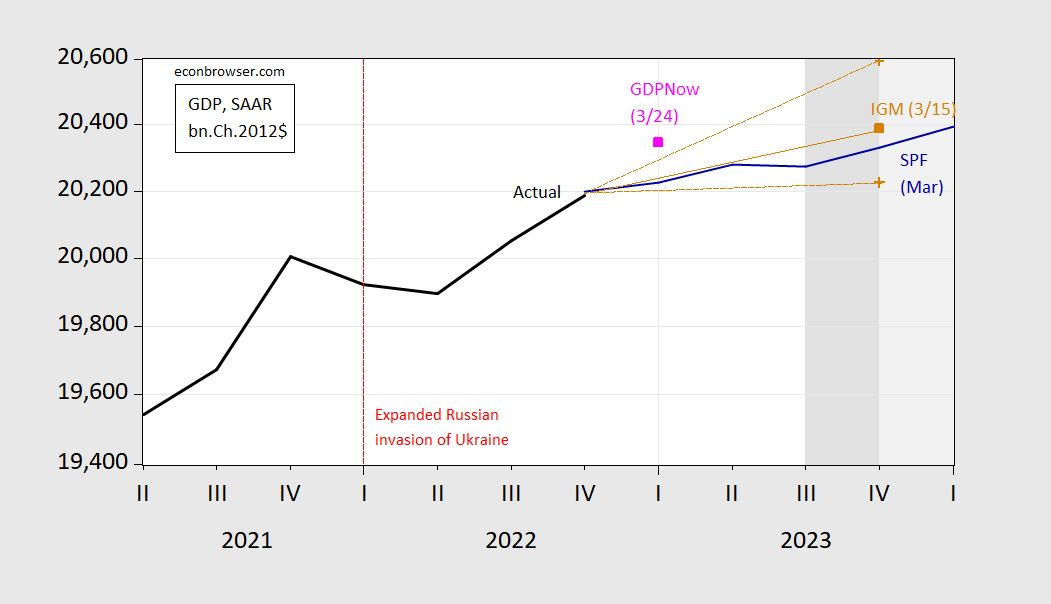

Here’s the growth path according to the FT-IGM survey that closed March 16th, about a week after the unfolding of events surrounding SVB.

Figure 1: GDP (black), SPF median (blue), FT-IGM Median (tan square), and 10th and 90th percentile (tan +), GDPNow (pink square), all in bn Ch.2012$ SAAR. Modal response for recession dates shaded dark gray. Source: BEA 2nd release, Atlanta Fed (3/24), Philadelphia Fed, FT-IGM March survey, and author’s calculations.

The median from the FT-IGM survey was for 1% growth q4/q4 in 2023, with 10th percentile at 0.2%, and 90th at 2% (my point estimate was 0.7%). The median growth rate places the GDP level slightly higher than that implied by the February Survey of Professional Forecasters median (survey completed near end of January).

Taking the Atlanta Fed’s GDPNow nowcast as of March 24 implies essentially zero net growth in Q2-Q4. Modal response for beginning of a recession (as determined by NBER) is 2023Q3 or 2023Q4.

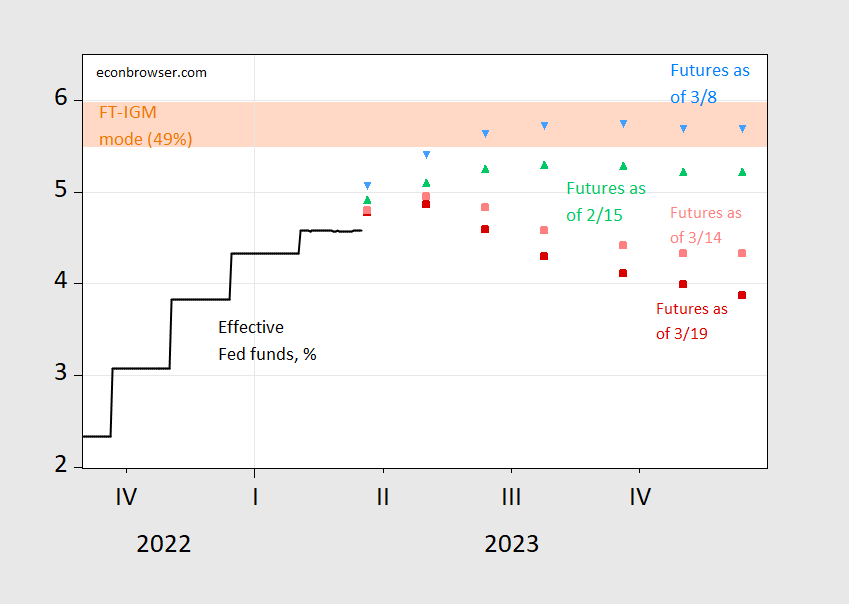

Another interesting result pertains to the peak Fed funds rate. The modal response (49% of respondents) was between 5.5%-6%. This was higher than the peak implied by CME futures as of 3/15, and even more so as of 3/19.

Figure 2: Effective Fed funds (black), implied Fed funds as of March 22 6PM CT (red square), March 19, 4:30 CT (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Light orange shading denotes modal response for peak rates from FT-IGM survey. Source: Fed via FRED, CME Fedwatch, FT-IGM March survey, and author’s calculations.

