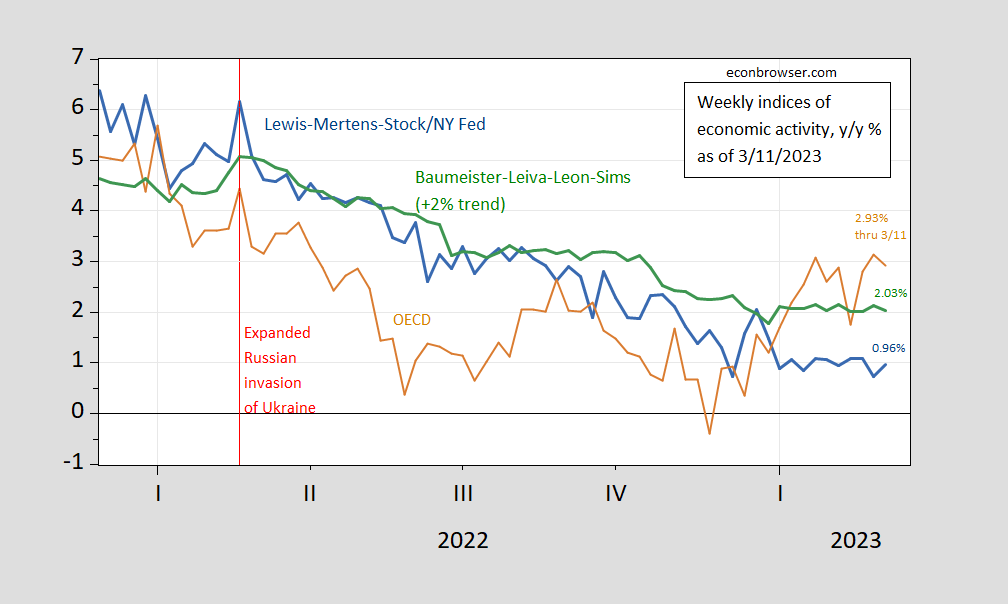

Deceleration was still in place, according to the WEI.

Figure 4: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

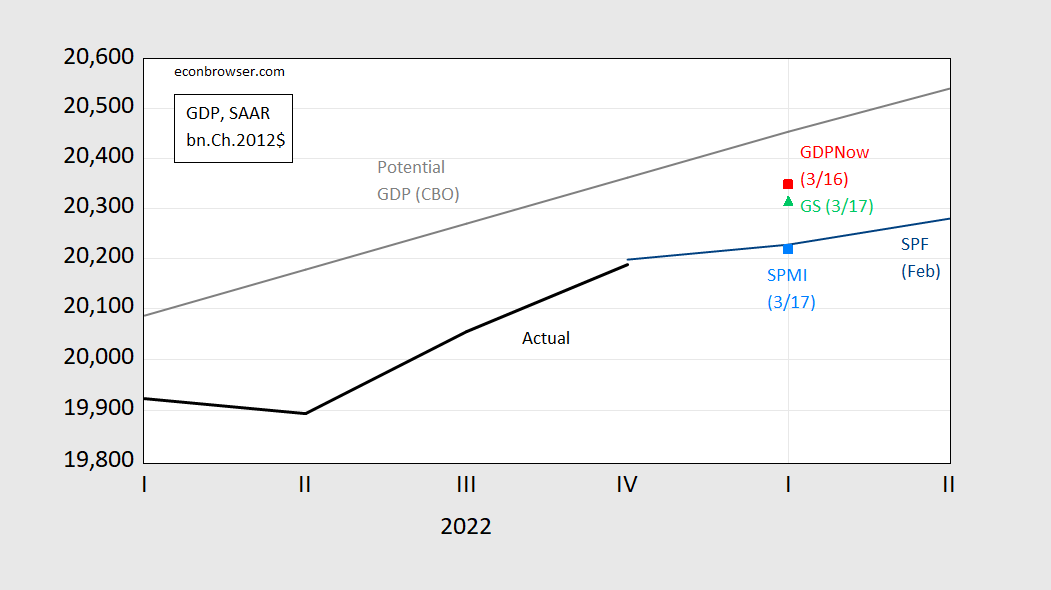

Still, nowcasts and tracking estimates were indicating growth in Q1, albeit with some wide variation (and all implying a negative output gap, taking the CBO estimate of potential as given).

