer or producers but the middle man says Jonny boy. Now the American Economic Review will expect some sort of theory which Jonny boy does not have and certainly some reliable data which Jonny boy never presents. So let’s help out.

Logistics costs are down??? Not according the data which shows these costs are higher than they were five years ago.

Oh Lowe’s has seen its retail margin fall says Jonny but the Lowe’s 10-K shows no fall in gross margins. Oh OK maybe this is due to a rise in the lumber retail margin Jonny boy claimed but he could never document.

Boy Jonny boy – the AER will demand evidence before they even consider Jonny boy’s incoherent babbling.

The point is that there is a value added chain after a product lands. In a competitive market there is no justification for products to me marked up by a fixed percent at each step. Logistics, marketing, and services costs are often fixed or are at least independent of the landed product’s cost. As result, you would expect that the percentage effects of a price increase of an imported product would diminish the farther along the value chain. At landing the percentage increase would be roughly equal to the tariff rate, paid to the government. As costs are added along the value chain are added, the percentage markup drops…unless you’re dealing with an oligopoly, which is free to use its pricing power to mark up products as it chooses…even turning a 10% tariff increase into a 10% price increase to the final user. Such a pass through, per Hemphill, is indicative of an oligopoly.

But, as I said, economists go ballistic if price increases are caused by tariffs but go silent when they are caused by oligopolists!

A lot of babble to skip past you complete inability to show whether the middle man’s margin rose or fell. Jonny boy – babble is not evidence.

Maybe I missed something 😉

Bruce Hall

March 28, 2022 at 4:58 pm

Just musing here….

Tariffs come at a cost to the country imposing them. Sanctions seem to be doing much the same thing. The intent is different between the two, but the results seem similar: reduce the amount of a product from a specific source at a significant increase in the cost to the importing country.

Bruce Hall: This line: “Certainly suppliers can choose to absorb some or all of the costs of the tariffs, but that’s unlikely to be a long term solution for them or who pays most of the tariff.” By the time you wrote that comment, we had already a bunch of evidence (cited in the U.S. ITC report) that suppliers had absorbed essentially none of the tariffs.

Okay, so what? How is the comment I cited from 3/28/22 inconsistent with the graphs in this post? Tariffs essentially became national sales taxes and successfully reduced import quantity (Figure G.1). Old uncle Joe has the same goal (reduce import quantity), but he he trying to accomplish that by spending government money as incentives for domestic manufacturing. The difference is that tariffs went to the Treasury coffers while Joe’s plan helps reduce them.

Even old uncle Joe seems to recognize that there are other considerations besides lowest purchase price. Of course, that wouldn’t be an economics issue.

Bruce Hall: The point is that you were wrong, wrong, wrong, wrong, on this point, even back in 2022, as was well documented even by 2021. As you are on almost every point you write on in the comments portion of this blog. You are indeed remarkable in your consistency. I applaud you for that.

Okay, then I guess others must also be wrong, wrong, wrong, wrong.

• https://www.cnbc.com/2019/09/05/target-demands-that-suppliers-absorb-tariff-costs-to-shield-consumers.html

Now there is a semantics issue about who is a “supplier”. That may well be the importer (middleman) whose margins get cut (and then seeks a new source?). If China doesn’t (didn’t) reduce their prices to importers and importers got squeezed by corporations like target, would it be wrong, wrong, wrong, wrong to presume that Figure G.1 is wrong, wrong, wrong, wrong and the quantity of goods imported did not go down, down, down, down?

https://www.azquotes.com/quote/1136725

While tariffs and sanctions tend to be a lose-lose proposition economically for the suppliers and buyers, the purpose of those tariffs and sanctions and the outcome is different, politically. Otherwise why this:

• https://www.politico.com/news/2022/12/26/china-trade-tech-00072232

or this

• https://fortune.com/2022/09/10/biden-biomanufacturing-executive-order-reduce-china-reliance/

or this

• https://www.cnn.com/2022/01/26/politics/china-tariffs-biden-policy/index.html

Sanctions, tariffs, and subsidies all cost… just differently.

But thanks for complimenting me on my consistency. 😉

Bruce Hall: Well, in this case Target didn’t get the foreign suppliers to absorb costs. In the language of trade economists, then, it was American purchasers that absorbed the costs, not foreign suppliers. Which is exactly what a tariff pass through of one says.

Now there is a semantics issue about who is a “supplier”. That may well be the importer (middleman) whose margins get cut (and then seeks a new source?).

Oh gee – Brucie boy has bought into the latest undocumented intellectual garbage from JohnH. I do think our Usual Suspects are doing all they can to dumb down any economic issues.

Yea you missed all of your freshman economics classes

Lucy must be jangling as she reread your past comments. Hey Brucie … your community College is offering economics for dummies. Do sign up

Let me get this straight – you are defending Trump’s little quote by telling us Target is absorbing the losses. Even if this dumb and undocumented assertion were valid – are you saying Target is managed and owned by the Chinese? Oh my – worse than the Tik Tok scandal.