A version of the FT article on the survey results is here.

The low end of the modal response range for the 2023 funds rate, at 5.5%, is barely inside the FOMC central tendency range of 5.1% to 5.6%. The high end of the modal range is above the top estimate among FOMC members, which was 5.9%.

This is odd. The professional economists don’t seem to be growth optimists, so they must either be inflation pessimists or believe the FOMC is intent on policy error to a greater extent than FOMC members’ own forecasts suggest. Markets are pricing in not only a lower funds rate than he modal economist forecast, but slowing inflation.

Markets seem to be pricing in that the Fed will overdo it, induce a recession, and be forced to backpedal. Problems in the banking sector appears to have precipitated that view. Not surprising that the Fed think they got this. Nobody predicts their own mistakes.

What problems in the banking sector???? You mean the artificially created bank run that now is dead???? Inflation has already collapsed. Mean trim CPI is at 1.6 the last 6 months. The lags from Shelter are a illusion, a lag in data. Ditto the production surge in January/February due to under production(likely a Covid wave fear enchanced and a warm winter) in November/December. Shelter a known lag pretty much crested a year ago. What will happen over the summer/fall and these numbers collapse???

This kind of rational makes little sense. CPI/PCE are flawed and overrated numbers. They never have been good and frankly, I think outside mean trimmed numbers, the rest should be abolished. Its sloppy attempts at “numbering inflation” and being frankly, unable to do so. Inflation like real estate is local in many respects. This is a Republic. Not a direct democracy.

Gregory Bott: And… get off my lawn!

What does the “Funds” have to do with “growth”. It doesn’t. The fact the yield curve is inverted is a sign of this disagreement. The Dealers are saying “you want to dirty the pot on the short end, we will lower rates on the long ends” and negate you. Frankly, the main problem I saw in the financial system in 2019 was subprime commercial banking. It was over leveraged and was jacking up rates trying to stop the bleeding. Covid really bailed that out. Its a nice alternative for the short end nowadays again.

As a Wisconsinite – I keep wondering when the WIGOP accepts Gov Evers’ budget is working for people of the state and agrees to spend the $7.1 billion budget surplus on roads/education/local emergency services as he has proposed and accept that ACA is working and take federal money to expand and increase healthcare for Wisconsinites (WI is now one of ten states that has not accepted Medicaid Expansion) ?

“Wisconsin Statewide Unemployment Rate Hits New Record Low of 2.7%” – https://dwd.wisconsin.gov/press/2023/230323-february-state.htm?fbclid=IwAR3LloTU7A8vYthhhcT4bv-iEZb1u-3Y0pxirLkAmIWiIR49ZnVD1TG_qHo

Also why do people keep voting for the WIGOP that literally do nothing for their constituents besides hold us back from progress?

If the Bloomberg consensus is accurate, nonfarm payroll may increase by about 240K as of today’s Bloomberg report.

My hobby efforts show 245K.

Interesting. You don’t always agree with consensus and you are right in line with the consensus number. You big status quo bozo. : )

Have you done your sectoral work-up? Always curious about that.

MD,

Are you referring to the 17 categories that I use to forecast nonfarm employment?

Yes, that seems to be the only way I have found to come close to the reported change in nonfarm employment. Each category has a different model.

It is very difficult for me to forecast each category as accurately as I would like, but often there are offsetting errors.

Did you have a specific category question?

I think the last time I agreed with the Bloomberg consensus, the reported change was quite different from the forecast, so I may have jinxed the report.

I’m interested because we have a few sources of data on sectoral employment growth, including payroll data and ADP. They sometimes diverge. Knowing what a forecasting model which tends to get the aggregate number right expects from the components allows an informed guess about who is right when there is disagreemant.

Depends. NFP was bloated by the warm winter. While March has been more normal nationally and outright bad weather in California(that can lower and boost jobs numbers). My guess around 150 on NFP. Then back up to 250 range in April. If self employment jobs are still surging, I will probably be low.

Gregory Bott: But self-employed are not counted in NFP. I do not understand.

@ Menzie

I’d still like to know, why we had roughly eight different quarterly reports, all of them with bond reclassifications shooting to the moon, with no Uni profs, bank analysts, or business media, discussing this number?? Please show me who was discussing the drastic change, which screamed quarterly report lies and high jinks. Someone should have been discussing this number BEFORE SVB’s self-implosion.

https://fred.stlouisfed.org/series/QBPBSTASSCHLDMAT

https://www.wsj.com/articles/as-interest-rates-rose-banks-did-a-balance-sheet-switcheroo-8e71336f

https://www.wsj.com/articles/banks-investors-revive-push-for-changes-to-securities-accounting-after-svb-collapse-99caa9ce

SOMEONE should have been ringing the alarm bell. You know, if certain people aren’t too busy making money shooting out hot air from their mouth as a side hustle~~ https://images.app.goo.gl/wcaEkiuWCqutJCQ5A they might have discussed why the HTM numbers were shooting to the moon. If that Juris Doctor isn’t too busy talking out of his A$$ I mean.