Ever wonder whether vehicle miles traveled (VMT) does a good job of predicting recessions? You should’ve stopped after looking at this Econbrowser post from January 4th, but I thought an update to most recent data would be of interest as we obtain December data. First take a look at what VMT does over recessions, versus heavy truck sales (suggested by Calculated Risk at some points), and the eponymous Sahm Rule (real time version).

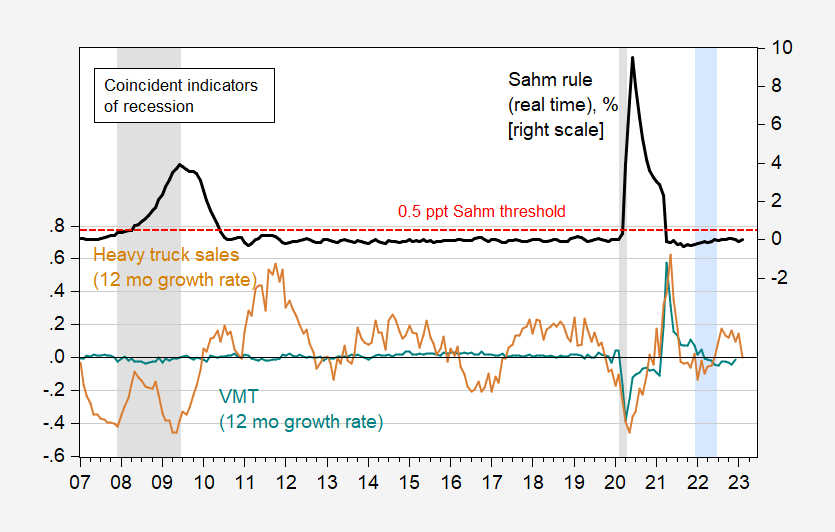

Figure 1: 12 month growth rate in the vehicle miles traveled, n.s.a. (teal), in heavy truck sales, s.a. (tan), and Sahm rule indicator – real time (black). Sahm rule is 3 month moving average unemployment rate relative to lowest unemployment rate in last 12 months. Red dashed liine denotes threshold for Sahm rule indicator. NBER defined peak-to-trough recession dates shaded gray. Hypothesized 2022H1 recession shaded lilac. Source: FHA via FRED, Census via FRED, FRED, and NBER.

It’s hard to see, but the 12 month change in VMT declined a few months ago before recovering in December (it’s this decline that Mr. Steven Kopits pointed to), while heavy truck sales were up through January, y/y. The Sahm rule is exactly at zero as of the February data released yesterday (it needs 0.5 ppts to breach the threshold).

In any case, VMT growth is a lousy indicator of recession (McFadden R2 of 0.07) compared to heavy truck sales (0.28) (see regression results in this post).