Who wouda think it?

Imagine, a national trade adviser recommending taxing local consumers and businesses in order to … hmm .. I forget the STUPID justification.

It’s possible that the 100% pass-through of tariffs to U.S. domestic prices damaged China’s aluminum industry by reducing Q rather than P. The whole Covid deal made it tough to identify the impact of the quantity of aluminum the U.S. demanded from China, but let’s have a look.

In 2022, China’ aluminum output hit a new record, with margins also up on the year:

https://www.reuters.com/markets/commodities/chinas-2022-aluminium-output-hits-record-high-4021-mln-tonnes-2023-01-17/

So that’s pretty healthy. But that’s production, not exports. So…:

https://tradingeconomics.com/china/exports-of-aluminum-products

Looks like China’s aluminum exports did really well after tariffs were imposed. Neither P nor Q took a tumble in response to tariffs.

But that’s all exports. What happened to China’s aluminum exports to the U.S? Should it matter? If the U.S. behaves like a small country in the global aluminum market, then won’t any exports directly from China simply be swapped out for substitutes, with no material effect beyond some scampering to redirect shipments? Too much for my wee head. Let’s look at volumes of U.S. aluminum imports from China:

https://tradingeconomics.com/united-states/imports/china/aluminum

There it is! U.S. aluminum imports from China did fall in 2018 through 2020 and then took off again during the recovery from Covid. New records for imports in 2021 and 2022, despite tariffs. So a bit of swapping cargoes around in the early days of tariffs, some Covid cooling before new highs in U.S. imports, all while tariffs boosted U.S. inflation 1-for-1. Cool.

Sure, but the tariffs were too small to actually matter besides the fact the U.S. got little aluminum from China. Something Trumps buddies in Shanghai told them in late 2017. A nice fake ploy. Yet, nobody calls them out. Just as they would expect. Most tariff regimes imposed on the administration were bogus. Made to make you believe. Watching markets flop over themselves on .25-.5% “tax” cracked me up. Most of the distortions were self chosen.

Why not put 500-1000 percentage tariffs on??? 5-10% tax surcharge would have really shook things up…….but disorderly unwound dollar globalism. Republicans couldn’t have that…….while they were really in liberalization mode instead.

The tariffs were 25% not 5%. Now tell us who has imposed tariffs over 500%.

The idiocy was saying “CHINA is now paying us billions”. Clearly the money is paid by the importers. The only question is to whom they pass that cost.

1. They can try to share it with the exporter, but are unlikely to get much give from that end. After all we presume they have already gotten the best deal possible.

2. They can cut their own profits, which is a last ditch response, if they are unable to pass the cost to their costumers without big loss of sales.

3. They can pass the tariff cost to costumers.

The default is always going to be passing the cost by increasing prices, but usually with a small fraction covered by the other 2 items.

In contrast to what the Orange moron stated, the main function of tariffs is not extracting money from the exporting country, but extraction of market share by increasing prices on the imports, making domestic producers of that product more competitive. Yes consumers will pay more, but the country will benefit from increased domestic production (unless domestic producers just increase their own profit by matching price increases on imports). The problem with tariffs on raw (and intermediate) materials is that you also increase cost for any of your own exporting industries using those raw material. So the metal tariffs increase the price of producing a car in the US, but not on producing it in EU. The metal tariffs were a clear example of government picking winners and losers; some companies got more competitive, others less. No doubt that the overall effect is likely to be somewhat positive, but only if other countries do not retaliate by adding their own tariff on goods imported from US. Unfortunately, the countries hit with Trump tariffs were a lot smarter with their choice of retaliation – they put tariffs on US end products and cherry picked those to be products where their domestic industries could really benefit from a boast in competitiveness.

“In contrast to what the Orange moron stated, the main function of tariffs is not extracting money from the exporting country”

True. But the main function of the tariffs was to bash China politically. Trump likely knew his tariffs would be economically insignificant, but he knew they would have a huge impact politically. In fact, Biden agrees with Trump on the political benefits of bashing China with tariffs which he has kept in place.

Bashing China is a dangerous game, of course, but nearly all politicians in Washington love to do it. Does anyone really believe that TikTok is a major threat to our national security and should be banned?

Serious problems like daily train wrecks, collapsing banks and mass shootings are completely ignored by Congress while TikToc and the Spy Balloon are top of Congress’ agenda. China Hate has been the result.

Agreed. But did you see in reference to your 2nd option – both Bruce Hall and JohnH is telling us Target ate the full cost of these tariffs? Did they bother to present a shred of evidence? Of course not – they never do.

And usually the retailer’s will take a little time to adjust prices in response to increased wholesale prices (whether for tariff or other reasons). They may increase prices 5% while they still have old stock and then another 5 % after they run out of old stock – just to ease the sticker shock effects. Some may proudly announce they will eat the full cost, as a PR stunt, then slowly increase prices and claim they’re doing it for other reasons.

