Here’re some indicators at the weeky frequency for the real economy.

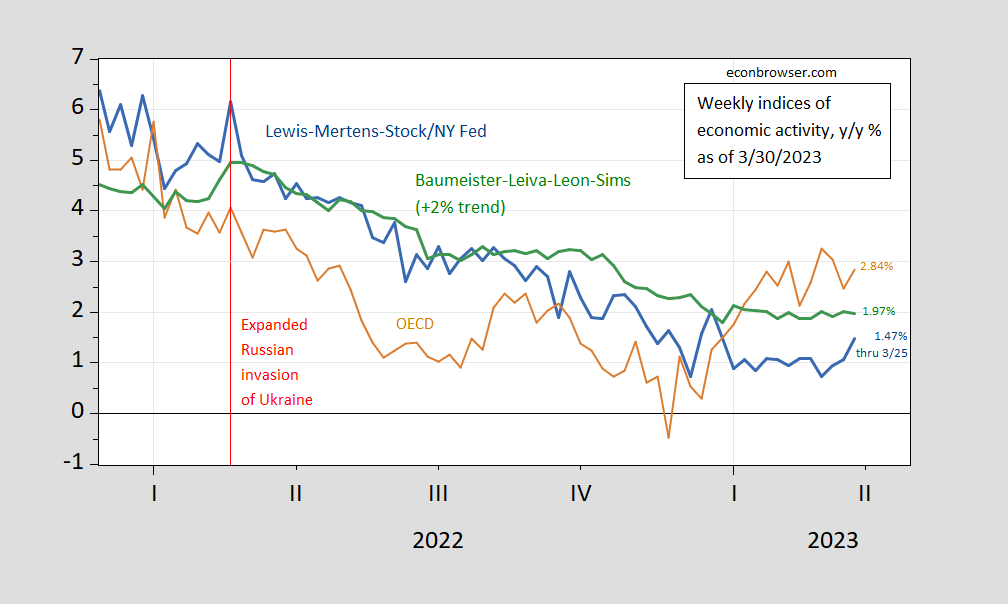

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, accessed 3/30, and author’s calculations.

The Weekly Tracker continues to read strong growth at 2.84%, for the week ending 3/25, exceeding the WEI (1.47%) and WECI+2% (1.97%). The WEI reading for the week ending 3/25 of 1.47% is interpretable as a y/y quarter growth of 1.47% if the 1.47% reading were to persist for an entire quarter.The Baumeister et al. reading of -0.03% is interpreted as a -0.03% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.97% growth rate for the year ending 3/25. The OECD Weekly Tracker reading of 2.84% is interpretable as a y/y growth rate of 2.84% for year ending 3/25.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model. The Weekly Tracker — at 2.84% — is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not rely on actual economic indices per se.

The WEI reading, if applied to Q1, implies 2.37% (q/q SAAR). GDPNow as of 3/24 was 3.2% (q/q SAAR), while as of today, S&P Market Insight (nee Macro Advisers/IHS Markit) tracking is at 1% q/q and Goldman Sachs tracking is at 2.9% (as of Tuesday).

For the implications of GDPNow nowcast and IGM median, see this post.

What do you guys think about Truflation? I read about them a while back and thought it’s a great idea – never been too impressed w/Fed inflation nowcasts, but the web3/blockchain stuff honestly turned me off a bit. Interested to get others’ thoughts – their data shows real-time CPI at 4% and continuing to trend down, which combined with these macro indicators gives the impression that markets may be correct about implied Fed rates path & suggests Q3/Q4 recession isn’t as inevitable as many seem to think

I was unable to find an actual Truflation data series. Only a graphic representation of the data. For my purposes, not that useful. But I’m not everybody.

Here’s the thing. Another inflation measure, in itself, offers only an incremental increase in our knowledge – yet another way of assessin the same inputs. Truflation’s 4.1% IS CPI’s 6% and IS the core PCE deflator’s 5.7%. If the Fed is targeting 2% y/y for the core PCE deflator and Truflation runs 1.6% below the core PCE deflator, then the Fed is targeting 0.4% Truflation. Same policy message.

If they have a data series most likely it is in a Github file. And I don’t know if they indeed make public the data or if the data series is indeed on Github. I only know Github is most likely where you would find the data series.

That is an important point. Consumers may want someway to find out “how bad are price increases”, maybe so they can compare to increases in their income. For economist its about what the Fed will do next, so the only number that counts is the number the Fed respond to.

@ Ivan

I was reading a well-respected economist. He mentioned that the Fed expects 2023 growth at 0.4%. This economist juxtaposed the 0.4% number with the fact that Q1 was roughly 2% and that the 2nd quarter was highly probable to have positive growth of ‘around” 1%. That means by implication the Fed foresees growth decreases 0.7% in both the 3rd and 4th quarters. I thought this was an interesting observation, and at least mathematically, makes sense.

He also says some (most??) Fed officials expect not to cut interest rates again in 2023, while the market sees otherwise, that the FFR drops in the latter half of 2023. The sentiment from most parties (Fed and private forecasters) would tilt to it being a “surprise” if there is no recession, even if Fed officials would never admit this in a public setting.

I wasn’t even aware of them until you brought it up (but many contemporary things I am not aware of or just don’t like). Truflation gives the appearance of being openware, but says they have customers. Slightly confusing.

bloomberg radio this morning. most commenters were moving towards the soft landing/no recession camp. not definitively. but there seems to be a mood that a recession may be avoided. based on the data and behavior of folks, today.

it is important to keep in mind that somebody is always going to complain about the outcome, no matter how deftly it is handled. even if we avoid recession, somebody will have a grievance and complain about failure. but if the economy continues to grow, considering the potential banking issues we are dealing with, that would be a good outcome.