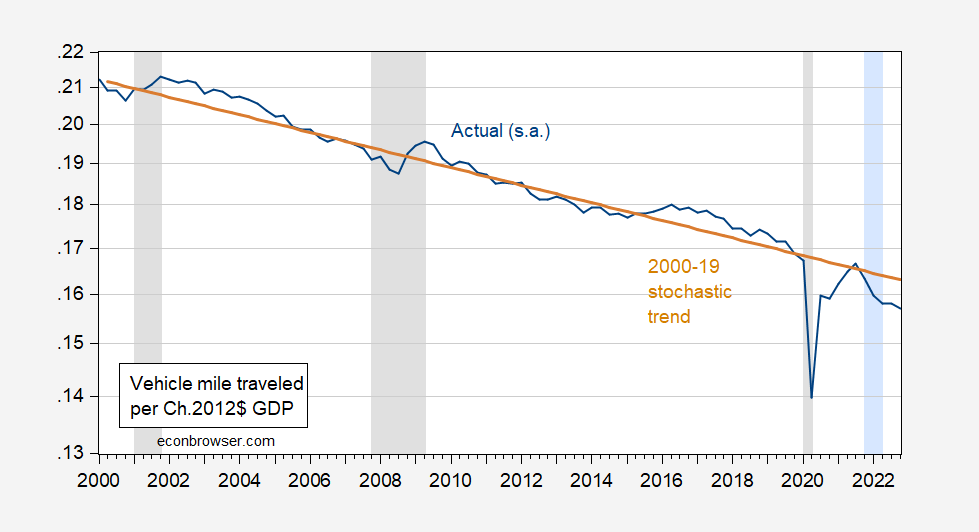

Looking forward, I would be even more careful about using VMT as an indicator, given that the relationship between VMT and GDP has seemingly experienced a structural break. In Figure 2 I plot Vehicle Miles Traveled (seasonally adjusted) at a quarterly rate per US GDP at a quarterly rate (so that the units are Vehicle Mile Traveled/real dollar GDP). There is an obvious trend at 1.15 percent decrease per year over the 2000-19 period. (I estimate a stochastic trend given I can’t come close to rejecting a unit root in the log ratio.) Using the estimated trend to project forward, I obtain:

Figure 2: Vehicle Miles Traveled per Ch.2012$ GDP (blue line), and stochastic trend estimated over 2000-19 (tan line), on log scale. NBER defined peak-to-trough recession dates shaded gray. Hypothesized 2022H1 recession shaded lilac. Source: FHA, BEA, NBER, and author’s calculations.

In other words, Mr. Kopits took the downshift to a seemingly new trend line as a cyclically induced reduction in VMT.

Is our Navy brat watching San Diego State tonight??

RV deliveries as reported by the RVIA as discussed on this blog in the past may be giving a warning about recession within 12 months.

A question about the current reliability of the RV indicator is whether the reported deliveries have been skewed by the pandemic.

RV deliveries were reported at 470.5K for 2020, 600.2K for 2021 dropping to 493K for 2022.

https://www.rvia.org/

Nice catch. I would guess the recent RV sales are skewed or even misleading, similar to the consumer spending numbers when America was at the very initial stages of getting past Covid-19. It gave the false impression~~to people who should have known better~~ that demand was higher than it was. But I still think it’s very worth looking at and keeping an eye on~~if for no other reason than what Professor Chinn and Macroduck touched on, on the structural break.

Recession is driven by macro factors. 1990(a recession nobody saw coming) was caused by personal credit crisis in 1990 which could have been worse. 2001??? Corporate balance sheet repair. 2008? End of the long run investment bank lending boom which went back to 1983….which why it was as so emphatic. Microrecessions occur like commodities in 2011-14. High Tech, 2013-21 in recent times.

VMT was and is a poor choice of coincident (or leading) recession indicator. VMT does have value for us, though; It offers the opportunity for your observation about a structural break. This is almost certainly not the only break that has occurred. Taking data regularities utterly for granted is never wise, but since the Covid shock, it’s downright reckless.

We have to rely on data, but we should do so very cautiously right now. Housing may not lead the business cycle. Curve inversion may not predict recession. Even Claudia Sahm may prove fallible (but I’ve got a twenty that says her rule still works – it’s a matter of definition). We have tickets for a fascinating show.

I really like this half-Asian kid Zach Edey at Purdue. And if some NBA team doesn’t draft him, they are all fools. The only thing this kid is missing in his toolbox is a nice jumper shot. Once this guy develops his jump shot he is going to be unstoppable. All you heed is a “specialist” type coach who knows how to teach youngsters on their jumpshot, tutor this kid one on one. I’d even “waste” a high pick in the draft if I was afraid someone was going to snag him. He reminds me of that Baylor Center (about 5 years back??) who had to drop out of playing because he had the heart condition. I really love watching this kid play, and I wanna see Edey play in the NBA, he is “for real” as the cliché goes. He’s got heart, a good head on his shoulders. I’ll take that over these cookie-cutter kids with their head in the clouds.

Edey reminds me a lot of KD.

I agree, some similarities, even in personality. Very team-oriented in his approach which is becoming more rare in the current era. I would argue KD has more speed and quickness. But Edey’s physicality might make him tougher and less prone to injuries than KD. KD can also dribble like a two guard which is very rare for a man his height. Edey might be able to dribble in the open court like KD, but that’s going to be 4-5 years away and tons of work.