Example:

Case 1: no tariff

product cost landed- $100

value added supply chain costs – $50 (50%)

Final cost to consumer – $150

Case 2: landed product with tariff and value added supply chain costs added

product cost landed- $100

10% tariff – $10

value added supply chain costs – $50

Final cost to consumer – $160

Case 3: landed product with tariff, and value added supply chain prices marked up, costs disregarded

product cost landed- $100

10% tariff – $10

value added supply chain prices marked by 10% – $55

Final cost to consumer – $165

In Case 2, the supply chain costs remained the same (no reason for change). No costs were absorbed, and prices to the consumer increased by $10 (6.7%)

In Case 3, the supply passed along the percentage increase of the tariff (10%) and increased the price to final consumer by $15, an absolute dollar amout 50% above the absolute dollar amount of the tariff, even though there were no additional supply chain costs. (Why would a tariff increase a trucker’s long haul costs, or a valued added reseller’s service costs, or advertising expenses? Yet prices get marked up as if they did!!!)

In a competitive market, you would expect case 2; in an oligopolistic market, Case 3. Any tariff price increase percentage should be mitigated as a product passes through the supply chain, since there is no reason for a tariff to apply to downstream costs. When you see tariff markups passed along to final consumers, it’s time to suspect oligopoly.

In the post above, “a 25% ad valorem tariff results in essentialy a 25% increase in price faced by a domestic consumer.” That smells of oligopoly.

But mainstream economists go ballistic at tariff increases but go silent when oligopolies inflate prices!

Making up silly examples is not evidence. Dude – you are worse than Princeton Steve at just pulling numbers out of your rear end.

BTW troll – the market concentration for this sector was high before the tariffs but Whirlpool whined about Asian supplier price competition. Which is why your boy Trump gave them additional protection from competition. A simple story which for some reason our Village Moron Jonny boy can not understand.

‘Final cost to consumer – $165’

How dumb is this example. Whirlpool washing machines are now going for over $500. I guess Jonny pulled out this stupid example from the 1970’s before the merger and those Trump tariffs. Come on Jonny boy – if you are going to just make up numbers try posting one for washing machines and not coffee machines.

More on why Jonny boy should refrain from mansplaining us on things he does not get with examples that are just stupid.

Case 2 is the one with 100% pass through not case 3 which pretends pass through was 150%. But Jonny boy flunked preK arithmetic.

Case 1 has a really high gross margin for the middle man so maybe Jonny boy thinks competitive markets exhibit market power.

But wait – anyone who has read the literature realizes that it talks about the market power of the producers like Whirlpool not the alleged market power of Lowes.

So once again Jonny boy proves he has no clue even on how to tie his shoe laces. But you knew that.

“That’s economist Trump in 2018” should be changed to “That’s politician Trump in 2018”. Huge (or is it yuge) difference.

What? Are you telling us Kudlow and Navarro did not get the Nobel Prize in economics?

Not necessarily related to overseas trade, but a very good read for “China watchers”.

https://nymag.com/intelligencer/2023/01/china-economy-property-bubble-reopening-zero-covid.html

Moses Herzog,

The article you posted has far more hyperbola than new insights.

One for the casual observer, not the China Hand.

I particularly like the part where the main foreign objective of the past few decades – to get China to rely more on consumption than investment – is now passed off as a dangerous trend.

The part about Mao-era under-investing was clearly written by someone who never read anything about the Great Leap Forward. Yes, the investment of that time was pretty useless, but “under investment” ? Nope, because that would imply over consumption, rather than starvation .

@ Mr. Rear,

I’m “not sure” your reading comprehension is particularly good if you came away with the idea the article was stating that the general public would be better off with less consumer spending.

And under investment (under Mao) did not imply at all that during Mao’s leadership there was “over consumption”. That seems to be your own poorly made conclusion, nothing that Pettis had stated. As for the rest of your comment, I’ll let your words speak for themselves.

Pgl is as usual eager to deflect blame for harm to consumers away from Corporate America and from research that shows their role in raising prices…

No little terp. I’m not the one defending Whirlpool’s jest for anti-competitive tariffs. That would by you Jonny boy. But I have bad news for you. Their CEO has decided you suck as their economic spokesperson so I suspect you will be fired tomorrow.

I’m sorry – should have consulted Urban Dictionary for what little Jonny is:

https://www.urbandictionary.com/define.php?term=twerp

Twerp. That says it all!

I just checked the 10-K for that company you are shilling for (Whirlpool). 2019 was a great year for them with their operating margin jumping to 7.7%. Now for the US they admit they sold less units but generated more revenue (something about the price mix – cough).

They actually claimed they face fierce competition never mentioning it is part of a global oligopoly and never mentioned those Trump tariffs.

Gee Jonny boy – you sure do a good job of lying for your boys at Whirlpool!