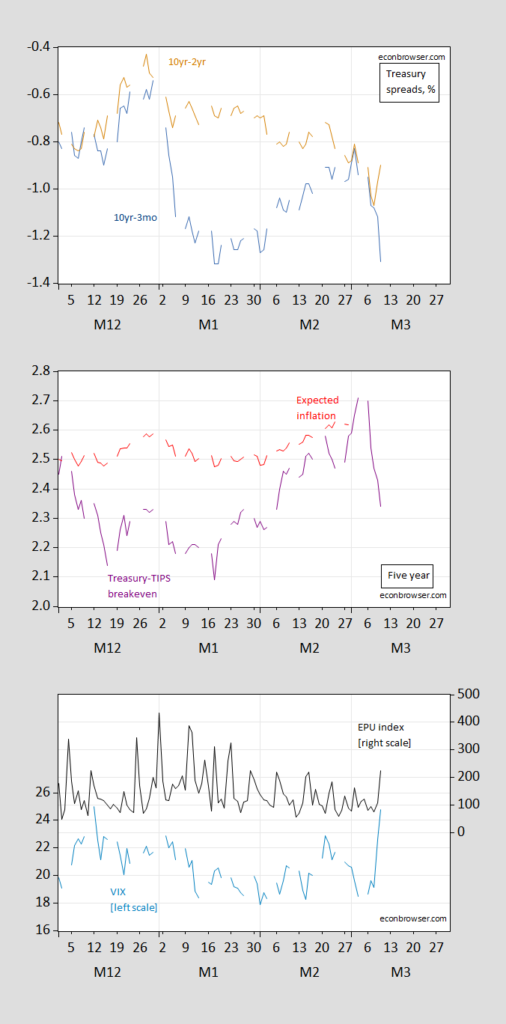

VIX and EPU up, inflation breakeven down, and term spreads diverge.

Figure 1: Top panel: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (tan), both in %; Middle panel: 5 year Treasury-TIPS spread (purple), 5 year spread adjusted for liquidity and risk premia (red); Bottom panel: VIX (sky blue, left scale), EPU (black, right scale). Source: Treasury via FRED, KWW following D’amico, Kim and Wei (DKW), CBOE via FRED, policyuncertainty.com.

Allianz Bank has a new report on TLTROs in Europe. Looks very interesting. If you’re one of those people like me who likes to scan for freebies online, check the usual outlets and you’ll find it.

Some things/people NEVER change.

https://nypost.com/2023/03/10/cnbcs-jim-cramer-touted-silicon-valley-bank-stock/

the contra cramer etf hit all time high yesterday!

on monday when cramer says svb is a black swan…..

I watched Mad Money only once. I kept thinking this Kramer Klown was even dumber than Donald Luskin.

Good show why spreads are pretty irrelevant. Pure “emotion” without any context. Lets remember, this is a micro-bubble. Its outside the main system and frankly tied to the Republican party in many respects. Its why Trump was scared of higher Fed rates in 2019 because the higher interest payments with a decayed loan return, is easy to manipulate as Peter Thiel did. So much of the streaming platforms and big media will pay a price. NFL,MLB,NBA won’t get the media deals in the future and I say good. No wonder VInce McMahon is trying to sell the WWE. “Sports entertainment” is over.

Yet, on the “mainstream” side, this is a great chance for state governments and private entities to really build up the infrastructure party. Lets fix this country for real. These so called tech startups since the financial crisis are junk. Rehashed tech trying to sell cheap to a oversaturated media. This ain’t the 80’s or 90’s. For the people that lose their jobs, there are plenty out there. My company is hiring at 20$. Please, come. Return to reality.

Your comments remind me of the Tonto, Tarzan, and Frankenstein skits on SNL.

Peter took a unheralded little bank in 2019 and made it a monster relatively speaking. He basically killed it by removing his allies money in it. Let’s note, SVB had more assets than liabilities. There is a reason why nobody bought it out.

https://jabberwocking.com/was-svb-management-incompetent-or-just-unlucky/

Kevin Drum offers his thoughts on the SVB melt down.

Any banks, regional or otherwise, that follow SVB’s practice of thinking they were safe because they were heavily invested in government securities will now have to be looked at. To some degree, the Fed’s rate raising precipitated the SVB failure (ie: rising rates, declining value of bonds on the market, hence inability to meet withdrawal demands with bond sales) but the government – according to Yellen – will not bail SVB out. However, the mechanism and the risk of it being repeated elsewhere are surely obvious to the Fed.

Will that influence future rate decisions? The Fed absolutely should not want to be seen as having caused bank runs or actual failures.

The Fed was irrelevant. The declining high tech income caused Thiel to bale. It’s Peter’s story. Time for the media to admit it. This is a impure liquidation. Not driven by fundamentals of the bank, but by greed.

Gregory Bott: Thiel to bale…what. Hay?

He’s got some classics doesn’t he?? “impure liquidation”. Sounds like Sister Angelica had a mishap making s’mores again.