Purdue? PURDUE???!!!

We can have no further conversation until after the finals.

Purdue…

For a second you had me thinking I misspelled it. I actually went to double check if the first “u” as an “e”. Are they a rival of your alma mater?? You know John Wooden was a graduate of Purdue. Just a little bit of cocoa butter on those legs and Richard Simmons would be jealous:

https://en.wikipedia.org/wiki/John_Wooden#/media/File:John_Wooden_Purdue.jpg

What’s the verdict guys?? Is this older chick better at the internet than I am??

https://twitter.com/ananavarro/status/1634681371695235072

Careful now, I’m sensitive type.

I will withhold comment on who beats who, ’cause I know how hurtful that can be. But don’t you just love clever paper craft?

Seriously I got a big kick out of it. BTW, Chinese are very good at paper decorations. I would never call her “chick” in person for fear of her denting my cranium with a quick half-flick of her knuckles. But in all seriousness I respect this lady and I bet she’s a sharpie.

In this post – Kevin Drum wants us to calm down over the SVB as Apple apparently holds a lot of “cash” in various forms to the tune of $180 billion:

https://jabberwocking.com/ffs-calm-down-about-silicon-valley-bank/

He is citing what Apple calls note 3 to its latest 10-Q filing. Now I get that Apple’s accountants go out of their way to confuse people reading their financials but come on Kevin.

About half of that circa $180 billion total represents issuances of Apple’s corporate debt. Just check their balance sheet. Summing a set of assets and a set of debt is National Review level stupidity.

If we look at the seasonally adjusted data, the VMT numbers are consistent with a recession from Dec. 2021 to June 2022.

Nov. 2022 VMT was notably weak, and Dec. was a bit weaker, but statistically indistinguishable from Nov. One down month does not a recession make, but there is no obvious reason for a decline in November that I can think of. Perhaps it signals a start of a recession. Perhaps it is something of an anomaly. We’ll see.

https://www.fhwa.dot.gov/policyinformation/travel_monitoring/tvt.cfm

Dec. 2022 xls

Tab SAVMT (last one)

I would add that, best I can tell, the regulators and Fed have thoroughly botched the SVB run.

Steven Kopits: Thanks for your thoroughly documented and carefully reasoned analysis.

I would like to return to your analysis of the recession of 2022H1. Please refer to the information contained in this post.

Menzie –

SVB’s sin appears to have been that it invested in MBSs and treasuries. Neither has collapsed. Rather, as I understand it, SVB has become a victim of interest rates movements.

The zero-rate policy during the pandemic led tech company valuations to soar and cash to flood into tech companies. A lot of this money was deposited, unsurprisingly, in Silicon Valley’s bank, literally SVB. So SVB was inundated with cash due to Fed policy and Treasury largesse.

Of course, this was going to reverse at the back end, when rates would have to be raised to bring inflation down. This means that SVB would have parked that cash in securities based on zero-rate policy, which would lead to paper losses when interest rates rose. Again, rising rates come from Fed policy and Treasury largesse.

So why is SVB failing? Best I can tell, due to bad Fed and bad Treasury policy.

If that’s the case, then we might have systemic risk across the board. And Yellen says, “No bailout!”. Goodness, analysis at Treasury and the Fed are weak.

And why did that happen? Because they confused a suppression for a depression.

Regulators aren’t in charge of the run. They’re in charge of the resolution. Resolution follows a pattern designed to minimize harm to depositors and the financial system. Making up a resolution of a failed bank on the fly would be dumb, so it’s done by the book as far as is possible. Nobody, especially not anybody who is a non-specialist, can know whether a resolution was handled well before doors open for small depositors on Monday. Having an opinion on Sunday is evidence that the opinion is uninformed.

Since the harm to the system will be modest and the depositors at risk are all rich fat cats, Princeton Steve is incapable of WTF he means by “botched”. But hey – that is par for the course for this arrogant Know Nothing.