Figure 2: GDP (bold black), GDPNow (red square), S&P Market Insight (sky blue square), Goldman Sachs (light green triangle), Survey of Professional Forecasters survey median forecast (blue line), all in bn.Ch.2012$ SAAR. Source: BEA 2022Q4 2nd release, Atlanta Fed, S&P Global (3/17), Goldman Sachs (3/17), Philadelphia Fed SPF (February), CBO Budget and Economic Outlook (Feb. 2023), and author’s calculations.

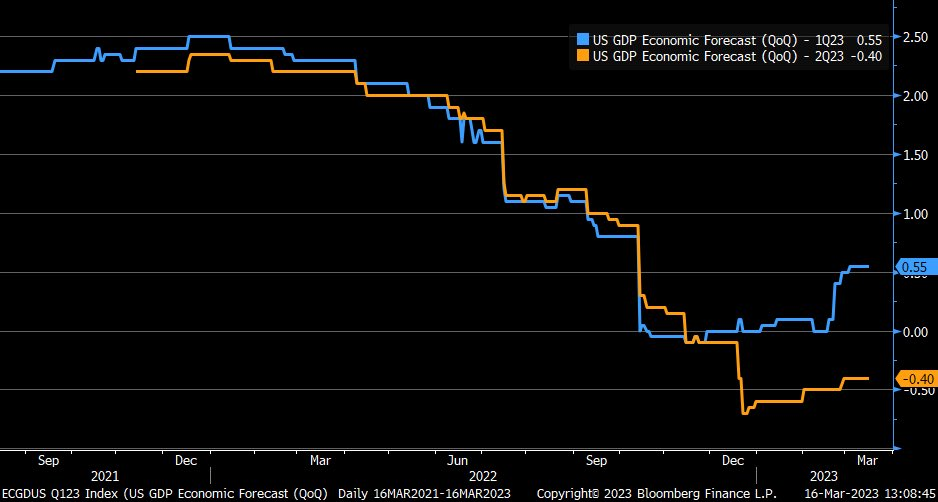

Q1 growth is positive, but barely, ranging from a low at 0.6% q/q SAAR from SPMI (formerly Macro Advisers, formerly IHS Markit), and a high of 3.2%, from Atlanta Fed’s GDPNow. We are now about 40 days from the advance 2023Q1 GDP release. Historically, GDPNow has slightly beaten (has a slightly smaller RMSFE) than the Bloomberg consensus at this horizon. As of yesterday, that seems to be around 0.55% q/q SAAR.

Source: Liz Ann Sonders, 17 March 2023.

Some of you have probably noticed press coverage of this:

https://fred.stlouisfed.org/series/WPC

“Primary Credit” is the main form of Fed discount window lending. This is the lender of last resort window. Borrow from the discount window has typically been avoided because it could lead depositos, investors and counterparties to freak out. Now, discount window borrowing is perhaps a sign of good management – rounding up cash against collateral that isn’t marked to market.

Some writers are treating this grab for cash as evidence of the severity of the banking problem. I’m not sure that’s true – the Fed has made it clear that discount window borrowing is the cool new thing to do. That’s a ton of cash now at banks. Once again, this is from the “liquidity preference” lecture.

Bagehot’s dictum (deduced rather than quoted from “Lombard Street”) is that central banks should deal with a credit crunch by lending freely at a high rate of interest on good collateral.

The Fed is lending freely (as evidenced by the sharp rise in primary credit). It is lending on good collateral – mostly Treasuries and Agency MBS. By taking collateral at face value, the Fed is NOT demanding a high rate of interest – the discount window is not demanding much of a discount. Walter Bagehot would be displeased, but I think this is the explanation for the heavy demand for primary credit. Discount window borrowing is a great deal right now.

There are about 186 banks that saw a surge in deposits in 2020 when the rich were(in crypto startups) surging deposits into these regional banks. Essentially they are solvent by raw assets to liabilities, but not with wealthy “owners” taking billions out of them. That is fundamentally what is going on. Can’t really save banks who’s should have never been that big in the first place. The real issue is how fast you let them go. Plenty of other banks to do what they did.

I agree, people still don’t get it, because they keep on looking at the bank themselves. It’s why the guilty rich are calling for depositors restitution.

In an odd way, it is banks that now have the Fed and FDIC over a barrel at the moment. To wit: Guarantee all deposits for two years, lend against treasuries at par, not market, guarantee that we have liquidity in the event of a run.. And the Fed and FDIC will comply.

Fear? Guilt? Complicity? Whatever.