Like when Paul Krugman and Mitt Romney are saying the same thing – one would think even the dumbest troll ever would not disagree. But then we are talking about Princeton Steve – worst consultant God ever created.

I never thought anyone could make a dumber comment about the SVB than Princeton Steve but yea the Governor of Florida just did:

https://www.msn.com/en-us/money/news/ron-desantis-blames-woke-culture-for-silicon-valley-bank-collapse-reminds-him-of-financial-crisis-and-bernie-madoff/ar-AA18xqHY?ocid=msedgdhp&pc=U531&cvid=c18b4a7bfd304db09b0d19d59508dbde&ei=16

Lol, Republicans need to give it up. 8% of total money lent was to “climate projects”. Most were to Republicans like Thiel invested Roku. Time to gaslight Desantis right back.

Botch is just a precise term – not. Sorry dude but the regulators did this the right way. Even Mitt Romney gets this but not the most incompetent consultant ever.

But if you disagree – tell us your solution? Nationalizing SVB so a bunch of rich people will not lose their investment money? Princeton Steve – socialist.

SVB created its own via Thiel be overlending in 2020. They have been long dead. It just took founders leaving the bank to make it official….of course.

Hey Stevie – I hope you saw what Treas. Sec. Janet Yellen had to say. If not – let me save you some time. She basically noted that your little “botched” claim was your usual loud mouth nonsense.

Then again Yellen gets monetary economics. You do not. So do us all a big favor – SHUT UP!

Menzie –

How many times historically have we had bank runs without recessions?

Steven Kopits: Well, quite a few recessions without bank panics (essentially the entire post-war period up to 2008), bank panic w/o recession (1984), and recession without bank panic (2020). I rely on this chronology from Baron, Verner, Xiong (forthcoming JPE), Table A2. If you understood anything about the history of bank deposit insurance in the US, you would know that this was the case.

I did not ask about two-way causality. I asked, specifically, how many times have we had bank runs without recessions? I did not ask how many times we have had recessions without bank runs.

I do not recall people standing in line for their money in 1984, although they did at Continental Illinois. But as I recall, that wasn’t a systemic event, but perhaps memory eludes me. Mostly, it had to do with the collapse of oil prices.

The ones I remember are.

– LTCM (1998), which did not lead to a recession in the US, but did in Asia and Russia

– Breaking the bank on money market funds in 2008, failure of Lehman and other i-banks

– SVB, Signature, CS in 2023

Both LTCM and the 2008 failures were associated with dropping real rates and a search for yield, leading to ever-greater leverage, ultimately ending in investment in dodgy vehicles like CMOs, CLOs, CDOs and other securities classically linked to late-stage expansions and subsequent crashes.

I think we should anticipate wide-spread contagion in the US and European banking sectors (and possibly beyond) with the various central banks really having to pull out all the stops to stabilize the situation. I would not be surprised to see the 3 mo rate down 2% (pp) in the next couple of weeks.

In this case, SVB was invested in ostensibly ‘safe’ assets. I don’t think I would have to work too hard to find a lecture in which you describe r*, the risk-free rate, as the interest rate on US government securities.

So, I guess the answer is that bank panics ordinarily lead to recessions. That would be my expectation in this case, but let’s see what the Fed and Treasury can cook up to stabilize the situation. Perhaps we endure higher inflation for longer as the trade-off (which would make Larry Summers right once again).

https://www.investopedia.com/terms/l/longtermcapital.asp

https://politicrossing.com/the-history-of-american-bank-runs-since-1984/

Steven Kopits: LTCM — that was a bank (and you’re referring to recession in the *entire world*)? You should’ve asked “when have we had a run on *financial institutions* without a recession”. Usually, a reference to a bank means that one is referring to a “deposit taking” bank. I stick with 2008 as the first instance of bank panic and recession in *the United States*.

I think there is a reasonable question (which exists in the economics literature, not that you could be bothered to read it) whether the bank panics “cause” the recessions or the panics are *caused* by the impending recession. I suggest you read some literature before you pontificate on something that you know little formally about.

You should also refer back to your stats books on what is a confidence interval.